Wall Street on:

[Wikipedia]

[Google]

[Amazon]

Wall Street is a street in the Financial District of

The original wall was constructed under orders from Director General of the

The original wall was constructed under orders from Director General of the  Slavery had been introduced to Manhattan in 1626, but it was not until December 13, 1711, that the New York City Common Council made a market at the foot of Wall Street the city's first official slave market for the sale and rental of enslaved Africans and Indians. The market operated from 1711 to 1762 at the corner of Wall and Pearl Streets, and consisted of a wooden structure with a roof and open sides, although walls may have been added over the years; it could hold approximately 50 people. New York's municipal authorities directly benefited from the sale of slaves by implementing taxes on every person who was bought and sold there.

In these early days, local merchants and traders would gather at disparate spots to buy and sell shares and bonds, and over time divided themselves into two classes—auctioneers and dealers. In the late 18th century, there was a

Slavery had been introduced to Manhattan in 1626, but it was not until December 13, 1711, that the New York City Common Council made a market at the foot of Wall Street the city's first official slave market for the sale and rental of enslaved Africans and Indians. The market operated from 1711 to 1762 at the corner of Wall and Pearl Streets, and consisted of a wooden structure with a roof and open sides, although walls may have been added over the years; it could hold approximately 50 people. New York's municipal authorities directly benefited from the sale of slaves by implementing taxes on every person who was bought and sold there.

In these early days, local merchants and traders would gather at disparate spots to buy and sell shares and bonds, and over time divided themselves into two classes—auctioneers and dealers. In the late 18th century, there was a  In 1789, Wall Street was the scene of the United States' first presidential inauguration when

In 1789, Wall Street was the scene of the United States' first presidential inauguration when

In the 1840s and 1850s, most residents moved further uptown to

In the 1840s and 1850s, most residents moved further uptown to

Business writer John Brooks in his book ''Once in Golconda'' considered the start of the 20th century period to have been Wall Street's heyday. The address of 23 Wall Street, the headquarters of J. P. Morgan & Company, known as ''The Corner'', was "the precise center, geographical as well as metaphorical, of financial America and even of the financial world".

Wall Street has had changing relationships with government authorities. In 1913, for example, when authorities proposed a $4 stock transfer tax, stock clerks protested. At other times, city and state officials have taken steps through tax incentives to encourage financial firms to continue to do business in the city. A post office was built at 60 Wall Street in 1905. During the

Business writer John Brooks in his book ''Once in Golconda'' considered the start of the 20th century period to have been Wall Street's heyday. The address of 23 Wall Street, the headquarters of J. P. Morgan & Company, known as ''The Corner'', was "the precise center, geographical as well as metaphorical, of financial America and even of the financial world".

Wall Street has had changing relationships with government authorities. In 1913, for example, when authorities proposed a $4 stock transfer tax, stock clerks protested. At other times, city and state officials have taken steps through tax incentives to encourage financial firms to continue to do business in the city. A post office was built at 60 Wall Street in 1905. During the

September 1929 was the peak of the stock market.The world in depression 1929–1939 October 3, 1929, was when the market started to slip, and it continued throughout the week of October 14.

In October 1929, renowned Yale economist

September 1929 was the peak of the stock market.The world in depression 1929–1939 October 3, 1929, was when the market started to slip, and it continued throughout the week of October 14.

In October 1929, renowned Yale economist  In 1987, the stock market plunged, and, in the relatively brief recession following, the surrounding area lost 100,000 jobs according to one estimate. Since telecommunications costs were coming down, banks and

In 1987, the stock market plunged, and, in the relatively brief recession following, the surrounding area lost 100,000 jobs according to one estimate. Since telecommunications costs were coming down, banks and

The first months of 2008 was a particularly troublesome period which caused

The first months of 2008 was a particularly troublesome period which caused  At the same time, the investment community was worried about proposed legal reforms, including the ''Wall Street Reform and Consumer Protection Act'' which dealt with matters such as credit card rates and lending requirements. The NYSE closed two of its trading floors in a move towards transforming itself into an electronic exchange. Beginning in September 2011, the Occupy Wall Street movement disenchanted with the financial system protested in parks and plazas around Wall Street.

On October 29, 2012, Wall Street was disrupted when New York and New Jersey were inundated by

At the same time, the investment community was worried about proposed legal reforms, including the ''Wall Street Reform and Consumer Protection Act'' which dealt with matters such as credit card rates and lending requirements. The NYSE closed two of its trading floors in a move towards transforming itself into an electronic exchange. Beginning in September 2011, the Occupy Wall Street movement disenchanted with the financial system protested in parks and plazas around Wall Street.

On October 29, 2012, Wall Street was disrupted when New York and New Jersey were inundated by

Wall Street's architecture is generally rooted in the Gilded Age. The older skyscrapers often were built with elaborate facades, which have not been common in corporate architecture for decades. There are numerous landmarks on Wall Street, some of which were erected as the headquarters of banks. These include:

*

Wall Street's architecture is generally rooted in the Gilded Age. The older skyscrapers often were built with elaborate facades, which have not been common in corporate architecture for decades. There are numerous landmarks on Wall Street, some of which were erected as the headquarters of banks. These include:

*

But chief banking analyst at

But chief banking analyst at

John Steele Gordon

"Wall Street's 10 Most Notorious Stock Traders," ''American Heritage'', Spring 2009.

With Wall Street being historically a commuter destination, a plethora of transportation infrastructure has been developed to serve it. Pier 11 near Wall Street's eastern end is a busy terminal for New York Waterway, NYC Ferry, New York Water Taxi, and SeaStreak. The Downtown Manhattan Heliport also serves Wall Street.

There are three

With Wall Street being historically a commuter destination, a plethora of transportation infrastructure has been developed to serve it. Pier 11 near Wall Street's eastern end is a busy terminal for New York Waterway, NYC Ferry, New York Water Taxi, and SeaStreak. The Downtown Manhattan Heliport also serves Wall Street.

There are three

online edition

* Jaffe, Stephen H. & Lautin, Jessica. ''Capital of Capital: Money, Banking, and Power in New York City, 1784–2012'' (2014) * Moody, John. ''The Masters of Capital: A Chronicle of Wall Street'' Yale University Press, (1921

online edition

* Morris, Charles R. ''The Tycoons: How Andrew Carnegie, John D. Rockefeller, Jay Gould, and J. P. Morgan Invented the American Supereconomy'' (2005) * Perkins, Edwin J. ''Wall Street to Main Street: Charles Merrill and Middle-class Investors'' (1999) * Sobel, Robert. ''The Big Board: A History of the New York Stock Market'' (1962) * Sobel, Robert. ''The Great Bull Market: Wall Street in the 1920s'' (1968) * Sobel, Robert. ''Inside Wall Street: Continuity & Change in the Financial District'' (1977) * Strouse, Jean. ''Morgan: American Financier.'' Random House, 1999. 796 pp. * Finkelman, Paul. ''Encyclopedia of African American History 1896 to the present.'' Oxford University Press Inc, (2009) * Kindleberger, Charles. ''The world in Depression 1929–1939.'' Berkeley and Los Angeles: University of California Press, (1973) * Gordon, John Steele. '' The Great Game: The Emergence of Wall Street as a World Power: 1653–2000''. Scribner, (1999)

New York Songlines: Wall Street

a virtual walking tour {{Authority control Colonial forts in New York (state) Financial District, Manhattan Forts of New Netherland Occupy Wall Street Streets in Manhattan Tourist attractions in Manhattan

Lower Manhattan

Lower Manhattan, also known as Downtown Manhattan or Downtown New York City, is the southernmost part of the Boroughs of New York City, New York City borough of Manhattan. The neighborhood is History of New York City, the historical birthplace o ...

in New York City

New York, often called New York City (NYC), is the most populous city in the United States, located at the southern tip of New York State on one of the world's largest natural harbors. The city comprises five boroughs, each coextensive w ...

. It runs eight city blocks between Broadway in the west and South Street and the East River

The East River is a saltwater Estuary, tidal estuary or strait in New York City. The waterway, which is not a river despite its name, connects Upper New York Bay on its south end to Long Island Sound on its north end. It separates Long Island, ...

in the east with a length of just under 2,000 feet. The term "Wall Street" has become a metonym

Metonymy () is a figure of speech in which a concept is referred to by the name of something associated with that thing or concept. For example, the word "wikt:suit, suit" may refer to a person from groups commonly wearing business attire, such ...

for the financial market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial marke ...

s of the United States as a whole, the American financial services industry, New York–based financial interests, or the Financial District. Anchored by Wall Street, New York has been described as the world's principal fintech and financial center

A financial centre (financial center in American English) or financial hub is a location with a significant concentration of commerce in financial services.

The commercial activity that takes place in a financial centre may include banking, ...

.

The street was originally known in Dutch as ''Het Cingel'' ("the Belt") when it was part of New Amsterdam

New Amsterdam (, ) was a 17th-century Dutch Empire, Dutch settlement established at the southern tip of Manhattan Island that served as the seat of the colonial government in New Netherland. The initial trading ''Factory (trading post), fac ...

during the 17th century. An actual city wall existed on the street from 1653 to 1699. During the 18th century, the location served as a slave market and securities trading site, and from 1703 onward, the location of New York's city hall, which became Federal Hall

Federal Hall was the first capitol building of the United States under the Constitution. Serving as the meeting place of the First United States Congress and the site of George Washington's first presidential inauguration, the building existe ...

. In the early 19th century, both residences and businesses occupied the area, but increasingly the latter predominated, and New York's financial industry became centered on Wall Street. During the 20th century, several early skyscrapers

The earliest stage of skyscraper design encompasses buildings built between 1884 and 1945, predominantly in the American cities of New York City, New York and Chicago. Cities in the United States were traditionally made up of low-rise buildings, ...

were built on Wall Street, including 40 Wall Street, once the world's tallest building. The street is near multiple subway stations and ferry terminals.

The Wall Street area is home to the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

, the world's largest stock exchange by total market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

, as well as the Federal Reserve Bank of New York, and commercial banks and insurance companies. Several other stock and commodity

In economics, a commodity is an economic goods, good, usually a resource, that specifically has full or substantial fungibility: that is, the Market (economics), market treats instances of the good as equivalent or nearly so with no regard to w ...

exchanges have also been located in Lower Manhattan near Wall Street, including the New York Mercantile Exchange and other commodity futures exchanges, along with the NYSE American. Many brokerage firms owned offices nearby to support the business they did on the exchanges. The economic impacts of Wall Street activities extend worldwide.

History

Early years

In the original records ofNew Amsterdam

New Amsterdam (, ) was a 17th-century Dutch Empire, Dutch settlement established at the southern tip of Manhattan Island that served as the seat of the colonial government in New Netherland. The initial trading ''Factory (trading post), fac ...

, the Dutch always called the street ''Het Cingel'' ("the Belt"), which was also the name of the original outer barrier street, wall, and canal of Amsterdam

Amsterdam ( , ; ; ) is the capital of the Netherlands, capital and Municipalities of the Netherlands, largest city of the Kingdom of the Netherlands. It has a population of 933,680 in June 2024 within the city proper, 1,457,018 in the City Re ...

. After the English conquest of New Netherland in 1664, they renamed the settlement "New York" and in tax records from April 1665 (still in Dutch) they refer to the street as ''Het Cingel ofte Stadt Wall'' ("the Belt or the City Wall"). This use of both names for the street also appears as late as 1691 on the Miller Plan of New York. New York Governor Thomas Dongan may have issued the first official designation of Wall Street in 1686, the same year he issued a new charter for New York. Confusion over the origins of the name Wall Street appeared in modern times because in the 19th and early 20th century some historians mistakenly thought the Dutch had called it "de Waal Straat", which to Dutch ears sounds like Walloon Street. However, in 17th century New Amsterdam, de Waal Straat (Wharf or Dock Street) was a section of what is today's Pearl Street.

Dutch West India Company

The Dutch West India Company () was a Dutch chartered company that was founded in 1621 and went defunct in 1792. Among its founders were Reynier Pauw, Willem Usselincx (1567–1647), and Jessé de Forest (1576–1624). On 3 June 1621, it was gra ...

, Peter Stuyvesant, at the start of the first Anglo-Dutch war soon after New Amsterdam was incorporated in 1653. Fearing an over land invasion of English troops from the colonies in New England

New England is a region consisting of six states in the Northeastern United States: Connecticut, Maine, Massachusetts, New Hampshire, Rhode Island, and Vermont. It is bordered by the state of New York (state), New York to the west and by the ...

(at the time Manhattan

Manhattan ( ) is the most densely populated and geographically smallest of the Boroughs of New York City, five boroughs of New York City. Coextensive with New York County, Manhattan is the County statistics of the United States#Smallest, larg ...

was easily accessible by land because the Harlem Ship Canal had not been dug), he ordered a ditch and wooden palisade

A palisade, sometimes called a stakewall or a paling, is typically a row of closely placed, high vertical standing tree trunks or wooden or iron stakes used as a fence for enclosure or as a defensive wall. Palisades can form a stockade.

Etymo ...

to be constructed on the northern boundary of the New Amsterdam settlement. The wall was built of dirt and wooden planks, measuring long and tall and was built using the labor of both Enslaved Africans and white colonists. In fact Stuyvesant had ordered that "the citizens, without exception, shall work on the constructions… by immediately digging a ditch from the East River to the North River, 4 to 5 feet deep and 11 to 12 feet wide..." And that "the soldiers and other servants of the Company, together with the free Negroes, no one excepted, shall complete the work on the fort by constructing a breastwork, and the farmers are to be summoned to haul the sod."

The first Anglo-Dutch War ended in 1654 without hostilities in New Amsterdam, but over time the "werken" (meaning the works or city fortifications) were reinforced and expanded to protect against potential incursions from Native Americans, pirates, and the English. The English also expanded and improved the wall after their 1664 takeover (a cause of the Second Anglo-Dutch War

The Second Anglo-Dutch War, began on 4 March 1665, and concluded with the signing of the Treaty of Breda (1667), Treaty of Breda on 31 July 1667. It was one in a series of Anglo-Dutch Wars, naval wars between Kingdom of England, England and the D ...

), as did the Dutch from 1673 to 1674 when they briefly retook the city during the Third Anglo-Dutch War, and by the late 1600s the wall encircled most of the city and had two large stone bastions on the northern side. The Dutch named these bastions "Hollandia" and "Zeelandia" after the ships that carried their invasion force. The wall started at Hanover Square on Pearl Street, which was the shoreline at that time, crossed the Indian path that the Dutch called ''Heeren Wegh'', now called Broadway, and ended at the other shoreline (today's Trinity Place), where it took a turn south and ran along the shore until it ended at the old fort. There was a gate at Broadway (the "Land Gate") and another at Pearl Street, the "Water Gate". The wall and its fortifications were eventually removed in 1699—it had outlived its usefulness because the city had grown well beyond the wall. A new City Hall was built at Wall and Nassau in 1700 using the stones from the bastions as materials for the foundation.

Slavery had been introduced to Manhattan in 1626, but it was not until December 13, 1711, that the New York City Common Council made a market at the foot of Wall Street the city's first official slave market for the sale and rental of enslaved Africans and Indians. The market operated from 1711 to 1762 at the corner of Wall and Pearl Streets, and consisted of a wooden structure with a roof and open sides, although walls may have been added over the years; it could hold approximately 50 people. New York's municipal authorities directly benefited from the sale of slaves by implementing taxes on every person who was bought and sold there.

In these early days, local merchants and traders would gather at disparate spots to buy and sell shares and bonds, and over time divided themselves into two classes—auctioneers and dealers. In the late 18th century, there was a

Slavery had been introduced to Manhattan in 1626, but it was not until December 13, 1711, that the New York City Common Council made a market at the foot of Wall Street the city's first official slave market for the sale and rental of enslaved Africans and Indians. The market operated from 1711 to 1762 at the corner of Wall and Pearl Streets, and consisted of a wooden structure with a roof and open sides, although walls may have been added over the years; it could hold approximately 50 people. New York's municipal authorities directly benefited from the sale of slaves by implementing taxes on every person who was bought and sold there.

In these early days, local merchants and traders would gather at disparate spots to buy and sell shares and bonds, and over time divided themselves into two classes—auctioneers and dealers. In the late 18th century, there was a buttonwood

Buttonwood or Buttonwoods may refer to:

* "Buttonwood", a finance column in ''The Economist''

* Buttonwood Agreement, 1792 effort to organize securities trading that created the predecessor of the New York Stock Exchange

Plants

Buttonwood or bu ...

tree at the foot of Wall Street under which traders and speculators would gather to trade securities. The benefit was being in proximity to each other. In 1792, traders formalized their association with the Buttonwood Agreement

The Buttonwood Agreement is the founding document of what is now the New York Stock Exchange and is one of the most important financial documents in U.S. history. The agreement organized securities trading in New York City and was signed on May ...

which was the origin of the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

. The idea of the agreement was to make the market more "structured" and "without the manipulative auctions", with a commission structure. Persons signing the agreement agreed to charge each other a standard commission rate; persons not signing could still participate but would be charged a higher commission for dealing.

In 1789, Wall Street was the scene of the United States' first presidential inauguration when

In 1789, Wall Street was the scene of the United States' first presidential inauguration when George Washington

George Washington (, 1799) was a Founding Fathers of the United States, Founding Father and the first president of the United States, serving from 1789 to 1797. As commander of the Continental Army, Washington led Patriot (American Revoluti ...

took the oath of office on the balcony of Federal Hall

Federal Hall was the first capitol building of the United States under the Constitution. Serving as the meeting place of the First United States Congress and the site of George Washington's first presidential inauguration, the building existe ...

on April 30, 1789. This was also the location of the passing of the Bill of Rights. Alexander Hamilton

Alexander Hamilton (January 11, 1755 or 1757July 12, 1804) was an American military officer, statesman, and Founding Fathers of the United States, Founding Father who served as the first U.S. secretary of the treasury from 1789 to 1795 dur ...

, who was the first Treasury secretary and "architect of the early United States financial system", is buried in the cemetery of Trinity Church, as is Robert Fulton

Robert Fulton (November 14, 1765 – February 24, 1815) was an American engineer and inventor who is widely credited with developing the world's first commercially successful steamboat, the (also known as ''Clermont''). In 1807, that steamboat ...

, famed for his steamboat

A steamboat is a boat that is marine propulsion, propelled primarily by marine steam engine, steam power, typically driving propellers or Paddle steamer, paddlewheels. The term ''steamboat'' is used to refer to small steam-powered vessels worki ...

s.

19th century

In the first few decades, both residences and businesses occupied the area, but increasingly, business predominated. "There are old stories of people's houses being surrounded by the clamor of business and trade and the owners complaining that they can't get anything done," according to a historian named Burrows. The opening of theErie Canal

The Erie Canal is a historic canal in upstate New York that runs east–west between the Hudson River and Lake Erie. Completed in 1825, the canal was the first navigability, navigable waterway connecting the Atlantic Ocean to the Great Lakes, ...

in the early 19th century meant a huge boom in business for New York City, since it was the only major eastern seaport which had direct access by inland waterways to ports on the Great Lakes

The Great Lakes, also called the Great Lakes of North America, are a series of large interconnected freshwater lakes spanning the Canada–United States border. The five lakes are Lake Superior, Superior, Lake Michigan, Michigan, Lake Huron, H ...

. Wall Street became the "money capital of America".

Historian Charles R. Geisst suggested that there has constantly been a "tug-of-war" between business interests on Wall Street and authorities in Washington, D.C., the capital of the United States by then. Generally during the 19th century Wall Street developed its own "unique personality and institutions" with little outside interference.

In the 1840s and 1850s, most residents moved further uptown to

In the 1840s and 1850s, most residents moved further uptown to Midtown Manhattan

Midtown Manhattan is the central portion of the New York City borough of Manhattan, serving as the city's primary central business district. Midtown is home to some of the city's most prominent buildings, including the Empire State Building, the ...

because of the increased business use at the lower tip of the island. The Civil War

A civil war is a war between organized groups within the same Sovereign state, state (or country). The aim of one side may be to take control of the country or a region, to achieve independence for a region, or to change government policies.J ...

greatly expanded the northern economy, bringing greater prosperity to cities like New York which "came into its own as the nation's banking center" connecting "Old World capital and New World ambition", according to one account. J. P. Morgan

John Pierpont Morgan Sr. (April 17, 1837 – March 31, 1913) was an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age and Progressive Era. As the head of the banking firm that ...

created giant trusts and John D. Rockefeller

John Davison Rockefeller Sr. (July 8, 1839 – May 23, 1937) was an American businessman and philanthropist. He was one of the List of richest Americans in history, wealthiest Americans of all time and one of the richest people in modern hist ...

's Standard Oil

Standard Oil Company was a Trust (business), corporate trust in the petroleum industry that existed from 1882 to 1911. The origins of the trust lay in the operations of the Standard Oil of Ohio, Standard Oil Company (Ohio), which had been founde ...

moved to New York City. Between 1860 and 1920, the economy changed from "agricultural to industrial to financial" and New York maintained its leadership position despite these changes, according to historian Thomas Kessner. New York was second only to London

London is the Capital city, capital and List of urban areas in the United Kingdom, largest city of both England and the United Kingdom, with a population of in . London metropolitan area, Its wider metropolitan area is the largest in Wester ...

as the world's financial capital.

In 1884, Charles Dow

Charles Henry Dow (; November 6, 1851 – December 4, 1902) was an American journalist who co-founded Dow Jones & Company with Edward Jones and Charles Bergstresser.

Dow also co-founded ''The Wall Street Journal'', which has become one of th ...

began tracking stocks, initially beginning with 11 stocks, mostly railroads. He looked at average prices for these eleven. Some of the companies included in Dow's original calculations were American Tobacco Company, General Electric

General Electric Company (GE) was an American Multinational corporation, multinational Conglomerate (company), conglomerate founded in 1892, incorporated in the New York (state), state of New York and headquartered in Boston.

Over the year ...

, Laclede Gas Company, National Lead Company, Tennessee Coal & Iron, and United States Leather Company. When the average "peaks and troughs" went up consistently, he deemed it a bull market

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time ...

condition; if averages dropped, it was a bear market

A market trend is a perceived tendency of the financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time ...

. He added up prices, and divided by the number of stocks to get his Dow Jones average. Dow's numbers were a "convenient benchmark" for analyzing the market and became an accepted way to look at the entire stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange a ...

. In 1889 the original stock report, ''Customers' Afternoon Letter'', became ''The Wall Street Journal

''The Wall Street Journal'' (''WSJ''), also referred to simply as the ''Journal,'' is an American newspaper based in New York City. The newspaper provides extensive coverage of news, especially business and finance. It operates on a subscriptio ...

''. Named in reference to the actual street, it became an influential international daily business newspaper published in New York City. After October 7, 1896, it began publishing Dow's expanded list of stocks. A century later, there were 30 stocks in the average.

20th century

Early part

Business writer John Brooks in his book ''Once in Golconda'' considered the start of the 20th century period to have been Wall Street's heyday. The address of 23 Wall Street, the headquarters of J. P. Morgan & Company, known as ''The Corner'', was "the precise center, geographical as well as metaphorical, of financial America and even of the financial world".

Wall Street has had changing relationships with government authorities. In 1913, for example, when authorities proposed a $4 stock transfer tax, stock clerks protested. At other times, city and state officials have taken steps through tax incentives to encourage financial firms to continue to do business in the city. A post office was built at 60 Wall Street in 1905. During the

Business writer John Brooks in his book ''Once in Golconda'' considered the start of the 20th century period to have been Wall Street's heyday. The address of 23 Wall Street, the headquarters of J. P. Morgan & Company, known as ''The Corner'', was "the precise center, geographical as well as metaphorical, of financial America and even of the financial world".

Wall Street has had changing relationships with government authorities. In 1913, for example, when authorities proposed a $4 stock transfer tax, stock clerks protested. At other times, city and state officials have taken steps through tax incentives to encourage financial firms to continue to do business in the city. A post office was built at 60 Wall Street in 1905. During the World War I

World War I or the First World War (28 July 1914 – 11 November 1918), also known as the Great War, was a World war, global conflict between two coalitions: the Allies of World War I, Allies (or Entente) and the Central Powers. Fighting to ...

years, occasionally there were fund-raising efforts for projects such as the National Guard

National guard is the name used by a wide variety of current and historical uniformed organizations in different countries. The original National Guard was formed during the French Revolution around a cadre of defectors from the French Guards.

...

.

On September 16, 1920, close to the corner of Wall and Broad Street, the busiest corner of the Financial District and across the offices of the Morgan Bank, a powerful bomb exploded. It killed 38 and seriously injured 143 people. The perpetrators were never identified or apprehended. The explosion did, however, help fuel the Red Scare that was underway at the time. A report from ''The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of ...

'':

The area was subjected to numerous threats; one bomb threat in 1921 led to detectives sealing off the area to "prevent a repetition of the Wall Street bomb explosion".

Regulation

September 1929 was the peak of the stock market.The world in depression 1929–1939 October 3, 1929, was when the market started to slip, and it continued throughout the week of October 14.

In October 1929, renowned Yale economist

September 1929 was the peak of the stock market.The world in depression 1929–1939 October 3, 1929, was when the market started to slip, and it continued throughout the week of October 14.

In October 1929, renowned Yale economist Irving Fisher

Irving Fisher (February 27, 1867 – April 29, 1947) was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt de ...

reassured worried investors that their "money was safe" on Wall Street. A few days later, on October 24, stock values plummeted. The stock market crash of 1929 ushered in the Great Depression

The Great Depression was a severe global economic downturn from 1929 to 1939. The period was characterized by high rates of unemployment and poverty, drastic reductions in industrial production and international trade, and widespread bank and ...

, in which a quarter of working people were unemployed, with soup kitchens, mass foreclosures of farms, and falling prices. During this era, development of the Financial District stagnated, and Wall Street "paid a heavy price" and "became something of a backwater in American life".

During the New Deal

The New Deal was a series of wide-reaching economic, social, and political reforms enacted by President Franklin D. Roosevelt in the United States between 1933 and 1938, in response to the Great Depression in the United States, Great Depressi ...

years, as well as the 1940s, there was much less focus on Wall Street and finance. The government clamped down on the practice of buying equities based only on credit, but these policies began to ease. From 1946 to 1947, stocks could not be purchased " on margin", meaning that an investor had to pay 100% of a stock's cost without taking on any loans. However, this margin requirement was reduced four times before 1960, each time stimulating a mini-rally and boosting volume, and when the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

reduced the margin requirements from 90% to 70%. These changes made it somewhat easier for investors to buy stocks on credit. The growing national economy and prosperity led to a recovery during the 1960s, with some down years during the early 1970s in the aftermath of the Vietnam War

The Vietnam War (1 November 1955 – 30 April 1975) was an armed conflict in Vietnam, Laos, and Cambodia fought between North Vietnam (Democratic Republic of Vietnam) and South Vietnam (Republic of Vietnam) and their allies. North Vietnam w ...

. Trading volumes climbed; in 1967, according to ''Time Magazine

''Time'' (stylized in all caps as ''TIME'') is an American news magazine based in New York City. It was published weekly for nearly a century. Starting in March 2020, it transitioned to every other week. It was first published in New York Cit ...

'', volume hit 7.5 million shares a day which caused a "traffic jam" of paper with "batteries of clerks" working overtime to "clear transactions and update customer accounts".

In 1973, the financial community posted a collective loss of $245 million, which spurred temporary help from the government. Reforms were instituted; the Securities & Exchange Commission eliminated fixed commissions, which forced "brokers to compete freely with one another for investors' business". In 1975, the SEC threw out the NYSE

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

's "Rule 394" which had required that "most stock transactions take place on the Big Board's floor", in effect freeing up trading for electronic methods. In 1976, banks were allowed to buy and sell stocks, which provided more competition for stockbroker

A stockbroker is an individual or company that buys and sells stocks and other investments for a financial market participant in return for a commission, markup, or fee. In most countries they are regulated as a broker or broker-dealer and ...

s. Reforms had the effect of lowering prices overall, making it easier for more people to participate in the stock market. Broker commissions for each stock sale lessened, but volume increased.

The Reagan years were marked by a renewed push for capitalism

Capitalism is an economic system based on the private ownership of the means of production and their use for the purpose of obtaining profit. This socioeconomic system has developed historically through several stages and is defined by ...

and business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for ...

, with national efforts to de-regulate industries such as telecommunications

Telecommunication, often used in its plural form or abbreviated as telecom, is the transmission of information over a distance using electronic means, typically through cables, radio waves, or other communication technologies. These means of ...

and aviation

Aviation includes the activities surrounding mechanical flight and the aircraft industry. ''Aircraft'' include fixed-wing and rotary-wing types, morphable wings, wing-less lifting bodies, as well as lighter-than-air aircraft such as h ...

. The economy resumed upward growth after a period in the early 1980s of languishing. A report in ''The New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of ...

'' described that the flushness of money and growth during these years had spawned a drug culture

Drug cultures are examples of countercultures that are primarily defined by Entheogen, spiritual, Self-medication, medical, and recreational drug use. They may be focused on a single drug, or endorse polydrug use. They sometimes eagerly or reluct ...

of sorts, with a rampant acceptance of cocaine

Cocaine is a tropane alkaloid and central nervous system stimulant, derived primarily from the leaves of two South American coca plants, ''Erythroxylum coca'' and ''Erythroxylum novogranatense, E. novogranatense'', which are cultivated a ...

use although the overall percent of actual users was most likely small. A reporter wrote:

In 1987, the stock market plunged, and, in the relatively brief recession following, the surrounding area lost 100,000 jobs according to one estimate. Since telecommunications costs were coming down, banks and

In 1987, the stock market plunged, and, in the relatively brief recession following, the surrounding area lost 100,000 jobs according to one estimate. Since telecommunications costs were coming down, banks and brokerage firm

A broker is a person or entity that arranges transactions between a Purchasing, buyer and a sales, seller. This may be done for a commission (remuneration), commission when the deal is executed. A broker who also acts as a seller or as a buyer b ...

s could move away from the Financial District to more affordable locations. One of the firms looking to move away was the NYSE. In 1998, the NYSE and the city struck a $900 million deal which kept the NYSE from moving across the river to Jersey City

Jersey City is the List of municipalities in New Jersey, second-most populous

; the deal was described as the "largest in city history to prevent a corporation from leaving town".

21st century

In 2001, the ''Big Board'', as some termed the NYSE, was described as the world's "largest and most prestigious stock market". When the World Trade Center was destroyed on September 11, 2001, the attacks "crippled" the communications network and destroyed many buildings in the Financial District, although the buildings on Wall Street itself saw only little physical damage. One estimate was that 45% of Wall Street's "best office space" had been lost. The NYSE was determined to re-open on September 17, almost a week after the attack. During this time Rockefeller Group Business Center opened additional offices at 48 Wall Street. Still, after September 11, the financial services industry went through a downturn with a sizable drop in year-end bonuses of $6.5 billion, according to one estimate from a state comptroller's office. To guard against terrorist attacks in the area, Wall Street from Broadway to William Street, and Broad Street from Beaver to Nassau was permanently closed to vehicular traffic and pedestrianized. The intersection of Broad and Wall in front of the NYSE, is a now public square. Vehicle traffic is only allowed for local residents and those with permission from local businesses and the city and only after being subject to a security search. Authorities built concrete barriers, and found ways over time to make them more aesthetically appealing by spending $5000 to $8000 apiece on bollards. Parts of Wall Street, as well as several other streets in the neighborhood, were blocked off by specially designed bollards: ''The Guardian

''The Guardian'' is a British daily newspaper. It was founded in Manchester in 1821 as ''The Manchester Guardian'' and changed its name in 1959, followed by a move to London. Along with its sister paper, ''The Guardian Weekly'', ''The Guardi ...

'' reporter Andrew Clark described the years of 2006 to 2010 as "tumultuous", in which the heartland of America was "mired in gloom" with high unemployment around 9.6%, with average house prices falling from $230,000 in 2006 to $183,000, and foreboding increases in the national debt to $13.4 trillion, but that despite the setbacks, the American economy was once more "bouncing back". What had happened during these heady years? Clark wrote:

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of ...

chairman Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Insti ...

to "work holidays and weekends" and which did an "extraordinary series of moves". It bolstered U.S. banks and allowed Wall Street firms to borrow "directly from the Fed" through a vehicle called the Fed's Discount Window, a sort of lender of last resort. These efforts were highly controversial at the time, but from the perspective of 2010, it appeared the Federal exertions had been the right decisions.

By 2010, Wall Street firms, in Clark's view, were "getting back to their old selves as engine rooms of wealth, prosperity and excess". A report by Michael Stoler in ''The New York Sun

''The New York Sun'' is an American Conservatism in the United States, conservative Online newspaper, news website and former newspaper based in Manhattan, Manhattan, New York. From 2009 to 2021, it operated as an (occasional and erratic) onlin ...

'' described a "phoenix-like resurrection" of the area, with residential, commercial, retail and hotels booming in the "third largest business district in the country".

Hurricane Sandy

Hurricane Sandy (unofficially referred to as Superstorm Sandy) was an extremely large and devastating tropical cyclone which ravaged the Caribbean and the coastal Mid-Atlantic (United States), Mid-Atlantic region of the United States in late ...

. Its storm surge, a local record, caused massive street flooding nearby. The NYSE was closed for weather-related reasons, the first time since Hurricane Gloria in September 1985 and the first two-day weather-related shutdown since the Blizzard of 1888.

Architecture

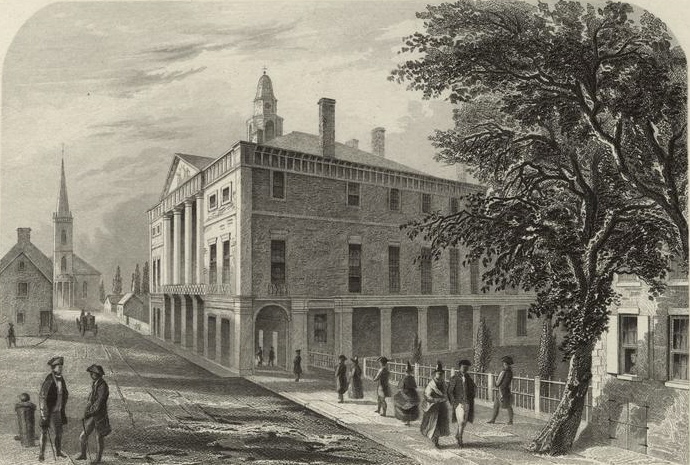

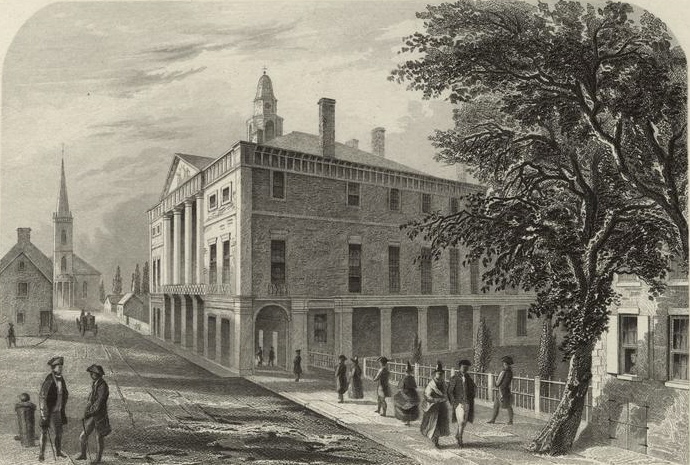

Federal Hall National Memorial

Federal Hall was the first capitol building of the United States under the Constitution. Serving as the meeting place of the First United States Congress and the site of George Washington's first presidential inauguration, the building existe ...

(26 Wall Street), built in 1833–1842. The building, which previously housed the United States Custom House and then the Subtreasury, is now a national monument

A national monument is a monument constructed in order to commemorate something of importance to national heritage, such as a country's founding, independence, war, or the life and death of a historical figure. The term may also refer to a sp ...

.

* 55 Wall Street, erected in 1836–1841 as the four-story Merchants Exchange, was turned into the United States Custom House in the late 19th century. An expansion in 1907–1910 turned it into the eight-story National City Bank Building.

* 14 Wall Street, a 32-story skyscraper with a 7-story stepped pyramid, built in 1910–1912 with an expansion in 1931–1933. It was originally the Bankers Trust Company Building.

* 23 Wall Street, a four-story headquarters built in 1914, was known as the "House of Morgan" and served for decades as the J.P. Morgan & Co. bank's headquarters and, by some accounts, was considered an important address in American finance. Cosmetic damage from the 1920 Wall Street bombing is still visible on the Wall Street side of this building.

* 48 Wall Street, a 32-story skyscraper built in 1927–1929 as the Bank of New York & Trust Company Building.

* 40 Wall Street, a 71-story skyscraper built in 1929–1930 as the Bank of Manhattan Company Building; it later became the Trump Building.

* 1 Wall Street, a 50-story skyscraper built in 1929–1931 with an expansion in 1963–1965. It was previously known as the Irving Trust Company Building and the Bank of New York Building.

* 75 Wall Street, built in 1987. It was built to be the U.S. headquarters of Barclays

Barclays PLC (, occasionally ) is a British multinational universal bank, headquartered in London, England. Barclays operates as two divisions, Barclays UK and Barclays International, supported by a service company, Barclays Execution Services ...

although several firms leased space in the building after it opened. It was converted in 2006–2009 into a mixed-use

Mixed use is a type of urban development, urban design, urban planning and/or a zoning classification that blends multiple uses, such as residential, commercial, cultural, institutional, or entertainment, into one space, where those functions ...

building with condominium

A condominium (or condo for short) is an ownership regime in which a building (or group of buildings) is divided into multiple units that are either each separately owned, or owned in common with exclusive rights of occupation by individual own ...

s and a hotel.

* 60 Wall Street, built in 1988. It was formerly the J.P. Morgan & Co. headquarters before becoming the U.S. headquarters of Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange.

...

. It is the last remaining major investment bank headquarters on Wall Street.

Another key anchor for the area is the New York Stock Exchange Building at the corner of Broad Street. It houses the New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It is the List of stock exchanges, largest stock excha ...

, which is by far the world's largest stock exchange per market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

of its listed companies, at US$28.5 trillion as of June 30, 2018. City authorities realize its importance, and believed that it has "outgrown its neoclassical temple at the corner of Wall and Broad streets", and in 1998, offered substantial tax incentives to try to keep it in the Financial District. Plans to rebuild it were delayed by the September 11 attacks. The exchange still occupies the same site. The exchange is the locus for a large amount of technology and data. For example, to accommodate the three thousand people who work directly on the exchange floor requires 3,500 kilowatts of electricity, along with 8,000 phone circuits on the trading floor alone, and of fiber-optic cable below ground.

Importance

As an economic engine

In the New York economy

Finance professor Charles R. Geisst wrote that the exchange has become "inextricably intertwined into New York's economy". Wall Street pay, in terms of salaries and bonuses and taxes, is an important part of the economy ofNew York City

New York, often called New York City (NYC), is the most populous city in the United States, located at the southern tip of New York State on one of the world's largest natural harbors. The city comprises five boroughs, each coextensive w ...

, the tri-state metropolitan area, and the United States

The United States of America (USA), also known as the United States (U.S.) or America, is a country primarily located in North America. It is a federal republic of 50 U.S. state, states and a federal capital district, Washington, D.C. The 48 ...

. Anchored by Wall Street, New York City has been called the world's most economically powerful city and leading financial center

A financial centre (financial center in American English) or financial hub is a location with a significant concentration of commerce in financial services.

The commercial activity that takes place in a financial centre may include banking, ...

. As such, a falloff in Wall Street's economy could have "wrenching effects on the local and regional economies". In 2008, after a downturn in the stock market, the decline meant $18 billion less in taxable income, with less money available for "apartments, furniture, cars, clothing and services".

Estimates vary about the number and quality of financial jobs in the city. One estimate was that Wall Street firms employed close to 200,000 persons in 2008. Another estimate was that in 2007, the financial services industry which had a $70 billion profit became 22 percent of the city's revenue. Another estimate (in 2006) was that the financial services industry makes up 9% of the city's work force and 31% of the tax base. An additional estimate from 2007 by Steve Malanga of the Manhattan Institute was that the securities industry accounts for 4.7 percent of the jobs in New York City but 20.7 percent of its wages, and he estimated there were 175,000 securities-industries jobs in New York (both Wall Street area and midtown) paying an average of $350,000 annually. Between 1995 and 2005, the sector grew at an annual rate of about 6.6% annually, a respectable rate, but that other financial centers were growing faster. Another estimate, made in 2008, was that Wall Street provided a fourth of all personal income earned in the city, and 10% of New York City's tax revenue. The city's securities industry, enumerating 163,400 jobs in August 2013, continues to form the largest segment of the city's financial sector and an important economic engine, accounting in 2012 for 5 percent of private sector jobs in New York City, 8.5 percent (US$3.8 billion) of the city's tax revenue, and 22 percent of the city's total wages, including an average salary of US$360,700.

The seven largest Wall Street firms in the 2000s were Bear Stearns

The Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that failed in 2008 during the 2008 financial crisis and the Great Recession. After its closure it was subsequently sold to JPMorgan Chas ...

, JPMorgan Chase

JPMorgan Chase & Co. (stylized as JPMorganChase) is an American multinational financial services, finance corporation headquartered in New York City and incorporated in Delaware. It is List of largest banks in the United States, the largest ba ...

, Citigroup

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services company based in New York City. The company was formed in 1998 by the merger of Citicorp, t ...

, Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

, Morgan Stanley

Morgan Stanley is an American multinational investment bank and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in 42 countries and more than 80,000 employees, the firm's clients in ...

, Merrill Lynch and Lehman Brothers

Lehman Brothers Inc. ( ) was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merril ...

. During the recession of 2008–10, many of these firms, including Lehman, went out of business or were bought up at firesale prices by other financial firms. In 2008, Lehman filed for bankruptcy, Bear Stearns

The Bear Stearns Companies, Inc. was an American investment bank, securities trading, and brokerage firm that failed in 2008 during the 2008 financial crisis and the Great Recession. After its closure it was subsequently sold to JPMorgan Chas ...

was bought by JPMorgan Chase

JPMorgan Chase & Co. (stylized as JPMorganChase) is an American multinational financial services, finance corporation headquartered in New York City and incorporated in Delaware. It is List of largest banks in the United States, the largest ba ...

forced by the U.S. government, and Merrill Lynch was bought by Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

in a similar shot-gun wedding. These failures marked a catastrophic downsizing of Wall Street as the financial industry goes through restructuring and change. Since New York's financial industry provides almost one-fourth of all income produced in the city, and accounts for 10% of the city's tax revenues and 20% of the state's, the downturn has had huge repercussions for government treasuries. New York's mayor Michael Bloomberg

Michael Rubens Bloomberg (born February 14, 1942) is an American businessman and politician. He is the majority owner and co-founder of Bloomberg L.P., and was its CEO from 1981 to 2001 and again from 2014 to 2023. He served as the 108th mayo ...

reportedly over a four-year period dangled over $100 million in tax incentives to persuade Goldman Sachs to build a 43-story headquarters

Headquarters (often referred to as HQ) notes the location where most or all of the important functions of an organization are coordinated. The term is used in a wide variety of situations, including private sector corporations, non-profits, mil ...

in the Financial District near the destroyed World Trade Center site. In 2009, things looked somewhat gloomy, with one analysis by the Boston Consulting Group

Boston Consulting Group, Inc. (BCG) is an American global management consulting firm founded in 1963 and headquartered in Boston, Massachusetts. It is one of the "Big Three (management consultancies), Big Three" (or MBB, the world's three large ...

suggesting that 65,000 jobs had been permanently lost because of the downturn. But there were signs that Manhattan property prices were rebounding with price rises of 9% annually in 2010, and bonuses were being paid once more, with average bonuses over $124,000 in 2010.

Versus Midtown Manhattan

A requirement of the New York Stock Exchange was that brokerage firms had to have offices "clustered around Wall Street" so clerks could deliver physical paper copies of stock certificates each week. There were some indications that midtown had been becoming the locus of financial services dealings even by 1911. But as technology progressed, in the middle and later decades of the 20th century, computers and telecommunications replaced paper notifications, meaning that the close proximity requirement could be bypassed in more situations. Many financial firms found that they could move toMidtown Manhattan

Midtown Manhattan is the central portion of the New York City borough of Manhattan, serving as the city's primary central business district. Midtown is home to some of the city's most prominent buildings, including the Empire State Building, the ...

, only away, and still operate effectively. For example, the former investment firm of Donaldson, Lufkin & Jenrette was described as a ''Wall Street firm'' but had its headquarters on Park Avenue

Park Avenue is a boulevard in New York City that carries north and southbound traffic in the borough (New York City), boroughs of Manhattan and the Bronx. For most of the road's length in Manhattan, it runs parallel to Madison Avenue to the wes ...

in Midtown. A report described the migration from Wall Street:

Nevertheless, a key magnet for the Wall Street remains the New York Stock Exchange Building. Some "old guard" firms such as Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

and Merrill Lynch (bought by Bank of America

The Bank of America Corporation (Bank of America) (often abbreviated BofA or BoA) is an American multinational investment banking, investment bank and financial services holding company headquartered at the Bank of America Corporate Center in ...

in 2009), have remained "fiercely loyal to the Financial District" location, and new ones such as Deutsche Bank

Deutsche Bank AG (, ) is a Germany, German multinational Investment banking, investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange.

...

have chosen office space in the district. So-called "face-to-face" trading between buyers and sellers remains a "cornerstone" of the NYSE, with a benefit of having all of a deal's players close at hand, including investment bankers

Investment banking is an advisory-based financial service for institutional investors, corporations, governments, and similar clients. Traditionally associated with corporate finance, such a bank might assist in raising financial capital by unde ...

, lawyer

A lawyer is a person who is qualified to offer advice about the law, draft legal documents, or represent individuals in legal matters.

The exact nature of a lawyer's work varies depending on the legal jurisdiction and the legal system, as w ...

s, and accountant

An accountant is a practitioner of accounting or accountancy.

Accountants who have demonstrated competency through their professional associations' certification exams are certified to use titles such as Chartered Accountant, Chartered Certif ...

s.

In the New Jersey economy

After Wall Street firms started to expand westward in the 1980s intoNew Jersey

New Jersey is a U.S. state, state located in both the Mid-Atlantic States, Mid-Atlantic and Northeastern United States, Northeastern regions of the United States. Located at the geographic hub of the urban area, heavily urbanized Northeas ...

, the direct economic impacts of Wall Street activities have gone beyond New York City. The employment in the financial services industry, mostly in the "back office" roles, has become an important part of New Jersey's economy. In 2009, the Wall Street employment wages were paid in the amount of almost $18.5 billion in the state. The industry contributed $39.4 billion or 8.4 percent to the New Jersey's gross domestic product

Gross domestic product (GDP) is a monetary measure of the total market value of all the final goods and services produced and rendered in a specific time period by a country or countries. GDP is often used to measure the economic performanc ...

in the same year. The most significant area with Wall Street employment is in Jersey City

Jersey City is the List of municipalities in New Jersey, second-most populous

. In 2008, the "Wall Street West" employment contributed to one third of the private sector

The private sector is the part of the economy which is owned by private groups, usually as a means of establishment for profit or non profit, rather than being owned by the government.

Employment

The private sector employs most of the workfo ...

jobs in Jersey City. Within the Financial Service cluster, there were three major sectors: more than 60 percent were in the securities industry; 20 percent were in bank

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital m ...

ing; and 8 percent in insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect ...

.

Additionally, New Jersey has become the main technology infrastructure to support the Wall Street operations. A substantial amount of securities traded in the United States are executed in New Jersey as the data center

A data center is a building, a dedicated space within a building, or a group of buildings used to house computer systems and associated components, such as telecommunications and storage systems.

Since IT operations are crucial for busines ...

s of electronic trading in the U.S. equity market for all major stock exchanges are located in North

North is one of the four compass points or cardinal directions. It is the opposite of south and is perpendicular to east and west. ''North'' is a noun, adjective, or adverb indicating Direction (geometry), direction or geography.

Etymology

T ...

and Central Jersey

Central Jersey, or Central New Jersey, is the middle region of the U.S. state of New Jersey. The designation Central Jersey is a distinct administrative toponym. While New Jersey is often divided into North Jersey and South Jersey, many resi ...

. A significant amount of securities clearing and settlement workforce is also in the state. This includes the majority of the workforce of Depository Trust Company, the primary U.S. securities depository; and the Depository Trust & Clearing Corporation, the parent company of National Securities Clearing Corporation, the Fixed Income Clearing Corporation and Emerging Markets Clearing Corporation. Having a direct tie to Wall Street employment can be problematic for New Jersey, however. The state lost 7.9 percent of its employment base from 2007 to 2010 in the financial services sector in the fallout of the subprime mortgage crisis.

Competing financial centers

Of the street's importance as a financial center, ''New York Times

''The New York Times'' (''NYT'') is an American daily newspaper based in New York City. ''The New York Times'' covers domestic, national, and international news, and publishes opinion pieces, investigative reports, and reviews. As one of ...

'' analyst Daniel Gross wrote:

An example is the alternative trading platform known as BATS

Bats are flying mammals of the order Chiroptera (). With their forelimbs adapted as wings, they are the only mammals capable of true and sustained flight. Bats are more agile in flight than most birds, flying with their very long spread-out ...

, based in Kansas City, which came "out of nowhere to gain a 9 percent share in the market for trading United States stocks". The firm has computers in the U.S. state of New Jersey

New Jersey is a U.S. state, state located in both the Mid-Atlantic States, Mid-Atlantic and Northeastern United States, Northeastern regions of the United States. Located at the geographic hub of the urban area, heavily urbanized Northeas ...

, and only two salespeople in New York City; the remaining 33 employees work in a center in Kansas.

In the public imagination

As a financial symbol

Wall Street in a conceptual sense represents financial and economic power. To Americans, it can sometimes represent elitism and power politics, and its role has been a source of controversy throughout the nation's history, particularly beginning around the Gilded Age period in the late 19th century. Wall Street became the symbol of a country and economic system that many Americans see as having developed through trade, capitalism, and innovation. The term "Wall Street" has become ametonym

Metonymy () is a figure of speech in which a concept is referred to by the name of something associated with that thing or concept. For example, the word "wikt:suit, suit" may refer to a person from groups commonly wearing business attire, such ...

for the financial markets of the United States as a whole, the American financial services industry, or New York–based financial interests. Wall Street has become synonymous with financial interests, often used negatively. During the subprime mortgage crisis from 2007 to 2010, Wall Street financing was blamed as one of the causes, although most commentators blame an interplay of factors. The U.S. government with the Troubled Asset Relief Program

The Troubled Asset Relief Program (TARP) is a program of the United States government to purchase toxic assets and equity from financial institutions to strengthen its financial sector that was passed by Congress and signed into law by U.S. Presi ...

bailed out the banks and financial backers with billions of taxpayer dollars, but the bailout was often criticized as politically motivated, and was criticized by journalists as well as the public. Analyst Robert Kuttner in the ''Huffington Post

''HuffPost'' (''The Huffington Post'' until 2017, itself often abbreviated as ''HPo'') is an American progressive news website, with localized and international editions. The site offers news, satire, blogs, and original content, and covers ...

'' criticized the bailout as helping large Wall Street firms such as Citigroup while neglecting to help smaller community development banks such as Chicago's ShoreBank. One writer in the ''Huffington Post'' looked at FBI

The Federal Bureau of Investigation (FBI) is the domestic Intelligence agency, intelligence and Security agency, security service of the United States and Federal law enforcement in the United States, its principal federal law enforcement ag ...

statistics on robbery, fraud, and crime and concluded that Wall Street was the "most dangerous neighborhood in the United States" if one factored in the $50 billion fraud

In law, fraud is intent (law), intentional deception to deprive a victim of a legal right or to gain from a victim unlawfully or unfairly. Fraud can violate Civil law (common law), civil law (e.g., a fraud victim may sue the fraud perpetrato ...

perpetrated by Bernie Madoff.

When large firms such as Enron

Enron Corporation was an American Energy development, energy, Commodity, commodities, and services company based in Houston, Texas. It was led by Kenneth Lay and developed in 1985 via a merger between Houston Natural Gas and InterNorth, both re ...

, WorldCom

MCI, Inc. (formerly WorldCom and MCI WorldCom) was a telecommunications company. For a time, it was the second-largest long-distance telephone company in the United States, after AT&T. WorldCom grew largely by acquiring other telecommunicatio ...

, and Global Crossing were found guilty of fraud, Wall Street was often blamed, even though these firms had headquarters around the nation and not in Wall Street. Many complained that the resulting Sarbanes-Oxley legislation dampened the business climate with regulations that were "overly burdensome". Interest groups seeking favor with Washington lawmakers, such as car dealers, have often sought to portray their interests as allied with ''Main Street'' rather than ''Wall Street'', although analyst Peter Overby on ''National Public Radio

National Public Radio (NPR) is an American public broadcasting organization headquartered in Washington, D.C., with its NPR West headquarters in Culver City, California. It serves as a national Radio syndication, syndicator to a network of more ...

'' suggested that car dealers have written over $250 billion in consumer loans and have real ties with ''Wall Street''.

When the United States Treasury bailed out large financial firms, to ostensibly halt a downward spiral in the nation's economy, there was tremendous negative political fallout, particularly when reports came out that monies supposed to be used to ease credit restrictions were being used to pay bonuses to highly paid employees. Analyst William D. Cohan argued that it was "obscene" how Wall Street reaped "massive profits and bonuses in 2009" after being saved by "trillions of dollars of American taxpayers' treasure" despite Wall Street's "greed and irresponsible risk-taking". ''Washington Post

''The Washington Post'', locally known as ''The'' ''Post'' and, informally, ''WaPo'' or ''WP'', is an American daily newspaper published in Washington, D.C., the national capital. It is the most widely circulated newspaper in the Washington m ...

'' reporter Suzanne McGee called for Wall Street to make a sort of public apology to the nation, and expressed dismay that people such as Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

chief executive Lloyd Blankfein hadn't expressed contrition despite being sued by the SEC in 2009. McGee wrote that "Bankers aren't the sole culprits, but their too-glib denials of responsibility and the occasional vague and waffling expression of regret don't go far enough to deflect anger."

But chief banking analyst at

But chief banking analyst at Goldman Sachs

The Goldman Sachs Group, Inc. ( ) is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered in Lower Manhattan in New York City, with regional headquarters in many internationa ...

, Richard Ramsden, is "unapologetic" and sees "banks as the dynamos that power the rest of the economy". Ramsden believes "risk-taking is vital" and said in 2010:

Others in the financial industry believe that they have been unfairly castigated by the public and by politicians. For example, Anthony Scaramucci reportedly told President Barack Obama

Barack Hussein Obama II (born August 4, 1961) is an American politician who was the 44th president of the United States from 2009 to 2017. A member of the Democratic Party, he was the first African American president in American history. O ...

in 2010 that he felt like a piñata, "whacked with a stick" by "hostile politicians". The financial misdeeds of various figures throughout American history sometimes casts a dark shadow on financial investing as a whole, and include names such as William Duer, Jim Fisk and Jay Gould

Jason Gould (; May 27, 1836 – December 2, 1892) was an American railroad magnate and financial speculator who founded the Gould family, Gould business dynasty. He is generally identified as one of the Robber baron (industrialist), robber bar ...

(the latter two believed to have been involved with an effort to collapse the U.S. gold market in 1869) as well as modern figures such as Bernard Madoff who "bilked billions from investors".

In addition, images of Wall Street and its figures have loomed large. The 1987 Oliver Stone

William Oliver Stone (born ) is an American filmmaker. Stone is an acclaimed director, tackling subjects ranging from the Vietnam War and American politics to musical film, musical Biographical film, biopics and Crime film, crime dramas. He has ...

film ''Wall Street

Wall Street is a street in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It runs eight city blocks between Broadway (Manhattan), Broadway in the west and South Street (Manhattan), South Str ...

'' created the iconic figure of Gordon Gekko who used the phrase "greed is good", which caught on in the cultural parlance. Gekko is reportedly based on multiple real-life individuals on Wall Street, including corporate raider Carl Icahn, disgraced stock trader Ivan Boesky, and investor Michael Ovitz. In 2009, Stone commented how the film had had an unexpected cultural influence, not causing them to turn away from corporate greed, but causing many young people to choose Wall Street careers because of the film. A reporter repeated other lines from the film: "I'm talking about liquid. Rich enough to have your own jet. Rich enough not to waste time. Fifty, a hundred million dollars, Buddy. A player." Wall Street firms have, however, also contributed to projects such as Habitat for Humanity, as well as done food programs in Haiti

Haiti, officially the Republic of Haiti, is a country on the island of Hispaniola in the Caribbean Sea, east of Cuba and Jamaica, and south of the Bahamas. It occupies the western three-eighths of the island, which it shares with the Dominican ...

, trauma centers in Sudan

Sudan, officially the Republic of the Sudan, is a country in Northeast Africa. It borders the Central African Republic to the southwest, Chad to the west, Libya to the northwest, Egypt to the north, the Red Sea to the east, Eritrea and Ethiopi ...

, and rescue boats during floods in Bangladesh

Bangladesh, officially the People's Republic of Bangladesh, is a country in South Asia. It is the List of countries and dependencies by population, eighth-most populous country in the world and among the List of countries and dependencies by ...

.

In popular culture

*Herman Melville

Herman Melville (Name change, born Melvill; August 1, 1819 – September 28, 1891) was an American novelist, short story writer, and poet of the American Renaissance (literature), American Renaissance period. Among his best-known works ar ...

's classic short story " Bartleby, the Scrivener" (first published in 1853 and republished in revised edition in 1856) is subtitled "A Story of Wall Street" and portrays the alienating forces at work within the confines of Wall Street.

* Many events of Tom Wolfe

Thomas Kennerly Wolfe Jr. (March 2, 1930 – May 14, 2018)Some sources say 1931; ''The New York Times'' and Reuters both initially reported 1931 in their obituaries before changing to 1930. See and was an American author and journalist widely ...

's 1987 novel '' The Bonfire of the Vanities'' center on Wall Street and its culture.

* The film ''Wall Street

Wall Street is a street in the Financial District, Manhattan, Financial District of Lower Manhattan in New York City. It runs eight city blocks between Broadway (Manhattan), Broadway in the west and South Street (Manhattan), South Str ...

'' (1987) and its sequel '' Wall Street: Money Never Sleeps'' (2010) exemplify many popular conceptions of Wall Street as a center of shady corporate dealings and insider trading

Insider trading is the trading of a public company's stock or other securities (such as bonds or stock options) based on material, nonpublic information about the company. In various countries, some kinds of trading based on insider informati ...

.

* In the ''Star Trek