March 2023 United States Bank Failures on:

[Wikipedia]

[Google]

[Amazon]

Over the course of five days in March 2023, three small- to mid-size U.S. banks failed, triggering a sharp decline in global bank stock prices and swift response by regulators to prevent potential global contagion.

Over the course of five days in March 2023, three small- to mid-size U.S. banks failed, triggering a sharp decline in global bank stock prices and swift response by regulators to prevent potential global contagion.

Despite conducting the majority of its business with cryptocurrency companies, Silvergate's

Despite conducting the majority of its business with cryptocurrency companies, Silvergate's

Signature Bank was a

Signature Bank was a

Intense scrutiny and pressure were applied to other banks like the

Intense scrutiny and pressure were applied to other banks like the

Western Alliance Bancorporation share price fell 47% and

Western Alliance Bancorporation share price fell 47% and

The Business Times, 21 March 2023. but Australia's central bank governors met and publicly indicated a potential pause in recent rate hikes. ''ABC News'' reported that the challenge for central banks is determining if the "banking turmoil close to crashing the real economy, or is inflation still the greater threat." In Japan the three main lenders,

Over the course of five days in March 2023, three small- to mid-size U.S. banks failed, triggering a sharp decline in global bank stock prices and swift response by regulators to prevent potential global contagion.

Over the course of five days in March 2023, three small- to mid-size U.S. banks failed, triggering a sharp decline in global bank stock prices and swift response by regulators to prevent potential global contagion. Silvergate Bank

Silvergate Bank is a Californian bank that mostly deals in cryptocurrency transactions.

Concerns have been raised about Silvergate's health following the fall in cryptocurrency prices and the bankruptcy of FTX in 2022.

History

Silvergate Ba ...

and Signature Bank

Signature Bank was an American full-service commercial bank headquartered in New York City and with 40 private client offices in the states of New York, Connecticut, California, Nevada, and North Carolina. In addition to banking products, spe ...

, both with significant exposure to cryptocurrency

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. It i ...

, failed in the midst of turbulence in that market. Silicon Valley Bank

Silicon Valley Bank is an American commercial bank. SVB is on the list of largest banks in the United States, and is the biggest bank in Silicon Valley based on local deposits. It is a subsidiary of SVB Financial Group.

History

Silicon Valley Ba ...

failed when a bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

was triggered after it sold its Treasury bond portfolio at a large loss, causing depositor concerns about the bank's liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include:

* Market liquidity, the ease with which an asset can be sold

* Accounting liquidity, the ability to meet cash obligations when due

* Liq ...

. The bonds had lost significant value as market interest rates rose after the bank had shifted its portfolio to longer-maturity bonds. The bank's clientele was primarily technology companies and wealthy individuals holding large deposits, but balances exceeding $250,000 were not insured by the Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cr ...

.

In response to the bank failures, the three major U.S. federal bank regulators announced in a joint communiqué

A press release is an official statement delivered to members of the news media for the purpose of providing information, creating an official statement, or making an announcement directed for public release. Press releases are also considere ...

that extraordinary measures would be taken to ensure that all deposits at Silicon Valley Bank and Signature Bank would be honored. The Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

established a Bank Term Funding Program (BTFP) to offer loans of up to one year to eligible depository institution

Colloquially, a depository institution is a financial institution in the United States (such as a savings bank, commercial bank, savings and loan associations, or credit unions) that is legally allowed to accept monetary deposits from consumer

...

s pledging qualifying assets as collateral

Collateral may refer to:

Business and finance

* Collateral (finance), a borrower's pledge of specific property to a lender, to secure repayment of a loan

* Marketing collateral, in marketing and sales

Arts, entertainment, and media

* ''Collate ...

. To prevent the situation from affecting more banks, global industry regulators, including the Federal Reserve, the Bank of Canada

The Bank of Canada (BoC; french: Banque du Canada) is a Crown corporation and Canada's central bank. Chartered in 1934 under the ''Bank of Canada Act'', it is responsible for formulating Canada's monetary policy,OECD. OECD Economic Surveys: C ...

, Bank of England

The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. Established in 1694 to act as the English Government's banker, and still one of the bankers for the Government o ...

, Bank of Japan

The is the central bank of Japan. Nussbaum, Louis Frédéric. (2005). "Nihon Ginkō" in The bank is often called for short. It has its headquarters in Chūō, Tokyo.

History

Like most modern Japanese institutions, the Bank of Japan was foun ...

, European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important centra ...

, and Swiss National Bank

The Swiss National Bank (SNB; german: Schweizerische Nationalbank; french: Banque nationale suisse; it, Banca nazionale svizzera; rm, Banca naziunala svizra) is the central bank of Switzerland, responsible for the nation's monetary policy an ...

intervened to provide extraordinary liquidity.

By March 16, large interbank flows of funds were occurring to shore up bank balance sheets and some analysts were talking of a possibly broader U.S. banking crisis

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

. Eleven of the largest U.S. banks provided up to $30 billion to support the teetering San Francisco-based First Republic regional bank, and the Federal Reserve's discount window

The discount window is an instrument of monetary policy (usually controlled by central banks) that allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by ...

liquidity facility had experienced approximately $150 billion in borrowing from various banks by March 16.

United States

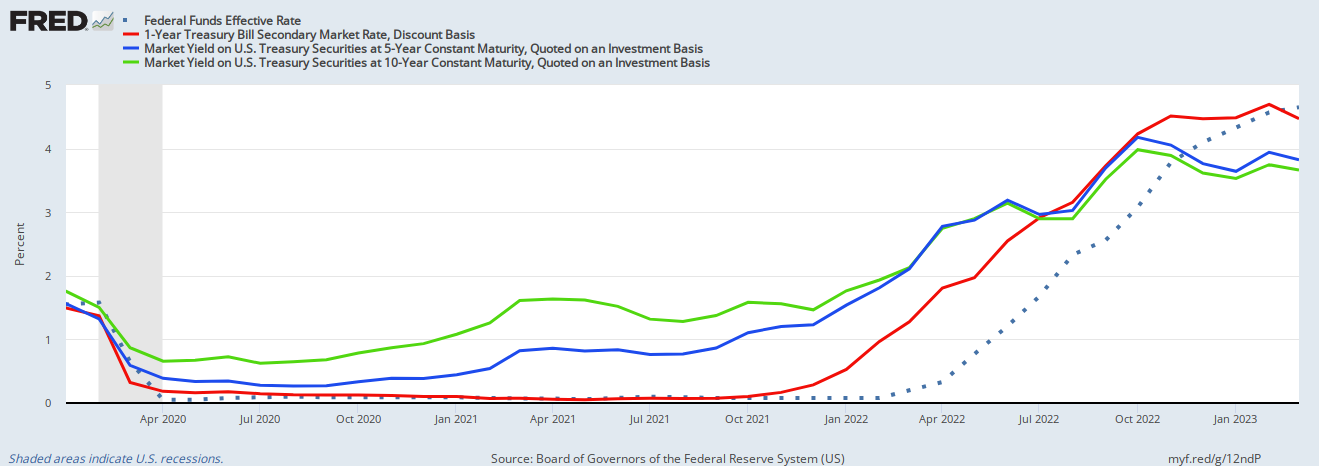

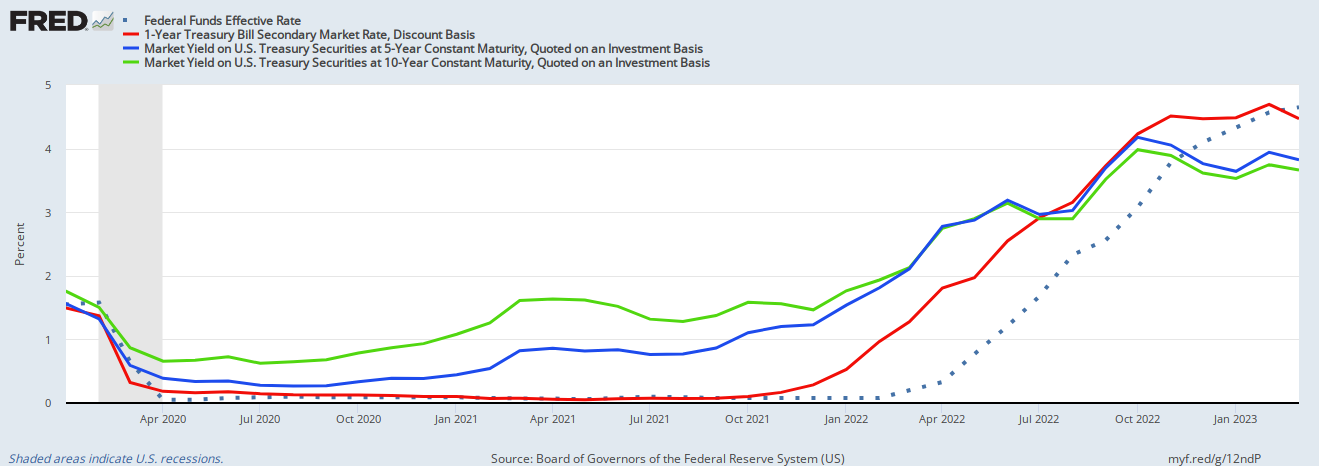

In the lead-up period, many banks within the United States had invested their reserves inU.S. Treasury securities

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. go ...

, which had been paying low interest rates for several years. As the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

began raising rates in 2022, bond prices declined, decreasing the market value of bank capital reserves, causing some banks to incur unrealized losses; to maintain liquidity, Silicon Valley Bank sold its bonds to realize steep losses. Also, several banks gained market exposure

In finance, market exposure (or exposure) is a measure of the proportion of money invested in the same industry sector. For example, a stock portfolio with a total worth of $500,000, with $100,000 in semiconductor

A semiconductor is a materi ...

to cryptocurrency and cryptocurrency-related firms prior to and during the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

; the 2020–2022 cryptocurrency bubble popped in late 2022. In this environment, three such banks failed or were shut down by regulators: The first bank to fail, cryptocurrency-focused Silvergate Bank

Silvergate Bank is a Californian bank that mostly deals in cryptocurrency transactions.

Concerns have been raised about Silvergate's health following the fall in cryptocurrency prices and the bankruptcy of FTX in 2022.

History

Silvergate Ba ...

, announced it would wind down on March 8, 2023 due to losses suffered in its loan portfolio. Two days later, upon announcement of an attempt to raise capital, a bank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

occurred at Silicon Valley Bank

Silicon Valley Bank is an American commercial bank. SVB is on the list of largest banks in the United States, and is the biggest bank in Silicon Valley based on local deposits. It is a subsidiary of SVB Financial Group.

History

Silicon Valley Ba ...

, causing it to collapse

Collapse or its variants may refer to:

Concepts

* Collapse (structural)

* Collapse (topology), a mathematical concept

* Collapsing manifold

* Collapse, the action of collapsing or telescoping objects

* Collapsing user interface elements

** ...

and be seized by regulators that day. Signature Bank

Signature Bank was an American full-service commercial bank headquartered in New York City and with 40 private client offices in the states of New York, Connecticut, California, Nevada, and North Carolina. In addition to banking products, spe ...

, a bank that frequently did business with cryptocurrency firms, was closed by regulators two days later on March 12, with regulators citing systemic risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to the risk associated with any one individual entity, group or component of a system, that can be contained therein without harming the ...

s. The collapses of Silicon Valley Bank and Signature Bank were the second- and third- largest bank failures in the history of the United States, respectively, smaller only than the collapse of Washington Mutual

Washington Mutual (often abbreviated to WaMu) was the United States' largest savings and loan association until its collapse in 2008.

A savings bank holding company is defined in United States Code: Title 12: Banks and Banking; Section 1842: Def ...

during the 2007–2008 financial crisis.

Liquidation of the Silvergate Bank

Background

Silvergate Bank is a California-based bank that began operations in 1988 as asavings and loan association

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" or "thrift" are mainly used in the United States; simi ...

. In the 2010s, the bank began to provide banking services to players within the cryptocurrency market. The bank sought regulatory approval in the summer of 2014 to do business with cryptocurrency firms. The bank expanded the assets on its balance sheet significantly—doubling its assets in its 2017 fiscal year to $1.9 billion—by servicing cryptocurrency exchange

A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may acc ...

s and other companies who were involved in the cryptocurrency business that could not secure financing from larger, more conservative banks. Despite its rapid growth, the company maintained a small physical footprint; , the bank had only three branches, all located in Southern California

Southern California (commonly shortened to SoCal) is a geographic and cultural region that generally comprises the southern portion of the U.S. state of California. It includes the Los Angeles metropolitan area, the second most populous urban ...

. By the fourth quarter of 2022, 90% of the bank's deposits had become cryptocurrency-related, with over $1 billion in deposits being tied to Sam Bankman-Fried

Samuel Benjamin Bankman-Fried (born March 6, 1992), also known by the initialism SBF, is an American suspected fraudster, entrepreneur, investor, and former billionaire. Bankman-Fried was the founder and CEO of the cryptocurrency exchange FTX ...

.

In addition to providing traditional banking services to its cryptocurrency clients, the bank operated as a clearinghouse for its banking clients; it involved itself in the business of resolving and settling

Settling is the process by which particulates move towards the bottom of a liquid and form a sediment. Particles that experience a force, either due to gravity or due to centrifugal motion will tend to move in a uniform manner in the direction ...

transactions in real-time through its proprietary Silvergate Exchange Network. The network allowed a client to send payments in U.S. dollars from its accounts with Silvergate to those of another client of the bank without requiring an interbank wire transfer

Wire transfer, bank transfer, or credit transfer, is a method of electronic funds transfer from one person or entity to another. A wire transfer can be made from one bank account to another bank account, or through a transfer of cash at a cash ...

. Due to the relative quickness of the transaction settling achieved on Silvergate's network, a large number of cryptocurrency companies set up accounts with the bank to take advantage of Silvergate's quick transaction settling times.

Despite conducting the majority of its business with cryptocurrency companies, Silvergate's

Despite conducting the majority of its business with cryptocurrency companies, Silvergate's investment portfolio

In finance, a portfolio is a collection of investments.

Definition

The term “portfolio” refers to any combination of financial assets such as stocks, bonds and cash. Portfolios may be held by individual investors or managed by financial pro ...

was fairly conservative; the company took large positions in mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment ba ...

as well as U.S. bonds. These sorts of assets, while reliable to be paid-in-full through their maturity date

Maturity or immaturity may refer to:

* Adulthood or age of majority

* Maturity model

** Capability Maturity Model, in software engineering, a model representing the degree of formality and optimization of processes in an organization

* Developmen ...

, carry risks associated with changes in interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, t ...

s; there is an inverse relationship between the mark-to-market

Mark-to-market (MTM or M2M) or fair value accounting is accounting for the " fair value" of an asset or liability based on the current market price, or the price for similar assets and liabilities, or based on another objectively assessed "fair ...

value of a bond and the bond's yield. As interest rates shot up during the 2021–2023 inflation surge, the mark-to-market price of these securities decreased significantly. When these losses are unrealized, this does not typically cause the bank to cease operating, as the bank will receive payment-in-full under the original terms of the bond. However, if forced to sell these securities at a lower mark-to-market price, the losses on these types of assets become realized, posing significant risks to the bank's ability to continue to operate.

Events

Silvergate was hit with abank run

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

in the wake of the bankruptcy of FTX

The bankruptcy of FTX is the ongoing liquidation of Bahamas-based cryptocurrency exchange FTX, beginning in November 2022. The collapse of FTX, caused by a liquidity crisis of the company's token, FTT, served as the impetus for its bankruptcy. P ...

; deposits from cryptocurrency-related firms dropped by 68% at the bank, with the bank facing requests from its clients to withdraw upwards of $8 billion in deposits. As Silvergate did not have enough cash-on-hand to satisfy the deposit withdrawals, the bank began to sell its assets at a steep loss; the company realized a loss of $718 million on withdrawal-related asset sales in the fourth fiscal quarter of 2022 alone. The bank, in a public statement, said that it was solvent at the end of Q4 2022, with an asset sheet containing assets of $4.6 billion in cash and $5.6 billion in liquid debt securities, with $3.8 billion in deposit obligations. Silvergate faced tight financial constraints in the coming months, selling assets at a loss and borrowing $3.6 billion from the Federal Home Loan Bank of San Francisco to maintain its liquidity. Silvergate wrote in a regulatory filing on March 1 that the bank risked losing its status as a well-capitalized bank and that the bank faced risks relating to its ability to continue operating.

Facing continued losses from sales of securities at mark-to-market price, Silvergate released a public notice

Public notice is a notice given to the public regarding certain types of legal proceedings.

__TOC__

By government

Public notices are issued by a government agency or legislative body in certain rulemaking or lawmaking proceeding.

It is a re ...

on March 8, 2023, saying that it would undergo voluntary liquidation and would return all deposited funds to their respective owners.

Collapse of Silicon Valley Bank

Background

Silicon Valley Bank (SVB) was a commercial bank founded in 1983 and headquartered inSanta Clara, California

Santa Clara (; Spanish for " Saint Clare") is a city in Santa Clara County, California. The city's population was 127,647 at the 2020 census, making it the eighth-most populous city in the Bay Area. Located in the southern Bay Area, the cit ...

. Until its collapse, SVB was the 16th largest bank in the United States and was heavily skewed toward serving companies and individuals from the technology industry. Nearly half of U.S. venture capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which h ...

-backed healthcare and technology companies were financed by SVB. Companies such as Airbnb

Airbnb, Inc. ( ), based in San Francisco, California, operates an online marketplace focused on short-term homestays and experiences. The company acts as a broker and charges a commission from each booking. The company was founded in 2008 b ...

, Cisco

Cisco Systems, Inc., commonly known as Cisco, is an American-based multinational digital communications technology conglomerate corporation headquartered in San Jose, California. Cisco develops, manufactures, and sells networking hardware, ...

, Fitbit

Fitbit (stylized as fitbit) is an American consumer electronics and fitness company. It produces wireless-enabled wearable technology, physical fitness monitors and activity trackers such as smartwatches, pedometers and monitors for heart rate, ...

, Pinterest

Pinterest is an American image sharing and social media service designed to enable saving and discovery of information (specifically "ideas") on the internet using images, and on a smaller scale, animated GIFs and videos, in the form of pinboard ...

, and Block, Inc.

Block, Inc. (formerly Square, Inc.) is an American multinational technology conglomerate founded in 2009 by Jack Dorsey and Jim McKelvey and launched its first platform in 2010. It has been traded as a public company on the New York Stock Exch ...

have been clients of the bank. In addition to financing venture-backed companies, SVB was well known as a source of private banking

Private banking is banking, investment and other financial services provided by banks and financial institutions primarily serving high-net-worth individuals (HNWIs)—defined as those with very high levels of income or sizable assets. A bank that ...

, personal credit lines, and mortgages to tech entrepreneurs. According to the Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures cr ...

(FDIC), it had $209 billion in assets at the end of 2022.

Silicon Valley Bank recorded an increase of its deposit holdings during the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identi ...

, when the tech sector experienced a period of growth. In 2021, it purchased long-term Treasury bonds

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. gov ...

to capitalize on the increased deposits. However, the current market value of these bonds decreased as the Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a ...

raised interest rates

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

to curb the 2021–2023 inflation surge. Higher interest rates also raised borrowing costs throughout the economy and some Silicon Valley Bank clients started pulling money out to meet their liquidity needs.

Events

To raise cash to pay withdrawals by its depositors, SVB announced on March 8 that it had sold over US$21 billion worth of securities, borrowed US$15billion, and would hold an emergency sale of some of itstreasury stock

A treasury stock or reacquired stock is stock which is bought back by the issuing company, reducing the amount of outstanding stock on the open market ("open market" including insiders' holdings).

Stock repurchases are used as a tax efficie ...

to raise US$2.25billion. The announcement, coupled with warnings from prominent Silicon Valley investors, caused a bank run as customers withdrew funds totaling US$42billion by the following day.

On March 10, 2023, as a result of the bank run, the California Department of Financial Protection and Innovation

The California Department of Financial Protection and Innovation (DFPI), formerly the Department of Business Oversight (DBO), regulates a variety of financial services, businesses, products, and professionals. The department operates under th ...

(DFPI) seized SVB and placed it under the receivership of the FDIC. The FDIC established a deposit insurance national bank, the Deposit Insurance National Bank of Santa Clara, to service insured deposits and announced that it would start paying dividends for uninsured deposits the following week; the dividends were funded by proceeds from the sale of SVB assets. Some 89 percent of the bank's US$172billion in deposit liabilities exceeded the maximum insured by the FDIC. Two days after the failure, the FDIC received exceptional authority from the Treasury and announced jointly with other agencies that all depositors would have full access to their funds the next morning. An initial auction of Silicon Valley Bank assets on the same day attracted a single bid, after PNC Financial Services

The PNC Financial Services Group, Inc. (stylized as PNC) is an American bank holding company and financial services corporation based in Pittsburgh, Pennsylvania. Its banking subsidiary, PNC Bank, operates in 27 states and the District of ...

and RBC Bank

RBC Bank is the trading name of RBC Bank (Georgia), N.A., the United States-based retail banking division of the Royal Bank of Canada (RBC) which is targeted toward Canadian snowbirds, expatriates, and frequent tourists. Despite its limited reach ...

backed away from making offers. The FDIC rejected this offer and plans to hold a second auction to attract bids from major banks, now that the bank's systemic risk

In finance, systemic risk is the risk of collapse of an entire financial system or entire market, as opposed to the risk associated with any one individual entity, group or component of a system, that can be contained therein without harming the ...

designation allows the FDIC to insure all deposits. The bank was later reopened as a newly organized bridge bank, Silicon Valley Bridge Bank, N. A.

On March 26, 2023, the FDIC announced that First Citizens BancShares

First Citizens Bancshares, Inc. is a bank holding company based in Raleigh, North Carolina. Its primary subsidiary is First Citizens Bank. It is on the list of largest banks in the United States.

As of December 31, 2019, the company operated 57 ...

would acquire the commercial banking business of SVB. As part of the deal, First Citizens brought around $56.5billion in deposits and $72billion of SVB's loans discounted by $16.5billion, while around $90billion of SVB's securities continue to remain in receivership. The FDIC received about $500million-worth of equity appreciation rights linked to First Citizens' shares. SVB's 17branches reopened under the First Citizens brand the next day, with all SVB depositors becoming depositors of First Citizens. SVB Private was initially going to be auctioned separately but First Citizens later acquired the business as well.

Collapse of Signature Bank

Background

Signature Bank was a

Signature Bank was a New York City

New York, often called New York City or NYC, is the List of United States cities by population, most populous city in the United States. With a 2020 population of 8,804,190 distributed over , New York City is also the L ...

-based bank founded in 2001. The bank began as a subsidiary of Bank Hapoalim

Bank Hapoalim ( he, בנק הפועלים lit. ''The Workers' Bank'') is one of Israel's largest banks.

History

The bank was established in 1921 by the '' Histadrut'', the Israeli trade union congress (lit. "General Federation of Laborers in the ...

that took on clients with assets of around $250,000, lending to small businesses based in New York City and in the surrounding metropolitan area. The bank provided financing within the multifamily residential

Multifamily residential (also known as multidwelling unit or MDU) is a classification of housing where multiple separate housing units for residential inhabitants are contained within one building or several buildings within one complex. Units c ...

rental housing market in the New York metropolitan area beginning in 2007, though it began to reduce its exposure to the market during the 2010s. By 2019, just over four-tenths of the value of the bank's loans were made to multifamily homeowners in the New York metropolitan area, comprising $15.8 billion of the bank's then-$38.9 billion in net loans.

Beginning in 2018, Signature Bank began to court customers in the cryptocurrency industry, securing hires that were experienced in the area with the goal of moving away from its dependence on real estate lending. The quantity of deposits held at the bank expanded significantly, with deposits increasing from about $36.3 billion at the end of the 2018 fiscal year to $104 billion by August 2022; that month, over one-quarter of the bank's deposits held were those of cryptocurrency companies. Its cryptocurrency-sector clients included large cryptocurrency exchange operators, such as Celsius Network and Binance

Binance is a cryptocurrency exchange which is the largest exchange in the world in terms of daily trading volume of cryptocurrencies. It was founded in 2017 and is registered in the Cayman Islands.

Binance was founded by Changpeng Zhao, a dev ...

. By early 2023, Signature Bank had become the second largest provider of banking services to the cryptocurrency industry—second only to Silvergate Bank.

In addition to providing traditional banking services to cryptocurrency clients, Signature Bank opened a proprietary payment network for use among its cryptocurrency clients. The payment network, Signet, had opened in 2019 for approved clients, and allowed the real-time gross settlement

Real-time gross settlement (RTGS) systems are specialist funds transfer systems where the transfer of money or securities takes place from one bank to any other bank on a "real-time" and on a " gross" basis. Settlement in "real time" means a paym ...

of fund transfers through the blockchain

A blockchain is a type of distributed ledger technology (DLT) that consists of growing lists of records, called ''blocks'', that are securely linked together using cryptography. Each block contains a cryptographic hash of the previous block, ...

without third parties or transaction fees. By the conclusion of 2020, Signature Bank had 740 clients using Signet. The network continued to expand during the following years; both Coinbase

Coinbase Global, Inc., branded Coinbase, is an American publicly traded company that operates a cryptocurrency exchange platform. Coinbase is a distributed company; all employees operate via remote work and the company lacks a physical headqua ...

and the TrueUSD dollar-pegged stablecoin

Stablecoins are cryptocurrencies where the price is supposed to be pegged to a reference asset, which is either fiat money, exchange-traded commodities (such as precious metals or industrial metals), or another cryptocurrency.

In theory, the p ...

had become integrated with Signet in 2022 and 2021, respectively.

Events

As cryptocurrency prices dropped significantly in 2022, particularly so after the collapse of cryptocurrency exchange FTX, depositors in Signature Bank began to withdraw deposits in the tune of billions of dollars; by the end of 2022, deposits in the bank totaled around $88.6 billion, down from $106.1 billion in deposits held at the beginning of the year—a time when over one-quarter of deposits were held by digital asset-related entities. Towards the end of 2022, Signature Bank cut business ties with cryptocurrency exchange Binance, seeking to reduce the bank's exposure to risk associated with the cryptocurrency market. According to Signature Bank board memberBarney Frank

Barnett Frank (born March 31, 1940) is a former American politician. He served as a member of the U.S. House of Representatives from Massachusetts from 1981 to 2013. A Democrat, Frank served as chairman of the House Financial Services Committ ...

, Signature Bank was hit with a multi-billion dollar bank run on Friday, March 10, with depositors expressing concern about cryptocurrency-related risks affecting the bank. Investor confidence in the bank was also badly shaken, and the bank's stock declined by 23% on that Friday—the day on which Silicon Valley bank collapsed—marking the then-largest single-day decline of the Signature Bank's value in its 22-year history.

On March 12, 2023, two days after the collapse of Silicon Valley Bank, Signature Bank was closed by regulators from the New York State Department of Financial Services

The New York State Department of Financial Services (DFS or NYSDFS) is the department of the Government of New York (state), New York state government responsible for regulating financial services and products, including those subject to the Consol ...

in what is the third-biggest banking collapse in U.S. history. The bank proved unable to close a sale or otherwise bolster its finances before markets opened on Monday morning in order to protect its assets after customers began withdrawing their deposits in favor of bigger institutions, and shareholders of the bank lost all invested funds. The bank was placed under receivership by the FDIC, which immediately established Signature Bridge Bank, N.A. to operate its marketed assets to bidders.

Signature Bank had been under multiple federal investigations that were ongoing at the time of the bank's collapse regarding the rigor of its anti-money laundering

Money laundering is the process of concealing the origin of money, obtained from illicit activities such as drug trafficking, corruption, embezzlement or gambling, by converting it into a legitimate source. It is a crime in many jurisdictio ...

measures. The U.S. Department of Justice

The United States Department of Justice (DOJ), also known as the Justice Department, is a federal executive department of the United States government tasked with the enforcement of federal law and administration of justice in the United State ...

had opened a criminal probe into whether the firm was performing due diligence when opening up new accounts and whether it was doing enough to detect and report potential criminal activity by its clients. The U.S. Securities and Exchange Commission

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market ...

had opened a separate, related civil probe.

On March 19, the New York Community Bank

New York Community Bancorp, Inc. (NYCB) is a bank headquartered in Westbury, New York with 225 branches in New York, New Jersey, Ohio, Florida and Arizona. NYCB is on the list of largest banks in the United States.

Almost all of the loans ori ...

(NYCB) agreed to purchase around $38.4 billion in Signature's assets for $2.7 billion. Due to the deal, 40 Signature branches were rebranded to Flagstar Bank

Flagstar Bank is a Michigan-based bank that has one of the largest residential mortgage servicers in the United States, as well as included in a list of the largest banks in the country. On April 26, 2021, New York Community Bancorp, Inc. (NYCB) ...

, one of NYCB's subsidiaries.

Federal response

Bank Term Funding Program

In response to the bank failures of March, the government took extraordinary measures to mitigate fallout across the banking sector. On March 12, Federal Reserve created the Bank Term Funding Program (BTFP), an emergency lending program providing loans of up to one year in length to banks, savings associations,credit union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provisi ...

s, and other eligible depository institution

Colloquially, a depository institution is a financial institution in the United States (such as a savings bank, commercial bank, savings and loan associations, or credit unions) that is legally allowed to accept monetary deposits from consumer

...

s that pledge U.S. Treasuries, agency debt and mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment ba ...

, and other qualifying assets as collateral

Collateral may refer to:

Business and finance

* Collateral (finance), a borrower's pledge of specific property to a lender, to secure repayment of a loan

* Marketing collateral, in marketing and sales

Arts, entertainment, and media

* ''Collate ...

. The program is designed to provide liquidity to financial institutions, following the collapse of Silicon Valley Bank and other bank failures, and to reduce the risks associated with current unrealized losses in the U.S. banking system that totaled over $600 billion at the time of the program's launch. Funded through the Deposit Insurance Fund

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credi ...

, the program offers loans of up to one year to eligible borrowers who pledge as collateral

Collateral may refer to:

Business and finance

* Collateral (finance), a borrower's pledge of specific property to a lender, to secure repayment of a loan

* Marketing collateral, in marketing and sales

Arts, entertainment, and media

* ''Collate ...

certain types of securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

including U.S. Treasuries, agency debt, and mortgage-backed securities

A mortgage-backed security (MBS) is a type of asset-backed security (an 'instrument') which is secured by a mortgage or collection of mortgages. The mortgages are aggregated and sold to a group of individuals (a government agency or investment ba ...

. The collateral will be valued at par instead of open-market value, so a bank can borrow on asset values that have not been impaired by a series of interest rate hikes since 2022. The Federal Reserve also eased conditions at its discount window

The discount window is an instrument of monetary policy (usually controlled by central banks) that allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by ...

. The Department of the Treasury will make available up to $25billion from its Exchange Stabilization Fund as a backstop for the program.

In addition to working with their counterparts at the FDIC and U.S. Treasury to provide liquidity to banks through the BTFP, the Federal Reserve has begun to internally discuss implementing stricter capital reserve and liquidity requirements for banks with between $100 billion and $250 billion in assets on their balance sheets. A review of regulations affecting regional banks has been ongoing since 2022, as Federal Reserve vice chairman Michael Barr and other officials in the Biden Administration

Joe Biden's tenure as the 46th president of the United States began with his inauguration on January 20, 2021. Biden, a Democrat from Delaware who previously served as vice president under Barack Obama, took office following his victory ...

had become increasingly concerned about the risk posed to the financial system by the rapidly increasing size of regional banks.

U.S. investigations

The collapse of Silicon Valley Bank itself has also spurred federal investigations from the U.S. Securities and Exchange Commission as well as the United States Department of Justice. Within the scope of both probes is the sales of stock made by senior officers of Silicon Valley Bank shortly before the bank failed, while the SEC's investigation also includes a review of past financial- and other risk-related disclosures made by Silicon Valley Bank to evaluate their accuracy and completeness.Aftermath of bank failures

As depositors began to move money ''en masse'' from smaller banks to larger banks, on Monday, March 13, shares of regional banks fell.First Republic Bank liquidity problems and private-sector rescue

Intense scrutiny and pressure were applied to other banks like the

Intense scrutiny and pressure were applied to other banks like the San Francisco

San Francisco (; Spanish for " Saint Francis"), officially the City and County of San Francisco, is the commercial, financial, and cultural center of Northern California. The city proper is the fourth most populous in California and 17th ...

-based First Republic Bank

First Republic Bank is an American full-service bank and wealth management company offering personal banking, business banking, trust, and wealth management services, catering to low-risk, high net-worth clientele, and focusing on providing pe ...

, whose shares subsequently fell by 67%. As the bank faced significant liquidity issues, on March 16, it received a $30 billion lifeline in the form of deposits from a number of major U.S. banks, on top of a $70 billion financing facility provided by JPMorgan Chase & Co. Eleven of the largest U.S. banks participated in the rescue effort.

On Sunday, S&P downgraded the credit rating of First Republic Bank further into junk by three notches saying it "may not solve the substantial business, liquidity, funding, and profitability challenges that we believe the bank is now likely facing."

Other market effects

Western Alliance Bancorporation share price fell 47% and

Western Alliance Bancorporation share price fell 47% and PacWest Bancorp

PacWest Bancorp is a bank holding company based in Beverly Hills, California, with one wholly owned banking subsidiary, Pacific Western Bank. It has 69 branches in California, primarily in the southern and central parts of the state, one in Denv ...

was down 21% recovering after their trading was halted. Moody's

Moody's Investors Service, often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Investors Service provides internationa ...

downgraded its outlook on the U.S. banking system to negative, citing what it described as "rapid deterioration" of the sector's financial footing. It also downgraded the credit ratings

A credit rating is an evaluation of the credit risk of a prospective debtor (an individual, a business, company or a government), predicting their ability to pay back the debt, and an implicit forecast of the likelihood of the debtor defaulting.

...

of several regional banks, including Western Alliance, First Republic, Intrust Bank, Comerica, UMB Financial Corporation

UMB Financial Corporation is an American financial services holding company founded in 1913 as City Center Bank and based in Kansas City, Missouri. It offers a number of financial services from checking and savings accounts, credit services inclu ...

, and Zions Bancorporation.

U.S. President Joe Biden made a statement about the first three bank failures on March 13, and asserted that government intervention was not a bailout and that the banking system was stable.

The initial bank failures led to speculation on 13 March that the Federal Reserve could pause or halt rate hikes. Beginning on March 13, traders began modifying their strategies in the expectation that fewer hikes than previously expected will occur. Some financial experts suggested that the BTFP, combined with a recent practice of finding buyers who would cover all deposits, may have effectively removed the FDIC's $250,000 deposit insurance limit. However, Treasury Secretary Janet Yellen

Janet Louise Yellen (born August 13, 1946) is an American economist serving as the 78th United States secretary of the treasury since January 26, 2021. She previously served as the 15th chair of the Federal Reserve from 2014 to 2018. Yellen is ...

clarified that any guarantee beyond that limit would need the approval of the Biden administration and Federal regulators.

The initial three bank failures and resulting pressures on other U.S. regional banks were expected to reduce available financing in the commercial real estate

Commercial property, also called commercial real estate, investment property or income property, is real estate (buildings or land) intended to generate a profit, either from capital gains or rental income. Commercial property includes office b ...

market and further slow commercial property development. The Federal Reserve's discount window liquidity facility saw around $150 billion in borrowing from various banks by March 16, more than 12 times the $12 billion that the BTFP provided.

By 16 March, large inter-bank flows of funds were occurring to shore up bank balance sheets and numerous analysts were reporting on a more general U.S. banking crisis

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (where banks no ...

. Many banks had invested their reserves in U.S. Treasury securities

United States Treasury securities, also called Treasuries or Treasurys, are government debt instruments issued by the United States Department of the Treasury to finance government spending as an alternative to taxation. Since 2012, U.S. go ...

, which had been paying low interest rates. As the Federal Reserve began raising rates in 2022, bond prices declined decreasing the market value of bank capital reserves, leading some banks to sell the bonds at steep losses as yields on new bonds were much higher. The Federal Reserve's discount window

The discount window is an instrument of monetary policy (usually controlled by central banks) that allows eligible institutions to borrow money from the central bank, usually on a short-term basis, to meet temporary shortages of liquidity caused by ...

liquidity facility had experienced approximately $150 billion in borrowing from various banks by March 16.

On 17 March, President Biden stated that the banking crisis had calmed down, while the ''New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'' said that the March banking crisis was hanging over the economy and had rekindled fear of recession as business borrowing would become more difficult as many regional and community banks would have to reduce lending.

Late on Sunday, the Federal Reserve and several other central banks announced significant USD liquidity measures in order to calm market turmoil. In a "coordinated action to enhance the provision of liquidity through the standing U.S. dollar swap line arrangements", the U.S. Federal Reserve, the Bank of Canada

The Bank of Canada (BoC; french: Banque du Canada) is a Crown corporation and Canada's central bank. Chartered in 1934 under the ''Bank of Canada Act'', it is responsible for formulating Canada's monetary policy,OECD. OECD Economic Surveys: C ...

, Bank of Japan

The is the central bank of Japan. Nussbaum, Louis Frédéric. (2005). "Nihon Ginkō" in The bank is often called for short. It has its headquarters in Chūō, Tokyo.

History

Like most modern Japanese institutions, the Bank of Japan was foun ...

, European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important centra ...

, and Swiss National Bank

The Swiss National Bank (SNB; german: Schweizerische Nationalbank; french: Banque nationale suisse; it, Banca nazionale svizzera; rm, Banca naziunala svizra) is the central bank of Switzerland, responsible for the nation's monetary policy an ...

joined together to organize daily U.S. dollar swap operations. These swaps had previously been set up to occur on a weekly cadence.

International impact

By Sunday, 19 March, concerns about the banking sector internationally had increased. That day, Swiss bank UBS Group AG bought its smaller competitor Credit Suisse in an emergency arrangement brokered by the Swiss government. One month before the events in the United States, Credit Suisse announced its largest annual loss since the 2008 financial crisis, as clients continued withdrawing their cash at a rapid pace; $147 billion had been withdrawn in the fourth quarter of 2022. It also disclosed it had found "material weaknesses" in its financial reporting. Its largest investor,Saudi National Bank

Saudi National Bank (SNB), also known as SNB AlAhli ( ar, البنك الأهلي السعودي, formerly known as The National Commercial Bank (NCB), is the largest commercial bank in Saudi Arabia.

In April 2021, National Commercial Bank merg ...

, announced on March 15 that it would not provide more support to Credit Suisse. Its share price plunged 25% on the news and UBS stepped in to buy the bank. Axel Lehmann

Axel P. Lehmann (born 1959) is the chairman of Credit Suisse since January 2022.

Early life

Lehmann was born in 1959, and is a Swiss citizen. He earned an MBA and a PhD from the University of St. Gallen. He is an adjunct professor at the unive ...

, former chairman of the bank, later sought to blame the American bank failures for triggering Credit Suisse's demise, though other analysts disputed that characterization. The bank had experienced many years of multi-billion dollar losses, scandals, executive turnover and weak business strategy.

Late on Sunday the Federal Reserve and several other central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

s announced significant USD liquidity measures in order to calm market turmoil.

In a "coordinated action to enhance the provision of liquidity through the standing U.S. dollar swap line arrangements", the U.S. Federal Reserve, the Bank of Canada

The Bank of Canada (BoC; french: Banque du Canada) is a Crown corporation and Canada's central bank. Chartered in 1934 under the ''Bank of Canada Act'', it is responsible for formulating Canada's monetary policy,OECD. OECD Economic Surveys: C ...

, Bank of Japan

The is the central bank of Japan. Nussbaum, Louis Frédéric. (2005). "Nihon Ginkō" in The bank is often called for short. It has its headquarters in Chūō, Tokyo.

History

Like most modern Japanese institutions, the Bank of Japan was foun ...

, European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important centra ...

(ECB) and Swiss National Bank

The Swiss National Bank (SNB; german: Schweizerische Nationalbank; french: Banque nationale suisse; it, Banca nazionale svizzera; rm, Banca naziunala svizra) is the central bank of Switzerland, responsible for the nation's monetary policy an ...

joined together to organize daily U.S. dollar swap operations. These swaps had previously been set up to occur on a weekly cadence.

On 21 March, ''The Business Times'' reported that Asian central banks were "unlikely to be greatly influenced by the banking crisis in the United States and Europe",

Asian central banks face little impact from US, Europe banking crisisThe Business Times, 21 March 2023. but Australia's central bank governors met and publicly indicated a potential pause in recent rate hikes. ''ABC News'' reported that the challenge for central banks is determining if the "banking turmoil close to crashing the real economy, or is inflation still the greater threat." In Japan the three main lenders,

Mitsubishi UFJ Financial Group

is a Japanese bank holding and financial services company headquartered in Chiyoda, Tokyo, Japan.

MUFG holds assets of around US$3.1 trillion as of 2016 and is one of the "Three Great Houses" of the Mitsubishi Group alongside Mitsubishi Corp ...

, Sumitomo Mitsui Financial Group

is a Japanese multinational banking and financial services institution headquartered in Yurakucho, Chiyoda, Tokyo, Japan. The group operates in retail, corporate, and investment banking segment worldwide. It provides financial products and ser ...

and Mizuho Financial Group

, abbreviated as MHFG, or simply called Mizuho, is a banking holding company headquartered in the Ōtemachi district of Chiyoda, Tokyo, Japan. The name "" literally means "abundant rice" in Japanese and "harvest" in the figurative sense. Upo ...

, lost share value between 10% and 12% due to the market turmoil and their exposure to the bond market. Japan's central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

held a crisis meeting in mid-March while the Topix

, commonly known as TOPIX, along with the Nikkei 225, is an important stock market index for the Tokyo Stock Exchange (TSE) in Japan, tracking all domestic companies of the exchange's Prime market division. It is calculated and published by the ...

banks index fell 17%. The fall was led by fears over the SVB collapse and the risks in Japan's regional banking sector, partly because of exposure to US interest rate hikes.

The cost to insure against default on Deutsche Bank

Deutsche Bank AG (), sometimes referred to simply as Deutsche, is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Sto ...

debt rose substantially on Friday, 24 March, with the 5-year CDS for the bank's debt rising 70%. The ECB and other European central banks raised interest rates the same day. The European STOXX 600 index fell around 4% with shares in Deutsche Bank down more than 14% at one point, closing the day at a loss of around 8%. The UK's banking index also fell around 3% led by falls of around 6% for both Barclays and Standard Chartered and a 4% drop for NatWest. Shares in other European banks also fell, among them Commerzbank, Austria's Raiffeisen Bank Raiffeisenbank refers to cooperative banks in Europe that are rooted in the early credit unions of Friedrich Wilhelm Raiffeisen. The name is found in:

* Raiffeisen Bankengruppe (Austria), Austrian group of cooperative banks.

** Raiffeisen Zentralba ...

and the French Société Générale

Société Générale S.A. (), colloquially known in English as SocGen (), is a French-based multinational financial services company founded in 1864, registered in downtown Paris and headquartered nearby in La Défense.

Société Générale ...

. According to the European Commission's Paolo Gentiloni

Paolo Gentiloni Silveri (; born 22 November 1954) is an Italian politician who has served as European Commissioner for Economy in the von der Leyen Commission since 1 December 2019. He previously served as prime minister of Italy from December ...

, finance ministers in the Euro zone called on the Commission to close loopholes in Crisis Management and Deposit Insurance (CMDI) provision, starting in the second quarter of 2023.

Chinese banks experienced little negative effect. According to ''Bloomberg News

Bloomberg News (originally Bloomberg Business News) is an international news agency headquartered in New York City and a division of Bloomberg L.P. Content produced by Bloomberg News is disseminated through Bloomberg Terminals, Bloomberg Tele ...

'', almost all of the 166 top performers during the market turmoil were in China. The banking crisis in the U.S. and Europe highlighted the relative stability of the Chinese banking system. While China's recovery from the pandemic remains fragile, inflation there is muted, and the People's Bank of China

The People's Bank of China (officially PBC or informally PBOC; ) is the central bank of the People's Republic of China, responsible for carrying out monetary policy and regulation of financial institutions in mainland China, as determined by ...

had adjusted interest rates at a slower pace than Western central banks.

The turbulence in the financial system caused India's central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

to put any further hikes in interest rate on hold on 6 April, with governor Shaktikanta Das

Shaktikanta Das (born 26 February 1957) is serving as the current & 25th List of Governors of Reserve Bank of India, governor of the Reserve Bank of India (RBI). He was earlier a member of the Fifteenth Finance Commission, FifteenthFinance Commi ...

saying "it's a pause not a pivot". A 25 basis point increase had been widely expected. Central banks in Australia, Canada and Indonesia also paused any further increases.

While rising interest rates give banks greater returns on customer's loans, the tighter financial conditions meant the sector saw a downturn in equity funding, with the S&P 500 bank index (SPXBK) in April down 14% year to date on expectation of lower quarterly earnings for some US banks. On 11 April the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

downgraded it's forecast for GDP growth globally in 2023 from 2.9% to 2.8%, saying "Uncertainty is high and the balance of risks has shifted firmly to the downside so long as the financial sector remains unsettled". The forecast marked a slowdown from 3.4% in 2022, but predicted growth could rise modestly to 3.0% in 2024. The IMF had been cutting its forecast since spring 2022.

See also

* List of banks acquired or bankrupted in the United States during the 2007–2008 financial crisis *Yield Curve Control

Yield Curve Control (YCC) is a monetary policy action whereby a central bank purchases variable amounts of government bonds or other financial assets in order to target interest rates at a certain level. It generally means buying bonds at a slow ...

References

{{Portal bar, Business and economics, Banks 2020s economic history 2023 in economics 2023 in Germany 2023 in Switzerland 2023 in the United States Bank failures in the United States Economic history of California Economic history of New York (state) Financial markets March 2023 events March 2023 events in the United States