Offshore financial centre on:

[Wikipedia]

[Google]

[Amazon]

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

"Offshore" does not refer to the location of the OFC, since many Financial Stability Forum–

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

"Offshore" does not refer to the location of the OFC, since many Financial Stability Forum– Research in 2013–14 showed OFCs harboured 8–10% of global wealth in tax-neutral structures, and acted as hubs for U.S. multinationals in particular, to avoid corporate taxes via base erosion and profit shifting ("BEPS") tools (e.g. the double Irish). A study in 2017 split the understanding of an OFC into 24 Sink OFCs, to which a disproportionate amount of value disappears from the economic system), and five Conduit OFCs, through which a disproportionate amount of value moves toward the Sink OFCs). In June 2018, research showed that major onshore IFCs, not offshore IFCs, had become the dominant locations for corporate tax avoidance BEPS schemes, costing US$200 billion in lost annual tax revenues. A June 2018 joint-IMF study showed much of the FDI from OFCs, into higher-tax countries, originated from higher-tax countries (e.g. the UK is the second largest investor in itself, via OFCs).

Research in 2013–14 showed OFCs harboured 8–10% of global wealth in tax-neutral structures, and acted as hubs for U.S. multinationals in particular, to avoid corporate taxes via base erosion and profit shifting ("BEPS") tools (e.g. the double Irish). A study in 2017 split the understanding of an OFC into 24 Sink OFCs, to which a disproportionate amount of value disappears from the economic system), and five Conduit OFCs, through which a disproportionate amount of value moves toward the Sink OFCs). In June 2018, research showed that major onshore IFCs, not offshore IFCs, had become the dominant locations for corporate tax avoidance BEPS schemes, costing US$200 billion in lost annual tax revenues. A June 2018 joint-IMF study showed much of the FDI from OFCs, into higher-tax countries, originated from higher-tax countries (e.g. the UK is the second largest investor in itself, via OFCs).

While from 2010 onwards, some researchers began to treat tax havens and OFCs as practically synonymous, the OECD and the EU went in a different direction depending on their desired outcome. By 2017, and after many years of regulatory changes in OFCs and some onshore IFCs, the OECD's list of "tax havens" only contained Trinidad & Tobago, which is not a prominent international financial centre. Signally, EU members are routinely not screened by activists including the EU itself. Oxfam, which has entities and activities in jurisdictions such as Lichtenstein, Luxembourg, Netherlands and Delaware, has become a prominent critic of OFCs and has produced reports with the Tax Justice Network, to try to depict their point of view. These are widely discredited by professionals and academics and prominent TJN leaders resigned complaining that the reports were not compiled by knowledgable tax experts and were manufactured to present a desired outcome, which detracts from good faith efforts to curb BEPS, aggressive tax planning and illicit funds flows.

In July 2017, the

While from 2010 onwards, some researchers began to treat tax havens and OFCs as practically synonymous, the OECD and the EU went in a different direction depending on their desired outcome. By 2017, and after many years of regulatory changes in OFCs and some onshore IFCs, the OECD's list of "tax havens" only contained Trinidad & Tobago, which is not a prominent international financial centre. Signally, EU members are routinely not screened by activists including the EU itself. Oxfam, which has entities and activities in jurisdictions such as Lichtenstein, Luxembourg, Netherlands and Delaware, has become a prominent critic of OFCs and has produced reports with the Tax Justice Network, to try to depict their point of view. These are widely discredited by professionals and academics and prominent TJN leaders resigned complaining that the reports were not compiled by knowledgable tax experts and were manufactured to present a desired outcome, which detracts from good faith efforts to curb BEPS, aggressive tax planning and illicit funds flows.

In July 2017, the

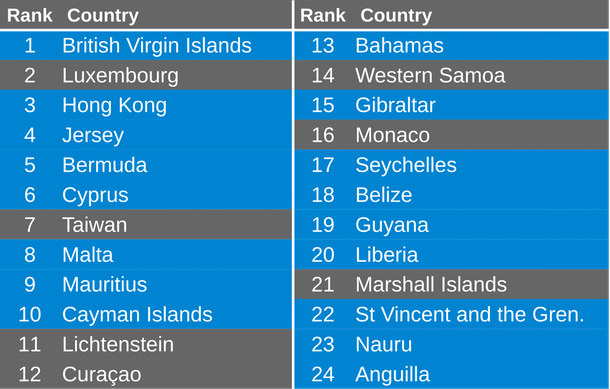

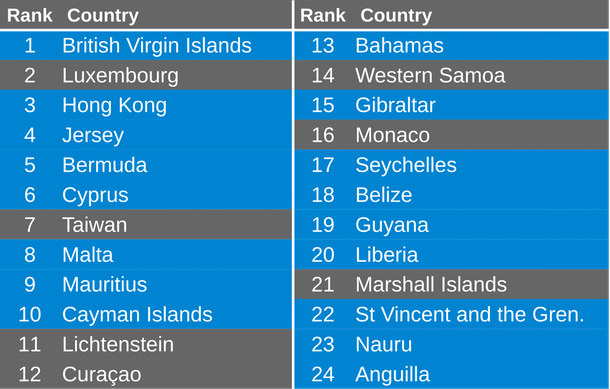

(Conduits are: Netherlands, United Kingdom, Switzerland, Singapore, and Ireland) Sink OFCs rely on Conduit OFCs to reroute funds from high-tax locations using the BEPS tools which are encoded, and accepted, in the Conduit OFC's extensive networks of bilateral tax treaties. Because Sink OFCs are more closely associated with traditional tax havens, they tend to have more limited treaty networks. CORPNET's lists of top five Conduit OFCs, and top five Sink OFCs, matched 9 of the top 10 havens in the Hines 2010 tax haven list, only differing in the United Kingdom, which only transformed their tax code in 2009–12, from a "worldwide" corporate tax system, to a "territorial" corporate tax system. All of CORPNET's Conduit OFCs, and eight of CORPNET's top 10 Sink OFCs, appeared in the of 22 OFCs. However, this theoretical work has been brought into question. Many of the "sink" jurisdictions by CORPNET's standards have proved to be conduit jurisdictions. When Economic Substance legislation was brought in, practically all of the companies in places like the Cayman Islands and British Virgin Islands were out of scope because BEPS is not a relevant industry in those jurisdictions. Those jurisdictions concentrate more on investment funds, which are self-evidently conduit vehicles where investors are not taxed in the OFC but in full where they are tax resident.

(Top 5 Conduit OFC) The IMF list contains all 5 largest Conduit OFCs: Netherlands, United Kingdom, Switzerland, Singapore and Ireland

(Top 10 Sink OFC) The IMF list contains 8 of the 10 largest Sink OFCs: missing British Virgin Islands (data was not available), and Taiwan (was not a major OFC in 2007).

(†) In the April 2000 FSF list of 42 OFCs, the June 2000 IMF list of 46 OFCs, and the April 2007 IMF list of 22 OFCs.

(†) In the April 2000 FSF list of 42 OFCs, the June 2000 IMF list of 46 OFCs, and the April 2007 IMF list of 22 OFCs.

(Top 5 Conduit OFC) The IMF list contains three of the largest Conduit OFCs: Netherlands, Singapore and Ireland

(Top 5 Sink OFC) The IMF list contains four of the five largest Sink OFCs: missing Jersey (fourth largest Sink OFC), but includes the Cayman Islands (tenth largest Sink OFC).

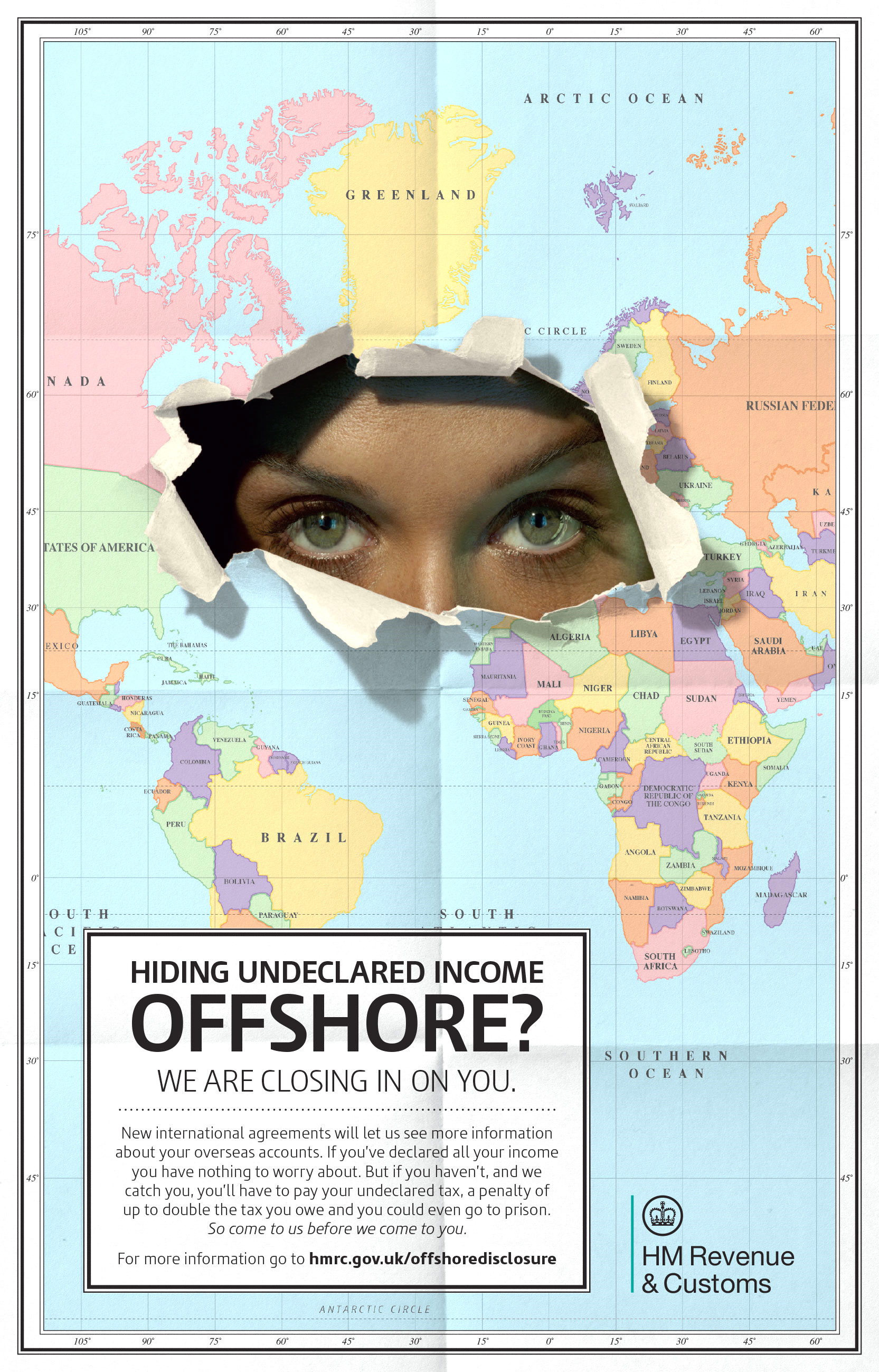

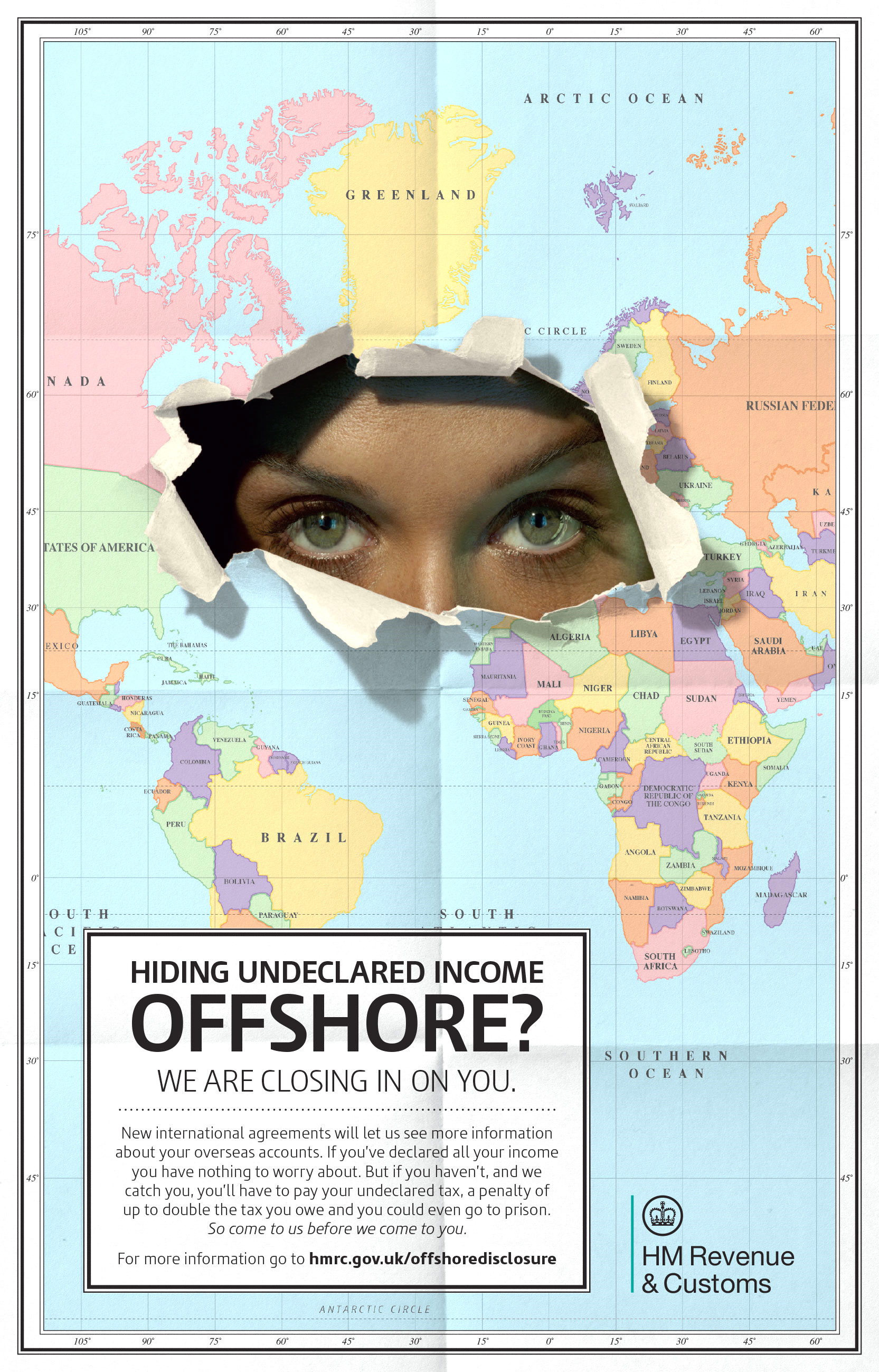

Offshore finance became the subject of increased attention since the FSF–IMF reports on OFC in 2000, and also from the April 2009 G20 meeting, during the height of the financial crisis, when heads of state resolved to "take action" against non-cooperative jurisdictions. Initiatives spearheaded by the

Offshore finance became the subject of increased attention since the FSF–IMF reports on OFC in 2000, and also from the April 2009 G20 meeting, during the height of the financial crisis, when heads of state resolved to "take action" against non-cooperative jurisdictions. Initiatives spearheaded by the

supports

increased government efforts to curb tax avoidance.

Early research on offshore financial centers, from 1978 to 2000, identified reasons for nonresidents using an OFC, over the financial system in their own home jurisdiction (which in most cases was more developed than the OFC). Prominent reasons in these lists were:

The third reason, ''Manage around currency and capital controls'', dissipated with globalisation of financial markets and free-floating exchange rate mechanisms, and ceases to appear in research after 2000. The second reason, ''Favourable regulations'', had also dissipated, but to a lesser degree, as a result of initiatives by the IMF–OECD–FATF post–2000, promoting common standards and regulatory compliance across OFCs and tax havens. For example, while the EU–28 contains some of the largest OFCs (e.g. Ireland and Luxembourg), these EU–OFCs cannot offer regulatory environments that differ from other EU–28 jurisdictions.

These earlier regimes are no longer relevant in today's World. OFCs each tend to have one or more core business areas which dominate their industries. Substantially, but not exclusively, Cayman and the BVI are investment funds jurisdictions, as well as structured finance and holding company vehicles for large assets (such as infrastructure, commercial real estate), or SPVs for investment into jurisdictions with less certain legal and judicial infrastructure, such as China, Russia or India. Bermuda has a large reinsurance industry and Cayman's insurance insurance industry is also now competitive.

In August 2013, Gabriel Zucman showed OFCs housed up to 8–10% of global wealth in tax–neutral structures. Often conflated are the reasons why private equity funds and hedge funds set up in OFCs, such as Delaware, the Cayman Islands, British Virgin Islands, and Luxembourg, and which the Investment Manager often sets up there as well. The former is to benefit from investment funds specific legislation designed for larger institutional, sovereign, High Net Worth or Development/NGO investors who are presumed to either be sophisticated in themselves or have access to sophisticated advice on account of their size. In this way, these funds are not open to retail investors whom are normally investors in jurisdictions that cater for greater investor protection. The zero tax rate, as in many onshore funds, is so that the profits are taxed in the countries where the investors who earned the profits are tax resident. Any tax that was levied on the fund itself would have to be deducted from the onshore tax on those profits in order that the same profit is not taxed twise.

On the other hand, the investment manager is often set up in low tax OFCs to facilitate the personal tax planning of the manager.

In August 2014, Zucman showed OFCs being used by U.S. multinationals, in particular, to execute base erosion and profit shifting ("BEPS") transactions to avoid corporate taxes. Zucman's work is widely quoted yet also frequently criticised as being confused and counterfactual.

Demonstrating that most BEPS activity occurs in US and EU IFCs, in Q1 2015, Apple executed the largest BEPS transaction in history, moving US$300 billion in

Early research on offshore financial centers, from 1978 to 2000, identified reasons for nonresidents using an OFC, over the financial system in their own home jurisdiction (which in most cases was more developed than the OFC). Prominent reasons in these lists were:

The third reason, ''Manage around currency and capital controls'', dissipated with globalisation of financial markets and free-floating exchange rate mechanisms, and ceases to appear in research after 2000. The second reason, ''Favourable regulations'', had also dissipated, but to a lesser degree, as a result of initiatives by the IMF–OECD–FATF post–2000, promoting common standards and regulatory compliance across OFCs and tax havens. For example, while the EU–28 contains some of the largest OFCs (e.g. Ireland and Luxembourg), these EU–OFCs cannot offer regulatory environments that differ from other EU–28 jurisdictions.

These earlier regimes are no longer relevant in today's World. OFCs each tend to have one or more core business areas which dominate their industries. Substantially, but not exclusively, Cayman and the BVI are investment funds jurisdictions, as well as structured finance and holding company vehicles for large assets (such as infrastructure, commercial real estate), or SPVs for investment into jurisdictions with less certain legal and judicial infrastructure, such as China, Russia or India. Bermuda has a large reinsurance industry and Cayman's insurance insurance industry is also now competitive.

In August 2013, Gabriel Zucman showed OFCs housed up to 8–10% of global wealth in tax–neutral structures. Often conflated are the reasons why private equity funds and hedge funds set up in OFCs, such as Delaware, the Cayman Islands, British Virgin Islands, and Luxembourg, and which the Investment Manager often sets up there as well. The former is to benefit from investment funds specific legislation designed for larger institutional, sovereign, High Net Worth or Development/NGO investors who are presumed to either be sophisticated in themselves or have access to sophisticated advice on account of their size. In this way, these funds are not open to retail investors whom are normally investors in jurisdictions that cater for greater investor protection. The zero tax rate, as in many onshore funds, is so that the profits are taxed in the countries where the investors who earned the profits are tax resident. Any tax that was levied on the fund itself would have to be deducted from the onshore tax on those profits in order that the same profit is not taxed twise.

On the other hand, the investment manager is often set up in low tax OFCs to facilitate the personal tax planning of the manager.

In August 2014, Zucman showed OFCs being used by U.S. multinationals, in particular, to execute base erosion and profit shifting ("BEPS") transactions to avoid corporate taxes. Zucman's work is widely quoted yet also frequently criticised as being confused and counterfactual.

Demonstrating that most BEPS activity occurs in US and EU IFCs, in Q1 2015, Apple executed the largest BEPS transaction in history, moving US$300 billion in

(†) Identified as one of the 5 Conduits (Ireland, Singapore, Switzerland, the Netherlands, and the United Kingdom), by CORPNET in 2017.

(‡) Identified as one of the largest 5

(Δ) Identified on the of 22 OFCs (note the IMF could not get sufficient data on The British Virgin Islands in 2007 for its study but did list the Cayman Islands).

(⹋) Identified on the of 8 major OFCs, or ''pass through economies'' (note the Caribbean contains the British Virgin Islands and the Cayman Islands).

* Joint venture vehicles: Offshore jurisdictions are frequently used to set up

* Joint venture vehicles: Offshore jurisdictions are frequently used to set up

Many offshore financial centres also provide registrations for ships (notably

Many offshore financial centres also provide registrations for ships (notably

Many offshore jurisdictions specialise in the formation of collective investment schemes, or mutual funds. The market leader is the Cayman Islands.

At year-end 2020, there were 24,591 funds registered with the Cayman Islands Monetary Authority (CIMA), including 583 Limited Investor Funds and 12,695 Private Funds. Total ending net asset value (NAV) increased to US$4.967 trillion from US$4.229 trillion in 2019 - excluding Limited Investor and Private Funds. At year-end 2020, total ending NAV for Limited Investor Funds submitting a FAR was US$107 billion and US$2.475 trillion for Private Funds. Worldwide there were 126,457 regulated open-ended funds with total net assets of US$63.1 trillion; 9,027 mutual funds with ending NAV of US$29.3 trillion in the United States and 57,753 funds with ending NAV of US$21.8 trillion in Europe.

But the greater appeal of offshore jurisdictions to form mutual funds is usually in the regulatory considerations. As offshore jurisdictions do not tend to cater to small retail investors, they tend to impose fewer if any restrictions on what investment strategy the mutual funds may pursue and no limitations on the amount of leverage which mutual funds can employ in their investment strategy. Many offshore jurisdictions (

Many offshore jurisdictions specialise in the formation of collective investment schemes, or mutual funds. The market leader is the Cayman Islands.

At year-end 2020, there were 24,591 funds registered with the Cayman Islands Monetary Authority (CIMA), including 583 Limited Investor Funds and 12,695 Private Funds. Total ending net asset value (NAV) increased to US$4.967 trillion from US$4.229 trillion in 2019 - excluding Limited Investor and Private Funds. At year-end 2020, total ending NAV for Limited Investor Funds submitting a FAR was US$107 billion and US$2.475 trillion for Private Funds. Worldwide there were 126,457 regulated open-ended funds with total net assets of US$63.1 trillion; 9,027 mutual funds with ending NAV of US$29.3 trillion in the United States and 57,753 funds with ending NAV of US$21.8 trillion in Europe.

But the greater appeal of offshore jurisdictions to form mutual funds is usually in the regulatory considerations. As offshore jurisdictions do not tend to cater to small retail investors, they tend to impose fewer if any restrictions on what investment strategy the mutual funds may pursue and no limitations on the amount of leverage which mutual funds can employ in their investment strategy. Many offshore jurisdictions (

Global Forum on Transparency and Exchange of Information for Tax Purposes, OECD

''The Economist'' survey on offshore financial centres

Lax Little Islands

by

Tax Justice Network

Oxfam Corporate Tax Avoidance Portal

Widen tax haven loophole report

• Jun 12, 2013 • US Corporations {{DEFAULTSORT:Offshore Financial Centre * Corporate tax avoidance Foreign direct investment Global issues International taxation Offshore companies Special economic zones Tax avoidance Tax evasion Taxation-related lists

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

"Offshore" does not refer to the location of the OFC, since many Financial Stability Forum–

An offshore financial centre (OFC) is defined as a "country or jurisdiction that provides financial services to nonresidents on a scale that is incommensurate with the size and the financing of its domestic economy."

"Offshore" does not refer to the location of the OFC, since many Financial Stability Forum–IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

OFCs, such as Delaware

Delaware ( ) is a state in the Mid-Atlantic region of the United States, bordering Maryland to its south and west; Pennsylvania to its north; and New Jersey and the Atlantic Ocean to its east. The state takes its name from the adjacen ...

, South Dakota

South Dakota (; Sioux language, Sioux: , ) is a U.S. state in the West North Central states, North Central region of the United States. It is also part of the Great Plains. South Dakota is named after the Lakota people, Lakota and Dakota peo ...

, Singapore

Singapore (), officially the Republic of Singapore, is a sovereign island country and city-state in maritime Southeast Asia. It lies about one degree of latitude () north of the equator, off the southern tip of the Malay Peninsula, borde ...

, Luxembourg

Luxembourg ( ; lb, Lëtzebuerg ; french: link=no, Luxembourg; german: link=no, Luxemburg), officially the Grand Duchy of Luxembourg, ; french: link=no, Grand-Duché de Luxembourg ; german: link=no, Großherzogtum Luxemburg is a small land ...

and Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China (abbr. Hong Kong SAR or HKSAR), is a city and special administrative region of China on the eastern Pearl River Delta i ...

, are located "onshore", but to the fact that the largest users of the OFC are non-resident, i.e. "offshore". The IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

lists OFCs as a third class of financial centre, with international financial centres (IFCs), and regional financial centres (RFCs); there is overlap (e.g. Singapore is an RFC and an OFC).

The Caribbean, including the Cayman Islands, the British Virgin Islands and Bermuda, has several major OFCs, facilitating many billions of dollars worth of trade and investment globally.

During April–June 2000, the Financial Stability Forum–International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster gl ...

produced the first list of 42–46 OFCs using a qualitative approach. In April 2007, the IMF produced a revised quantitative-based list of 22 OFCs, and in June 2018, another revised quantitative-based list of eight major OFCs, who are responsible for 85% of OFC financial flows, which include Ireland, the Caribbean, Luxembourg, Singapore, Hong Kong and the Netherlands. The removal of foreign exchange

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspec ...

and capital controls, the early driver for the creation and use of many OFCs in the 1960s and 1970s, saw taxation and/or regulatory regimes become the primary reasons for using OFCs from the 1980s on. Progress from 2000 onwards from IMF

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

–OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate ...

– FATF initiatives on common standards, regulatory compliance, and banking transparency, has significantly weakened the regulatory attraction of OFCs.

''Tax-neutral'' is a term that OFCs use to describe legal structures where the OFC does not levy any corporation taxes, duties or VAT on fund flows into, during, or exiting (e.g. no withholding taxes) the corporate vehicle. Popular examples are the Irish qualifying investor alternative investment fund (QIAIF), and the Cayman Islands exempted company, which is used in investment funds, corporate structuring vehicles, and asset securitization. Many onshore jurisdictions also have equivalent tax neutrality in their investment funds industries, such as the UK, USA, and France. Tax neutrality at the level of these vehicles means that taxes are not paid at the OFC but in the places where the investors are tax resident. If the OFC levied a tax, this would in most cases reduce the tax paid in the places where investors are tax resident by that same amount, on the principles of avoiding double taxation of the same activity.

Definitions

Core definition

The definition of an ''offshore financial centre'' dates back to academic papers by Dufry & McGiddy (1978), and McCarthy (1979) regarding locations that are: ''Cities, areas or countries which have made a conscious effort to attract offshore banking business, i.e., non-resident foreign currency denominated business, by allowing relatively free entry and by adopting a flexible attitude where taxes, levies and regulation are concerned.”'' An April 2007 review of the historical definition of an OFC by the IMF, summarised the 1978–2000 academic work regarding the attributes that define an OFC, into the following four main attributes, which still remain relevant: In April 2000, the term rose to prominence when the Financial Stability Forum ("FSF"), concerned about OFCs on global financial stability, produced a report listing 42 OFCs. The FSF used a qualitative approach to defining OFCs, noting that: ''Offshore financial centres (OFCs) are not easily defined, but they can be characterised as jurisdictions that attract a high level of non-resident activity ..and volumes of non-resident business substantially exceeds the volume of domestic business.'' In June 2000, the IMF accepted the FSF's recommendation to investigate the impact of OFCs on global financial stability. On the 23 June 2000, the IMF published a working paper on OFCs which expanded the FSF list to 46 OFCs, but split into three Groups based on the level of co-operation and adherence to international standards by the OFC. The IMF paper categorised OFCs as a third type of financial centre, and listed them in order of importance: International Financial Centre ("IFC"), Regional Financial Centres ("RFC") and Offshore Financial Centres ("OFC"); and gave a definition of an OFC: The June 2000 IMF paper then listed three major attributes of offshore financial centres: A subsequent April 2007 IMF on OFCs, established a quantitative approach to defining OFCs which the paper stated was captured by the following definition: The April 2007 IMF paper used a quantitative ''proxy text'' for the above definition: ''More specifically, it can be considered that the ratio of net financial services exports to GDP could be an indicator of the OFC status of a country or jurisdiction''. This approach produced a revised list of 22 OFCs,; however, the list had a strong correlation with the original list of 46 OFCs from the IMF's June 2000 paper. The revised list was much shorter than the original IMF list as it only focused on OFCs where the national economic accounts produced breakdowns of net financial services exports data. By September 2007, the definition of an OFC from the most cited academic paper on OFCs, showed a strong correlation with the FSF–IMF definitions of an OFC:Link to tax havens

The common FSF–IMF–Academic definition of an OFC focused on the ''outcome'' of non-resident activity in a location (e.g. financial flows that are disproportionate to the local economy), and not on the reason that non-residents decide to conduct financial activity in a location. However, since the early academic papers into OFCs in the late 1970s, and the FSF-IMF investigations, it has been consistently noted that tax planning is only one of many drivers of OFC activity. Others include deal structuring and asset holding in a neutral jurisdiction with laws based on English common law, favourable/tailored regulation (eg investment funds), or regulatory arbitrage, such as in OFCs like Liberia, that focus on shipping. In April–June 2000, when the FSF–IMF produced lists of OFCs, activist groups highlighted the similarity with theirtax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

lists. Large projects were carried out by the IMF and the OECD from 2000 onwards, on improving data transparency and compliance with international standards and regulations, in jurisdictions that had been labeled OFCs and/or tax havens by the IMF–OECD. The reduction in ''banking secrecy'', was partially credited to these projects as well as global advances in combatting illicit finance flows, and Anti-Money Laundering legislation and regulations. Academics who study tax havens and OFCs are now able to distinguish between those jurisdictions which are used in BEPS activity, and those which are simply tax-neutral, pass-through jurisdictions such as the Cayman Islands, British Virgin Islands and Bermuda.

Many leading OFCs have recently implemented recommended legislation to reduce or eliminate BEPS. Jurisdictions such as the Cayman Islands, British Virgin Islands and Bermuda found that over 90% of their business companies were out of scope because their core industry does not cater to BEPS strategies.

Conduit and Sink OFCs

While from 2010 onwards, some researchers began to treat tax havens and OFCs as practically synonymous, the OECD and the EU went in a different direction depending on their desired outcome. By 2017, and after many years of regulatory changes in OFCs and some onshore IFCs, the OECD's list of "tax havens" only contained Trinidad & Tobago, which is not a prominent international financial centre. Signally, EU members are routinely not screened by activists including the EU itself. Oxfam, which has entities and activities in jurisdictions such as Lichtenstein, Luxembourg, Netherlands and Delaware, has become a prominent critic of OFCs and has produced reports with the Tax Justice Network, to try to depict their point of view. These are widely discredited by professionals and academics and prominent TJN leaders resigned complaining that the reports were not compiled by knowledgable tax experts and were manufactured to present a desired outcome, which detracts from good faith efforts to curb BEPS, aggressive tax planning and illicit funds flows.

In July 2017, the

While from 2010 onwards, some researchers began to treat tax havens and OFCs as practically synonymous, the OECD and the EU went in a different direction depending on their desired outcome. By 2017, and after many years of regulatory changes in OFCs and some onshore IFCs, the OECD's list of "tax havens" only contained Trinidad & Tobago, which is not a prominent international financial centre. Signally, EU members are routinely not screened by activists including the EU itself. Oxfam, which has entities and activities in jurisdictions such as Lichtenstein, Luxembourg, Netherlands and Delaware, has become a prominent critic of OFCs and has produced reports with the Tax Justice Network, to try to depict their point of view. These are widely discredited by professionals and academics and prominent TJN leaders resigned complaining that the reports were not compiled by knowledgable tax experts and were manufactured to present a desired outcome, which detracts from good faith efforts to curb BEPS, aggressive tax planning and illicit funds flows.

In July 2017, the University of Amsterdam

The University of Amsterdam (abbreviated as UvA, nl, Universiteit van Amsterdam) is a public research university located in Amsterdam, Netherlands. The UvA is one of two large, publicly funded research universities in the city, the other bein ...

's CORPNET group ignored any definition of a tax haven and followed a quantitive approach, analyzing 98 million global corporate connections on the Orbis database. CORPNET used a variation of the technique in the IMF's 2007 OFC working paper, and ranked the jurisdictions by the scale of international corporate connections relative to the connections from the local economy. In addition, CORPNET split the resulting OFCs into jurisdictions that acted like a ''terminus'' for corporate connections (a Sink), and jurisdictions that acted like ''nodes'' for corporate connections (a Conduit).

CORPNET's Conduit and Sink OFCs study split the understanding of an offshore financial centre into two classifications:

* 24 Sink OFCs: jurisdictions in which a disproportionate amount of value disappears from the economic system (e.g. the traditional tax havens).

* 5 Conduit OFCs: jurisdictions through which a disproportionate amount of value moves toward sink OFCs (e.g. the modern corporate tax havens)(Conduits are: Netherlands, United Kingdom, Switzerland, Singapore, and Ireland) Sink OFCs rely on Conduit OFCs to reroute funds from high-tax locations using the BEPS tools which are encoded, and accepted, in the Conduit OFC's extensive networks of bilateral tax treaties. Because Sink OFCs are more closely associated with traditional tax havens, they tend to have more limited treaty networks. CORPNET's lists of top five Conduit OFCs, and top five Sink OFCs, matched 9 of the top 10 havens in the Hines 2010 tax haven list, only differing in the United Kingdom, which only transformed their tax code in 2009–12, from a "worldwide" corporate tax system, to a "territorial" corporate tax system. All of CORPNET's Conduit OFCs, and eight of CORPNET's top 10 Sink OFCs, appeared in the of 22 OFCs. However, this theoretical work has been brought into question. Many of the "sink" jurisdictions by CORPNET's standards have proved to be conduit jurisdictions. When Economic Substance legislation was brought in, practically all of the companies in places like the Cayman Islands and British Virgin Islands were out of scope because BEPS is not a relevant industry in those jurisdictions. Those jurisdictions concentrate more on investment funds, which are self-evidently conduit vehicles where investors are not taxed in the OFC but in full where they are tax resident.

Lists

FSF–IMF 2000 list

The following 46 OFCs are from the June 2007 IMF background paper that used a qualitative approach to identify OFCs; and which also incorporated the April 2000 FSF list which had also used a qualitative approach to identify 42 OFCs. (*) Groups are as per the IMF June 2000 categories: (‡) Dominica, Grenada, Montserrat and Palau were not on the FSF April 2000 list of 42 OFCs but were on the IMF June 2000 list of 46 OFCs.IMF 2007 list

The following 22 OFCs are from an April 2007 IMF working paper that used a strictly quantitative approach to identifying OFCs (only where specific data was available). (†) In on both the April 2000 FSF list of 42 OFCs, and the June 2000 IMF list of 46 OFCs.(Top 5 Conduit OFC) The IMF list contains all 5 largest Conduit OFCs: Netherlands, United Kingdom, Switzerland, Singapore and Ireland

(Top 10 Sink OFC) The IMF list contains 8 of the 10 largest Sink OFCs: missing British Virgin Islands (data was not available), and Taiwan (was not a major OFC in 2007).

IMF 2018 list

The following eight OFCs (or also called ''pass through economies'') were co-identified by an IMF working paper, as being responsible for 85% of the world's investment in structured vehicles. (†) In the April 2000 FSF list of 42 OFCs, the June 2000 IMF list of 46 OFCs, and the April 2007 IMF list of 22 OFCs.

(†) In the April 2000 FSF list of 42 OFCs, the June 2000 IMF list of 46 OFCs, and the April 2007 IMF list of 22 OFCs.(Top 5 Conduit OFC) The IMF list contains three of the largest Conduit OFCs: Netherlands, Singapore and Ireland

(Top 5 Sink OFC) The IMF list contains four of the five largest Sink OFCs: missing Jersey (fourth largest Sink OFC), but includes the Cayman Islands (tenth largest Sink OFC).

FSF 2018 Shadow Bank OFC list

Shadow banking is a key service line for OFCs. The Financial Stability Forum ("FSF") produces a report each year on ''Global Shadow Banking'', or ''other financial intermediaries'' ("OFI"s). In a similar method to the various IMF lists, the FSF produces a table of the locations with the highest concentration of OFI/shadow banking financial assets, versus domestic GDP, in its 2018 report, thus creating a ranked table of "Shadow Banking OFCs". The fuller table is produced in the section, however, the 4 largest OFCs for shadow banking with OFI assets over 5x GDP are:Countermeasures

Offshore finance became the subject of increased attention since the FSF–IMF reports on OFC in 2000, and also from the April 2009 G20 meeting, during the height of the financial crisis, when heads of state resolved to "take action" against non-cooperative jurisdictions. Initiatives spearheaded by the

Offshore finance became the subject of increased attention since the FSF–IMF reports on OFC in 2000, and also from the April 2009 G20 meeting, during the height of the financial crisis, when heads of state resolved to "take action" against non-cooperative jurisdictions. Initiatives spearheaded by the Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organization, intergovernmental organisation with 38 member countries ...

(OECD), the Financial Action Task Force on Money Laundering (FATF) and the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster gl ...

have had an effect on curbing some excesses in the offshore financial centre industry, although it would drive the OFC industry towards a for institutional and corporate clients. The World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Inte ...

's 2019 World Development Report on the future of worsupports

increased government efforts to curb tax avoidance.

Tax services

Early research on offshore financial centers, from 1978 to 2000, identified reasons for nonresidents using an OFC, over the financial system in their own home jurisdiction (which in most cases was more developed than the OFC). Prominent reasons in these lists were:

The third reason, ''Manage around currency and capital controls'', dissipated with globalisation of financial markets and free-floating exchange rate mechanisms, and ceases to appear in research after 2000. The second reason, ''Favourable regulations'', had also dissipated, but to a lesser degree, as a result of initiatives by the IMF–OECD–FATF post–2000, promoting common standards and regulatory compliance across OFCs and tax havens. For example, while the EU–28 contains some of the largest OFCs (e.g. Ireland and Luxembourg), these EU–OFCs cannot offer regulatory environments that differ from other EU–28 jurisdictions.

These earlier regimes are no longer relevant in today's World. OFCs each tend to have one or more core business areas which dominate their industries. Substantially, but not exclusively, Cayman and the BVI are investment funds jurisdictions, as well as structured finance and holding company vehicles for large assets (such as infrastructure, commercial real estate), or SPVs for investment into jurisdictions with less certain legal and judicial infrastructure, such as China, Russia or India. Bermuda has a large reinsurance industry and Cayman's insurance insurance industry is also now competitive.

In August 2013, Gabriel Zucman showed OFCs housed up to 8–10% of global wealth in tax–neutral structures. Often conflated are the reasons why private equity funds and hedge funds set up in OFCs, such as Delaware, the Cayman Islands, British Virgin Islands, and Luxembourg, and which the Investment Manager often sets up there as well. The former is to benefit from investment funds specific legislation designed for larger institutional, sovereign, High Net Worth or Development/NGO investors who are presumed to either be sophisticated in themselves or have access to sophisticated advice on account of their size. In this way, these funds are not open to retail investors whom are normally investors in jurisdictions that cater for greater investor protection. The zero tax rate, as in many onshore funds, is so that the profits are taxed in the countries where the investors who earned the profits are tax resident. Any tax that was levied on the fund itself would have to be deducted from the onshore tax on those profits in order that the same profit is not taxed twise.

On the other hand, the investment manager is often set up in low tax OFCs to facilitate the personal tax planning of the manager.

In August 2014, Zucman showed OFCs being used by U.S. multinationals, in particular, to execute base erosion and profit shifting ("BEPS") transactions to avoid corporate taxes. Zucman's work is widely quoted yet also frequently criticised as being confused and counterfactual.

Demonstrating that most BEPS activity occurs in US and EU IFCs, in Q1 2015, Apple executed the largest BEPS transaction in history, moving US$300 billion in

Early research on offshore financial centers, from 1978 to 2000, identified reasons for nonresidents using an OFC, over the financial system in their own home jurisdiction (which in most cases was more developed than the OFC). Prominent reasons in these lists were:

The third reason, ''Manage around currency and capital controls'', dissipated with globalisation of financial markets and free-floating exchange rate mechanisms, and ceases to appear in research after 2000. The second reason, ''Favourable regulations'', had also dissipated, but to a lesser degree, as a result of initiatives by the IMF–OECD–FATF post–2000, promoting common standards and regulatory compliance across OFCs and tax havens. For example, while the EU–28 contains some of the largest OFCs (e.g. Ireland and Luxembourg), these EU–OFCs cannot offer regulatory environments that differ from other EU–28 jurisdictions.

These earlier regimes are no longer relevant in today's World. OFCs each tend to have one or more core business areas which dominate their industries. Substantially, but not exclusively, Cayman and the BVI are investment funds jurisdictions, as well as structured finance and holding company vehicles for large assets (such as infrastructure, commercial real estate), or SPVs for investment into jurisdictions with less certain legal and judicial infrastructure, such as China, Russia or India. Bermuda has a large reinsurance industry and Cayman's insurance insurance industry is also now competitive.

In August 2013, Gabriel Zucman showed OFCs housed up to 8–10% of global wealth in tax–neutral structures. Often conflated are the reasons why private equity funds and hedge funds set up in OFCs, such as Delaware, the Cayman Islands, British Virgin Islands, and Luxembourg, and which the Investment Manager often sets up there as well. The former is to benefit from investment funds specific legislation designed for larger institutional, sovereign, High Net Worth or Development/NGO investors who are presumed to either be sophisticated in themselves or have access to sophisticated advice on account of their size. In this way, these funds are not open to retail investors whom are normally investors in jurisdictions that cater for greater investor protection. The zero tax rate, as in many onshore funds, is so that the profits are taxed in the countries where the investors who earned the profits are tax resident. Any tax that was levied on the fund itself would have to be deducted from the onshore tax on those profits in order that the same profit is not taxed twise.

On the other hand, the investment manager is often set up in low tax OFCs to facilitate the personal tax planning of the manager.

In August 2014, Zucman showed OFCs being used by U.S. multinationals, in particular, to execute base erosion and profit shifting ("BEPS") transactions to avoid corporate taxes. Zucman's work is widely quoted yet also frequently criticised as being confused and counterfactual.

Demonstrating that most BEPS activity occurs in US and EU IFCs, in Q1 2015, Apple executed the largest BEPS transaction in history, moving US$300 billion in intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, cop ...

("IP") assets to Ireland, an IMF OFC, to use the Irish " Green Jersey" BEPS tool (see " Leprechaun economics"). In August 2016, the EU Commission levied the largest tax fine in history, at US$13 billion, against Apple in Ireland for abuse of the double Irish BEPS tool from 2004 to 2014. In January 2017, the OECD estimated that BEPS tools, mostly located in OFCs, were responsible for US$100 to 240 billion in annual tax avoidance. However, it is notable that developing countries often suffer from kleptocracy and serious corruption regarding national wealth, and BEPS is very much a secondary concern.

In June 2018, Gabriel Zucman (''et alia'') produced a report stating that OFC corporate BEPs tools were responsible for over US$200 billion in annual corporate tax losses, and produced the a table (see below) of the largest BEPS locations in the world, which showed how synonymous the largest tax havens, the largest Conduit and Sink OFCs, and the largest of OFCs had become.

In June 2018, another joint-IMF study showed that 8 ''pass-through economies'', namely, the Netherlands, Luxembourg, Hong Kong SAR, the British Virgin Islands, Bermuda, the Cayman Islands, Ireland, and Singapore; host more than 85 per cent of the world's investment in special purpose entities. It is important that these entities are tax neutral because any taxation at the OFC entity would have an equivalent reduction in the home or investor countries.

(*) One of the largest 10 tax havens by James R. Hines Jr. in 2010 (the Hines 2010 List).(†) Identified as one of the 5 Conduits (Ireland, Singapore, Switzerland, the Netherlands, and the United Kingdom), by CORPNET in 2017.

(‡) Identified as one of the largest 5

Sinks

A sink is a bowl-shaped plumbing fixture for washing hands, dishwashing, and other purposes. Sinks have a tap (faucet) that supply hot and cold water and may include a spray feature to be used for faster rinsing. They also include a drain to ...

(British Virgin Islands, Luxemburg, Hong Kong, Jersey, Bermuda), by CORPNET in 2017.(Δ) Identified on the of 22 OFCs (note the IMF could not get sufficient data on The British Virgin Islands in 2007 for its study but did list the Cayman Islands).

(⹋) Identified on the of 8 major OFCs, or ''pass through economies'' (note the Caribbean contains the British Virgin Islands and the Cayman Islands).

Finance services

Shadow banking

Research into OFCs highlighted shadow banking as an original service of OFCs. Shadow banking enabled pools of ''offshore'' capital, mostly dollars, that had escaped capital controls in the 1960s and 1970s, and thus the main ''onshore'' banking systems, to be recycled back into the economic system while paying interest to the capital's owner, thus encouraging them to keep their capital offshore. They highlight the Eurodollar capital market as particularly important. However, as OFCs developed in the 1980s, it became apparent that OFC banks were not just recycling Eurodollars from foreign corporate transactions, but also capital from tax avoidance (e.g. money being hidden in tax havens), and also from other criminal and illegal sources. Many OFCs, such as Switzerland, had bank secrecy laws protecting the identity of the owners of the ''offshore'' capital in the OFC. Over the years, a has weakened the ability of OFCs to provide bank secrecy. Shadow banking, however, remains a key part of OFCs services, and the Financial Stability Forum list of major shadow banking locations are all recognized OFCs.Securitisation

OFCs, however, have expanded into a related area to shadow banking, which is asset securitisation. Unlike traditional shadow banking, where the OFC bank needs to access a pool of ''offshore capital'' to operate, securitisation involves no provision of capital. OFC securitisation involves the provision of legal structures, registered in the OFC, into which foreign capital is placed to finance foreign assets (e.g. aircraft, ships, mortgages assets etc.), used by foreign operators and foreign investors. The OFC thus behaves more like a ''legal conduit'' rather than providing actual banking services. This has seen a rise in large specialist legal and accounting firms, who provide the legal structures for securitisations, in OFC locations. In normal securitisations, the foreign capital, assets and operators can all come from major ''onshore'' locations. For example, Deutsche Bank in Germany might lend Euro 5 billion into an Irish Section 110 SPV (the Irish securitisation legal structure), which then buys Euro 5 billion in aircraft engines from Boeing, and then leases the engines to Delta Airlines. The reason why Deutsche Bank would use an Irish Section 110 SPV is that it is tax neutral, and that it has certain legal features, particularly orphaning, which are helpful to Deutsche Bank, but which are not available in Germany. Orphaning poses considerable risks of tax abuse and tax avoidance to the tax base of higher-tax jurisdictions; even Ireland discovered a major domestic tax avoidance scheme in 2016, by U.S. distressed debt funds, using the Irish Section 110 SPVs, on Irish domestic investments.Defences

Better regulations

OFCs have more recently become leaders in regulation, operating under higher standards than onshore jurisdictions, and having advanced legal systems with sophisticated commercial courts and arbitration centres. Because OFCs are willing to create legal structures for broad classes of assets, including investment funds,intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, cop ...

("IP") assets, cryptocurrency assets, and carbon credit assets, there is a justification that OFCs often seek to be at the forefront of certain types of regulation. Many OFCs have verified beneficial ownership and director registers, which while not yet public, put those OFCs at the forefront of global anti-money laundering regulation. When the UK, USA and EU issued sanctions against certain Russian people, assets and companies, those which were held in OFCs with verified KYC documentation assisted greatly in identifying ownership trails - something that would not necessarily have been possible if European jurisdictions, Delaware or English entities had been used. The fact that the OFCs' registers were not public did not detract from this exercise. Industry experts suspect that illicit commerce or those likely to risk sanctions are more likely to use lesser-regulated jurisdictions, making future sanctions projects much more difficult or impossible.

In certain situations, the costs of regulation and operation in OFCs can be lower than in the onshore financial centres

A financial centre ( BE), financial center ( AE), or financial hub, is a location with a concentration of participants in banking, asset management, insurance or financial markets with venues and supporting services for these activities to ta ...

. However, often the contrary is true owing to rising compliance, regulatory and legal costs. Some OFCs advertise fast approval times, perhaps 24 hours, for approval of new legal structures and special purpose vehicles

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited ...

, or only a few weeks for a mutual fund, however many onshore OFCs with negligible KYC requirements, such as the UK and Delaware, often offer same day services.

Securitisation transactions

One of the most important service lines for OFCs is in providing legal structures for global securitisation transactions for all types of asset classes, including aircraft finance, shipping finance, equipment finance, and collateralised loan vehicles. OFCs provide what are called ''tax neutral''special purpose vehicles

A special-purpose entity (SPE; or, in Europe and India, special-purpose vehicle/SPV; or, in some cases in each EU jurisdiction, FVC, financial vehicle corporation) is a legal entity (usually a limited company of some type or, sometimes, a limited ...

("SPVs") where no taxes, VAT, levies or duties are taken by the OFC on the SPV. In addition, aggressive legal structuring, including Orphan structures

Orphan structure or Orphan SPV or orphaning are terms used in structured finance closely associated with creating SPVs (" Special Purpose Vehicles") for securitisation transactions where the notional equity of the SPV is deliberately handed over ...

, is facilitated to support requirements for Bankruptcy remoteness, which would not be allowed in larger financial centres

A financial centre ( BE), financial center ( AE), or financial hub, is a location with a concentration of participants in banking, asset management, insurance or financial markets with venues and supporting services for these activities to ta ...

, as it could damage the local tax base, but are needed by banks in securitisations. As the ''effective'' tax rate in most OFCs is near zero (e.g. they are really tax havens), this is a lower risk, although, the experience of U.S. distressed debt funds abusing Irish Section 110 SPVs in 2012–2016 is notable. However, OFCs play a key role in providing the legal structure for global securitisation transactions that could not be performed from the main financial centres

A financial centre ( BE), financial center ( AE), or financial hub, is a location with a concentration of participants in banking, asset management, insurance or financial markets with venues and supporting services for these activities to ta ...

.

Promotion of growth

The most controversial claim is that OFCs promote global economic growth by providing a preferred platform, even if due to tax avoidance or regulatory arbitrage reasons, from which global capital is more readily deployed. There are strong academic advocates, and studies, on both sides of this argument. Some of the most cited researchers into tax havens/offshore financial centres, includingHines Hines may refer to:

Places in the United States

*Hines, Florida, an unincorporated community in Dixie County

*Hines, Illinois, an unincorporated community

* Hines, Minnesota, an unincorporated community

* Hines Township, Beltrami County, Minnesot ...

, Dharmapala and Desai show evidence that, in certain cases, tax havens/OFCs, appear to promote economic growth in neighbouring higher-tax countries, and can solve issues that the higher-tax countries can have in their own tax or regulatory systems, which deter capital investment.

The most cited paper specifically on OFCs, also came a similar conclusion (although recognising that there are strong negatives as well):

However, other major tax academics take the opposite view and accuse Hines (and others) of mixing cause and effect (e.g. the capital investment would have come through the normal taxed channels had the OFC option not been available), and include papers by Slemrod, and Zucman. Critics of this theory also point to studies showing that in many cases, the capital that is invested into the high tax economy via the OFC, actually originated from the high-tax economy, and for example, that the largest source of FDI into the U.K., is from the U.K., but via OFCs.

This claim can get into wider, and also contested, economic debates around the optimised rate of taxation on capital and other free-market theories, as expressed by Hines in 2011.

Structures

Legal structures

The bedrock of most offshore financial centres is the formation of offshore legal structures (also called tax-free legal wrappers): * Asset holding vehicles: Many corporate conglomerates employ a large number of holding companies, and often high-risk assets are parked in separate companies to prevent legal risk accruing to the main group (i.e. where the assets relate to asbestos, see the English case of ''Adams v Cape Industries

''Adams v Cape Industries plc'' 990Ch 433 is a UK company law case on separate legal personality and limited liability of shareholders. The case also addressed long-standing issues under the English conflict of laws as to when a company would be ...

''). Similarly, it is quite common for fleets of ships to be separately owned by separate offshore companies to try to circumvent laws relating to group liability under certain environmental legislation.

* Asset protection: Wealthy individuals who live in politically unstable countries utilise offshore companies to hold family wealth to avoid potential expropriation or exchange control restrictions in the country in which they live. These structures work best when the wealth is foreign-earned, or has been expatriated over a significant period of time (aggregating annual exchange control allowances).

* Avoidance of forced heirship provisions: Many countries from France to Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in Western Asia. It covers the bulk of the Arabian Peninsula, and has a land area of about , making it the List of Asian countries by area, fifth-largest country in Asia ...

(and the U.S. state of Louisiana

Louisiana , group=pronunciation (French: ''La Louisiane'') is a U.S. state, state in the Deep South and South Central United States, South Central regions of the United States. It is the List of U.S. states and territories by area, 20th-smal ...

) continue to employ forced heirship provisions in their succession law, limiting the testator's freedom to distribute assets upon death. By placing assets into an offshore company, and then having probate for the shares in the offshore determined by the laws of the offshore jurisdiction (usually in accordance with a specific will or codicil sworn for that purpose), the testator can sometimes avoid such strictures.

* Collective Investment Vehicles: Mutual funds, Hedge funds, unit trusts and SICAVs are formed offshore to facilitate international distribution. By being domiciled in a low tax jurisdiction investors only have to consider the tax implications of their own domicile or residency.

* Derivatives and securities trading: Wealthy individuals often form offshore vehicles to engage in risky investments, such as derivatives

The derivative of a function is the rate of change of the function's output relative to its input value.

Derivative may also refer to:

In mathematics and economics

*Brzozowski derivative in the theory of formal languages

*Formal derivative, an ...

and global securities trading, which may be extremely difficult to engage in directly onshore due to cumbersome financial markets regulation.

* Exchange control trading vehicles'':'' In countries where there is either exchange control or is perceived to be increased political risk with the repatriation of funds, major exporters often form trading vehicles in offshore companies so that the sales from exports can be "parked" in the offshore vehicle until needed for further investment. Trading vehicles of this nature have been criticised in a number of shareholder lawsuits which allege that by manipulating the ownership of the trading vehicle, majority shareholders can illegally avoid paying minority shareholders their fair share of trading profits.

* Joint venture vehicles: Offshore jurisdictions are frequently used to set up

* Joint venture vehicles: Offshore jurisdictions are frequently used to set up joint venture

A joint venture (JV) is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. Companies typically pursue joint ventures for one of four reasons: to acce ...

companies, either as a compromise neutral jurisdiction (see for example, TNK-BP) and/or because the jurisdiction where the joint venture has its commercial centre has insufficiently sophisticated corporate and commercial laws.

* Stock market listing vehicles: Successful companies who are unable to obtain a stock market listing because of the underdevelopment of the corporate law in their home country often transfer shares into an offshore vehicle, and list the offshore vehicle. Offshore vehicles are listed on the NASDAQ, Alternative Investment Market, the Hong Kong Stock Exchange

The Stock Exchange of Hong Kong (SEHK, also known as Hong Kong Stock Exchange) is a stock exchange based in Hong Kong. As of the end of 2020, it has 2,538 listed companies with a combined market capitalization of HK$47 trillion. It is rep ...

and the Singapore Stock Exchange.

* Trade finance vehicles: Large corporate groups often form offshore companies, sometimes under an orphan structure to enable them to obtain financing (either from bond issues

In finance, a bond is a type of security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as i ...

or by way of a syndicated loan

A syndicated loan is one that is provided by a group of lenders and is structured, arranged, and administered by one or several commercial banks or investment banks known as lead arrangers.

The syndicated loan market is the dominant way for larg ...

) and to treat the financing as " off-balance-sheet" under applicable accounting procedures. In relation to bond issues, offshore special purpose vehicles are often used in relation to asset-backed securities transactions (particularly securitisations).

* Creditor avoidance: Highly indebted persons may seek to escape the effect of bankruptcy by transferring cash and assets into an anonymous offshore company.

* Market manipulation: The Enron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional compani ...

and Parmalat scandals demonstrated how companies could form offshore vehicles in part of their structures to manipulate financial results.

* Tax evasion: Although numbers are difficult to ascertain, some individuals and corporations unlawfully evade tax through not declaring gains made by onshore and offshore vehicles that they own. Tax reporting regulations and agreements are now in place which aid authorities in investigating and prosecuting such criminality. Multinationals including GlaxoSmithKline

GSK plc, formerly GlaxoSmithKline plc, is a British Multinational corporation, multinational pharmaceutical and biotechnology company with global headquarters in London, England. Established in 2000 by a Mergers and acquisitions, merger of Gl ...

and Sony

, commonly stylized as SONY, is a Japanese multinational conglomerate corporation headquartered in Minato, Tokyo, Japan. As a major technology company, it operates as one of the world's largest manufacturers of consumer and professional ...

have previously been accused of transferring profits from the higher-tax jurisdictions in which they are made to zero-tax offshore centres. BEPS-focussed regulations make this activity more difficult.

Ship and aircraft registrations

Many offshore financial centres also provide registrations for ships (notably

Many offshore financial centres also provide registrations for ships (notably Bahamas

The Bahamas (), officially the Commonwealth of The Bahamas, is an island country within the Lucayan Archipelago of the West Indies in the North Atlantic. It takes up 97% of the Lucayan Archipelago's land area and is home to 88% of the archi ...

and Panama

Panama ( , ; es, link=no, Panamá ), officially the Republic of Panama ( es, República de Panamá), is a transcontinental country spanning the southern part of North America and the northern part of South America. It is bordered by Co ...

) or aircraft

An aircraft is a vehicle that is able to fly by gaining support from the air. It counters the force of gravity by using either static lift or by using the dynamic lift of an airfoil, or in a few cases the downward thrust from jet engines. ...

(notably Aruba, Bermuda

)

, anthem = " God Save the King"

, song_type = National song

, song = "Hail to Bermuda"

, image_map =

, map_caption =

, image_map2 =

, mapsize2 =

, map_caption2 =

, subdivision_type = Sovereign state

, subdivision_name =

, ...

and the Cayman Islands). Aircraft are frequently registered in offshore jurisdictions where they are leased or purchased by carriers in emerging markets but financed by banks in major onshore financial centres. The financing institution is reluctant to allow the aircraft to be registered in the carrier's home country (either because it does not have sufficient regulation governing civil aviation, or because it feels the courts in that country would not cooperate fully if it needed to enforce any security interest over the aircraft), and the carrier is reluctant to have the aircraft registered in the financier's jurisdiction (often the United States or the United Kingdom) either because of personal or political reasons, or because they fear spurious lawsuits and potential arrest of the aircraft.

For example, in 2003, state carrier Pakistan International Airlines re-registered its entire fleet in the Cayman Islands as part of the financing of its purchase of eight new Boeing 777s; the U.S. bank refused to allow the aircraft to remain registered in Pakistan, and the airline refused to have the aircraft registered in the United States.

Insurance

A number of offshore jurisdictions promote the incorporation of captive insurance companies within the jurisdiction to allow the sponsor to manage risk. In more sophisticated offshore insurance markets, onshoreinsurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge ...

companies can also establish an offshore subsidiary in the jurisdiction to reinsure certain risks underwritten by the onshore parent, and thereby reduce overall reserve and capital requirements. Onshore reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own ins ...

companies may also incorporate an offshore subsidiary to reinsure catastrophic risks.

Bermuda's insurance and re-insurance market is now the third largest in the world. There are also signs the primary insurance market is becoming increasingly focused upon Bermuda; in September 2006 Hiscox PLC, the FTSE 250 insurance company announced that it planned to relocate to Bermuda citing tax and regulatory advantages.

Collective investment vehicles

Many offshore jurisdictions specialise in the formation of collective investment schemes, or mutual funds. The market leader is the Cayman Islands.

At year-end 2020, there were 24,591 funds registered with the Cayman Islands Monetary Authority (CIMA), including 583 Limited Investor Funds and 12,695 Private Funds. Total ending net asset value (NAV) increased to US$4.967 trillion from US$4.229 trillion in 2019 - excluding Limited Investor and Private Funds. At year-end 2020, total ending NAV for Limited Investor Funds submitting a FAR was US$107 billion and US$2.475 trillion for Private Funds. Worldwide there were 126,457 regulated open-ended funds with total net assets of US$63.1 trillion; 9,027 mutual funds with ending NAV of US$29.3 trillion in the United States and 57,753 funds with ending NAV of US$21.8 trillion in Europe.

But the greater appeal of offshore jurisdictions to form mutual funds is usually in the regulatory considerations. As offshore jurisdictions do not tend to cater to small retail investors, they tend to impose fewer if any restrictions on what investment strategy the mutual funds may pursue and no limitations on the amount of leverage which mutual funds can employ in their investment strategy. Many offshore jurisdictions (

Many offshore jurisdictions specialise in the formation of collective investment schemes, or mutual funds. The market leader is the Cayman Islands.

At year-end 2020, there were 24,591 funds registered with the Cayman Islands Monetary Authority (CIMA), including 583 Limited Investor Funds and 12,695 Private Funds. Total ending net asset value (NAV) increased to US$4.967 trillion from US$4.229 trillion in 2019 - excluding Limited Investor and Private Funds. At year-end 2020, total ending NAV for Limited Investor Funds submitting a FAR was US$107 billion and US$2.475 trillion for Private Funds. Worldwide there were 126,457 regulated open-ended funds with total net assets of US$63.1 trillion; 9,027 mutual funds with ending NAV of US$29.3 trillion in the United States and 57,753 funds with ending NAV of US$21.8 trillion in Europe.

But the greater appeal of offshore jurisdictions to form mutual funds is usually in the regulatory considerations. As offshore jurisdictions do not tend to cater to small retail investors, they tend to impose fewer if any restrictions on what investment strategy the mutual funds may pursue and no limitations on the amount of leverage which mutual funds can employ in their investment strategy. Many offshore jurisdictions (Bermuda

)

, anthem = " God Save the King"

, song_type = National song

, song = "Hail to Bermuda"

, image_map =

, map_caption =

, image_map2 =

, mapsize2 =

, map_caption2 =

, subdivision_type = Sovereign state

, subdivision_name =

, ...

, British Virgin Islands

)

, anthem = " God Save the King"

, song_type = Territorial song

, song = "Oh, Beautiful Virgin Islands"

, image_map = File:British Virgin Islands on the globe (Americas centered).svg

, map_caption =

, mapsize = 290px

, image_map2 = Bri ...

, Cayman Islands and Guernsey) allow promoters to incorporate '' segregated portfolio companies'' (or SPCs) for use as mutual funds; the complexity of incorporating a similar corporate vehicle onshore alongside other onshore company regimes has resulted in sophisticated investor clients preferring the simplicity of offshore incorporated funds.

Banking

Traditionally, a number of offshore jurisdictions offered banking licences to institutions with relatively little scrutiny. International initiatives have largely stopped this practice, and very few offshore financial centres will now issue licences to offshore banks that do not already hold a banking licence in a major onshore jurisdiction. The most recent reliable figures for offshore banks indicates that the Cayman Islands has 285 licensed banks, theBahamas

The Bahamas (), officially the Commonwealth of The Bahamas, is an island country within the Lucayan Archipelago of the West Indies in the North Atlantic. It takes up 97% of the Lucayan Archipelago's land area and is home to 88% of the archi ...

Not treating Switzerland (with 500) as an offshore financial centre for these purposes. has 301. By contrast, the British Virgin Islands

)

, anthem = " God Save the King"

, song_type = Territorial song

, song = "Oh, Beautiful Virgin Islands"

, image_map = File:British Virgin Islands on the globe (Americas centered).svg

, map_caption =

, mapsize = 290px

, image_map2 = Bri ...

only has seven licensed offshore banks.

See also

* Corporate tax haven * Financial centre * Ireland as a tax haven * Market manipulation * Panama Papers * Pandora Papers * Paradise Papers *Tax haven

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

* United States as a tax haven

In 2010, the United States implemented the Foreign Account Tax Compliance Act; the law required financial firms around the world to report accounts held by US citizens to the Internal Revenue Service.

The US on the other hand refused the Co ...

Explanatory notes

References

Further reading

*External links

Global Forum on Transparency and Exchange of Information for Tax Purposes, OECD

''The Economist'' survey on offshore financial centres

Lax Little Islands

by

David Cay Johnston

David Cay Boyle Johnston (born December 24, 1948) is an American investigative journalist and author, a specialist in economics and tax issues, and winner of the 2001 Pulitzer Prize for Beat Reporting.

From July 2011 until September 2012 he was a ...

, '' The Nation'', May 13, 2009

Tax Justice Network

Oxfam Corporate Tax Avoidance Portal

Widen tax haven loophole report

• Jun 12, 2013 • US Corporations {{DEFAULTSORT:Offshore Financial Centre * Corporate tax avoidance Foreign direct investment Global issues International taxation Offshore companies Special economic zones Tax avoidance Tax evasion Taxation-related lists