Platinum as an investment on:

[Wikipedia]

[Google]

[Amazon]

Platinum as an investment has a much shorter history in the financial sector than

Platinum as an investment has a much shorter history in the financial sector than

Platinum is traded as an ETF (

Platinum is traded as an ETF (

Information about Platinum as a commodity from New York Mercantile ExchangeLondon Platinum and Palladium Market

Platinum Precious metals as investment Commodities used as an investment Precious metals

Platinum as an investment has a much shorter history in the financial sector than

Platinum as an investment has a much shorter history in the financial sector than gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile met ...

or silver

Silver is a chemical element with the Symbol (chemistry), symbol Ag (from the Latin ', derived from the Proto-Indo-European wikt:Reconstruction:Proto-Indo-European/h₂erǵ-, ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, whi ...

, which were known to ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold, on the basis of annual mine production. Since 2014, platinum rates have fallen significantly lower than gold rates. More than 75% of global platinum is mined in South Africa

South Africa, officially the Republic of South Africa (RSA), is the southernmost country in Africa. It is bounded to the south by of coastline that stretch along the South Atlantic and Indian Oceans; to the north by the neighbouring countri ...

.

Overview

Platinum

Platinum is a chemical element with the symbol Pt and atomic number 78. It is a dense, malleable, ductile, highly unreactive, precious, silverish-white transition metal. Its name originates from Spanish , a diminutive of "silver".

Platinu ...

is relatively scarce

In economics, scarcity "refers to the basic fact of life that there exists only a finite amount of human and nonhuman resources which the best technical knowledge is capable of using to produce only limited maximum amounts of each economic good. ...

even among the precious metals

Precious metals are rare, naturally occurring metallic chemical elements of high economic value.

Chemically, the precious metals tend to be less reactive than most elements (see noble metal). They are usually ductile and have a high lustre. ...

. New mine

Mine, mines, miners or mining may refer to:

Extraction or digging

* Miner, a person engaged in mining or digging

*Mining, extraction of mineral resources from the ground through a mine

Grammar

*Mine, a first-person English possessive pronoun

...

production totals approximately only a year. In contrast, gold mine production runs approximately a year, and silver production is approximately . That being so, platinum tends to trade at higher per-unit prices.

Platinum is traded on the New York Mercantile Exchange

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

...

(NYMEX) and the London Platinum and Palladium Market

The London Platinum and Palladium Market (LPPM) is an over-the-counter trading centre for platinum and palladium and a commodity trading association. London has always been a centre for the research in and development of most of the platinum group ...

. To be saleable on most commodity market

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investin ...

s, platinum ingot

An ingot is a piece of relatively pure material, usually metal, that is cast into a shape suitable for further processing. In steelmaking, it is the first step among semi-finished casting products. Ingots usually require a second procedure of sh ...

s must be assay

An assay is an investigative (analytic) procedure in laboratory medicine, mining, pharmacology, environmental biology and molecular biology for qualitatively assessing or quantitatively measuring the presence, amount, or functional activity of a ...

ed and hallmark

A hallmark is an official mark or series of marks struck on items made of metal, mostly to certify the content of noble metals—such as platinum, gold, silver and in some nations, palladium. In a more general sense, the term ''hallmark'' can al ...

ed in a manner similar to the way gold and silver are.

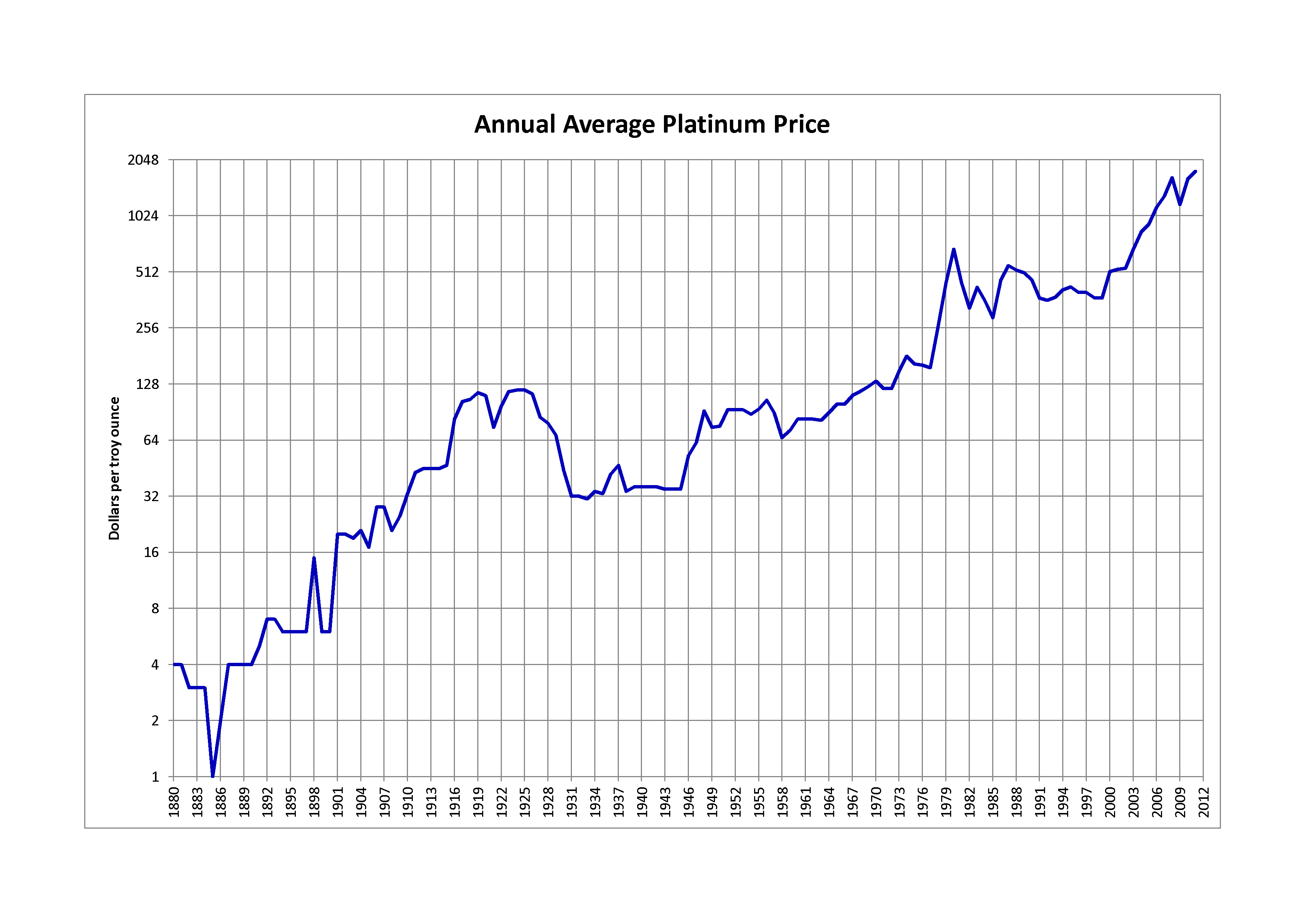

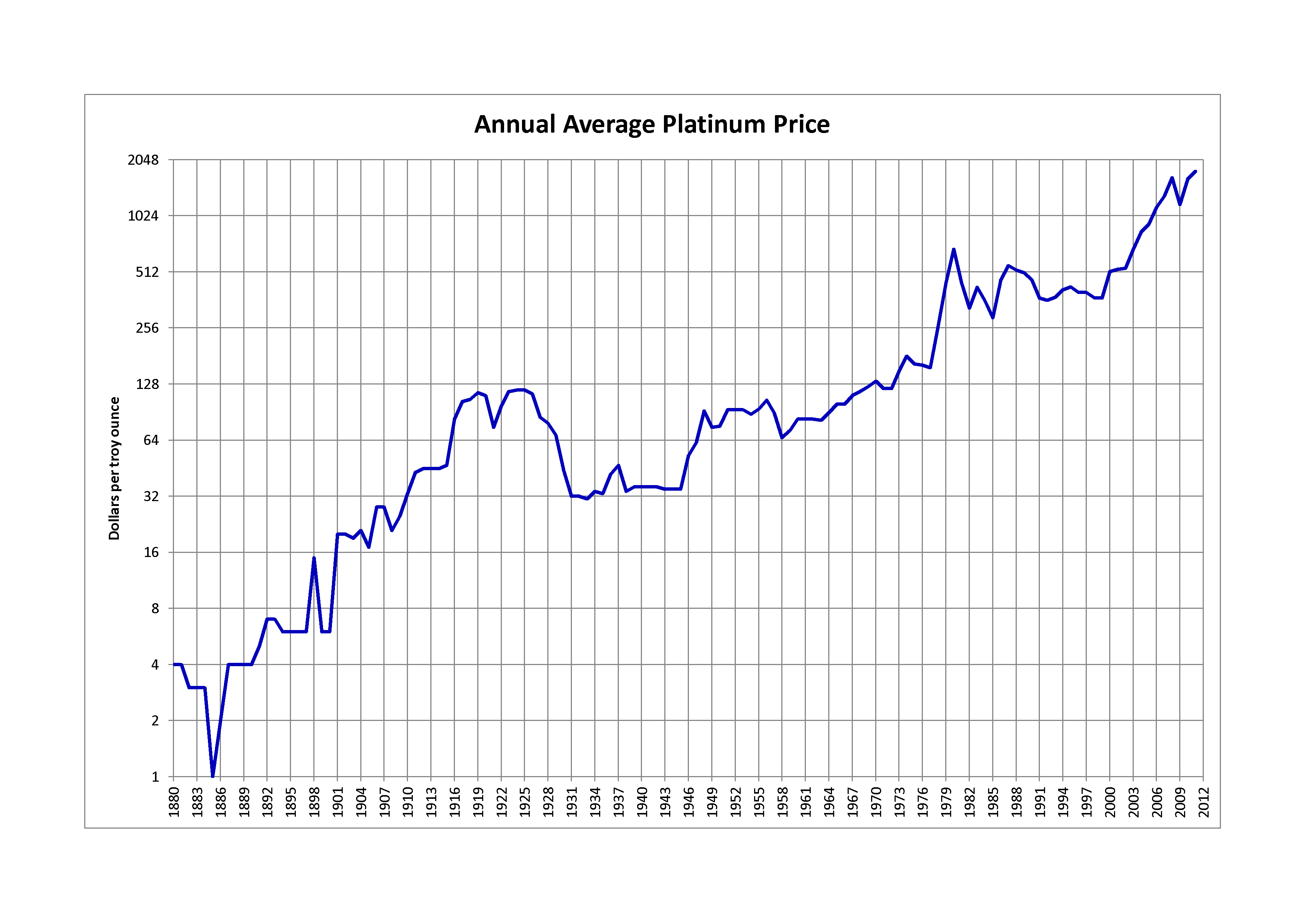

The price of platinum changes along with its supply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a ...

; during periods of sustained economic stability and growth, the price of platinum tends to be as much as twice the price of gold; whereas, during periods of economic uncertainty, the price of platinum tends to decrease because of reduced demand, falling below the price of gold, partly due to increased gold prices. Platinum price peaked at US$2,252 per troy ounce

Troy weight is a system of units of mass that originated in 15th-century England, and is primarily used in the precious metals industry. The troy weight units are the grain, the pennyweight (24 grains), the troy ounce (20 pennyweights), and the ...

in March 2008 driven on production concerns (brought about partly due to power delivery problems to South Africa

South Africa, officially the Republic of South Africa (RSA), is the southernmost country in Africa. It is bounded to the south by of coastline that stretch along the South Atlantic and Indian Oceans; to the north by the neighbouring countri ...

n mines). It subsequently fell to US$774 per troy ounce ($25/g) in November 2008. As of 21 November 2022, the platinum spot price in New York was $980 per ounce, compared to $1,742 per ounce for gold and $20.84 per ounce for silver. Platinum is traded in the spot market

The spot market or cash market is a public financial market in which financial instruments or commodities are traded for immediate delivery. It contrasts with a futures market, in which delivery is due at a later date. In a spot market, settle ...

with the code

In communications and information processing, code is a system of rules to convert information—such as a letter, word, sound, image, or gesture—into another form, sometimes shortened or secret, for communication through a communication ...

"XPT". When settled in United States Dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

s, the code is "XPTUSD". As the cost of platinum per ounce fell, the cost per ounce for other metals in the platinum group - especially Palladium - rose strongly. As of November 2022, Palladium sits at around US$1900 per ounce, compared to US$980 for platinum.

Investment vehicles

Exchange-traded products

Platinum is traded as an ETF (

Platinum is traded as an ETF (exchange-traded fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the ...

) on the London Stock Exchange

London Stock Exchange (LSE) is a stock exchange in the City of London, England, United Kingdom. , the total market value of all companies trading on LSE was £3.9 trillion. Its current premises are situated in Paternoster Square close to St Pau ...

under the ticker symbol and on the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its listed c ...

as ticker symbols and

There are also several ETNs (exchange-traded note An exchange-traded product (ETP) is a regularly priced security which trades during the day on a national stock exchange. ETPs may embed derivatives but it is not a requirement that they do so - and the investment memorandum (or offering documents ...

) available, some of which are inverse to the price of platinum.

Platinum coins and bars

Platinum bar

Platinum as an investment has a much shorter history in the financial sector than gold or silver, which were known to ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold, on the basis of annual mine producti ...

s are available from different foundries in different sizes, like 1 oz, 10 oz, 1 kg. Platinum coin

Platinum coins are a form of currency. Platinum has an international currency symbol under ISO 4217 of XPT. The issues of legitimate platinum coins were initiated by Spain in Spanish-colonized America in the 18th century and continued by the Rus ...

s are another way to invest in platinum, although relatively few varieties of platinum coins have been minted, due to its cost and difficulty in working. Since 1997, the United States Mint

The United States Mint is a bureau of the Department of the Treasury responsible for producing coinage for the United States to conduct its trade and commerce, as well as controlling the movement of bullion. It does not produce paper money; tha ...

has been selling American Platinum Eagle

The American Platinum Eagle is the official platinum bullion coin of the United States. In 1995, Director of the United States Mint Philip N. Diehl, American Numismatic Association President David L. Ganz, and Platinum Guild International Execu ...

coins to investors.

Accounts

MostSwiss bank

Banking in Switzerland dates to the early eighteenth century through Switzerland's merchant trade and has, over the centuries, grown into a complex, regulated, and international industry. Banking is seen as emblematic of Switzerland, along with ...

s offer platinum accounts where platinum can be instantly bought or sold just like any foreign currency. Unlike physical platinum, the customer does not own the actual metal but rather has a claim against the bank for a certain quantity of metal.

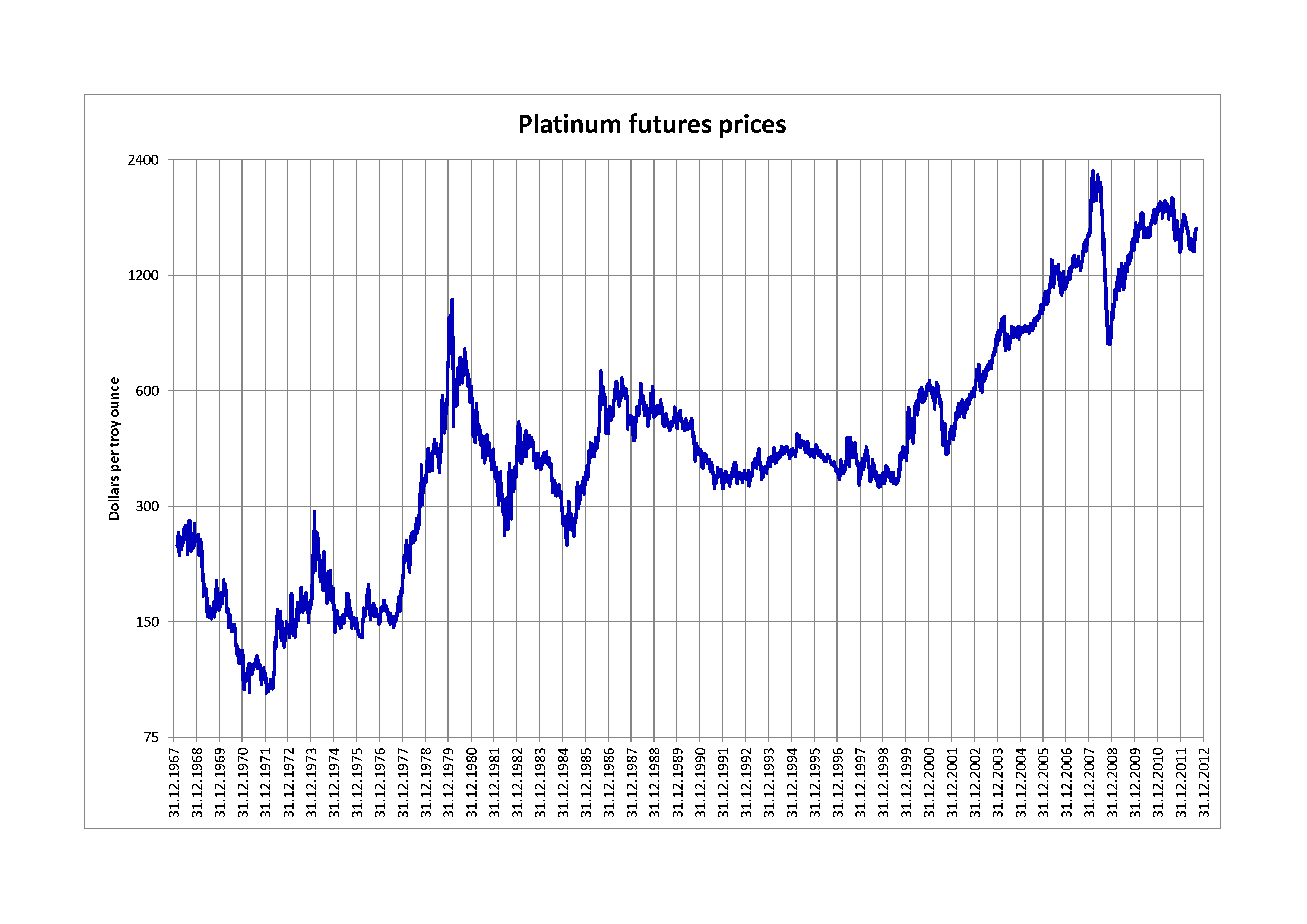

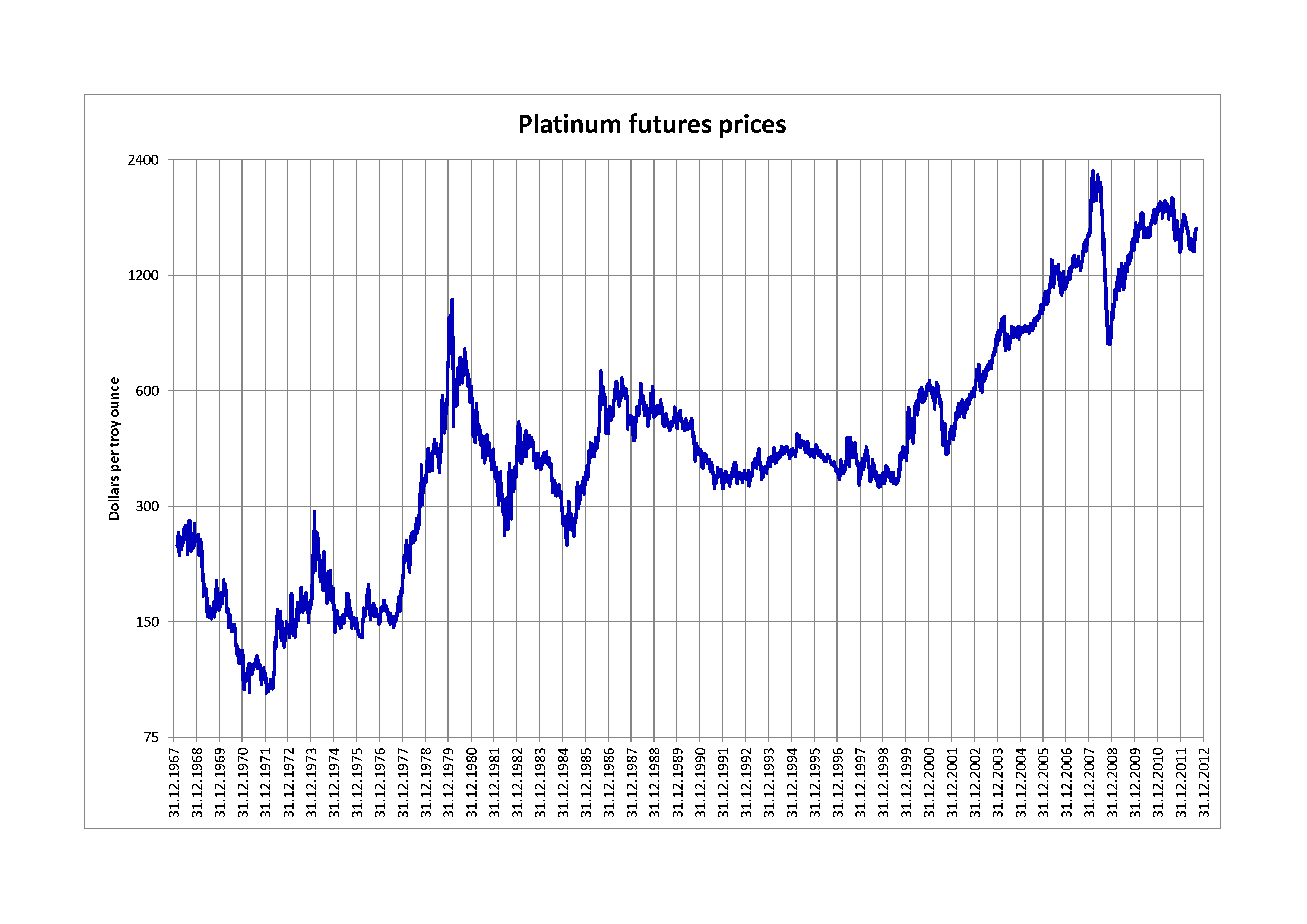

Futures

Another investment option is to create a futures contract where a predetermined time and place is designated to buy or sell the platinum. Unlike options, the transaction is an obligation, and not a right. TheNew York Mercantile Exchange

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

...

(NYMEX) and the Tokyo Commodity Exchange

Tokyo Commodity Exchange, also known as TOCOM, is Japan's largest and one of Asia's most prominent commodity futures exchanges. TOCOM operates electronic markets for precious metals, oil, rubber and soft commodities. It offers futures and options ...

(TOCOM) trades in platinum futures with a minimum contract size of 50 troy ounces and 500 grams respectively.

Others

Other ways of investing in platinum includespread betting

Spread betting is any of various types of wagering on the outcome (game theory), outcome of an event where the pay-off is based on the accuracy of the wager, rather than a simple "win or lose" outcome, such as fixed-odds betting, fixed-odds (or mon ...

or contracts for difference on the price of the metal, owning shares in mining companies with substantial platinum assets or exposure, owning traded options in platinum (only available in the US market).

See also

*Alternative investment

An alternative investment, also known as an alternative asset or alternative investment fund (AIF), is an investment in any asset class excluding stocks, bonds, and cash. The term is a relatively loose one and includes tangible assets such as ...

s

* Gold as an investment

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and ...

* Inflation hedge An inflation hedge is an investment intended to protect the investor against (hedge) a decrease in the purchasing power of money (inflation). There is no investment known to be a successful hedge in all inflationary environments, just as there is no ...

* London Platinum and Palladium Market

The London Platinum and Palladium Market (LPPM) is an over-the-counter trading centre for platinum and palladium and a commodity trading association. London has always been a centre for the research in and development of most of the platinum group ...

* Palladium as an investment

Palladium is a chemical element with the symbol Pd and atomic number 46. It is a rare and lustrous silvery-white metal discovered in 1803 by the English chemist William Hyde Wollaston. He named it after the asteroid Pallas, which was itself na ...

* Silver as an investment

Silver is a chemical element with the symbol Ag (from the Latin ', derived from the Proto-Indo-European ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, white, lustrous transition metal, it exhibits the highest electrical cond ...

References

{{ReflistExternal links

Information about Platinum as a commodity from New York Mercantile Exchange

Platinum Precious metals as investment Commodities used as an investment Precious metals