Deutsche Bank AG (), sometimes referred to simply as Deutsche, is a German multinational

investment bank

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing is ...

and

financial services

Financial services are the Service (economics), economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, acco ...

company headquartered in

Frankfurt, Germany, and dual-listed on the

Frankfurt Stock Exchange

The Frankfurt Stock Exchange (german: link=no, Börse Frankfurt, former German name – FWB) is the world's 12th largest stock exchange by market capitalization. It has operations from 8:00 am to 10:00 pm ( German time).

Organisation

Locat ...

and the

New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed c ...

. It was founded in 1870 and grew through multiple acquisitions, including

Disconto-Gesellschaft in 1929 (as a consequence of which it was known from 1929 to 1937 as Deutsche Bank und Disconto-Gesellschaft or "DeDi-Bank"),

Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corpor ...

in 1998, and

Deutsche Postbank in 2010.

As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. As of 2021, Deutsche Bank was the

21st largest bank in the world by total assets and 93rd in the world by market capitalization.

It is a component of the

DAX

Dax or DAX may refer to:

Business and organizations

* DAX, stock market index of the top 40 German companies

** DAX 100, an expanded index of 100 stocks, superseded by the HDAX

** TecDAX, stock index of the top 30 German technology firms

* Dax ...

stock market index, and often referred to as the

largest German banking institution even though the

Sparkassen-Finanzgruppe

The ''Sparkassen-Finanzgruppe'' ("Savings Banks Financial Group") is a network of public banks that together form the largest financial services group in Germany and in all of Europe. Its name refers to local government-controlled savings banks t ...

comes well ahead in terms of combined assets. Deutsche Bank has been designated as a global

systemically important bank by the

Financial Stability Board

The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. It was established after the G20 London summit in April 2009 as a successor to the Financial Stability Forum ...

since 2011.

Deutsche Bank is a

universal bank

A universal bank participates in many kinds of banking activities and is both a commercial bank and an investment bank as well as providing other financial services such as insurance.deal flow

Deal flow is a term used by finance professionals such as venture capitalists, angel investors, private equity investors and investment bankers to refer to the rate at which they receive business proposals/investment offers. The term is also use ...

.

According to the ''New Yorker'', Deutsche Bank has long had an "abject" reputation among major banks, as it has been involved in major scandals across different issue areas.

History

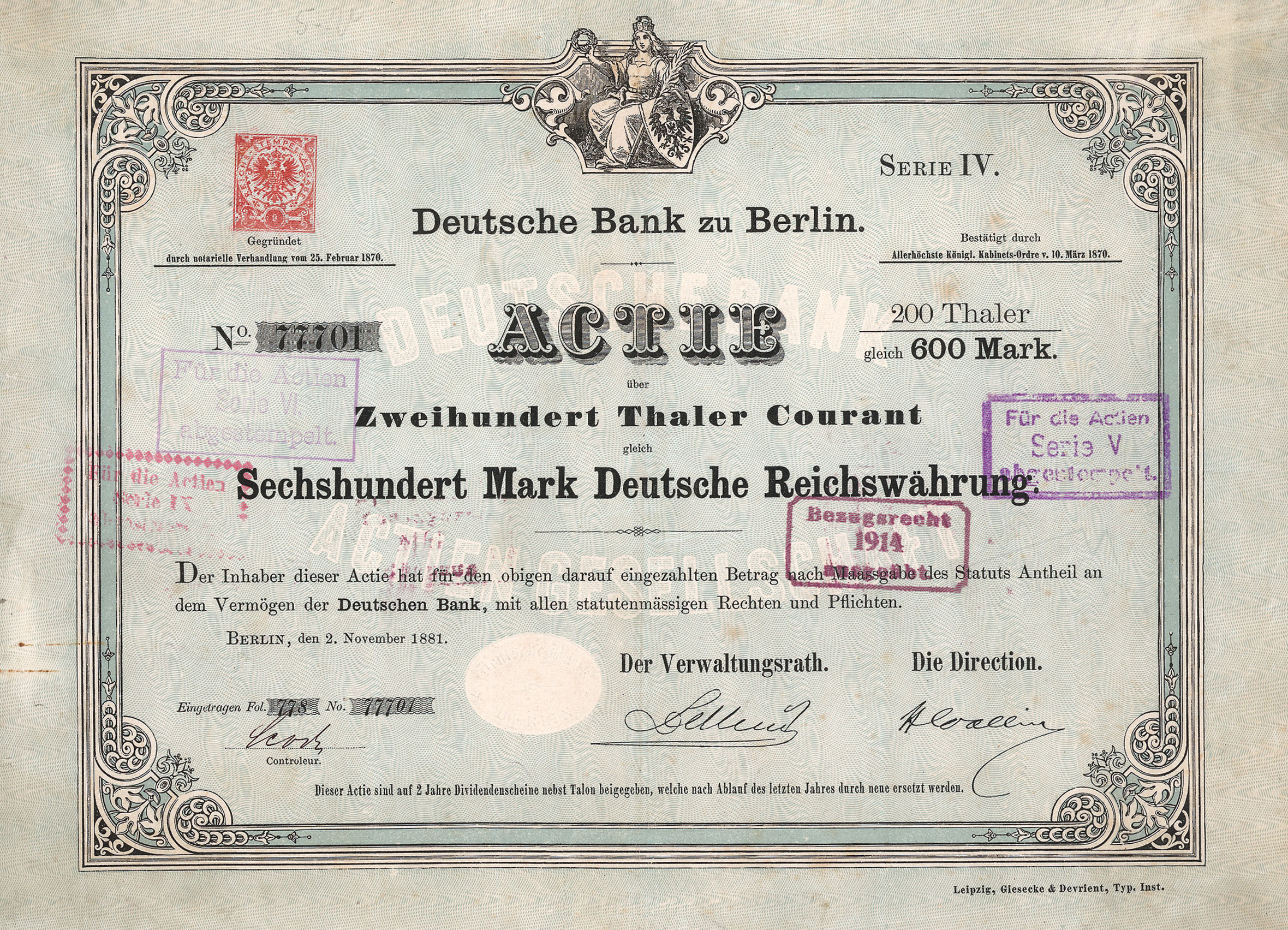

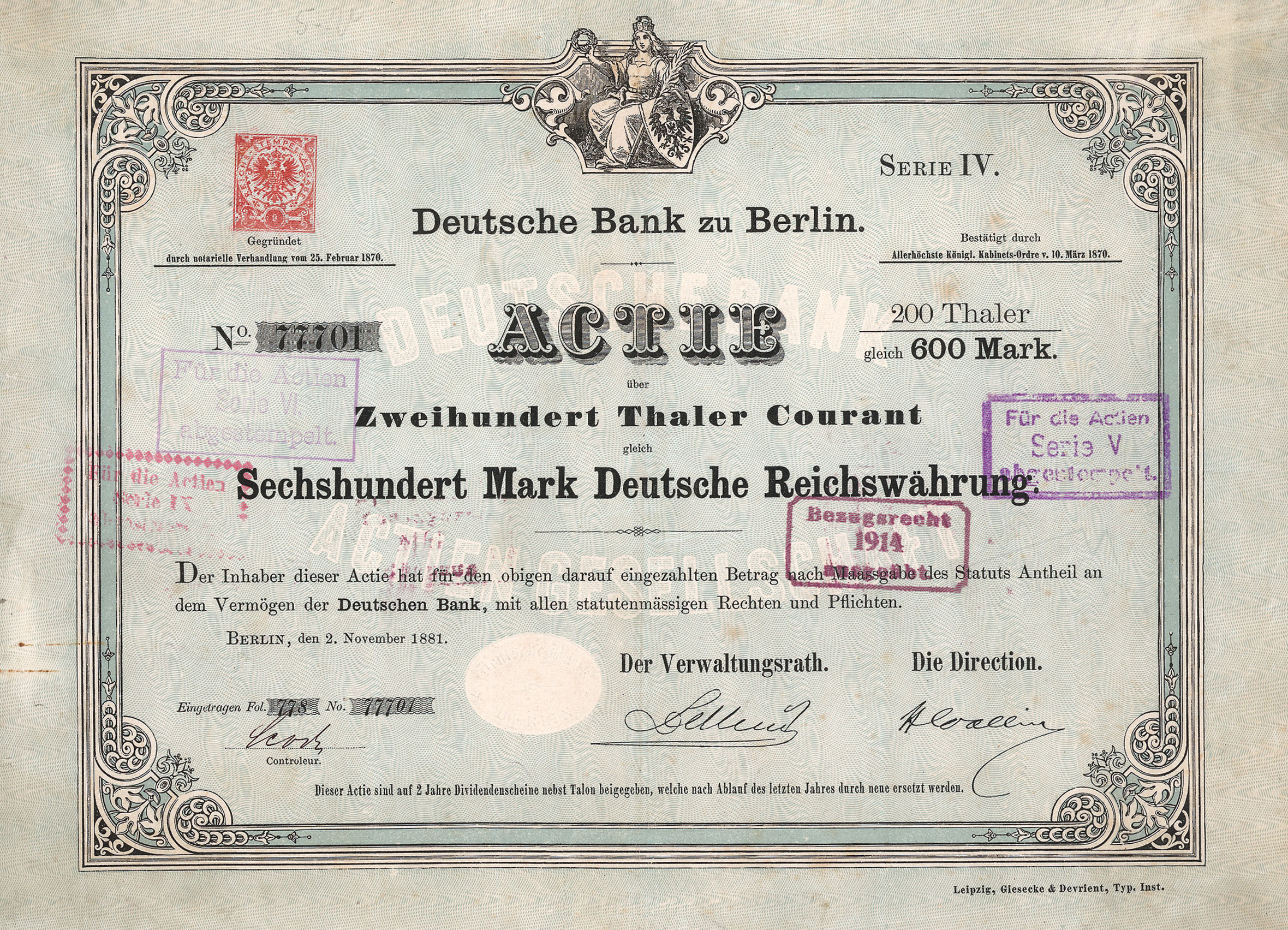

1870–1919

Deutsche Bank was founded on 1870 in

Berlin

Berlin ( , ) is the capital and largest city of Germany by both area and population. Its 3.7 million inhabitants make it the European Union's most populous city, according to population within city limits. One of Germany's sixteen constitue ...

as a specialist bank for financing foreign trade and promoting German exports.

It subsequently played a large part in developing Germany's financial services industry, as its business model focused on providing finance to industrial customers.

The bank's statute was adopted on 22 January 1870, and on 10 March 1870 the

Prussia

Prussia, , Old Prussian: ''Prūsa'' or ''Prūsija'' was a German state on the southeast coast of the Baltic Sea. It formed the German Empire under Prussian rule when it united the German states in 1871. It was ''de facto'' dissolved by an em ...

n government granted it a banking license. The statute laid great stress on foreign business:

Three of the founders were Georg Siemens, whose father's cousin had founded

Siemens and Halske;

Adelbert Delbrück and

Ludwig Bamberger

Ludwig Bamberger (22 July 1823 – 14 March 1899) was a German Jewish economist, politician, revolutionary and writer.

Early life

Bamberger was born into the wealthy Ashkenazi Jewish Bamberger family in Mainz. After studying at Giessen, Heid ...

.

Prior to the founding of Deutsche Bank, German importers and exporters were dependent upon British and French banking institutions in the world markets—a serious handicap in that German

bills were almost unknown in international commerce, generally disliked and subject to a higher rate of a discount than English or French bills.

Founding members

*

Hermann Zwicker (Bankhaus Gebr. Schickler, Berlin)

*

Anton Adelssen (Bankhaus Adelssen & Co., Berlin)

*

Adelbert Delbrück (Bankhaus Delbrück, Leo & Co.)

*

Heinrich von Hardt (Hardt & Co., Berlin, New York)

*

Ludwig Bamberger

Ludwig Bamberger (22 July 1823 – 14 March 1899) was a German Jewish economist, politician, revolutionary and writer.

Early life

Bamberger was born into the wealthy Ashkenazi Jewish Bamberger family in Mainz. After studying at Giessen, Heid ...

(politician, former chairman of Bischoffsheim, Goldschmidt & Co)

*

Victor Freiherr von Magnus (Bankhaus F. Mart Magnus)

* (Bankhaus Deichmann & Co., Cologne)

*

Gustav Kutter (Bankhaus Gebrüder Sulzbach, Frankfurt)

* Gustav Müller (Württembergische Vereinsbank, Stuttgart)

First directors

* Wilhelm Platenius,

Georg Siemens and

Hermann Wallich

Hermann Wallich (December 28, 1833 – April 30, 1928) was a German Jewish banker.

Together with Georg von Siemens, he co-founded Deutsche Bank.

Hermann Wallich was born in Bonn. He married Anna Jacoby in 1875. The couple had a son, Paul Wallich ...

The bank's first domestic branches, inaugurated in 1871 and 1872, were opened in

Bremen

Bremen (Low German also: ''Breem'' or ''Bräm''), officially the City Municipality of Bremen (german: Stadtgemeinde Bremen, ), is the capital of the German state Free Hanseatic City of Bremen (''Freie Hansestadt Bremen''), a two-city-state consis ...

and

Hamburg

(male), (female) en, Hamburger(s),

Hamburgian(s)

, timezone1 = Central (CET)

, utc_offset1 = +1

, timezone1_DST = Central (CEST)

, utc_offset1_DST = +2

, postal ...

. Its first oversea-offices opened in Shanghai in 1872 and London in 1873 followed by South American offices between 1874 and 1886.

The branch opening in London, after one failure and another partially successful attempt, was a prime necessity for the establishment of credit for the German trade in what was then the world's money center.

[

Major projects in the early years of the bank included the Northern Pacific Railroad in the US and the Baghdad Railway (1888). In Germany, the bank was instrumental in the financing of bond offerings of steel company ]Krupp

The Krupp family (see pronunciation), a prominent 400-year-old German dynasty from Essen, is notable for its production of steel, artillery, ammunition and other armaments. The family business, known as Friedrich Krupp AG (Friedrich Krup ...

(1879) and introduced the chemical company Bayer

Bayer AG (, commonly pronounced ; ) is a German multinational corporation, multinational pharmaceutical and biotechnology company and one of the largest pharmaceutical companies in the world. Headquartered in Leverkusen, Bayer's areas of busi ...

to the Berlin stock market.

The second half of the 1890s saw the beginning of a new period of expansion at Deutsche Bank. The bank formed alliances with large regional banks, giving itself an entry into Germany's main industrial regions. Joint ventures were symptomatic of the concentration then under way in the German banking industry. For Deutsche Bank, domestic branches of its own were still something of a rarity at the time; the Frankfurt branch dated from 1886 and the Munich branch from 1892, while further branches were established in Dresden and Leipzig in 1901.

In addition, the bank rapidly perceived the value of specialist institutions for the promotion of foreign business. Gentle pressure from the Foreign Ministry played a part in the establishment of Deutsche Ueberseeische Bank in 1886 and the stake taken in the newly established Deutsch-Asiatische Bank three years later, but the success of those companies showed that their existence made sound commercial sense.

1919–1933

In 1919, the bank purchased the state's share of Universum Film Aktiengesellschaft (Ufa).

In 1919, the bank purchased the state's share of Universum Film Aktiengesellschaft (Ufa).

1933–1945

After Adolf Hitler

Adolf Hitler (; 20 April 188930 April 1945) was an Austrian-born German politician who was dictator of Nazi Germany, Germany from 1933 until Death of Adolf Hitler, his death in 1945. Adolf Hitler's rise to power, He rose to power as the le ...

came to power, instituting the Third Reich, Deutsche Bank dismissed its three Jewish

Jews ( he, יְהוּדִים, , ) or Jewish people are an ethnoreligious group and nation originating from the Israelites Israelite origins and kingdom: "The first act in the long drama of Jewish history is the age of the Israelites""The ...

board members in 1933.Gestapo

The (), abbreviated Gestapo (; ), was the official secret police of Nazi Germany and in German-occupied Europe.

The force was created by Hermann Göring in 1933 by combining the various political police agencies of Prussia into one organi ...

and loaned the funds used to build the Auschwitz

Auschwitz concentration camp ( (); also or ) was a complex of over 40 concentration and extermination camps operated by Nazi Germany in occupied Poland (in a portion annexed into Germany in 1939) during World War II and the Holocaust. It con ...

camp and the nearby IG Farben

Interessengemeinschaft Farbenindustrie AG (), commonly known as IG Farben (German for 'IG Dyestuffs'), was a German chemical and pharmaceutical conglomerate (company), conglomerate. Formed in 1925 from a merger of six chemical companies—BASF, ...

facilities.Prague

Prague ( ; cs, Praha ; german: Prag, ; la, Praga) is the capital and largest city in the Czech Republic, and the historical capital of Bohemia. On the Vltava river, Prague is home to about 1.3 million people. The city has a temperate ...

, with branches in the Protectorate

A protectorate, in the context of international relations, is a State (polity), state that is under protection by another state for defence against aggression and other violations of law. It is a dependent territory that enjoys autonomy over m ...

and in Slovakia

Slovakia (; sk, Slovensko ), officially the Slovak Republic ( sk, Slovenská republika, links=no ), is a landlocked country in Central Europe. It is bordered by Poland to the north, Ukraine to the east, Hungary to the south, Austria to the s ...

, the Bankverein in Yugoslavia

Yugoslavia (; sh-Latn-Cyrl, separator=" / ", Jugoslavija, Југославија ; sl, Jugoslavija ; mk, Југославија ;; rup, Iugoslavia; hu, Jugoszlávia; rue, label=Pannonian Rusyn, Югославия, translit=Juhoslavija ...

(which has now been divided into two financial corporations, one in Serbia

Serbia (, ; Serbian language, Serbian: , , ), officially the Republic of Serbia (Serbian language, Serbian: , , ), is a landlocked country in Southeast Europe, Southeastern and Central Europe, situated at the crossroads of the Pannonian Bas ...

and one in Croatia

, image_flag = Flag of Croatia.svg

, image_coat = Coat of arms of Croatia.svg

, anthem = "Lijepa naša domovino"("Our Beautiful Homeland")

, image_map =

, map_caption =

, capit ...

), the Albert de Barry Bank in Amsterdam

Amsterdam ( , , , lit. ''The Dam on the River Amstel'') is the Capital of the Netherlands, capital and Municipalities of the Netherlands, most populous city of the Netherlands, with The Hague being the seat of government. It has a population ...

, the National Bank of Greece in Athens, the Creditanstalt-Bankverein in Austria and Hungary, the Deutsch-Bulgarische Kreditbank in Bulgaria

Bulgaria (; bg, България, Bǎlgariya), officially the Republic of Bulgaria,, ) is a country in Southeast Europe. It is situated on the eastern flank of the Balkans, and is bordered by Romania to the north, Serbia and North Macedon ...

, and Banca Comercială Română ''(The Romanian Commercial Bank)'' in Bucharest

Bucharest ( , ; ro, București ) is the capital and largest city of Romania, as well as its cultural, industrial, and financial centre. It is located in the southeast of the country, on the banks of the Dâmbovița River, less than north of ...

. It also maintained a branch in Istanbul

Istanbul ( , ; tr, İstanbul ), formerly known as Constantinople ( grc-gre, Κωνσταντινούπολις; la, Constantinopolis), is the List of largest cities and towns in Turkey, largest city in Turkey, serving as the country's economic, ...

, Turkey.

In 1999, Deutsche Bank confirmed officially that it had been involved in the Auschwitz camp.Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corpor ...

, a major American bank, if it did not contribute to the fund. The history of Deutsche Bank during the Second World War

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposin ...

has since been documented by independent historians commissioned by the Bank.

Post-World War II

Following Germany's defeat in

Following Germany's defeat in World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposin ...

, the Allied authorities, in 1948, ordered Deutsche Bank's break-up into regional banks.Milan

Milan ( , , Lombard: ; it, Milano ) is a city in northern Italy, capital of Lombardy, and the second-most populous city proper in Italy after Rome. The city proper has a population of about 1.4 million, while its metropolitan city h ...

(1977), Moscow

Moscow ( , US chiefly ; rus, links=no, Москва, r=Moskva, p=mɐskˈva, a=Москва.ogg) is the capital and largest city of Russia. The city stands on the Moskva River in Central Russia, with a population estimated at 13.0 million ...

, London

London is the capital and largest city of England and the United Kingdom, with a population of just under 9 million. It stands on the River Thames in south-east England at the head of a estuary down to the North Sea, and has been a majo ...

, Paris

Paris () is the capital and most populous city of France, with an estimated population of 2,165,423 residents in 2019 in an area of more than 105 km² (41 sq mi), making it the 30th most densely populated city in the world in 2020. S ...

, and Tokyo

Tokyo (; ja, 東京, , ), officially the Tokyo Metropolis ( ja, 東京都, label=none, ), is the capital and largest city of Japan. Formerly known as Edo, its metropolitan area () is the most populous in the world, with an estimated 37.468 ...

. In the 1980s, this continued when the bank paid U$603 million in 1986 to acquire Banca d'America e d'Italia

Deutsche Bank S.p.A. is an Italian bank based in Milan, Lombardy. It is a subsidiary of Deutsche Bank A.G..

History

Banca dell'Italia Meridionale was found in 1917. It was acquired by Amadeo Giannini, the founder of Bank of Italy (United States) i ...

.

In 1972, the bank established its ''Fiduciary Services Division'' which provides support to its private wealth division.Alfred Herrhausen

Alfred Herrhausen (30 January 1930 in Essen – 30 November 1989 in Bad Homburg vor der Höhe) was a German banker and the Chairman of Deutsche Bank, who was assassinated in 1989. He was a member of the Steering Committee of the Bilderberg Group a ...

, chairman of Deutsche Bank, was killed when a car that he was in exploded while he was traveling in the Frankfurt

Frankfurt, officially Frankfurt am Main (; Hessian: , "Frank ford on the Main"), is the most populous city in the German state of Hesse. Its 791,000 inhabitants as of 2022 make it the fifth-most populous city in Germany. Located on its na ...

suburb of Bad Homburg

Bad Homburg vor der Höhe () is the district town of the Hochtaunuskreis, Hesse, on the southern slope of the Taunus mountains. Bad Homburg is part of the Frankfurt Rhein-Main Regional Authority, Frankfurt Rhein-Main urban area. The town's offic ...

. The Red Army Faction claimed responsibility for the blast.

In 1989, the first steps towards creating a significant investment-banking presence were taken with the acquisition of Morgan, Grenfell & Co., a UK-based investment bank which was renamed Deutsche Morgan Grenfell in 1994. In 1995 to greatly expand into international investments and money management, Deutsche Bank hired Edson Mitchell, a risk specialist from Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

, who hired two other former Merrill Lynch risk specialists Anshu Jain and William S. Broeksmit.[Deutsche Bank Flew and Fell. Some Paid a High Price.](_blank)

/ref> By the mid-1990s, the buildup of a capital-markets operation had got underway with the arrival of a number of high-profile figures from major competitors. Ten years after the acquisition of Morgan Grenfell, the US firm Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corpor ...

was added. Bankers Trust suffered losses during the 1998 Russian financial crisis

The Russian financial crisis (also called the ruble crisis or the Russian flu) began in Russia on 17 August 1998. It resulted in the Russian government and the Russian Central Bank devaluing the ruble and defaulting on its debt. The crisis had s ...

since it had a large position in Russian government bonds,UBS

UBS Group AG is a multinational Investment banking, investment bank and financial services company founded and based in Switzerland. Co-headquartered in the cities of Zürich and Basel, it maintains a presence in all major financial centres ...

, Fidelity Investments

Fidelity Investments, commonly referred to as Fidelity, earlier as Fidelity Management & Research or FMR, is an American multinational financial services corporation based in Boston, Massachusetts. The company was established in 1946 and is on ...

, and the Japanese post office's life insurance fund.[ At the time, Deutsche Bank owned a 12% stake in DaimlerChrysler but United States banking laws prohibit banks from owning industrial companies, so Deutsche Bank received an exception to this prohibition through 1978 legislation from Congress.][

Deutsche continued to build up its presence in Italy with the acquisition in 1993 of ]Banca Popolare di Lecco

Banca Popolare di Lecco (BPL) was a bank that operated in Lecco, in northern Lombardy in Italy between 1872 and 1993. It was founded in 1872 as the Società Cooperativa di Credito Banca Popolare, and eventually expanded to 20 branches. The idea w ...

from Banca Popolare di Novara

Banca Popolare di Novara was an Italian cooperative bank based in Novara, Piedmont. The bank was absorbed into parent company Banco Popolare in 2011 (Banco Popolare itself was merged in 2017 to form Banco BPM). However, the former company still op ...

for about $476 million. In 1999, it acquired a minority interest in Cassa di Risparmio di Asti

Cassa di Risparmio di Asti known as Banca CR Asti or just Banca di Asti, is an Italian saving bank based in Asti, Piedmont. It serves Piedmont and Lombardy regions.

History

The bank was found on 25 January 1842 in Asti, in the Kingdom of Sardinia. ...

.

21st century

In the 11 September 2001 terrorist attacks

The September 11 attacks, commonly known as 9/11, were four coordinated suicide terrorist attacks carried out by al-Qaeda against the United States on Tuesday, September 11, 2001. That morning, nineteen terrorists hijacked four commerc ...

the Deutsche Bank Building in Lower Manhattan

Lower Manhattan (also known as Downtown Manhattan or Downtown New York) is the southernmost part of Manhattan, the central borough for business, culture, and government in New York City, which is the most populated city in the United States with ...

, formerly Bankers Trust Plaza, was heavily damaged by the collapse of the South Tower of the World Trade Center. Demolition work on the 39-story building continued for nearly a decade, and was completed in early 2011.

In October 2001, Deutsche Bank was listed on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed c ...

. This was the first NYSE listing after interruption due to 11 September attacks

The September 11 attacks, commonly known as 9/11, were four coordinated Suicide attack, suicide List of terrorist incidents, terrorist attacks carried out by al-Qaeda against the United States on Tuesday, September 11, 2001. That morning, ...

. The following year, Josef Ackermann became CEO of Deutsche Bank and served as CEO until 2012 when he became involved with the Bank of Cyprus

The Bank of Cyprus (BoC) ( el, Τράπεζα Κύπρου, tr, Kıbrıs Bankası) is a Cypriot financial services company established in 1899 with its headquarters in Strovolos.

Current operations

The Bank of Cyprus currently operates 108 bra ...

.Boris Fyodorov

Boris Grigoryevich Fyodorov (russian: Борис Григорьевич Фёдоров) (13 February 1958 in Moscow – 20 November 2008 in London) was a Russian economist, politician, and reformer.

Early life

He was awarded a doctor of economi ...

which followed Anshu Jain

Anshuman Jain (7 January 1963 – 12 August 2022) was an Indian-born British business executive. From 2017 to 2022, he was the president of the American financial services firm Cantor Fitzgerald.

He previously served as the Global co-CEO and ...

's aggressive expansion to gain strong relationships with state partners in Russia.Yaroslavl region

Yaroslavl Oblast (russian: Яросла́вская о́бласть, ''Yaroslavskaya oblast'') is a federal subject of Russia (an oblast), which is located in the Central Federal District, surrounded by Tver, Moscow, Ivanovo, Vladimir, Kostroma, ...

of Russia.[ He was not wearing a helmet.]VTB Capital

VTB Capital (russian: ВТБ Капитал) is a Russian investment bank. It is one of the three strategic business arms of VTB Group, along with the corporate and retail businesses.

VTB Capital has been ranked among the top investment banks in ...

, numerous bankers from Deutsche Bank's Moscow office were hired by VTB Capital.Dresdner Bank

Dresdner Bank AG was a German bank and was based in Frankfurt. It was one of Germany's largest banking corporations and was acquired by competitor Commerzbank in May 2009.

History

19th century

The Dresdner Bank was established on 12 Novemb ...

entered into a payment transaction agreement with Postbank Postbank or Post bank may refer to:

Postal savings systems

(alphabetical by country)

* Bulgarian Postbank, a Bulgarian retail bank

* Chunghwa Post, a Taiwanese postal service that provides savings account services

* Deutsche Postbank, a German reta ...

to have Postbank process payments as the clearing center for the three banks.

Since the mid-1990s Deutsche Bank commercial real estate division offered Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who served as the 45th president of the United States from 2017 to 2021.

Trump graduated from the Wharton School of the University of Pe ...

financial backing, even though in the early 1990s Citibank

Citibank, N. A. (N. A. stands for " National Association") is the primary U.S. banking subsidiary of financial services multinational Citigroup. Citibank was founded in 1812 as the City Bank of New York, and later became First National City ...

, Manufacturers Hanover

Manufacturers Hanover Corporation was the bank holding company formed as parent of Manufacturers Hanover Trust Company, a large New York bank formed by a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufac ...

, Chemical, Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corpor ...

, and 68 other entities refused to financially support him.Rosemary Vrablic

Rosemary Teresa Vrablic (born 1960/1961) is an American banker who worked as the managing director and senior private banker of Deutsche Bank's U.S. private wealth management (PWM) business. In 2013, Vrablic was managing assets valued at $5.5 bil ...

, formerly of Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking ...

, Bank of America

The Bank of America Corporation (often abbreviated BofA or BoA) is an American multinational investment bank and financial services holding company headquartered at the Bank of America Corporate Center in Charlotte, North Carolina. The bank w ...

, and Merrill Lynch

Merrill (officially Merrill Lynch, Pierce, Fenner & Smith Incorporated), previously branded Merrill Lynch, is an American investment management and wealth management division of Bank of America. Along with BofA Securities, the investment bank ...

, becoming Trump's new personal banker at Deutsche Bank.[A Mar-a-Lago Weekend and an Act of God: Trump’s History With Deutsche Bank](_blank)

/ref>

In 2007, the company's headquarters, the Deutsche Bank Twin Towers

The Deutsche Bank Twin Towers, also known as Deutsche Bank Headquarters (German: ''Zwillingstürme der Deutschen Bank'' or ''Hauptverwaltung Deutsche Bank AG''), is a twin tower skyscraper complex in the Westend-Süd district of Frankfurt, Ge ...

building, was extensively renovated for three years, certified LEED

Leadership in Energy and Environmental Design (LEED) is a

green building certification program used worldwide. Developed by the non-profit U.S. Green Building Council (USGBC), it includes a set of rating systems for the design, construction ...

Platinum and DGNB Gold.

In 2010, the bank developed and owned the Cosmopolitan of Las Vegas

The Cosmopolitan of Las Vegas (commonly referred to simply as The Cosmopolitan or The Cosmo) is a resort casino and hotel on the Las Vegas Strip in Paradise, Nevada. The resort opened on December 15, 2010, and is located just south of the B ...

, after the casino's original developer defaulted on its borrowings. Deutsche Bank ran it at a loss until its sale in May 2014. The bank's exposure at the time of sale was more than $4 billion, and sold the property to Blackstone Group for $1.73 billion.

Great Recession and European debt crisis (2007–2012)

Housing credit bubble and CDO market

Deutsche Bank was one of the major drivers of the expansion of the collateralized debt obligation (CDO) market during the housing credit bubble from 2004 to 2008, creating about $32 billion worth. The 2011 US Senate Permanent Select Committee on Investigations report on "Wall Street and the Financial Crisis" analyzed Deutsche Bank as a case study of investment banking involvement in the mortgage bubble, CDO market, credit crunch, and recession. It concluded that even as the market was collapsing in 2007, and its top global CDO trader was deriding the CDO market and betting against some of the mortgage bonds in its CDOs, Deutsche bank continued to churn out bad CDO products to investors.[

]Greg Lippmann

Greg Holden Lippmann (born 1968/1969) is an American hedge fund manager, and one of the key figures in Michael Lewis' book ''The Big Short''.

Early life

Greg Lippmann is the son of Susan Lippmann, a business manager at Purchase College, and Thoma ...

, head of global CDO trading, was betting against the CDO market, with approval of management, even as Deutsche was continuing to churn out product. He was a major character in Michael Lewis' book ''The Big Short

''The Big Short: Inside the Doomsday Machine'' is a nonfiction book by Michael Lewis about the build-up of the United States housing bubble during the 2000s. It was released on March 15, 2010, by W. W. Norton & Company. It spent 28 weeks on '' ...

'', which detailed his efforts to find 'shorts' to buy Credit Default Swaps

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default (by the debtor) or other credit event. That is, the seller of the CDS insures the buyer against som ...

(CDS) for the construction of Synthetic CDOs. He was one of the first traders to foresee the bubble in the CDO market as well as the tremendous potential that CDS offered in this. As portrayed in ''The Big Short'', Lipmann in the middle of the CDO and MBS frenzy was orchestrating presentations to investors, demonstrating his bearish view of the market, offering them the idea to start buying CDS, especially to AIG in order to profit from the forthcoming collapse. As regards the Gemstone VII deal, even as Deutsche was creating and selling it to investors, Lippman emailed colleagues that it 'blew', and he called parts of it 'crap' and 'pigs' and advised some of his clients to bet against the mortgage securities it was made of. Lippman called the CDO market a 'ponzi scheme', but also tried to conceal some of his views from certain other parties because the bank was trying to sell the products he was calling 'crap'. Lippman's group made money off of these bets, even as Deutsche overall lost money on the CDO market.[

Deutsche was also involved with ]Magnetar Capital

Magnetar Capital is a hedge fund based in Evanston, Illinois. The firm was founded in 2005 and invests in fixed income, energy, quantitative and event-driven strategies. The firm was actively involved in the collateralized debt obligation (CDO) m ...

in creating its first Orion CDO. Deutsche had its own group of bad CDOs called START. It worked with Elliot Advisors on one of them; Elliot bet against the CDO even as Deutsche sold parts of the CDO to investors as good investments. Deutsche also worked with John Paulson, of the Goldman Sachs

Goldman Sachs () is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, H ...

Abacus CDO controversy, to create some START CDOs. Deutsche lost money on START, as it did on Gemstone.[

On 3 January 2014, it was reported that Deutsche Bank would settle a lawsuit brought by US shareholders, who had accused the bank of bundling and selling bad real estate loans before the 2008 downturn. This settlement came subsequent and in addition to Deutsche's $1.93 billion settlement with the US Housing Finance Agency over similar litigation related to the sale of mortgage-backed securities to Fannie Mae and Freddie Mac.

]

Leveraged super-senior trades

Former employees including Eric Ben-Artzi and Matthew Simpson have claimed that, during the crisis, Deutsche failed to recognize up to $12 billion of paper losses on its $130 billion portfolio of leveraged super senior trades, although the bank rejects the claims.[ One of them claims that "If Lehman Brothers didn't have to mark its books for six months it might still be in business, and if Deutsche had marked its books it might have been in the same position as Lehman."][

Deutsche had become the biggest operator in this market, which were a form of credit derivative designed to behave like the most senior tranche of a CDO.][ Deutsche bought insurance against default by ]blue-chip companies

A blue chip is stock in a ''stock corporation'' (contrasted with non-stock one) with a national reputation for quality, reliability, and the ability to operate profitably in good and bad times.

Origin

As befits the sometimes high-risk nature of ...

from investors, mostly Canadian pension funds, who received a stream of insurance premiums as income in return for posting a small amount of collateral.[ The bank then sold protection to US investors via the CDX credit index, the spread between the two was tiny but was worth $270m over the 7 years of the trade.][ It was considered very unlikely that many blue chips would have problems at the same time, so Deutsche required collateral of just 10% of the contract value.

The risk of Deutsche taking large losses if the collateral was wiped out in a crisis was called the gap option.][ Ben-Artzi claims that after modeling came up with "economically unfeasible" results, Deutsche accounted for the gap option first with a simple 15% "haircut" on the trades (described as inadequate by another employee in 2006) and then in 2008 by a $1–2bn reserve for the credit correlation desk designed to cover all risks, not just the gap option.][ In October 2008, it stopped modeling the gap option and just bought S&P put options to guard against further market disruption, but one of the whistleblowers has described this as an inappropriate hedge.][ A model from Ben-Artzi's previous job at Goldman Sachs suggested that the gap option was worth about 8% of the value of the trades, worth $10.4bn. Simpson claims that traders were not simply understating the gap option but actively ]mismarking Mismarking in securities valuation takes place when the value that is assigned to securities does not reflect what the securities are actually worth, due to intentional fraudulent mispricing. Mismarking misleads investors and fund executives about ...

the value of their trades.[

]

European debt crisis, 2009–today

In 2008, Deutsche Bank reported its first annual loss in five decades, despite receiving billions of dollars from its insurance arrangements with AIG, including US$11.8 billion from funds provided by US taxpayers

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

to bail out AIG.

Based on a preliminary estimation from the European Banking Authority (EBA), in late 2011, Deutsche Bank AG needed to raise capital of about €3.2 billion as part of a required 9% core Tier 1 ratio after sovereign debt write-down starting in mid-2012.

As of 2012, Deutsche Bank had negligible exposure to Greece

Greece,, or , romanized: ', officially the Hellenic Republic, is a country in Southeast Europe. It is situated on the southern tip of the Balkans, and is located at the crossroads of Europe, Asia, and Africa. Greece shares land borders with ...

, but Spain and Italy accounted for a tenth of its European private and corporate banking business with credit risks of about €18 billion in Italy and €12 billion in Spain.

In 2017, Deutsche Bank needed to get its common equity tier-1 capital ratio up to 12.5% in 2018 to be marginally above the 12.25% required by regulators.

Since 2012

In January 2014, Deutsche Bank reported a €1.2 billion ($1.6 billion) pre-tax loss for the fourth quarter of 2013. This came after analysts had predicted a profit of nearly €600 million, according to FactSet estimates. Revenues slipped by 16% versus the prior year.

Deutsche Bank's Capital Ratio Tier-1 (CET1) was reported in 2015 to be only 11.4%, lower than the 12% median CET1 ratio of Europe's 24 biggest publicly traded banks, so there would be no dividend for 2015 and 2016. Furthermore, 15,000 jobs were to be cut.

In June 2015, the then co-CEOs, Jürgen Fitschen and Anshu Jain, both offered their resignations to the bank's supervisory board, which were accepted. Jain's resignation took effect in June 2015, but he provided consultancy to the bank until January 2016. Fitschen continued as joint CEO until May 2016. The appointment of John Cryan as joint CEO was announced, effective July 2016; he became sole CEO at the end of Fitschen's term.

In January 2016, Deutsche Bank pre-announced a 2015 loss before income taxes of approximately €6.1 billion and a net loss of approximately €6.7 billion. Following this announcement, a bank analyst at Citigroup, Citi declared: "We believe a capital increase now looks inevitable and see an equity shortfall of up to €7 billion, on the basis that Deutsche may be forced to book another €3 billion to €4 billion of litigation charges in 2016."

Leadership history

When Deutsche Bank was first organized in 1870 there was no CEO. Instead the board was represented by a speaker of the board. Beginning in February 2012, the bank has been led by two co-CEOs; in July 2015 it announced it would be led by one CEO beginning in 2016. The management bodies are the annual general meeting, supervisory board and management board.

Logotype

In 1972, the bank created the world-known blue logo "Slash in a Square" – designed by Anton Stankowski and intended to represent growth within a risk-controlled framework.

Corporate governance

Shareholders

Deutsche Bank is one of the leading listed companies in German post-war history. Its shares are traded on the Frankfurt Stock Exchange

The Frankfurt Stock Exchange (german: link=no, Börse Frankfurt, former German name – FWB) is the world's 12th largest stock exchange by market capitalization. It has operations from 8:00 am to 10:00 pm ( German time).

Organisation

Locat ...

and, since 2001, also on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed c ...

and are included in various indices, including the DAX

Dax or DAX may refer to:

Business and organizations

* DAX, stock market index of the top 40 German companies

** DAX 100, an expanded index of 100 stocks, superseded by the HDAX

** TecDAX, stock index of the top 30 German technology firms

* Dax ...

and the Euro Stoxx 50. As the share had lost value since mid-2015 and market capitalization had shrunk to around €18 billion, it temporarily withdrew from the Euro Stoxx 50 on 8 August 2016. With a 0.73% stake, it is currently the company with the lowest index weighting.

In 2001, Deutsche Bank merged its mortgage banking business with that of Dresdner Bank

Dresdner Bank AG was a German bank and was based in Frankfurt. It was one of Germany's largest banking corporations and was acquired by competitor Commerzbank in May 2009.

History

19th century

The Dresdner Bank was established on 12 Novemb ...

and Commerzbank to form Eurohypo, Eurohypo AG. In 2005, Deutsche Bank sold its stake in the joint company to Commerzbank.

Business divisions

The bank's business model rests on three pillars – the Corporate & Investment Bank (CIB), the Private & Commercial Bank and Asset Management (DWS).

Corporate & Investment Bank (CIB)

The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business. The CIB comprises the below six units.

* Corporate Finance is responsible for advisory and mergers & acquisitions (M&A).

* Equities / Fixed Income & Currencies. These two units are responsible for sales and trading of securities.

* Global Capital Markets (GCM) is focused on financing and risk management solutions. It includes debt and equity issuances.

* Global Transaction Banking (GTB) caters to corporates and financial institutions by providing commercial banking products including cross-border payments, cash management, Securities Services, securities services, and international trade finance.

* Deutsche Bank Research provides analysis of products, markets, and trading strategies.

The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business. The CIB comprises the below six units.

* Corporate Finance is responsible for advisory and mergers & acquisitions (M&A).

* Equities / Fixed Income & Currencies. These two units are responsible for sales and trading of securities.

* Global Capital Markets (GCM) is focused on financing and risk management solutions. It includes debt and equity issuances.

* Global Transaction Banking (GTB) caters to corporates and financial institutions by providing commercial banking products including cross-border payments, cash management, Securities Services, securities services, and international trade finance.

* Deutsche Bank Research provides analysis of products, markets, and trading strategies.

Private & Commercial Bank

* Private & Commercial Clients Germany / International is the retail bank of Deutsche Bank. In Germany, it operates under two brands – Deutsche Bank and Postbank. Additionally, it has operations in Belgium, Italy, Spain and India. The businesses in Poland and Portugal are in the process of being sold.

* Wealth Management functions as the bank's private banking arm, serving high-net-worth individuals and families worldwide. The division has a presence in the world's private banking hotspots, including Switzerland, Luxembourg, the Channel Islands, the Cayman Islands and Dubai.

Deutsche Asset Management (DWS)

Deutsche Bank holds a majority stake in the listed asset manager DWS Group (formerly Deutsche Asset Management), which was separated from the bank in March 2018.

Controversies

Deutsche Bank in general as well as specific employees have frequently figured in controversies and allegations of deceitful behavior or illegal transactions. As of 2016, the bank was involved in some 7,800 legal disputes and calculated €5.4 billion as litigation reserves, with a further €2.2 billion held against other contingent liabilities.

Role in financial crisis of 2007–2008

In January 2017, Deutsche Bank agreed to a $7.2 billion settlement with the United States Department of Justice over its sale and pooling of toxic mortgage securities in the years leading up to the Financial crisis of 2007–2008. As part of the agreement, Deutsche Bank was required to pay a civil monetary penalty of $3.1 billion and provide $4.1 billion in consumer relief, such as loan forgiveness. At the time of the agreement, Deutsche Bank was still facing investigations into the alleged manipulation of foreign exchange rates, suspicious equities trades in Russia, as well as alleged violations of United States sanctions against Iran and other countries. Since 2012, Deutsche Bank had paid more than €12 billion for litigation, including a deal with U.S. mortgage-finance giants Fannie Mae and Freddie Mac.

Espionage scandal, 2009

In 2009, the bank admitted it engaged in covert espionage on its critics from 2001 to 2007 directed by its corporate security department, although it characterized the incidents as "isolated".[ This was confirmed by the Public Prosecutor's Office in Frankfurt in October 2009. BaFin found deficiencies in operations within Deutsche Bank's security unit in Germany but no systemic misconduct. The bank said it took steps to strengthen controls for the mandating of external service providers by its Corporate Security Department.][

]

Deutsche Bank document release, 2014

On 26 January 2014, William S. Broeksmit, a risk specialist at Deutsche Bank who was very close to Anshu Jain and hired by Edson Mitchell to spearhead Deutsche Bank's foray into international investments and money management in the 1990s, released numerous Deutsche Bank documents from the New York branch of the Deutsche Bank Trust Company Americas (DBTCA), which Broeksmit's adopted son Val Broeksmit, who is a close friend of Moby, later gave, along with numerous emails, to both Welt am Sonntag and ZDF, which revealed numerous irregularities including both a $10 billion money laundering scheme spearheaded by the Russia branch of Deutsche Bank at Moscow, which the New York State Department of Financial Services fined Deutsche Bank $425 million, and derivatives improprieties.[Me and My Whistle-Blower](_blank)

/ref>

Libor scandal, 2015

On 23 April 2015, Deutsche Bank agreed to a combined US$2.5 billion in fines – a US$2.175 billion fine by American regulators, and a €227 million penalty by British authorities – for its involvement in the Libor scandal uncovered in June 2012. It was one of several banks colluding to fix interest rates used to price hundreds of trillions of dollars of loans and contracts worldwide, including mortgages and student loans.

U.S. sanctions violations, 2015

On 5 November 2015, Deutsche Bank was ordered to pay US$258 million (€237.2 million) in penalties imposed by the New York State Department of Financial Services (NYDFS) and the United States Federal Reserve Bank after the bank was caught doing business with Burma, Libya, Sudan, Iran, and Syria, which were under US sanctions at the time. According to the US federal authorities, Deutsche Bank handled 27,200 US dollar clearing transactions valued at more than US$10.86 billion (€9.98 billion) to help evade US sanctions between early 1999 until 2006 which were done on behalf of Iranian, Libyan, Syrian, Burmese, and Sudanese financial institutions and other entities subject to US sanctions, including entities on the Specially Designated Nationals by the Office of Foreign Assets Control.

In response to the penalties, the bank will pay US$200 million (€184 million) to the NYDFS while the rest (US$58 million; €53.3 million) will go to the Federal Reserve. In addition to the payment, the bank will install an independent monitor, fire six employees who were involved in the incident, and ban three other employees from any work involving the bank's US-based operations.

Tax evasion, 2016

In June 2016 six former employees in Germany were accused of being involved in a major tax fraud deal with CO2 emission certificates, and most of them were subsequently convicted. It was estimated that the sum of money in the tax evasion scandal might have been as high as €850 million. Deutsche Bank itself was not convicted due to an absence of corporate liability laws in Germany.

Dakota Access Pipeline, 2016

Environmentalists criticize Deutsche Bank for co-financing the controversial Dakota Access Pipeline, which is planned to run close to an Indian reservation and is seen as a threat to their livelihood by its inhabitants.

Deutsche Bank has issued a statement addressing the criticism it received from various environmental groups.

Russian money-laundering operations

In January 2017, the bank was fined $425 million by the New York State Department of Financial Services (DFS) and £163 million by the UK Financial Conduct Authority regarding accusations of money laundering, laundering $10 billion out of Russia.

The Global Laundromat scandal revealed Deutsche Bank's involvement in a vast money-laundering operation over the period 2010–2014. The operation may have involved as much as $80 billion. In 2019, ''The Guardian'' reported that a confidential internal report at Deutsche Bank showed that the bank could face fines, legal action, and even possible prosecution of senior management over the bank's role in the money laundering.

In 2020, it was reported that Deutsche Bank was pursuing an expansion of its Russia operations.

In the wake of 2022 Russian invasion of Ukraine, Russia's 2022 invasion of Ukraine, Deutsche Bank refused to close down its Russia business. At the same time, other banks and major businesses were exiting Russia.

Relationship with Donald Trump, 1995-2021

Deutsche Bank is widely recognized as being the largest creditor to real-estate-mogul-turned-politician Donald Trump

Donald John Trump (born June 14, 1946) is an American politician, media personality, and businessman who served as the 45th president of the United States from 2017 to 2021.

Trump graduated from the Wharton School of the University of Pe ...

, 45th President of the United States, lending him and his company more than $2 billion over twenty years ending 2020. The bank held more than $360 million in outstanding loans to him prior to his 2016 election. Although his 2019 final report never mentioned Deutsche Bank, as of December 2017, Mueller special counsel investigation, Special Counsel Robert Mueller investigated Deutsche Bank's role in Trump and Russian parties allegedly cooperating to elect him.

Fine for business with Jeffrey Epstein, 2020

Deutsche Bank lent money and traded currencies for the well-known sex offender Jeffrey Epstein up to May 2019, long after Epstein's 2008 guilty plea in Florida to soliciting prostitution from underage girls, according to news reports.

Involvement in Danske Bank money-laundering scandal, 2018

On 19 November 2018, a whistleblower of the Danske Bank money laundering scandal stated that a large European bank was involved in helping Danske process $150 billion in suspect funds.

Improper handling of ADRs, 2018

On 20 July 2018, Deutsche Bank agreed to pay nearly $75 million to settle charges of improper handling of "pre-released" American depositary receipt (ADRs) under investigation of the U.S. Securities and Exchange Commission (SEC). Deutsche Bank didn't admit or deny the investigation findings but agreed to pay disgorgement of more than $44.4 million in ill-gotten gains plus $6.6 million in prejudgment interest and a penalty of $22.2 million.

Malaysian 1MDB fund

In July 2019, U.S. prosecutors investigated Deutsche Bank's role in a multibillion-dollar fraud scandal involving the 1Malaysia Development Berhad, or 1MDB.

Commodities trading, bribery fine, 2021

In January 2021, Deutsche Bank agreed to pay a U.S. fine of more than $130 million for a scheme to conceal bribes to foreign officials in countries such as Saudi Arabia and China, and the city of Abu Dhabi, between 2008 and 2017 and a commodities case where it Spoofing (finance), spoofed precious metals futures.

Strip club scandal, 2022

In March 2022, Ben Darsney, Ravi Raghunathan, Brandon Sun, and Daniel Gaona were exposed for trying to expense strip club nights out as legitimate business visits. Brandon Sun attempted to cover up the incident, but the bankers were let go for violating the Company Code of Conduct.

Acquisitions

* Disconto-Gesellschaft in Berlin, 1929

* Mendelssohn & Co. 1938

* Morgan, Grenfell & Company, 1990

* Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corpor ...

, 30 November 1998

* Scudder Investments, 2001

* RREEF, 2002

* Berkshire Mortgage Finance, 22 October 2004

* Chapel Funding (now DB Home Lending), 12 September 2006

* Norisbank, 2 November 2006

* MortgageIT, 3 January 2007

* Hollandsche Bank-Unie, 2 July 2008

* Sal. Oppenheim, 2010

* Deutsche Postbank, 2010

Notable employees

* Hermann Josef Abs, former chair (1957–1968)

* Paul Achleitner, chairman of the supervisory board

* Josef Ackermann, former CEO (2002–2012)

* Friedrich Wilhelm Christians, former co-head of Deutsche Bank

* Michael Cohrs, former head of Global Banking (2002–2010)

* John Cryan, former CEO (2015–2018)

* Sir John Craven – financier in London

* Jürgen Fitschen, former co-chair

* David Folkerts-Landau, head of Research

* Katherine Garrett-Cox, chief executive officer

* Alfred Herrhausen

Alfred Herrhausen (30 January 1930 in Essen – 30 November 1989 in Bad Homburg vor der Höhe) was a German banker and the Chairman of Deutsche Bank, who was assassinated in 1989. He was a member of the Steering Committee of the Bilderberg Group a ...

, former chair (1988–1989)

* Henry Jackson (businessman), Henry Jackson – founder of OpCapita

* Anshu Jain

Anshuman Jain (7 January 1963 – 12 August 2022) was an Indian-born British business executive. From 2017 to 2022, he was the president of the American financial services firm Cantor Fitzgerald.

He previously served as the Global co-CEO and ...

, former head of Corporate and Investment Banking

* Sajid Javid, former Managing-Director (2007–2009)

* Josh Frydenberg, former director of global banking (2005)

* Otto Hermann Kahn – philanthropist

* Karl Kimmich, former chair (1942–1945)

* Hilmar Kopper, former chairman of the board of Deutsche Bank (1989–1997)

* Philip May, spouse of a former prime minister of the United Kingdom

* Steven Reich – CEO of Deutsche Bank Trust Company Americas, associate deputy attorney general (2011–2013)

* Georg von Siemens, co-founder and director (1870–1900)

* Georg Solmssen, former chair (short time 1933)

* Johannes Teyssen, (chair of the management board of E.ON)

* Ted Virtue – executive board member

* Hermann Wallich

Hermann Wallich (December 28, 1833 – April 30, 1928) was a German Jewish banker.

Together with Georg von Siemens, he co-founded Deutsche Bank.

Hermann Wallich was born in Bonn. He married Anna Jacoby in 1875. The couple had a son, Paul Wallich ...

, co-founder and director (1870–1893)

* Boaz Weinstein – derivatives trader

* Chandra Wilson – actress

See also

*European Financial Services Roundtable

*Cash Group

*List of largest banks

*List of corporate collapses and scandals

Notes

References

External links

*

*

*

Historical Association of Deutsche Bank

Deutsche Bank

in the Federal Financial Supervisory Authority (BaFin) database

Literature by and about Deutsche Bank

in the German National Library

{{Authority control

Deutsche Bank,

1870 establishments in Germany

Banks established in 1870

Banks under direct supervision of the European Central Bank

Companies listed on the Frankfurt Stock Exchange

Companies listed on the New York Stock Exchange

Exchange-traded funds

Financial services companies established in 1870

German brands

Companies involved in the Holocaust

German companies established in 1870

Investment banks

Investment management companies of Germany

Multinational companies headquartered in Germany

Primary dealers

Systemically important financial institutions

In 1919, the bank purchased the state's share of Universum Film Aktiengesellschaft (Ufa). In 1926, the bank assisted in the merger of Daimler and Benz.

The bank merged with other local banks in 1929 to create Deutsche Bank and Disconto-Gesellschaft. In 1937, the company name changed back to Deutsche Bank.

In 1919, the bank purchased the state's share of Universum Film Aktiengesellschaft (Ufa). In 1926, the bank assisted in the merger of Daimler and Benz.

The bank merged with other local banks in 1929 to create Deutsche Bank and Disconto-Gesellschaft. In 1937, the company name changed back to Deutsche Bank.

Following Germany's defeat in

Following Germany's defeat in  The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business. The CIB comprises the below six units.

* Corporate Finance is responsible for advisory and mergers & acquisitions (M&A).

* Equities / Fixed Income & Currencies. These two units are responsible for sales and trading of securities.

* Global Capital Markets (GCM) is focused on financing and risk management solutions. It includes debt and equity issuances.

* Global Transaction Banking (GTB) caters to corporates and financial institutions by providing commercial banking products including cross-border payments, cash management, Securities Services, securities services, and international trade finance.

* Deutsche Bank Research provides analysis of products, markets, and trading strategies.

The Corporate & Investment Bank (CIB) is Deutsche Bank's capital markets business. The CIB comprises the below six units.

* Corporate Finance is responsible for advisory and mergers & acquisitions (M&A).

* Equities / Fixed Income & Currencies. These two units are responsible for sales and trading of securities.

* Global Capital Markets (GCM) is focused on financing and risk management solutions. It includes debt and equity issuances.

* Global Transaction Banking (GTB) caters to corporates and financial institutions by providing commercial banking products including cross-border payments, cash management, Securities Services, securities services, and international trade finance.

* Deutsche Bank Research provides analysis of products, markets, and trading strategies.