Income taxes in the United States are imposed by the

federal government

A federation (also known as a federal state) is a political entity characterized by a union of partially self-governing provinces, states, or other regions under a central federal government (federalism). In a federation, the self-governin ...

, and most

states. The

income tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Tax ...

es are determined by applying a tax rate, which

may increase as income increases, to

taxable income Taxable income refers to the base upon which an income tax system imposes tax. In other words, the income over which the government imposed tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. Th ...

, which is the total income less allowable

deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income.

Partnerships

A partnership is an arrangement where parties, known as business partners, agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, business entity, businesses, interest-based organizations, schoo ...

are not taxed (with some exceptions in the case of Federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of

credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

In the

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

, the term "payroll tax" usually refers to

FICA taxes that are paid to fund

Social Security

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specificall ...

and

Medicare, while "income tax" refers to taxes that are paid into state and federal general funds.

Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits.

Capital gains

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares ...

are taxable, and capital losses reduce taxable income to the extent of gains (plus, in certain cases, $3,000 or $1,500 of ordinary income). Individuals currently pay a lower rate of tax on capital gains and certain corporate dividends.

Taxpayers generally must self assess income tax by filing

tax returns

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer.

Taxation is one of ...

. Advance payments of tax are required in the form of withholding tax or estimated tax payments. Taxes are determined separately by each jurisdiction imposing tax. Due dates and other administrative procedures vary by jurisdiction. April 15 following the tax year is the deadline for individuals to file tax returns for federal and many state and local returns. Tax as determined by the taxpayer may be adjusted by the taxing jurisdiction.

Basics

Sources of U.S. income tax laws

United States income tax law comes from a number of sources. These sources have been divided by one author into three tiers as follows:

*''Tier 1''

**

United States Constitution

The Constitution of the United States is the Supremacy Clause, supreme law of the United States, United States of America. It superseded the Articles of Confederation, the nation's first constitution, in 1789. Originally comprising seven ar ...

**

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 ...

(IRC) (legislative authority, written by the

United States Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washing ...

through

legislation

Legislation is the process or result of enrolled bill, enrolling, enactment of a bill, enacting, or promulgation, promulgating laws by a legislature, parliament, or analogous Government, governing body. Before an item of legislation becomes law i ...

)

**

Treasury regulations

Treasury Regulations are the tax regulations issued by the United States Internal Revenue Service (IRS), a bureau of the United States Department of the Treasury. These regulations are the Treasury Department's official interpretations of the Inter ...

**

Federal court opinions

An opinion is a judgment, viewpoint, or statement that is not conclusive, rather than facts, which are true statements.

Definition

A given opinion may deal with subjective matters in which there is no conclusive finding, or it may deal with ...

(judicial authority, written by courts as interpretation of legislation)

**

Treaties

A treaty is a formal, legally binding written agreement between actors in international law. It is usually made by and between sovereign states, but can include international organizations, individuals, business entities, and other legal pers ...

(executive authority, written in conjunction with other countries, subject to ratification in the United States by advice and consent of the U.S. Senate - other countries have their own ratification procedures)

*''Tier 2''

** Agency interpretative regulations (executive authority, written by the

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory ta ...

(IRS) and

Department of the Treasury), including:

*** Final, Temporary and Proposed Regulations promulgated under IRC § 7805 or other specific statutory authority;

*** Treasury Notices and Announcements;

*** Executive agreements with other countries;

** Public Administrative Rulings (IRS Revenue Rulings, which provide informal guidance on specific questions and are binding on all taxpayers)

*''Tier 3''

** Legislative History

** Private Administrative Rulings (private parties may approach the IRS directly and ask for a Private Letter Ruling on a specific issue – these rulings are binding only on the requesting taxpayer).

Where conflicts exist between various sources of tax authority, an authority in Tier 1 outweighs an authority in Tier 2 or 3. Similarly, an authority in Tier 2 outweighs an authority in Tier 3.

[''Id.''] Where conflicts exist between two authorities in the same tier, the "last-in-time rule" is applied. As the name implies, the "last-in-time rule" states that the authority that was issued later in time is controlling.

Regulations and case law serve to interpret the statutes. Additionally, various sources of law attempt to do the same thing. Revenue Rulings, for example, serves as an interpretation of how the statutes apply to a very specific set of facts. Treaties serve in an international realm.

Basic concepts

A tax is imposed on net

taxable income Taxable income refers to the base upon which an income tax system imposes tax. In other words, the income over which the government imposed tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. Th ...

in the United States by the federal, most state, and some local governments. Income tax is imposed on individuals, corporations, estates, and trusts. The definition of net taxable income for most sub-federal jurisdictions mostly follows the federal definition.

[CCH ''State Tax Handbook'' 2018, page 617, ''et seq''.]

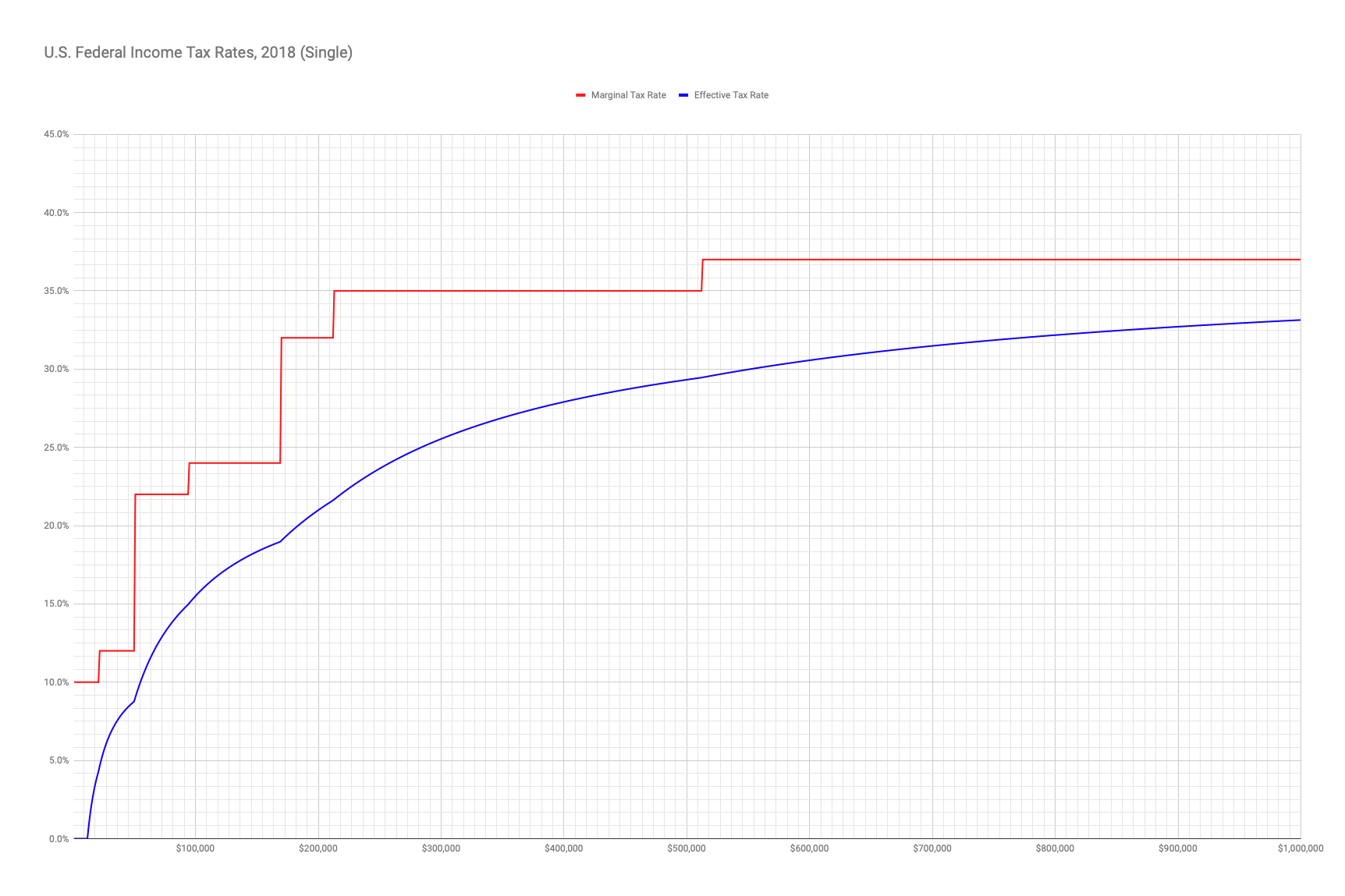

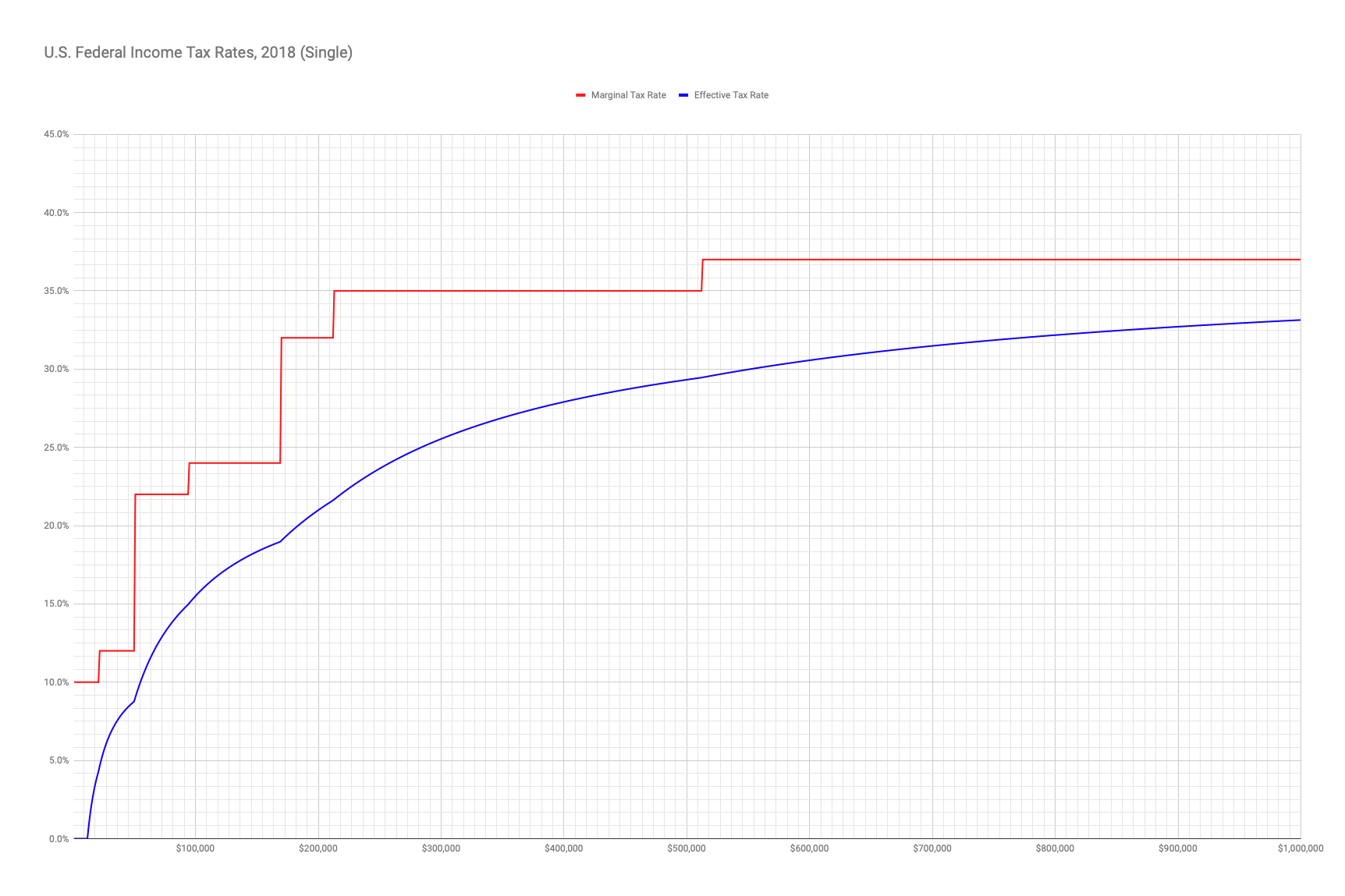

The rate of tax at the federal level is graduated; that is, the tax rates on higher amounts of income are higher than on lower amounts. Federal individual tax rates vary from 10% to 37%. Some states and localities impose an income tax at a graduated rate, and some at a flat rate on all taxable income.

Individuals are eligible for a reduced rate of federal income tax on

capital gains

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares ...

and

qualifying dividends. The tax rate and some deductions are different for individuals depending o

filing status Married individuals may compute tax as a couple or separately. Single individuals may be eligible for reduced tax rates if they are head of a household in which they live with a dependent.

Taxable income is defined in a comprehensive manner in the

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 ...

and tax regulations issued by the Department of Treasury and the

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory ta ...

. Taxable income is

gross income as adjusted minus

deductions. Most states and localities follow these definitions at least in part,

though some make adjustments to determine income taxed in that jurisdiction. Taxable income for a company or business may not be the same as its book income.

Gross income include

all income earned or received from whatever source This includes salaries and wages, tips, pensions, fees earned for services, price of goods sold, other business income, gains on sale of other property, rents received, interest and

dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-in ...

s received, proceeds from selling crops, and many other types of income. Some income, such as municipal bond interest, is

exempt from income tax.

Adjustments (usually reductions) to gross income

Adjustments (usually reductions) to gross incomeof individuals are made for contributions to many types of retirement or health savings plans, certain student loan interest, half of self-employment tax, and a few other items. The

cost of goods sold

Cost of goods sold (COGS) is the carrying value of goods sold during a particular period.

Costs are associated with particular goods using one of the several formulas, including specific identification, first-in first-out (FIFO), or average cost ...

in a business is a direct reduction of gross income.

Business deductions: Taxable income of all taxpayers is reduced by

deductions for expenses related to their business. These include salaries, rent, and other business expenses paid or accrued, as well as allowances for

depreciation

In accountancy, depreciation is a term that refers to two aspects of the same concept: first, the actual decrease of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wear, and second, the a ...

. The deduction of expense

may result in a loss Generally, such loss can reduce other taxable income, subject to some limits.

Personal deductions: The former deduction for personal exemptions wa

repealed for 2018 through 2025

Standard deduction: Individuals get a deduction from taxable income for certain personal expenses. An individual may claim a

standard deductionFor 2021, the basic standard deductionwas $12,550 for single individuals or married persons filing separately, $25,100 for a joint return or surviving spouse, and $18,800 for a head of household.

Itemized deductions: Those who choose to claim actua

itemized deductionsmay deduct the following, subject to many conditions and limitations:

*Medical expenses in excess of 10% of adjusted gross income,

*Certain taxe

limited to $10,000 or $5,000 in 2018 through 2025

*Home mortgage interest,

*Contributions to charities,

*Losses on nonbusiness property due to casualty, and

*Deductions for expenses incurred in the production of income in excess of 2% of adjusted gross income.

Capital gains:

Capital gains

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares ...

include gains on selling stocks and bonds, real estate, and other capital assets. The gain is the excess of the proceeds over the adjusted

tax basis

Under U.S. federal tax law, the tax basis of an asset is generally its cost basis. Determining such cost may require allocations where multiple assets are acquired together. Tax basis may be reduced by allowances for depreciation. Such reduced ba ...

(cost less

depreciation deductions allowed) of the property. This lower rate of tax also applies to qualified dividends from U.S. corporations and many foreign corporations. There are limits on how much net capital loss may reduce other taxable income.

Tax credits: All taxpayers are allowed a

credit

Credit (from Latin verb ''credit'', meaning "one believes") is the trust which allows one party to provide money or resources to another party wherein the second party does not reimburse the first party immediately (thereby generating a debt) ...

for

foreign taxes and for a percentage o

certain types of business expenses Individuals are also allowe

creditsrelated to education expenses, retirement savings, and child care expenses. Each of the credits is subject to specific rules and limitations. Some credits are treated as refundable payments.

Alternative minimum tax: All taxpayers are also subject to the

Alternative Minimum Tax

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all ...

if their income exceeds certain exclusion amounts. This tax applies only if it exceeds regular income tax and is reduced by some credits.

Additional Medicare tax: High-income earners may also have to pay an additional 0.9% tax on wages, compensation, and self-employment income.

Net investment income tax: Net investment income is subject to a

additional 3.8% taxfor individuals with income in excess of certain thresholds.

Tax returns: U.S. corporations and most resident individuals must file

income tax returns to self assess income tax if any tax is due or to claim a

tax refund

A tax refund or tax rebate is a payment to the taxpayer due to the taxpayer having paid more tax than they owed.

By country

United States

According to the Internal Revenue Service, 77% of tax returns filed in 2004 resulted in a refund check, ...

. Some taxpayers must file an income tax return because they satisfy one of the several other conditions. Tax returns may b

filed electronically Generally, an individual'

tax return covers the calendar year. Corporations may elect a different tax year Most states and localities follow the federal tax year and require separate returns.

Tax payment: Taxpayers mus

pay income taxdue without waiting for an assessment. Many taxpayers are subject to

withholding tax

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a ''Prélèvement à la source'', is income tax paid to the government by the payer of the income rather than by the recipient of the income ...

es when they receive income. To the extent withholding taxes do not cover all taxes due, all taxpayers must mak

estimated tax paymentsor face penalties.

Tax penalties: Failing to make payments on time, or failing to file returns, can result in substantial

penalties

Penalty or The Penalty may refer to:

Sports

* Penalty (golf)

* Penalty (gridiron football)

* Penalty (ice hockey)

* Penalty (rugby)

* Penalty (rugby union)

* Penalty kick (association football)

* Penalty shoot-out (association football)

* Penalty ...

. Certain intentional failures may result in jail time.

Tax returns may b

examined and adjustedby tax authorities. Taxpayers hav

rights to appealany change to tax, and these rights vary by jurisdiction. Taxpayers may also go to court to contest tax changes. Tax authorities may not make changes after a certain period of time (generally three or four years from the tax return due date).

Federal income tax rates for individuals

Federal income brackets and tax rates for individuals are adjusted annually for inflation. The

Internal Revenue Service

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory ta ...

(IRS) accounts for changes to the

CPI

A consumer price index (CPI) is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

Overview

A CPI is a statistic ...

and publishes the new rates as "

Tax Rate Schedules".

Marginal tax rates

Beginning in 2013, an additional tax of 3.8% applies to net investment income in excess of certain thresholds.

An individual pays tax at a given bracket only for each dollar within that

tax bracket

Tax brackets are the divisions at which tax rates change in a progressive tax system (or an explicitly regressive tax system, though that is rarer). Essentially, tax brackets are the cutoff values for taxable income—income past a certain point ...

's range. The top marginal rate does not apply in certain years to certain types of income. Significantly lower rates apply after 2003 to capital gains and qualifying dividends (see below).

Example of a tax computation

Income tax for year 2017:

Single taxpayer making $40,000 gross income, no children, under 65 and not blind, taking standard deduction;

* $40,000 gross income – $6,350

standard deduction – $4,050

personal exemption = $29,600 taxable income

** amount in the first income bracket = $9,325; taxation of the amount in the first income bracket = $9,325 × 10% = $932.50

** amount in the second income bracket = $29,600 – $9,325 = $20,275.00; taxation of the amount in the second income bracket = $20,275.00 × 15% = $3,041.25

* Total income tax is $932.50 + $3,041.25 = $3,973.75 (~9.93%

effective tax)

Note, however, that taxpayers with taxable income of less than $100,000 must use IRS provided tax tables. Under that table for 2016, the income tax in the above example would be $3,980.00.

In addition to income tax, a wage earner would also have to pay

Federal Insurance Contributions Act tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for reti ...

(FICA) (and an equal amount of FICA tax must be paid by the employer):

* $40,000 (adjusted gross income)

** $40,000 × 6.2% = $2,480 (Social Security portion)

** $40,000 × 1.45% = $580 (Medicare portion)

* Total FICA tax paid by employee = $3,060 (7.65% of income)

* Total federal tax of individual = $3,973.75 + $3,060.00 = $7,033.75 (~17.58% of income)

Total federal tax including employer's contribution:

* Total FICA tax contributed by employer = $3,060 (7.65% of income)

* Total federal tax of individual including employer's contribution = $3,973.75 + $3,060.00 + $3,060.00 = $10,093.75 (~25.23% of income)

Effective income tax rates

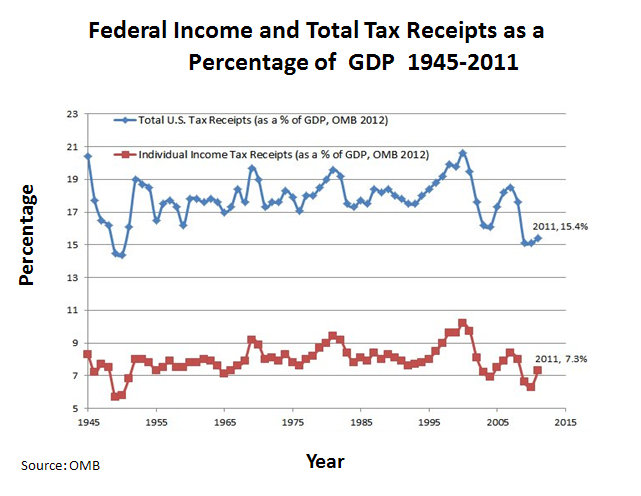

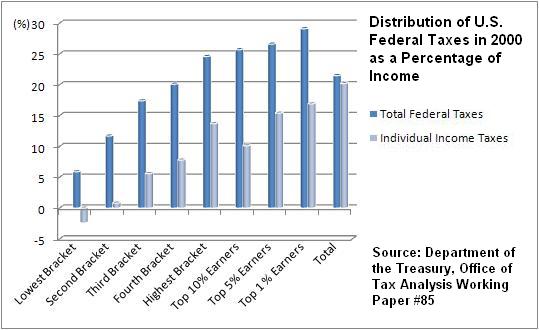

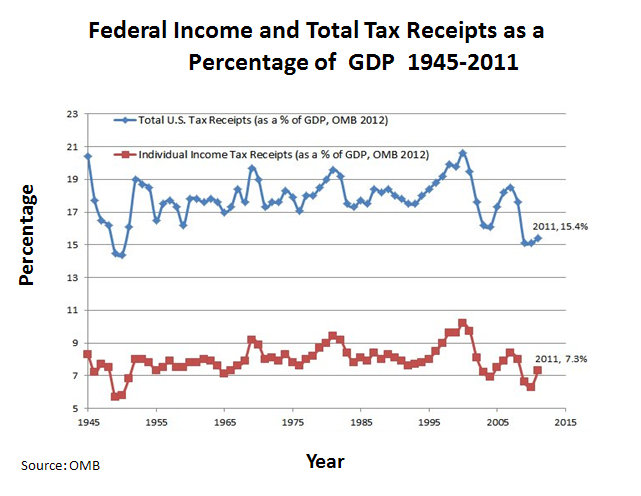

Effective tax rates are typically lower than marginal rates due to various deductions, with some people actually having a negative liability. The individual income tax rates in the following chart include capital gains taxes, which have different marginal rates than regular income.

Only the first $118,500 of someone's income is subject to social insurance (Social Security) taxes in 2016. The table below also does not reflect changes, effective with 2013 law, which increased the average tax paid by the top 1% to the highest levels since 1979, at an effective rate of 33%, while most other taxpayers have remained near the lowest levels since 1979.

Taxable income

Income tax is imposed as a tax rate times taxable income. Taxable income is defined as

gross income less allowable

deductions. Taxable income as determined for federal tax purposes may be modified for state tax .

Gross income

The

Internal Revenue Code

The Internal Revenue Code (IRC), formally the Internal Revenue Code of 1986, is the domestic portion of federal statutory tax law in the United States, published in various volumes of the United States Statutes at Large, and separately as Title 26 ...

states that "gross income means all income from whatever source derived," and gives specific examples.

[26 USC 61](_blank)

Gross income is not limited to cash received, but "includes income realized in any form, whether money, property, or services." Gross income includes wages and tips, fees for performing services, gain from sale of inventory or other property, interest, dividends, rents, royalties, pensions, alimony, and many other types of income.

Items must be included in income when received or accrued. The amount included is the amount the taxpayer is entitled to receive. Gains on property are the gross proceeds less amounts returned,

cost of goods sold

Cost of goods sold (COGS) is the carrying value of goods sold during a particular period.

Costs are associated with particular goods using one of the several formulas, including specific identification, first-in first-out (FIFO), or average cost ...

, or

tax basis

Under U.S. federal tax law, the tax basis of an asset is generally its cost basis. Determining such cost may require allocations where multiple assets are acquired together. Tax basis may be reduced by allowances for depreciation. Such reduced ba ...

of property sold.

Certain types of income are

exempt from income tax. Among the more common types of exempt income are interest on municipal bonds, a portion of Social Security benefits, life insurance proceeds, gifts or inheritances, and the value of many employee benefits.

Gross income is reduced by adjustments and

deductions. Among the more common adjustments are reductions for alimony paid and

IRA

Ira or IRA may refer to:

*Ira (name), a Hebrew, Sanskrit, Russian or Finnish language personal name

*Ira (surname), a rare Estonian and some other language family name

*Iran, UNDP code IRA

Law

*Indian Reorganization Act of 1934, US, on status of ...

and certain other retirement plan contributions. Adjusted gross income is used in calculations relating to various deductions, credits, phase outs, and penalties.

Business deductions

Most business deductions are allowed regardless of the form in which the business is conducted. Therefore, an individual small business owner is allowed most of the same business deductions as a publicly traded corporation. A business is an activity conducted regularly to make a profit. Only a few business-related deductions are unique to a particular form of business-doing. The deduction of investment expenses by individuals, however, has several limitations, along with other itemized (personal) deductions.

The amount and timing of deductions for income tax purposes is determined under tax accounting rules, not financial accounting ones. Tax rules are based on principles similar in many ways to accounting rules, but there are significant differences. Federal deductions for most meals and entertainment costs are limited to 50% of the costs (with an exception for tax year 2021, allowing a 100% deduction for meals purchased in a restaurant). Costs of starting a business (sometimes called pre-operating costs) are deductible ratably over 60 months. Deductions for lobbying and political expenses are limited. Some other limitations apply.

Expenses likely to produce future benefits must be capitalized. The capitalized costs are then deductible as depreciation (see

MACRS

The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for de ...

) or amortization over the period future benefits are expected. Examples include costs of machinery and equipment and costs of making or building property. IRS tables specify lives of assets by class of asset or industry in which used. When an asset the cost of which was capitalized is sold, exchanged, or abandoned, the proceeds (if any) are reduced by the remaining unrecovered cost to determine gain or loss. That gain or loss may be ordinary (as in the case of inventory) or capital (as in the case of stocks and bonds), or a combination (for some buildings and equipment).

Most personal, living, and family expenses are not deductible. Business deductions allowed for federal income tax are almost always allowed in determining state income tax. Only some states, however, allow itemized deductions for individuals. Some states also limit deductions by corporations for investment related expenses. Many states allow different amounts for depreciation deductions. State limitations on deductions may differ significantly from federal limitations.

Business deductions in excess of business income result in losses that may offset other income. However, deductions for losses from passive activities may be deferred to the extent they exceed income from other passive activities. Passive activities include most rental activities (except for real estate professionals) and business activities in which the taxpayer does not materially participate. In addition, losses may not, in most cases, be deducted in excess of the taxpayer's amount at risk (generally tax basis in the entity plus share of debt).

Personal deductions

Prior to 2018, individuals were allowed a special deduction called a

personal exemption. This wa

not allowed after 2017 but will be allowed again in 2026 This was a fixed amount allowed each taxpayer, plus an additional fixed amount for each child or other dependents the taxpayer supports. The amount of this deduction was $4,000 for 2015. The amount is indexed annually for inflation. The amount of exemption was phased out at higher incomes through 2009 and after 2012 (no phase out in 2010–2012).

Citizens

Citizenship is a "relationship between an individual and a state to which the individual owes allegiance and in turn is entitled to its protection".

Each state determines the conditions under which it will recognize persons as its citizens, and ...

and individuals with U.S.

tax residence

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, physical presence in a jurisdiction is the main test. Some jurisdictio ...

may deduct a flat amount as a

standard deduction. This was $12,550 for single individuals and $25,100 for married individuals filing a joint return for 2021. Alternatively, individuals may claim

itemized deductions

Under United States tax law, itemized deductions are eligible expenses that individual taxpayers can claim on federal income tax returns and which decrease their taxable income, and is claimable in place of a standard deduction, if available.

Mos ...

for actual amounts incurred for specific categories of nonbusiness expenses. Expenses incurred to produce tax exempt income and several other items are not deductible. Home owners may deduct the amount of interest and

property taxes

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheri ...

paid on their principal and second homes. Local and

state income taxes are deductible through the

SALT deduction although this deduction is currently limited to $10,000. Contributions to

charitable organizations

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educational, religious or other activities serving the public interest or common good).

The legal definition of a ...

are deductible by individuals and corporations, but the deduction is limited to 50% and 10% of gross income, respectively. Medical expenses in excess of 10% of

adjusted gross income

In the United States income tax system, adjusted gross income (AGI) is an individual's total gross income minus specific deductions. It is used to calculate taxable income, which is AGI minus allowances for personal exemptions and itemized deduc ...

are deductible, as are uninsured casualty losses. Other income producing expenses in excess of 2% of adjusted gross income are also deductible. Before 2010, the allowance of itemized deductions was phased out at higher incomes. The phase out expired for 2010.

Retirement savings and fringe benefit plans

Employers get a deduction for amounts contributed to a qualified employee retirement plan or benefit plan. The employee does not recognize income with respect to the plan until he or she receives a distribution from the plan. The plan itself is organized as a trust and is considered a separate entity. For the plan to qualify for

tax exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, redu ...

, and for the employer to get a deduction, the plan must meet minimum participation, vesting, funding, and operational standards.

Examples of qualified plans include:

*Pension plans (

defined benefit pension plan

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age ...

),

*Profit sharing plans (

defined contribution plan

A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these a ...

),

*

Employee Stock Ownership Plan

Employee stock ownership, or employee share ownership, is where a company's employees own shares in that company (or in the parent company of a group of companies). US employees typically acquire shares through a share option plan. In the UK, Em ...

(ESOPs),

*Stock purchase plans,

*Health insurance plans,

*Employee benefit plans,

*

Cafeteria plan

A cafeteria plan or cafeteria system is a type of employee benefit plan offered in the United States pursuant to Section 125 of the Internal Revenue Code. Its name comes from the earliest such plans that allowed employees to choose between differe ...

s.

Employees or former employees are generally taxed on distributions from retirement or stock plans. Employees are not taxed on distributions from health insurance plans to pay for medical expenses. Cafeteria plans allow employees to choose among benefits (like choosing food in a cafeteria), and distributions to pay those expenses are not taxable.

In addition, individuals may make contributions to

Individual Retirement Account

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's ear ...

s (IRAs). Those not currently covered by other retirement plans may claim a deduction for contributions to certain types of IRAs. Income earned within an IRA is not taxed until the individual withdraws it.

Capital gains

Taxable income includes

capital gains

Capital gain is an economic concept defined as the profit earned on the sale of an asset which has increased in value over the holding period. An asset may include tangible property, a car, a business, or intangible property such as shares ...

. However, individuals are taxed at a lower rate on long term capital gains and qualified dividends (see below). A capital gain is the excess of the sales price over the

tax basis

Under U.S. federal tax law, the tax basis of an asset is generally its cost basis. Determining such cost may require allocations where multiple assets are acquired together. Tax basis may be reduced by allowances for depreciation. Such reduced ba ...

(usually, the cost) of

capital assets

A capital asset is defined as property of any kind held by an assessee, whether connected with their business or profession or not connected with their business or profession. It includes all kinds of property, movable or immovable, tangible or int ...

, generally those assets not held for sale to customers in the ordinary course of business. Capital losses (where basis is more than sales price) are deductible, but deduction for long term capital losses is limited to the total capital gains for the year, plus for individuals up to $3,000 of ordinary income ($1,500 if married filing separately). An individual may exclude $250,000 ($500,000 for a married couple filing jointly) of capital gains on the sale of the individual's

primary residence A person's primary residence, or main residence is the dwelling where they usually live, typically a house or an apartment. A person can only have one ''primary'' residence at any given time, though they may share the residence with other people. A ...

, subject to certain conditions and limitations. Gains on depreciable property used in a business are treated as ordinary income to the extent of depreciation previously claimed.

In determining gain, it is necessary to determine which property is sold and the amount of basis of that property. This may require identification conventions, such as first-in-first-out, for identical properties like shares of stock. Further, tax basis must be allocated among properties purchased together unless they are sold together. Original basis, usually cost paid for the asset, is reduced by deductions for

depreciation

In accountancy, depreciation is a term that refers to two aspects of the same concept: first, the actual decrease of fair value of an asset, such as the decrease in value of factory equipment each year as it is used and wear, and second, the a ...

or loss.

Certain capital gains are deferred; that is, they are taxed at a time later than the year of disposition. Gains on property sold for installment payments may be recognized as those payments are received. Gains on real property exchanged fo

like-kindproperty are not recognized, and the tax basis of the new property is based on the tax basis of the old property.

Before 1986 and from 2004 onward, individuals were subject to a reduced rate of federal tax on capital gains (called long-term capital gains) on certain property held more than 12 months. The reduced rate of 15% applied for regular tax and the Alternative Minimum Tax through 2011. The reduced rate also applies to dividends from corporations organized in the United States or a country with which the United States has an income tax treaty. This 15% rate was increased to 20% in 2012. Beginning in 2013, capital gains above certain thresholds is included in net investment income subject to an additional 3.8% tax.

:

*Capital gains up to $250,000 ($500,000 if filed jointly)

on real estate used as primary residence are exempt

Accounting periods and methods

The US tax system allows individuals and entities to choose their tax year

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

. Most individuals choose the calendar year. There are restrictions on choice of tax year for some closely held

A privately held company (or simply a private company) is a company whose shares and related rights or obligations are not offered for public subscription or publicly negotiated in the respective listed markets, but rather the company's stock is ...

entities. Taxpayers may change their tax year in certain circumstances, and such change may require IRS approval.

Taxpayers must determine their taxable income based on their method of accounting for the particular activity. Most individuals use the cash method for all activities. Under this method, income is recognized when received and deductions taken when paid. Taxpayers may choose or be required to use the accrual method for some activities. Under this method, income is recognized when the right to receive it arises, and deductions are taken when the liability to pay arises and the amount can be reasonably determined. Taxpayers recognizing cost of goods sold

Cost of goods sold (COGS) is the carrying value of goods sold during a particular period.

Costs are associated with particular goods using one of the several formulas, including specific identification, first-in first-out (FIFO), or average cost ...

on inventory must use the accrual method with respect to sales and costs of the inventory.

Methods of accounting may differ for financial reporting and tax purposes. Specific methods are specified for certain types of income or expenses. Gain on sale of property other than inventory may be recognized at the time of sale or over the period in which installment sale

In United States income tax law, an installment sale is generally a "disposition of property where at least 1 loan payment is to be received after the close of the taxable year in which the disposition occurs." The term "installment sale" does n ...

payments are received. Income from long-term contracts must be recognized ratably over the term of the contract, not just at completion. Other special rules also apply.

Other taxable and tax exempt entities

Partnerships and LLCs

Business entities treated as partnerships

A partnership is an arrangement where parties, known as business partners, agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, business entity, businesses, interest-based organizations, schoo ...

ar

not subject to income tax

at the entity level. Instead, their member

include their share

of income, deductions, and credits in computing their own tax. The character of the partner's share of income (such as capital gains) is determined at the partnership level. Many types of business entities, including limited liability companies

A limited liability company (LLC for short) is the US-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a ...

(LLCs), may elect to be treated as a corporation or as a partnership. Distributions from partnerships are not taxed as dividends.

Corporations

Corporate tax is imposed in the U.S. at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. A corporation wholly owned by U.S. citizens and resident individuals may elect for the corporation to be taxed similarly to partnerships as an S Corporation. Corporate income tax is based on

Corporate tax is imposed in the U.S. at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. A corporation wholly owned by U.S. citizens and resident individuals may elect for the corporation to be taxed similarly to partnerships as an S Corporation. Corporate income tax is based on taxable income Taxable income refers to the base upon which an income tax system imposes tax. In other words, the income over which the government imposed tax. Generally, it includes some or all items of income and is reduced by expenses and other deductions. Th ...

, which is defined similarly to individual taxable income.

Shareholders (including other corporations) of corporations (other than S Corporations) are taxed on dividend

A dividend is a distribution of profits by a corporation to its shareholders. When a corporation earns a profit or surplus, it is able to pay a portion of the profit as a dividend to shareholders. Any amount not distributed is taken to be re-in ...

distributions from the corporation. They are also subject to tax on capital gains upon sale or exchange of their shares for money or property. However, certain exchanges, such as in reorganizations, are not taxable.

Multiple corporations may file a consolidated return

Consolidated may refer to:

*Consolidated (band)

**''¡Consolidated!'', a 1989 extended play

*Consolidated Aircraft (later Convair), an aircraft manufacturer

* Consolidated city-county

*Consolidated Communications

* Consolidated school district

*Co ...

at the federal and some state levels with their common parent.

Corporate tax rates

Federal corporate income tax is imposed a

21%

from 2018. Dividend exclusions and certain corporation-only deductions may significantly lower the effective rate.

Deductions for corporations

Most expenses of corporations are deductible, subject to limitations also applicable to other taxpayers. (See relevant deductions for details.) In addition, regular U.S. corporations are allowed a deduction o

100% of dividends received

from 10% or more foreign subsidiaries

50% of amounts included in income

unde

section 951A

an

37.5% of foreign branch income

Some deductions of corporations are limited at federal or state levels. Limitations apply to items due t

related parties

including interest and royalty expenses.

Estates and trusts

Estates and trusts may b

subject to income tax

at the estate or trust level, or th

beneficiaries may be subject to income tax

on their share of income. Where income must be distributed, the beneficiaries are taxed similarly to partners in a partnership. Where income may be retained, the estate or trust is taxed. It may get a deduction for later distributions of income. Estates and trusts are allowed only those deductions related to producing income, plus $1,000. They are taxed at graduated rates that increase rapidly to the maximum rate for individuals. The tax rate for trust and estate income in excess of $11,500 was 35% for 2009. Estates and trusts are eligible for the reduced rate of tax on dividends and capital gains through 2011.

Tax-exempt entities

U.S. tax law exempts certain types of entities from income and some other taxes. These provisions arose during the late 19th century. Charitable organizations and cooperatives may apply to the IRS for tax exemption

Tax exemption is the reduction or removal of a liability to make a compulsory payment that would otherwise be imposed by a ruling power upon persons, property, income, or transactions. Tax-exempt status may provide complete relief from taxes, redu ...

. Exempt organizations are still taxed on any business income. An organization which participates in lobbying

In politics, lobbying, persuasion or interest representation is the act of lawfully attempting to influence the actions, policies, or decisions of government officials, most often legislators or members of regulatory agency, regulatory agencie ...

, political campaign

A political campaign is an organized effort which seeks to influence the decision making progress within a specific group. In democracies, political campaigns often refer to electoral campaigns, by which representatives are chosen or referend ...

ing, or certain other activities may lose its exempt status. Special taxes apply to prohibited transactions and activities of tax-exempt entities.

Social insurance taxes (Social Security tax and Medicare tax, or FICA)

The United States social insurance system is funded by a tax similar to an income tax. Social Security tax of 6.2% is imposed on wages paid to employees. The tax is imposed on both the employer and the employee. The maximum amount of wages subject to the tax for 2020 was $137,700. This amount is indexed for inflation. A companion Medicare Tax of 1.45% of wages is imposed on employers and employees with no limitation. A self-employment tax composed of both the employer and employee amounts (totaling 15.3%) is imposed on self-employed persons.

Other tax items

Credits

The federal and state systems offer numerous tax credits

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "disc ...

for individuals and businesses. Among the key federal credits for individuals are:

* Child credit: For 2017, a credit up to $1,000 per qualifying child. For 2018 to 2025, the credit rose to $2,000 per qualifying child but made having a Social Security Number

In the United States, a Social Security number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act, codified as . The number is issued to ...

(SSN) a condition of eligibility for each child. For 2021, the credit was temporarily raised to $3,000 per child aged 6 to 17 and $3,600 per qualifying child aged 0 to 5 and was made fully refundable.

*Child and dependent care credit

The Household and Dependent Care Credit is a nonrefundable tax credit available to United States taxpayers. Taxpayers that care for a qualifying individual are eligible. The purpose of the credit is to allow the taxpayer (or their spouse, if mar ...

: a credit up to $6,000, phased out at incomes above $15,000. For 2021, the credit was raised up to $16,000, phased out at $125,000.

*Earned Income Tax Credit

The United States federal earned income tax credit or earned income credit (EITC or EIC) is a refundable tax credit for low- to moderate-income working individuals and couples, particularly those with children. The amount of EITC benefit depends ...

: this refundable credit is granted for a percentage of income earned by a low income individual. The credit is calculated and capped based on the number of qualifying children, if any. This credit is indexed for inflation and phased out for incomes above a certain amount. For 2015, the maximum credit was $6,422.

*Credit for the elderly and disabled: A nonrefundable credit up to $1,125.

*Two mutually exclusive credits for college expenses.

Businesses are also eligible for several credits. These credits are available to individuals and corporations and can be taken by partners in business partnerships. Among the federal credits included in a "general business credit" are:

* Credit for increasing research expenses.

*Work Incentive Credit or credit for hiring people in certain enterprise zones or on welfare.

*A variety of industry specific credits.

In addition, a federal foreign tax credit

A foreign tax credit (FTC) is generally offered by income tax systems that tax residents on worldwide income, to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have be ...

is allowed for foreign income taxes paid. This credit is limited to the portion of federal income tax arising due to foreign source income. The credit is available to all taxpayers.

Business credits and the foreign tax credit may be offset taxes in other years.

States and some localities offer a variety of credits that vary by jurisdiction. States typically grant a credit to resident individuals for income taxes paid to other states, generally limited in proportion to income taxed in the other state(s).

Alternative minimum tax

Taxpayers must pay the higher of the regular income tax or the alternative minimum tax

The alternative minimum tax (AMT) is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all ...

(AMT). Taxpayers who have paid AMT in prior years may claim a credit against regular tax for the prior AMT. The credit is limited so that regular tax is not reduced below current year AMT.

AMT is imposed at a nearly flat rate (20% for corporations, 26% or 28% for individuals, estates, and trusts) on taxable income as modified for AMT. Key differences between regular taxable income and AMT taxable income include:

*The standard deduction and personal exemptions are replaced by a single deduction, which is phased out at higher income levels,

*No deduction is allowed for individuals for state taxes,

*Most miscellaneous itemized deductions are not allowed for individuals,

*Depreciation deductions are computed differently, and

*Corporations must make a complex adjustment to more closely reflect economic income.

Special taxes

There are many federal tax rules designed to prevent people from abusing the tax system. Provisions related to these taxes are often complex. Such rules include:

*Accumulated earnings tax on corporation accumulations in excess of business needs,

* Personal holding company taxes,

*Passive foreign investment company

For purposes of income tax in the United States, U.S. persons owning shares of a passive foreign investment company (PFIC) may choose between (i) current taxation on the income of the PFIC or (ii) deferral of such income subject to a deemed tax and ...

rules, and

*Controlled foreign corporation

Controlled foreign corporation (CFC) rules are features of an income tax system designed to limit artificial deferral of tax by using offshore low taxed entities. The rules are needed only with respect to income of an entity that is not currently ...

provisions.

Special industries

Tax rules recognize that some types of businesses do not earn income in the traditional manner and thus require special provisions. For example, insurance companies must ultimately pay claims to some policy holders from the amounts received as premiums. These claims may happen years after the premium payment. Computing the future amount of claims requires actuarial estimates until claims are actually paid. Thus, recognizing premium income as received and claims expenses as paid would seriously distort an insurance company's income.

Special rules apply to some or all items in the following industries:

Insurance companies

(rules related to recognition of income and expense; different rules apply to life insurance and to property and casualty insurance)

*Shipping (rules related to the revenue recognition cycle)

(rules related to expenses for exploration and development and for recovery of capitalized costs)

In addition, mutual funds

are subject to special rules allowing them to be taxed only at the owner level. The company must report to each owner his/her share of ordinary income, capital gains, and creditable foreign taxes. The owners then include these items in their own tax calculation. The fund itself is not taxed, and distributions are treated as a return of capital

Return of capital (ROC) refers to principal payments back to "capital owners" (shareholders, partners, unitholders) that exceed the growth (net income/taxable income) of a business or investment. It should not be confused with Rate of Return (ROR ...

to the owners. Similar rules apply t

real estate investment trusts

an

State, local and territorial income taxes

Income tax is also levied by most

Income tax is also levied by most U.S. state

In the United States, a state is a constituent political entity, of which there are 50. Bound together in a political union, each state holds governmental jurisdiction over a separate and defined geographic territory where it shares its sover ...

s and many localities on individuals, corporations, estates, and trusts. These taxes are in addition to federal income tax and are deductible for federal tax purposes. State and local income tax rates vary from zero to 16% of taxable income. Some state and local income tax rates are flat (single rate), and some are graduated. State and local definitions of what income is taxable vary highly. Some states incorporate the federal definitions by reference. Taxable income is defined separately and differently for individuals and corporations in some jurisdictions. Some states impose alternative or additional taxes based on a second measure of income or capital.

States and localities tend to tax all income of residents. States and localities only tax nonresidents on income allocated or apportioned to the jurisdiction. Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state. Many states require partnerships to pay tax for nonresident partners.

Tax returns are filed separately for states and localities imposing income tax, and may be due on dates that differ from federal due dates. Some states permit related corporations to file combined or consolidated returns. Most states and localities imposing income tax require estimated payments where tax exceeds certain thresholds and require withholding tax

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a ''Prélèvement à la source'', is income tax paid to the government by the payer of the income rather than by the recipient of the income ...

on payment of wages.

Puerto Rico

Puerto Rico (; abbreviated PR; tnq, Boriken, ''Borinquen''), officially the Commonwealth of Puerto Rico ( es, link=yes, Estado Libre Asociado de Puerto Rico, lit=Free Associated State of Puerto Rico), is a Caribbean island and Unincorporated ...

also imposes its own taxation laws; however, unlike in the states, only some residents there pay federal income taxes (though everyone must pay all other federal taxes).[Contrary to common misconception, residents of Puerto Rico do pay U.S. federal taxes: customs taxes (which are subsequently returned to the Puerto Rico Treasury) (Se]

Dept of the Interior, Office of Insular Affairs. DOI.gov)

, import/export taxes (Se

Stanford.wellsphere.com)

, federal commodity taxes (Se

Stanford.wellsphere.com)

, social security taxes (Se

etc. Residents pay federal payroll tax

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the em ...

es, such as Social Security

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specificall ...

(Se

IRS.gov

and Medicare (Se

Reuters.com)

as well as Commonwealth of Puerto Rico income taxes (Se

an

). All federal employees (Se

Heritage.org)

, those who do business with the federal government (Se

MCVPR.com)

, Puerto Rico-based corporations that intend to send funds to the U.S. (Se

p. 9, line 1.)

and some others (For example, Puerto Rican residents that are members of the U.S. military, Se

Heritage.org

; and Puerto Rico residents who earned income from sources outside Puerto Rico, Se

pp 14–15.)

also pay federal income taxes. In addition, because the cutoff point for income taxation is lower than that of the U.S. IRS code, and because the per-capita income in Puerto Rico is much lower than the average per-capita income on the mainland, more Puerto Rico residents pay income taxes to the local taxation authority than if the IRS code were applied to the island. This occurs because "the Commonwealth of Puerto Rico government has a wider set of responsibilities than do U.S. State and local governments" (Se

GAO.gov

. As residents of Puerto Rico pay into Social Security, Puerto Ricans are eligible for Social Security benefits upon retirement, but are excluded from the Supplemental Security Income

Supplemental Security Income (SSI) is a means-tested program that provides cash payments to disabled children, disabled adults, and individuals aged 65 or older who are citizens or nationals of the United States. SSI was created by the Social Se ...

(SSI) (Commonwealth of Puerto Rico residents, unlike residents of the Commonwealth of the Northern Mariana Islands and residents of the 50 States, do not receive the SSI. Se

Socialsecurity.gov)

and the island actually receives less than 15% of the Medicaid

Medicaid in the United States is a federal and state program that helps with healthcare costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and pers ...

funding it would normally receive if it were a U.S. state. However, Medicare providers receive less-than-full state-like reimbursements for services rendered to beneficiaries in Puerto Rico, even though the latter paid fully into the system (Se

p 252).

In general, "many federal social welfare programs have been extended to Puerto Rican (''sic'') residents, although usually with caps inferior to those allocated to the states." (The Louisiana Purchase and American Expansion: 1803–1898. By Sanford Levinson and Bartholomew H. Sparrow. New York: Rowman and Littlefield Publishers. 2005. Page 167. For a comprehensive coverage of federal programs made extensive to Puerto Rico see Richard Cappalli's Federal Aid to Puerto Rico (1970)). It has also been estimated (Se

that, because the population of the Island is greater than that of 50% of the States, if it were a state, Puerto Rico would have six to eight seats in the House, in addition to the two seats in the Senate.(Se

an

Thomas.gov

Puerto_Rico_Democracy_Act_of_2007."_These_are_the_steps_to_follow

THOMAS.gov

>_Committee_Reports_>_110_>_drop_down_"Word/Phrase"_and_pick_"Report_Number"_>_type_"597"_next_to_Report_Number._This_will_provide_the_document_"House_Report_110-597_-__2007",_then_from_the_Table_of_Contents_choose_"Background_and_need_for_legislation".)._Another_misconception_is_that_the_import/export_taxes_collected_by_the_U.S._on_products_manufactured_in_Puerto_Rico_are_all_returned_to_the_Puerto_Rico_Treasury._This_is_not_the_case._Such_import/export_taxes_are_returned_''only''_for_rum_products,_and_even_then_the_US_Treasury_keeps_a_portion_of_those_taxes_(See_the_"House_Report_110-597_-_Puerto_Rico_Democracy_Act#Puerto_Rico_Democracy_Act_of_2007.html" ;"title="Puerto Rico Democracy Act#Puerto Rico Democracy Act of 2007">Puerto Rico Democracy Act of 2007." These are the steps to follow

THOMAS.gov

> Committee Reports > 110 > drop down "Word/Phrase" and pick "Report Number" > type "597" next to Report Number. This will provide the document "House Report 110-597 - 2007", then from the Table of Contents choose "Background and need for legislation".). Another misconception is that the import/export taxes collected by the U.S. on products manufactured in Puerto Rico are all returned to the Puerto Rico Treasury. This is not the case. Such import/export taxes are returned ''only'' for rum products, and even then the US Treasury keeps a portion of those taxes (See the "House Report 110-597 - Puerto_Rico_Democracy_Act_of_2007"_mentioned_above.)_The_other_unincorporated_territories_of_Guam.html" ;"title="Puerto Rico Democracy Act#Puerto Rico Democracy Act of 2007">Puerto Rico Democracy Act of 2007" mentioned above.) The other unincorporated territories of Guam">Puerto Rico Democracy Act#Puerto Rico Democracy Act of 2007">Puerto Rico Democracy Act of 2007" mentioned above.) The other unincorporated territories of Guam, American Samoa, the Northern Mariana Islands and the U.S. Virgin Islands, Virgin Islands also impose their own income taxation laws, under a "mirror" tax law based on federal income tax law.

International aspects

The United States imposes tax on all citizens of the United States, including those who are residents of other countries, all individuals who are residents for tax purposes, and domestic corporations, defined as corporations created or organized in the United States or under Federal or state law.

Federal income tax is imposed on citizens, residents, and domestic corporations based on their worldwide income. To mitigate double taxation, a credit is allowed for foreign income taxes. This

The United States imposes tax on all citizens of the United States, including those who are residents of other countries, all individuals who are residents for tax purposes, and domestic corporations, defined as corporations created or organized in the United States or under Federal or state law.

Federal income tax is imposed on citizens, residents, and domestic corporations based on their worldwide income. To mitigate double taxation, a credit is allowed for foreign income taxes. This foreign tax credit

A foreign tax credit (FTC) is generally offered by income tax systems that tax residents on worldwide income, to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have be ...

is limited to that part of current year tax attributable to foreign source income. Determining such part involves determining the source of income and allocating and apportioning deductions to that income. Many, but not all, tax resident individuals and corporations on their worldwide income, but few allow a credit for foreign taxes.

In addition, federal income tax may be imposed on non-resident non-citizens as well as foreign corporations on U.S. source income. Federal tax applies to interest, dividends, royalties, and certain other income of nonresident aliens and foreign corporations not effectively connected with a U.S. trade or business at a flat rate of 30%. This rate is often reduced under tax treaties. Foreign persons are taxed on income effectively connected with a U.S. business and gains on U.S. realty similarly to U.S. persons. Nonresident aliens who are present in the United States for a period of 183 days in a given year are subject to U.S. capital gains tax on certain net capital gains realized during that year from sources within the United States. The states tax non-resident individuals only on income earned within the state (wages, etc.), and tax individuals and corporations on business income apportioned to the state.

The United States has income tax treaties wit

over 65 countries

These treaties reduce the chance of double taxation by allowing each country to fully tax its citizens and residents and reducing the amount the other country can tax them. Generally the treaties provide for reduced rates of tax on investment income and limits as to which business income can be taxed. The treaties each define which taxpayers can benefit from the treaty. U.S. treaties do not apply to income taxes imposed by the states or political subdivisions, except for the non discrimination provisions that appear in almost every treaty. Also, U.S. treaties generally do not permit U.S. persons from invoking treaty provisions with respect to U.S. taxes, with certain relatively standard exceptions.

Tax collection and examinations

Tax returns

Individuals (with income above a minimum level), corporations, partnerships, estates, and trusts must file annual reports, called tax returns

A tax return is the completion of documentation that calculates an entity or individual's income earned and the amount of taxes to be paid to the government or government organizations or, potentially, back to the taxpayer.

Taxation is one of ...

, with federal and appropriate state tax authorities. These returns vary greatly in complexity level depending on the type of filer and complexity of their affairs. On the return, the taxpayer reports income and deductions, calculates the amount of tax owed, reports payments and credits, and calculates the balance due.

Federal individual, estate, and trust income tax returns are due by April 15[Publication 509: Tax Calendars for use in 2017](_blank)

U.S. Internal Revenue Service, Cat. No. 15013X for most taxpayers. Corporate and partnership federal returns are due two and one half months following the corporation's year end. Tax exempt entity returns are due four and one half months following the entity's year end. All federal returns may b

with most extensions available by merely filing a single page form. Due dates and extension provisions for state and local income tax returns vary.

Income tax returns generally consist of the basic form with attached forms and schedules. Several forms are available for individuals and corporations, depending on the complexity and nature of the taxpayer's affairs. Many individuals are able to use the one pag

Form 1040-EZ

which requires no attachments except wage statements from employers

Forms W-2

. Individuals claiming itemized deductions must complet

Schedule A

Similar schedules apply for interest (Schedule B), dividends (Schedule B), business income (Schedule C), capital gains (Schedule D), farm income (Schedule F), and self-employment tax (Schedule-SE). All taxpayers must file those forms for credits, depreciation, AMT, and other items that apply to them.

Electronic filing of tax returns may be done for taxpayers by registered tax preparers.

If a taxpayer discovers an error on a return, or determines that tax for a year should be different, the taxpayer should file an amended return. These returns constitute claims for refund if taxes are determined to have been overpaid. The IRS, state, and local tax authorities may examine a tax return and propose changes. Changes to tax returns may be made with minimal advance involvement by taxpayers, such as changes to wage or dividend income to correct errors. Other examination of returns may require extensive taxpayer involvement, such as an audit by the IRS. These audits often require that taxpayers provide the IRS or other tax authority access to records of income and deductions. Audits of businesses are usually conducted by IRS personnel at the business location.

Changes to returns are subject to appeal by the taxpayer, including going to court. IRS changes are often first issued a

The IRS, state, and local tax authorities may examine a tax return and propose changes. Changes to tax returns may be made with minimal advance involvement by taxpayers, such as changes to wage or dividend income to correct errors. Other examination of returns may require extensive taxpayer involvement, such as an audit by the IRS. These audits often require that taxpayers provide the IRS or other tax authority access to records of income and deductions. Audits of businesses are usually conducted by IRS personnel at the business location.

Changes to returns are subject to appeal by the taxpayer, including going to court. IRS changes are often first issued a

proposed adjustments

The taxpayer may agree to the proposal or may advise the IRS why it disagrees. Proposed adjustments are often resolved by the IRS and taxpayer agreeing to what the adjustment should be. For those adjustments to which agreement is not reached, the IRS issues

advising of the adjustment. The taxpayer ma

appeal

this preliminary assessment within 30 days within the IRS.

The Appeals Division reviews the IRS field team determination and taxpayer arguments, and often proposes a solution that the IRS team and the taxpayer find acceptable. When an agreement is still not reached, the IRS issues an assessment as a notice of deficiency o

The taxpayer then has three choices: file suit in United States Tax Court

The United States Tax Court (in case citations, T.C.) is a federal trial court of record established by Congress under Article I of the U.S. Constitution, section 8 of which provides (in part) that the Congress has the power to "constitute Trib ...

without paying the tax, pay the tax and sue for refund in regular court, or simply pay the tax and be done. Recourse to court can be costly and time-consuming but is often successful.

IRS computers routinely make adjustments to correct mechanical errors in returns. In addition, the IRS conducts an extensive document matching computer program that compares taxpayer amounts of wages, interest, dividends, and other items to amounts reported by taxpayers. These programs automatically issue 30-day letters advising of proposed changes. Only a very small percentage of tax returns are actually examined. These are selected by a combination of computer analysis of return information and random sampling. The IRS has long maintained

program to identify patterns

on returns most likely to require adjustment.

Procedures for examination by state and local authorities vary by jurisdiction.

Tax collection

Taxpayers are required to pay all taxes owed based on the self-assessed tax returns, as adjusted. The IR

may provide time payment plans that include interest and a "penalty" that is merely added interest. Where taxpayers do not pay tax owed, the IRS has strong means to enforce collection. These include the ability to levy bank accounts and seize property. Generally, significant advance notice is given before levy or seizure. However, in certain rarely use

the IRS may immediately seize money and property. The IR

are responsible for most collection activities.

Withholding of tax

Persons paying wages or making certain payments to foreign persons are required to withhold income tax from such payments. Income tax withholding on wages is based o

declarations by employees

an

tables provided by the IRS

Persons paying interest, dividends, royalties, and certain other amounts to foreign persons must also withhold income tax at a flat rate of 30%. This rate may be reduced by a tax treaty

A tax treaty, also called double tax agreement (DTA) or double tax avoidance agreement (DTAA), is an agreement between two countries to avoid or mitigate double taxation. Such treaties may cover a range of taxes including income taxes, inheritance ...

. These withholding requirements also apply to non-U.S. financial institutions. Additiona

backup withholding

provisions apply to some payments of interest or dividends to U.S. persons. The amount of income tax withheld is treated as a payment of tax by the person receiving the payment on which tax was withheld.

Employers and employees must also pay Social Security tax

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) contribution directed towards both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for reti ...

, the employee portion of which is also to be withheld from wages. Withholding of income and Social Security taxes are often referred to as payroll tax

Payroll taxes are taxes imposed on employers or employees, and are usually calculated as a percentage of the salaries that employers pay their employees. By law, some payroll taxes are the responsibility of the employee and others fall on the em ...

.

Statute of limitations

The IRS is precluded from assessing additional tax after a certain period of time. In the case of federal income tax, this period is generally three years from the later of the due date of the original tax return or the date the original return was filed. The IRS has an additional three more years to make changes if the taxpayer has substantially understated gross income. The period under which the IRS may make changes is unlimited in the case of fraud, or in the case of failure to file a return.

Penalties

Taxpayers who fail to file returns, file late, or file returns that are wrong, may be subject to penalties. These penalties vary based on the type of failure. Some penalties are computed as interest, some are fixed amounts, and some are based on other measures. Penalties for filing or paying late are generally based on the amount of tax that should have been paid and the degree of lateness. Penalties for failures related to certain forms are fixed amounts, and vary by form from very small to huge.

Intentional failures, including tax fraud, may result in criminal penalties. These penalties may include jail time or forfeiture of property. Criminal penalties are assessed in coordination with the United States Department of Justice

The United States Department of Justice (DOJ), also known as the Justice Department, is a federal executive department of the United States government tasked with the enforcement of federal law and administration of justice in the United State ...

.

History

Constitutional

Article I, Section 8, Clause 1 of the United States Constitution (the "

Article I, Section 8, Clause 1 of the United States Constitution (the "Taxing and Spending Clause

The Taxing and Spending Clause (which contains provisions known as the General Welfare Clause and the Uniformity Clause), Article I, Section 8, Clause 1 of the United States Constitution, grants the federal government of the United States it ...

"), specifies Congress

A congress is a formal meeting of the representatives of different countries, constituent states, organizations, trade unions, political parties, or other groups. The term originated in Late Middle English to denote an encounter (meeting of a ...

's power to impose "Taxes, Duties, Imposts and Excises", but Article I, Section 8 requires that, "Duties, Imposts and Excises shall be uniform throughout the United States."

The Constitution specifically stated Congress' method of imposing direct taxes, by requiring Congress to distribute direct taxes in proportion to each state's population "determined by adding to the whole Number of free Persons, including those bound to Service for a Term of Years, and excluding Indians not taxed, three fifths of all other Persons". It had been argued that head tax

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources.

Head taxes were important sources of revenue for many governments fr ...

es and property tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inheri ...

es (slaves could be taxed as either or both) were likely to be abused, and that they bore no relation to the activities in which the federal government had a legitimate interest. The fourth clause of section 9 therefore specifies that, "No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken."

Taxation was also the subject of Federalist No. 33