disposable personal income on:

[Wikipedia]

[Google]

[Amazon]

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income.

Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements.

The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%.

For the purposes of calculating the amount of income subject to garnishments, United States' federal law defines disposable income as an individual's compensation (including salary, overtime, bonuses, commission, and paid leave) after the deduction of health insurance premiums and any amounts required to be deducted by law. Amounts required to be deducted by law include federal, state, and local taxes, state unemployment and disability taxes, social security taxes, and other garnishments or levies, but does not include such deductions as voluntary retirement contributions and transportation deductions. Those deductions would be made only after calculating the amount of the garnishment or levy. The definition of disposable income varies for the purpose of state and local garnishments and levies.

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income.

Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements.

The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%.

For the purposes of calculating the amount of income subject to garnishments, United States' federal law defines disposable income as an individual's compensation (including salary, overtime, bonuses, commission, and paid leave) after the deduction of health insurance premiums and any amounts required to be deducted by law. Amounts required to be deducted by law include federal, state, and local taxes, state unemployment and disability taxes, social security taxes, and other garnishments or levies, but does not include such deductions as voluntary retirement contributions and transportation deductions. Those deductions would be made only after calculating the amount of the garnishment or levy. The definition of disposable income varies for the purpose of state and local garnishments and levies.

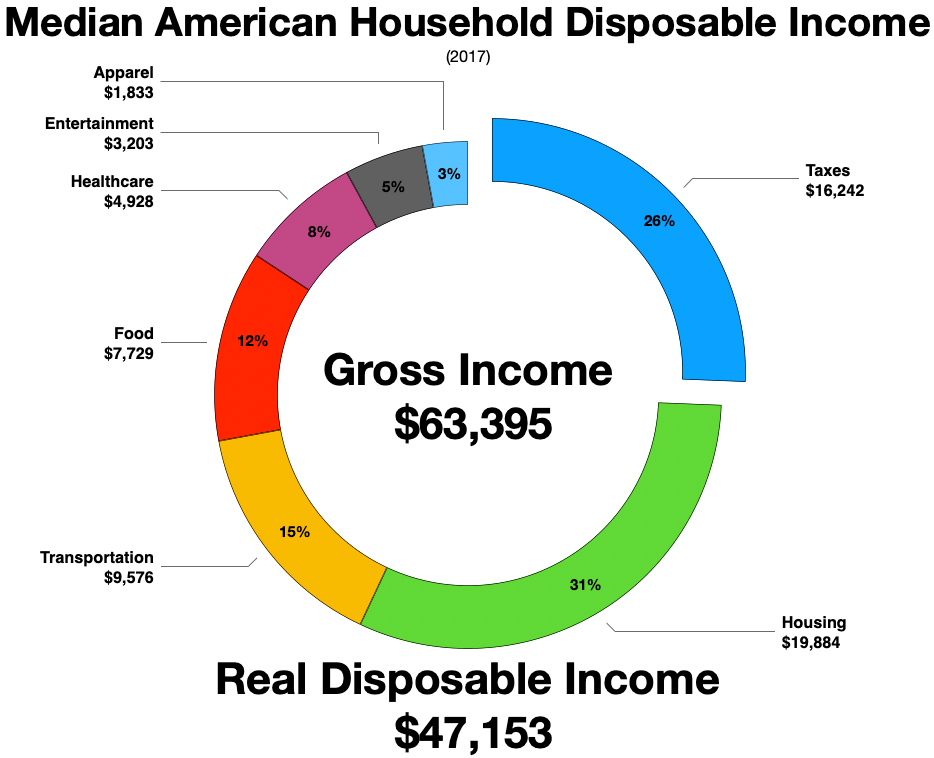

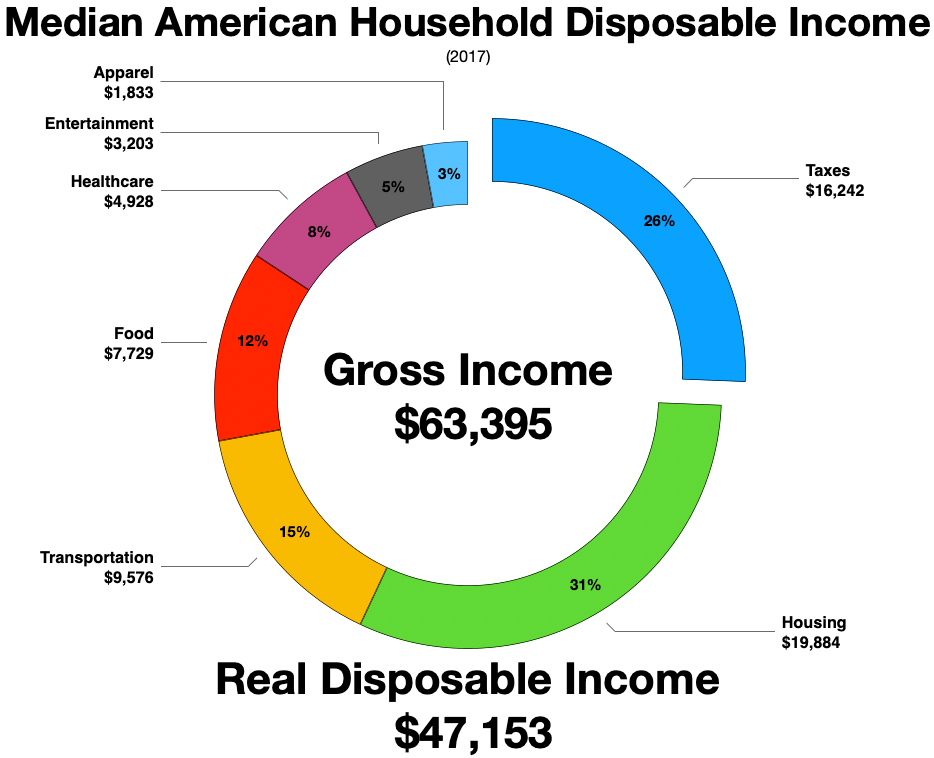

A simple discretionary income calculator

€”even though this says it's measuring "disposable income," using the economist's language, it's discretionary income. * Eurostat, News Release No. 60/2010

Household Savings and Disposable Income

30 April 2010 * Eurostat, Statistics Explained, Glossary article

National Disposable Income

OECD Disposable income statistics

Google – public data

GDP and Personal Income of the U.S. (annual): Disposal Personal Income

Google – public data

GDP and Personal Income of the U.S. (annual): Disposal Personal Income per capita {{Authority control Personal taxes Household income Family economics

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income.

Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements.

The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%.

For the purposes of calculating the amount of income subject to garnishments, United States' federal law defines disposable income as an individual's compensation (including salary, overtime, bonuses, commission, and paid leave) after the deduction of health insurance premiums and any amounts required to be deducted by law. Amounts required to be deducted by law include federal, state, and local taxes, state unemployment and disability taxes, social security taxes, and other garnishments or levies, but does not include such deductions as voluntary retirement contributions and transportation deductions. Those deductions would be made only after calculating the amount of the garnishment or levy. The definition of disposable income varies for the purpose of state and local garnishments and levies.

Disposable income is total personal income minus current income taxes. In national accounts definitions, personal income minus personal current taxes equals disposable personal income. Subtracting personal outlays (which includes the major category of personal r privateconsumption expenditure) yields personal (or, private) savings, hence the income left after paying away all the taxes is referred to as disposable income.

Restated, consumption expenditure plus savings equals disposable income after accounting for transfers such as payments to children in school or elderly parents’ living and care arrangements.

The marginal propensity to consume (MPC) is the fraction of a change in disposable income that is consumed. For example, if disposable income rises by $100, and $65 of that $100 is consumed, the MPC is 65%. Restated, the marginal propensity to save is 35%.

For the purposes of calculating the amount of income subject to garnishments, United States' federal law defines disposable income as an individual's compensation (including salary, overtime, bonuses, commission, and paid leave) after the deduction of health insurance premiums and any amounts required to be deducted by law. Amounts required to be deducted by law include federal, state, and local taxes, state unemployment and disability taxes, social security taxes, and other garnishments or levies, but does not include such deductions as voluntary retirement contributions and transportation deductions. Those deductions would be made only after calculating the amount of the garnishment or levy. The definition of disposable income varies for the purpose of state and local garnishments and levies.

Meanings of disposable income

Disposable income can be understood as: * National disposable income of a country: The national income minus current transfers (current taxes on income, wealth etc., social contributions, social benefits and other current transfers), plus current transfers receivable by resident units from the rest of the world. * Disposable personal (or family/household) income: The income that individuals or households have for their spending.Discretionary income

Discretionary income is disposable income (after-tax income), minus all payments that are necessary to meet current bills. It is total personal income after subtracting taxes and minimal survival expenses (such as food, medicine, rent or mortgage, utilities, insurance, transportation, property maintenance, child support, etc.) to maintain a certainstandard of living

Standard of living is the level of income, comforts and services available, generally applied to a society or location, rather than to an individual. Standard of living is relevant because it is considered to contribute to an individual's quality ...

. It is the amount of an individual's income available for spending after the essentials have been taken care of:

Discretionary income = gross income – taxes – all compelled payments (bills)

The term "disposable income" is often incorrectly used to denote ''discretionary income''. For example, people commonly refer to disposable income as the amount of "play money" left to spend or save. The Consumer Leverage Ratio is the expression of the ratio of total household debt

Household debt is the combined debt of all people in a household, including consumer debt and mortgage loans. A significant rise in the level of this debt coincides historically with many severe economic crises and was a cause of the U.S. and su ...

to disposable income.

See also

*List of countries by disposable income

Household income is a measure of the combined incomes of all people sharing a particular household or place of residence. It includes every form of income, e.g., salaries and wages, retirement income, near cash government transfers like food sta ...

References

External links

A simple discretionary income calculator

€”even though this says it's measuring "disposable income," using the economist's language, it's discretionary income. * Eurostat, News Release No. 60/2010

Household Savings and Disposable Income

30 April 2010 * Eurostat, Statistics Explained, Glossary article

National Disposable Income

OECD Disposable income statistics

Google – public data

GDP and Personal Income of the U.S. (annual): Disposal Personal Income

Google – public data

GDP and Personal Income of the U.S. (annual): Disposal Personal Income per capita {{Authority control Personal taxes Household income Family economics