Debt Crises on:

[Wikipedia]

[Google]

[Amazon]

Debt crisis is a situation in which a government (nation, state/province, county, or city etc.) loses the ability of paying back its governmental debt. When the

A debt crisis can also refer to a general term for a proliferation of massive public debt relative to tax revenues, especially in reference to Latin American countries during the 1980s, the United States and the European Union since the mid-2000s, and the Chinese debt crises of 2015.

A debt crisis can also refer to a general term for a proliferation of massive public debt relative to tax revenues, especially in reference to Latin American countries during the 1980s, the United States and the European Union since the mid-2000s, and the Chinese debt crises of 2015.

In 2007 the global financial crisis began with a crisis in the subprime mortgage market in the United States, and developed into a full-blown international banking crisis with the collapse of the investment bank Lehman Brothers on 15 September 2008. The crisis was nonetheless followed by a global

In 2007 the global financial crisis began with a crisis in the subprime mortgage market in the United States, and developed into a full-blown international banking crisis with the collapse of the investment bank Lehman Brothers on 15 September 2008. The crisis was nonetheless followed by a global

Mark Brown and Alex Chambers, Euromoney, September 2005 This allowed the sovereigns to mask their deficit and debt levels through a combination of techniques, including inconsistent accounting, off-balance-sheet transactions, and the use of complex currency and credit derivatives structures. From late 2009 on, after Greece's newly elected, PASOK government stopped masking its true indebtedness and budget deficit, fears of sovereign defaults in certain

2011 July – November - The debt crisis deepens. All three main credit ratings agencies cut Greece's to a level associated with substantial risk of default. In November 2011, Greece faced with a storm of criticism over his referendum plan, Mr Papandreou withdraws it and then announces his resignation.

2011 July – November - The debt crisis deepens. All three main credit ratings agencies cut Greece's to a level associated with substantial risk of default. In November 2011, Greece faced with a storm of criticism over his referendum plan, Mr Papandreou withdraws it and then announces his resignation.

2012 February - December - The second bailout programme was ratified in February 2012. A total of was to be transferred in regular tranches through December 2014. The recession worsened and the government continued to dither over bailout program implementation. In December 2012 the Troika provided Greece with more debt relief, while the IMF extended an extra €8.2bn of loans to be transferred from January 2015 to March 2016.

2014 - In 2014 the outlook for the Greek economy was optimistic. The government predicted a

2012 February - December - The second bailout programme was ratified in February 2012. A total of was to be transferred in regular tranches through December 2014. The recession worsened and the government continued to dither over bailout program implementation. In December 2012 the Troika provided Greece with more debt relief, while the IMF extended an extra €8.2bn of loans to be transferred from January 2015 to March 2016.

2014 - In 2014 the outlook for the Greek economy was optimistic. The government predicted a

Several thousand homeless and jobless Argentines found work as ''

Several thousand homeless and jobless Argentines found work as ''

2005 Venezuela was one of the largest single investors in Argentine bonds following these developments, which bought a total of more than $5 billion in restructured Argentine bonds from 2005 to 2007. Between 2001 and 2006, Venezuela was the largest single buyer of Argentina's debt. In 2005 and 2006,

2005 Venezuela was one of the largest single investors in Argentine bonds following these developments, which bought a total of more than $5 billion in restructured Argentine bonds from 2005 to 2007. Between 2001 and 2006, Venezuela was the largest single buyer of Argentina's debt. In 2005 and 2006,

''Global Waves of Debt: Causes and Consequences''

Edited by M. Ayhan Kose, Peter Nagle, Franziska Ohnsorge, and Naotaka Sugawara.

expenditures

An expense is an item requiring an outflow of money, or any form of Wealth, fortune in general, to another person or group as payment for an item, service, or other category of costs. For a leasehold estate, tenant, renting, rent is an expense. Fo ...

of a government are more than its tax revenues

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resourc ...

for a prolonged period, the government may enter into a debt crisis. Various forms of governments finance their expenditures

An expense is an item requiring an outflow of money, or any form of Wealth, fortune in general, to another person or group as payment for an item, service, or other category of costs. For a leasehold estate, tenant, renting, rent is an expense. Fo ...

primarily by raising money through taxation. When tax revenues

Tax revenue is the income that is collected by governments through taxation. Taxation is the primary source of government revenue. Revenue may be extracted from sources such as individuals, public enterprises, trade, royalties on natural resourc ...

are insufficient, the government can make up the difference by issuing debt.

Debt wall

Hitting the debt wall is a dire financial situation that can occur when a nation depends on foreign debt and/or investment to subsidize their budget and then commercialdeficits

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''g ...

stop being the recipient of foreign capital flows. The lack of foreign capital flows reduces the demand for the local currency. The increased supply of currency coupled with an increased demand then causes a significant devaluation of the currency. This hurts the industrial base of the country since it can no longer afford to buy those imported supplies needed for production. Further, any obligations in foreign currency are now significantly more expensive to service both for the government and businesses.

This same concept has also been applied to personal debt. Specifically it has been applied to students who get in over their heads with student loans to finance their education.

Current and recent debt crises

Europe

European debt crisis

The European debt crisis is a crisis affecting several eurozone countries since the end of 2009. Member states affected by this crisis were unable to repay their government debt or to bail out indebted financial institutions without the assistance of third-parties (namely the International Monetary Fund, European Commission, and the European Central Bank). The causes of the crisis included high-risk lending and borrowing practices, burst real estate bubbles, and hefty deficit spending. As a result, investors have reduced their exposure to European investment products, and the value of the Euro has decreased. In 2007 the global financial crisis began with a crisis in the subprime mortgage market in the United States, and developed into a full-blown international banking crisis with the collapse of the investment bank Lehman Brothers on 15 September 2008. The crisis was nonetheless followed by a global

In 2007 the global financial crisis began with a crisis in the subprime mortgage market in the United States, and developed into a full-blown international banking crisis with the collapse of the investment bank Lehman Brothers on 15 September 2008. The crisis was nonetheless followed by a global economic downturn

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various ...

, the Great Recession. The European debt crisis, a crisis in the banking system of the European countries using the euro, followed later.

In sovereign

''Sovereign'' is a title which can be applied to the highest leader in various categories. The word is borrowed from Old French , which is ultimately derived from the Latin , meaning 'above'.

The roles of a sovereign vary from monarch, ruler or ...

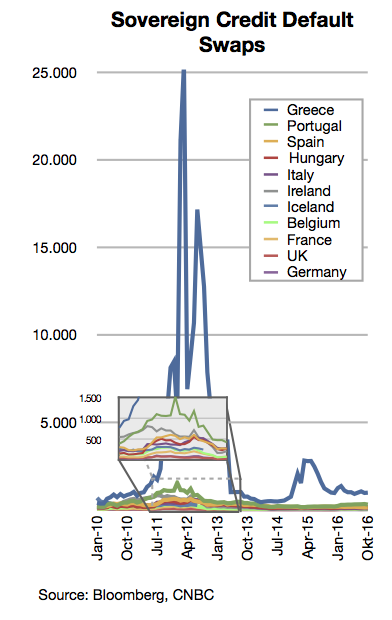

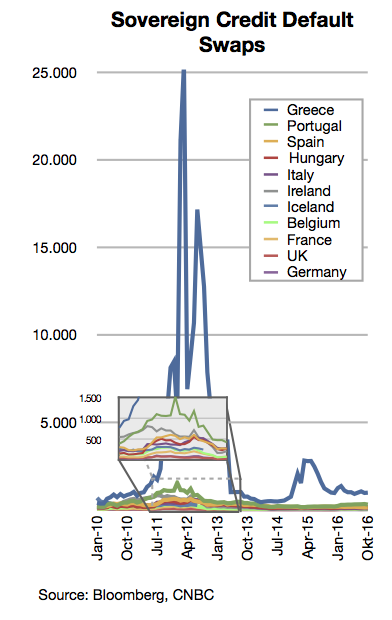

debt markets of PIIGS ( Portugal, Ireland, Italy, Greece, Spain) created unprecedented funding pressure that spread to the national banks of the euro-zone countries and the European Central Bank (ECB)

The European Central Bank (ECB) is the prime component of the monetary Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's most important central b ...

in 2010. The PIIGS announced strong fiscal reforms and austerity measures, but toward the end of the year, the euro once again suffered from stress.

Causes

The eurozone crisis resulted from the structural problem of the eurozone and a combination of complex factors, including the globalisation of finance, easy credit conditions during the 2002–2008 period that encouraged high-risk lending and borrowing practices, the financial crisis of 2007–08, international trade imbalances, real estate bubbles that have since burst; the Great Recession of 2008–2012, fiscal policy choices related to government revenues and expenses, and approaches used by states to bail out troubled banking industries and private bondholders, assuming private debt burdens or socializing losses. In 1992, members of the European Union signed the Maastricht Treaty, under which they pledged to limit their deficit spending and debt levels. However, in the early 2000s, some EU member states were failing to stay within the confines of the Maastricht criteria and turned to securitising future government revenues to reduce their debts and/or deficits, sidestepping best practice and ignoring international standards."How Europe's Governments have Enronized their debts"Mark Brown and Alex Chambers, Euromoney, September 2005 This allowed the sovereigns to mask their deficit and debt levels through a combination of techniques, including inconsistent accounting, off-balance-sheet transactions, and the use of complex currency and credit derivatives structures. From late 2009 on, after Greece's newly elected, PASOK government stopped masking its true indebtedness and budget deficit, fears of sovereign defaults in certain

European states

The list below includes all entities falling even partially under any of the various common definitions of Europe, geographical or political. Fifty generally recognised sovereign states, Kosovo with limited, but substantial, international reco ...

developed in the public, and the government debt of several states was downgraded. The crisis subsequently spread to Ireland and Portugal, while raising concerns about Italy, Spain, and the European banking system, and more fundamental imbalances within the eurozone.

Other European debt crises

Greek debt crisis

Timeline of Greek debt crisis

2009 December - One of the world's three leading rating agencies downgrades Greece's credit rating amid fears the government could default on its ballooning debt. PM Papandrou announces programme of tough public spending cuts. 2010 January–March - Two more rounds of tough austerity measures are announced by government, and government faces mass protests and strikes. 2010 April–May - The deficit was estimated that up to 70% of Greek government bonds were held by foreign investors, primarily banks. After publication of GDP data which showed an intermittent period of recession starting in 2007, credit rating agencies then downgraded Greek bonds to junk status in late April 2010. On 1 May 2010, the Greek government announced a series of austerity measures. 2011 July – November - The debt crisis deepens. All three main credit ratings agencies cut Greece's to a level associated with substantial risk of default. In November 2011, Greece faced with a storm of criticism over his referendum plan, Mr Papandreou withdraws it and then announces his resignation.

2011 July – November - The debt crisis deepens. All three main credit ratings agencies cut Greece's to a level associated with substantial risk of default. In November 2011, Greece faced with a storm of criticism over his referendum plan, Mr Papandreou withdraws it and then announces his resignation.

2012 February - December - The second bailout programme was ratified in February 2012. A total of was to be transferred in regular tranches through December 2014. The recession worsened and the government continued to dither over bailout program implementation. In December 2012 the Troika provided Greece with more debt relief, while the IMF extended an extra €8.2bn of loans to be transferred from January 2015 to March 2016.

2014 - In 2014 the outlook for the Greek economy was optimistic. The government predicted a

2012 February - December - The second bailout programme was ratified in February 2012. A total of was to be transferred in regular tranches through December 2014. The recession worsened and the government continued to dither over bailout program implementation. In December 2012 the Troika provided Greece with more debt relief, while the IMF extended an extra €8.2bn of loans to be transferred from January 2015 to March 2016.

2014 - In 2014 the outlook for the Greek economy was optimistic. The government predicted a structural surplus

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget ...

in 2014, opening access to the private lending market to the extent that its entire financing gap for 2014 was covered via private bond sales.

2015 June – July - The Greek parliament approved the referendum with no interim bailout agreement. Many Greeks continued to withdraw cash from their accounts fearing that capital controls would soon be invoked. On 13 July, after 17 hours of negotiations, Eurozone leaders reached a provisional agreement on a third bailout programme, substantially the same as their June proposal. Many financial analysts, including the largest private holder of Greek debt, private equity firm manager, Paul Kazarian

Paul B. Kazarian ( ; born October 15, 1955) is an Armenian-American investor, philanthropist, and former Investment banking, investment banker. He is the founder, managing director and chief executive officer (CEO) of Japonica Partners, a Hedge fun ...

, found issue with its findings, citing it as a distortion of net debt position.

2017 - The Greek finance ministry reported that the government's debt load is now €226.36 billion after increasing by €2.65 billion in the previous quarter. In June 2017, news reports indicated that the "crushing debt burden" had not been alleviated and that Greece was at the risk of defaulting on some payments.

2018 - Greek successfully exited (as declared) the bailouts on 20 August 2018.

Greek debt restructuring

It stands out in the history of sovereign defaults. Greek debt restructuring of 2012 achieved very large debt relief – with minimal financial disruption, using a combination of new legal techniques, exceptionally large cash incentives, and official sector pressure on key creditors. But it did so at a cost. The timing and design of the restructuring left money on the table from the perspective of Greece, set precedents and created a large risk for taxpayer – particularly in its very generous treatment of holdout creditors – that are likely to make future debt restructurings in Europe more difficult.Effects

To take considerations that the most characteristic feature of the Greek social landscape in the current crisis is the steep rise in joblessness. The unemployment rate had fluctuated around the 10 per cent mark in the first half of the previous decade. It then began to fall until May 2008, when unemployment figures reached their lowest level for over a decade (325,000 workers or 6.6 per cent of the labour force). While job losses involved an unusually high number of workers, loss of earnings for those still in employment was also significant. Average real gross earnings for employees have lost more ground since the onset of the crisis than they gained in the nine years before that. In February 2012, it was reported that 20,000 Greeks had been made homeless during the preceding year, and that 20 per cent of shops in the historic city centre of Athens were empty. * Irish financial crisis * Portuguese economic crisisLatin America

Argentine debt crisis

Background

Argentina's turbulent economic history: Argentina has a history of chronic economic, monetary and political problems. Economic reforms of the 1990s. In 1989, Carlos Menem became president. After some fumbling, he adopted a free-market approach that reduced the burden of government by privatizing, deregulating, cutting some tax rates, and reforming the state. The centerpiece of Menem's policies was the Convertibility Law, which took effect on 1 April 1991. Argentina's reforms were faster and deeper than any country of the time outside the former communist bloc. Real GDP grew more than 10 percent a year in 1991 and 1992, before slowing to a more normal rate of slightly below 6 percent in 1993 and 1994. The1998–2002 Argentine great depression

The Argentine Great Depression was an economic depression in Argentina, which began in the third quarter of 1998 and lasted until the second quarter of 2002. It followed the fifteen years stagnation and a brief period of free-market reforms. ...

was an economic depression

An economic depression is a period of carried long-term economical downturn that is result of lowered economic activity in one major or more national economies. Economic depression maybe related to one specific country were there is some economic ...

in Argentina, which began in the third quarter of 1998 and lasted until the second quarter of 2002. It almost immediately followed the 1974–1990 Great Depression after a brief period of rapid economic growth.

Effects

cartoneros

A waste picker is a person who salvages reusable or recyclable materials thrown away by others to sell or for personal consumption. There are millions of waste pickers worldwide, predominantly in developing countries, but increasingly in post-in ...

'', cardboard collectors. An estimate in 2003 had 30,000 to 40,000 people scavenging the streets for cardboard to sell to recycling plants. Such desperate measures were common because of the unemployment rate, nearly 25%.

Argentine agricultural products were rejected in some international markets for fear that they might have been damaged by the chaos. The US Department of Agriculture put restrictions on Argentine food and drug exports.

Debt restructuring history

2005 Venezuela was one of the largest single investors in Argentine bonds following these developments, which bought a total of more than $5 billion in restructured Argentine bonds from 2005 to 2007. Between 2001 and 2006, Venezuela was the largest single buyer of Argentina's debt. In 2005 and 2006,

2005 Venezuela was one of the largest single investors in Argentine bonds following these developments, which bought a total of more than $5 billion in restructured Argentine bonds from 2005 to 2007. Between 2001 and 2006, Venezuela was the largest single buyer of Argentina's debt. In 2005 and 2006, Banco Occidental de Descuento

Banco Occidental de Descuento (BOD) (English: ''Western Discount Bank'') (WDB) was a Venezuelan bank. With around 6.6% of the Venezuelan market, it was Venezuela's fifth-largest bank in 2009.

The owner of BOD is the Grupo Financiero BOD (English: ...

and Fondo Común

Banco Fondo Común (''Banco Fondo Común CA'', BFC) is a bank in Venezuela

Venezuela (; ), officially the Bolivarian Republic of Venezuela ( es, link=no, República Bolivariana de Venezuela), is a country on the northern coast of South Am ...

, owned by Venezuelan bankers Victor Vargas Irausquin and Victor Gill Ramirez respectively, bought most of Argentina's outstanding bonds and resold them on to the market. The banks bought $100 million worth of Argentine bonds and resold the bonds for a profit of approximately $17 million. People who criticize Vargas have said that he made a $1 billion "backroom deal" with swaps of Argentine bonds as a sign of his friendship with Chavez. The ''Financial Times'' interviewed financial analysts in the United States who said that the banks profited from the resale of the bonds; the Venezuelan government did not profit.

Bondholders who had accepted the 2005 swap (three out of four did so) saw the value of their bonds rise 90% by 2012, and these continued to rise strongly during 2013.

2010 On 15 April 2010, the debt exchange was re-opened to bondholders who rejected the 2005 swap; 67% of these latter accepted the swap, leaving 7% as holdouts. Holdouts continued to put pressure on the government by attempting to seize Argentine assets abroad, and by suing to attach future Argentine payments on restructured debt to receive better treatment than cooperating creditors.

The government reached an agreement in 2005 by which 76% of the defaulted bonds were exchanged for other bonds at a nominal value of 25 to 35% of the original and at longer terms. A second debt restructuring in 2010 brought the percentage of bonds out of default to 93%, but some creditors have still not been paid. Foreign currency denominated debt thus fell as a percentage of GDP from 150% in 2003 to 8.3% in 2013.

U.S. interventions

The U.S. foreign policy known as the Roosevelt Corollary asserted that the United States would intervene on behalf of European countries to avoid those countries intervening militarily to press their interests, including repayment of debts. This policy was used to justify interventions in the early 1900s in Venezuela, Cuba, Nicaragua, Haiti, and the Dominican Republic (1916–1924).North America

*United States debt-ceiling crisis of 2011

The 2011 United States debt-ceiling crisis was a stage in the ongoing political debate in the United States Congress about the appropriate level of government spending and its effect on the national debt and deficit. The debate centered on the ...

* United States debt-ceiling crisis of 2013

* Puerto Rican debt crisis (2015-present)

See also

* Debt *Debt of developing countries

The debt of developing countries usually refers to the external debt incurred by governments of developing countries.

There have been several historical episodes of governments of developing countries borrowing in quantities beyond their abilit ...

* Government debt

* List of countries by credit rating

This is a list of countries by credit rating, showing long-term foreign currency credit ratings for sovereign bonds as reported by the largest three major credit rating agencies: Standard & Poor's, Fitch, and Moody's. The list also includes all ...

* List of countries by net international investment position __FORCETOC__

The net international investment position (NIIP) is the difference in the external financial assets and liabilities of a country. External debt of a country includes government debt and private debt. External assets publicly and privat ...

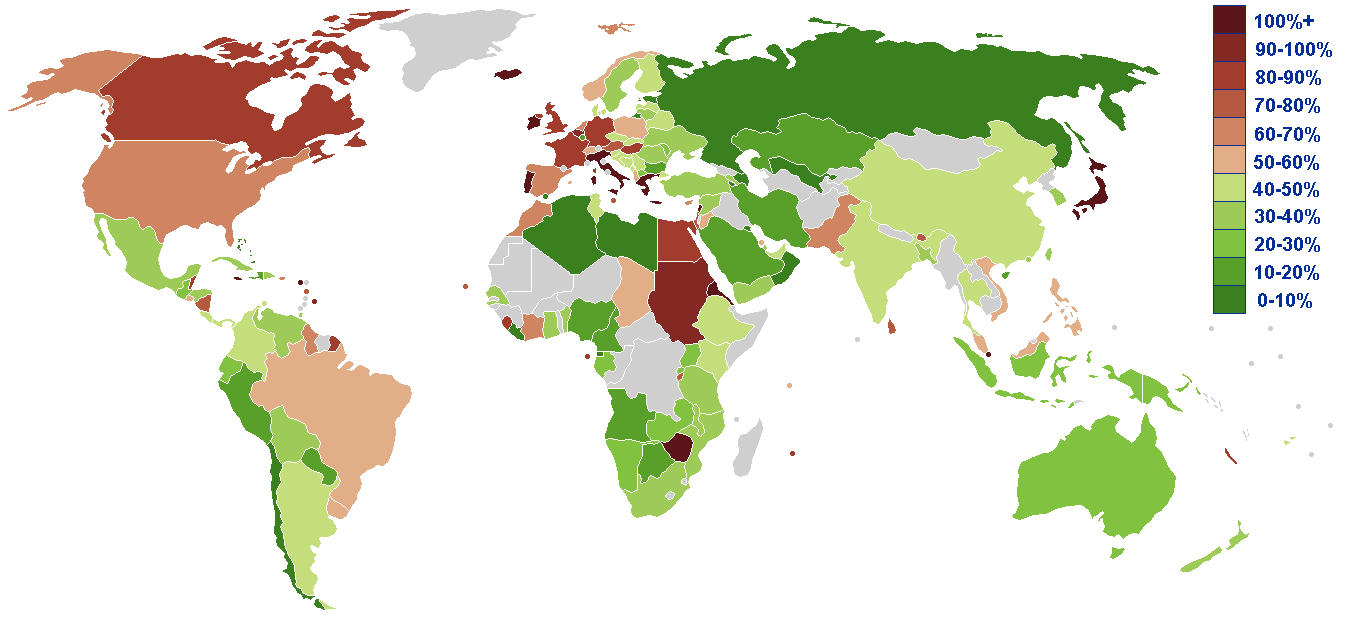

* List of countries by public debt

* Monetary sovereignty

* Odious debt

* Sovereign default

* State (polity)

A state is a centralized political organization that imposes and enforces rules over a population within a territory. There is no undisputed definition of a state. One widely used definition comes from the German sociologist Max Weber: a "sta ...

* Tax

* World debt The global debt is 305 trillion US $ in 2022, including debt by public and private debtors. (A trillion is defined here as a million millions, or 1012.)

This debt consists of

* 23% private household debt

* 38% private debt of non-financial corporat ...

Further reading

* World Bank, 2019''Global Waves of Debt: Causes and Consequences''

Edited by M. Ayhan Kose, Peter Nagle, Franziska Ohnsorge, and Naotaka Sugawara.

References

{{Financial crises Government debt Financial crises