Opposition To Taxes on:

[Wikipedia]

[Google]

[Amazon]

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of

The earliest and most widespread forms of taxation were the corvée and tithe, both of which can be traced back to the beginning of civilization. The corvée was state-imposed

The earliest and most widespread forms of taxation were the corvée and tithe, both of which can be traced back to the beginning of civilization. The corvée was state-imposed  Because taxation is often oppressive, governments have always struggled with tax noncompliance and resistance. It has been suggested that tax resistance played a significant role in the collapse of several empires, including the

Because taxation is often oppressive, governments have always struggled with tax noncompliance and resistance. It has been suggested that tax resistance played a significant role in the collapse of several empires, including the

Tax resisters come from a wide range of backgrounds with diverse ideologies and aims. For example,

Tax resisters come from a wide range of backgrounds with diverse ideologies and aims. For example,

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption taxes on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up cycling; to avoid income tax, a resister may reduce their income below the tax threshold by embracing simple living or a

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption taxes on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up cycling; to avoid income tax, a resister may reduce their income below the tax threshold by embracing simple living or a

Not paying phone tax becomes war protest

''San Francisco Chronicle'' 4 December 2005

Climate change and my tax returnConscience Canada

*

Death and Taxes

' - NWTRCC film about war tax resisters and their motivations

History of War Tax Resistance

by Peace Tax Seven (U.S./UK focus)

Resistance to Civil Government

by

Silence and Courage: Income Taxes, War and Mennonites 1940-1993

— tax resistance in the women's suffrage movement

by Lawrence Rosenwald {{Lady Godiva Civil disobedience Community organizing Protest tactics Anarchist theory Libertarian theory Tax noncompliance

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of

Tax resistance is the refusal to pay tax because of opposition to the government that is imposing the tax, or to government policy, or as opposition to taxation in itself. Tax resistance is a form of direct action

Direct action originated as a political activist term for economic and political acts in which the actors use their power (e.g. economic or physical) to directly reach certain goals of interest, in contrast to those actions that appeal to oth ...

and, if in violation of the tax regulations, also a form of civil disobedience

Civil disobedience is the active, professed refusal of a citizen to obey certain laws, demands, orders or commands of a government (or any other authority). By some definitions, civil disobedience has to be nonviolent to be called "civil". Hen ...

.

Examples of tax resistance campaigns include those advocating home rule, such as the Salt March led by Mahatma Gandhi, and those promoting women's suffrage, such as the Women's Tax Resistance League

The Women's Tax Resistance League (WTRL) was from 1909 to 1918 a direct action group associated with the Women's Freedom League that used tax resistance to protest against the disenfranchisement of women during the British women's suffrage move ...

. War tax resistance is the refusal to pay some or all taxes that pay for war, and may be practiced by conscientious objector

A conscientious objector (often shortened to conchie) is an "individual who has claimed the right to refuse to perform military service" on the grounds of freedom of thought, conscience, or religion. The term has also been extended to object ...

s, pacifists

Pacifism is the opposition or resistance to war, militarism (including conscription and mandatory military service) or violence. Pacifists generally reject theories of Just War. The word ''pacifism'' was coined by the French peace campaigne ...

, or those protesting against a particular war.

Tax resisters are distinct from "tax protesters

A tax protester is someone who refuses to pay a tax claiming that the tax laws are unconstitutional or otherwise invalid. Tax protesters are different from tax resisters, who refuse to pay taxes as a protest against a government or its policies ...

", who deny that the legal obligation to pay taxes exists or applies to them. Tax resisters may accept that some law commands them to pay taxes but they still choose to resist taxation.

History

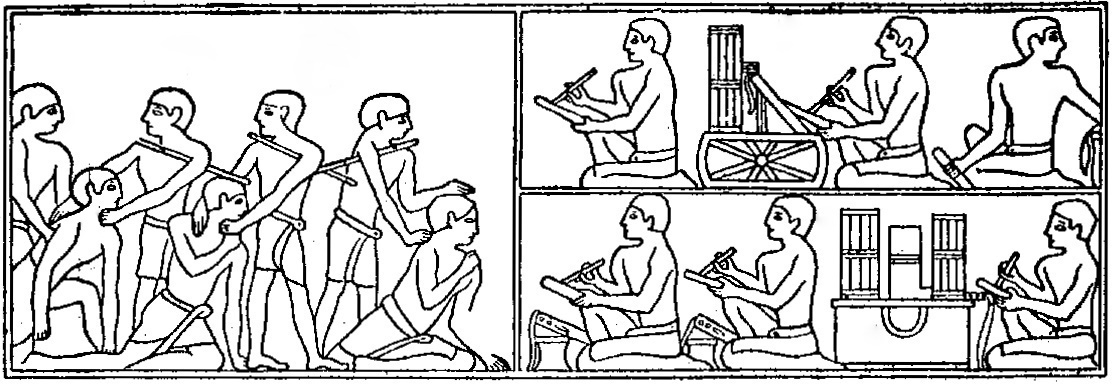

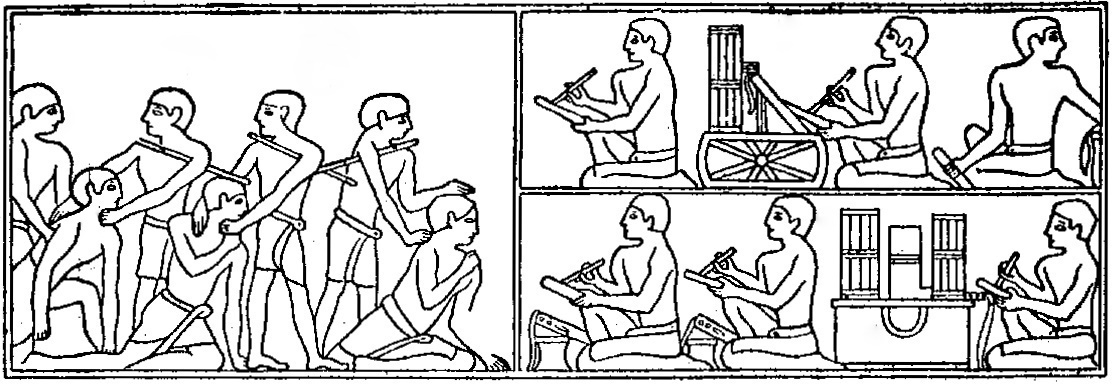

The earliest and most widespread forms of taxation were the corvée and tithe, both of which can be traced back to the beginning of civilization. The corvée was state-imposed

The earliest and most widespread forms of taxation were the corvée and tithe, both of which can be traced back to the beginning of civilization. The corvée was state-imposed forced labour

Forced labour, or unfree labour, is any work relation, especially in modern or early modern history, in which people are employed against their will with the threat of destitution, detention, violence including death, or other forms of ex ...

on peasants too poor to pay other forms of taxation (''labour'' in ancient Egyptian is a synonym for taxes). Low taxes helped the Roman aristocracy increase their wealth, which equalled or exceeded the revenues of the central government. An emperor sometimes replenished his treasury by confiscating the estates of the "super-rich", but in the later period, the resistance of the wealthy to paying taxes was one of the factors contributing to the collapse of the Empire. Morris, p. 184.

Because taxation is often oppressive, governments have always struggled with tax noncompliance and resistance. It has been suggested that tax resistance played a significant role in the collapse of several empires, including the

Because taxation is often oppressive, governments have always struggled with tax noncompliance and resistance. It has been suggested that tax resistance played a significant role in the collapse of several empires, including the Egyptian

Egyptian describes something of, from, or related to Egypt.

Egyptian or Egyptians may refer to:

Nations and ethnic groups

* Egyptians, a national group in North Africa

** Egyptian culture, a complex and stable culture with thousands of years of ...

, Roman, Spanish, and Aztec.

Reports of collective tax refusal include Zealots resisting the Roman poll tax

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources.

Head taxes were important sources of revenue for many governments fr ...

during the 1st century AD, culminating in the First Jewish–Roman War. Other historic events that originated as tax revolts include Magna Carta

(Medieval Latin for "Great Charter of Freedoms"), commonly called (also ''Magna Charta''; "Great Charter"), is a royal charter of rights agreed to by King John of England at Runnymede, near Windsor, on 15 June 1215. First drafted by the ...

, the American Revolution and the French Revolution.

War tax resisters often highlight the relationship between income tax and war. In Britain income tax was introduced in 1799, to pay for weapons and equipment in preparation for the Napoleonic wars, whilst the US federal government imposed their first income tax in the Revenue Act of 1861 to help pay for the American Civil War.

Views and aims

Tax resisters come from a wide range of backgrounds with diverse ideologies and aims. For example,

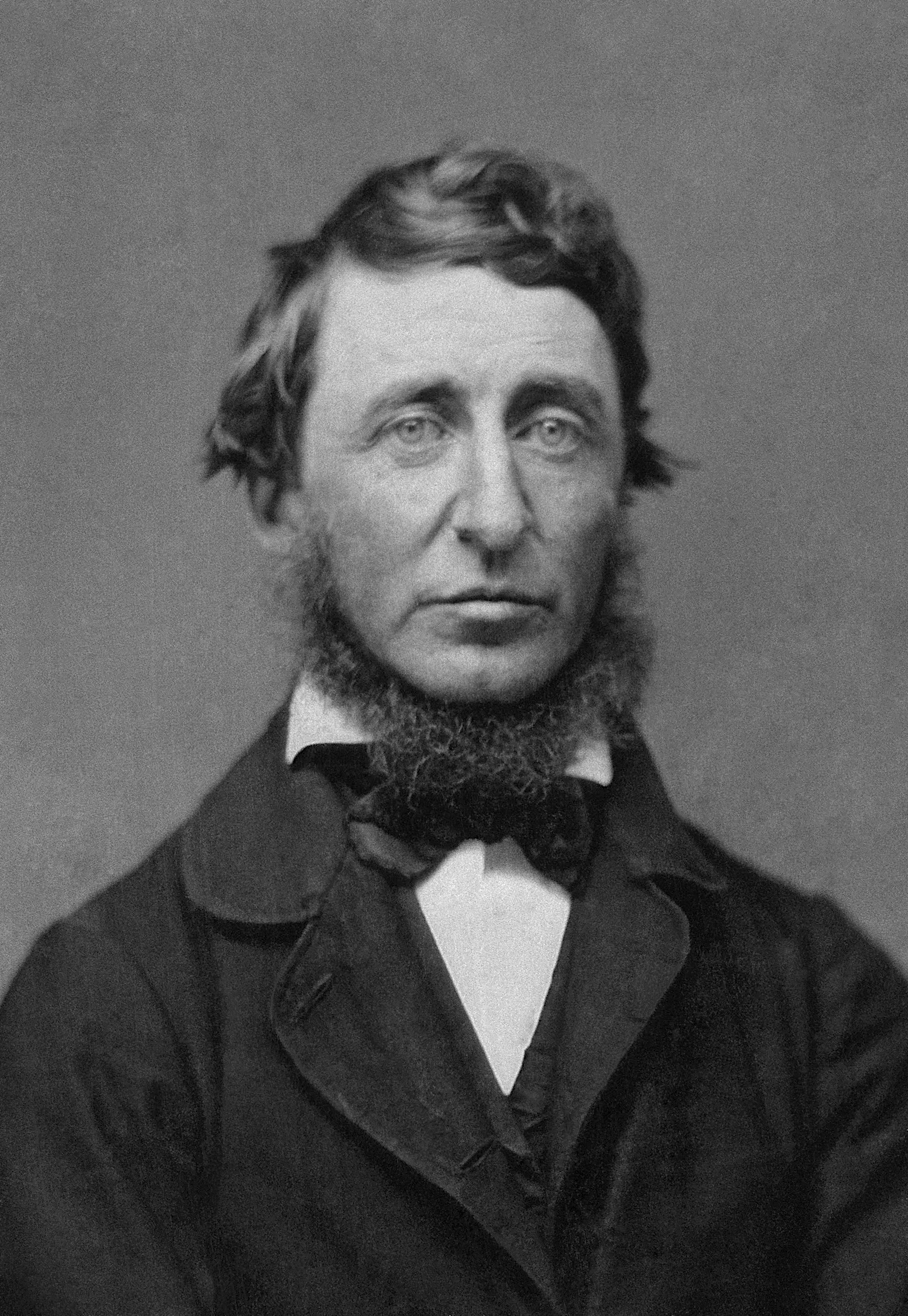

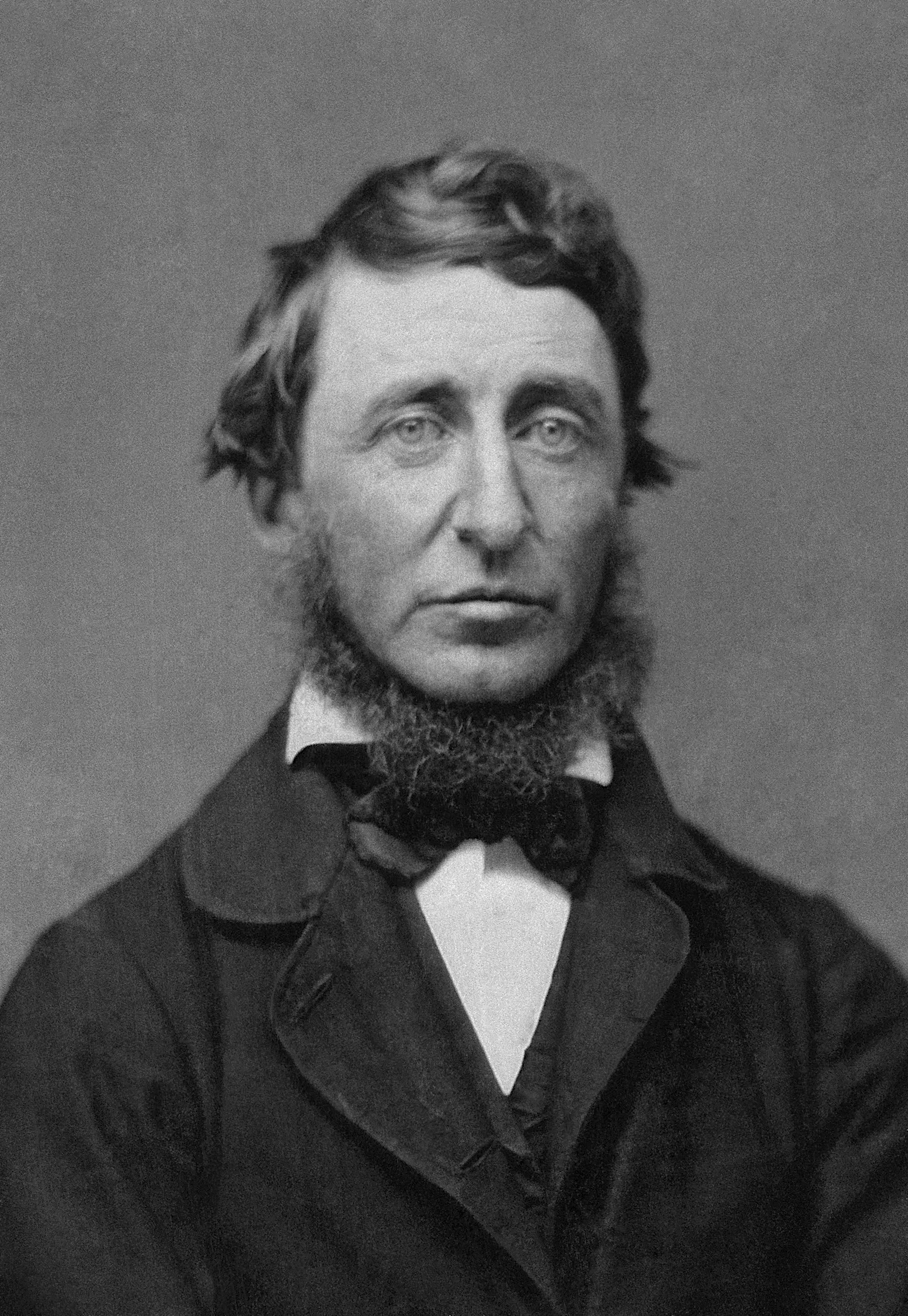

Tax resisters come from a wide range of backgrounds with diverse ideologies and aims. For example, Henry David Thoreau

Henry David Thoreau (July 12, 1817May 6, 1862) was an American naturalist, essayist, poet, and philosopher. A leading Transcendentalism, transcendentalist, he is best known for his book ''Walden'', a reflection upon simple living in natural su ...

and William Lloyd Garrison drew inspiration from the American Revolution and the stubborn pacifism of the Quakers. Some tax resisters refuse to pay tax because their conscience will not allow them to fund war, whilst others resist tax as part of a campaign to overthrow the government.

Tax resisters have been violent revolutionaries like John Adams and pacifist nonresistants like John Woolman; communists like Karl Marx and capitalists like Vivien Kellems

Vivien Kellems (June 7, 1896 – January 25, 1975) was an American industrialist, inventor, public speaker, and political candidate who became known for her battle with the Federal government of the United States over withholding unde26 U.S.C. ...

; solitary anti-war

An anti-war movement (also ''antiwar'') is a social movement, usually in opposition to a particular nation's decision to start or carry on an armed conflict, unconditional of a maybe-existing just cause. The term anti-war can also refer to pa ...

activists like Ammon Hennacy and leaders of independence movements like Mahatma Gandhi.

Leo Tolstoy, a Christian anarchist

Christian anarchism is a Christian movement in political theology that claims anarchism is inherent in Christianity and the Gospels. It is grounded in the belief that there is only one source of authority to which Christians are ultimately an ...

, urged government leaders to change their attitude to war and citizens to taxes:

Methods

As an example of the numerous tax resistance methods, below are some of the legal and illegal techniques used by war tax resisters:Legal

Avoidance

A resister may lower their tax payments by using legal tax avoidance techniques.Paying under protest

Some taxpayers pay their taxes, but include protest letters along with their tax forms. Others pay in a protesting form—for instance, by writing their cheque on a toilet seat or a mock-up of a missile. Others pay in a way that creates inconvenience for the collector—for instance, by paying the entire amount in low-denomination coins. This last method is less effective in countries where small coins are legal tender only in limited amounts, allowing the tax authority legally to reject such payments; for example in England and Wales, 1p coins are legal tender only in amounts up to 20p.Reducing taxable income and consumption

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption taxes on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up cycling; to avoid income tax, a resister may reduce their income below the tax threshold by embracing simple living or a

Other tax resisters change their lifestyles so that they owe less tax. For instance; to avoid consumption taxes on alcohol, a resister might home-brew beer; to avoid excise taxes on gasoline, a resister might take up cycling; to avoid income tax, a resister may reduce their income below the tax threshold by embracing simple living or a freegan

Freeganism is an ideology of limited participation in the conventional economy and minimal consumption of resources, particularly through recovering wasted goods like food. The word "freegan" is a portmanteau of "free" and "vegan". While vegan ...

lifestyle. For example, British citizens pay no income tax if their income is below the personal allowance. In the US the equivalent tax-free annual income is the standard deduction

Under United States tax law, the standard deduction is a dollar amount that non- itemizers may subtract from their income before income tax (but not other kinds of tax, such as payroll tax) is applied. Taxpayers may choose either itemized deducti ...

, though many deductions and credits allow people to earn much more than this and still avoid income tax.

Opposition to war has led some, such as Ammon Hennacy and Ellen Thomas, to a form of tax resistance in which they reduce their income below the tax threshold by taking up a simple living

Simple living refers to practices that promote simplicity in one's lifestyle. Common practices of simple living include reducing the number of possessions one owns, depending less on technology and services, and spending less money. Not only is ...

lifestyle. These individuals believe that their government is engaged in immoral, unethical or destructive activities such as war, and that paying taxes inevitably funds these activities.

These methods differ from tax evasion in that they stay within the tax laws, and they differ from tax avoidance in that the goal is to pay as little tax as possible rather than to keep as much post-tax income as possible.

Illegal

Evasion

A resister may decide to reduce their tax paid through illegal tax evasion. For instance, one way to evade income tax is to only work forcash-in-hand

Unreported employment, also known as money under the table, working under the table, off the books, cash-in-hand, or illicit work is illegal employment that is not reported to the government. The employer or the employee often does so for tax eva ...

, therefore circumventing withholding tax.

Redirection

Some tax resisters refuse to pay all or a portion of the taxes due, but then make an equivalent donation to charity. In this way, they demonstrate that the intent of their resistance is not selfish and that they want to use a portion of their earnings to contribute to the common good. For instance,Julia Butterfly Hill

''Sequoia sempervirens'' ()''Sunset Western Garden Book,'' 1995:606–607 is the sole living species of the genus '' Sequoia'' in the cypress family Cupressaceae (formerly treated in Taxodiaceae). Common names include coast redwood, coastal ...

resisted about $150,000 in federal taxes, and donated that money to after school programs, arts and cultural programs, community gardens, programs for Native Americans, alternatives to incarceration, and environmental protection programs. She said:

I actually take the money that the IRS says goes to them and I give it to the places where our taxes ''should'' be going. And in my letter to the IRS I said: "I'm not refusing to pay my taxes. I'm actually paying them but I'm paying them where they belong because you refuse to do so."

Refusing specific taxes

Some resisters refuse to willingly pay only certain taxes, either because those taxes are especially noxious to them, or because they present a useful symbolic target, or because they are more easily resisted. For instance, in the United States, many tax resisters resist thetelephone federal excise tax

The federal telephone excise tax is a statutory federal excise tax imposed under the Internal Revenue Code in the United States under on amounts paid for certain "communications services". The tax was to be imposed on the person paying for the c ...

. The tax was initiated to pay for the Spanish–American War and has frequently been raised or extended by the government during times of war. This made it an attractive symbolic target as a "war tax

A war tax stamp is a type of postage stamp added to an envelope in addition to regular postage. It is similar to a postal tax stamp, but the revenue is used to defray the costs of a war; as with other postal taxes, its use is obligatory for so ...

". Such refusal is relatively safe: because this tax is typically small, resistance very rarely triggers significant government retaliation. Phone companies will cooperate with such resisters by removing the excise tax from their phone bills and reporting their resistance to the government.''San Francisco Chronicle'' 4 December 2005

Refusing to pay

The most dramatic and characteristic method of tax resistance is to refuse to pay a tax – either by quietly ignoring the tax bill or by openly declaring the refusal to pay. Some tax resisters resist only a portion of the taxes due. For instance, some war tax resisters refuse to pay a percentage of their taxes equivalent to the military percentage of the government's budget.See also

*Draft resistance

Draft evasion is any successful attempt to elude a government-imposed obligation to serve in the military forces of one's nation. Sometimes draft evasion involves refusing to comply with the military draft laws of one's nation. Illegal draft ev ...

* Tax choice

* Taxation as theft

The position that taxation is theft, and therefore immoral, is found in a number of political philosophies considered radical. It marks a significant departure from conservatism and classical liberalism. This position is often held by anarcho-c ...

References

Further reading

* War Resisters League (2003) ''War Tax Resistance: A Guide To Withholding Your Support from the Military''. * Donald D. Kaufman (2006) ''What Belongs to Caesar?: A Discussion on the Christian's Response to Payment of War Taxes''. * Donald D. Kaufman (2006) ''The Tax Dilemma: Praying for Peace, Paying for War''. * David M. Gross (2008) ''We Won't Pay: A Tax Resistance Reader''. * David M. Gross (2009) ''Against War and War Taxes: Quaker Arguments for War Tax Refusal''. * Marian Franz (2009) ''Persistent Voice: Marian Franz and Conscientious Objection to Military Taxation''. * David M. Gross (2011) ''American Quaker War Tax Resistance''. *External links

Climate change and my tax return

*

Death and Taxes

' - NWTRCC film about war tax resisters and their motivations

History of War Tax Resistance

by Peace Tax Seven (U.S./UK focus)

Resistance to Civil Government

by

Henry David Thoreau

Henry David Thoreau (July 12, 1817May 6, 1862) was an American naturalist, essayist, poet, and philosopher. A leading Transcendentalism, transcendentalist, he is best known for his book ''Walden'', a reflection upon simple living in natural su ...

Silence and Courage: Income Taxes, War and Mennonites 1940-1993

— tax resistance in the women's suffrage movement

by Lawrence Rosenwald {{Lady Godiva Civil disobedience Community organizing Protest tactics Anarchist theory Libertarian theory Tax noncompliance