Disinflation on:

[Wikipedia]

[Google]

[Amazon]

Disinflation is a decrease in the rate of

Disinflation is a decrease in the rate of

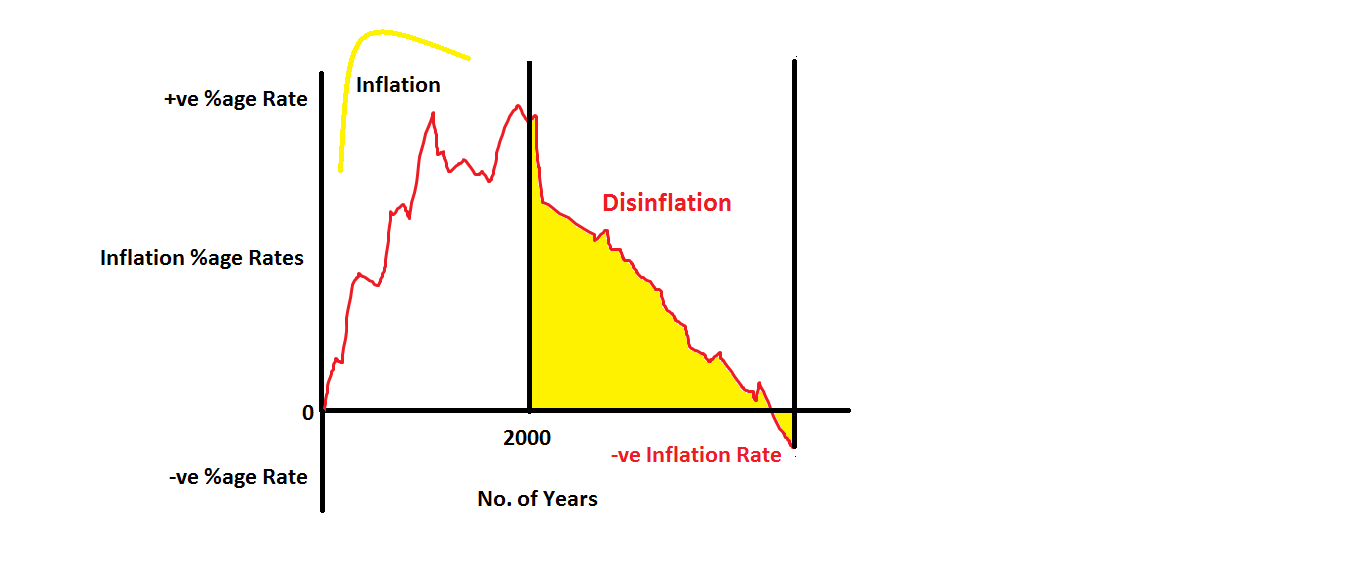

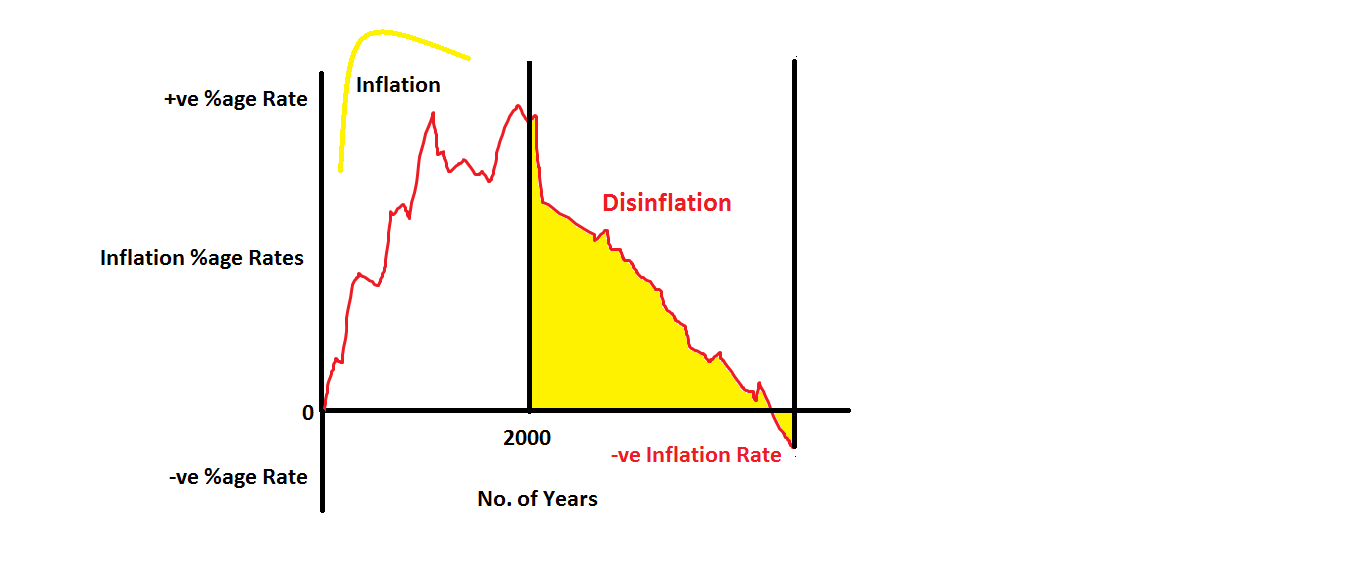

Inflation Rates for Jan 2000 - Present

So the distinction between deflation and disinflation at that point was simply one of which time period was being referring to, the monthly basis or the annual basis. Over the year, prices were up 3.66% while over the month prices were down 1.01%. Deflation is a sustained decrease in the general price level (after Inflation drops below zero percent) resulting in a sustained increase in the real value of money and other monetary items. Money and other monetary items are worth more all the time during deflation as opposed to being worth less all the time during inflation. Deflation is negative inflation. Disinflation is lower inflation. Prices are still rising during disinflation, but at a lower rate. The general price level still rises, but, at a slower rate resulting in a continued, but, lower rate of real value destruction in money and other monetary items. A lowering of inflation is not deflation but disinflation. Deflation means the general price level is not increasing at all, but, actually decreasing continuously and the internal functional currency – money - and other monetary items are worth more all the time. Deflation causes an increase in the real value of money and other monetary items. Disinflation happens after a period of higher inflation in what are normally considered low inflation economies and is initially popularly confused with deflation. During disinflation many prominent prices, for example, oil, fuel, commodity, property and food prices are falling, but, the general price level is still actually rising, albeit at a much slower rate than during normal low inflation. When the slowing annual inflation rate moves lower and lower it eventually gets to a zero percent annual rate for maybe a month or two. When the general price level then continues to decline even further - below zero percent per annum - the economy moves from inflation to deflation: not just a slower increase in the general increasing price level as during disinflation but actually a sustained decrease in the general price level below zero percent per annum which causes an increase in the real value of money and other monetary items: the opposite of inflation or negative inflation.

Globalization and Global Disinflation

by

What is Disinflation

by Timothy McMahon, at InflationData.com * http://www.voxeu.org/index.php?q=node/3025 * http://economia.unipv.it/pagp/pagine_personali/gascari/disiflation_msvsirr_may_2011.pdf {{United States – Commonwealth of Nations recessions Inflation

Disinflation is a decrease in the rate of

Disinflation is a decrease in the rate of inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduct ...

– a slowdown in the rate of increase of the general price level

The general price level is a hypothetical measure of overall prices for some set of goods and services (the consumer basket), in an economy or monetary union during a given interval (generally one day), normalized relative to some base set ...

of goods and services in a nation's gross domestic product

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is of ...

over time. It is the opposite of reflation.

If the inflation rate

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

is not very high to start with, disinflation can lead to deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflatio ...

– decreases in the general price level

The general price level is a hypothetical measure of overall prices for some set of goods and services (the consumer basket), in an economy or monetary union during a given interval (generally one day), normalized relative to some base set ...

of goods and services. For example if the annual inflation rate one month is 5% and it is 4% the following month, prices disinflated by 1% but are still increasing at a 4% annual rate. If the current rate is 1% and it is the -2% the following month, prices disinflated by 3% and are decreasing at a 2% annual rate.

Causes, characteristics, and an example

There is widespread consensus among economists that inflation is caused by increases in thesupply of money

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include currency in circula ...

available for use in a nation's economy. Inflation can also occur when the economy 'overheats' because of excess aggregate demand

In macroeconomics, aggregate demand (AD) or domestic final demand (DFD) is the total demand for final goods and services in an economy at a given time. It is often called effective demand, though at other times this term is distinguished. This is ...

(this is called demand-pull inflation). The causes of disinflation are the opposite, either a decrease in the growth rate of the money supply, or a business cycle

Business cycles are intervals of expansion followed by recession in economic activity. These changes have implications for the welfare of the broad population as well as for private institutions. Typically business cycles are measured by examin ...

contraction (recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

). During a recession, competition among businesses for customers becomes more intense, and so retailers are no longer able to pass on higher prices to their customers. In contrast, deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflatio ...

occurs when prices are actually dropping.

Disinflation distinguished from deflation

If disinflation continues until the inflation rate is zero, the economy enters a deflationary period, with decreasing general prices on all goods and services produced. An example of this happened during the month of October 2008, when U.S. consumer prices fell (deflation) by 1.01% but the overall annual inflation rate simply decreased (disinflation) from an annual rate of 4.94% to 3.66%.So the distinction between deflation and disinflation at that point was simply one of which time period was being referring to, the monthly basis or the annual basis. Over the year, prices were up 3.66% while over the month prices were down 1.01%. Deflation is a sustained decrease in the general price level (after Inflation drops below zero percent) resulting in a sustained increase in the real value of money and other monetary items. Money and other monetary items are worth more all the time during deflation as opposed to being worth less all the time during inflation. Deflation is negative inflation. Disinflation is lower inflation. Prices are still rising during disinflation, but at a lower rate. The general price level still rises, but, at a slower rate resulting in a continued, but, lower rate of real value destruction in money and other monetary items. A lowering of inflation is not deflation but disinflation. Deflation means the general price level is not increasing at all, but, actually decreasing continuously and the internal functional currency – money - and other monetary items are worth more all the time. Deflation causes an increase in the real value of money and other monetary items. Disinflation happens after a period of higher inflation in what are normally considered low inflation economies and is initially popularly confused with deflation. During disinflation many prominent prices, for example, oil, fuel, commodity, property and food prices are falling, but, the general price level is still actually rising, albeit at a much slower rate than during normal low inflation. When the slowing annual inflation rate moves lower and lower it eventually gets to a zero percent annual rate for maybe a month or two. When the general price level then continues to decline even further - below zero percent per annum - the economy moves from inflation to deflation: not just a slower increase in the general increasing price level as during disinflation but actually a sustained decrease in the general price level below zero percent per annum which causes an increase in the real value of money and other monetary items: the opposite of inflation or negative inflation.

See also

*Hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as t ...

*Stagflation

In economics, stagflation or recession-inflation is a situation in which the inflation rate is high or increasing, the economic growth rate slows, and unemployment remains steadily high. It presents a dilemma for economic policy, since actio ...

*Devaluation

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national curre ...

*Chronic inflation

Chronic inflation is an economic phenomenon occurring when a country experiences high inflation for a prolonged period (several years or decades) due to continual increases in the money supply among other things. In countries with chronic infla ...

*Deflation

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflatio ...

References

Further reading

* * * * *External links

Globalization and Global Disinflation

by

Kenneth Rogoff

Kenneth Saul Rogoff (born March 22, 1953) is an American economist and chess Grandmaster. He is the Thomas D. Cabot Professor of Public Policy and professor of economics at Harvard University.

Early life

Rogoff grew up in Rochester, New York. ...

, at IMF.comWhat is Disinflation

by Timothy McMahon, at InflationData.com * http://www.voxeu.org/index.php?q=node/3025 * http://economia.unipv.it/pagp/pagine_personali/gascari/disiflation_msvsirr_may_2011.pdf {{United States – Commonwealth of Nations recessions Inflation