Fiat Currency on:

[Wikipedia]

[Google]

[Amazon]

Fiat money (from la, fiat, "let it be done") is a type of

Fiat money (from la, fiat, "let it be done") is a type of

The

The

Money in the American Colonies

." EH.Net Encyclopedia, edited by Robert Whaples. Provincial governments produced notes which were fiat currency, with the promise to allow holders to pay taxes with those notes. The notes were issued to pay current obligations and could be used for taxes levied at a later time. Since the notes were denominated in the local unit of account, they were circulated from person to person in non-tax transactions. These types of notes were issued particularly in

Fiat money (from la, fiat, "let it be done") is a type of

Fiat money (from la, fiat, "let it be done") is a type of currency

A currency, "in circulation", from la, currens, -entis, literally meaning "running" or "traversing" is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins.

A more general ...

that is not backed by any commodity such as gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile me ...

or silver

Silver is a chemical element with the symbol Ag (from the Latin ', derived from the Proto-Indo-European ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, white, lustrous transition metal, it exhibits the highest electrical ...

. It is typically designated by the issuing government to be legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in ...

. Throughout history, fiat money was sometimes issued by local banks and other institutions. In modern times, fiat money is generally authorized by government regulation.

Fiat money generally does not have intrinsic value and does not have use value

Use value (german: Gebrauchswert) or value in use is a concept in classical political economy and Marxist economics. It refers to the tangible features of a commodity (a tradeable object) which can satisfy some human requirement, want or need, or ...

. It has value only because the individuals who use it as a unit of account or, in the case of currency, a medium of exchange

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is ass ...

agree on its value. They trust that it will be accepted by merchants and other people.

Fiat money is an alternative to commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

This is in contrast to representat ...

, which is a currency that has intrinsic value because it contains, for example, a precious metal such as gold or silver which is embedded in the coin. Fiat also differs from representative money

Representative money or receipt money is any medium of exchange, printed or digital, that represents something of Value (economics), value, but has little or no value of its own (intrinsic value). Unlike some forms of fiat money (which may have n ...

, which is money that has intrinsic value because it is backed by and can be converted into a precious metal or another commodity. Fiat money can look similar to representative money (such as paper bills), but the former has no backing, while the latter represents a claim on a commodity (which can be redeemed to a greater or lesser extent).

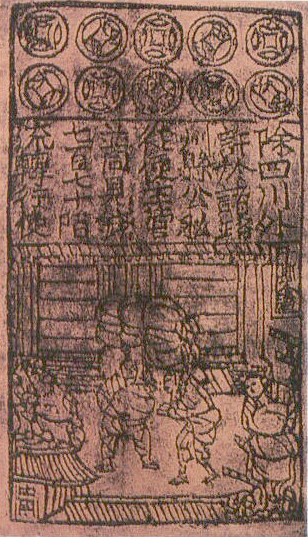

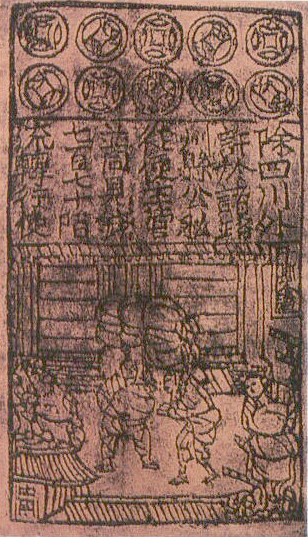

Government-issued fiat money banknote

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

s were used first during the 11th century in China. Fiat money started to predominate during the 20th century. Since President Richard Nixon's decision to suspend US dollar convertibility to gold in 1971, a system of national fiat currencies has been used globally.

Fiat money can be:

* Any money that is not backed by a commodity.

* Money declared by a person, institution or government to be legal tender

Legal tender is a form of money that courts of law are required to recognize as satisfactory payment for any monetary debt. Each jurisdiction determines what is legal tender, but essentially it is anything which when offered ("tendered") in ...

, meaning that it must be accepted in payment of a debt in specific circumstances.

* State-issued money which is neither convertible through a central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

to anything else nor fixed in value in terms of any objective standard.

* Money used because of government decree.

* An otherwise non-valuable object that serves as a medium of exchange (also known as fiduciary

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties (person or group of persons). Typically, a fiduciary prudently takes care of money or other assets for another person. One party, for examp ...

money.)

The term ''fiat'' derives from the Latin

Latin (, or , ) is a classical language belonging to the Italic branch of the Indo-European languages. Latin was originally a dialect spoken in the lower Tiber area (then known as Latium) around present-day Rome, but through the power of the ...

word , meaning "let it be done" used in the sense of an order, decree or resolution.

Treatment in economics

Inmonetary economics

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions (such as medium of exchange, store of value and unit of account), and ...

, fiat money is an intrinsically valueless object or record that is accepted widely as a means of payment. Accordingly, the value of fiat money is greater than the value of its metal content.

One justification for fiat money comes from a micro-founded model. In most economic models, agents are intrinsically happier when they have more money. In a model by Lagos and Wright, fiat money doesn't have an intrinsic worth but agents get more of the goods they want when they trade assuming fiat money is valuable. Fiat money's value is created internally by the community and, at equilibrium, makes otherwise infeasible trades possible.

Another mathematical model that explains the value of fiat money comes from game theory. In a game where agents produce and trade objects, there can be multiple Nash equilibria

In game theory, the Nash equilibrium, named after the mathematician John Nash, is the most common way to define the solution of a non-cooperative game involving two or more players. In a Nash equilibrium, each player is assumed to know the equili ...

where agents settle on stable behavior. In a model by Kiyotaki and Wright, an object with no intrinsic worth can have value during trade in one (or more) of the Nash Equilibria.

History

China

China has a long history with paper money, beginning in the 7th century CE. During the 11th century, the government established a monopoly on its issuance, and about the end of the 12th century, convertibility was suspended. The use of such money became widespread during the subsequent Yuan andMing

The Ming dynasty (), officially the Great Ming, was an imperial dynasty of China, ruling from 1368 to 1644 following the collapse of the Mongol-led Yuan dynasty. The Ming dynasty was the last orthodox dynasty of China ruled by the Han peop ...

dynasties.

The

The Song Dynasty

The Song dynasty (; ; 960–1279) was an imperial dynasty of China that began in 960 and lasted until 1279. The dynasty was founded by Emperor Taizu of Song following his usurpation of the throne of the Later Zhou. The Song conquered the rest ...

in China was the first to issue paper money, ''jiaozi

''Jiaozi'' (; ; pinyin: jiǎozi) are Chinese dumplings commonly eaten in China and other parts of East Asia. ''Jiaozi'' are folded to resemble Chinese sycee and have great cultural significance attached to them within China. ''Jiaozi'' are ...

'', about the 10th century CE. Although the notes were valued at a certain exchange rate for gold, silver, or silk, conversion was never allowed in practice. The notes were initially to be redeemed after three years' service, to be replaced by new notes for a 3% service charge, but, as more of them were printed without notes being retired, inflation became evident. The government made several attempts to maintain the value of the paper money by demanding taxes partly in currency and making other laws, but the damage had been done, and the notes became disfavored.

The succeeding Yuan Dynasty

The Yuan dynasty (), officially the Great Yuan (; xng, , , literally "Great Yuan State"), was a Mongol-led imperial dynasty of China and a successor state to the Mongol Empire after its division. It was established by Kublai, the fift ...

was the first dynasty of China to use paper currency as the predominant circulating medium. The founder of the Yuan Dynasty, Kublai Khan, issued paper money known as Jiaochao during his reign. The original notes during the Yuan Dynasty were restricted in area and duration as in the Song Dynasty.

During the 13th century, Marco Polo described the fiat money of the Yuan Dynasty

The Yuan dynasty (), officially the Great Yuan (; xng, , , literally "Great Yuan State"), was a Mongol-led imperial dynasty of China and a successor state to the Mongol Empire after its division. It was established by Kublai, the fift ...

in his book ''The Travels of Marco Polo

''Book of the Marvels of the World'' ( Italian: , lit. 'The Million', deriving from Polo's nickname "Emilione"), in English commonly called ''The Travels of Marco Polo'', is a 13th-century travelogue written down by Rustichello da Pisa from st ...

''.

Europe

Washington Irving

Washington Irving (April 3, 1783 – November 28, 1859) was an American short-story writer, essayist, biographer, historian, and diplomat of the early 19th century. He is best known for his short stories "Rip Van Winkle" (1819) and " The Legen ...

records an emergency use of paper money by the Spanish for a siege during the Conquest of Granada (1482–1492). In 1661, Johan Palmstruch issued the first regular paper money in the West, by royal charter from the Kingdom of Sweden, through a new institution, the Bank of Stockholm. While this private paper currency was largely a failure, the Swedish parliament eventually assumed control of the issue of paper money in the country. By 1745, its paper money was inconvertible to specie

Specie may refer to:

* Coins or other metal money in mass circulation

* Bullion coins

* Hard money (policy)

* Commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects ...

, but acceptance was mandated by the government. This fiat currency depreciated so rapidly that by 1776 it was returned to a silver standard. Fiat money also has other beginnings in 17th-century Europe, having been introduced by the Bank of Amsterdam in 1683.

New France 1685–1770

In 17th centuryNew France

New France (french: Nouvelle-France) was the area colonized by France in North America, beginning with the exploration of the Gulf of Saint Lawrence by Jacques Cartier in 1534 and ending with the cession of New France to Great Britain and Spa ...

, now part of Canada, the universally accepted medium of exchange

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is ass ...

was the beaver pelt. As the colony expanded, coins from France came to be used widely, but there was usually a shortage of French coins. In 1685, the colonial authorities in New France found themselves seriously short of money. A military expedition against the Iroquois

The Iroquois ( or ), officially the Haudenosaunee ( meaning "people of the longhouse"), are an Iroquoian-speaking confederacy of First Nations peoples in northeast North America/ Turtle Island. They were known during the colonial years to ...

had gone badly and tax revenues were down, reducing government money reserves. Typically, when short of funds, the government would simply delay paying merchants for purchases, but it was not safe to delay payment to soldiers due to the risk of mutiny.

Jacques de Meulles, the Intendant of Finance, conceived an ingenious ad hoc

Ad hoc is a Latin phrase meaning literally 'to this'. In English, it typically signifies a solution for a specific purpose, problem, or task rather than a generalized solution adaptable to collateral instances. (Compare with '' a priori''.)

C ...

solution – the temporary issuance of paper money to pay the soldiers, in the form of playing card

A playing card is a piece of specially prepared card stock, heavy paper, thin cardboard, plastic-coated paper, cotton-paper blend, or thin plastic that is marked with distinguishing motifs. Often the front (face) and back of each card has a f ...

s. He confiscated all the playing cards in the colony, had them cut into pieces, wrote denominations on the pieces, signed them, and issued them to the soldiers as pay in lieu of gold and silver. Because of the chronic shortages of money of all types in the colonies, these cards were accepted readily by merchants and the public and circulated freely at face value. It was intended to be purely a temporary expedient, and it was not until years later that its role as a medium of exchange

In economics, a medium of exchange is any item that is widely acceptable in exchange for goods and services. In modern economies, the most commonly used medium of exchange is currency.

The origin of "mediums of exchange" in human societies is ass ...

was recognized. The first issue of playing card money occurred during June 1685 and was redeemed three months later. However, the shortages of coinage reoccurred and more issues of card money were made during subsequent years. Because of their wide acceptance as money and the general shortage of money in the colony, many of the playing cards were not redeemed but continued to circulate, acting as a useful substitute for scarce gold and silver coins from France. Eventually, the Governor of New France The governor of New France was the viceroy of the King of France in North America. A French nobleman, he was appointed to govern the colonies of New France, which included Canada, Acadia and Louisiana. The residence of the Governor was at the Chate ...

acknowledged their useful role as a circulating medium of exchange.

As the finances of the French government deteriorated because of European wars, it reduced its financial assistance to its colonies, so the colonial authorities in Canada relied more and more on card money. By 1757, the government had discontinued all payments in coin and payments were made in paper instead. In an application of Gresham’s Law – bad money drives out good – people hoarded gold and silver, and used paper money instead. The costs of the Seven Years' War

The Seven Years' War (1756–1763) was a global conflict that involved most of the European Great Powers, and was fought primarily in Europe, the Americas, and Asia-Pacific. Other concurrent conflicts include the French and Indian War (175 ...

resulted in rapid inflation in New France. After the British conquest in 1760, the paper money became almost worthless, but business did not end because gold and silver that had been hoarded came back into circulation. By the Treaty of Paris (1763)

The Treaty of Paris, also known as the Treaty of 1763, was signed on 10 February 1763 by the kingdoms of Great Britain, France and Spain, with Portugal in agreement, after Great Britain and Prussia's victory over France and Spain during the S ...

, the French government agreed to convert the outstanding card money into debenture

In corporate finance, a debenture is a medium- to long-term debt instrument used by large companies to borrow money, at a fixed rate of interest. The legal term "debenture" originally referred to a document that either creates a debt or acknowle ...

s, but with the French government essentially bankrupt, these bonds were defaulted and by 1771 they were worthless.

The Royal Canadian Mint

}) is the mint of Canada and a Crown corporation, operating under the ''Royal Canadian Mint Act''. The shares of the Mint are held in trust for the Crown in right of Canada.

The Mint produces all of Canada's circulation coins, and manufacture ...

still issues Playing Card Money in commemoration of its history, but now in 92.5% silver form with gold plate on the edge. It therefore has an intrinsic value which considerably exceeds its fiat value. The Bank of Canada and Canadian economists often use this early form of paper currency to illustrate the true nature of money for Canadians.

18th and 19th century

An early form of fiat currency in the American Colonies was "bills of credit Bills of credit are documents similar to banknotes issued by a government that represent a government's indebtedness to the holder. They are typically designed to circulate as currency or currency substitutes. Bills of credit are mentioned in Art ...

."Michener, Ron (2003).Money in the American Colonies

." EH.Net Encyclopedia, edited by Robert Whaples. Provincial governments produced notes which were fiat currency, with the promise to allow holders to pay taxes with those notes. The notes were issued to pay current obligations and could be used for taxes levied at a later time. Since the notes were denominated in the local unit of account, they were circulated from person to person in non-tax transactions. These types of notes were issued particularly in

Pennsylvania

Pennsylvania (; ( Pennsylvania Dutch: )), officially the Commonwealth of Pennsylvania, is a state spanning the Mid-Atlantic, Northeastern, Appalachian, and Great Lakes regions of the United States. It borders Delaware to its southeast, ...

, Virginia

Virginia, officially the Commonwealth of Virginia, is a state in the Mid-Atlantic and Southeastern regions of the United States, between the Atlantic Coast and the Appalachian Mountains. The geography and climate of the Commonwealth ar ...

and Massachusetts

Massachusetts (Massachusett: ''Muhsachuweesut Massachusett_writing_systems.html" ;"title="nowiki/> məhswatʃəwiːsət.html" ;"title="Massachusett writing systems">məhswatʃəwiːsət">Massachusett writing systems">məhswatʃəwiːsət'' En ...

. Such money was sold at a discount of silver, which the government would then spend, and would expire at a fixed date later.

Bills of credit have generated some controversy from their inception. Those who have wanted to emphasize the dangers of inflation have emphasized the colonies where the bills of credit depreciated most dramatically: New England and the Carolinas. Those who have wanted to defend the use of bills of credit in the colonies have emphasized the middle colonies, where inflation was practically nonexistent.

Colonial powers consciously introduced fiat currencies backed by taxes (e.g., hut tax

The hut tax was a form of taxation introduced by British in their African possessions on a "per hut" (or other forms of household) basis. It was variously payable in money, labour, grain or stock and benefited the colonial authorities in four int ...

es or poll taxes

A poll tax, also known as head tax or capitation, is a tax levied as a fixed sum on every liable individual (typically every adult), without reference to income or resources.

Head taxes were important sources of revenue for many governments f ...

) to mobilise economic resources in their new possessions, at least as a transitional arrangement. The purpose of such taxes was later served by property tax

A property tax or millage rate is an ad valorem tax on the value of a property.In the OECD classification scheme, tax on property includes "taxes on immovable property or net wealth, taxes on the change of ownership of property through inhe ...

es. The repeated cycle of deflationary hard money, followed by inflationary paper money continued through much of the 18th and 19th centuries. Often nations would have dual currencies, with paper trading at some discount to money which represented specie

Specie may refer to:

* Coins or other metal money in mass circulation

* Bullion coins

* Hard money (policy)

* Commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects ...

.

Examples include the “Continental

Continental may refer to:

Places

* Continent, the major landmasses of Earth

* Continental, Arizona, a small community in Pima County, Arizona, US

* Continental, Ohio, a small town in Putnam County, US

Arts and entertainment

* ''Continental'' ( ...

” bills issued by the U.S. Congress

The United States Congress is the legislature of the federal government of the United States. It is bicameral, composed of a lower body, the House of Representatives, and an upper body, the Senate. It meets in the U.S. Capitol in Washin ...

before the United States Constitution; paper versus gold ducats in Napoleon

Napoleon Bonaparte ; it, Napoleone Bonaparte, ; co, Napulione Buonaparte. (born Napoleone Buonaparte; 15 August 1769 – 5 May 1821), later known by his regnal name Napoleon I, was a French military commander and political leader who ...

ic era Vienna

en, Viennese

, iso_code = AT-9

, registration_plate = W

, postal_code_type = Postal code

, postal_code =

, timezone = CET

, utc_offset = +1

, timezone_DST ...

, where paper often traded at 100:1 against gold; the South Sea Bubble, which produced bank notes not representing sufficient reserves; and the Mississippi Company

The Mississippi Company (french: Compagnie du Mississippi; founded 1684, named the Company of the West from 1717, and the Company of the Indies from 1719) was a corporation holding a business monopoly in French colonies in North America and th ...

scheme of John Law

John Law may refer to:

Arts and entertainment

* John Law (artist) (born 1958), American artist

* John Law (comics), comic-book character created by Will Eisner

* John Law (film director), Hong Kong film director

* John Law (musician) (born 1961) ...

.

During the American Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by other names) was a civil war in the United States. It was fought between the Union ("the North") and the Confederacy ("the South"), the latter formed by states ...

, the Federal Government issued United States Note

A United States Note, also known as a Legal Tender Note, is a type of paper money that was issued from 1862 to 1971 in the U.S. Having been current for 109 years, they were issued for longer than any other form of U.S. paper money. They were k ...

s, a form of paper fiat currency known popularly as 'greenbacks'. Their issue was limited by Congress at slightly more than $340 million. During the 1870s, withdrawal of the notes from circulation was opposed by the United States Greenback Party

The Greenback Party (known successively as the Independent Party, the National Independent Party and the Greenback Labor Party) was an American political party with an anti-monopoly ideology which was active between 1874 and 1889. The party ran ...

. It was termed 'fiat money' in an 1878 party convention.

20th century

AfterWorld War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, the United States, and the Ottoman Empire, with fightin ...

, governments and banks generally still promised to convert notes and coins into their nominal commodity (redemption by specie

Specie may refer to:

* Coins or other metal money in mass circulation

* Bullion coins

* Hard money (policy)

* Commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects ...

, typically gold) on demand. However, the costs of the war and the required repairs and economic growth based on government borrowing afterward made governments suspend redemption by specie. Some governments were careful of avoiding sovereign default

A sovereign default is the failure or refusal of the

government of a sovereign state to pay back its debt in full when due. Cessation of due payments (or receivables) may either be accompanied by that government's formal declaration that it wi ...

but not wary of the consequences of paying debts by consigning newly printed cash not associated with a metal standard to their creditors, which resulted in hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

– for example the hyperinflation in the Weimar Republic

Hyperinflation affected the German Papiermark, the currency of the Weimar Republic, between 1921 and 1923, primarily in 1923. It caused considerable internal political instability in the country, the occupation of the Ruhr by France and Belgium, ...

.

From 1944 to 1971, the Bretton Woods agreement

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretto ...

fixed the value of 35 United States dollars to one troy ounce

Troy weight is a system of units of mass that originated in 15th-century England, and is primarily used in the precious metals industry. The troy weight units are the grain, the pennyweight (24 grains), the troy ounce (20 pennyweights), and th ...

of gold. Other currencies were calibrated with the U.S. dollar at fixed rates. The U.S. promised to redeem dollars with gold transferred to other national banks. Trade imbalances were corrected by gold reserve exchanges or by loans from the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster glo ...

(IMF).

The Bretton Woods system was ended by what became known as the Nixon shock. This was a series of economic changes by United States President Richard Nixon

Richard Milhous Nixon (January 9, 1913April 22, 1994) was the 37th president of the United States, serving from 1969 to 1974. A member of the Republican Party, he previously served as a representative and senator from California and was ...

in 1971, including unilaterally canceling the direct convertibility

Convertibility is the quality that allows money or other financial instruments to be converted into other liquid stores of value. Convertibility is an important factor in international trade, where instruments valued in different currencies mus ...

of the United States dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the officia ...

to gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile me ...

. Since then, a system of national fiat monies has been used globally, with variable exchange rates between the major currencies.

Precious metal coinage

During the 1960s, production ofsilver coin

Silver coins are considered the oldest mass-produced form of coinage. Silver has been used as a coinage metal since the times of the Greeks; their silver drachmas were popular trade coins. The ancient Persians used silver coins between 612–33 ...

s for circulation ceased when the face value of the coin was less than the cost of the precious metal it contained (whereas it had been greater historically ). In the United States, the Coinage Act of 1965

The Coinage Act of 1965, , eliminated silver from the circulating United States dime (ten-cent piece) and quarter dollar coins. It also reduced the silver content of the half dollar from 90 percent to 40 percent; silver in the half dollar was s ...

eliminated silver

Silver is a chemical element with the symbol Ag (from the Latin ', derived from the Proto-Indo-European ''h₂erǵ'': "shiny" or "white") and atomic number 47. A soft, white, lustrous transition metal, it exhibits the highest electrical ...

from circulating dimes and quarter dollars, and most other countries did the same with their coins. The Canadian penny, which was mostly copper

Copper is a chemical element with the symbol Cu (from la, cuprum) and atomic number 29. It is a soft, malleable, and ductile metal with very high thermal and electrical conductivity. A freshly exposed surface of pure copper has a pinkis ...

until 1996, was removed from circulation altogether during the autumn of 2012 due to the cost of production relative to face value.

In 2007, the Royal Canadian Mint produced a million dollar gold

Gold is a chemical element with the symbol Au (from la, aurum) and atomic number 79. This makes it one of the higher atomic number elements that occur naturally. It is a bright, slightly orange-yellow, dense, soft, malleable, and ductile me ...

bullion coin

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes fro ...

and sold five of them. In 2015, the gold in the coins was worth more than 3.5 times the face value.

Money creation and regulation

Acentral bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

introduces new money into an economy by purchasing financial asset

A financial asset is a non-physical asset whose value is derived from a contractual claim, such as bank deposits, bonds, and participations in companies' share capital. Financial assets are usually more liquid than other tangible assets, such a ...

s or lending money to financial institutions. Commercial bank

A commercial bank is a financial institution which accepts deposits from the public and gives loans for the purposes of consumption and investment to make profit.

It can also refer to a bank, or a division of a large bank, which deals with co ...

s then redeploy or repurpose this base money by credit creation through fractional reserve banking, which expands the total supply of " broad money" (cash plus demand deposit

Demand deposits or checkbook money are funds held in demand accounts in commercial banks. These account balances are usually considered money and form the greater part of the narrowly defined money supply of a country. Simply put, these are depo ...

s).

In modern economies, relatively little of the supply of broad money is physical currency. For example, in December 2010 in the U.S., of the $8,853.4 billion

Billion is a word for a large number, and it has two distinct definitions:

*1,000,000,000, i.e. one thousand million, or (ten to the ninth power), as defined on the short scale. This is its only current meaning in English.

* 1,000,000,000,000, i. ...

of broad money supply (M2), only $915.7 billion (about 10%) consisted of physical coins and paper money. The manufacturing of new physical money is usually the responsibility of the national bank, or sometimes, the government's treasury

A treasury is either

*A government department related to finance and taxation, a finance ministry.

*A place or location where treasure, such as currency or precious items are kept. These can be state or royal property, church treasure or i ...

.

The Bank for International Settlements

The Bank for International Settlements (BIS) is an international financial institution owned by central banks that "fosters international monetary and financial cooperation and serves as a bank for central banks".

The BIS carries out its work thr ...

published a detailed review of payment system developments in the Group of Ten ( G10) countries in 1985, in the first of a series that has become known as "red books". Currently the red books cover the participating countries on Committee on Payments and Market Infrastructures (CPMI). A red book summary of the value of banknotes and coins in circulation is shown in the table below where the local currency is converted to US dollars using the end of the year rates. The value of this physical currency as a percentage of GDP ranges from a maximum of 19.4% in Japan to a minimum of 1.7% in Sweden with the overall average for all countries in the table being 8.9% (7.9% for the US).

The most notable currency not included in this table is the Chinese yuan, for which the statistics are listed as "not available".

Inflation

The adoption of fiat currency by many countries, from the 18th century onwards, made much larger variations in the supply of money possible. Since then, huge increases in the supply ofpaper money

A banknote—also called a bill (North American English), paper money, or simply a note—is a type of negotiable promissory note, made by a bank or other licensed authority, payable to the bearer on demand.

Banknotes were originally issued ...

have occurred in a number of countries, producing hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

s – episodes of extreme inflation rates much greater than those observed during earlier periods of commodity money

Commodity money is money whose value comes from a commodity of which it is made. Commodity money consists of objects having value or use in themselves (intrinsic value) as well as their value in buying goods.

This is in contrast to representat ...

. The hyperinflation in the Weimar Republic

Hyperinflation affected the German Papiermark, the currency of the Weimar Republic, between 1921 and 1923, primarily in 1923. It caused considerable internal political instability in the country, the occupation of the Ruhr by France and Belgium, ...

of Germany is a notable example.

Economists

An economist is a professional and practitioner in the social science discipline of economics.

The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are ...

generally believe that high rates of inflation and hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

are caused by an excessive growth of the money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circul ...

. Presently, most economists favor a small and steady rate of inflation.Hummel, Jeffrey Rogers. "Death and Taxes, Including Inflation: the Public versus Economists" (January 2007). p. 56 Small (as opposed to zero or negative) inflation reduces the severity of economic recessions

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

by enabling the labor market to adjust more quickly to a recession, and reduces the risk that a liquidity trap (a reluctance to lend money due to low rates of interest) prevents monetary policy

Monetary policy is the policy adopted by the monetary authority of a nation to control either the interest rate payable for very short-term borrowing (borrowing by banks from each other to meet their short-term needs) or the money supply, often a ...

from stabilizing the economy. However, money supply growth does not always cause nominal increases of price. Money supply growth may instead result in stable prices at a time in which they would otherwise be decreasing. Some economists maintain that with the conditions of a liquidity trap, large monetary injections are like "pushing on a string".

The task of keeping the rate of inflation small and stable is usually given to monetary authorities. Generally, these monetary authorities are the national bank

In banking, the term national bank carries several meanings:

* a bank owned by the state

* an ordinary private bank which operates nationally (as opposed to regionally or locally or even internationally)

* in the United States, an ordinary p ...

s that control monetary policy by the setting of interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, ...

s, by open market operations, and by the setting of banking reserve requirements.

Loss of backing

A fiat-money currency greatly loses its value should the issuing government orcentral bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a central b ...

either lose the ability to, or refuse to, continue to guarantee its value. The usual consequence is hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

. Some examples of this are the Zimbabwean dollar

The Zimbabwean dollar (sign: $, or Z$ to distinguish it from other dollar-denominated currencies) was the name of four official currencies of Zimbabwe from 1980 to 12 April 2009. During this time, it was subject to periods of extreme inflat ...

, China's money during 1945 and the Weimar Republic's mark during 1923. A more recent example is the currency instability in Venezuela that began in 2016 during the country's ongoing socioeconomic and political crisis.

But this need not necessarily occur, especially if a currency continues to be the most easily available; for example, the pre-1990 Iraqi dinar

The Iraqi dinar () (Arabic: دينار; sign: ID in Latin, د.ع in Arabic; code: IQD) is the currency of Iraq. It is issued by the Central Bank of Iraq and is subdivided into 1,000 fils (فلس), although inflation has rendered the fils obsolet ...

continued to retain value in the Kurdistan Regional Government

The Kurdistan Regional Government (KRG) ( ku, حکوومەتی هەرێمی کوردستان, ''Hikûmetî Herêmî Kurdistan'') is the official executive body of the autonomous Kurdistan Region of northern Iraq.

The cabinet is selected by the m ...

even after its legal tender status was ended by the Iraqi government which issued the notes..

See also

* Criticism of the Federal Reserve *Debasement

A debasement of coinage is the practice of lowering the intrinsic value of coins, especially when used in connection with commodity money, such as gold or silver coins. A coin is said to be debased if the quantity of gold, silver, copper or nick ...

* Fractional-reserve banking

Fractional-reserve banking is the system of banking operating in almost all countries worldwide, under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve, ...

* Hard currency

In macroeconomics, hard currency, safe-haven currency, or strong currency is any globally traded currency that serves as a reliable and stable store of value. Factors contributing to a currency's ''hard'' status might include the stability and ...

* Hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

* Inflation hedge An inflation hedge is an investment intended to protect the investor against (hedge) a decrease in the purchasing power of money (inflation). There is no investment known to be a successful hedge in all inflationary environments, just as there is n ...

* Modern monetary theory

Modern Monetary Theory or Modern Money Theory (MMT) is a heterodox

*

*

*

*

*

* macroeconomic theory that describes currency as a public monopoly and unemployment as evidence that a currency monopolist is overly restricting the supply of t ...

* Money creation

* Money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circul ...

* Network effect

In economics, a network effect (also called network externality or demand-side economies of scale) is the phenomenon by which the value or utility a user derives from a good or service depends on the number of users of compatible products. Net ...

* Seigniorage

Seigniorage , also spelled seignorage or seigneurage (from the Old French ''seigneuriage'', "right of the lord (''seigneur'') to mint money"), is the difference between the value of money and the cost to produce and distribute it. The term can be ...

* Cryptocurrency

* Silver coin

Silver coins are considered the oldest mass-produced form of coinage. Silver has been used as a coinage metal since the times of the Greeks; their silver drachmas were popular trade coins. The ancient Persians used silver coins between 612–33 ...

* Silver standard

The silver standard is a monetary system in which the standard economic unit of account is a fixed weight of silver. Silver was far more widespread than gold as the monetary standard worldwide, from the Sumerians 3000 BC until 1873. Following ...

Notes

References

{{DEFAULTSORT:Fiat Money Currency Monetary reform Numismatics