Euro Zone on:

[Wikipedia]

[Google]

[Amazon]

euro_banknotes_

Banknotes_of_the_euro,_the_common_currency_of_the_Eurozone_(euro_area_members),_have_been_in_circulation_since_the_first_series_(also_called_''ES1'')_was_issued_in_2002._They_are_issued_by_the_national_central_banks_of_the_Eurosystem_or_the_Eur_...

_and_the_volume_of__

The euro area, commonly called eurozone (EZ), is a

by Leigh Phillips, '' EUobserver'', 8 September 2011The Eurozone crisis – the final stage?

" by Charles Proctor,

" by Phoebus Athanassiou, Principal Legal Counsel with the

by Daniel Tost, EurActiv, 29 July 2015 On the issue of leaving the eurozone, the European Commission has stated that " e irrevocability of membership in the euro area is an integral part of the Treaty framework and the Commission, as a guardian of the EU Treaties, intends to fully respect hat irrevocability" It added that it "does not intend to propose nyamendment" to the relevant Treaties, the current status being "the best way going forward to increase the resilience of euro area Member States to potential economic and financial crises.Text

of response by Olli Rehn, European Commissioner for Economic and Monetary Affairs and the Euro, on behalf of the European Commission, to question submitted by Claudio Morganti, Member of the European Parliament, 22 June 2012 The European Central Bank, responding to a question by a Member of the European Parliament, has stated that an exit is not allowed under the Treaties. Likewise there is no provision for a state to be expelled from the euro. Some, however, including the Dutch government, favour the creation of an expulsion provision for the case whereby a heavily indebted state in the eurozone refuses to comply with an EU economic reform policy. In a Texas law journal, University of Texas at Austin law professor Jens Dammann has argued that even now EU law contains an implicit right for member states to leave the eurozone if they no longer meet the criteria that they had to meet in order to join it. Furthermore, he has suggested that, under narrow circumstances, the European Union can expel member states from the eurozone. University of California, Berkeley professor of Economics and Political ScienceEichengreen,_Barry_(23_July_201

Can_the_Euro_Area_Hit_the_Rewind_Button?

_(PDF),_University_of_California._Retrieved_8_September_2011

In_2011,_he_still_believed_the_probability_of_Grexit_was_"very_low"_and_in_case_of_any_bank_run_"the_Greek_government_would_almost_certainly_receive_support_for_its_banks_from_its_European_Union_partners_and_the__European_Central_Bank”._

The_monetary_policy_of_all_countries_in_the_eurozone_is_managed_by_the__European_Central_Bank_(ECB)_and_the__Eurosystem_which_comprises_the_ECB_and_the_central_banks_of_the_EU_states_who_have_joined_the_eurozone._Countries_outside_the_eurozone_are_not_represented_in_these_institutions._Whereas_all_EU_member_states_are_part_of_the_European_System_of_Central_Banks_

The_European_System_of_Central_Banks_(ESCB)_is_an_institution_that_comprises_the_European_Central_Bank_(ECB)_and_the_national_central_banks_(NCBs)_of_all_27__member_states_of_the_European_Union_(EU)._Its_objective_is_to_ensure_price_stability_t_...

_(ESCB),_non_EU_member_states_have_no_say_in_all_three_institutions,_even_those_with_monetary_agreements_such_as_Monaco._The_ECB_is_entitled_to_authorise_the_design_and_printing_of_currency union

A currency union (also known as monetary union) is an intergovernmental agreement that involves two or more states sharing the same currency. These states may not necessarily have any further integration (such as an economic and monetary union, ...

of 19 member states of the European Union (EU) that have adopted the euro (€

The euro sign () is the currency sign used for the euro, the official currency of the eurozone and unilaterally adopted by Kosovo and Montenegro. The design was presented to the public by the European Commission on 12 December 1996. It consists o ...

) as their primary currency and sole legal tender, and have thus fully implemented EMU

The emu () (''Dromaius novaehollandiae'') is the second-tallest living bird after its ratite relative the ostrich. It is endemic to Australia where it is the largest native bird and the only extant member of the genus ''Dromaius''. The em ...

policies.

The 19 eurozone members are Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The eight non-eurozone members of the EU are Bulgaria, Czech Republic, Croatia, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, albeit all but Denmark are obliged to join once they meet the euro convergence criteria. Croatia will become the 20th member on 1 January 2023. Among non-EU member states, Andorra

, image_flag = Flag of Andorra.svg

, image_coat = Coat of arms of Andorra.svg

, symbol_type = Coat of arms

, national_motto = la, Virtus Unita Fortior, label=none (Latin)"United virtue is stro ...

, Monaco, San Marino, and Vatican City have formal agreements with the EU to use the euro as their official currency and issue their own coins. In addition, Kosovo and Montenegro have adopted the euro unilaterally. These countries, however, have no representation in any eurozone institution.

The Eurosystem is the monetary authority

In finance and economics, a monetary authority is the entity that manages a country’s currency and money supply, often with the objective of controlling inflation, interest rates, real GDP or unemployment rate. With its monetary tools, a mone ...

of the eurozone, the Eurogroup is an informal body of finance ministers

A finance minister is an executive or cabinet position in charge of one or more of government finances, economic policy and financial regulation.

A finance minister's portfolio has a large variety of names around the world, such as "treasury", ...

that makes fiscal policy for the currency union and the European System of Central Banks

The European System of Central Banks (ESCB) is an institution that comprises the European Central Bank (ECB) and the national central banks (NCBs) of all 27 member states of the European Union (EU). Its objective is to ensure price stability t ...

is responsible for fiscal and monetary cooperation between eurozone and none-eurozone EU members. The European Central Bank (ECB) makes monetary policy for the eurozone, sets its base interest rate

An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum). The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, th ...

, and issues euro banknotes and coins.

Since the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

, the eurozone has established and used provisions for granting emergency loans to member states in return for enacting economic reforms. The eurozone has also enacted some limited fiscal integration; for example, in peer review of each other's national budgets. The issue is political and in a state of flux in terms of what further provisions will be agreed for eurozone change. No eurozone member state has left, and there are no provisions to do so or to be expelled.

Territory

Eurozone

In 1998, eleven member states of the European Union had met the euro convergence criteria, and the eurozone came into existence with the official launch of the euro (alongside national currencies) on 1 January 1999 in those countries: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal, and Spain. Greece qualified in 2000 and was admitted on 1 January 2001. The physicaleuro banknotes

Banknotes of the euro, the common currency of the Eurozone (euro area members), have been in circulation since the first series (also called ''ES1'') was issued in 2002. They are issued by the national central banks of the Eurosystem or the Eur ...

and euro coins were introduced in the preceding twelve members on 1 January 2002. All their pre-euro national coins and notes were taken out of circulation and rendered invalid after a short transition period. Between 2007 and 2015, seven new states acceded: Cyprus, Estonia, Latvia, Lithuania, Malta, Slovakia, and Slovenia.

Dependent territories of EU member states — outside EU

Three of the dependent territories of EU member states not part of the EU have adopted the euro: * Territorial collectivity of Saint Barthélemy (French territory, with France ensuring eurozone laws are implemented) * Overseas Collectivity of Saint-Pierre and Miquelon (French territory, with France ensuring eurozone laws are implemented) * French Southern and Antarctic Lands (French territory, with France ensuring eurozone laws are implemented)Non-member usage

With formal agreement

The euro is also used in countries outside the EU. Four states (Andorra, Monaco, San Marino, and Vatican City) have signed formal agreements with the EU to use the euro and issue their own coins. Nevertheless, they are not considered part of the eurozone by the ECB and do not have a seat in the ECB or Euro Group.Akrotiri and Dhekelia

Akrotiri and Dhekelia, officially the Sovereign Base Areas of Akrotiri and Dhekelia (SBA),, ''Periochés Kyríarchon Váseon Akrotiríou ke Dekélias''; tr, Ağrotur ve Dikelya İngiliz Egemen Üs Bölgeleri is a British Overseas Territories ...

(located on the island of Cyprus) belong to the United Kingdom, but there are agreements between the UK and Cyprus and between UK and EU about their partial integration with Cyprus and partial adoption of Cypriot law, including the usage of euro in Akrotiri and Dhekelia.

Several currencies are pegged to the euro, some of them with a fluctuation band and others with an exact rate. The Bosnia and Herzegovina convertible mark

The convertible mark ( Bosanski: , sign: KM; code: BAM) is the currency of Bosnia and Herzegovina. It is divided into 100 or (/) and locally abbreviated ''KM''. While the currency and its subunits are uniform for both constituent polities of B ...

was once pegged to the Deutsche mark at par, and continues to be pegged to the euro today at the Deutsch mark's old rate (1.95583 per euro). The West African

West Africa or Western Africa is the westernmost region of Africa. The United Nations defines Western Africa as the 16 countries of Benin, Burkina Faso, Cape Verde, The Gambia, Ghana, Guinea, Guinea-Bissau, Ivory Coast, Liberia, Mali, ...

and Central African CFA francs are pegged exactly at 655.957 CFA to 1 EUR. In 1998, in anticipation of Economic and Monetary Union of the European Union, the Council of the European Union

The Council of the European Union, often referred to in the treaties and other official documents simply as the Council, and informally known as the Council of Ministers, is the third of the seven Institutions of the European Union (EU) as ...

addressed the monetary agreements France had with the CFA Zone and Comoros, and ruled that the ECB had no obligation towards the convertibility of the CFA and Comorian franc

The franc (french: link=no, franc comorien; ar, فرنك قمري; sign: FC; ISO 4217 code: KMF) is the official currency of Comoros. It is nominally subdivided into 100 ''centimes'', although no centime denominations have ever been issued.

His ...

s. The responsibility of the free convertibility remained in the French Treasury.

Other

Kosovo and Montenegro officially adopted the euro as their sole currency without an agreement and, therefore, have no issuing rights. These states are not considered part of the eurozone by the ECB. However, sometimes the term ''eurozone'' is applied to all territories that have adopted the euro as their sole currency. Further unilateral adoption of the euro (euroisation

The international status and usage of the euro has grown since its launch in 1999. When the euro formally replaced 12 currencies on 1 January 2002, it inherited their use in territories such as Montenegro and replaced minor currencies tied ...

), by both non-euro EU and non-EU members, is opposed by the ECB and EU.

Historical eurozone enlargements and exchange-rate regimes for EU members

The chart below provides a full summary of all applyingexchange-rate regime

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many o ...

s for EU members, since the birth, on 13 March 1979, of the European Monetary System with its Exchange Rate Mechanism and the related new common currency ECU. On 1 January 1999, The euro replaced the ECU 1:1 at the exchange rate markets. During 1979–1999, the D-Mark functioned as a de facto anchor for the ECU, meaning there was only a minor difference between pegging a currency against the ECU and pegging it against the D-mark.

The eurozone was born with its first 11 member states on 1 January 1999. The first enlargement of the eurozone

The enlargement of the eurozone is an ongoing process within the European Union (EU). All member states of the European Union, except Denmark which negotiated an opt-out from the provisions, are obliged to adopt the euro as their sole currency ...

, to Greece, took place on 1 January 2001, one year before the euro physically entered into circulation. The next enlargements were to states which joined the EU in 2004, and then joined the eurozone on 1 January in the year noted: Slovenia (2007), Cyprus (2008), Malta (2008), Slovakia (2009), Estonia (2011), Latvia (2014), and Lithuania (2015).

All new EU members joining the bloc after the signing of the Maastricht Treaty

The Treaty on European Union, commonly known as the Maastricht Treaty, is the foundation treaty of the European Union (EU). Concluded in 1992 between the then-twelve member states of the European Communities, it announced "a new stage in the p ...

in 1992 are obliged to adopt the euro under the terms of their accession treaties. However, the last of the five economic convergence criteria which need first to be complied with in order to qualify for euro adoption, is the exchange rate stability criterion, which requires having been an ERM-member for a minimum of two years without the presence of "severe tensions" for the currency exchange rate.

In September 2011, a diplomatic source close to the euro adoption preparation talks with the seven remaining new member states who had yet to adopt the euro (Bulgaria, Czech Republic, Hungary, Latvia, Lithuania, Poland, and Romania), claimed that the monetary union (eurozone) they had thought they were going to join upon their signing of the accession treaty may very well end up being a very different union, entailing a much closer fiscal, economic, and political convergence than originally anticipated. This changed legal status of the eurozone could potentially cause them to conclude that the conditions for their promise to join were no longer valid, which "could force them to stage new referendums" on euro adoption.

Future enlargement

Eight countries (Bulgaria

Bulgaria (; bg, България, Bǎlgariya), officially the Republic of Bulgaria,, ) is a country in Southeast Europe. It is situated on the eastern flank of the Balkans, and is bordered by Romania to the north, Serbia and North Maced ...

, Croatia, Czech Republic, Denmark, Hungary, Poland, Romania, and Sweden) are EU members but do not use the euro.

Before joining the eurozone, a state must spend at least two years in the European Exchange Rate Mechanism

The European Exchange Rate Mechanism (ERM II) is a system introduced by the European Economic Community on 1 January 1999 alongside the introduction of a single currency, the euro (replacing ERM 1 and the euro's predecessor, the ECU) as ...

(ERM II). , the Danish central bank, Bulgarian central bank, and Croatian central bank participate in ERM II.

Denmark obtained a special opt-out in the original Maastricht Treaty

The Treaty on European Union, commonly known as the Maastricht Treaty, is the foundation treaty of the European Union (EU). Concluded in 1992 between the then-twelve member states of the European Communities, it announced "a new stage in the p ...

, and thus is legally exempt from joining the eurozone unless its government decides otherwise, either by parliamentary vote or referendum. The United Kingdom likewise had an opt-out prior to withdrawing from the EU in 2020.

The remaining seven countries are obliged to adopt the euro in future, although the EU has so far not tried to enforce any time plan. They should join as soon as they fulfill the convergence criteria, which include being part of ERM II for two years. Sweden, which joined the EU in 1995 after the Maastricht Treaty was signed, is required to join the eurozone. However, the Swedish people turned down euro adoption in a 2003 referendum and since then the country has intentionally avoided fulfilling the adoption requirements by not joining ERM II, which is voluntary. Bulgaria and Croatia joined ERM II on 10 July 2020.

Interest in joining the eurozone increased in Denmark, and initially in Poland, as a result of the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

. In Iceland, there was an increase in interest in joining the European Union, a pre-condition for adopting the euro. However, by 2010 the debt crisis in the eurozone caused interest from Poland, as well as the Czech Republic, Denmark and Sweden to cool.

On 12 July 2022, the Council

A council is a group of people who come together to consult, deliberate, or make decisions. A council may function as a legislature, especially at a town, city or county/shire level, but most legislative bodies at the state/provincial or nat ...

adopted the final three legal acts that were required to enable Croatia to introduce the euro, which will enable Croatia to become the 20th member from 1 January 2023. Prices in Croatia are displayed in both the euro and the local currency, the kuna

Kuna may refer to:

Places

* Kuna, Idaho, a town in the United States

** Kuna Caves, a lava tube in Idaho

* Kuna Peak, a mountain in California

* , a village in the Orebić municipality, Croatia

* , a village in the Konavle municipality, Croatia ...

, from 5 September 2022 until 31 December 2023. Payment in euro is possible from 1 January 2023 (dual kuna/euro circulation in effect 1 January - 14 January 2023).

Expulsion and withdrawal

In the opinion of journalist Leigh Phillips andLocke Lord

Locke Lord LLP is an international law firm formed on October 2, 2007, after the combination of Texas-based Locke Liddell & Sapp PLLC and Lord Bissell & Brook LLP. Locke Lord's earliest predecessor firms date from 1887 and 1891. The firm is head ...

's Charles Proctor,"Brussels: No one can leave the euro"by Leigh Phillips, '' EUobserver'', 8 September 2011The Eurozone crisis – the final stage?

" by Charles Proctor,

Locke Lord

Locke Lord LLP is an international law firm formed on October 2, 2007, after the combination of Texas-based Locke Liddell & Sapp PLLC and Lord Bissell & Brook LLP. Locke Lord's earliest predecessor firms date from 1887 and 1891. The firm is head ...

, 15 May 2012 there is no provision in any European Union treaty for an exit from the eurozone. In fact, they argued, the Treaties make it clear that the process of monetary union

A currency union (also known as monetary union) is an intergovernmental agreement that involves two or more states sharing the same currency. These states may not necessarily have any further integration (such as an economic and monetary union, ...

was intended to be "irreversible" and "irrevocable". However, in 2009, a European Central Bank legal study argued that, while voluntary withdrawal is legally not possible, expulsion remains "conceivable".Withdrawal and Expulsion from the EU and EMU : Some reflections" by Phoebus Athanassiou, Principal Legal Counsel with the

Directorate-General for Legal Service

The Legal Service of the European Commission (Le Service juridique – SJ) is the in-house legal counsel to the commission, located in Brussels. It ensures that Commission decisions comply with EU law, preventing or reducing the risk of subsequen ...

, ECB, 2009 Although an explicit provision for an exit option does not exist, many experts and politicians in Europe have suggested an option to leave the eurozone should be included in the relevant treaties."German advisory council calls for exit option in the eurozone"by Daniel Tost, EurActiv, 29 July 2015 On the issue of leaving the eurozone, the European Commission has stated that " e irrevocability of membership in the euro area is an integral part of the Treaty framework and the Commission, as a guardian of the EU Treaties, intends to fully respect hat irrevocability" It added that it "does not intend to propose nyamendment" to the relevant Treaties, the current status being "the best way going forward to increase the resilience of euro area Member States to potential economic and financial crises.Text

of response by Olli Rehn, European Commissioner for Economic and Monetary Affairs and the Euro, on behalf of the European Commission, to question submitted by Claudio Morganti, Member of the European Parliament, 22 June 2012 The European Central Bank, responding to a question by a Member of the European Parliament, has stated that an exit is not allowed under the Treaties. Likewise there is no provision for a state to be expelled from the euro. Some, however, including the Dutch government, favour the creation of an expulsion provision for the case whereby a heavily indebted state in the eurozone refuses to comply with an EU economic reform policy. In a Texas law journal, University of Texas at Austin law professor Jens Dammann has argued that even now EU law contains an implicit right for member states to leave the eurozone if they no longer meet the criteria that they had to meet in order to join it. Furthermore, he has suggested that, under narrow circumstances, the European Union can expel member states from the eurozone. University of California, Berkeley professor of Economics and Political Science

Barry Eichengreen

Barry Julian Eichengreen (born 1952) is an American economist and economic historian who holds the title of George C. Pardee and Helen N. Pardee Professor of Economics and Political Science at the University of California, Berkeley, where he h ...

, argued in 2007 that "Europe’s leap to monetary union was a mistake...compounded by opting for a large monetary union...including also...Italy, Spain, Portugal and Greece," calling these countries “highly indebted…countries”, despite that, at that time, the Spanish deficit (35,6%) was lower than the Eurozone average (64,9%), and that of countries such as Germany (63,7) or France (64,3). And Portugal had a deficit (68,4%) very similar to that of the last mentioned. Eichengreen, this time focused in the Greek case, added that "although a breakup was not impossible...it was unlikely," given the technical, political and above all economic obstacles. "On the first minute…that the reekgovernment was discussing the possibility f_a_Grexit.html"_;"title="Grexit.html"_;"title="f_a_Grexit">f_a_Grexit">Grexit.html"_;"title="f_a_Grexit">f_a_Grexitinvestors_would_sell_their_Greek_stocks_and_bonds"_and_there_"would_be_a_full-fledged_financial_panic..._a_full-out_bank_run...Greece_would_have_to_close_down_its_banking_system_until_order_was_restored._It_would_have_to_suspend_trading_on_its_financial_markets._It_would_probably_have_to_seal_its_borders_to_prevent_residents_from_ferrying_cash_out_of_the_country."_(PDF),_University_of_California._Retrieved_8_September_2011

__Administration_and_representation_

Can the Euro Area Hit the Rewind Button?

(PDF), University of California. Retrieved 8 September 2011 In 2011, he still believed the probability of Grexit was "very low" and in case of any bank run "the Greek government would almost certainly receive support for its banks from its European Union partners and the European Central Bank”.

Administration and representation

The monetary policy of all countries in the eurozone is managed by the European Central Bank (ECB) and the Eurosystem which comprises the ECB and the central banks of the EU states who have joined the eurozone. Countries outside the eurozone are not represented in these institutions. Whereas all EU member states are part of the

The monetary policy of all countries in the eurozone is managed by the European Central Bank (ECB) and the Eurosystem which comprises the ECB and the central banks of the EU states who have joined the eurozone. Countries outside the eurozone are not represented in these institutions. Whereas all EU member states are part of the European System of Central Banks

The European System of Central Banks (ESCB) is an institution that comprises the European Central Bank (ECB) and the national central banks (NCBs) of all 27 member states of the European Union (EU). Its objective is to ensure price stability t ...

(ESCB), non EU member states have no say in all three institutions, even those with monetary agreements such as Monaco. The ECB is entitled to authorise the design and printing of euro banknotes

Banknotes of the euro, the common currency of the Eurozone (euro area members), have been in circulation since the first series (also called ''ES1'') was issued in 2002. They are issued by the national central banks of the Eurosystem or the Eur ...

and the volume of euro coins minted, and President of the European Central Bank">its president is currently Christine Lagarde.

The eurozone is represented politically by its finance ministers, known collectively as the Eurogroup, and is presided over by a president, currently Paschal Donohoe

Paschal Donohoe (born 19 September 1974) is an Irish Fine Gael politician who has served as Minister for Public Expenditure and Reform since December 2022 and President of the Eurogroup since July 2020. He has been a Teachta Dála (TD) for the ...

. The finance ministers of the EU member states that use the euro meet a day before a meeting of the Economic and Financial Affairs Council

The Economic and Financial Affairs Council (ECOFIN) is one of the oldest configurations of the Council of the European Union and is composed of the economics and finance ministers of the 27 European Union member states, as well as Budget Minist ...

(Ecofin) of the Council of the European Union

The Council of the European Union, often referred to in the treaties and other official documents simply as the Council, and informally known as the Council of Ministers, is the third of the seven Institutions of the European Union (EU) as ...

. The Group is not an official Council formation but when the full EcoFin council votes on matters only affecting the eurozone, only Euro Group members are permitted to vote on it.

Since the global financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

, the Euro Group has met irregularly not as finance ministers, but as heads of state and government (like the European Council). It is in this forum, the Euro summit, that many eurozone reforms have been decided upon. In 2011, former French President

The president of France, officially the president of the French Republic (french: Président de la République française), is the executive head of state of France, and the commander-in-chief of the French Armed Forces. As the presidency is ...

Nicolas Sarkozy pushed for these summits to become regular and twice a year in order for it to be a 'true economic government'.

Reform

In April 2008 inBrussels

Brussels (french: Bruxelles or ; nl, Brussel ), officially the Brussels-Capital Region (All text and all but one graphic show the English name as Brussels-Capital Region.) (french: link=no, Région de Bruxelles-Capitale; nl, link=no, Bruss ...

, future European Commission President

President most commonly refers to:

*President (corporate title)

*President (education), a leader of a college or university

*President (government title)

President may also refer to:

Automobiles

* Nissan President, a 1966–2010 Japanese ful ...

Jean-Claude Juncker suggested that the eurozone should be represented at the IMF as a bloc, rather than each member state separately: "It is absurd for those 15 countries not to agree to have a single representation at the IMF. It makes us look absolutely ridiculous. We are regarded as buffoons on the international scene". In 2017 Juncker stated that he aims to have this agreed by the end of his mandate in 2019. However, Finance Commissioner Joaquín Almunia stated that before there is common representation, a common political agenda should be agreed upon.

Leading EU figures including the commission and national governments have proposed a variety of reforms to the eurozone's architecture; notably the creation of a Finance Minister, a larger eurozone budget, and reform of the current bailout mechanisms into either a "European Monetary Fund" or a eurozone Treasury

A treasury is either

*A government department related to finance and taxation, a finance ministry.

*A place or location where treasure, such as currency or precious items are kept. These can be state or royal property, church treasure or ...

. While many have similar themes, details vary greatly.

Economy

Comparison table

Inflation

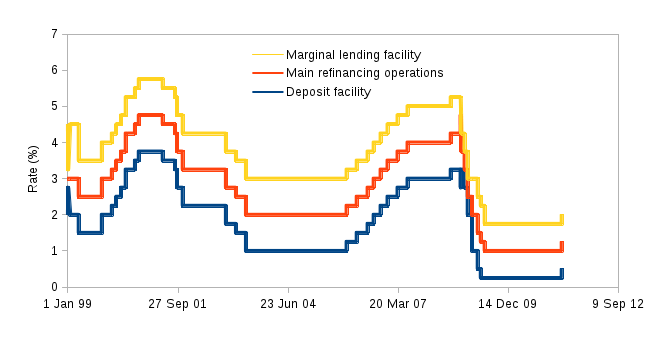

HICP figures from the ECB, overall index:Interest rates

Interest rates for the eurozone, set by the ECB since 1999. Levels are in percentages per annum. Between June 2000 and October 2008, the ''main refinancing operations'' were variable rate tenders, as opposed to fixed rate tenders. The figures indicated in the table from 2000 to 2008 refer to the minimum interest rate at which counterparties may place their bids.Key ECB interest rates, ECB

Public debt

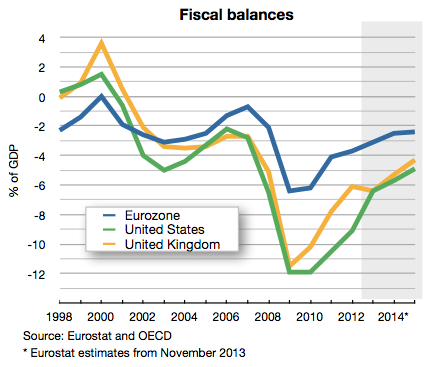

The following table states the ratio of public debt to GDP in percent for eurozone countries given by EuroStat. The euro convergence criterion is 60%.Fiscal policies

The primary means for fiscal coordination within the EU lies in the Broad Economic Policy Guidelines which are written for every member state, but with particular reference to the 19 current members of the eurozone. These guidelines are not binding, but are intended to represent policy coordination among the EU member states, so as to take into account the linked structures of their economies.

For their mutual assurance and stability of the currency, members of the eurozone have to respect the Stability and Growth Pact, which sets agreed limits on

The primary means for fiscal coordination within the EU lies in the Broad Economic Policy Guidelines which are written for every member state, but with particular reference to the 19 current members of the eurozone. These guidelines are not binding, but are intended to represent policy coordination among the EU member states, so as to take into account the linked structures of their economies.

For their mutual assurance and stability of the currency, members of the eurozone have to respect the Stability and Growth Pact, which sets agreed limits on deficits

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''g ...

and national debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit o ...

, with associated sanctions for deviation. The Pact originally set a limit of 3% of GDP for the yearly deficit of all eurozone member states; with fines for any state which exceeded this amount. In 2005, Portugal, Germany, and France had all exceeded this amount, but the Council of Ministers had not voted to fine those states. Subsequently, reforms were adopted to provide more flexibility and ensure that the deficit criteria took into account the economic conditions of the member states, and additional factors.

The Fiscal Compact (formally, the Treaty on Stability, Coordination and Governance in the Economic and Monetary Union), is an intergovernmental treaty introduced as a new stricter version of the Stability and Growth Pact, signed on 2 March 2012 by all member states of the European Union (EU), except the Czech Republic, the United Kingdom, and Croatia (subsequently acceding the EU in July 2013). The treaty entered into force on 1 January 2013 for the 16 states which completed ratification prior of this date. As of 1 April 2014, it had been ratified and entered into force for all 25 signatories.

Olivier Blanchard suggests that a fiscal union in the eurozone can mitigate devastating effects of the single currency on the eurozone peripheral countries. But he adds that the currency bloc will not work perfectly even if a fiscal transfer system is built, because, he argues, the fundamental issue about competitiveness adjustment is not tackled. The problem is, since the eurozone peripheral countries do not have their own currencies, they are forced to adjust their economies by decreasing their wages instead of devaluation.

Bailout provisions

Thefinancial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

prompted a number of reforms in the eurozone. One was a U-turn on the eurozone's bailout

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy.

A bailout differs from the term ''bail-in'' (coined in 2010) under which the bondholders or depositors of global syst ...

policy that led to the creation of a specific fund to assist eurozone states in trouble. The European Financial Stability Facility (EFSF) and the European Financial Stability Mechanism

The European Financial Stabilisation Mechanism (EFSM) is an emergency funding programme reliant upon funds raised on the financial markets and guaranteed by the European Commission using the budget of the European Union as collateral. It runs un ...

(EFSM) were created in 2010 to provide, alongside the International Monetary Fund (IMF), a system and fund to bail out members. However, the EFSF and EFSM were temporary, small and lacked a basis in the EU treaties. Therefore, it was agreed in 2011 to establish a European Stability Mechanism

The European Stability Mechanism (ESM) is an intergovernmental organization located in Luxembourg City, which operates under public international law for all eurozone member states having ratified a special ESM intergovernmental treaty. It ...

(ESM) which would be much larger, funded only by eurozone states (not the EU as a whole as the EFSF/EFSM were) and would have a permanent treaty basis. As a result of that its creation involved agreeing an amendment to TEFU Article 136 allowing for the ESM and a new ESM treaty to detail how the ESM would operate. If both are successfully ratified according to schedule, the ESM would be operational by the time the EFSF/EFSM expire in mid-2013.

In February 2016, the UK secured further confirmation that countries that do not use the Euro would not be required to contribute to bailouts for eurozone countries.

Peer review

In June 2010, a broad agreement was finally reached on a controversial proposal for member states to peer review each other's budgets prior to their presentation to national parliaments. Although showing the entire budget to each other was opposed by Germany, Sweden and the UK, each government would present to their peers and the Commission their estimates for growth, inflation, revenue and expenditure levels six months before they go to national parliaments. If a country was to run a deficit, they would have to justify it to the rest of the EU while countries with a debt more than 60% of GDP would face greater scrutiny.EU agrees controversial peer review of national budgetsEU Observer The plans would apply to all EU members, not just the eurozone, and have to be approved by EU leaders along with proposals for states to face sanctions before they reach the 3% limit in the Stability and Growth Pact. Poland has criticised the idea of withholding regional funding for those who break the deficit limits, as that would only impact the poorer states. In June 2010 France agreed to back Germany's plan for suspending the voting rights of members who breach the rules.Willis, Andrew (15 June 2010

Merkel: Spain can access aid if needed

EU Observer In March 2011 was initiated a new reform of the Stability and Growth Pact aiming at straightening the rules by adopting an automatic procedure for imposing of penalties in case of breaches of either the deficit or the debt rules.

Criticism

Nobel prize-winning economistJames Tobin

James Tobin (March 5, 1918 – March 11, 2002) was an American economist who served on the Council of Economic Advisers and consulted with the Board of Governors of the Federal Reserve System, and taught at Harvard and Yale Universities. He de ...

thought that the euro project would not succeed without making drastic changes to European institutions, pointing out the difference between the US and the eurozone.J. Tobin, Policy Opinions, 31 (2001) Concerning monetary policies, the system of Federal Reserve bank

A Federal Reserve Bank is a regional bank of the Federal Reserve System, the central banking system of the United States. There are twelve in total, one for each of the twelve Federal Reserve Districts that were created by the Federal Reserve A ...

s in the US aims at both growth and reducing unemployment, while the ECB tends to give its first priority to price stability under the Bundesbank's supervision. As the price level of the currency bloc is kept low, the unemployment level of the region has become higher than that of US since 1982.

When it comes to fiscal policies, 12 percent of the US federal budget is used for transfers to states and local governments. Also, when a state has financial or economic difficulties, a fair amount of money is automatically transferred to the state. The US government does not impose restrictions on state budget policies. This is different from the fiscal policies of the eurozone, where Treaty of Maastricht

The Treaty on European Union, commonly known as the Maastricht Treaty, is the foundation treaty of the European Union (EU). Concluded in 1992 between the then-twelve member states of the European Communities, it announced "a new stage in the p ...

requires each eurozone member country to run its budget deficit smaller than 3 percent of its GDP.

In February 2019, a study from the Centre for European Policy concluded that while some countries had gained from adopting the euro, several countries were poorer than they would have been had they not adopted it, with France and Italy being particularly affected. The authors argued that this was down to its effect on competitiveness; usually countries would devalue their currencies to make their exports cheaper on the world market but this was not possible due to the common currency.Nicole Ng"CEP study: Germans gain most from euro introduction"

''Deutsche Welle'', 25/02/19, accessed 05/03/19

Economic policemen

In 1997, Arnulf Baring expressed concern that the European Monetary Union would make Germans the most hated people in Europe. Baring suspected the possibility that the people in Mediterranean countries would regard Germans and the currency bloc as economic policemen.This Prediction about the Euro Deserves a ‘Nostradamus Award’W. Richter, Wolf Street, 16 July 2015

See also

*Greek withdrawal from the eurozone

A Greek withdrawal from the eurozone was a hypothetical scenario, debated mostly in the early to mid 2010s, under which Greece would withdraw from the Eurozone to deal with the Greek government-debt crisis of the time. This conjecture was give ...

* List of acronyms associated with the eurozone crisis

* List of people associated with the eurozone crisis

* Sixpack (European Union law)

The EU economic governance, Sixpack describes a set of European legislative measures to reform the Stability and Growth Pact and introduces greater macroeconomic surveillance, in response to the European debt crisis of 2009. These measures were ...

* Special territories of members of the European Economic Area

* Economic and Monetary Union of the European Union

* Capital Markets Union

The Capital Markets Union (CMU) is an economic policy initiative launched by the former president of the European Commission, Jean-Claude Junker in the initial exposition of his policy agenda on 15 July 2014. The main target was to create a sin ...

* European banking union

The banking union of the European Union is the transfer of responsibility for banking policy from the national to the EU level in several EU member states, initiated in 2012 as a response to the Eurozone crisis. The motivation for banking union w ...

Notes

References

External links

Eurozone official portal

European Central Bank

{{Authority control Multi-speed Europe