Monetarism on:

[Wikipedia]

[Google]

[Amazon]

Monetarism is a

Monetarism is a

Monetarists not only sought to explain present problems; they also interpreted historical ones. Milton Friedman and

Monetarists not only sought to explain present problems; they also interpreted historical ones. Milton Friedman and

PDF

(30 sec. load: press +) an

HTML.

* _____, 1969. "Monetary and Fiscal Actions: A Test of Their Relative Importance in Economic Stabilisation — Reply", Federal Reserve Bank of St. Louis ''Review'' (April), pp. 12–16

PDF

(15 sec. load; press +) an

HTML.

* Brunner, Karl, and Allan H. Meltzer, 1993. ''Money and the Economy: Issues in Monetary Analysis'', Cambridge

Description

and chapter previews, pp

ix

x.

* Cagan, Phillip, 1965. ''Determinants and Effects of Changes in the Stock of Money, 1875–1960''. NBER. Foreword by Milton Friedman, pp. xiii–xxviii

Table of Contents.

* Friedman, Milton, ed. 1956. ''Studies in the Quantity Theory of Money'', Chicago. Chapter 1 is previewed at Friedman, 2005, ch. 2 link. * _____, 1960. ''A Program for Monetary Stability''. Fordham University Press. * _____, 1968. "The Role of Monetary Policy", ''American Economic Review'', 58(1), pp

1–17

(press +). * _____,

Description

an

table of contents

with previews of 3 chapters. * Friedman, Milton, and David Meiselman, 1963. "The Relative Stability of Monetary Velocity and the Investment Multiplier in the United States, 1897–1958", in ''Stabilization Policies'', pp. 165–268. Prentice-Hall/Commission on Money and Credit, 1963. * Friedman, Milton, and Anna Jacobson Schwartz, 1963a. "Money and Business Cycles", ''Review of Economics and Statistics'', 45(1), Part 2, Supplement, p

p. 32

€“64. Reprinted in Schwartz, 1987, ''Money in Historical Perspective'', ch. 2. * _____. 1963b. ''A Monetary History of the United States, 1867–1960''. Princeton. Page-searchable links to chapters o

1929-41

an

1948–60

* Johnson, Harry G., 1971. "The Keynesian Revolutions and the Monetarist Counter-Revolution", ''American Economic Review'', 61(2), p

p. 1

€“14. Reprinted in

p. 72–

88. Routledge, * Laidler, David E.W., 1993. ''The Demand for Money: Theories, Evidence, and Problems'', 4th ed

Description.

* Schwartz, Anna J., 1987. ''Money in Historical Perspective'', University of Chicago Press

Description

and Chapter-preview links, pp

viiviii.

* Warburton, Clark, 1966. ''Depression, Inflation, and Monetary Policy; Selected Papers, 1945–1953'' Johns Hopkins Press

Amazon Summary

in Anna J. Schwartz, ''Money in Historical Perspective'', 1987.

at The New School's Economics Department's History of Economic Thought website. *

Monetarism

from the Economics A–Z of

Monetarism is a

Monetarism is a school of thought

A school of thought, or intellectual tradition, is the perspective of a group of people who share common characteristics of opinion or outlook of a philosophy, discipline, belief, social movement, economics, cultural movement, or art movement.

H ...

in monetary economics

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and it ...

that emphasizes the role of governments in controlling the amount of money in circulation

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circula ...

. Monetarist theory asserts that variations in the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

have major influences on national output

A variety of measures of national income and output are used in economics to estimate total economic activity in a country or region, including gross domestic product (GDP), gross national product (GNP), net national income (NNI), and adjusted nati ...

in the short run and on price level

The general price level is a hypothetical measure of overall prices for some set of goods and services (the consumer basket), in an economy or monetary union during a given interval (generally one day), normalized relative to some base set. ...

s over longer periods. Monetarists assert that the objectives of monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

are best met by targeting the growth rate of the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

rather than by engaging in discretionary monetary policy.Phillip Cagan

Phillip David Cagan (April 30, 1927 – June 15, 2012) was an American scholar and author. He was Professor of Economics Emeritus at Columbia University.

Biography

Born in Seattle, Washington, Cagan and his family moved to Southern California shor ...

, 1987. "Monetarism", '' The New Palgrave: A Dictionary of Economics'', v. 3, Reprinted in John Eatwell et al. (1989), ''Money: The New Palgrave'', pp. 195–205, 492–97. Monetarism is commonly associated with neoliberalism

Neoliberalism (also neo-liberalism) is a term used to signify the late 20th century political reappearance of 19th-century ideas associated with free-market capitalism after it fell into decline following the Second World War. A prominent fa ...

.

Monetarism today is mainly associated with the work of Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

, who was among the generation of economists to reject Keynesian economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output an ...

and criticise Keynes's theory of fighting economic downturns using fiscal policy

In economics and political science, fiscal policy is the use of government revenue collection (taxes or tax cuts) and expenditure to influence a country's economy. The use of government revenue expenditures to influence macroeconomic variables ...

(government spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual o ...

). Friedman and Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Schwar ...

wrote an influential book, ''A Monetary History of the United States, 1867–1960

''A Monetary History of the United States, 1867–1960'' is a book written in 1963 by Nobel Memorial Prize in Economic Sciences, Nobel Prize–winning economist Milton Friedman and Anna J. Schwartz. It uses historical time series and economic anal ...

'', and argued "inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

is always and everywhere a monetary phenomenon".

Though he opposed the existence of the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

, Friedman advocated, given its existence, a central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central ba ...

policy aimed at keeping the growth of the money supply at a rate commensurate with the growth in productivity and demand for goods.

Description

Monetarism is an economic theory that focuses on themacroeconomic

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

effects of the supply of money and central banking. Formulated by Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

, it argues that excessive expansion of the money supply is inherently inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

ary, and that monetary authorities should focus solely on maintaining price stability Price stability is a goal of monetary and fiscal policy aiming to support sustainable rates of economic activity. Policy is set to maintain a very low rate of inflation or deflation. For example, the European Central Bank (ECB) describes price s ...

.

This theory draws its roots from two historically antagonistic schools of thought: the hard money policies that dominated monetary thinking in the late 19th century, and the monetary theories of John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in ...

, who, working in the inter-war period during the failure of the restored gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the la ...

, proposed a demand-driven model for money. While Keynes had focused on the stability of a currency's value, with panics based on an insufficient money supply leading to the use of an alternate currency and collapse of the monetary system, Friedman focused on price stability.

The result was summarised in a historical analysis of monetary policy, ''Monetary History of the United States 1867–1960'', which Friedman coauthored with Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Schwar ...

. The book attributed inflation to excess money supply generated by a central bank. It attributed deflationary spirals to the reverse effect of a failure of a central bank to support the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

during a liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include:

* Market liquidity, the ease with which an asset can be sold

* Accounting liquidity, the ability to meet cash obligations when due

* Liqui ...

crunch.

Friedman originally proposed a fixed ''monetary rule'', called Friedman's k-percent rule

In macroeconomics, Friedman's k-percent rule (named for Milton Friedman) is the monetarist proposal that the money supply should be increased by the central bank by a constant percentage rate every year, irrespective of business cycles.

Definiti ...

, where the money supply would be automatically increased by a fixed percentage per year. Under this rule, there would be no leeway for the central reserve bank, as money supply increases could be determined "by a computer", and business could anticipate all money supply changes. With other monetarists he believed that the active manipulation of the money supply or its growth rate is more likely to destabilise than stabilise the economy.

Opposition to the gold standard

Most monetarists oppose thegold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the la ...

. Friedman viewed a pure gold standard as impractical. For example, whereas one of the benefits of the gold standard is that the intrinsic limitations to the growth of the money supply by the use of gold would prevent inflation, if the growth of population or increase in trade outpaces the money supply, there would be no way to counteract deflation and reduced liquidity (and any attendant recession) except for the mining of more gold. But he also admitted that if a government was willing to surrender control over its monetary policy and not to interfere with economic activities, a gold-based economy would be possible.

Rise

Clark Warburton

Clark Warburton (27 January 1896, near Buffalo, New York – 18 September 1979, Fairfax, Virginia) was an American economist. He was described as the "first monetarist of the post-World War II period," the most uncompromising upholder of a stric ...

is credited with making the first solid empirical case for the monetarist interpretation of business fluctuation

Business cycles are intervals of Economic expansion, expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are ...

s in a series of papers from 1945.p. 493 Within mainstream economics, the rise of monetarism accelerated from Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

's 1956 restatement of the quantity theory of money

In monetary economics, the quantity theory of money (often abbreviated QTM) is one of the directions of Western economic thought that emerged in the 16th-17th centuries. The QTM states that the general price level of goods and services is directly ...

. Friedman argued that the demand for money

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1 (directly spendable ...

could be described as depending on a small number of economic variables.

Thus, where the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

expanded, people would not simply wish to hold the extra money in idle money balances; i.e., if they were in equilibrium before the increase, they were already holding money balances to suit their requirements, and thus after the increase they would have money balances surplus to their requirements. These excess money balances would therefore be spent and hence aggregate demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is ...

would rise. Similarly, if the money supply were reduced people would want to replenish their holdings of money by reducing their spending. In this, Friedman challenged a simplification attributed to Keynes suggesting that "money does not matter." Thus the word 'monetarist' was coined.

The rise of the popularity of monetarism also picked up in political circles when Keynesian economics seemed unable to explain or cure the seemingly contradictory problems of rising unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for Work (human activity), w ...

and inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

in response to the collapse of the Bretton Woods system in 1972 and the oil shocks of 1973. On the one hand, higher unemployment seemed to call for Keynesian reflation

Reflation is used to describe a return of prices to a previous rate of inflation. One usage describes an act of stimulating the economy by increasing the money supply or by reducing taxes, seeking to bring the economy (specifically the price level ...

, but on the other hand rising inflation seemed to call for Keynesian disinflation

Disinflation is a decrease in the rate of inflation – a slowdown in the rate of increase of the general price level of goods and services in a nation's gross domestic product over time. It is the opposite of reflation.

If the inflation ra ...

. The social-democratic post-war consensus

The post-war consensus, sometimes called the post-war compromise, was the economic order and social model of which the major political parties in post-war Britain shared a consensus supporting view, from the end of World War II in 1945 to the ...

that had prevailed in first world countries

The concept of First World originated during the Cold War and comprised countries that were under the influence of the United States and the rest of NATO and opposed the Soviet Union and/or communism during the Cold War. Since the collapse of ...

was thus called into question by the rising neoliberal

Neoliberalism (also neo-liberalism) is a term used to signify the late 20th century political reappearance of 19th-century ideas associated with free-market capitalism after it fell into decline following the Second World War. A prominent fa ...

political forces.

In 1979, United States President Jimmy Carter

James Earl Carter Jr. (born October 1, 1924) is an American politician who served as the 39th president of the United States from 1977 to 1981. A member of the Democratic Party (United States), Democratic Party, he previously served as th ...

appointed as Federal Reserve chief Paul Volcker

Paul Adolph Volcker Jr. (September 5, 1927 – December 8, 2019) was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended the ...

, who made fighting inflation his primary objective, and who restricted the money supply (in accordance with the Friedman rule

The Friedman rule is a monetary policy rule proposed by Milton Friedman.M. Friedman (1969), ''The Optimum Quantity of Money,'' Macmillan Friedman advocated monetary policy that would result in the nominal interest rate being at or very near zero. H ...

) to tame inflation in the economy. The result was a major rise in interest rates, not only in the United States; but worldwide. The "Volcker shock" continued from 1979 to the summer of 1982, decreasing inflation and increasing unemployment.

By the time Margaret Thatcher

Margaret Hilda Thatcher, Baroness Thatcher (; 13 October 19258 April 2013) was Prime Minister of the United Kingdom from 1979 to 1990 and Leader of the Conservative Party (UK), Leader of the Conservative Party from 1975 to 1990. S ...

, Leader of the Conservative Party

The Conservative Party is a name used by many political parties around the world. These political parties are generally right-wing though their exact ideologies can range from center-right to far-right.

Political parties called The Conservative P ...

in the United Kingdom

The United Kingdom of Great Britain and Northern Ireland, commonly known as the United Kingdom (UK) or Britain, is a country in Europe, off the north-western coast of the continental mainland. It comprises England, Scotland, Wales and North ...

, won the 1979 general election defeating the sitting Labour Government led by James Callaghan

Leonard James Callaghan, Baron Callaghan of Cardiff, ( ; 27 March 191226 March 2005), commonly known as Jim Callaghan, was Prime Minister of the United Kingdom from 1976 to 1979 and Leader of the Labour Party from 1976 to 1980. Callaghan is ...

, the UK had endured several years of severe inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

, which was rarely below the 10% mark and by the time of the May 1979 general election, stood at 15.4%. Thatcher implemented monetarism as the weapon in her battle against inflation, and succeeded at reducing it to 4.6% by 1983. However, unemployment in the United Kingdom

Unemployment in the United Kingdom is measured by the Office for National Statistics.

In the most recent three-month figures (July to September 2022) the unemployment rate was estimated at 3.6%, which is 0.2 percentage points lower than the pr ...

increased from 5.7% in 1979 to 12.2% in 1983, reaching 13.0% in 1982; starting with the first quarter of 1980, the UK economy contracted in terms of real gross domestic product for six straight quarters.

Monetarists not only sought to explain present problems; they also interpreted historical ones. Milton Friedman and

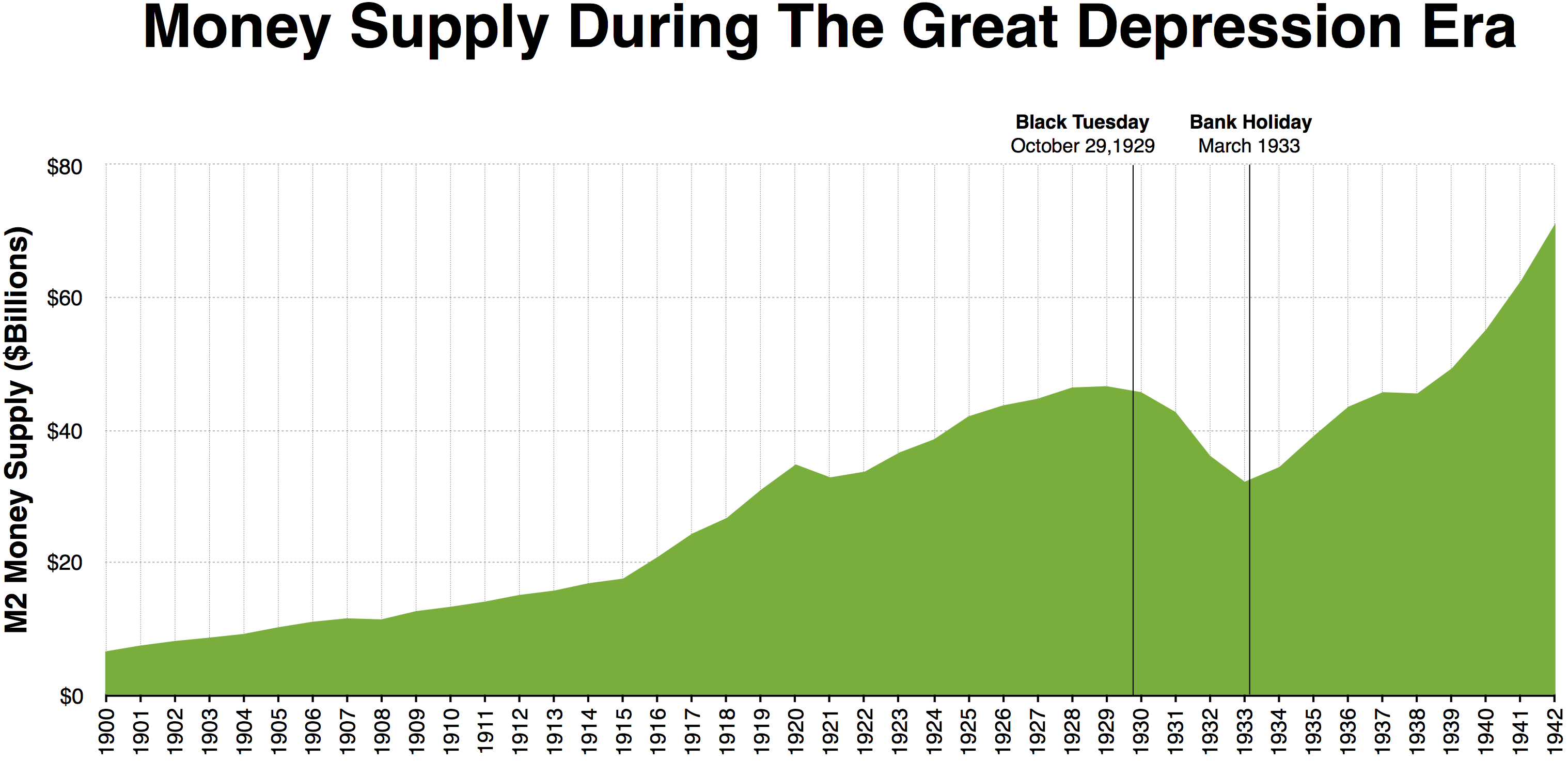

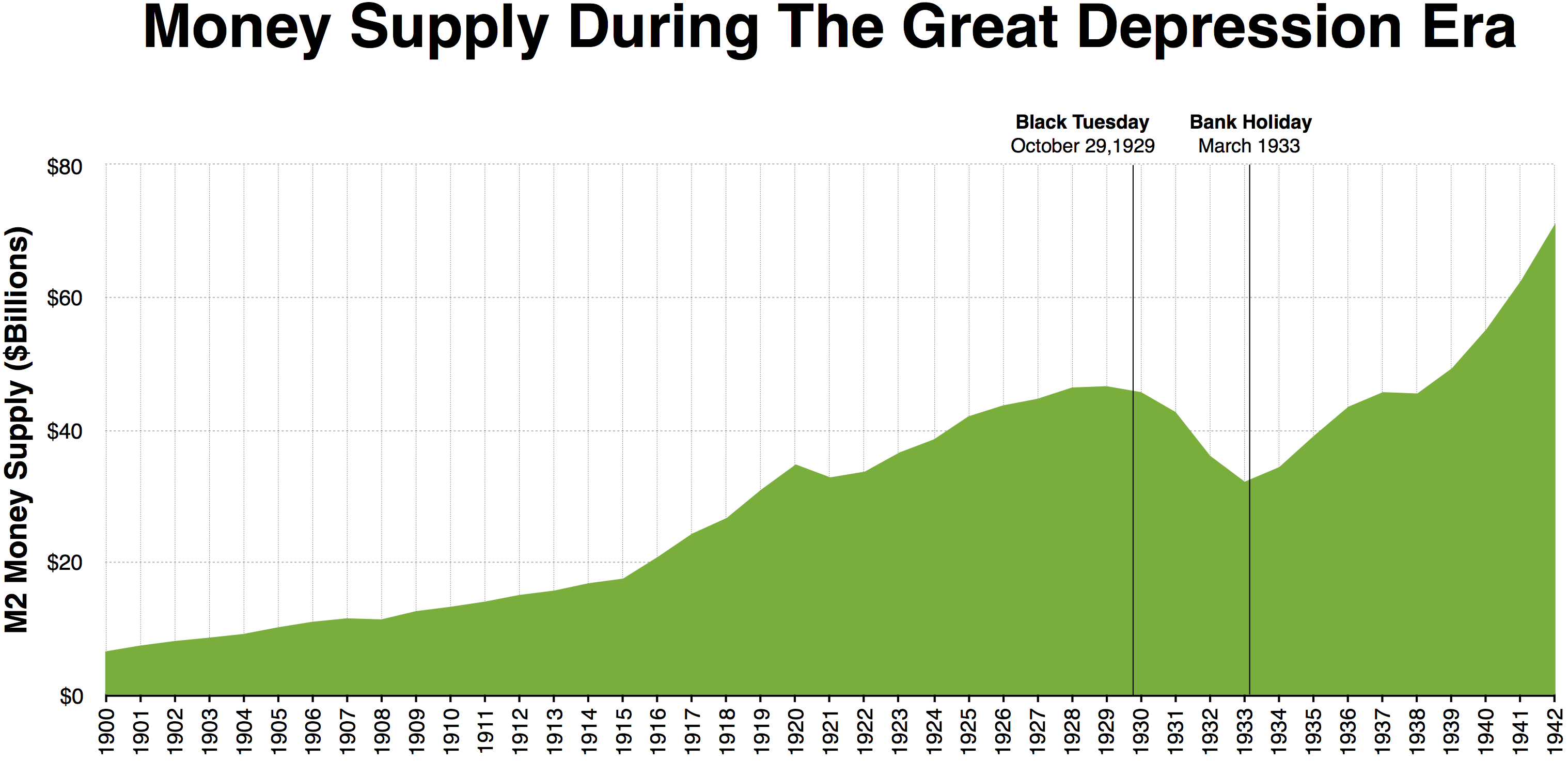

Monetarists not only sought to explain present problems; they also interpreted historical ones. Milton Friedman and Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Schwar ...

in their book ''A Monetary History of the United States, 1867–1960'' argued that the Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagio ...

of the 1930s was caused by a massive contraction of the money supply (they deemed it "the Great Contraction

The Great Contraction is the recession, recessionary period from 1929 until 1933, i.e., the early years of the Great Depression, as characterized by economist Milton Friedman. The phrase was the title of a chapter in the landmark 1963 book ''A Mone ...

"), and not by the lack of investment Keynes had argued. They also maintained that post-war inflation was caused by an over-expansion of the money supply.

They made famous the assertion of monetarism that "inflation is always and everywhere a monetary phenomenon." Many Keynesian economists initially believed that the Keynesian vs. monetarist debate was solely about whether fiscal or monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

was the more effective tool of demand management. By the mid-1970s, however, the debate had moved on to other issues as monetarists began presenting a fundamental challenge to Keynesianism.

Monetarists argued that central banks sometimes caused major unexpected fluctuations in the money supply. They asserted that actively increasing demand through the central bank can have negative unintended consequences.

Current state

Former Federal Reserve chairmanAlan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. ...

argued that the 1990s decoupling was explained by a virtuous cycle

A vicious circle (or cycle) is a complex chain of events that reinforces itself through a feedback loop, with detrimental results. It is a system with no tendency toward equilibrium (social, economic, ecological, etc.), at least in the short r ...

of productivity and investment on one hand, and a certain degree of "irrational exuberance

"Irrational exuberance" is the phrase used by the then-Federal Reserve Board chairman, Alan Greenspan, in a speech given at the American Enterprise Institute during the dot-com bubble of the 1990s. The phrase was interpreted as a warning that the ...

" in the investment sector on the other.

There are also arguments that monetarism is a special case of Keynesian theory. The central test case over the validity of these theories would be the possibility of a liquidity trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rathe ...

, like that experienced by Japan. Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Fed, he was appointed a distinguished fellow at the Brookings Institution. Durin ...

, Princeton professor and another former chairman of the U.S. Federal Reserve, argued that monetary policy could respond to zero interest rate conditions by direct expansion of the money supply. In his words, "We have the keys to the printing press, and we are not afraid to use them."

These disagreements—along with the role of monetary policies in trade liberalisation, international investment, and central bank policy—remain lively topics of investigation and argument.

Notable proponents

* Karl Brunner *Phillip D. Cagan

Phillip David Cagan (April 30, 1927 – June 15, 2012) was an American scholar and author. He was Professor of Economics Emeritus at Columbia University.

Biography

Born in Seattle, Washington, Cagan and his family moved to Southern California shor ...

* Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the ...

* Alan Greenspan

Alan Greenspan (born March 6, 1926) is an American economist who served as the 13th chairman of the Federal Reserve from 1987 to 2006. He works as a private adviser and provides consulting for firms through his company, Greenspan Associates LLC. ...

* David Laidler

David Ernest William Laidler (born 12 August 1938, North Shields, England) is an English/Canadian economist who has been one of the foremost scholars of monetarism. He published major economics journal articles on the topic in the late 1960s an ...

* Allan Meltzer

Allan H. Meltzer (; February 6, 1928 – May 8, 2017) was an American economist and Allan H. Meltzer Professor of Political Economy at Carnegie Mellon University's Tepper School of Business and Institute for Politics and Strategy in Pittsburgh, ...

* Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Schwar ...

* Margaret Thatcher

Margaret Hilda Thatcher, Baroness Thatcher (; 13 October 19258 April 2013) was Prime Minister of the United Kingdom from 1979 to 1990 and Leader of the Conservative Party (UK), Leader of the Conservative Party from 1975 to 1990. S ...

* Paul Volcker

Paul Adolph Volcker Jr. (September 5, 1927 – December 8, 2019) was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended the ...

* Clark Warburton

Clark Warburton (27 January 1896, near Buffalo, New York – 18 September 1979, Fairfax, Virginia) was an American economist. He was described as the "first monetarist of the post-World War II period," the most uncompromising upholder of a stric ...

See also

*Austrian School of economics

The Austrian School is a Heterodox economics, heterodox Schools of economic thought, school of economic thought that advocates strict adherence to methodological individualism, the concept that social phenomena result exclusively from the motiva ...

* Chicago school of economics

The Chicago school of economics is a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago, some of whom have constructed and popularized its principles. Milton Friedman and George Stigle ...

* Demurrage (currency)

Demurrage is the cost associated with owning or holding currency over a given period. It is sometimes referred to as a carrying cost of money. For commodity money such as gold, demurrage is the cost of storing and securing the gold. For paper curr ...

* Fiscalism

Fiscalism is a term sometimes used to refer the economic theory that the government should rely on fiscal policy as the main instrument of macroeconomic policy. Fiscalism in this sense is contrasted with monetarism, which is associated with relian ...

(usually contrasted to monetarism)

* Inflation targeting

In macroeconomics, inflation targeting is a monetary policy where a central bank follows an explicit target for the inflation rate for the medium-term and announces this inflation target to the public. The assumption is that the best that moneta ...

* Market monetarism

Market monetarism is a school of macroeconomic thought that advocates that central banks target the level of nominal income instead of inflation, unemployment, or other measures of economic activity, including in times of shocks such as the burs ...

* Modern Monetary Theory

Modern Monetary Theory or Modern Money Theory (MMT) is a heterodox

*

*

*

*

*

* macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of t ...

General:

* Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

* Political economy

Political economy is the study of how Macroeconomics, economic systems (e.g. Marketplace, markets and Economy, national economies) and Politics, political systems (e.g. law, Institution, institutions, government) are linked. Widely studied ph ...

References

Further references

* Andersen, Leonall C., and Jerry L. Jordan, 1968. "Monetary and Fiscal Actions: A Test of Their Relative Importance in Economic Stabilisation", Federal Reserve Bank of St. Louis ''Review'' (November), pp. 11–24(30 sec. load: press +) an

HTML.

* _____, 1969. "Monetary and Fiscal Actions: A Test of Their Relative Importance in Economic Stabilisation — Reply", Federal Reserve Bank of St. Louis ''Review'' (April), pp. 12–16

(15 sec. load; press +) an

HTML.

* Brunner, Karl, and Allan H. Meltzer, 1993. ''Money and the Economy: Issues in Monetary Analysis'', Cambridge

Description

and chapter previews, pp

ix

x.

* Cagan, Phillip, 1965. ''Determinants and Effects of Changes in the Stock of Money, 1875–1960''. NBER. Foreword by Milton Friedman, pp. xiii–xxviii

Table of Contents.

* Friedman, Milton, ed. 1956. ''Studies in the Quantity Theory of Money'', Chicago. Chapter 1 is previewed at Friedman, 2005, ch. 2 link. * _____, 1960. ''A Program for Monetary Stability''. Fordham University Press. * _____, 1968. "The Role of Monetary Policy", ''American Economic Review'', 58(1), pp

1–17

(press +). * _____,

969

Year 969 ( CMLXIX) was a common year starting on Friday (link will display the full calendar) of the Julian calendar, the 969th year of the Common Era (CE) and ''Anno Domini'' (AD) designations, the 969th year of the 1st millennium, the 69th ...

2005. ''The Optimum Quantity of Money''Description

an

table of contents

with previews of 3 chapters. * Friedman, Milton, and David Meiselman, 1963. "The Relative Stability of Monetary Velocity and the Investment Multiplier in the United States, 1897–1958", in ''Stabilization Policies'', pp. 165–268. Prentice-Hall/Commission on Money and Credit, 1963. * Friedman, Milton, and Anna Jacobson Schwartz, 1963a. "Money and Business Cycles", ''Review of Economics and Statistics'', 45(1), Part 2, Supplement, p

p. 32

€“64. Reprinted in Schwartz, 1987, ''Money in Historical Perspective'', ch. 2. * _____. 1963b. ''A Monetary History of the United States, 1867–1960''. Princeton. Page-searchable links to chapters o

1929-41

an

1948–60

* Johnson, Harry G., 1971. "The Keynesian Revolutions and the Monetarist Counter-Revolution", ''American Economic Review'', 61(2), p

p. 1

€“14. Reprinted in

John Cunningham Wood

John Cunningham Wood (born 1952) is an Australian economist, author, and the Chief Executive Officer of the University Division at Navitas, known as series editor of the "Critical Assessment of Leading Economists" series of Taylor & Francis.

Biog ...

and Ronald N. Woods, ed., 1990, ''Milton Friedman: Critical Assessments'', v. 2, pp. 72

88. Routledge, * Laidler, David E.W., 1993. ''The Demand for Money: Theories, Evidence, and Problems'', 4th ed

Description.

* Schwartz, Anna J., 1987. ''Money in Historical Perspective'', University of Chicago Press

Description

and Chapter-preview links, pp

vii

* Warburton, Clark, 1966. ''Depression, Inflation, and Monetary Policy; Selected Papers, 1945–1953'' Johns Hopkins Press

Amazon Summary

in Anna J. Schwartz, ''Money in Historical Perspective'', 1987.

External links

at The New School's Economics Department's History of Economic Thought website. *

Monetarism

from the Economics A–Z of

The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Econo ...

{{Authority control

Monetary economics

Milton Friedman

20th-century economic history

21st-century economic history

Schools of economic thought