Fair And Equitable Treatment on:

[Wikipedia]

[Google]

[Amazon]

An international investment agreement (IIA) is a type of

In sum, recent developments have made the system increasingly complex and diverse. Moreover, even to the extent that the principal components of IIAs are similar across most of the agreements, substantial divergences can be found in the details of these provisions. All of this makes managing the interaction among IIAs increasingly challenging for countries, particularly those in the developing world, and also complicates the negotiation of new agreements.

In the past, there have been several initiatives for the establishment of a more multilateral approach to international investment rulemaking. These attempts include the

In sum, recent developments have made the system increasingly complex and diverse. Moreover, even to the extent that the principal components of IIAs are similar across most of the agreements, substantial divergences can be found in the details of these provisions. All of this makes managing the interaction among IIAs increasingly challenging for countries, particularly those in the developing world, and also complicates the negotiation of new agreements.

In the past, there have been several initiatives for the establishment of a more multilateral approach to international investment rulemaking. These attempts include the

Investment Policy Hub

giving stakeholders the opportunity to critically assess policy guidelines and recommend any appropriate changes.

Guidelines for International Investment

updating its 1972 recommendations. The guidelines are "a reaffirmation of the fundamental principles for investment set out by the business community in 1972 as essentials for further economic development." The ICC hopes "that these Guidelines will be useful for investors and governments alike in creating a more enabling environment for cross-border investment and in understanding more clearly their shared responsibilities and opportunities in fulfilling the vast potential of cross-border investment for shared global growth." The 2012 update "retains the proven construct of the 1972 Guidelines, setting forth separately responsibilities of the investor, the home government and the host government." In addition, the update has added an introduction to provide setting and context, and updated or added chapters on labour, fiscal policy, competitive neutrality, and corporate responsibility.

United Nations Conference on Trade and Development (UNCTAD) work programme on IIAs

offering various databases and publications on the subject

UNCTAD publications

including the UNCTAD Series on Issues in International Investment Agreements, the UNCTAD Series on International Investment Policies for Development and the UNCTAD IIA Monitor

International Centre for Settlement of Investment Disputes (ICSID)

SICE - Foreign Trade Information System

of the Organization of American States (OAS), offering a database of trade and investment agreements

Investment Treaty News

informs and analyses on the role of international investment law in economic development.

Investment Arbitration Reporter

a news publication on international investment law

Digest of International Investment Jurisprudence

a collection of statements made by tribunals concerned with international investment agreements.

Bilaterals.org

provides news and analysis on bilateral trade and investment agreements.

Discover the dark side of investment

Resources critiquing investment agreements for prioritising corporate profits above human rights and protection of the environment

here

* UNCTAD, ''International Investment Rulemaking: Stocktaking, Challenges and the Way Forward'', New York and Geneva, 2008. * Rudolf Dolzer and Christoph Schreuer, ''Principles of International Investment Law'', Oxford University Press, 2008. * Peter T. Muchlinski, ''Multinational Enterprises & The Law,'' Oxford University Press, 2007. * M. Sornarajah, ''The International Law on Foreign Direct Investment,'' Cambridge University Press, 2004. * ''Journal of International Arbitration,'' Kluwer Law International. * ''Recent developments in international investment law'' August Reinisch, Ed. A.Pedone, Paris, 2009,

treaty

A treaty is a formal, legally binding written agreement between actors in international law. It is usually made by and between sovereign states, but can include international organizations

An international organization or international o ...

between countries that addresses issues relevant to cross-border investment

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing i ...

s, usually for the purpose of protection, promotion and liberalization of such investments. Most IIAs cover foreign direct investment

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct co ...

(FDI) and portfolio investment

Portfolio investments are investments in the form of a group (portfolio) of assets, including transactions in equity, securities, such as common stock, and debt securities, such as banknotes, bonds, and debentures.

Portfolio investments are p ...

, but some exclude the latter. Countries concluding IIAs commit themselves to adhere to specific standards on the treatment of foreign investments within their territory. IIAs further define procedures for the resolution of disputes should these commitments not be met. The most common types of IIAs are bilateral investment treaties

A bilateral investment treaty (BIT) is an agreement establishing the terms and conditions for private investment by nationals and companies of one state in another state. This type of investment is called foreign direct investment (FDI). BITs are e ...

(BITs) and preferential trade and investment agreements (PTIAs). International taxation agreements and double taxation treaties (DTTs) are also considered IIAs, as taxation commonly has an important impact on foreign investment.

Bilateral investment treaties deal primarily with the admission, treatment and protection of foreign investment. They usually cover investments by enterprises or individuals of one country in the territory of its treaty partner. Preferential trade and investment agreements are treaties among countries on cooperation in economic and trade areas. Usually they cover a broader set of issues and are concluded at bilateral or regional levels. In order to classify as IIAs, PTIAs must include, among other content, specific provisions on foreign investment. International taxation agreements deal primarily with the issue of double taxation in international financial activities (e.g., regulating taxes on income, assets or financial transactions). They are commonly concluded bilaterally, though some agreements also involve a larger number of countries.

Contents

Countries conclude IIAs primarily for the protection and, indirectly, promotion of foreign investment, and increasingly also for the purpose of liberalization of such investment. IIAs offer companies and individuals from contracting parties increased security and certainty underinternational law

International law (also known as public international law and the law of nations) is the set of rules, norms, and standards generally recognized as binding between states. It establishes normative guidelines and a common conceptual framework for ...

when they invest or set up a business in other countries party to the agreement. The reduction of the investment risk flowing from an IIA is meant to encourage companies and individuals to invest in the country that concluded the IIA. Allowing foreign investors to settle disputes with the host country through international arbitration, rather than only the host country’s domestic courts, is an important aspect in this context.

Typical provisions found in BITs and PTIAs are clauses on the standards of protection and treatment of foreign investments, usually addressing issues such as fair and equitable treatment, full protection and security, national treatment National treatment is a principle in international law. Utilized in many treaty regimes involving trade and intellectual property, it requires equal treatment of foreigners and locals. Under national treatment, a state that grants particular right ...

, and most-favored nation treatment. Provisions on compensation for losses incurred by foreign investors as a result of expropriation

Nationalization (nationalisation in British English) is the process of transforming privately-owned assets into public assets by bringing them under the public ownership of a national government or state. Nationalization usually refers to pri ...

or due to war and strife usually also form a core part of such agreements. Most IIAs additionally regulate the cross-border transfer of funds in connection with foreign investments.

Contrary to investment protection, provisions on investment promotion are rarely formally included in IIAs, and if so such provisions usually remain non-binding. Nevertheless, the assumption is that the enhanced protection formally offered to foreign investors through an IIA will encourage and promote cross-border investments. The benefits that increased foreign investment can bring about are important for developing countries

A developing country is a sovereign state with a lesser developed industrial base and a lower Human Development Index (HDI) relative to other countries. However, this definition is not universally agreed upon. There is also no clear agreem ...

that aim at using foreign investment and IIAs as tools to enhance their economic development

In the economics study of the public sector, economic and social development is the process by which the economic well-being and quality of life of a nation, region, local community, or an individual are improved according to targeted goals and o ...

.

BITs and some PTIAs also include a provision on investor-State dispute settlement. Usually this gives investors the right to submit a case to an international arbitral tribunal

An arbitral tribunal or arbitration tribunal, also arbitration commission, arbitration committee or arbitration council is a panel of unbiased adjudicators which is convened and sits to resolve a dispute by way of arbitration. The tribunal may co ...

when a dispute with the host country arises. Common venues through which arbitration is sought are the International Centre for Settlement of Investment Disputes

The International Centre for Settlement of Investment Disputes (ICSID) is an international arbitration institution established in 1966 for legal dispute resolution and conciliation between international investors and States. ICSID is part of ...

(ICSID), the United Nations Commission on International Trade Law (UNCITRAL) and the International Chamber of Commerce (ICC).

International taxation agreements deal primarily with the elimination of double taxation, but may in parallel address related issues such as the prevention of tax evasion.

Types

Bilateral investment treaties

To a large extent, the international legal aspects of the relationship between countries and foreign investors are addressed bilaterally between two countries. The conclusion of BITs has evolved from the second half of the 20th century onwards, and today these agreements constitute a key component of the contemporary international law on foreign investment. TheUnited Nations Conference on Trade and Development

The United Nations Conference on Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the ...

(UNCTAD) defines BITs as "agreements between two countries for the reciprocal encouragement, promotion and protection of investments in each other's territories by companies based in either country." While the basic content of BITs has largely remained the same over the years, focusing on investment protection as the core issue, matters reflecting public policy

Public policy is an institutionalized proposal or a decided set of elements like laws, regulations, guidelines, and actions to solve or address relevant and real-world problems, guided by a conception and often implemented by programs. Public p ...

concerns (e.g. health, safety, essential security or environmental protection) have in recent years more frequently been incorporated into BITs.

A typical BIT starts with a preamble

A preamble is an introductory and expressionary statement in a document that explains the document's purpose and underlying philosophy. When applied to the opening paragraphs of a statute, it may recite historical facts pertinent to the subj ...

that outlines the general intention of the agreement and provisions on its scope of application. This is followed by a definition of key terms, clarifying amongst others the meanings of "investment" and "investor". BITs then address issues related to the admission and establishment of foreign investments, including standards of treatment enjoyed by foreign investors (minimum standard of treatment, fair and equitable treatment, full protection and security, national treatment and most-favored nation treatment). The free transfer of funds across national borders in connection with a foreign investment is usually also regulated in BITs. Moreover, BITs deal with the issue of expropriation or damage to an investment, determining how much and how compensation would be paid to the investor in such a situation. They also specify the degree of protection and compensation that investors should expect in situations of war or civil unrest. Another core element of BITs relates to the settlement of disputes between an investor and the country in which the investment took place. These provisions, often called investor-state dispute settlement, usually mention the forums to which investors can resort for establishing international arbitral tribunals (e.g. ICSID, UNCITRAL or ICC) and how this relates to proceedings in host countries' domestic courts. BITs also typically include a clause on State-State dispute settlement. Finally, BITs usually refer to the time frame of the treaty, clarifying how the agreement is extended and terminated, and specifying to what extent investments conducted prior to conclusion and ratification

Ratification is a principal's approval of an act of its agent that lacked the authority to bind the principal legally. Ratification defines the international act in which a state indicates its consent to be bound to a treaty if the parties inten ...

of the treaty are covered.

Preferential trade and investment agreements

Preferential Trade and Investment Agreements (PTIAs) are broader economic agreements among countries that are concluded for the purpose of facilitatinginternational trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (see: World economy)

In most countries, such trade represents a significant ...

and the transfer of factors of production across borders. They can be economic integration

Economic integration is the unification of economic policies between different states, through the partial or full abolition of tariff and Non-tariff barriers to trade, non-tariff restrictions on trade.

The trade-stimulation effects intended b ...

agreements, free trade agreement

A free-trade agreement (FTA) or treaty is an agreement according to international law to form a free-trade area between the cooperating states. There are two types of trade agreements: bilateral and multilateral. Bilateral trade agreements occur ...

s (FTAs), economic partnership agreements (EPAs) or similar types of agreements that cover, among many other things, provisions dealing with foreign investment. In PTIAs, the section dealing with foreign investment forms only a small part of the treaty, usually encompassing one or two chapters. Other issues dealt with in PTIAs are trade in goods and services, tariffs and non-tariff barriers, customs

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs ...

procedures, specific provisions pertaining to selected sectors, competition, intellectual property

Intellectual property (IP) is a category of property that includes intangible creations of the human intellect. There are many types of intellectual property, and some countries recognize more than others. The best-known types are patents, cop ...

, temporary entry of people, and many more. PTIAs pursue the liberalization

Liberalization or liberalisation (British English) is a broad term that refers to the practice of making laws, systems, or opinions less severe, usually in the sense of eliminating certain government regulations or restrictions. The term is used m ...

of trade and investment in the context of this broader focus. Frequently, the structure and appearance of the respective chapter on foreign investments is similar to a BIT.

There exist many examples of PTIAs. A notable one is the North American Free Trade Agreement

The North American Free Trade Agreement (NAFTA ; es, Tratado de Libre Comercio de América del Norte, TLCAN; french: Accord de libre-échange nord-américain, ALÉNA) was an agreement signed by Canada, Mexico, and the United States that crea ...

(NAFTA). While the NAFTA agreement deals with a very broad set of issues, most importantly cross-border trade between Canada

Canada is a country in North America. Its ten provinces and three territories extend from the Atlantic Ocean to the Pacific Ocean and northward into the Arctic Ocean, covering over , making it the world's second-largest country by tot ...

, Mexico

Mexico (Spanish: México), officially the United Mexican States, is a country in the southern portion of North America. It is bordered to the north by the United States; to the south and west by the Pacific Ocean; to the southeast by Guatema ...

and the United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

, chapter 11 of this agreement covers detailed provisions on foreign investment similar to those found in BITs. Other examples of PTIAs concluded bilaterally can be found in the EPA between Japan

Japan ( ja, 日本, or , and formally , ''Nihonkoku'') is an island country in East Asia. It is situated in the northwest Pacific Ocean, and is bordered on the west by the Sea of Japan, while extending from the Sea of Okhotsk in the north ...

and Singapore

Singapore (), officially the Republic of Singapore, is a sovereign island country and city-state in maritime Southeast Asia. It lies about one degree of latitude () north of the equator, off the southern tip of the Malay Peninsula, borde ...

, the FTA between the Republic of Korea

South Korea, officially the Republic of Korea (ROK), is a country in East Asia, constituting the southern part of the Korean Peninsula and sharing a land border with North Korea. Its western border is formed by the Yellow Sea, while its east ...

and Chile

Chile, officially the Republic of Chile, is a country in the western part of South America. It is the southernmost country in the world, and the closest to Antarctica, occupying a long and narrow strip of land between the Andes to the east a ...

, and the FTA between the United States and Australia

Australia, officially the Commonwealth of Australia, is a Sovereign state, sovereign country comprising the mainland of the Australia (continent), Australian continent, the island of Tasmania, and numerous List of islands of Australia, sma ...

.

International taxation agreements

The main purpose of international taxation agreements is to regulate how taxes imposed on the global income of multinational enterprises are distributed among countries. In most cases, this is done through the elimination of double taxation. The core of the problem lies in the disagreements among countries on who hasjurisdiction

Jurisdiction (from Latin 'law' + 'declaration') is the legal term for the legal authority granted to a legal entity to enact justice. In federations like the United States, areas of jurisdiction apply to local, state, and federal levels.

Jur ...

over the taxable income of multinational corporation

A multinational company (MNC), also referred to as a multinational enterprise (MNE), a transnational enterprise (TNE), a transnational corporation (TNC), an international corporation or a stateless corporation with subtle but contrasting senses, i ...

s. Most commonly, such conflicts are addressed through bilateral agreements that deal solely with taxation on income and sometimes also capital. Nevertheless, a few multilateral agreements on taxation as well as bilateral agreements that address taxation together with other issues have also been concluded in the past.

In contemporary treaty practice, avoidance of double taxation is achieved by concurrently applying two separate approaches. The first approach is the elimination of definition mismatches for terms such as "residence" or "income" that could otherwise be a cause of double taxation. The second approach constitutes the relief from double taxation through one of three methods. The credit method allows foreign tax to be credited against the tax paid in the residence country. According to the exemption method, foreign income and resulting taxation is simply disregarded by the residence country. The deduction method taxes income net of foreign tax, but it is rarely applied.

Trends in international investment rulemaking

Historically, the emergence of the international investment framework can be divided into two separate eras. The first era – from 1945 to 1989 – was characterized by disagreements among countries about the degree of protection that international law should offer to foreign investors. While most developed countries argued that foreign investors should be entitled to a minimum standard of treatment in any host economy, developing andsocialist

Socialism is a left-wing economic philosophy and movement encompassing a range of economic systems characterized by the dominance of social ownership of the means of production as opposed to private ownership. As a term, it describes the e ...

countries tended to contend that foreign investors do not need to be treated differently from national firms. In 1959, the first BITs were concluded, and during the following decade, much of the content that forms the basis of a majority of the BITs currently in force were developed and refined. In 1965, the Convention for the Settlement of Investment Disputes Between States and Nationals of Other States was opened to countries for signature. The rationale was to establish ICSID as an institution that facilitates the arbitration of investor-State disputes.

The second era – from 1989 to today – is characterized by a generally more welcoming sentiment towards foreign investment, and a substantial increase in the number of BITs concluded. Amongst others, this growth in BITs was due to the opening up of many developing economies to foreign investment, which hoped that the conclusion of BITs would make them a more attractive destination for foreign companies. The mid-1990s also saw the creation of three multilateral agreements that touched upon investment issues as part of the Uruguay Round of trade negotiations and the creation of the World Trade Organization

The World Trade Organization (WTO) is an intergovernmental organization that regulates and facilitates international trade. With effective cooperation

in the United Nations System, governments use the organization to establish, revise, and e ...

(WTO). These were the General Agreement on Trade in Services (GATS), the Agreement on Trade-Related Investment Measures

The Agreement on Trade-Related Investment Measures (TRIMs) are rules that are applicable to the domestic regulations a country applies to foreign investors, often as part of an industrial policy. The agreement, concluded in 1994, was negotiated u ...

(TRIMS), and the Agreement on Trade-Related Aspects of Intellectual Property Rights

The Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) is an international legal agreement between all the member nations of the World Trade Organization (WTO). It establishes minimum standards for the regulation by nat ...

(TRIPS). In addition, this era saw the growth of PTIAs, such as regional, interregional or plurilateral A plurilateral agreement is a multi-national legal or trade agreement between countries. In the jargon of global economics, it is an agreement between more than two countries, but not a great many, which would be multilateral agreement.

Use of the ...

agreements, as exemplified in the conclusion of the NAFTA in 1992 and the establishment of the ASEAN

ASEAN ( , ), officially the Association of Southeast Asian Nations, is a political and economic union of 10 member states in Southeast Asia, which promotes intergovernmental cooperation and facilitates economic, political, security, militar ...

Framework Agreement on the ASEAN Investment Area in 1998. These agreements typically also began to pursue liberalization of investment more intensively. However, IIAs may be entering a new era as regional agreements, such as the European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been des ...

, North American Free Trade Agreement

The North American Free Trade Agreement (NAFTA ; es, Tratado de Libre Comercio de América del Norte, TLCAN; french: Accord de libre-échange nord-américain, ALÉNA) was an agreement signed by Canada, Mexico, and the United States that crea ...

, and dozens of others already in existence or under negotiation are set to supplant traditional bilateral agreements.

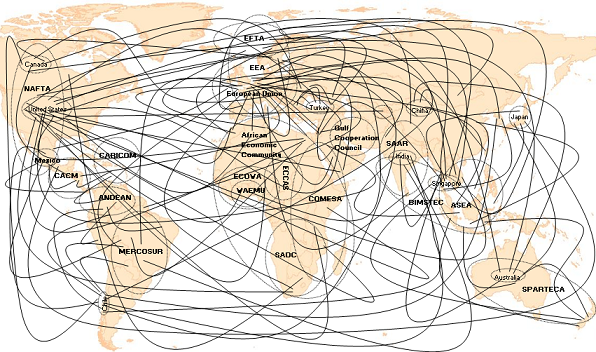

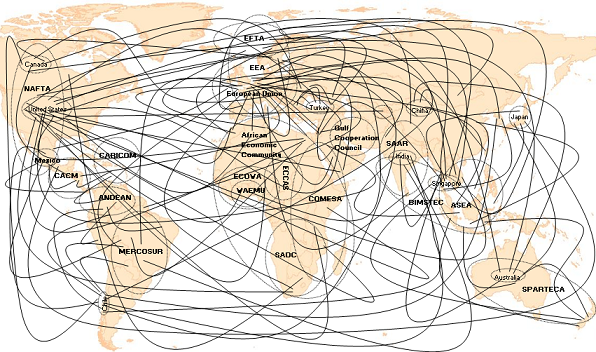

Statistics show the rapid expansion of IIAs during the last two decades. By 2007 year-end, the entire number of IIAs had already surpassed 5,500, and increasingly involved the conclusion of PTIAs with a focus beyond investment issues. As the types and contents of IIAs are becoming increasingly diverse and as almost all countries participate in the conclusion of new IIAs, the global IIA system has become extremely complex and hard to see through. Exacerbating this problem has been the shift among many States from a bilateral model of investment agreements to a regional model without fully replacing the existing framework resulting in an increasingly complex and dense web of investment agreements that will surely increasingly contradict and overlap.

Moreover, the number of IIA-based investor-State dispute settlement cases has also been on the rise in recent years. By the end of the year 2008, the total number of known cases reached 317.

Another new development in the global system of IIAs is the increased conclusion of such agreements among developing countries. In the past, industrialized countries

A developed country (or industrialized country, high-income country, more economically developed country (MEDC), advanced country) is a sovereign state that has a high quality of life, developed economy and advanced technological infrastruct ...

usually concluded IIAs to protect their firms when they undertake overseas investments, while developing countries tended to sign IIAs in order to encourage and promote inflows of FDI from industrialized countries. The current trend towards increased conclusions of IIAs among developing countries reflects the economic changes underlying international investment relations. Developing countries and emerging economies are increasingly not only destinations but also significant source countries of FDI flows. In line with their emerging role as outward investors and their improved economic competitiveness, developing countries are increasingly pursuing the dual interests of encouraging FDI inflows but also seeking to protect the investments of their companies abroad.

Another key trend relates to the myriad of different agreements. As a result, the evolving international system of IIAs has been equated with the metaphor of a "spaghetti bowl". According to UNCTAD, the system is universal, as practically every country has signed at least one IIA. At the same time, it can be considered as atomized due to the large number of individual agreements currently in existence. The system is multi-layered, with agreements being signed at all levels (bilateral, sectoral, regional etc.). It is also multi-faceted, as an increasing number of IIAs include provisions on issues traditionally considered only distantly related to investment, such as trade, intellectual property, labor rights and environmental protection. The system is also dynamic, as its key characteristics are currently rapidly evolving. For example, more recent IIAs tend to include provisions addressing issues such as public health, safety, national security

National security, or national defence, is the security and defence of a sovereign state, including its citizens, economy, and institutions, which is regarded as a duty of government. Originally conceived as protection against military atta ...

or the environment more frequently, with a view to better reflect public policy concerns. Finally, beyond IIAs, there is other international law relevant for countries' domestic investment frameworks, including customary international law, United Nations instruments and the WTO agreement (e.g., TRIMS).

In sum, recent developments have made the system increasingly complex and diverse. Moreover, even to the extent that the principal components of IIAs are similar across most of the agreements, substantial divergences can be found in the details of these provisions. All of this makes managing the interaction among IIAs increasingly challenging for countries, particularly those in the developing world, and also complicates the negotiation of new agreements.

In the past, there have been several initiatives for the establishment of a more multilateral approach to international investment rulemaking. These attempts include the

In sum, recent developments have made the system increasingly complex and diverse. Moreover, even to the extent that the principal components of IIAs are similar across most of the agreements, substantial divergences can be found in the details of these provisions. All of this makes managing the interaction among IIAs increasingly challenging for countries, particularly those in the developing world, and also complicates the negotiation of new agreements.

In the past, there have been several initiatives for the establishment of a more multilateral approach to international investment rulemaking. These attempts include the Havana Charter

Havana (; Spanish: ''La Habana'' ) is the capital and largest city of Cuba. The heart of the La Habana Province, Havana is the country's main port and commercial center.

of 1948, the United Nations Draft Code of Conduct on Transnational Corporations in the 1980s, and the Multilateral Agreement on Investment

The Multilateral Agreement on Investment (MAI) was a draft agreement negotiated in secret between members of the Organisation for Economic Co-operation and Development (OECD) between 1995 and 1998. It sought to establish a new body of universal inv ...

(MAI) of the Organisation for Economic Co-operation and Development

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organization, intergovernmental organisation with 38 member countries ...

(OECD) in the 1990s. None of these initiatives reached successful conclusion, due to disagreements among countries and, in case of the MAI, also in light of strong opposition by civil society groups. Further attempts of advancing the process towards establishment of a multilateral agreement have since been made within the WTO, but also without success. Concerns have been raised regarding the specific objectives that such a multilateral agreement is meant to accomplish, who would benefit in what way from it, and what impact such a multilateral agreement would have on countries' broader public policies, including those related to environmental, social and other issues. Particularly developing countries may require "policy space" to develop their regulatory frameworks, such as in the area of economic or financial policies, and one major concern was that a multilateral agreement on investment would diminish such policy space. As a result, current international investment rulemaking remains short of having a unified system based on a multilateral agreement. In this respect, investment differs for example from trade and finance, as the WTO fulfills the purpose of creating a more unified global system for trade and the International Monetary Fund

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster globa ...

(IMF) plays a similar role with respect to the international financial system.

The development dimension

By providing additional security and certainty under international law to investors operating in foreign countries, IIAs can encourage companies to invest overseas. While there is a scientific debate on the extent to which IIAs increase the amount of FDI flows to signatory host countries, policymakers do tend to anticipate that IIAs encourage cross-border investment and thereby also support economic development. Amongst others, FDI can facilitate the inflows of capital and technology into host countries, help generate employment and have other positivespillover effect

In economics a spillover is an economic event in one context that occurs because of something else in a seemingly unrelated context. For example, externalities of economic activity are non-monetary spillover effects upon non-participants. Odors f ...

s. Accordingly, developing country governments seek to establish an adequate framework to encourage such inflows, amongst others through the conclusion of IIAs.

However, despite this potential to generate pro-development benefits, the evolving complexity of the IIA system may also create challenges. Amongst others, the complexity of today's IIA network makes it difficult for countries to maintain policy coherence. Provisions agreed upon in one IIA may be inconsistent with those included in a different IIA. For developing countries with lower capacity to participate in the global IIA system, this complexity of the IIA framework is particularly hard to manage. Additional challenges arise from the need to ensure consistency between a country's national and international investment laws, and from the objective to design investment policies that best support a county's specific development goals.

Furthermore, even if governments conclude IIAs with general development goals in mind, these agreements themselves usually do not directly deal with problems of economic development. While IIAs rarely contain specific obligations on investment promotion, some include provisions that advocate information exchange about investment opportunities, encourage the use of investment incentives, or suggest the establishment of investment promotion agencies

Investment is the dedication of money to purchase of an asset to attain an increase in value over a period of time. Investment requires a sacrifice of some present asset, such as time, money, or effort.

In finance, the purpose of investing is ...

(IPAs). Some also contain provisions that address public policy concerns related to development, such as exceptions related to health or environmental issues, or exceptions related to essential security. Some IIAs also grant countries specific regulatory flexibility, amongst others when it comes to making commitments for investment liberalization.

An additional burden arises from the growing number of investor-State disputes, which are increasingly lodged against governments from developing countries. These disputes are very costly for the affected countries, which have to shoulder substantial expenses for the arbitration procedures, for the payment of lawyer's fees and, most importantly, for the financial compensation to be paid to the investor in case the tribunal decides against the host country. The problem is further exacerbated by inconsistencies in the case law

Case law, also used interchangeably with common law, is law that is based on precedents, that is the judicial decisions from previous cases, rather than law based on constitutions, statutes, or regulations. Case law uses the detailed facts of a l ...

that is emerging from investor-State disputes. Increasingly, tribunals addressing similar cases come to differing interpretations and decisions. This increases the uncertainty among countries and investors about the outcome of a dispute.

One of the key organizations concerned with the development dimension of IIAs is the United Nations Conference on Trade and Development

The United Nations Conference on Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the ...

(UNCTAD), which is the key focal point of the United Nations

The United Nations (UN) is an intergovernmental organization whose stated purposes are to maintain international peace and international security, security, develop friendly relations among nations, achieve international cooperation, and be ...

(UN) for dealing with matters related to IIAs and their development dimension. This organization's program on IIAs supports developing countries in their efforts to participate effectively in the complex system of investment rulemaking. UNCTAD offers capacity building

Capacity building (or capacity development, capacity strengthening) is the improvement in an individual's or organization's facility (or capability) "to produce, perform or deploy". The terms ''capacity building'' and ''capacity development'' ha ...

services, is widely recognized for its research and policy analysis on IIAs and functions as an important forum for intergovernmental discussions and consensus building on issues related to international investment law and development.

Investment Policy Framework for Sustainable Development

Within their roles,United Nations Conference on Trade and Development

The United Nations Conference on Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the ...

has published the Investment Policy Framework for Sustainable Development

The 'Investment Policy Framework for Sustainable Development (IPFSD)'' is a dynamic document created to help governments formulate sound investment policy, especially international investment agreements (IIAs), that capitalize on foreign direct in ...

(IPFSD) which is a dynamic document created to help governments formulate sound investment policy, especially international investment agreements, that capitalize on foreign direct investment

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct co ...

(FDI) for sustainable development

Sustainable development is an organizing principle for meeting human development goals while also sustaining the ability of natural systems to provide the natural resources and ecosystem services on which the economy and society depend. The des ...

. IPFSD intends to promote a new generation of investment agreements by pursuing a broader development agenda; and offer guidance to policymakers when formulating their national and international investment policies. To that end, IPFSD defines eleven critical Core Principles. Flowing from these Core Principles IPFSD provides States guidelines and advice on formulating good investment policy including clause-by-clause options for negotiators to enhance the sustainable development

Sustainable development is an organizing principle for meeting human development goals while also sustaining the ability of natural systems to provide the natural resources and ecosystem services on which the economy and society depend. The des ...

value of domestic investment policies.

The IPFSD proposes clause-by-clause options for negotiators to strengthen the sustainable development aspects of IIAs.

IPFSD also offers an interactive online platform, thInvestment Policy Hub

giving stakeholders the opportunity to critically assess policy guidelines and recommend any appropriate changes.

International Chamber of Commerce Guidelines for International Investment

Similar to UNCTAD's IPFSD, in 2012, the International Chamber of Commerce (ICC) issued itGuidelines for International Investment

updating its 1972 recommendations. The guidelines are "a reaffirmation of the fundamental principles for investment set out by the business community in 1972 as essentials for further economic development." The ICC hopes "that these Guidelines will be useful for investors and governments alike in creating a more enabling environment for cross-border investment and in understanding more clearly their shared responsibilities and opportunities in fulfilling the vast potential of cross-border investment for shared global growth." The 2012 update "retains the proven construct of the 1972 Guidelines, setting forth separately responsibilities of the investor, the home government and the host government." In addition, the update has added an introduction to provide setting and context, and updated or added chapters on labour, fiscal policy, competitive neutrality, and corporate responsibility.

See also

* Free trade agreement * Double taxation *Foreign direct investment

A foreign direct investment (FDI) is an investment in the form of a controlling ownership in a business in one country by an entity based in another country. It is thus distinguished from a foreign portfolio investment by a notion of direct co ...

* International Centre for Settlement of Investment Disputes

The International Centre for Settlement of Investment Disputes (ICSID) is an international arbitration institution established in 1966 for legal dispute resolution and conciliation between international investors and States. ICSID is part of ...

(ICSID)

* Preferential trading area

* Tax treaty

* Commercial treaty

* Investor State Dispute Settlement

An investor is a person who allocates financial capital with the expectation of a future return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some species of property. Type ...

(ISDS)

* Investment Policy Framework for Sustainable Development

The 'Investment Policy Framework for Sustainable Development (IPFSD)'' is a dynamic document created to help governments formulate sound investment policy, especially international investment agreements (IIAs), that capitalize on foreign direct in ...

* United Nations Conference on Trade and Development

The United Nations Conference on Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the ...

* International Chamber of Commerce

* Sustainable Development

Sustainable development is an organizing principle for meeting human development goals while also sustaining the ability of natural systems to provide the natural resources and ecosystem services on which the economy and society depend. The des ...

External links

United Nations Conference on Trade and Development (UNCTAD) work programme on IIAs

offering various databases and publications on the subject

UNCTAD publications

including the UNCTAD Series on Issues in International Investment Agreements, the UNCTAD Series on International Investment Policies for Development and the UNCTAD IIA Monitor

International Centre for Settlement of Investment Disputes (ICSID)

SICE - Foreign Trade Information System

of the Organization of American States (OAS), offering a database of trade and investment agreements

Investment Treaty News

informs and analyses on the role of international investment law in economic development.

Investment Arbitration Reporter

a news publication on international investment law

Digest of International Investment Jurisprudence

a collection of statements made by tribunals concerned with international investment agreements.

Bilaterals.org

provides news and analysis on bilateral trade and investment agreements.

Discover the dark side of investment

Resources critiquing investment agreements for prioritising corporate profits above human rights and protection of the environment

Further reading

* UNCTAD, "World Investment Report 2012: Towards a New Generation of Investment Policies", New York and Geneva, 2012, availablhere

* UNCTAD, ''International Investment Rulemaking: Stocktaking, Challenges and the Way Forward'', New York and Geneva, 2008. * Rudolf Dolzer and Christoph Schreuer, ''Principles of International Investment Law'', Oxford University Press, 2008. * Peter T. Muchlinski, ''Multinational Enterprises & The Law,'' Oxford University Press, 2007. * M. Sornarajah, ''The International Law on Foreign Direct Investment,'' Cambridge University Press, 2004. * ''Journal of International Arbitration,'' Kluwer Law International. * ''Recent developments in international investment law'' August Reinisch, Ed. A.Pedone, Paris, 2009,

References

{{reflist Investment Foreign direct investment Commercial treaties de:Investitionsschutzabkommen zh:國際投資協定