Federal Farm Loan Act on:

[Wikipedia]

[Google]

[Amazon]

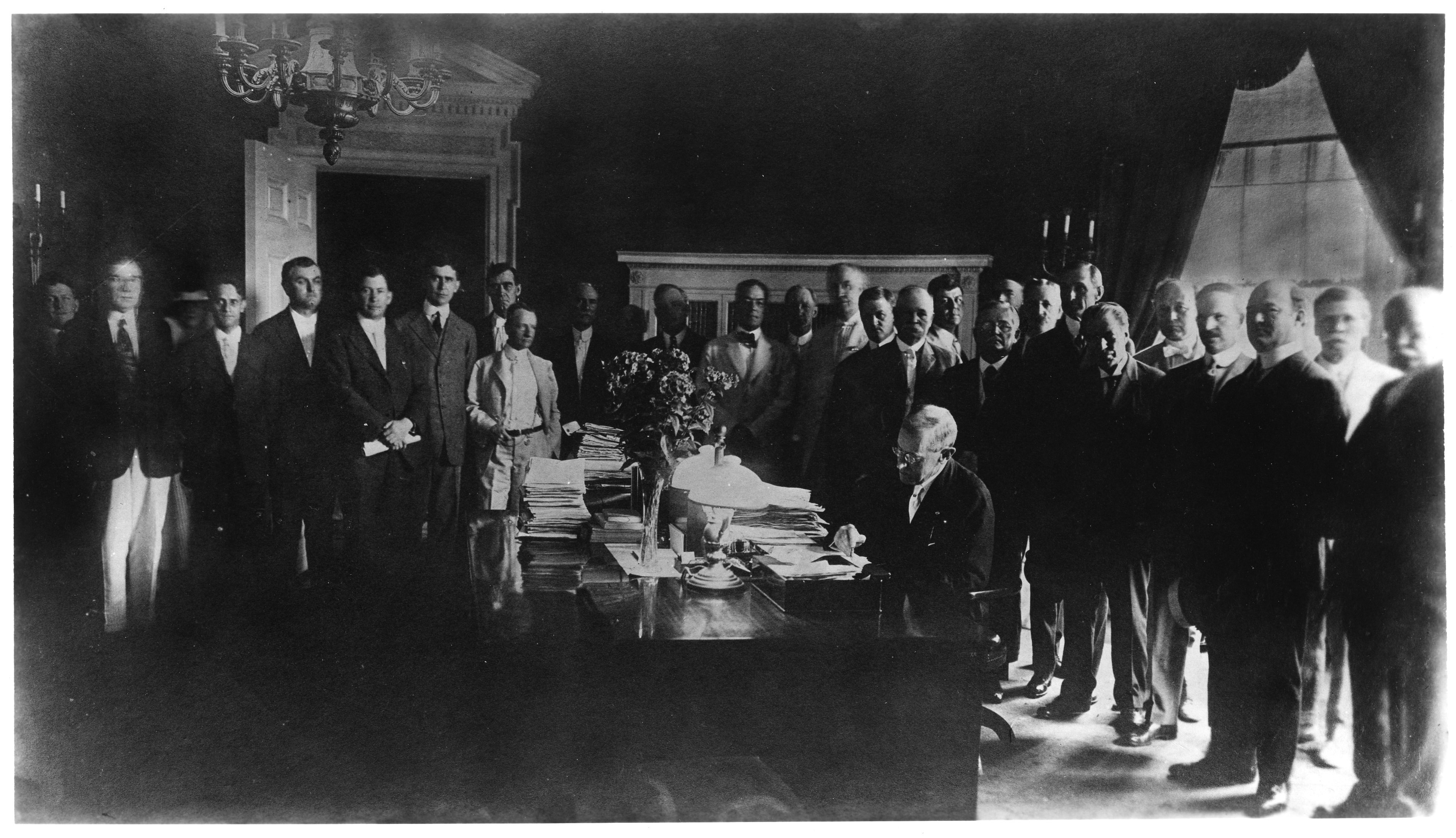

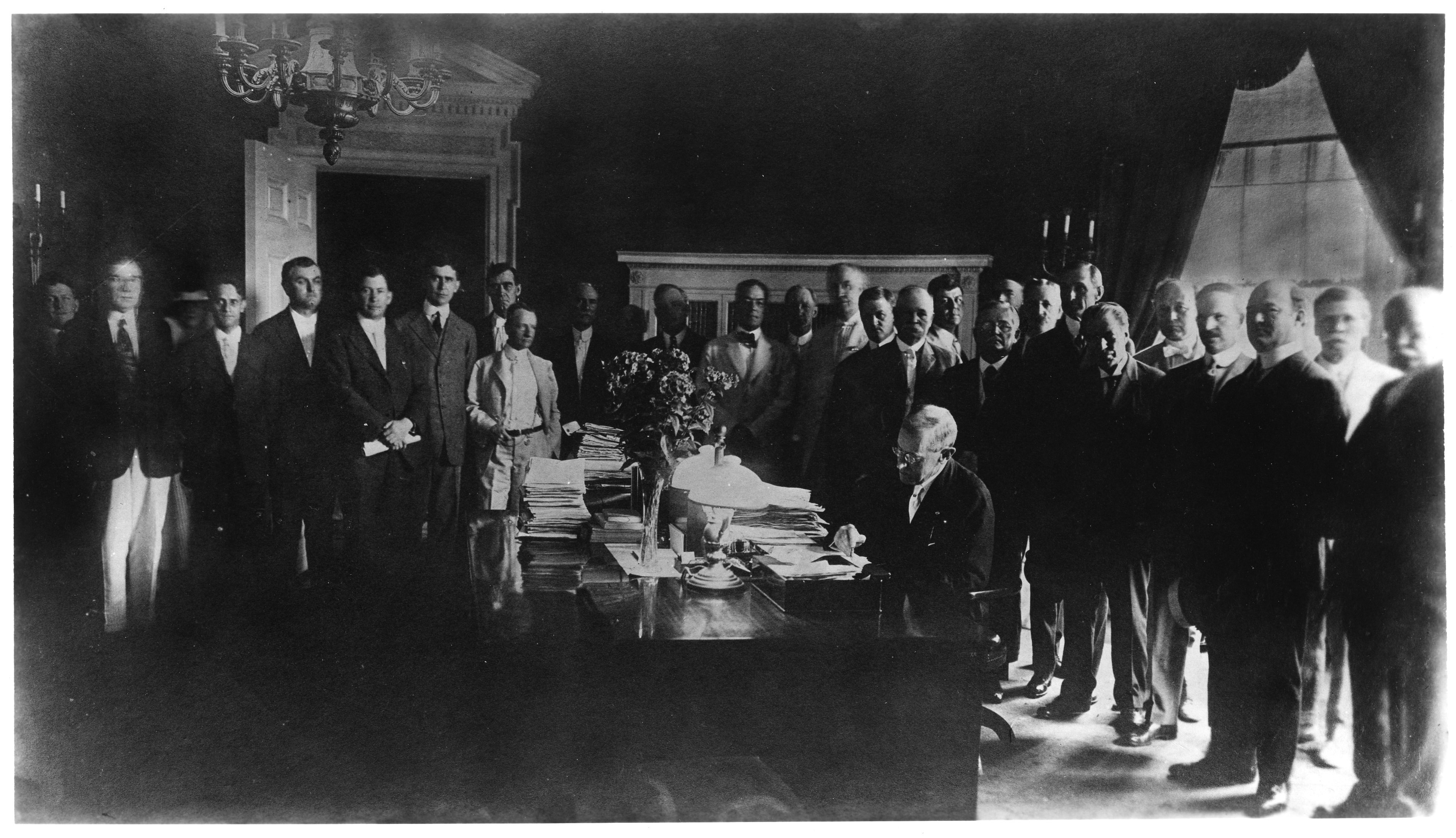

The Federal Farm Loan Act of 1916 () was a

In 1908, the Administration of

In 1908, the Administration of

United States federal law

The law of the United States comprises many levels of codified and uncodified forms of law, of which the most important is the nation's Constitution, which prescribes the foundation of the federal government of the United States, as well as va ...

aimed at increasing credit to rural family farmers. It did so by creating a federal farm loan board, twelve regional farm loan banks and tens of farm loan associations. The act was signed into law by President of the United States

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United Stat ...

Woodrow Wilson

Thomas Woodrow Wilson (December 28, 1856February 3, 1924) was an American politician and academic who served as the 28th president of the United States from 1913 to 1921. A member of the Democratic Party, Wilson served as the president of ...

.

Background

In 1908, the Administration of

In 1908, the Administration of Theodore Roosevelt

Theodore Roosevelt Jr. ( ; October 27, 1858 – January 6, 1919), often referred to as Teddy or by his initials, T. R., was an American politician, statesman, soldier, conservationist, naturalist, historian, and writer who served as the 26t ...

commissioned a study on the problems facing rural families. At this point in U.S. history, these families made up the largest demographic of Americans. The commission concluded that access to credit was one of the most serious problems facing rural farmers and recommended the introduction of a cooperative credit system.

Four years later, Presidents William Howard Taft

William Howard Taft (September 15, 1857March 8, 1930) was the 27th president of the United States (1909–1913) and the tenth chief justice of the United States (1921–1930), the only person to have held both offices. Taft was elected pr ...

and Woodrow Wilson

Thomas Woodrow Wilson (December 28, 1856February 3, 1924) was an American politician and academic who served as the 28th president of the United States from 1913 to 1921. A member of the Democratic Party, Wilson served as the president of ...

sent a commission of Americans to study cooperative credit systems for farmers in Europe. Components of such European programs at the time included cooperative land-mortgage banks and rural credit unions. This commission concluded that the best form of cooperative credit system would include both long-term credit to cover land mortgages and short-term credit to cover regular business needs.

Effect on the rural farmer

The most visible component of the Act were the loans to individual farmers and their families. Under the act, farmers could borrow up to 50% of the value of their land and 20% of the value of their improvements. The minimum loan was $100 and the maximum was $10,000. Loans made through the Act were paid off through amortization over 5 to 40 years. Borrowers also purchased shares of the National Farm Loan Association. This meant that it served as a cooperative agency that lent money from farmer to farmer. This was heavily influenced by a successful cooperative credit system in Germany called Landschaft. The next most visible component of the Act were the mortgage-backed bonds that were issued. The rate of interest on the mortgages could be no more than 1 percent higher than the rate of interest on the bonds. This spread covered the issuers' administrative costs, but did not lead to a significant profit. In addition, the maximum rate of interest on the bonds was 6 percent, ensuring that borrowing costs for farmers was often much lower than before the Act was passed. The act furthered Wilson's reputation against trusts and big business. By providing small farmers with competitive loans, they were now more able to compete with big business. As a result, the likelihood of agricultural monopolies decreased. While Wilson's commission suggested that short-term credit also be incorporated in any nationalized credit system, the Act lacked this crucial component. Due to increased competition and the need for agriculture machinery, a system for short-term credit was incorporated into the current system in Agricultural Credits Act of 1923. Sponsored by Senator Henry F. Hollis (D) of New Hampshire and Representative Asbury F. Lever (D) of South Carolina, it was a reintroduced version of the Hollis-Bulkley Act of 1914 that had not passed Congress due to Wilson's opposition.Structure of implementation

The Act established the Federal Farm Loan Board to oversee and supervise federal land banks and national farm loan associations. It was also responsible for setting benchmark rates of interest for mortgages and bonds. Finally, it could intervene when it thought specific banks were making irresponsible loans. The twelve Federal Land Banks were required to hold at least $750,000 in capital. Stock ownership of the banks were held by national farm loan associations and other interested investors, including any individual, corporation or fund. In the case of insufficient capital, the U.S. Treasury (through the Federal Farm Loan Board) made up the difference. When additional subscriptions were made from other sources, federal ownership in the banks was retired. National Farm Loan Associations were established groups of 10 or more mortgage-holding farmers who together owned 5% or more of a federal land bank. Once formed, they were subject to a charter review process by the Federal Farm Loan Board. This structure aimed to align the incentives of individual farmers with the banks, as farmers held two roles: borrowers and lenders.Subsequent history

Under the administration ofHerbert Hoover

Herbert Clark Hoover (August 10, 1874 – October 20, 1964) was an American politician who served as the 31st president of the United States from 1929 to 1933 and a member of the Republican Party, holding office during the onset of the Gr ...

, the Agricultural Marketing Act of 1929

The Agricultural Marketing Act of 1929, under the administration of Herbert Hoover, established the Federal Farm Board from the Federal Farm Loan Board established by the Federal Farm Loan Act of 1916 with a revolving fund of half a billion dolla ...

established the Federal Farm Board The Federal Farm Board was established by the Agricultural Marketing Act of 1929 from the Federal Farm Loan Board established by the Federal Farm Loan Act of 1916, with a revolving fund of half a billion dollarsChapter 4: Crisis and Activism: 1929-1940

online

*Stuart W. Shulman, "The Origin of the Federal Farm Loan Act: Agenda-Setting in the Progressive Era Print Press", University of Oregon, Department of Political Science, Dissertation, 199

*Stuart W. Shulman, "The Origin of the Federal Farm Loan Act: Issue Emergence and Agenda‐Setting in the Progressive Era Print Press," in Jane Adams (Ed.). ''Fighting for the Farm: Rural America Transformed'' (U. of Pennsylvania Press, 2003), 113‐128.

Public Law 64-158, 64th Congress, S. 2986: The Federal Farm Loan Act

{{Authority control 1916 in American law Farm Loan Act Presidency of Woodrow Wilson Progressive Era in the United States United States federal agriculture legislation

United States Government Printing Office

The United States Government Publishing Office (USGPO or GPO; formerly the United States Government Printing Office) is an agency of the legislative branch of the United States Federal government. The office produces and distributes information ...

See also

*Farm Credit System

The Farm Credit System (FCS) in the United States is a nationwide network of borrower-owned lending institutions and specialized service organizations. The Farm Credit System provides more than $304 billion in loans, leases, and related services t ...

Further reading

*Christopher W. Shaw, “'Tired of Being Exploited': The Grassroots Origin of the Federal Farm Loan Act of 1916," ''Agricultural History'' 92:4 (2018): 512-540online

*Stuart W. Shulman, "The Origin of the Federal Farm Loan Act: Agenda-Setting in the Progressive Era Print Press", University of Oregon, Department of Political Science, Dissertation, 199

*Stuart W. Shulman, "The Origin of the Federal Farm Loan Act: Issue Emergence and Agenda‐Setting in the Progressive Era Print Press," in Jane Adams (Ed.). ''Fighting for the Farm: Rural America Transformed'' (U. of Pennsylvania Press, 2003), 113‐128.

References

External links

Public Law 64-158, 64th Congress, S. 2986: The Federal Farm Loan Act

{{Authority control 1916 in American law Farm Loan Act Presidency of Woodrow Wilson Progressive Era in the United States United States federal agriculture legislation