Homeownership in the United States on:

[Wikipedia]

[Google]

[Amazon]

The home-ownership rate in the

The home-ownership rate in the

SignOnSanDiego.com, URL accessed 28 December 2008 Home-ownership was most common in rural areas and suburbs, with three quarters of suburban households being homeowners. Among the country's regions, the

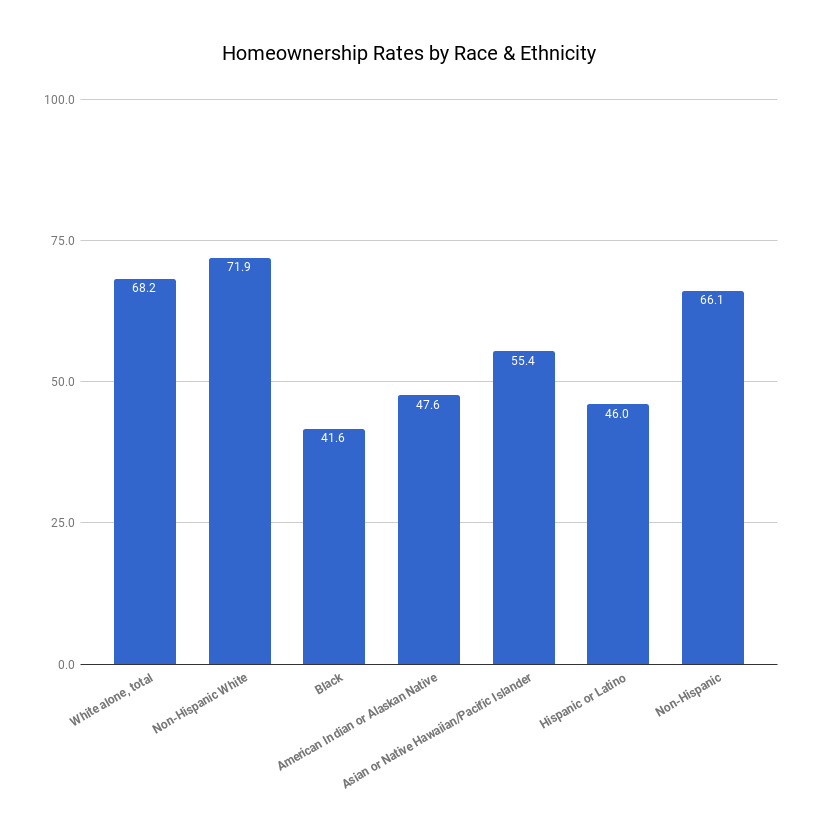

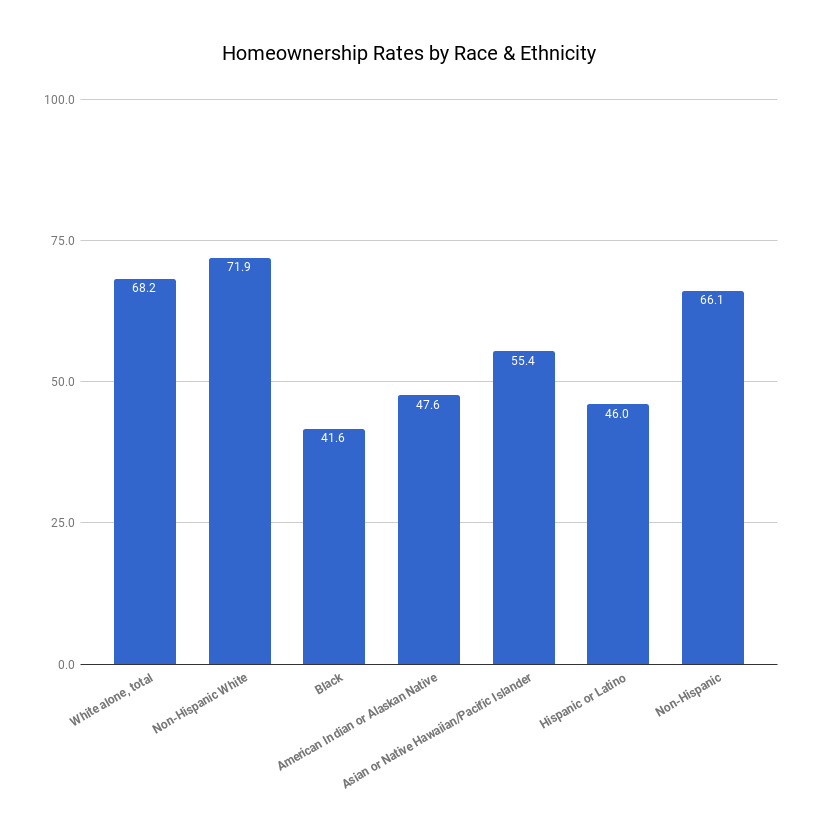

The homeownership rate, as well as its change over time, has varied significantly by race. While homeowners constitute the majority of

The homeownership rate, as well as its change over time, has varied significantly by race. While homeowners constitute the majority of  The strongest increase in the percentage of homeowners in the first half of the decade of the 2000s was among non-white minorities. The homeownership rate for minorities approached the sixty percent mark in 2006, which was a significant change because less than half of all minority households owned homes as recently as 1994. The ownership rate for minorities increased by 25.6%, from 47.7% in 1993 to 59.9% in 2006. This rate fell after the 2006 peak, consistent with overall homeownership rates.

The increase among

The strongest increase in the percentage of homeowners in the first half of the decade of the 2000s was among non-white minorities. The homeownership rate for minorities approached the sixty percent mark in 2006, which was a significant change because less than half of all minority households owned homes as recently as 1994. The ownership rate for minorities increased by 25.6%, from 47.7% in 1993 to 59.9% in 2006. This rate fell after the 2006 peak, consistent with overall homeownership rates.

The increase among

U.S. Census Bureau's Housing Vacancy Survey

{{North America in topic, Home-ownership in Wealth in the United States Economy of the United States Housing in the United States Ownership

The home-ownership rate in the

The home-ownership rate in the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

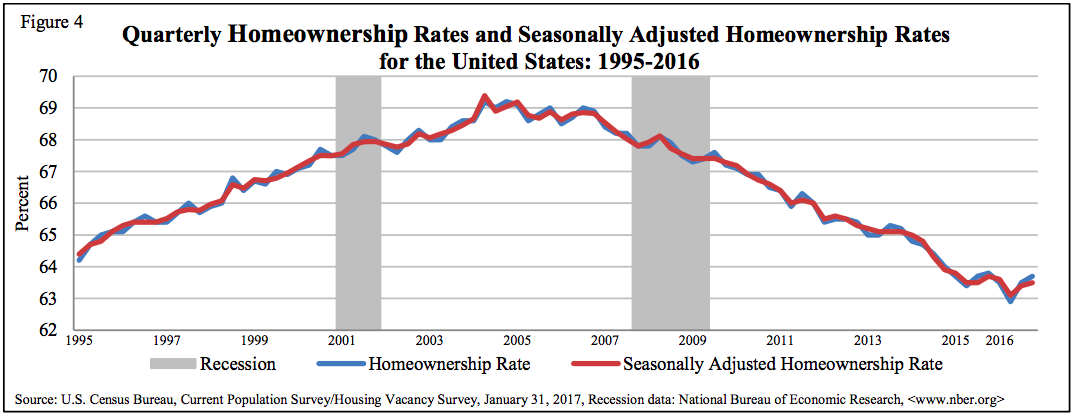

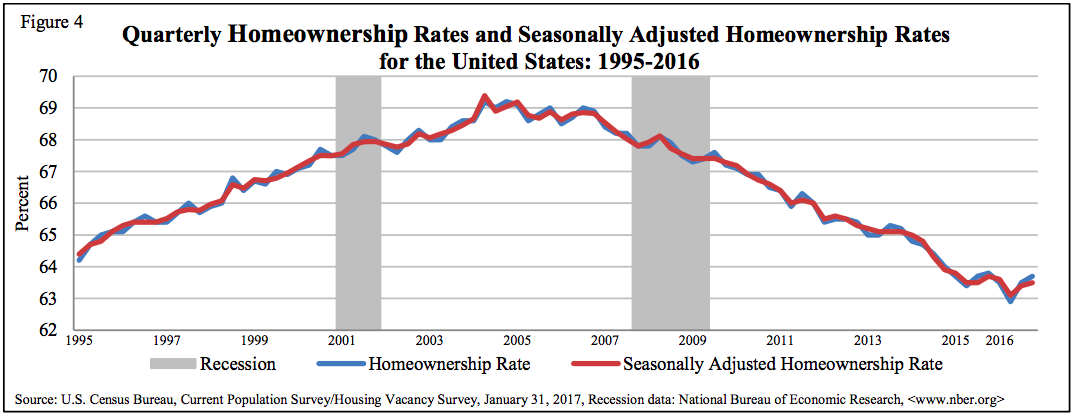

is the percentage of homes that are owned by their occupants. In 2009, it remained similar to that in some other post-industrial nations with 67.4% of all occupied housing units being occupied by the unit's owner. Home ownership rates vary depending on demographic characteristics of households such as ethnicity, race, type of household as well as location and type of settlement. In 2018, home-ownership dropped to a lower rate than it was in 1994, with a rate of 64.2%.

Since 1960, the home-ownership rate in the United States has remained relatively stable. It has decreased 1.0% since 1960, when 65.2% of American households owned their own home. Additionally, homeowner equity has fallen steadily since World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposin ...

and is now less than 50% of the value of homes on average.Federal Reserve report shows homeowner equity dipping below 50 percent, lowest on recordSignOnSanDiego.com, URL accessed 28 December 2008 Home-ownership was most common in rural areas and suburbs, with three quarters of suburban households being homeowners. Among the country's regions, the

Midwestern United States

The Midwestern United States, also referred to as the Midwest or the American Midwest, is one of four census regions of the United States Census Bureau (also known as "Region 2"). It occupies the northern central part of the United States. I ...

had the highest home-ownership rate and the Western United States

The Western United States (also called the American West, the Far West, and the West) is the region comprising the westernmost states of the United States. As American settlement in the U.S. expanded westward, the meaning of the term ''the Wes ...

had the lowest. Recent research has examined the decline in home-ownership rates among households with "heads" aged 25 to 44 years. The rates fell substantially between 1980 and 2000, and recovered only partially during the United States housing bubble

The 2000s United States housing bubble was a real-estate bubble affecting over half of the U.S. states. It was the impetus for the subprime mortgage crisis. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reac ...

of the early 2000s. This research indicates that a trend toward marrying later and the increase in household earnings risk that occurred after 1980 account for a large share of the decline in young home-ownership.

In general, homeowners in the United States also tend to have higher incomes. Households residing in their own home were more likely to be families (as opposed to individuals) than were their tenant counterparts. Among racial demographics, White Americans

White Americans are Americans who identify as and are perceived to be white people. This group constitutes the majority of the people in the United States. As of the 2020 Census, 61.6%, or 204,277,273 people, were white alone. This represented ...

had the country's highest home-ownership rate, while African Americans

African Americans (also referred to as Black Americans and Afro-Americans) are an ethnic group consisting of Americans with partial or total ancestry from sub-Saharan Africa. The term "African American" generally denotes descendants of ens ...

had the lowest home-ownership rate. One study shows that home-ownership rates appear correlated with higher school attainment.

The name "home-ownership rate" can be misleading. As defined by the US Census Bureau

The United States Census Bureau (USCB), officially the Bureau of the Census, is a principal agency of the U.S. Federal Statistical System, responsible for producing data about the American people and economy. The Census Bureau is part of the ...

, it is the percentage of homes that are occupied by the owner. It is not the percentage of adults that own their own home. This latter percentage will be significantly lower than the home-ownership rate. Many households that are owner-occupied contain adult relatives (often young adult

A young adult is generally a person in the years following adolescence. Definitions and opinions on what qualifies as a young adult vary, with works such as Erik Erikson's stages of human development significantly influencing the definition of ...

s, descendants of the owner) who do not own their own home. Single building multi-bedroom rental units can contain more than one adult, all of whom do not own a home.

The term "home-ownership rate" can also be misleading because it includes households that owe on a mortgage

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any pu ...

. Which means that they do not fully own the equity in their own home, which they are said to "own". According to ATTOM Data Research, only "34 percent of all American homeowners have 100 percent equity in their properties — they’ve either paid off their entire mortgage debt or they never had a mortgage".

According to the ''Financial Post

The ''Financial Post'' was an English Canadian business newspaper, which published from 1907 to 1998. In 1998, the publication was folded into the new ''National Post'',"Black says Post to merge with new paper". ''The Globe and Mail'', July 23, ...

'' the cost of the average U.S. house in 2016 was US$187,000.

Measuring method

In the United States, the home ownership rate is created through the ''Housing Vacancy Survey'' by the U.S. Census Bureau. It is created by dividing theowner occupied

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, ...

units by the total number of occupied units. This is an important point to understand changes in the home ownership rate over time. The bust of the housing bubble

A housing bubble (or a housing price bubble) is one of several types of asset price bubbles which periodically occur in the market. The basic concept of a housing bubble is the same as for other asset bubbles, consisting of two main phases. Firs ...

resulted in many houses becoming foreclosed. However, the decrease in the home ownership rate from 3Q2007 to 4Q2007 was mostly a result of an increase in the renter's population and less due to a decrease in the homeowner population.

Government policy

Homeownership has been promoted as government policy using several means involving mortgage debt and thegovernment sponsored entities

A state-owned enterprise (SOE) is a government entity which is established or nationalised by the ''national government'' or ''provincial government'' by an executive order or an act of legislation in order to earn profit for the government ...

Freddie Mac

The Federal Home Loan Mortgage Corporation (FHLMC), commonly known as Freddie Mac, is a publicly traded, government-sponsored enterprise (GSE), headquartered in Tysons Corner, Virginia.Fannie Mae

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the N ...

, and the Federal Home Loan Banks

The Federal Home Loan Banks (FHLBanks, or FHLBank System) are 11 U.S. government-sponsored banks that provide liquidity to the members of financial institutions to support housing finance and community investment.

Overview

The FHLBank System was ...

, which fund or guarantee $6.5 trillion of assets with the purpose of directly or indirectly promoting homeownership. Homeownership has been further promoted through tax policy which allows a tax deduction

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. T ...

for mortgage interest payments on a primary residence A person's primary residence, or main residence is the dwelling where they usually live, typically a house or an apartment. A person can only have one ''primary'' residence at any given time, though they may share the residence with other people. A ...

. The Community Reinvestment Act

The Community Reinvestment Act (CRA, P.L. 95-128, 91 Stat. 1147, title VIII of the Housing and Community Development Act of 1977, ''et seq.'') is a United States federal law designed to encourage commercial banks and savings associations to hel ...

also encourages homeownership for low-income earners. The promotion of homeownership by the government through encouraging mortgage borrowing and lending has given rise to debates regarding government policies and the subprime mortgage crisis

The U.S. subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007. It was characterized by a rise in subprime mortgage delinquencies and foreclosures, and the resulting d ...

.

Race

: The homeownership rate, as well as its change over time, has varied significantly by race. While homeowners constitute the majority of

The homeownership rate, as well as its change over time, has varied significantly by race. While homeowners constitute the majority of white

White is the lightest color and is achromatic (having no hue). It is the color of objects such as snow, chalk, and milk, and is the opposite of black. White objects fully reflect and scatter all the visible wavelengths of light. White on ...

, Asian

Asian may refer to:

* Items from or related to the continent of Asia:

** Asian people, people in or descending from Asia

** Asian culture, the culture of the people from Asia

** Asian cuisine, food based on the style of food of the people from Asi ...

and Native American households, the homeownership rates for African American

African Americans (also referred to as Black Americans and Afro-Americans) are an ethnic group consisting of Americans with partial or total ancestry from sub-Saharan Africa. The term "African American" generally denotes descendants of ens ...

s and Latinos

Hispanic and Latino Americans ( es, Estadounidenses hispanos y latinos; pt, Estadunidenses hispânicos e latinos) are Americans of Spanish and/or Latin American ancestry. More broadly, these demographics include all Americans who identify as ...

have typically fallen short of the fifty percent threshold. Whites have had the highest homeownership rate, followed by Asians

Asian people (or Asians, sometimes referred to as Asiatic people)United States National Library of Medicine. Medical Subject Headings. 2004. November 17, 200Nlm.nih.gov: ''Asian Continental Ancestry Group'' is also used for categorical purpos ...

and Native Americans.

Although a landmark United States Supreme Court

The Supreme Court of the United States (SCOTUS) is the highest court in the federal judiciary of the United States. It has ultimate appellate jurisdiction over all U.S. federal court cases, and over state court cases that involve a point o ...

ruling ''Shelley v. Kraemer

''Shelley v. Kraemer'', 334 U.S. 1 (1948), is a List of landmark court decisions in the United States, landmark United States Supreme Court case that held that racially restrictive housing Covenant (law), covenants cannot legally be enforced.

The ...

'' , ruled invalid exclusionary racial covenants, which almost always barred black citizens from owning a home but often extended to American Jews

American Jews or Jewish Americans are American citizens who are Jewish, whether by religion, ethnicity, culture, or nationality. Today the Jewish community in the United States consists primarily of Ashkenazi Jews, who descend from diaspora J ...

, Asian Americans, Mexican Americans

Mexican Americans ( es, mexicano-estadounidenses, , or ) are Americans of full or partial Mexican heritage. In 2019, Mexican Americans comprised 11.3% of the US population and 61.5% of all Hispanic and Latino Americans. In 2019, 71% of Mexica ...

, and non-citizens and other ethnic groups and could be used by white real estate owners to enforce or introduce racial segregation

Racial segregation is the systematic separation of people into race (human classification), racial or other Ethnicity, ethnic groups in daily life. Racial segregation can amount to the international crime of apartheid and a crimes against hum ...

, threats of legal action allowed them to remain effective for some time afterwards. Racial steering Racial steering refers to the practice in which real estate brokers guide prospective home buyers towards or away from certain neighborhoods based on their race. The term is used in the context of ''de facto'' residential segregation in the United S ...

practices later on also affected patterns of home ownership among non-whites and the cumulative effects of exclusionary covenants, racial steering, and other segregation measures have resulted in lower property values, less capital accumulation, lower municipal tax revenues, and disinvestment in black communities. Despite the fact that the ''Shelley v. Kraemer'' decision found exclusionary covenants to be unconstitutional under the Fourteenth Amendment to the United States Constitution

The Fourteenth Amendment (Amendment XIV) to the United States Constitution was adopted on July 9, 1868, as one of the Reconstruction Amendments. Often considered as one of the most consequential amendments, it addresses citizenship rights and ...

's Equal Protection Clause

The Equal Protection Clause is part of the first section of the Fourteenth Amendment to the United States Constitution. The clause, which took effect in 1868, provides "''nor shall any State ... deny to any person within its jurisdiction the equal ...

ago, and hence unenforceable, the clauses are still present in many deeds well into the twenty-first century.

Hispanics had the lowest homeownership rate in the country in all years, except for 2002, up until 2005. For the last half of the decade of the 2000s the homeownership rate for Hispanics exceeded that of African American

African Americans (also referred to as Black Americans and Afro-Americans) are an ethnic group consisting of Americans with partial or total ancestry from sub-Saharan Africa. The term "African American" generally denotes descendants of ens ...

s. Temporal fluctuations were slight for all races, with rates commonly not changing more than two percentage points per year.

:

The strongest increase in the percentage of homeowners in the first half of the decade of the 2000s was among non-white minorities. The homeownership rate for minorities approached the sixty percent mark in 2006, which was a significant change because less than half of all minority households owned homes as recently as 1994. The ownership rate for minorities increased by 25.6%, from 47.7% in 1993 to 59.9% in 2006. This rate fell after the 2006 peak, consistent with overall homeownership rates.

The increase among

The strongest increase in the percentage of homeowners in the first half of the decade of the 2000s was among non-white minorities. The homeownership rate for minorities approached the sixty percent mark in 2006, which was a significant change because less than half of all minority households owned homes as recently as 1994. The ownership rate for minorities increased by 25.6%, from 47.7% in 1993 to 59.9% in 2006. This rate fell after the 2006 peak, consistent with overall homeownership rates.

The increase among white American

White Americans are Americans who identify as and are perceived to be white people. This group constitutes the majority of the people in the United States. As of the 2020 Census, 61.6%, or 204,277,273 people, were white alone. This represented ...

s was less substantial. In 2005, 75.8% of white Americans owned their own homes, compared to 70% in 1993, and the rate fell during the last half of the decade of the 2000s, slightly more slowly than for the rest of the population. Thus one can conclude that despite a large remaining discrepancy between the homeownership rates among different racial groups, the gap had been closing up until the peak, with ownership rates increasing more substantially for minorities than for whites, but subsequently began slightly widening.

SOURCE: US Census Bureau, 2016

Type of household

There is a strong correlation between the type and age of a household's family structure and homeownership. As of 2006, married couple families, which also have the highestmedian income

The median income is the income amount that divides a population into two equal groups, half having an income above that amount, and half having an income below that amount. It may differ from the mean (or average) income. Both of these are ways of ...

of any household type, were most likely to own a home. Age played a significant role as well with homeownership increasing with the age of the householder until age 65, when a slight decrease becomes visible. While only 43% of households with a householder under the age of thirty-five owned a home, 81.6% of those with a householder between the ages of 55 and 64 did.

This means that households with a middle-aged

In the history of Europe, the Middle Ages or medieval period lasted approximately from the late 5th to the late 15th centuries, similar to the Post-classical, post-classical period of World history (field), global history. It began with t ...

householder were nearly twice as likely to own a home as those with a young householder. Overall married couple families with a householder age 70 to 74 had the highest homeownership rate with 93.3% being homeowners. The lowest homeownership rate was recorded for single females under the age of twenty-five of whom only 13.6%, were homeowners. Yet, single females had an overall higher homeownership rate than single males and single mothers.

Income

There are considerable correlations betweenincome

Income is the consumption and saving opportunity gained by an entity within a specified timeframe, which is generally expressed in monetary terms. Income is difficult to define conceptually and the definition may be different across fields. For ...

, homeownership rate and housing characteristics. As income is closely linked to social status

Social status is the level of social value a person is considered to possess. More specifically, it refers to the relative level of respect, honour, assumed competence, and deference accorded to people, groups, and organizations in a society. Stat ...

, sociologist Leonard Beeghley has made the hypothesis that "the lower the social class, then the fewer amenities built into housing." According to 2002, US Census Bureau data housing characteristics vary considerably with income. For homeowners with middle-range household incomes, ranging from $40,000 to $60,000, the median home value

A home, or domicile, is a space used as a permanent or semi-permanent residence for one or many humans, and sometimes various companion animals. It is a fully or semi sheltered space and can have both interior and exterior aspects to it. H ...

was $112,000, while the median size was and the median year of construction was 1970. A slight majority, 54% of homes occupied by owners in this group had two or more bathrooms.

Among homeowners with household incomes in the top 10%, those earning more than $120,000 a year, home values were considerably higher while houses were larger and newer. The median value for homes in this demographic was $256,000 while median square footage was 2,500 and the median year of construction was 1977. The vast majority, 80%, had two or more bathrooms. Overall, houses of those with higher incomes were larger, newer, more expensive with more amenities.

Political influence

Homeownership influences the political participation of individuals, with homeowners more likely to participate inlocal elections

In many parts of the world, local elections take place to select office-holders in local government, such as mayors and councillors. Elections to positions within a city or town are often known as "municipal elections". Their form and conduct vary ...

. Owning a home increases the likelihood of participating in local primaries by 35%. Voter turnout probability increases with the value of the home. Becoming a homeowner influences an individual's political outlook, as they are more likely to vote in ways they perceive as protecting their investment. Being a homeowner increases the likelihood of political participation by 75% when issue of zoning

Zoning is a method of urban planning in which a municipality or other tier of government divides land into areas called zones, each of which has a set of regulations for new development that differs from other zones. Zones may be defined for a si ...

are decided. For national elections, homeowners are more likely than renters to participate in primaries and general elections; their turnout is about 10 points higher than renters for general elections.

For those who use private mortgages to finance homeownership, their party affiliation polarizes towards one of the two major political parties. Individuals who buy homes through Federal Housing Administration

The Federal Housing Administration (FHA), also known as the Office of Housing within the Department of Housing and Urban Development (HUD), is a United States government agency founded by President Franklin Delano Roosevelt, created in part ...

-supported mortgages are much more likely to become Democrats.

Historical

International comparison (2002)

See also

* List of countries by home ownership rate *Household income in the United States

Household income is an economic standard that can be applied to one household, or aggregated across a large group such as a county, city, or the whole country. It is commonly used by the United States government and private institutions to ...

*Real estate pricing

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value for real property (usually market value). Real estate transactions often require appraisals because they occur infrequently and every prop ...

*Economy of the United States

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita GD ...

*Housing insecurity in the United States

Housing insecurity is the lack of security in an individual shelter that is the result of high housing costs relative to income, poor housing quality, unstable neighborhoods, overcrowding, and, but may not include, homelessness.

Measuring hou ...

*Eviction in the United States

Eviction in the United States refers to the pattern of tenant removal by landlords in the United States. In an eviction process, landlords forcibly remove tenants from their place of residence and reclaim the property."Eviction". 2022. LII / Legal ...

*Poverty in the United States

In the United States, poverty has both social and political implications. In 2020, there were 37.2 million people in poverty. Some of the many causes include income inequality, inflation, unemployment, debt traps and poor education.Western, B ...

*Homelessness in the United States

Homelessness in the United States refers to the issue of homelessness in the United States, a condition wherein people lack a fixed, regular, and adequate residence. The number of homeless people varies from different federal government accou ...

Footnotes

References

Further reading

* Kwak, Nancy H. ''A World of Homeowners: American Power and the Politics of Housing Aid'' ( University of Chicago Press, 2015). 328 pp. * Thurston, Chloe N. (2018). '' At the Boundaries of Homeownership: Credit, Discrimination, and the American State''. Cambridge University Press.External links

U.S. Census Bureau's Housing Vacancy Survey

{{North America in topic, Home-ownership in Wealth in the United States Economy of the United States Housing in the United States Ownership