Markup Rule on:

[Wikipedia]

[Google]

[Amazon]

A markup rule is the pricing practice of a producer with

:

By definition is the reciprocal of the

:

By definition is the reciprocal of the

market power

In economics, market power refers to the ability of a firm to influence the price at which it sells a product or service by manipulating either the supply or demand of the product or service to increase economic profit. In other words, market powe ...

, where a firm charges a fixed mark-up over its marginal cost

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is incremented, the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it r ...

.Roger LeRoy Miller, ''Intermediate Microeconomics Theory Issues Applications, Third Edition'', New York: McGraw-Hill, Inc, 1982.Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988.

Derivation of the markup rule

Mathematically, the markup rule can be derived for a firm with price-setting power by maximizing the following expression forprofit

Profit may refer to:

Business and law

* Profit (accounting), the difference between the purchase price and the costs of bringing to market

* Profit (economics), normal profit and economic profit

* Profit (real property), a nonpossessory intere ...

:

:

:where

:Q = quantity sold,

:P(Q) = inverse demand function In economics, an inverse demand function is the inverse function of a demand function. The inverse demand function views price as a function of quantity.

Quantity demanded, ''Q'', is a function f (the demand function) of price; the inverse demand f ...

, and thereby the price at which Q can be sold given the existing demand

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item ...

:C(Q) = total cost

In economics, total cost (TC) is the minimum dollar cost of producing some quantity of output. This is the total economic cost of production and is made up of variable cost, which varies according to the quantity of a good produced and includes ...

of producing Q.

: = economic profit

Profit maximization

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit (or just profit in short). In neoclassical economics, w ...

means that the derivative of with respect to Q is set equal to 0:

:

: where

:P'(Q) = the derivative

In mathematics, the derivative of a function of a real variable measures the sensitivity to change of the function value (output value) with respect to a change in its argument (input value). Derivatives are a fundamental tool of calculus. F ...

of the inverse demand function In economics, an inverse demand function is the inverse function of a demand function. The inverse demand function views price as a function of quantity.

Quantity demanded, ''Q'', is a function f (the demand function) of price; the inverse demand f ...

.

:C'(Q) = marginal cost–the derivative of total cost

In economics, total cost (TC) is the minimum dollar cost of producing some quantity of output. This is the total economic cost of production and is made up of variable cost, which varies according to the quantity of a good produced and includes ...

with respect to output.

This yields:

:

or "marginal revenue" = "marginal cost".

price elasticity of demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good, but it falls more for some than for others. The price elastici ...

(or ). Hence

:

Letting be the reciprocal of the price elasticity of demand

A good's price elasticity of demand (E_d, PED) is a measure of how sensitive the quantity demanded is to its price. When the price rises, quantity demanded falls for almost any good, but it falls more for some than for others. The price elastici ...

,

:

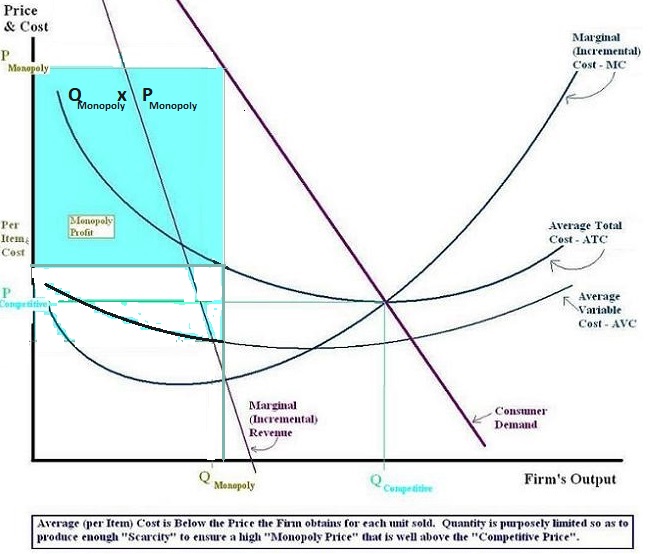

Thus a firm with market power chooses the output quantity at which the corresponding price satisfies this rule. Since for a price-setting firm this means that a firm with market power will charge a price above marginal cost and thus earn a monopoly rent

In economics, economic rent is any payment (in the context of a market transaction) to the owner of a factor of production in excess of the cost needed to bring that factor into production. In classical economics, economic rent is any payment m ...

. On the other hand, a competitive firm by definition faces a perfectly elastic demand; hence it has which means that it sets the quantity such that marginal cost equals the price.

The rule also implies that, absent menu cost In economics, the menu cost is a cost that a firm incurs due to changing its prices. It is one microeconomic explanation of the price-stickiness of the macroeconomy put by New Keynesian economists. The term originated from the cost when restaurants ...

s, a firm with market power will never choose a point on the inelastic

In economics, elasticity measures the percentage change of one economic variable in response to a percentage change in another. If the price elasticity of the demand of something is -2, a 10% increase in price causes the demand quantity to fall b ...

portion of its demand curve (where and ). Intuitively, this is because starting from such a point, a reduction in quantity and the associated increase in price along the demand curve would yield both an increase in revenues (because demand is inelastic at the starting point) and a decrease in costs (because output has decreased); thus the original point was not profit-maximizing.

References

{{reflist Pricing