Payday loans in the United States on:

[Wikipedia]

[Google]

[Amazon]

A payday loan (also called a payday advance, salary loan, payroll loan, small dollar loan, short term, or cash advance loan) is a small, short-term unsecured loan, "regardless of whether repayment of loans is linked to a borrower's payday." The loans are also sometimes referred to as " cash advances," though that term can also refer to cash provided against a prearranged line of credit such as a

A payday loan (also called a payday advance, salary loan, payroll loan, small dollar loan, short term, or cash advance loan) is a small, short-term unsecured loan, "regardless of whether repayment of loans is linked to a borrower's payday." The loans are also sometimes referred to as " cash advances," though that term can also refer to cash provided against a prearranged line of credit such as a

As early as the 1930s check cashers cashed post-dated checks for a daily fee until the check was negotiated at a later date. In the early 1990s, check cashers began offering payday loans in states that were unregulated or had loose regulations. Many payday lenders of this time listed themselves in

As early as the 1930s check cashers cashed post-dated checks for a daily fee until the check was negotiated at a later date. In the early 1990s, check cashers began offering payday loans in states that were unregulated or had loose regulations. Many payday lenders of this time listed themselves in

Banking

Banking

Rolling over debt is a process in which the borrower extends the length of their debt into the next period, generally with a fee while still accruing

Rolling over debt is a process in which the borrower extends the length of their debt into the next period, generally with a fee while still accruing

Payday lenders get competition from

Payday lenders get competition from

FDIC Guidelines on Payday Lending

Payday loan answers

- Consumer Financial Protection Bureau {{Payday loans by country Finance in the United States

A payday loan (also called a payday advance, salary loan, payroll loan, small dollar loan, short term, or cash advance loan) is a small, short-term unsecured loan, "regardless of whether repayment of loans is linked to a borrower's payday." The loans are also sometimes referred to as " cash advances," though that term can also refer to cash provided against a prearranged line of credit such as a

A payday loan (also called a payday advance, salary loan, payroll loan, small dollar loan, short term, or cash advance loan) is a small, short-term unsecured loan, "regardless of whether repayment of loans is linked to a borrower's payday." The loans are also sometimes referred to as " cash advances," though that term can also refer to cash provided against a prearranged line of credit such as a credit card

A credit card is a payment card issued to users (cardholders) to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt (i.e., promise to the card issuer to pay them for the amounts plus the o ...

. Payday advance loans rely on the consumer having previous payroll and employment records. Legislation regarding payday loans varies widely between different countries and, within the United States, between different states.

To prevent usury

Usury () is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is ch ...

(unreasonable and excessive rates of interest), some jurisdictions limit the annual percentage rate (APR) that any lender, including payday lenders, can charge. Some jurisdictions outlaw payday lending entirely, and some have very few restrictions on payday lenders. In the United States, the rates of these loans were formerly restricted in most states by the Uniform Small Loan Laws (USLL), with 360%–400% APR generally the norm.

Federal regulation

The federal government regulates payday loans because of: (a) significantly higher rates of bankruptcy amongst those who use loans (due to interest rates as high as 1000%); (b) unfair and illegal debt collection practices; and (c) loans with automatic rollovers which further increase debt owed to lenders. The federal Truth in Lending Act of 1968 requires various disclosures, including all fees and payment terms. TheDodd–Frank Wall Street Reform and Consumer Protection Act

The Dodd–Frank Wall Street Reform and Consumer Protection Act, commonly referred to as Dodd–Frank, is a United States federal law that was enacted on July 21, 2010. The law overhauled financial regulation in the aftermath of the Great Recess ...

gave the Consumer Financial Protection Bureau

The Consumer Financial Protection Bureau (CFPB) is an agency of the United States government responsible for consumer protection in the financial sector. CFPB's jurisdiction includes banks, credit unions, securities firms, payday lenders, mor ...

(CFPB) specific authority to regulate all payday lenders, regardless of size. Also, the Military Lending Act imposes a 36% rate cap on tax refund loans and certain payday and auto title loans made to active duty armed forces members and their covered dependents, and prohibits certain terms in such loans.

The CFPB has issued several enforcement actions against payday lenders for reasons such as violating the prohibition on lending to military members and aggressive collection tactics.

In 2017, the CFPB issued a rule that payday, automobile title, and other lenders check to see if borrowers could afford to repay high-interest loans before issuing them. It revoked this rule in 2020, but retained other requirements.

Payday lenders have made effective use of the sovereign status of Native American reservations, often forming partnerships with members of a tribe to offer loans over the internet which evade state law. However, the Federal Trade Commission has begun to aggressively monitor these lenders as well. While some tribal lenders are operated by Native Americans, there is also evidence many are simply a creation of so-called "rent-a-tribe" schemes, where a non-Native company sets up operations on tribal land.

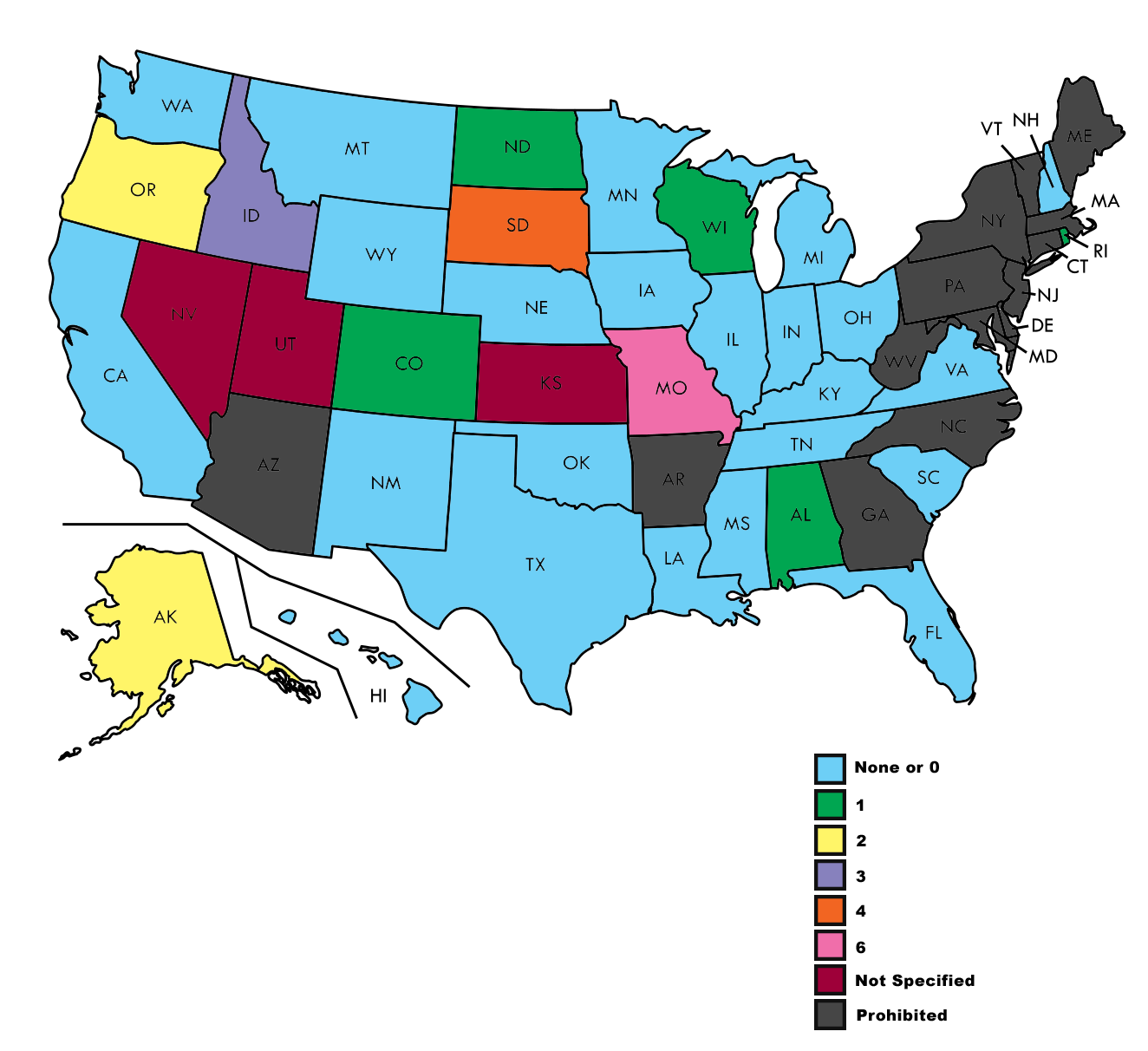

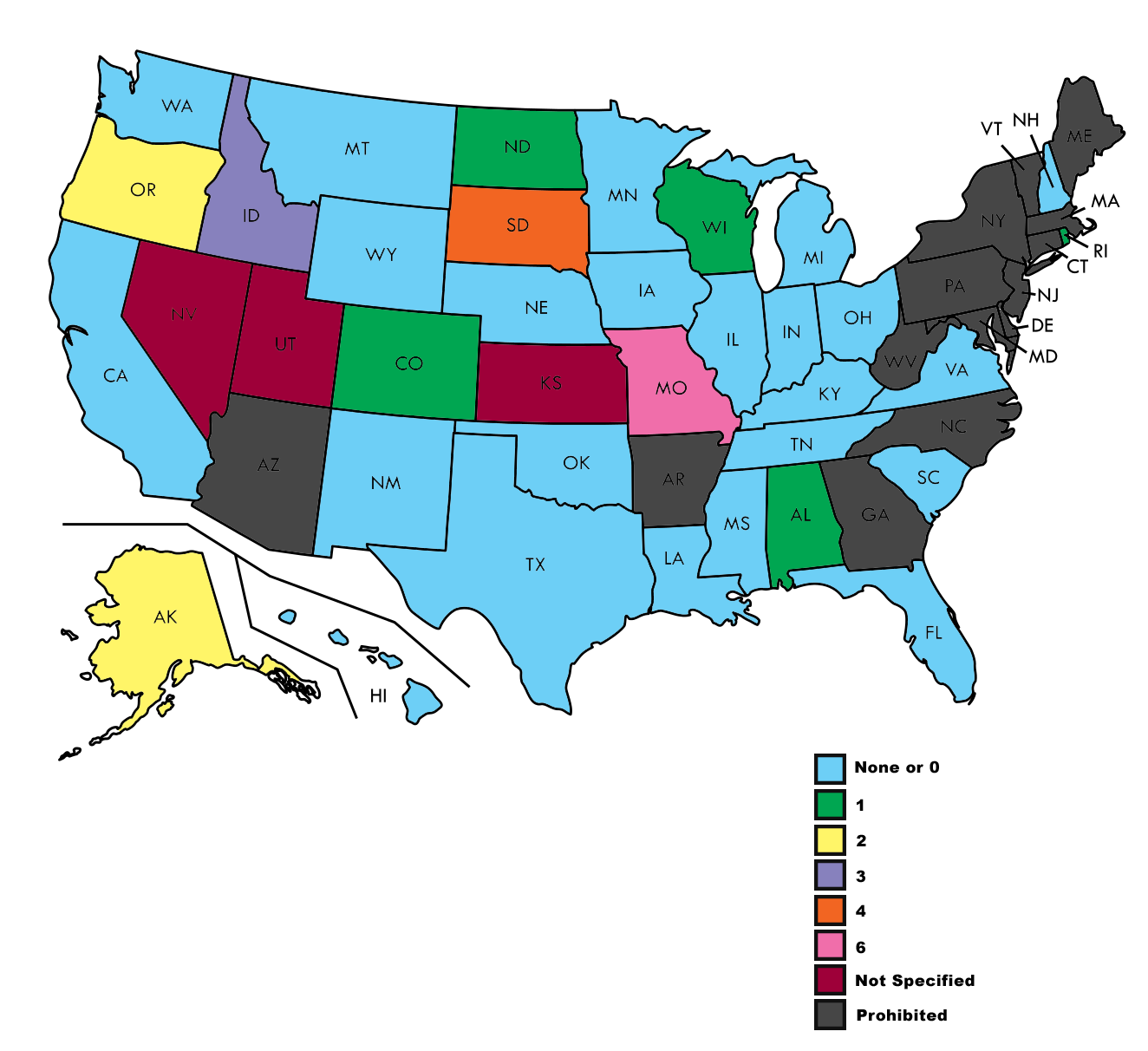

State and district regulation

Payday lending is legal in 27 states, with 9 others allowing some form of short term storefront lending with restrictions. The remaining 14 and the District of Columbia forbid the practice. Some states have aggressively pursued lenders they felt violate their state laws. Some states have laws limiting the number of loans a borrower can take at a single time according to LATimes report. This is currently being accomplished by single, statewide realtime databases. These systems are required in Florida, Michigan, Illinois, Indiana, North Dakota, New Mexico, Oklahoma, South Carolina, and Virginia States Statues. These systems require all licensed lenders to conduct a real time verification of the customer's eligibility to receive a loan before conducting a loan. Reports published by state regulators in these states indicate that this system enforces all of the provisions of the state's statutes. Some states also cap the number of loans per borrower per year (Virginia, Washington), or require that after a fixed number of loan renewals, the lender must offer a lower interest loan with a longer term, so that the borrower can eventually get out of the debt cycle by following some steps. Borrowers can circumvent these laws by taking loans from more than one lender if there is not an enforcement mechanism in place by the state. Some states allow that a consumer can have more than one loan outstanding (Oklahoma). Currently, the states with the most payday lenders per capita are Alabama, Mississippi, Louisiana, South Carolina and Oklahoma. States which have prohibited payday lending have reported lower rates of bankruptcy, a smaller volume of complaints regarding collection tactics, and the development of new lending services from banks andcredit unions

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision ...

.

Regulation in the District of Columbia

Effective January 9, 2008, the maximum interest rate that payday lenders may charge in theDistrict of Columbia

)

, image_skyline =

, image_caption = Clockwise from top left: the Washington Monument and Lincoln Memorial on the National Mall, United States Capitol, Logan Circle, Jefferson Memorial, White House, Adams Morgan ...

is 24 percent, which is the same maximum interest rate for banks and credit unions. Payday lenders also must have a license from the District government in order to operate.

Banning in Georgia

Georgia law prohibited payday lending for more than 100 years, but the state was not successful in shutting the industry down until the 2004 legislation made payday lending a felony, allowed for racketeering charges and permitted potentially costly class-action lawsuits. In 2013 this law was used to sue Western Sky, a tribal internet payday lender.Regulation in New Mexico

New Mexico caps fees, restricts total loans by a consumer and prohibits immediate loan rollovers, in which a consumer takes out a new loan to pay off a previous loan, under a law that took effect November 1, 2007. A borrower who is unable to repay a loan is automatically offered a 130-day payment plan, with no fees or interest. Once a loan is repaid, under the new law, the borrower must wait 10 days before obtaining another payday loan. The law allows the term of a loan to run from 14 to 35 days, with the fees capped at $15.50 for each $100 borrowed 58-15-33 NMSA 1978. There is also a 50-cent administrative fee to cover costs of lenders verifying whether a borrower qualifies for the loan, such as determining whether the consumer is still paying off a previous loan. This is accomplished by verifying in real time against the approved lender compliance database administered by the New Mexico regulator. The statewide database does not allow a loan to be issued to a consumer by a licensed payday lender if the loan would result in a violation of state statute. A borrower's cumulative payday loans cannot exceed 25 percent of the individual's gross monthly income. In 2017, theNew Mexico Legislature

The New Mexico Legislature ( es, Legislatura de Nuevo México) is the legislative branch of the state government of New Mexico. It is a bicameral body made up of the New Mexico House of Representatives and the New Mexico Senate.

History

The ...

banned payday loans.

Withdrawal from North Carolina

In 2006, the North Carolina Department of Justice announced the state had negotiated agreements with all the payday lenders operating in the state. The state contended that the practice of funding payday loans through banks chartered in other states illegally circumvents North Carolina law. Under the terms of the agreement, the last three lenders will stop making new loans, will collect only principal on existing loans and will pay $700,000 to non-profit organizations for relief.Operation Sunset in Arizona

Arizona usury law prohibits lending institutions to charge greater than 36% annual interest on a loan. On July 1, 2010, a law exempting payday loan companies from the 36% cap expired. State Attorney General Terry Goddard initiated Operation Sunset, which aggressively pursues lenders who violate the lending cap. The expiration of the law caused many payday loan companies to shut down their Arizona operations, notablyAdvance America Advance America may refer to:

* Advance America (advocacy group), a political lobbying organization in Indiana

* A payday loan provider in the United States owned by Grupo Elektra

Grupo Elektra is a Mexican financial and retailing corporation es ...

.

Regulation in Illinois

On March 23, 2021, Gov. J.B. Pritzker signed an interest cap of 36% on loans from payday lenders in Illinois.Proposed postal banking

Some countries offer basic banking services through their postal systems. TheUnited States Post Office Department

The United States Post Office Department (USPOD; also known as the Post Office or U.S. Mail) was the predecessor of the United States Postal Service, in the form of a Cabinet department, officially from 1872 to 1971. It was headed by the postma ...

offered such a service in the past. Called the United States Postal Savings System it was discontinued in 1967. In January 2014 the Office of the Inspector General of the United States Postal Service issued a white paper suggesting that the USPS could offer banking services, to include small dollar loans for under 30% APR. Both support and criticism quickly followed, however the major criticism isn't that the service would not help the consumer but that the payday lenders themselves would be forced out of business due to competition and the plan is nothing more than a scheme to support postal employees.

According to some sources the USPS Board of Governors could authorize these services under the same authority with which they offer money orders now.

Industry growth

19th century salary lenders

In the early 1900s some lenders participated insalary

A salary is a form of periodic payment from an employer to an employee, which may be specified in an employment contract. It is contrasted with piece wages, where each job, hour or other unit is paid separately, rather than on a periodic basis.

F ...

purchases. Salary purchases are where lenders buy a worker’s next salary for an amount less than the salary, days before the salary is paid out. These salary purchases were early payday loans structured to avoid state usury

Usury () is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. The term may be used in a moral sense—condemning taking advantage of others' misfortunes—or in a legal sense, where an interest rate is ch ...

laws.

20th century check cashing

As early as the 1930s check cashers cashed post-dated checks for a daily fee until the check was negotiated at a later date. In the early 1990s, check cashers began offering payday loans in states that were unregulated or had loose regulations. Many payday lenders of this time listed themselves in

As early as the 1930s check cashers cashed post-dated checks for a daily fee until the check was negotiated at a later date. In the early 1990s, check cashers began offering payday loans in states that were unregulated or had loose regulations. Many payday lenders of this time listed themselves in yellow pages

The yellow pages are telephone directories of businesses, organized by category rather than alphabetically by business name, in which advertising is sold. The directories were originally printed on yellow paper, as opposed to Telephone direct ...

as "Check Cashers."

1990s to present

Banking

Banking deregulation

Deregulation is the process of removing or reducing state regulations, typically in the economic sphere. It is the repeal of governmental regulation of the economy. It became common in advanced industrial economies in the 1970s and 1980s, as a r ...

in the late 1980s caused small community banks to go out of business. This created a void in the supply of short-term microcredit

:''This article is specific to small loans, often provided in a pooled manner. For direct payments to individuals for specific projects, see Micropatronage. For financial services to the poor, see Microfinance. For small payments, see Micropa ...

, which was not supplied by large banks due to lack of profitability. The payday loan industry sprang up in order to fill this void and to supply microcredit to the working class at expensive rates.

In 1993, Check Into Cash

Check Into Cash is a financial services retailer with more than 1,100 stores in 30 states. The company was founded in 1993 by W. Allan Jones in Cleveland, Tennessee, where the headquarters are located today.

The firm offers payday loans, online ...

was founded by businessman Allan Jones in Cleveland

Cleveland ( ), officially the City of Cleveland, is a city in the U.S. state of Ohio and the county seat of Cuyahoga County. Located in the northeastern part of the state, it is situated along the southern shore of Lake Erie, across the U ...

, Tennessee

Tennessee ( , ), officially the State of Tennessee, is a landlocked state in the Southeastern region of the United States. Tennessee is the 36th-largest by area and the 15th-most populous of the 50 states. It is bordered by Kentucky to ...

. This business model was made possible after Jones donated to the campaigns of legislators in multiple states, convincing them to legalize loans with such high interest rates.

Subsequently, the industry grew from fewer than 500 storefronts to over 22,000 and a total size of $46 billion. This number has risen even higher over the years. By 2008 payday loan stores nationwide outnumbered Starbucks shops and McDonald's fast food restaurants.

Deregulation also caused states to roll back usury caps, and lenders were able to restructure their loans to avoid these caps after federal laws were changed.

State and federal regulation on growth

The Consumer Financial Protection Bureau, in a June 2016 report on payday lending, found that loan volume decreased 13% in Texas after the January 2012 disclosure reforms. The reform required lenders to disclose "information on how the cost of the loan is impacted by whether (and how many times) it is renewed, typical patterns of repayment, and alternative forms of consumer credit that a consumer may want to consider, among other information". The report cites that the decrease is due to borrowers taking fewer loans rather than borrowing smaller amounts each time. Re-borrowing rates slightly declined by 2.1% in Texas after the disclosure law took effect. The Consumer Financial Protection Bureau has proposedrulemaking

In administrative law, rulemaking is the process that executive and independent agencies use to create, or ''promulgate'', regulations. In general, legislatures first set broad policy mandates by passing statutes, then agencies create more de ...

in June 2016, which would require payday lenders to verify the financial situation of their customers, provide borrowers with disclosure statements prior to each transaction, and limit the number of debt rollovers allowed, decreasing the industry by 55 percent. Another option would allow the lender to skip the ability to repay assessment for loans of $500 or less, but the lender would have to provide a realistic repayment schedule and limit the number of loans lent over the course of a year.

Debt rollover

Rolling over debt is a process in which the borrower extends the length of their debt into the next period, generally with a fee while still accruing

Rolling over debt is a process in which the borrower extends the length of their debt into the next period, generally with a fee while still accruing interest

In finance and economics, interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (that is, the amount borrowed), at a particular rate. It is disti ...

. An empirical

Empirical evidence for a proposition is evidence, i.e. what supports or counters this proposition, that is constituted by or accessible to sense experience or experimental procedure. Empirical evidence is of central importance to the sciences and ...

study published in ''The Journal of Consumer Affairs'' found that low income individuals who reside in states that permit three or more rollovers were more likely to use payday lenders and pawnshops to supplement their income. The study also found that higher income individuals are more likely to use payday lenders in areas that permit rollovers. The article argues that payday loan rollovers lead low income individuals into a debt-cycle where they will need to borrow additional funds to pay the fees associated with the debt rollover. Of the states that allow payday lending, 22 states do not allow borrowers to rollover their debt and only three states allow unlimited rollovers. States that allow unlimited rollovers leave the number of rollovers allowed up to the individual businesses.

Payday lending legality and number of rollovers allowed

Effects of regulation

Price regulation in the United States has caused unintended consequences. Before a regulation policy took effect in Colorado, prices of payday finance charges were loosely distributed around a market equilibrium. The imposition of a price ceiling above this equilibrium served as a target where competitors could agree to raise their prices. This weakenedcompetition

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, ind ...

and caused the development of cartel

A cartel is a group of independent market participants who collude with each other in order to improve their profits and dominate the market. Cartels are usually associations in the same sphere of business, and thus an alliance of rivals. Mo ...

behavior. Because payday loans near minority neighborhoods and military bases are likely to have inelastic demand, this artificially higher price doesn't come with a lower quantity demanded for loans, allowing lenders to charge higher prices without losing many customers.

In 2006, Congress passed a law capping the annualized rate at 36 percent that lenders could charge members of the military. Even with these regulations and efforts to even outright ban the industry, lenders are still finding loopholes. The number of states in which payday lenders operate has fallen, from its peak in 2014 of 44 states to 36 in 2016.

Competition and alternatives

Payday lenders get competition from

Payday lenders get competition from credit unions

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision ...

, banks, and major financial institutions, which fund the Center for Responsible Lending

The Center for Responsible Lending (CRL) is a nonprofit organization research and policy group based in Durham, North Carolina. Its stated purpose is to educate the public about financial products and to push for policies that curb predatory len ...

, a non-profit that fights against payday loans.

Uber

Uber Technologies, Inc. (Uber), based in San Francisco, provides mobility as a service, ride-hailing (allowing users to book a car and driver to transport them in a way similar to a taxi), food delivery ( Uber Eats and Postmates), pack ...

and Lyft

Lyft, Inc. offers mobility as a service, ride-hailing, vehicles for hire, motorized scooters, a bicycle-sharing system, rental cars, and food delivery in the United States and select cities in Canada. Lyft sets fares, which vary using a ...

offer Instant Pay and Express Pay for their drivers.

The website NerdWallet

NerdWallet is an American personal finance company, founded in 2009 by Tim Chen and Jacob Gibson. It has a website and app that earns money by promoting financial products to its users.

History

NerdWallet was founded in August 2009 by Tim Chen ...

helps redirect potential payday borrowers to non-profit organizations with lower interest rates or to government organizations that provide short-term assistance. Its revenue comes from commissions on credit cards and other financial services that are also offered on the site.

The social institution of lending to trusted friends and relatives can involve embarrassment for the borrower. The impersonal nature of a payday loan is a way to avoid this embarrassment. Tim Lohrentz, the program manager of the Insight Center for Community Economic Development, suggested that it might be best to borrow from people you know to save a lot of money instead of trying to avoid embarrassment.

Economic effects

While designed to provide consumers with emergencyliquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include:

* Market liquidity, the ease with which an asset can be sold

* Accounting liquidity, the ability to meet cash obligations when due

* Liqu ...

, payday loans divert money away from consumer spending and towards paying interest rates. Some major banks offer payday loans with interest rates of 225 to 300 percent, while storefront and online payday lenders charge rates of 200 to 500 percent. Online loans are predicted to account for 60% of payday loans by 2016. In 2011, $774 million of consumer spending was lost to repaying payday loans and $169 million was lost to 56,230 bankruptcies

Bankruptcy is a legal process through which people or other entities who cannot repay debts to creditors may seek relief from some or all of their debts. In most jurisdictions, bankruptcy is imposed by a court order, often initiated by the debtor ...

related to payday loans. Additionally, 14,000 jobs were lost. By 2013, twelve million people were taking out a payday loan each year. On average, each borrower is supplied with $375 in emergency cash from each payday loan and the borrower pays $520 per year in interest. Each borrower takes out an average of eight of these loans in a year. In 2011, over a third of bank customers took out more than 20 payday loans.

Potentially, some positive attributes of payday loans exist. Borrowers may be able to use payday loans to avoid more-expensive late fees charged by utilities and other household creditors, and the use of payday loans could prevent overdraft fees which would otherwise have been charged to the borrower's checking account.

Although borrowers typically have payday loan debt for much longer than the loan's advertised two-week period, averaging about 200 days of debt, most borrowers have an accurate idea of when they will have paid off their loans. About 60% of borrowers pay off their loans within two weeks of the days they predict.

When interest rates on payday loans were capped to 150% in Oregon, causing a mass exit from the industry and preventing borrowers from taking out payday loans, there was a negative effect with bank overdrafts, late bills, and employment. The effect is in the opposite direction for military personnel. Job performance and military readiness declines with increasing access to payday loans.

Criticism

Income

Payday loans are marketed towards low-income households, because they can not provide collateral in order to obtain low interest loans, so they obtain high interest rate loans. The study found payday lenders to target the young and the poor, especially those populations and low-income communities near military bases. The Consumer Financial Protection Bureau states that renters, and not homeowners, are more likely to use these loans. It also states that people who are married, disabled, separated or divorced are likely consumers. Payday loan rates are high relative to those of traditional banks and do not encourage savings or asset accumulation. This property will be exhausted in low-income groups. Many people do not know that the borrowers' higher interest rates are likely to send them into a "debt spiral" where the borrower must constantly renew. A 2012 study by Pew Charitable research found that the majority of payday loans were taken out to bridge the gap of everyday expenses rather than for unexpected emergencies. The study found that 69% of payday loans are borrowed for recurring expenses, 16% were attributed to unexpected emergencies, 8% for special purchases, and 2% for other expenses.Race

Black and Latino people have made up a "disproportionally high percentage" of customers, according to a paper written by Jim Hawkins, a law professor, and Tiffany Penner, a law student, both at theUniversity of Houston

The University of Houston (UH) is a Public university, public research university in Houston, Texas. Founded in 1927, UH is a member of the University of Houston System and the List of universities in Texas by enrollment, university in Texas ...

.

Defaulted loans

The Center for Responsible Lending found that almost half of payday loan borrowers will default on their loan within the first two years. Taking out payday loans increases the difficulty of paying the mortgage, rent, and utility bills. The possibility of increased economic difficulties leads to homelessness and delays in medical care, sometimes causing dire health consequences that could have been prevented otherwise. For military men, using payday loans lowers overall performance and shortens service periods. To limit the issuance of military payday loans, the 2007 Military Lending Act established an interest rate ceiling of 36% on military payday loans. A 2013 article by Dobbie and Skiba found that more than 19% of initial loans in their study ended in default. Based on this, Dobbie and Skiba claim that the payday loan market is high risk.Premium pricing structure

A 2012 Pew Charitable Trusts study found that the average borrower took out eight loans of $375 each and paid interest of $520 across the loans. The equation for the annual cost of a loan in percent is:Asymmetric information

The payday loan industry takes advantage of the fact that most borrowers do not know how to calculate their loan's APR and do not realize that they are being charged rates up to 390% interest annually. Critics of payday lending cite the possibility that transactions with in the payday market may reflect a market failure that is due to asymmetric information or the borrowers' cognitive biases or limitations. The formula for the total cost of a Payday loan is: where is the money people borrowed from the payday loan, is the interest rate per period (not annual), and is the number of borrowing periods, which are typically 2 weeks long. For example, a $100 payday loan with a 15% 2-week interest rate will have to be repaid as $115, but if it was not paid on time, within 20 weeks it will be $404.56. In 48 weeks it will be $2,862.52. The interest could be much larger than expected if the loan is not returned on time.Debt trap

A debt trap is defined as "A situation in which a debt is difficult or impossible to repay, typically because high interest payments prevent repayment of the principal." According to the Center for Responsible Lending, 76% of the total volume of payday loans are due to loan churning, where loans are taken out within two weeks of a previous loan. The center states that the devotion of 25–50 percent of the borrowers' paychecks leaves most borrowers with inadequate funds, compelling them to take new payday loans immediately. The borrowers will continue to pay high percentages to float the loan across longer time periods, effectively placing them in a debt trap.

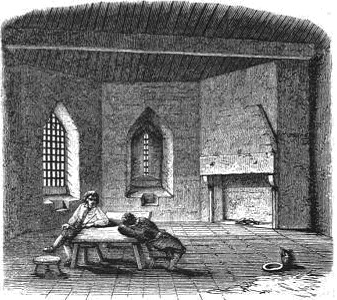

Debtors' prison

Debtors' prisons were federally banned in 1833, but over a third of states in 2011 allowed late borrowers to be jailed. In Texas, some payday loan companies file criminal complaints against late borrowers. Texas courts and prosecutors becomede facto

''De facto'' ( ; , "in fact") describes practices that exist in reality, whether or not they are officially recognized by laws or other formal norms. It is commonly used to refer to what happens in practice, in contrast with '' de jure'' ("by l ...

collections agencies that warn borrowers that they could face arrest, criminal charges, jail time, and fines. On top of the debts owed, district attorneys charge additional fees. Threatening to pursue criminal charges against borrowers is illegal when a post-dated check is involved, but using checks dated for the day the loan is given allows lenders to claim theft. Borrowers have been jailed for owing as little as $200. Most borrowers who failed to pay had lost their jobs or had their hours reduced at work.

See also

* Community Financial Services Association of America * '' Buckeye Check Cashing, Inc. v. Cardegna'' *Operation Choke Point

Operation Choke Point was an initiative of the United States Department of Justice beginning in 2013 which investigated banks in the United States and the business they did with firearm dealers, payday lenders, and other companies believed to be ...

References

External links

FDIC Guidelines on Payday Lending

Payday loan answers

- Consumer Financial Protection Bureau {{Payday loans by country Finance in the United States