Russian Oil Price Cap on:

[Wikipedia]

[Google]

[Amazon]

As part of the sanctions imposed on the

The Russian economy is heavily funded by oil and gas taxes. In 2021 Russia's revenue from all sources was $343 billion with oil and gas providing $127 billion. In 2022 revenue from all sources was $358 billion with oil and gas providing $166 billion or 46% of the budget. Oil revenue is a major sanction target.

French Finance Minister

The Russian economy is heavily funded by oil and gas taxes. In 2021 Russia's revenue from all sources was $343 billion with oil and gas providing $127 billion. In 2022 revenue from all sources was $358 billion with oil and gas providing $166 billion or 46% of the budget. Oil revenue is a major sanction target.

French Finance Minister

Since the onset of war, various sanctions and refusal to trade with a pariah nation, much of Russia's liquid petroleum products has been re-routed through terminals at the Baltic terminals Port of Ust-Luga and

Since the onset of war, various sanctions and refusal to trade with a pariah nation, much of Russia's liquid petroleum products has been re-routed through terminals at the Baltic terminals Port of Ust-Luga and

Around 55 percent of the tankers that transport Russian oil out of the country were Greek-owned, they can continue operating provided the price cap conditions are met. In December the percentage of Greek-owned ships moving Russian oil fell to 33% with the gap being filled by shadow fleet tankers. Cyprus reported that in two months from the beginning of October 2022, around 20% (900,000 gross tonnes) of their flagged oil tanker fleet have departed, by changing their registry. Higher losses being recorded in Greek and Maltese fleets.

It is believed that Russia has been experimenting with altering a ship transponder to avoid sanctions, with a tanker, the ''Kapitan Schemilkin'' giving in May to July 2022 a location near Greece when the tanker was near Malta, satellite imagery was used to prove the false location and identify the tanker's real position.

Ship to ship transfers of crude oil in the Mediterranean hit a record high in January of 1.7m tonnes as smaller tankers transferred their loads to larger vessels for onward transport to the Far East.

The rates that tankers can charge has risen, with a fee of $10.5m to transport 700,000b of crude, sold below the price cap, from the Baltic to India in January, compared to a fee a year earlier of $1m. In March

Around 55 percent of the tankers that transport Russian oil out of the country were Greek-owned, they can continue operating provided the price cap conditions are met. In December the percentage of Greek-owned ships moving Russian oil fell to 33% with the gap being filled by shadow fleet tankers. Cyprus reported that in two months from the beginning of October 2022, around 20% (900,000 gross tonnes) of their flagged oil tanker fleet have departed, by changing their registry. Higher losses being recorded in Greek and Maltese fleets.

It is believed that Russia has been experimenting with altering a ship transponder to avoid sanctions, with a tanker, the ''Kapitan Schemilkin'' giving in May to July 2022 a location near Greece when the tanker was near Malta, satellite imagery was used to prove the false location and identify the tanker's real position.

Ship to ship transfers of crude oil in the Mediterranean hit a record high in January of 1.7m tonnes as smaller tankers transferred their loads to larger vessels for onward transport to the Far East.

The rates that tankers can charge has risen, with a fee of $10.5m to transport 700,000b of crude, sold below the price cap, from the Baltic to India in January, compared to a fee a year earlier of $1m. In March

G7 / „EU pause its promised regular Russian oil cap reviews: report“

Insurance Marine News. Accessed 9 Sep 2023.

OFAC Guidance on Implementation of the Price Cap Policy

Russian Federation

Russia (, , ), or the Russian Federation, is a List of transcontinental countries, transcontinental country spanning Eastern Europe and North Asia, Northern Asia. It is the List of countries and dependencies by area, largest country in the ...

as a result of the Russo-Ukrainian War

The Russo-Ukrainian War; uk, російсько-українська війна, rosiisko-ukrainska viina. has been ongoing between Russia (alongside Russian separatist forces in Donbas, Russian separatists in Ukraine) and Ukraine since Feb ...

, on September 2, 2022, finance ministers of the G7 group of nations agreed to cap the price of Russian oil and petroleum products in an effort intended to reduce Russia's ability to finance its war on Ukraine while at the same time hoping to curb further increases to the 2021–2023 inflation surge.

In 2022 the Russian Federation was cushioned against energy sanctions because of a global rise in oil and gas prices. The rationale for the price cap is to remove that added value so that revenues earned by Russia are restricted and should not rise if world oil and gas prices increase again in the future. In addition, it will complicate maritime oil shipments for Russia and further restrict the amount of oil Russia can sell and ship to customers, further reducing revenue.

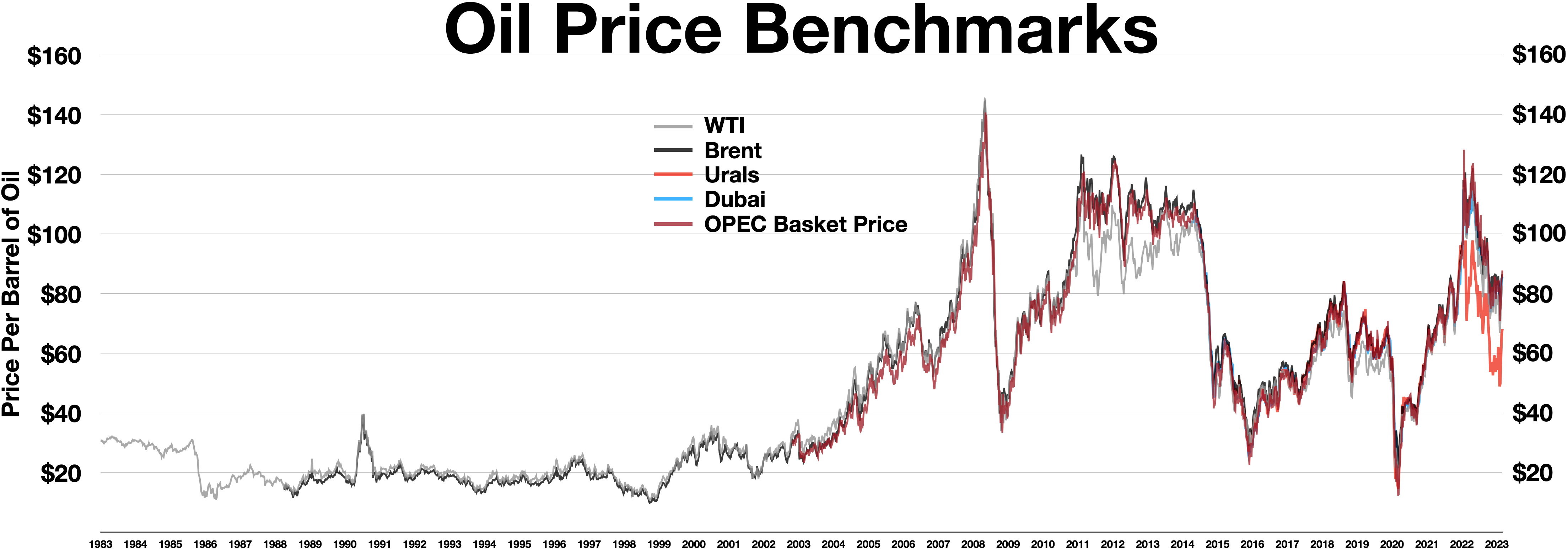

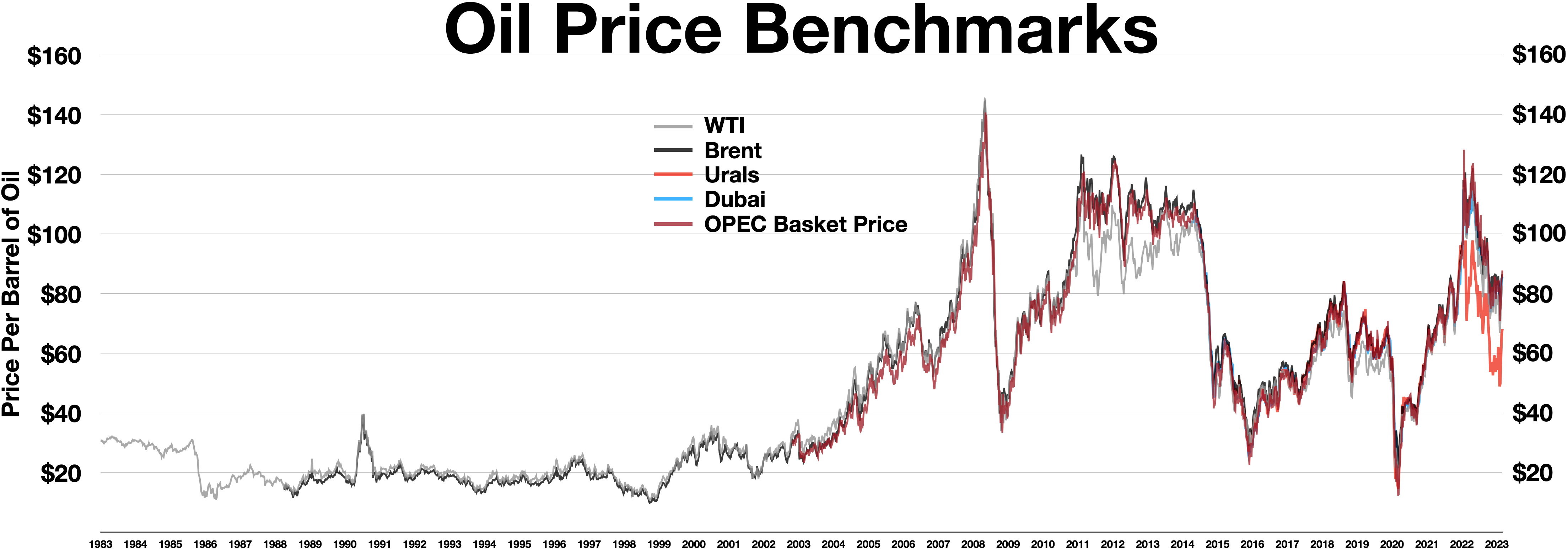

The 2022 Russian crude oil cap would be enforced by a maritime attestation that Russian crude was purchased below a certain set price, irrespective of market conditions. On 3 December 2022, this price cap has been set at USD $60 per barrel. G-7-based finance companies would only be allowed to provide transport and other services to Russian-based crude under these conditions.

Flow of Russian oil through pipelines has been exempted from the price capping on which land locked countries like Hungary is mostly dependent on for supply.

G7 and EU countries duplicated the price cap system over crude oil to provide a price cap on petroleum products from Russia, the price cap on refined oil products

Petroleum products are materials derived from crude oil (petroleum) as it is processed in oil refineries. Unlike petrochemicals, which are a collection of well-defined usually pure organic compounds, petroleum products are complex mixtures. The m ...

came into effect in early 2023.

By May 2023 the G7 countries considered the sanctions had been successful in achieving oil supply stability and reducing Russian tax revenue.

In August 2023 the price of Russian oil and diesel exceeded the cap.

Sanction Proposals

The Russian economy is heavily funded by oil and gas taxes. In 2021 Russia's revenue from all sources was $343 billion with oil and gas providing $127 billion. In 2022 revenue from all sources was $358 billion with oil and gas providing $166 billion or 46% of the budget. Oil revenue is a major sanction target.

French Finance Minister

The Russian economy is heavily funded by oil and gas taxes. In 2021 Russia's revenue from all sources was $343 billion with oil and gas providing $127 billion. In 2022 revenue from all sources was $358 billion with oil and gas providing $166 billion or 46% of the budget. Oil revenue is a major sanction target.

French Finance Minister Bruno Le Maire

Bruno Le Maire (; born 15 April 1969) is a French politician and former diplomat who has served as Minister of the Economy and Finance since 2017 under President Emmanuel Macron. A former member of The Republicans (LR), which he left in 2017 to ...

said the proposal would require wider international participation to be successful, saying "it should not be a Western measure against Russia, it should be a global measure against war." In response, Russia said it would suspend sales to countries supporting the price cap. Some energy analysts expressed skepticism that a price cap would be realistic because the coalition is "not broad enough"; OPEC+

The Organization of the Petroleum Exporting Countries (OPEC, ) is a cartel of countries. Founded on 14 September 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), it has, since 1965, been headquart ...

called the plan "absurd". The U.S. and the E.U. will likely attempt to follow through with the plan by limiting Russia's access to Western insurance services.

The level of the price cap was discussed at length between the parties to the agreement, the International Working Group on Russian Sanctions at FSI Stanford reported on 28 November 2022 that a price cap of USD75pb would be worse than having no price cap, whereas a price of USD55pb would reduce Russian oil revenue to USD166bn a restriction on finances for the Russian state, before recommending a cap of USD35pb as this would reduce revenue to USD100bn, giving a severe financial change, whilst still leaving the price above the cost of production.

The price cap level eventually agreed for the price cap was a balance between the levelling of Russia's revenue stream without causing a major disruption to global oil markets. It was also important to show Russia that Russia had lost the ability to disrupt the international economic order without facing pushback.

Russian production in 2021 was 540 million tonnes (4,030m barrels) of crude oil, with 260 million tonnes (1,940m barrels) (48%) exported as crude oil, 290 million tonnes was refined of which 140 million tonnes (48%) were exported as refined products. Over 70% of Russian produced oil is exported. Around 1,100m barrels of crude oil were exported by ship in 2021, 1,400m barrels in 2022, with 75% leaving from western and 25% from eastern ports.

Price Cap price

The G7 Oil Price Cap for crude oil of US$60 per barrel came into effect 5 December 2022. TheEuropean Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been des ...

had tentatively agreed on 1 December 2022 to set an initial USD60 barrel price cap on Russian seaborne oil with an adjustment mechanism to keep the cap at 5% below the market price, as reported by the International Energy Agency

The International Energy Agency (IEA) is a Paris-based autonomous intergovernmental organisation, established in 1974, that provides policy recommendations, analysis and data on the entire global energy sector, with a recent focus on curbing carb ...

, reviewed every two months. On 2 December 2022 the EU confirmed the price cap rate and joined the US, other G7 countries and Australia in imposing the sanction from 5 December 2022 with two monthly reviews on the level of the price cap.

Price cap review mid January 2023. With Russian Urals oil trading well below the Cap price, reducing Russian revenue, not all countries are willing to undertake the political trading to get agreement on a lower price cap at this time, preferring to wait and see how the cap on refined oil, due to come into effect on 5 February will work. G7 countries have agreed that the next review would be in March 2023 after the refined oil products price cap is set. No change was made in March or April.

Reactions

China

The pipeline to China is not affected by the sanctions, which only concerns shipped oil. The eastern oil is a higher quality than the western Urals oil, attracts a higher price and represents about 20-30% of Russia's production. Whilst China has not joined in the price cap it appears that they are increasing purchases from Russia whilst using the cap to argue for lower prices for future deliveries. The Chinese companyCOSCO Shipping

China COSCO Shipping Corporation Limited, abbreviated as COSCO Shipping, is a Chinese state-owned multinational conglomerate headquartered in Shanghai. The group is focused on marine transportation services. COSCO Shipping was established in J ...

appears to have pulled out of shipping oil from Far East Russian ports since 5 December where oil shipments have fallen by 50%. A Chinese shipping company believes China could divert up to 18 supertankers and 16 smaller Aframax

An Aframax vessel is an oil tanker with a deadweight between 80,000 and 120,000 metric tonnes. The term is based on the Average Freight Rate Assessment (AFRA), a tanker rate system created in 1954 by Shell Oil to standardize shipping contract ...

tankers in 2023 which could transport 110m barrels per annum, being 10% of shipped Russian Urals oil.

India

India has rejected the price cap, and Russia supported India's tanker fleet to enable them to ship Russian oil directly to India, bypassing the sanctions. In late 2022, India was buying around one shipload of 1m bpd. During December India increased Russian oil imports, receiving a discount of USD12-15pb which is around USD7pb higher discount than in October, giving a buy price below the price cap. Imports from Russia in 2022 totalled 33.4m tonnes (250m barrels).Russia

TheKremlin

The Kremlin ( rus, Московский Кремль, r=Moskovskiy Kreml', p=ˈmɐˈskofskʲɪj krʲemlʲ, t=Moscow Kremlin) is a fortified complex in the center of Moscow founded by the Rurik dynasty, Rurik dynasty. It is the best known of th ...

issued a presidential decree that prohibits Russian companies and any traders from selling oil to anyone that participates in a price cap. The decree also forbids dealings with both companies and countries that join the price-cap mechanism. This decree was amended in April 2023 to allow sales to "friendly countries", such as China and India.

With shipping insurance and reinsurance normally coming from Europe or the US and Lloyd's syndicates declaring Russian waters a war risk zone, making insurance hard to get and expensive, Russia is seeking to boost acceptance of its own shipping insurance through Russian National Reinsurance Company

Russian National Reinsurance Company (RNRC) is the largest Russian reinsurance company. Central Bank of Russia is a full shareholder of RNRC. The state-owned reinsurance company was set up in 2016. RNRC is No 1 in terms of the authorized share c ...

.

An experiment in sending one of its three ice-breaking oil tankers to China, sailing through the arctic circle north of Russia, has been tested, the journey is 3,300 miles and will take around 8 weeks.

It is believed that Russia has been purchasing around 100 old (12-15 year) oil tankers to create a " shadow fleet" in order to circumvent sanctions, and paying two to three times the normal price for tankers with ice-class ratings. Russia needs around 240 tankers for its current level of production.

On 4 December 2022 Russia stated that it rejected the price cap of USD60 but would wait before responding to the sanction. Three responses have been suggested, which could become operational at the end of December 2022, a ban on sales to the price Cap participants, (only Japan is still importing ship borne oil from Russia), setting a floor price where Russian producers could not sell crude oil below a pre determined price and thirdly a maximum discount on Russian crude oil compared to the market price of crude oil from other suppliers.

On 27 December 2022 Russia issued a decree applicable from 1 February 2023 until 1 July 2023 which banned the sale of crude oil and finished oil products to any country or company that, directly or indirectly, referred to the price cap in the contract.

Russia announced that its tax on oil production would be based on a $20-25 discount on Brent oil, rather than actual Urals oil prices, which will result in increased tax revenue and equivalent increased costs for producers.

Announced in February 2023 was a reduction in production of 5% (500,000 b/d) as a response to the price caps for whole of 2023.

Russia claims its exports had already involved different types of crude oil sources. The RF exported Urals crude, a type of commodity that undergoes particular dynamics controlled by Russia, and as these discounts are gradually reduced, income flows to Russia will increase again, "contributing to the gradual recovery of tax revenues from the oil sector, especially in the second half of 2023," according to TASS

The Russian News Agency TASS (russian: Информацио́нное аге́нтство Росси́и ТАСС, translit=Informatsionnoye agentstvo Rossii, or Information agency of Russia), abbreviated TASS (russian: ТАСС, label=none) ...

, quoting the Ministry of Finance.

To reduce the taxation impact of the sanctions, Russia set a maximum discount to Brent oil for tax purposes of $34 in April 2023, decreasing monthly to $25 in July 2023, resulting in oil companies paying higher taxes if the real discount is higher. Russia is also seeking to create a Ural price index, rather than using western indices, for tax revenue purposes.

Ukraine

Ukrainian presidentVolodymyr Zelenskyy

Volodymyr Oleksandrovych Zelenskyy, ; russian: Владимир Александрович Зеленский, Vladimir Aleksandrovich Zelenskyy, (born 25 January 1978; also transliterated as Zelensky or Zelenskiy) is a Ukrainian politicia ...

called the oil cap "a weak position" and not "serious" enough to damage to the Russian economy.

In December 2022 Ukraine provided the International Maritime Organization

The International Maritime Organization (IMO, French: ''Organisation maritime internationale'') is a specialised agency of the United Nations responsible for regulating shipping. The IMO was established following agreement at a UN conference ...

a list of 30 oil tankers that they believed were involved in ship to ship transfers of Russian oil, risking environment pollution. The tankers flagged by Malta, Greece, Panama and Liberia with some switching-off AIS AIS may refer to:

Medicine

* Abbreviated Injury Scale, an anatomical-based coding system to classify and describe the severity of injuries

* Acute ischemic stroke, the thromboembolic type of stroke

* Androgen insensitivity syndrome, an intersex ...

transponders.

OPEC

Global oil production was 100m bpd in 2022. The ten OPEC countries produce around 24.5m bpd and generally produce 1m bpd less than their target production. Russia is not in OPEC, its roughly 10m bpd comes into the OPEC+ number of around 40m bpd in 2022. SomeOPEC

The Organization of the Petroleum Exporting Countries (OPEC, ) is a cartel of countries. Founded on 14 September 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), it has, since 1965, been headquart ...

delegates attending an OPEC meeting in Vienna on 4 December 2022 believed that the production of Russian oil could decrease from the current 9.9m bpd by over 1m bpd because of the price cap. The International Energy Agency

The International Energy Agency (IEA) is a Paris-based autonomous intergovernmental organisation, established in 1974, that provides policy recommendations, analysis and data on the entire global energy sector, with a recent focus on curbing carb ...

believes the drop in production could be 1.4m bpd. Some OPEC delegates believe global production should be decreased to force the recent fall in oil prices back to a higher level, whilst others believe a small increase in production could be undertaken to fill the gap left by the predicted fall in Russian production. The OPEC decision was to not change production levels from those set in October 2022.

OPEC production in February 2023 was up 0.15m bpd from January but still 0.88m bpd short of the targeted production. In March OPEC oil shipped was 24.1m bpd up 0.53m bpd from February and 1m bpd higher than March 2022. addition to the existing 0.5m bpd cut by Russia, Saudi Arabia will cut oil production by a similar amount and Iran by 0.21m bpd, UAE, Kuwait, Algeria and Oman are making smaller cuts.

On 4 June 2023 at an OPEC meeting Saudi Arabia announced it would continue further cuts through 2024 as the oil price had fallen below the $80 level it needed to cover its budget, other countries, including OPEC+, agreed to continue their previous cuts.

Crude oil price, production per day and export duty

‡ excludinggas condensate

Natural-gas condensate, also called natural gas liquids, is a low-density mixture of hydrocarbon liquids that are present as gaseous components in the raw natural gas produced from many natural gas fields. Some gas species within the raw natur ...

† Export duty on crude oil from 2017 to 2020 averaged $100 per tonne, from 2020 to 2022 $50.

¶ Production data suppressed by Russia until April 2024

Operation of sanctions

Bulgaria

An exemption was given to Bulgaria by the EU in June 2022 to allow it to continue importing Russian crude oil by ship, subject to the Russian ownedLukoil

The PJSC Lukoil Oil Company ( stylized as LUKOIL or ЛУКОЙЛ in Cyrillic script) is a Russian multinational energy corporation headquartered in Moscow, specializing in the business of extraction, production, transport, and sale of petrol ...

refinery only being allowed to sell diesel locally or export it to Ukraine. The refinery was also required to pay taxes to Bulgaria, which it has not done for years. The exemption lasts until December 2024. In May 2023 Bulgaria imported 63,000 barrels p/d. In September 2023 Bulgaria took over the Black Sea oil terminal at Rosenets from Lukoil Neftohim, whose 35 year lease was terminated due to force majeure circumstances.

Trade routes

Since the onset of war, various sanctions and refusal to trade with a pariah nation, much of Russia's liquid petroleum products has been re-routed through terminals at the Baltic terminals Port of Ust-Luga and

Since the onset of war, various sanctions and refusal to trade with a pariah nation, much of Russia's liquid petroleum products has been re-routed through terminals at the Baltic terminals Port of Ust-Luga and Port of Primorsk

Primorsk Port (also ''Primorsk Commercial Sea Port'') is the largest Russian oil-loading port in the Baltic Sea and the end point of the Baltic Pipeline System. The port is located on the Björkösund mainland of the Gulf of Finland in the Baltic S ...

, likely the source for transfers off Ceuta

Ceuta (, , ; ar, سَبْتَة, Sabtah) is a Spanish autonomous city on the north coast of Africa.

Bordered by Morocco, it lies along the boundary between the Mediterranean Sea and the Atlantic Ocean. It is one of several Spanish territorie ...

. Russian oil exports from are expected to rise to 7.1m tonnes in January 2023 with 70% going to India.

Port of Novorossiysk

Novorossiysk Sea Port (russian: Новороссийский морской порт, NSP) is one of the largest ports in the Black Sea basin and the largest in Krasnodar Krai. At 8.3 km, the NSP berthing line is the longest among all the ports o ...

and Tuapse oil terminal maritime locations on the Black Sea

The Black Sea is a marginal mediterranean sea of the Atlantic Ocean lying between Europe and Asia, east of the Balkans, south of the East European Plain, west of the Caucasus, and north of Anatolia. It is bounded by Bulgaria, Georgia, Roma ...

were likely the source for ship-to-ship transfers in the Greek Bay of Lakonikos. Another report places the transfers from Aframax

An Aframax vessel is an oil tanker with a deadweight between 80,000 and 120,000 metric tonnes. The term is based on the Average Freight Rate Assessment (AFRA), a tanker rate system created in 1954 by Shell Oil to standardize shipping contract ...

-class vessels to VLCC

An oil tanker, also known as a petroleum tanker, is a ship designed for the bulk transport of oil or its products. There are two basic types of oil tankers: crude tankers and product tankers. Crude tankers move large quantities of unrefined crud ...

s bound for China

China, officially the People's Republic of China (PRC), is a country in East Asia. It is the world's most populous country, with a population exceeding 1.4 billion, slightly ahead of India. China spans the equivalent of five time zones and ...

off Gibraltar

)

, anthem = " God Save the King"

, song = " Gibraltar Anthem"

, image_map = Gibraltar location in Europe.svg

, map_alt = Location of Gibraltar in Europe

, map_caption = United Kingdom shown in pale green

, mapsize =

, image_map2 = Gib ...

. In the east of the country, the Port of Kozmino is the terminus of the Eastern Siberia-Pacific Ocean pipeline; Rosneft

PJSC Rosneft Oil Company ( stylized as ROSNEFT) is a Russian Vertical integration, integrated energy company headquartered in Moscow. Rosneft specializes in the exploration, Extraction of petroleum, extraction, production, refining, Petroleum t ...

, Gazpromneft Invest Union (formerly Gazpromneft) is a Russian company based in St. Petersburg and a former subsidiary of Gazprom. It is not to be confused with Gazprom Neft (formerly Sibneft), which is another company.

On 19 December 2004, Gazpromneft (along wi ...

and Surgutneftegas

Surgutneftegas ( rus, ПАО «Сургутнефтегаз», p=sʊrɡʊtnʲɪftʲɪˈɡas) is a Russian oil and gas company created by merging several previously state-owned companies owning large oil and gas reserves in Western Siberia. The ...

use it to funnel their product through intermediaries to China.

An analyst says "the Russians are just taking a page out of that same book and they're sort of copying what the Iranians and the Venezuelans did" and using a shadow fleet of approximately 250 vessels. The United Arab Emirates

The United Arab Emirates (UAE; ar, اَلْإِمَارَات الْعَرَبِيَة الْمُتَحِدَة ), or simply the Emirates ( ar, الِْإمَارَات ), is a country in Western Asia (The Middle East). It is located at th ...

is developing as a favoured location for anonymous ship holding companies, as well as Shanghai

Shanghai (; , , Standard Mandarin pronunciation: ) is one of the four direct-administered municipalities of the People's Republic of China (PRC). The city is located on the southern estuary of the Yangtze River, with the Huangpu River flow ...

. Greek shipowners have been doing business with Russians since the 19th century and they intend not to stop. Another report suggests that the Gulf of Lakonikos is a favourite transfer point because it is sheltered and Greek territorial waters extend only to six nautical miles from the shoreline.

Oil tankers

Around 55 percent of the tankers that transport Russian oil out of the country were Greek-owned, they can continue operating provided the price cap conditions are met. In December the percentage of Greek-owned ships moving Russian oil fell to 33% with the gap being filled by shadow fleet tankers. Cyprus reported that in two months from the beginning of October 2022, around 20% (900,000 gross tonnes) of their flagged oil tanker fleet have departed, by changing their registry. Higher losses being recorded in Greek and Maltese fleets.

It is believed that Russia has been experimenting with altering a ship transponder to avoid sanctions, with a tanker, the ''Kapitan Schemilkin'' giving in May to July 2022 a location near Greece when the tanker was near Malta, satellite imagery was used to prove the false location and identify the tanker's real position.

Ship to ship transfers of crude oil in the Mediterranean hit a record high in January of 1.7m tonnes as smaller tankers transferred their loads to larger vessels for onward transport to the Far East.

The rates that tankers can charge has risen, with a fee of $10.5m to transport 700,000b of crude, sold below the price cap, from the Baltic to India in January, compared to a fee a year earlier of $1m. In March

Around 55 percent of the tankers that transport Russian oil out of the country were Greek-owned, they can continue operating provided the price cap conditions are met. In December the percentage of Greek-owned ships moving Russian oil fell to 33% with the gap being filled by shadow fleet tankers. Cyprus reported that in two months from the beginning of October 2022, around 20% (900,000 gross tonnes) of their flagged oil tanker fleet have departed, by changing their registry. Higher losses being recorded in Greek and Maltese fleets.

It is believed that Russia has been experimenting with altering a ship transponder to avoid sanctions, with a tanker, the ''Kapitan Schemilkin'' giving in May to July 2022 a location near Greece when the tanker was near Malta, satellite imagery was used to prove the false location and identify the tanker's real position.

Ship to ship transfers of crude oil in the Mediterranean hit a record high in January of 1.7m tonnes as smaller tankers transferred their loads to larger vessels for onward transport to the Far East.

The rates that tankers can charge has risen, with a fee of $10.5m to transport 700,000b of crude, sold below the price cap, from the Baltic to India in January, compared to a fee a year earlier of $1m. In March VLCC

An oil tanker, also known as a petroleum tanker, is a ship designed for the bulk transport of oil or its products. There are two basic types of oil tankers: crude tankers and product tankers. Crude tankers move large quantities of unrefined crud ...

tanker rates were on average 108% higher than March 2022, Suezmax

"Suezmax" is a naval architecture term for the largest ship measurements capable of transiting the Suez Canal in a laden condition, and is almost exclusively used in reference to tankers. The limiting factors are beam, draft, height (because ...

rates were up 56% and Aframax

An Aframax vessel is an oil tanker with a deadweight between 80,000 and 120,000 metric tonnes. The term is based on the Average Freight Rate Assessment (AFRA), a tanker rate system created in 1954 by Shell Oil to standardize shipping contract ...

up 40% on 2022.

By February 2023 around 400 tankers (20% of the world fleet) have changed to transporting Russian oil, leading to a shortage of tankers elsewhere and increasing shipping costs.

Gatik Ship Management, based in Mumbai

Mumbai (, ; also known as Bombay — the official name until 1995) is the capital city of the Indian state of Maharashtra and the ''de facto'' financial centre of India. According to the United Nations, as of 2018, Mumbai is the second- ...

, India, increased their fleet from 2 to over 58 tankers in two years by buying up old oil tankers costing around $1.3 billion, becoming the largest "dark-fleet" operator. Suspected of being tied to Russian oil company Rosneft

PJSC Rosneft Oil Company ( stylized as ROSNEFT) is a Russian Vertical integration, integrated energy company headquartered in Moscow. Rosneft specializes in the exploration, Extraction of petroleum, extraction, production, refining, Petroleum t ...

, 21 ships lost American Bureau of Shipping

American(s) may refer to:

* American, something of, from, or related to the United States of America, commonly known as the "United States" or "America"

** Americans, citizens and nationals of the United States of America

** American ancestry, pe ...

listing and 21 their Lloyd's Register

Lloyd's Register Group Limited (LR) is a technical and professional services organisation and a maritime classification society, wholly owned by the Lloyd’s Register Foundation, a UK charity dedicated to research and education in science and ...

listing, 36 ships were de-flagged in April 2023 ships also lost their USA insurance cover after the company was suspected of shipping Russian oil costing more than the price cap level. Since then, 30 vessels have moved from Gatik management to other companies, Mongolia and Gabon have flagged a number of ships and 36 have joined the Indian Register of Shipping

Indian Register of Shipping (IRClass) is an internationally recognised, independent ship classification society, founded in India in 1975. It is a public limited company incorporated under Section 25 of the Indian Companies Act 1956 (Section 8 o ...

listing.

Concern over safety has resulted in Singapore holding 33 oil and chemical tankers that have failed inspections in the last year, more than in a normal decade, many of the ships are older, "shadow fleet" ones. China has also been undertaking additional checks on ships over 20 years old, delaying them, often for weeks. The tanker ''Titan'', which has had seven different names and is managed through a postbox in the Seychelles failed a safety check in China on 23 counts.

The June 2023 11th round of sanctions bans any tankers that have transhipped oil at sea from entering sanctioning countries territorial waters, as are tankers that have switched off their transponders whilst in Russian territorial waters or to hide the fact that they have transhipped oil from Russia.

EU terms of Oil Price Cap

The EU introduced rules similar to the USA rules with a 45-day wind down for the regulations and changes to enable ships to comply. EU parties may not deal with any vessel that within the previous 90 days had discharged Russian oil at a price over the cap level. Any price cap changes will require a unanimous decision of the 27 EU Member States comprising the Council.UK terms of Oil Price Cap

The Office of Financial Sanctions Implementation (OFSI) is responsible for the sanctions in the UK and Overseas Territories. Crown Dependencies, as well as Bermuda and Gibraltar will legislate themselves. The rules follow those published by the US and include oil directly shipped from Russia, the transfer of goods between ships and the mixing of loads from different countries. The permitted maximum monetary penalty is the greater of £1,000,000 or 50% of the estimated value of the breach. A licence can give written permission from OFSI to allow an act that would otherwise breach prohibitions imposed by sanctions.USA terms of Oil Price Cap

On 22 November 2022 theOffice of Foreign Assets Control

The Office of Foreign Assets Control (OFAC) is a financial intelligence and enforcement agency of the U.S. Treasury Department. It administers and enforces economic and trade sanctions in support of U.S. national security and foreign policy ob ...

(OFAC) in the USA published guidance on the operation of the Price Cap Policy.

A coalition of G7 countries, the European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been des ...

and Australia

Australia, officially the Commonwealth of Australia, is a Sovereign state, sovereign country comprising the mainland of the Australia (continent), Australian continent, the island of Tasmania, and numerous List of islands of Australia, sma ...

have agreed to prohibit the import of crude oil and petroleum products of Russian origin, supported by a broad range of companies involved in the transport of oil.

The object is to maintain the supply of oil whilst reducing the revenue of the Russian Federation

Russia (, , ), or the Russian Federation, is a List of transcontinental countries, transcontinental country spanning Eastern Europe and North Asia, Northern Asia. It is the List of countries and dependencies by area, largest country in the ...

.

US persons will be permitted to undertake services relating to:

* Trading/commodities brokering

* Financing

* Shipping

* Insurance, including reinsurance and protection and indemnity

* Flagging

* Customs brokering

under the condition that the oil price is the same as the Price Cap or lower.

Oil loaded before 12:01 am on 5 December 2022 and delivered before 12:01 am 19 January 2023 will be exempt.

Oil cannot be shipped to a jurisdiction that has a ban on the import of oil from the Russian Federation, such as the USA.

Sanctions cease when the oil is landed outside of Russian territory and handed to the purchaser.

On 21 December the US and OFAC agreed to grant some exemptions, such as if the oil is for humanitarian UN or Red Cross

The International Red Cross and Red Crescent Movement is a Humanitarianism, humanitarian movement with approximately 97 million Volunteering, volunteers, members and staff worldwide. It was founded to protect human life and health, to ensure re ...

purposes.

Effect of price cap sanctions

December 2022

The number of sales of oil tankers in 2022 broke the 2021 levels with buyers for old oil tankers reported in the Middle East, in early December 2022 the charter price of a tanker in the Mediterranean was reported to have risen from 80,000 to USD 130,000 per day if carrying oil from Russia. On 8 December 2022 Norway and Switzerland announced that they were joining the price cap sanctioning countries. In the first week, Russian oil price at Baltic ports was reported as being as low as USD45.10 pb. Seaborne exports also fell by around 500,000 bpd. From 5 December 2022 Turkey demanded proof of full insurance on all tankers proposing to use its straits, to enter or leave the Black Sea, causing a traffic jam of tankers. The temporary holdup was resolved by 12 December. On 27 December 2022 in response Russia has ordered to ban all oil sales to countries and companies which have agreed on the oil price cap starting 1 February 2023 to the next five months. The EU, by 31 December, had reduced their import of Russian oil and oil products by 90% and whilst Russia continues to sell oil to other countries, the price obtained is on average USD30 per barrel less than oil on the global market. This is a material drop in revenue for Russia. December saw Russia pumping an average of 10.9m b/d with seaborne oil exports averaged 2.65m b/d a decrease of 14% on November and the lowest month in 2022, with 71% heading to Asia compared to 26% in 2021. 60% of Russian oil transported in December was in tankers controlled byUAE

The United Arab Emirates (UAE; ar, اَلْإِمَارَات الْعَرَبِيَة الْمُتَحِدَة ), or simply the Emirates ( ar, الِْإمَارَات ), is a country in Western Asia (The Middle East). It is located at th ...

, China, India and Russia, twice previous levels.

January - February 2023

The USA believe African countries can benefit from the Price Cap by buying oil from Russia at discounted prices, saving up to USD6 billion p.a. Japan managed to reduce their import of Russian oil by 56%, reducing it to just 1.46% of its oil imports in 2022. Russian revenue from oil export duty reportedly fell from USD120m per week to USD47m a week after sanctions came into effect, a fall of 60%. In the 4 weeks to 27 January, around 1.1m b/d of shipped Russian crude oil was moved by tankers that did not indicate their destination. Malaysia has reported increasing their crude oil sales to China to 1.5m b/d even though Malaysia only produces 400,000 b/d. Oil and gas export revenue fell $8b (30%) in January compared to January 2022. Total oil exports amounted to just $13b (down 36% from December sales). On 10 February Russia announced that in March, Russia will reduce oil production by 500,000 b/d, around 5% of January and February production. Being a drop of 25% in exports from western ports. The Danish owned "Maersk

(), also known simply as Maersk (), is a Danish shipping company, active in ocean and inland freight transportation and associated services, such as supply chain management and port operation. Maersk was the largest container shipping line a ...

Magellan" tanker was refused entry into a Spanish port after it had collected a trans shipped load of diesel oil from Vietnamese-flagged product tanker "Elephant" which had acquired it from Cameroon-registered "Nobel" tanker, a ship registered in Russia until 1 July 2022, Elephant was fined $130,000 for breaching Spanish rules. Maersk Magellan transhipped its oil to another ship outside the EU in mid March. Three ships have been detained in Europe, Vietnam-flagged "Melogy" and "Elephant" and Liberia-flagged "HS Arge". Three tankers belonging to Sovcomflot

Sovcomflot (russian: ПАО «Совкомфлот», ПАО «Современный коммерческий флот», , Modern Commercial Fleet). Sovcomflot is Russia's largest shipping company, and one of the global leaders in the maritime ...

are being de-flagged by Cyprus as they belong to a sanctioned entity.

Oil and gas tax mineral extraction tax (MET) fell to $6.9 billion (521 billion Rubles) in February according to Russian Finance Ministry. This is 46% lower than February 2022. Oil export revenue in February was $11.6 billion, compared to $14.3 billion in January (18% fall) and $20 billion in February 2022 (42% fall).

March - April 2023

Russian oil and gas mineral extraction tax (MET) in March was lower than February, but was boosted by a 220 billion roubles quarterly profit-based tax on oil companies giving a total monthly income of $8.7 billion (688 billion roubles), 43% down compared to March 2022. Russian oil exports reach highest since February 2022. In March 2023, unidentified tankers, shipping oil through theGulf of Finland

The Gulf of Finland ( fi, Suomenlahti; et, Soome laht; rus, Фи́нский зали́в, r=Finskiy zaliv, p=ˈfʲinskʲɪj zɐˈlʲif; sv, Finska viken) is the easternmost arm of the Baltic Sea. It extends between Finland to the north and E ...

after the G7 implemented a $60 price cap on Russian oil, were noted by a lieutenant commander

Lieutenant commander (also hyphenated lieutenant-commander and abbreviated Lt Cdr, LtCdr. or LCDR) is a commissioned officer rank in many navies. The rank is superior to a lieutenant and subordinate to a commander. The corresponding rank i ...

of the Finnish navy

The Finnish Navy ( fi, Merivoimat, sv, Marinen) is one of the branches of the Finnish Defence Forces. The navy employs 2,300 people and about 4,300 conscripts are trained each year. Finnish Navy vessels are given the ship prefix "FNS", short for ...

. He warned that a lack of transparency could increase the risk of collisions and oil spills there. Consequences of maritime incidences from oil tankers would pose a significant risk to oceans and shoreline communities across the world, according to the statement. Ghost ship

A ghost ship, also known as a phantom ship, is a vessel with no living crew aboard; it may be a fictional ghostly vessel, such as the ''Flying Dutchman'', or a physical derelict found adrift with its crew missing or dead, like the ''Mary Celest ...

s are not only used by Russian entities but other maritime shipping companies to evade sanctions.

The threat of OPEC+ reductions caused the price of Ural oil to rise just past the Price Cap of $60. The third largest bank in India, the State Bank of India

State Bank of India (SBI) is an Indian multinational public sector bank and financial services statutory body headquartered in Mumbai, Maharashtra. SBI is the 49th largest bank in the world by total assets and ranked 221st in the ''Fortune ...

, advised that it would not process transactions in breach of the price cap. Around 20% of tankers collect fuel from the eastern Russian ports. Greek tankers moved around 40% of Russian oil in March but this will cease if the Ural price exceeds the price cap.

OFAC

The Office of Foreign Assets Control (OFAC) is a financial intelligence and enforcement agency of the U.S. Treasury Department. It administers and enforces economic and trade sanctions in support of U.S. national security and foreign policy o ...

issued an alert regarding possible sanction breaking with tankers using eastern ports turning off their Automatic Identification Systems (AIS).

January to April Urals price averaged $51 per barrel compared to an average price on $85 in the same period of 2022. Contrary to Russia's announcement of falling production, exports of shipborne oil by Russia increased in April.

May - June 2023

In the 6 weeks to 28 May seaborne exports averaged 3.64m b/d which was 1.4m b/d higher than in December 2022 and 0.27m b/d higher than February 2023. The 4 week average export tax revenue to 28 May was $50m per week, down $3m from April and considerably less than the $140m per week average for 2020-2022. China and India bought 80% of Russian crude oil in May, 2.2m b/d and 2m b/d. Tankers in May and June were receiving premiums of 60% to 100% over non Russian oil freight rates. 45% of Russian crude oil was transported by tankers with P&I Club insurance in June 2023. It is estimated that Russia's shadow fleet contains 131 tankers, 99 over 15 years old.July - August 2023

Russia announced on 7 July a reduction of 500,000 b/d in exports from 1 August 2023 to compliment its already announced reduction in production. In August 2023 the price of Russian oil exceeded the cap and reached $73.57 per barrel. Over 50% of Russian oil is transported by a shadow fleet of tankers operating outside western financial and insurance circles. Despite the rise in crude oil price, the drop in volume meant that Russia had the second lowest revenue month for seaborne crude oil sales in July since the invasion took place. China reduced their purchases of crude oil from Russia by 20% in July. In August India reduced theirs by 22%, from 2.1m b/d to 1.63m b/d. Poland stated that their oil companies had chartered 10 tankers that had shipped Russian Urals crude oil to the Far East, to bring Middle East crude oil to Poland on the return journey. This only being possible if the tankers were not Russian and had not transhipped oil or carried oil above the price cap price, or they would face arrest.Analysis of Economic Impact

Russia's Finance MinisterAnton Siluanov

Anton Germanovich Siluanov ( rus, Анто́н Ге́рманович Силуа́нов, p=ɐnˈton ˈɡʲɛrmənəvʲɪtɕ sʲɪlʊˈanəf; born 12 April 1963) is a Russian politician and economist serving as Minister of Finance since 2011. H ...

said in late December 2022 that the effect of the price cap may increase Russia's budget deficit of 2% for 2023. Russia claims their actions in diverting oil to other buyers has effectively eliminated effects of the direct price cap on the Russian economy. The economic cost to Russia of losing the European market is huge, both in redundant pipelines and facilities and in lost future revenue.

The average price for Russian crude oil in January 2023 was $49.48pb down 42% in January 2022 prices and well below the $60pb price cap. Early projections by the EU estimated that the price cap on Russian oil would cost Russia around 160m euros ($175m) every day ($60b pa). While some analysts have ascertained that reduced earnings for the Russian energy sector in late 2022 and early 2023 were due to the price cap, others have noted that commodity prices have fallen in that period, crude by at least 20%.

The economic impact of the sanctions in the first quarter on Russian revenues are clearly shown in the total oil and gas revenue received by Russia in quarter 1 of 2023 was 1.6 trillion rubles ($19.61 billion), compared to an average of $42 billion per quarter in 2022 (down 41%) and $32 billion per quarter in 2021.

A US Treasury report in May 2023 highlighted that Russian oil exports were continuing to rise, providing stability in the world market, as planned, whilst Russia's revenue was being restrained by the price cap to $5-6 billion per month, compared with $8-15 billion a month in 2022. Russia now levies more tax on oil producers to help offset falling revenue. Market participants and geopolitical analysts now acknowledge that the price cap is accomplishing both of its goals.

Russia's revenue from oil and gas remained low in the second quarter of 2023 with June oil and revenues at 528 billion rubles, the total for the half year being 3.38 trillion rubles ($37.4 billion).

Russia remains reliant on the European & G7 shipping industry to freight 50% of its crude and 65% of its processed oil.

In July 2023, the price for Urals crude for the first time topped the price of 60$ per barrel, and this was seen as the first real test whether the price cap is effective. Urals oil

Urals oil is a reference oil brand used as a basis for pricing of the Russian export oil mixture. It is a mix of heavy sour oil of Urals and the Volga region with light oil of Western Siberia. Other reference oils are Brent, West Texas Interme ...

is a mixture of petroleum from different Russian oil fields and the main type of oil Russia exports. Many nations such as India and China had been purchasing Russian oil at a discount set by Russia, and the current price increase triggered by a renewed OPEC cut and voluntary reduction of Russian crude exports were seen as critical factors that could undermine the sanctions regime implemented by the E.U. the U.S. and other Western nations. Overall volumes of Russian crude have fluctuated after the onset of the war but did not meaningfully decline except by those reductions set by Russia. Furthermore over half of maritime exports of Russian crude to India and China do not directly involve E.U or US-based insurance services. Russia reduced discounts on crude exports and at the same time lowered tax revenue streams from exported oil. In September 2023, G7/EU appear to have paused its Russian oil cap reviews.Insurance Marine News. Accessed 9 Sep 2023.

See also

* * * *External links

OFAC Guidance on Implementation of the Price Cap Policy

References

{{2022 Russian invasion of Ukraine, Impact Sanctions and boycotts during the Russo-Ukrainian War 2020s in international relations Foreign relations of Russia International sanctions Sanctions against Russia Reactions to the Russian invasion of Ukraine