Government Pension Fund Of Norway on:

[Wikipedia]

[Google]

[Amazon]

The Government Pension Fund of Norway ( no, Statens pensjonsfond) comprises two entirely separate

The domestic fund, the Government Pension Fund Norway, is managed by Folketrygdfondet. The global investment fund is managed by Norges Bank Investment Management (NBIM), part of the Norwegian Central Bank on the behalf of the

The domestic fund, the Government Pension Fund Norway, is managed by Folketrygdfondet. The global investment fund is managed by Norges Bank Investment Management (NBIM), part of the Norwegian Central Bank on the behalf of the

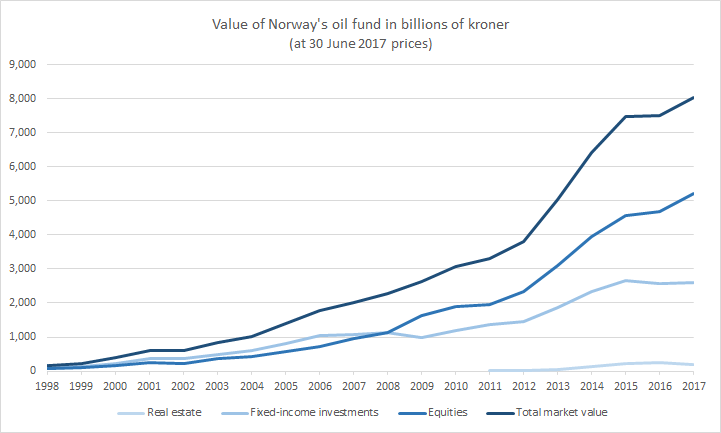

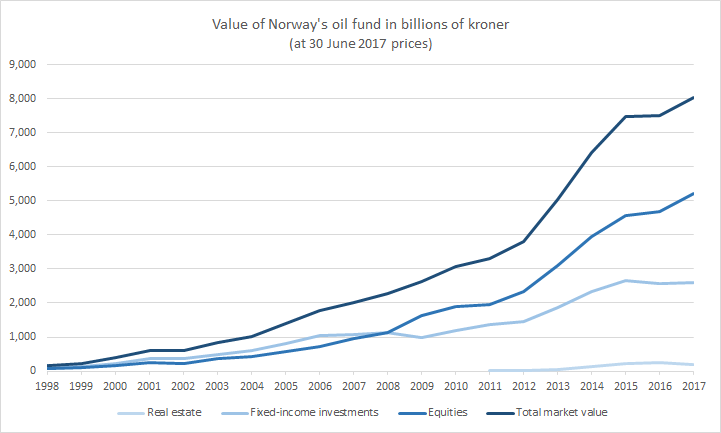

15 August 2015 It is the largest pension fund in Europe and larger than the California public-employees pension fund ( CalPERS), one of the largest in the United States. As of June 2011, it was the largest pension fund in the world, but it is not a pension fund in the conventional sense, as it derives its financial backing from oil profits, not pension contributions. In September 2017, the fund exceeded US$1 trillion in value for the first time, a thirteen-fold increase since 2002. With a population of 5.2 million people, the fund was worth $192,307 per Norwegian citizen. Of the assets, 65% were equities (accounting for 1.3% of global equity markets), and the rest were property and fixed-income investments. Norway can withdraw up to 3% of the fund's value each year. The first withdrawal in its history was made in 2016. In a parliamentary white paper in April 2011, the Norwegian Ministry of Finance forecast that the fund would reach $1 trillion by the end of 2019. According to the forecast, a worst-case scenario for the fund value in 2030 was forecast at $455 billion, and a best case scenario at $3.3 trillion. With 2.33 percent of European stocks, it is the largest stock owner in Europe. In 1998, the fund was allowed to invest up to 40 percent of its portfolio in the international

Norwegian Ministry of Finance: On the Government Pension FundThe Government Pension Fund – Norway: Official siteThe Government Pension Fund – Global: Official site

{{DEFAULTSORT:Government Pension Fund Of Norway, The 1967 establishments in Norway 1990 establishments in Norway 1967 in politics 1990 in politics 1967 in economics 1990 in economics Sovereign wealth funds Public pension funds Public finance of Norway Retirement in Norway Government of Norway North Sea energy

sovereign wealth fund

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as ...

s owned by the government of Norway

The politics of Norway take place in the framework of a parliamentary system, parliamentary, representative democracy, representative democratic constitutional monarchy. Executive power is exercised by the Council of State (Norway), Council of St ...

.

The Government Pension Fund Global, also known as the Oil Fund, was established in 1990 to invest the surplus revenues of the Norwegian petroleum sector. It has over US$1.19 trillion in assets, and holds 1.4% of all of the world’s listed companies, making it among the world’s largest sovereign wealth funds. In December 2021, it was worth about $250,000 per Norwegian citizen. It also holds portfolios of real estate and fixed-income investments. Many companies are excluded by the fund on ethical grounds.

The Government Pension Fund Norway is smaller and was established in 1967 as a type of national insurance fund. It is managed separately from the Oil Fund and is limited to domestic and Scandinavian investments and is therefore a key stock holder in many large Norwegian companies, predominantly via the Oslo Stock Exchange

Oslo Stock Exchange ( no, Oslo Børs) (OSE: OSLO) is a stock exchange within the Nordic countries and offers Norway’s only regulated markets for securities trading today. The stock exchange offers a full product range including equities, der ...

.

Government Pension Fund Global

The Government Pension Fund Global ( no, Statens pensjonsfond Utland, SPU) is a fund into which thesurplus

Surplus may refer to:

* Economic surplus, one of various supplementary values

* Excess supply, a situation in which the quantity of a good or service supplied is more than the quantity demanded, and the price is above the equilibrium level determ ...

wealth produced by Norwegian petroleum income is deposited. Its name changed in January 2006 from the Petroleum Fund of Norway. The fund is commonly referred to as the Oil Fund ().

The purpose of the fund is to invest parts of the large surplus generated by the Norwegian petroleum sector, mainly from taxes of companies but also payment for licenses to explore for oil as well as the State's Direct Financial Interest and dividends from the partly state-owned Equinor

Equinor ASA (formerly Statoil and StatoilHydro) is a Norwegian state-owned multinational energy company headquartered in Stavanger. It is primarily a petroleum company, operating in 36 countries with additional investments in renewable energy. I ...

. Current revenue from the petroleum sector is estimated to be at its peak period and to decline in the future decades. The Petroleum Fund was established in 1990 after a decision by the country's legislature to counter the effects of the forthcoming decline in income and to smooth out the disruptive effects of highly fluctuating oil prices.

As its name suggests, the Government Pension Fund Global is invested in international financial markets, so the risk is independent from the Norwegian economy. Over 9,123 companies in 73 countries are invested in the fund (2021). On 25 October 2019, the fund's value reached 10,000 billion Kroner, according to its official website.

Background

Norway has experiencedeconomic

An economy is an area of the production, distribution and trade, as well as consumption of goods and services. In general, it is defined as a social domain that emphasize the practices, discourses, and material expressions associated with th ...

surpluses since the development of its hydrocarbon

In organic chemistry, a hydrocarbon is an organic compound consisting entirely of hydrogen and carbon. Hydrocarbons are examples of group 14 hydrides. Hydrocarbons are generally colourless and hydrophobic, and their odors are usually weak or ...

resources

Resource refers to all the materials available in our environment which are technologically accessible, economically feasible and culturally sustainable and help us to satisfy our needs and wants. Resources can broadly be classified upon their av ...

in the 70s. This reality, coupled with the desire to mitigate volatility stemming from fluctuating oil prices

The price of oil, or the oil price, generally refers to the spot price of a barrel () of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPE ...

, motivated the creation of Norway's Oil Fund, now the Government Pension Fund-Global (GPF-G). The instability of oil prices has been of constant concern for oil-dependent countries since the start of the oil boom

An oil boom is a period of large inflow of income as a result of high global oil prices or large oil production in an economy. Generally, this short period initially brings economic benefits, in terms of increased GDP growth, but might later le ...

, but especially so in the decades following the first oil shocks in the 1970s. As the real GDP

Real gross domestic product (real GDP) is a macroeconomic measure of the value of economic output adjusted for price changes (i.e. inflation or deflation). This adjustment transforms the money-value measure, nominal GDP, into an index for quantity ...

of oil-exporting states is linked with the price of oil, it has been a goal of these exporters to stabilize oil consumption patterns, and a host of these exporting states singled out sovereign wealth funds as an effective policy tool

Policy is a deliberate system of guidelines to guide decisions and achieve rational outcomes. A policy is a statement of intent and is implemented as a procedure or protocol. Policies are generally adopted by a governance body within an organ ...

for achieving this outcome. The adoption of the GPF-G has been in line global economic trends, especially investment patterns. International investment

International is an adjective (also used as a noun) meaning "between nations".

International may also refer to:

Music Albums

* ''International'' (Kevin Michael album), 2011

* ''International'' (New Order album), 2002

* ''International'' (The T ...

has increased at a significantly higher pace than either global GDP or global trade of goods

In economics, goods are items that satisfy human wants

and provide utility, for example, to a consumer making a purchase of a satisfying product. A common distinction is made between goods which are transferable, and services, which are not ...

and services, increasing by 175% over a period at which the former two metrics increased by 53% and 93% respectively.

Management and size

The domestic fund, the Government Pension Fund Norway, is managed by Folketrygdfondet. The global investment fund is managed by Norges Bank Investment Management (NBIM), part of the Norwegian Central Bank on the behalf of the

The domestic fund, the Government Pension Fund Norway, is managed by Folketrygdfondet. The global investment fund is managed by Norges Bank Investment Management (NBIM), part of the Norwegian Central Bank on the behalf of the Ministry of Finance A ministry of finance is a part of the government in most countries that is responsible for matters related to the finance.

Lists of current ministries of finance

Named "Ministry"

* Ministry of Finance (Afghanistan)

* Ministry of Finance and Ec ...

.theglobeandmail.com: "Alberta and Norway: Two oil powers, worlds apart"15 August 2015 It is the largest pension fund in Europe and larger than the California public-employees pension fund ( CalPERS), one of the largest in the United States. As of June 2011, it was the largest pension fund in the world, but it is not a pension fund in the conventional sense, as it derives its financial backing from oil profits, not pension contributions. In September 2017, the fund exceeded US$1 trillion in value for the first time, a thirteen-fold increase since 2002. With a population of 5.2 million people, the fund was worth $192,307 per Norwegian citizen. Of the assets, 65% were equities (accounting for 1.3% of global equity markets), and the rest were property and fixed-income investments. Norway can withdraw up to 3% of the fund's value each year. The first withdrawal in its history was made in 2016. In a parliamentary white paper in April 2011, the Norwegian Ministry of Finance forecast that the fund would reach $1 trillion by the end of 2019. According to the forecast, a worst-case scenario for the fund value in 2030 was forecast at $455 billion, and a best case scenario at $3.3 trillion. With 2.33 percent of European stocks, it is the largest stock owner in Europe. In 1998, the fund was allowed to invest up to 40 percent of its portfolio in the international

stock market

A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks (also called shares), which represent ownership claims on businesses; these may include ''securities'' listed on a public stock exchange, ...

. In June 2009, the ministry decided to raise the stock portion to 60 percent. In May 2014, the Central Bank governor proposed raising the rate to 70 percent. The Norwegian government planned that up to 5 percent of the fund should be invested in real estate

Real estate is property consisting of land and the buildings on it, along with its natural resources such as crops, minerals or water; immovable property of this nature; an interest vested in this (also) an item of real property, (more genera ...

, beginning in 2010. A specific policy for the real estate investments was suggested in a report the Swiss Partners Group wrote for the Norwegian Ministry of Finance.

Norway's sovereign wealth fund is taking steps to become more active in company governance. In the second quarter of 2013, the sovereign fund voted in 6,078 general meetings as well as 239 shareholder proposals on environmental and social issues. Norway's Government Pension Fund Global (GPFG) has the potential to influence the corporate governance market in Europe, and possibly China as well, greatly. It has also started to become active in pushing for lower executive pay.

Relationship to sovereignty

The rise of globalization as the predominant political-economic system has had several key effects on states, especially in regard tointerdependence

Systems theory is the interdisciplinary study of systems, i.e. cohesive groups of interrelated, interdependent components that can be natural or human-made. Every system has causal boundaries, is influenced by its context, defined by its structu ...

and sovereignty

Sovereignty is the defining authority within individual consciousness, social construct, or territory. Sovereignty entails hierarchy within the state, as well as external autonomy for states. In any state, sovereignty is assigned to the perso ...

. The erosion of fully independent socioeconomic

Socioeconomics (also known as social economics) is the social science that studies how economic activity affects and is shaped by social processes. In general it analyzes how modern societies progress, stagnate, or regress because of their l ...

structures has provoked new questions regarding the role of the state and its ability to project

A project is any undertaking, carried out individually or collaboratively and possibly involving research or design, that is carefully planned to achieve a particular goal.

An alternative view sees a project managerially as a sequence of even ...

its sovereignty on a set of global economic systems that seem largely out of reach both legally

Law is a set of rules that are created and are enforceable by social or governmental institutions to regulate behavior,Robertson, ''Crimes against humanity'', 90. with its precise definition a matter of longstanding debate. It has been vari ...

and pragmatically for most states. Sovereign wealth funds are an inherently nationalist

Nationalism is an idea and movement that holds that the nation should be congruent with the state. As a movement, nationalism tends to promote the interests of a particular nation (as in a group of people), Smith, Anthony. ''Nationalism: Th ...

type of investment vehicle, and there exists potential for their use as a mitigating force to the supranational forces of globalization. The issue with this is that such practices may lead to a general increase in protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulation ...

as nations attempt to wrestle back control of their economies from external forces, an outcome that most economic intergovernmental organizations, such as the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

, would like to see avoided. Some commentators, like Professor Gordon L. Clark of the University of Oxford

, mottoeng = The Lord is my light

, established =

, endowment = £6.1 billion (including colleges) (2019)

, budget = £2.145 billion (2019–20)

, chancellor ...

, express concerns regarding non-profit considerations motivating the practices of the GPF-G, especially in regards to its ethical concerns and how these considerations may be used as a means of exerting Norwegian standards on foreign firms. On the other hand, the OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate ...

has stated that sovereign wealth funds have had a stabilizing influence on international markets due to their ability to provide capital during times of domestic investor pessimism. The OECD has taken steps to minimize the possibilities of economic protectionism by instituting the Freedom of Investment project, where participating states agree upon guiding sets of principles that seek to boost transparency and transnational investment, while also advising states on how to best handle issues of foreign investment in the sphere of national security

National security, or national defence, is the security and defence of a sovereign state, including its citizens, economy, and institutions, which is regarded as a duty of government. Originally conceived as protection against military att ...

.

Debate

As a result of the large size of the fund relative to the low number of people living in Norway (5.2 million people in 2017), the ''Oil Fund'' has become a hot political issue, dominated by three main issues: * Whether the country should use more of the petroleum revenues for thestate budget

A government budget is a document prepared by the government and/or other political entity presenting its anticipated tax revenues (Inheritance tax, income tax, corporation tax, import taxes) and proposed spending/expenditure (Healthcare, Educa ...

instead of saving the funds for the future. The main matter of debate is to what degree increased government spending would increase inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

.

* Whether the high level of exposure (around 65 percent in 2017) to the highly volatile stock market is financially safe. Others claim that the high diversification and extreme long-term nature of the investments will dilute the risk and that the state is losing considerable amounts of money because of the low investment percentage in the stock market.

* Whether the investment policy of the Petroleum Fund is ethical

Ethics or moral philosophy is a branch of philosophy that "involves systematizing, defending, and recommending concepts of right and wrong behavior".''Internet Encyclopedia of Philosophy'' The field of ethics, along with aesthetics, concerns ma ...

.

Concerns and potential outcomes

There are diverse concerns and predicted effects of sovereign wealth funds on internationalfinancial markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial ma ...

and the global economy as a whole, with experts expressing strong fears regarding destabilization

The word destabilisation can be applied to a wide variety of contexts such as attempts to undermine political, military or economic power.

Psychology

In a psychological context it is used as a technique in brainwashing and abuse to disorient ...

and protectionism

Protectionism, sometimes referred to as trade protectionism, is the economic policy of restricting imports from other countries through methods such as tariffs on imported goods, import quotas, and a variety of other government regulation ...

stemming from sovereign wealth funds. The destabilization argument, often cited by Roland Beck of the European Central Bank

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important centra ...

, is that non-market investment motives may lead sovereign wealth funds managers to make decisions that go against market logic, in turn causing an unexpected and potentially disastrous ripple effect. The protectionist argument, mentioned above in relation to sovereignty and sovereign wealth funds, is essentially a fear that sovereign wealth funds could be used in a non-market, protectionist manner where competing states would perpetuate ever-increasing anti-global free trade

Free trade is a trade policy that does not restrict imports or exports. It can also be understood as the free market idea applied to international trade. In government, free trade is predominantly advocated by political parties that hold econ ...

movements. However, despite these fears, there is also strong evidence to suggest that sovereign wealth funds are unlikely to gain board of directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit orga ...

seats in their acquisitions. Additionally, Norway’s GPF-G is especially unlikely to gain any board-of-directors seats in a company headquartered in an OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate ...

country. Furthermore, some experts directly contradict fears regarding the destabilizing effect of sovereign wealth funds, arguing that these funds increase the stability of global finance due to the fact that they serve to increase the variety of owners of risky financial vehicles, minimizing exposure to shocks in any one particular industry, while also simultaneously limiting the absolute loss any actor can suffer in a particular global economic sector

One classical breakdown of economic activity distinguishes three sectors:

* Primary: involves the retrieval and production of raw-material commodities, such as corn, coal, wood or iron. Miners, farmers and fishermen are all workers in the p ...

.

Ethical council

Part of the investment policy debate is related to the discovery of several cases of investment by The Petroleum Fund in very controversial companies, involved in businesses such as arms production, tobacco and fossil fuels. The Petroleum Fund’s Advisory Council on Ethics was established 19 November 2004 by royaldecree

A decree is a legal proclamation, usually issued by a head of state (such as the president of a republic or a monarch), according to certain procedures (usually established in a constitution). It has the force of law. The particular term used ...

. Accordingly, the Ministry of Finance issued a new regulation on the management of the Government Petroleum Fund, which also includes ethical guidelines.

According to its ethical guidelines, the Norwegian pension fund cannot invest money in companies that directly or indirectly contribute to killing, torture, deprivation of freedom or other violations of human rights

Human rights are moral principles or normsJames Nickel, with assistance from Thomas Pogge, M.B.E. Smith, and Leif Wenar, 13 December 2013, Stanford Encyclopedia of PhilosophyHuman Rights Retrieved 14 August 2014 for certain standards of hu ...

in conflict situations or wars. Contrary to popular belief, the fund is allowed to invest in a number of arms-producing companies, as only some kind of weapons, such as nuclear arms, are banned by the ethical guidelines as investment objects.

To support the ethical screening process, the Council on Ethics works with RepRisk

RepRisk AG is an environmental, social, and corporate governance (ESG) data science company based in Zurich, Switzerland, specializing in ESG and business-conduct risk research, and quantitative solutions.

The company runs an online due-dilig ...

ESG Business Intelligence, a global research firm and provider of environmental, social and governance (ESG) risk data. RepRisk monitors the companies in the Norwegian Pension Fund’s portfolio for issues such as severe human rights violations, particularly regarding child labor, forced labour, and violations of individual rights in conflict areas as well as gross environmental degradation

Environmental degradation is the deterioration of the environment through depletion of resources such as quality of air, water and soil; the destruction of ecosystems; habitat destruction; the extinction of wildlife; and pollution. It is defin ...

and corruption. RepRisk has been working with the Council on Ethics since 2009 and in 2014, re-won the tender for ESG data provision for 2014-2017.

An investigation by the Norwegian business newspaper in February 2012 showed that Norway has invested more than $2 billion in 15 technology companies producing technology that can and has been used for filtering, wiretapping

Telephone tapping (also wire tapping or wiretapping in American English) is the monitoring of telephone and Internet-based conversations by a third party, often by covert means. The wire tap received its name because, historically, the monitorin ...

, or surveillance of communication in various countries, among them Iran

Iran, officially the Islamic Republic of Iran, and also called Persia, is a country located in Western Asia. It is bordered by Iraq and Turkey to the west, by Azerbaijan and Armenia to the northwest, by the Caspian Sea and Turkmeni ...

, Syria

Syria ( ar, سُورِيَا or سُورِيَة, translit=Sūriyā), officially the Syrian Arab Republic ( ar, الجمهورية العربية السورية, al-Jumhūrīyah al-ʻArabīyah as-Sūrīyah), is a Western Asian country loc ...

, and Burma

Myanmar, ; UK pronunciations: US pronunciations incl. . Note: Wikipedia's IPA conventions require indicating /r/ even in British English although only some British English speakers pronounce r at the end of syllables. As John C. Wells, Joh ...

. Although surveillance tech is not the primary activity of all the 15 companies, they have all had or still have some kind of connection to such technology. The Ministry of Finance in Norway stated that it would not withdraw investing in these companies or discuss an eventual exclusion of surveillance industry companies from its investments.

On 19 January 2010 the Ministry of Finance announced that 17 tobacco companies had been excluded from the fund. The total divestment from these companies was $2 billion (NOK 14.2 billion), making it the largest divestment caused by ethical recommendations in the history of the fund.

In March 2014, as the result of both domestic and international pressure, the parliament appointed a panel to investigate whether the fund should divest its coal assets in line with its ethical investment mandate. The panel released its recommendations in December 2014, recommending the fund follow a strategy of corporate engagement rather than divestment. The parliament was set to make its decision early in 2015. In the event, the fund will be required to divest from companies that derive at least 30℅ of their business from coal.

In 2014, the fund divested from 53 coal companies around the world, including 16 companies in the US (among them Peabody Energy

Peabody Energy is a coal mining and energy company headquartered in St. Louis, Missouri. Its primary business consists of the mining, sale, and distribution of coal, which is purchased for use in electricity generation and steelmaking. Peabody ...

, Arch Coal, and Alpha Natural Resources), 13 companies in India (including Coal India

Coal India Limited (CIL) is an Indian central public sector undertaking under the ownership of the Ministry of Coal, Government of India. It is headquartered at Kolkata. It is the ''largest government-owned-coal-producer'' in the world. It is ...

) and 3 companies in China. As a result, the total value of the fund’s coal holdings fell by 5% to $9.7 billion. In 2014, the fund also sold its stakes in 59 out of 90 oil and gas companies in which it holds shares by $30 billion.

On 8 March 2019, the Ministry of Finance recommended divestiture from its oil and gas exploration and production holdings. This came after the August 2017 Lofoten Declaration The Lofoten Declaration, drafted in August 2017, is an international manifesto calling for the end of hydrocarbon exploration and further expansion of fossil fuel reserves for the purpose of climate change mitigation. It calls for fossil fuel dive ...

which demanded leadership in a global fossil fuel phase-out

Fossil fuel phase-out is the gradual reduction of the use and production of fossil fuels to zero.

It is part of the ongoing renewable energy transition. Current efforts in fossil fuel phase-out involve replacing fossil fuels with sustainabl ...

from the countries that can most afford to act, such as Norway.

Green energy is becoming an important aspect for the Government Pension Fund since fossil fuel stocks simply are not producing as much value as they used to. As of 2019, new guidelines will prohibit the fund from investing in companies that produce over 20 million tons of coal annually. The fund plans to sell off over $10 billion in stocks from companies using too many fossil fuels. In hopes of improving the Norwegian economy, the firm is becoming more environmentally-friendly by investing in companies that promote renewable energy. For example, the fund will continue to hold stakes in firms like Shell using renewable energy divisions.

In March 2021, it was reported that the Government Pension Fund was examining whether companies in the fund had used forced labor from Xinjiang internment camps

The Xinjiang internment camps, officially called vocational education and training centers ( zh, 职业技能教育培训中心, Zhíyè jìnéng jiàoyù péixùn zhōngxīn) by the government of China, are internment camps operated ...

.

On 1 December 2021, the fund's head of Governance and Compliance, Carine Smith Ihenacho, told Reuters

Reuters ( ) is a news agency owned by Thomson Reuters Corporation. It employs around 2,500 journalists and 600 photojournalists in about 200 locations worldwide. Reuters is one of the largest news agencies in the world.

The agency was est ...

that companies in its portfolio will be asked to take more specific action on climate change.

Excluded companies

The following companies have been excluded from the Government Pension Fund of Norway for activities in breach of the ethical guidelines: The fund does not announce exclusions until it has completed sales of its positions, so as not to affect the share price at the time of the transaction. In 2016, Norges Bank decided to exclude 52 coal companies from the fund.Reinstated companies

Several previously excluded companies have later been reinstated to the fund because the companies were no longer involved in the activities that had led to their exclusion.Companies "under observation"

As an alternative to full exclusion from the fund, companies may be placed "under observation" to help put pressure on the company to improve. It has been proposed that one more company, Goldcorp, should be placed under similar observation.Currency portfolio

In October 2010 the fund spent NOK 600 million ($136.4 million as of October 2010) daily buying foreign currencies. That figure would be increased to 800 million kroner daily in November. This practice was suspended in January 2011, and on 31 January it was announced that this would also be the case in February.Government Pension Fund – Norway

The Government Pension Fund – Norway (, SPN) was established by the ''National Insurance Act'' () in 1967 under the name ''National Insurance Scheme Fund'' (). The name was changed at the same time as the former Petroleum Fund, on 1 January 2006. It continues to be managed by a separate board and separate government entity, still named . The Government Pension Fund – Norway had a value of NOK 240.2 billion at the end of 2017. Unlike the Global division, it is required to limit its investments to companies in the Norwegian stock market, predominantly on theOslo Stock Exchange

Oslo Stock Exchange ( no, Oslo Børs) (OSE: OSLO) is a stock exchange within the Nordic countries and offers Norway’s only regulated markets for securities trading today. The stock exchange offers a full product range including equities, der ...

. The Fund is not allowed to own more than a 15% interest in any single Norwegian company.

Notes

See also

*The budgetary rule

The budgetary rule ( no, handlingsregelen) is a rule concerning the usage of capital gains from The Government Pension Fund - Global of Norway. The rule states that a maximum of 3% of the fund's value should be allocated to the yearly governm ...

– concerning the usage of capital gains from The Government Pension Fund – Global

* Pensions in Norway

Pensions in Norway fall into three major divisions; State Pensions, Occupational Pensions and Individual or personal Pensions.

State pensions (Alderspensjon)

All Norwegians citizens are entitled to get a state pension from the age of 67 in accor ...

* Economy of Norway

The economy of Norway is a highly developed mixed economy with state-ownership in strategic areas. Although sensitive to global business cycles, the economy of Norway has shown robust growth since the start of the industrial era. The country ...

* Sovereign wealth fund

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as ...

* Energy Resources of Norway

* Ethical investing

References

External links

Norwegian Ministry of Finance: On the Government Pension Fund

{{DEFAULTSORT:Government Pension Fund Of Norway, The 1967 establishments in Norway 1990 establishments in Norway 1967 in politics 1990 in politics 1967 in economics 1990 in economics Sovereign wealth funds Public pension funds Public finance of Norway Retirement in Norway Government of Norway North Sea energy