Crude Oil Price on:

[Wikipedia]

[Google]

[Amazon]

The price of oil, or the oil price, generally refers to the

The price of oil, or the oil price, generally refers to the

Oil prices are determined by global forces of

Oil prices are determined by global forces of

Major benchmark references, or pricing markers, include Brent, WTI, the

Major benchmark references, or pricing markers, include Brent, WTI, the

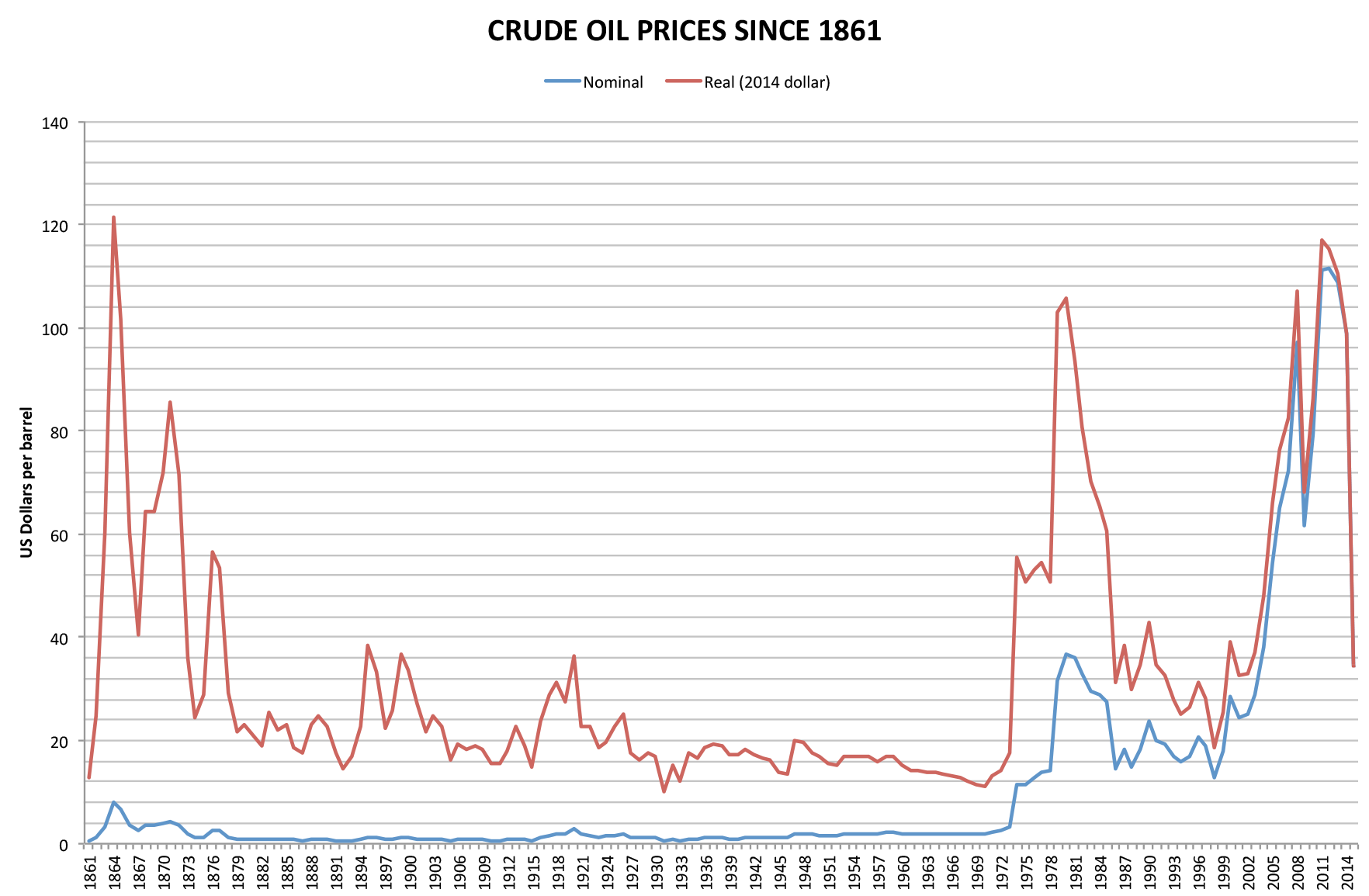

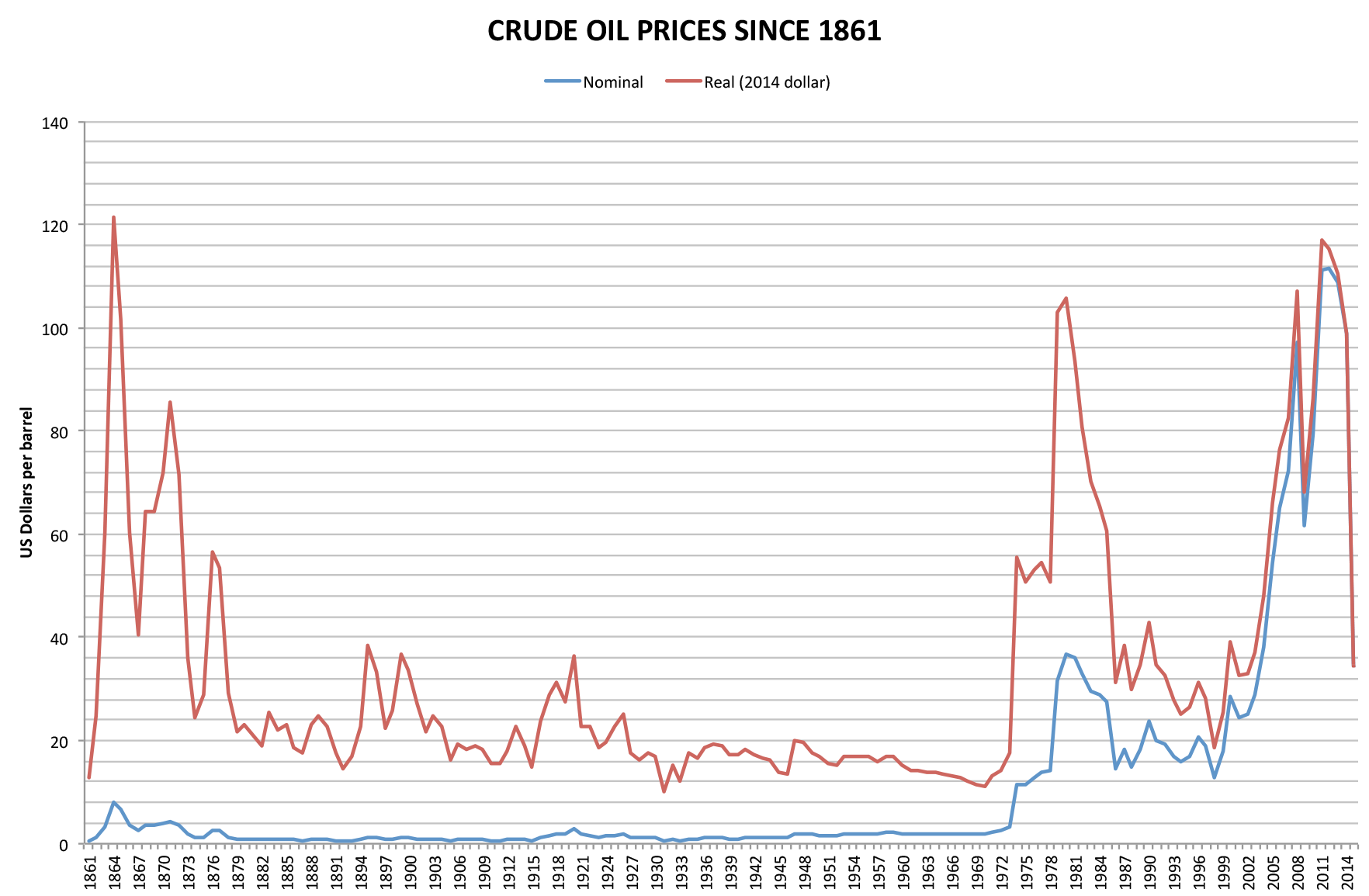

The price of oil remained "relatively consistent" from 1861 until the 1970s. In

The price of oil remained "relatively consistent" from 1861 until the 1970s. In  Starting in 1999, the price of oil rose significantly. It was explained by the rising oil demand in countries like China and India. A dramatic increase from US$50 in early 2007, to a peak of US$147 in July 2008, was followed by a decline to US$34 in December 2008, as the

Starting in 1999, the price of oil rose significantly. It was explained by the rising oil demand in countries like China and India. A dramatic increase from US$50 in early 2007, to a peak of US$147 in July 2008, was followed by a decline to US$34 in December 2008, as the  The 1 November 2018 U.S. Energy Information Administration (EIA) report announced that the US had become the "leading crude oil producer in the world" when it hit a production level of 11.3 million barrels per day (bpd) in August 2018, mainly because of its

The 1 November 2018 U.S. Energy Information Administration (EIA) report announced that the US had become the "leading crude oil producer in the world" when it hit a production level of 11.3 million barrels per day (bpd) in August 2018, mainly because of its  In 2020, the economic turmoil caused by the

In 2020, the economic turmoil caused by the

The oil-storage trade, also referred to as contango, a market strategy in which large, often vertically integrated oil companies purchase oil for immediate delivery and storage—when the price of oil is low— and hold it in storage until the price of oil increases. Investors bet on the future of oil prices through a

The oil-storage trade, also referred to as contango, a market strategy in which large, often vertically integrated oil companies purchase oil for immediate delivery and storage—when the price of oil is low— and hold it in storage until the price of oil increases. Investors bet on the future of oil prices through a

Oil price data

Federal Reserve Economic Data

Gasoline and diesel fuel prices in Europe

* [http://www.nymex.com NYMEX:BZ] is the most commonly quoted price for Brent crude oil *

Energy Futures Databrowser

Current and historical charts of NYMEX energy futures chains.

Live oil prices

NYMEX Crude oil price chart

U.S. Energy Information Administration

Part of the U.S. Department of Energy, official source of price and other statistical information ** ** * * {{DEFAULTSORT:Price Of Petroleum Petroleum economics Oil and gas markets Pricing Late modern economic history

The price of oil, or the oil price, generally refers to the

The price of oil, or the oil price, generally refers to the spot price

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement (payment and delivery) on the spot date, which is normally two business days after the ...

of a barrel

A barrel or cask is a hollow cylindrical container with a bulging center, longer than it is wide. They are traditionally made of wooden staves and bound by wooden or metal hoops. The word vat is often used for large containers for liquids, ...

() of benchmark crude oil

A benchmark crude or marker crude is a Petroleum, crude oil that serves as a reference price for buyers and sellers of crude oil. There are three primary benchmarks, West Texas Intermediate (WTI), Brent Blend, and Dubai Crude. Other well-known b ...

—a reference price for buyers and sellers of crude oil such as West Texas Intermediate

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract tr ...

(WTI), Brent Crude

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE (Intercon ...

, Dubai Crude

Dubai Crude is a medium sour crude oil extracted from Dubai. Dubai Crude is used as a price benchmark or oil marker because it is one of only a few Persian Gulf crude oils available immediately. There are two other main oil markers: Brent Crude a ...

, OPEC Reference Basket

The OPEC Reference Basket (ORB), also referred to as the OPEC Basket, is a weighted average of prices for petroleum blends produced by OPEC members. It is used as an important benchmark for crude oil prices. OPEC has often attempted to keep the p ...

, Tapis crude

Tapis crude is a Malaysian crude oil used as a pricing benchmark in Singapore. Tapis is very light, with an API gravity of 43°-45°, and very sweet, with only about 0.04% sulfur. While it is not traded on a market like Brent Crude or West Texa ...

, Bonny Light

Bonny Light oil was found at Oloibiri in the Niger delta region of Nigeria in 1956 for its commercial use.. Due to its features of generating high profit, it is highly demanded by refiners. Bonny light oil has an API of 32.9, classified as light ...

, Urals oil

Urals oil is a reference oil brand used as a basis for pricing of the Russian export oil mixture. It is a mix of heavy sour oil of Urals and the Volga region with light oil of Western Siberia. Other reference oils are Brent, West Texas Interme ...

, Isthmus

An isthmus (; ; ) is a narrow piece of land connecting two larger areas across an expanse of water by which they are otherwise separated. A tombolo is an isthmus that consists of a spit or bar, and a strait is the sea counterpart of an isthmu ...

and Western Canadian Select

Western Canadian Select (WCS) is a heavy sour blend of crude oil that is one of North America's largest heavy crude oil streams and, historically, its cheapest. It was established in December 2004 as a new heavy oil stream by EnCana (now Cenov ...

(WCS). Oil prices are determined by global supply and demand, rather than any country's domestic production level.

The global price of crude oil was relatively consistent in the nineteenth century and early twentieth century. This changed in the 1970s, with a significant increase in the price of oil globally.

There have been a number of structural drivers of global oil prices historically, including oil supply, demand, and storage shocks, and shocks to global economic growth affecting oil prices.

Notable events driving significant price fluctuations include the 1973 OPEC

The Organization of the Petroleum Exporting Countries (OPEC, ) is a cartel of countries. Founded on 14 September 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), it has, since 1965, been headquart ...

oil embargo

Economic sanctions are commercial and financial penalties applied by one or more countries against a targeted self-governing state, group, or individual. Economic sanctions are not necessarily imposed because of economic circumstances—they m ...

targeting nations that had supported Israel during the Yom Kippur War

The Yom Kippur War, also known as the Ramadan War, the October War, the 1973 Arab–Israeli War, or the Fourth Arab–Israeli War, was an armed conflict fought from October 6 to 25, 1973 between Israel and a coalition of Arab states led by Egy ...

resulting in the 1973 oil crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supp ...

, the Iranian Revolution

The Iranian Revolution ( fa, انقلاب ایران, Enqelâb-e Irân, ), also known as the Islamic Revolution ( fa, انقلاب اسلامی, Enqelâb-e Eslâmī), was a series of events that culminated in the overthrow of the Pahlavi dynas ...

in the 1979 oil crisis, and the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

, and the more recent 2013 oil supply glut that led to the "largest oil price declines in modern history" in 2014 to 2016. The 70% decline in global oil prices was "one of the three biggest declines since World War II, and the longest lasting since the supply-driven collapse of 1986."

By 2015, the United States had become the 3rd largest producer of oil—moving from importer to exporter.

The 2020 Russia–Saudi Arabia oil price war

On 8 March 2020, Saudi Arabia initiated a price war on oil with Russia, facilitating a 65% quarterly fall in the price of oil. In the first few weeks of March, US oil prices fell by 34%, crude oil fell by 26%, and Brent oil fell by 24%. The pr ...

resulted in a 65% decline in global oil prices at the beginning of the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identif ...

. In 2021, the record-high energy prices were driven by a global surge in demand as the world recovered from the COVID-19 recession

The COVID-19 recession, also referred to as the Great Lockdown, is a global recession, global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020.

After a year of global economic slowdown ...

. By December 2021, an unexpected rebound in the demand for oil from United States, China and India, coupled with U.S. shale industry investors' "demands to hold the line on spending", has contributed to "tight" oil inventories globally. On 18 January 2022, as the price of Brent crude oil reached its highest since 2014—$88, concerns were raised about the rising cost of gasoline—which hit a record high in the United Kingdom.

Structural drivers of global oil price

According toOur World in Data

Our World in Data (OWID) is a scientific online publication that focuses on large global problems such as poverty, disease, hunger, climate change, war, existential risks, and inequality.

It is a project of the Global Change Data Lab, a re ...

, in the nineteenth and early twentieth century the global crude oil prices were "relatively consistent." In the 1970s, there was a "significant increase" in the price of oil globally, partially in response to the 1973

Events January

* January 1 - The United Kingdom, the Republic of Ireland and Denmark enter the European Economic Community, which later becomes the European Union.

* January 15 – Vietnam War: Citing progress in peace negotiations, U.S. ...

and 1979

Events

January

* January 1

** United Nations Secretary-General Kurt Waldheim heralds the start of the ''International Year of the Child''. Many musicians donate to the ''Music for UNICEF Concert'' fund, among them ABBA, who write the song ...

oil crises. In 1980, globally averaged prices "spiked" to US$107.27.

Historically, there have been a number of factors affecting the global price of oil. These have included the Organization of Arab Petroleum Exporting Countries led by Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in Western Asia. It covers the bulk of the Arabian Peninsula, and has a land area of about , making it the fifth-largest country in Asia, the second-largest in the A ...

resulting in the 1973 oil crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supp ...

, the Iranian Revolution in the 1979 oil crisis, Iran–Iraq War

The Iran–Iraq War was an armed conflict between Iran and Iraq that lasted from September 1980 to August 1988. It began with the Iraqi invasion of Iran and lasted for almost eight years, until the acceptance of United Nations Security Council ...

(1980–1988), the 1990 Invasion of Kuwait

The Iraqi invasion of Kuwait was an operation conducted by Iraq on 2 August 1990, whereby it invaded the neighboring State of Kuwait, consequently resulting in a seven-month-long Iraqi military occupation of the country. The invasion and Ira ...

by Iraq

Iraq,; ku, عێراق, translit=Êraq officially the Republic of Iraq, '; ku, کۆماری عێراق, translit=Komarî Êraq is a country in Western Asia. It is bordered by Turkey to Iraq–Turkey border, the north, Iran to Iran–Iraq ...

, the 1991 Gulf War

The Gulf War was a 1990–1991 armed campaign waged by a 35-country military coalition in response to the Iraqi invasion of Kuwait. Spearheaded by the United States, the coalition's efforts against Iraq were carried out in two key phases: ...

, the 1997 Asian financial crisis

The Asian financial crisis was a period of financial crisis that gripped much of East Asia and Southeast Asia beginning in July 1997 and raised fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1 ...

, the September 11 attacks

The September 11 attacks, commonly known as 9/11, were four coordinated suicide terrorist attacks carried out by al-Qaeda against the United States on Tuesday, September 11, 2001. That morning, nineteen terrorists hijacked four commercia ...

, the 2002–2003 national strike in Venezuela

Venezuela (; ), officially the Bolivarian Republic of Venezuela ( es, link=no, República Bolivariana de Venezuela), is a country on the northern coast of South America, consisting of a continental landmass and many islands and islets in th ...

's state-owned oil company Petróleos de Venezuela, S.A. (PDVSA), Organization of the Petroleum Exporting Countries (OPEC), the 2007–2008 global financial collapse (GFC), OPEC 2009 cut in oil production, the Arab Spring

The Arab Spring ( ar, الربيع العربي) was a series of Nonviolent resistance, anti-government protests, Rebellion, uprisings and Insurgency, armed rebellions that spread across much of the Arab world in the early 2010s. It began in T ...

2010s uprisings in Egypt and Libya, the ongoing Syrian civil war (2011–present), the 2013 oil supply glut that led to the "largest oil price declines in modern history" in 2014 to 2016. The 70% decline in global oil prices was "one of the three biggest declines since World War II, and the longest lasting since the supply-driven collapse of 1986." By 2015 the United States was the 3rd largest producer of oil moving from importer to exporter. The 2020 Russia–Saudi Arabia oil price war

On 8 March 2020, Saudi Arabia initiated a price war on oil with Russia, facilitating a 65% quarterly fall in the price of oil. In the first few weeks of March, US oil prices fell by 34%, crude oil fell by 26%, and Brent oil fell by 24%. The pr ...

resulted in a 65% decline in global oil prices at the beginning of the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identif ...

.

Structural drivers affecting historical global oil prices include are "oil supply shocks, oil-market-specific demand shocks, storage demand shocks", "shocks to global economic growth", and "speculative demand for oil stocks above the ground".

Analyses of oil price fluctuations

Oil prices are determined by global forces of

Oil prices are determined by global forces of supply and demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a ...

, according to the classical economic model of price determination in microeconomics. The demand for oil is highly dependent on global macroeconomic conditions. According to the International Energy Agency

The International Energy Agency (IEA) is a Paris-based autonomous intergovernmental organisation, established in 1974, that provides policy recommendations, analysis and data on the entire global energy sector, with a recent focus on curbing carb ...

, high oil prices generally have a large negative impact on global economic growth

Economic growth can be defined as the increase or improvement in the inflation-adjusted market value of the goods and services produced by an economy in a financial year. Statisticians conventionally measure such growth as the percent rate of ...

.

In response to the 1973 oil crisis, in 1974, the RAND Corporation

The RAND Corporation (from the phrase "research and development") is an American nonprofit global policy think tank created in 1948 by Douglas Aircraft Company to offer research and analysis to the United States Armed Forces. It is financed ...

presented a new economic model of the global oil market that included four sectors—"crude production, transportation, refining, and consumption of products" and these regions—United States, Canada, Latin America, Europe, the Middle East and Africa, and Asia. The study listed exogenous variables that can affect the price of oil: "regional supply and demand equations, the technology of refining, and government policy variables". Based on these exogenous variables, their proposed economic model would be able to determine the "levels of consumption, production, and price for each commodity in each region, the pattern of world trade flows, and the refinery capital structure and output in each region".

A system dynamics economic model of oil price determination "integrates various factors affecting" the dynamics of the price of oil, according to a 1992 ''European Journal of Operational Research

The ''European Journal of Operational Research'' (EJOR) is a peer-reviewed academic journal in operations research. It was founded in 1977 by the Association of European Operational Research Societies, and is published by Elsevier, with Roman Sł ...

'' article.

A widely cited 2008 ''The Review of Economics and Statistics

''The'' ''Review of Economics and Statistics'' is a peer-reviewed 103-year-old general journal that focuses on applied economics, with specific relevance to the scope of quantitative economics. The ''Review'', edited at the Harvard University’s K ...

'', article by Lutz Killian, examined the extent to which "exogenous oil supply shocks"—such as the Iranian revolution (1978–1979), Iran–Iraq War (1980–1988), Persian Gulf War (1990–1991), Iraq War (2003), Civil unrest in Venezuela (2002–2003), and perhaps the Yom Kippur War/Arab oil embargo (1973–1974)"—explain changes in the price of oil." Killian stated that, by 2008, there was "widespread recognition" that "oil prices since 1973 must be considered endogenous with respect to global macroeconomic conditions," but Kilian added that these "standard theoretical models of the transmission of oil price shocks that maintain that everything else remains fixed, as the real price of imported crude oil increases, are misleading and must be replaced by models that allow for the endogenous determination of the price of oil." Killian found that there was "no evidence that the 1973–1974 and 2002–2003 oil supply shocks had a substantial impact on real growth in any G7 country, whereas the 1978–1979, 1980, and 1990–1991 shocks contributed to lower growth in at least some G7 countries."

A 2019 Bank of Canada

The Bank of Canada (BoC; french: Banque du Canada) is a Crown corporation and Canada's central bank. Chartered in 1934 under the ''Bank of Canada Act'', it is responsible for formulating Canada's monetary policy,OECD. OECD Economic Surveys: Ca ...

(BOC) report, described the usefulness of a structural vector autoregressive (SVAR) model for conditional forecasts of global GDP growth and oil consumption in relation to four types of oil shocks. The structural vector autoregressive model was proposed by the American econometrician

Econometrics is the application of statistical methods to economic data in order to give empirical content to economic relationships.M. Hashem Pesaran (1987). "Econometrics," '' The New Palgrave: A Dictionary of Economics'', v. 2, p. 8 p. 8� ...

and macroeconomist

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole.

For example, using interest rates, taxes, and ...

Christopher A. Sims

Christopher Albert Sims (born October 21, 1942) is an American econometrician and macroeconomist. He is currently the John J.F. Sherrerd '52 University Professor of Economics at Princeton University. Together with Thomas Sargent, he won the N ...

in 1982 as an alternative statistical framework model for macroeconomists. According to the BOC report—using the SVAR model—"oil supply shocks were the dominant force during the 2014–15 oil price decline".

By 2016, despite improved understanding of oil markets, predicting oil price fluctuations remained a challenge for economists, according to a 2016 article in the ''Journal of Economic Perspectives'' , which was based on an extensive review of academic literature by economists on "all major oil price fluctuations between 1973 and 2014".

A 2016 article in the Oxford Institute for Energy Studies

The Oxford Institute for Energy Studies is an energy research institution which was founded in 1982, and serves a worldwide audience with its research, guides understanding of all major energy issues. It is a recognised independent centre of the U ...

describes how analysts offered differing views on why the price of oil had decreased 55% from "June 2014 to January 2015" following "four years of relative stability at around US$105 per barrel". A 2015 World Bank report said that the low prices "likely marks the end of the commodity supercycle that began in the early 2000s" and they expected prices to "remain low for a considerable period of time".

Goldman Sachs

Goldman Sachs () is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, H ...

, for example, has called this structural shift, the "New Oil Order"—created by the U.S. shale revolution. Goldman Sachs said that this structural shift was "reshaping global energy markets and bringing with it a new era of volatility" by "impacting markets, economies, industries and companies worldwide" and will keep the price of oil lower for a prolonged period. Others say that this cycle is like previous cycles and that prices will rise again.

A 2020 ''Energy Economics'' article confirmed that the "supply and demand of global crude oil and the financial market" continued to be the major factors that affected the global price of oil. The researchers using a new Bayesian structural time series model, found that shale oil production continued to increase its impact on oil price but it remained "relatively small".

Benchmark pricing

Major benchmark references, or pricing markers, include Brent, WTI, the

Major benchmark references, or pricing markers, include Brent, WTI, the OPEC Reference Basket

The OPEC Reference Basket (ORB), also referred to as the OPEC Basket, is a weighted average of prices for petroleum blends produced by OPEC members. It is used as an important benchmark for crude oil prices. OPEC has often attempted to keep the p ...

(ORB)—introduced on 16 June 2005 and is made up of Saharan Blend (from Algeria

)

, image_map = Algeria (centered orthographic projection).svg

, map_caption =

, image_map2 =

, capital = Algiers

, coordinates =

, largest_city = capital

, relig ...

), Girassol (from Angola

, national_anthem = " Angola Avante"()

, image_map =

, map_caption =

, capital = Luanda

, religion =

, religion_year = 2020

, religion_ref =

, coordina ...

), Oriente (from Ecuador

Ecuador ( ; ; Quechua: ''Ikwayur''; Shuar: ''Ecuador'' or ''Ekuatur''), officially the Republic of Ecuador ( es, República del Ecuador, which literally translates as "Republic of the Equator"; Quechua: ''Ikwadur Ripuwlika''; Shuar: ''Eku ...

), Rabi Light (from Gabon

Gabon (; ; snq, Ngabu), officially the Gabonese Republic (french: République gabonaise), is a country on the west coast of Central Africa. Located on the equator, it is bordered by Equatorial Guinea to the northwest, Cameroon to the north ...

), Iran Heavy (from Iran

Iran, officially the Islamic Republic of Iran, and also called Persia, is a country located in Western Asia. It is bordered by Iraq and Turkey to the west, by Azerbaijan and Armenia to the northwest, by the Caspian Sea and Turkmeni ...

), Basra Light

Basra ( ar, ٱلْبَصْرَة, al-Baṣrah) is an Iraqi city located on the Shatt al-Arab. It had an estimated population of 1.4 million in 2018. Basra is also Iraq's main port, although it does not have deep water access, which is hand ...

(from Iraq

Iraq,; ku, عێراق, translit=Êraq officially the Republic of Iraq, '; ku, کۆماری عێراق, translit=Komarî Êraq is a country in Western Asia. It is bordered by Turkey to Iraq–Turkey border, the north, Iran to Iran–Iraq ...

), Kuwait Export

Kuwait (; ar, الكويت ', or ), officially the State of Kuwait ( ar, دولة الكويت '), is a country in Western Asia. It is situated in the northern edge of Eastern Arabia at the tip of the Persian Gulf, bordering Iraq to the nort ...

(from Kuwait

Kuwait (; ar, الكويت ', or ), officially the State of Kuwait ( ar, دولة الكويت '), is a country in Western Asia. It is situated in the northern edge of Eastern Arabia at the tip of the Persian Gulf, bordering Iraq to the nort ...

), Es Sider

Es, ES, or similar may refer to:

Arts and entertainment

* An alternate name for the musical note E♭ (E-flat)

* ''E's'', a manga series by Satoru Yuiga

* ''Es'' (film), the German title of ''It'', a 1966 West German film directed by Ulrich Scham ...

(from Libya

Libya (; ar, ليبيا, Lībiyā), officially the State of Libya ( ar, دولة ليبيا, Dawlat Lībiyā), is a country in the Maghreb region in North Africa. It is bordered by the Mediterranean Sea to the north, Egypt to Egypt–Libya bo ...

), Bonny Light

Bonny Light oil was found at Oloibiri in the Niger delta region of Nigeria in 1956 for its commercial use.. Due to its features of generating high profit, it is highly demanded by refiners. Bonny light oil has an API of 32.9, classified as light ...

(from Nigeria

Nigeria ( ), , ig, Naìjíríyà, yo, Nàìjíríà, pcm, Naijá , ff, Naajeeriya, kcg, Naijeriya officially the Federal Republic of Nigeria, is a country in West Africa. It is situated between the Sahel to the north and the Gulf o ...

), Qatar Marine (from Qatar

Qatar (, ; ar, قطر, Qaṭar ; local vernacular pronunciation: ), officially the State of Qatar,) is a country in Western Asia. It occupies the Qatar Peninsula on the northeastern coast of the Arabian Peninsula in the Middle East; it sh ...

), Arab Light

The Arabs (singular: Arab; singular ar, عَرَبِيٌّ, DIN 31635: , , plural ar, عَرَب, DIN 31635: , Arabic pronunciation: ), also known as the Arab people, are an ethnic group mainly inhabiting the Arab world in Western Asia, N ...

(from Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in Western Asia. It covers the bulk of the Arabian Peninsula, and has a land area of about , making it the fifth-largest country in Asia, the second-largest in the A ...

), Murban (from UAE

The United Arab Emirates (UAE; ar, اَلْإِمَارَات الْعَرَبِيَة الْمُتَحِدَة ), or simply the Emirates ( ar, الِْإمَارَات ), is a country in Western Asia (The Middle East). It is located at th ...

), and Merey (from Venezuela

Venezuela (; ), officially the Bolivarian Republic of Venezuela ( es, link=no, República Bolivariana de Venezuela), is a country on the northern coast of South America, consisting of a continental landmass and many islands and islets in th ...

), Dubai Crude

Dubai Crude is a medium sour crude oil extracted from Dubai. Dubai Crude is used as a price benchmark or oil marker because it is one of only a few Persian Gulf crude oils available immediately. There are two other main oil markers: Brent Crude a ...

, and Tapis Crude

Tapis crude is a Malaysian crude oil used as a pricing benchmark in Singapore. Tapis is very light, with an API gravity of 43°-45°, and very sweet, with only about 0.04% sulfur. While it is not traded on a market like Brent Crude or West Texa ...

(Singapore).

In North America the benchmark price refers to the spot price

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement (payment and delivery) on the spot date, which is normally two business days after the ...

of West Texas Intermediate

West Texas Intermediate (WTI) is a grade or mix of crude oil; the term is also used to refer to the spot price, the futures price, or assessed price for that oil. In colloquial usage, WTI usually refers to the WTI Crude Oil futures contract tr ...

(WTI), also known as Texas Light Sweet, a type of crude oil used as a benchmark in oil pricing and the underlying commodity of New York Mercantile Exchange's oil futures contracts. WTI is a light crude oil

Petroleum, also known as crude oil, or simply oil, is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons, and is found in geological formations. The name ''petroleum'' covers both naturally occurring unprocessed crude ...

, lighter than Brent Crude

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE (Intercon ...

oil. It contains about 0.24% sulfur, rating it a sweet crude, sweeter than Brent. Its properties and production site make it ideal for being refined in the United States, mostly in the Midwest and Gulf Coast regions. WTI has an API gravity of around 39.6 (specific gravity approx. 0.827) per barrel (159 liters) of either WTI/light crude Light crude oil is liquid petroleum that has a low density and flows freely at room temperature. It has a low viscosity, low specific gravity and high API gravity due to the presence of a high proportion of light hydrocarbon fractions. It generally ...

as traded on the New York Mercantile Exchange

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

...

(NYMEX) for delivery at Cushing, Oklahoma

Cushing ( sac, Koshineki, iow, Amína P^óp^oye Chína, ''meaning: "Soft-seat town"'') is a city in Payne County, Oklahoma, United States. The population was 7,826 at the time of the 2010 census, a decline of 6.5% since 8,371 in 2000. Cushing w ...

. Cushing, Oklahoma

Cushing ( sac, Koshineki, iow, Amína P^óp^oye Chína, ''meaning: "Soft-seat town"'') is a city in Payne County, Oklahoma, United States. The population was 7,826 at the time of the 2010 census, a decline of 6.5% since 8,371 in 2000. Cushing w ...

, a major oil supply hub connecting oil suppliers to the Gulf Coast, has become the most significant trading hub for crude oil in North America.

In Europe and some other parts of the world, the price of the oil benchmark is Brent Crude

Brent Crude may refer to any or all of the components of the Brent Complex, a physically and financially traded oil market based around the North Sea of Northwest Europe; colloquially, Brent Crude usually refers to the price of the ICE (Intercon ...

as traded on the Intercontinental Exchange

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell ...

(ICE, into which the International Petroleum Exchange

International is an adjective (also used as a noun) meaning "between nations".

International may also refer to:

Music Albums

* ''International'' (Kevin Michael album), 2011

* ''International'' (New Order album), 2002

* ''International'' (The T ...

has been incorporated) for delivery at Sullom Voe

Sullom Voe is an inlet of the North Sea between the parishes of Delting and Northmavine in Shetland, Scotland. It is a location of the Sullom Voe oil terminal and Shetland Gas Plant. The word Voe is from the Old Norse ' and denotes a small ba ...

. Brent oil is produced in coastal waters (North Sea

The North Sea lies between Great Britain, Norway, Denmark, Germany, the Netherlands and Belgium. An epeiric sea on the European continental shelf, it connects to the Atlantic Ocean through the English Channel in the south and the Norwegian S ...

) of UK and Norway. The total consumption of crude oil in UK and Norway

Norway, officially the Kingdom of Norway, is a Nordic country in Northern Europe, the mainland territory of which comprises the western and northernmost portion of the Scandinavian Peninsula. The remote Arctic island of Jan Mayen and t ...

is more than the oil production in these countries. So Brent crude market is very opaque with very low oil trade physically. Brent price is used widely to fix the prices of crude oil, LPG, LNG

Liquefied natural gas (LNG) is natural gas (predominantly methane, CH4, with some mixture of ethane, C2H6) that has been cooled down to liquid form for ease and safety of non-pressurized storage or transport. It takes up about 1/600th the volu ...

, natural gas, etc. trade globally including Middle East crude oils.

There is a differential in the price of a barrel of oil based on its grade—determined by factors such as its specific gravity or API gravity

The American Petroleum Institute gravity, or API gravity, is a measure of how heavy or light a petroleum liquid is compared to water: if its API gravity is greater than 10, it is lighter and floats on water; if less than 10, it is heavier and sinks ...

and its sulfur content—and its location—for example, its proximity to tidewater and refineries. Heavier, sour crude oil Sour crude oil is crude oil containing a high amount of the impurity sulfur. It is common to find crude oil containing some impurities. When the total sulfur level in the oil is more than 0.5% (by weight), the oil is called "sour".

The impurities n ...

s lacking in tidewater access—such as Western Canadian Select—are less expensive than lighter, sweeter oil—such as WTI.

The Energy Information Administration

The U.S. Energy Information Administration (EIA) is a principal agency of the U.S. Federal Statistical System responsible for collecting, analyzing, and disseminating energy information to promote sound policymaking, efficient markets, and publ ...

(EIA) uses the imported refiner acquisition cost, the weighted average

The weighted arithmetic mean is similar to an ordinary arithmetic mean (the most common type of average), except that instead of each of the data points contributing equally to the final average, some data points contribute more than others. The ...

cost of all oil imported into the US, as its "world oil price".

Global oil prices: a chronology

The price of oil remained "relatively consistent" from 1861 until the 1970s. In

The price of oil remained "relatively consistent" from 1861 until the 1970s. In Daniel Yergin

Daniel Howard Yergin (born February 6, 1947) is an American author, speaker, energy expert, and economic historian. Yergin is vice chairman of S&P Global. He was formerly vice chairman of IHS Markit, which merged with S&P in 2022. He founded Ca ...

's 1991 Pulitzer prize-winning book '' The Prize: The Epic Quest for Oil, Money, and Power'', Yergin described how the "oil-supply management system"—which had been run by "international oil companies"—had "crumbled" in 1973. Yergin states that the role of Organization of the Petroleum Exporting Countries

The Organization of the Petroleum Exporting Countries (OPEC, ) is a cartel of countries. Founded on 14 September 1960 in Baghdad by the first five members (Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela), it has, since 1965, been headquart ...

(OPEC)—which had been established in 1960, by Iran

Iran, officially the Islamic Republic of Iran, and also called Persia, is a country located in Western Asia. It is bordered by Iraq and Turkey to the west, by Azerbaijan and Armenia to the northwest, by the Caspian Sea and Turkmeni ...

, Iraq

Iraq,; ku, عێراق, translit=Êraq officially the Republic of Iraq, '; ku, کۆماری عێراق, translit=Komarî Êraq is a country in Western Asia. It is bordered by Turkey to Iraq–Turkey border, the north, Iran to Iran–Iraq ...

, Kuwait

Kuwait (; ar, الكويت ', or ), officially the State of Kuwait ( ar, دولة الكويت '), is a country in Western Asia. It is situated in the northern edge of Eastern Arabia at the tip of the Persian Gulf, bordering Iraq to the nort ...

, Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in Western Asia. It covers the bulk of the Arabian Peninsula, and has a land area of about , making it the fifth-largest country in Asia, the second-largest in the A ...

and Venezuela

Venezuela (; ), officially the Bolivarian Republic of Venezuela ( es, link=no, República Bolivariana de Venezuela), is a country on the northern coast of South America, consisting of a continental landmass and many islands and islets in th ...

— in controlling the price of oil, was dramatically changed. Since 1927, a cartel

A cartel is a group of independent market participants who collude with each other in order to improve their profits and dominate the market. Cartels are usually associations in the same sphere of business, and thus an alliance of rivals. Mos ...

known as the " Seven Sisters"—five of which were headquartered in the United States—had been controlling posted prices since the so-called 1927 Red Line Agreement The Red Line Agreement is an agreement signed by partners in the Turkish Petroleum Company (TPC) on July 31, 1928, in Ostend, Belgium. The agreement was signed between Anglo-Persian Company (later renamed British Petroleum), Royal Dutch/Shell, Compa ...

and 1928 Achnacarry Agreement

Achnacarry ( gd, Achadh na Cairidh) is a hamlet, private estate, and a castle in the Lochaber region of the Highlands, Scotland. It occupies a strategic position on an isthmus between Loch Lochy to the east, and Loch Arkaig to the west.

Achna ...

, and had achieved a high level of price stability until 1972, according to Yergin.

There were two major energy crisis in the 1970s: the 1973 oil crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supp ...

and the 1979 energy crisis

The 1979 oil crisis, also known as the 1979 Oil Shock or Second Oil Crisis, was an energy crisis caused by a drop in oil production in the wake of the Iranian Revolution. Although the global oil supply only decreased by approximately four per ...

that affected the price of oil. Starting in the early 1970s—when domestic production of oil was insufficient to satisfy increasing domestic demands—the US had become increasingly dependent on oil imports from the Middle East. Until the early 1970s, the price of oil in the United States was regulated domestically and indirectly by the Seven Sisters. The "magnitude" of the increase in the price of oil following OPEC's 1973 embargo in reaction to the Yom Kippur War

The Yom Kippur War, also known as the Ramadan War, the October War, the 1973 Arab–Israeli War, or the Fourth Arab–Israeli War, was an armed conflict fought from October 6 to 25, 1973 between Israel and a coalition of Arab states led by Egy ...

and the 1979 Iranian Revolution

The Iranian Revolution ( fa, انقلاب ایران, Enqelâb-e Irân, ), also known as the Islamic Revolution ( fa, انقلاب اسلامی, Enqelâb-e Eslâmī), was a series of events that culminated in the overthrow of the Pahlavi dynas ...

, was without precedent. In the 1973 Yom Kippur War

The Yom Kippur War, also known as the Ramadan War, the October War, the 1973 Arab–Israeli War, or the Fourth Arab–Israeli War, was an armed conflict fought from October 6 to 25, 1973 between Israel and a coalition of Arab states led by Egy ...

, a coalition of Arab states led by Egypt

Egypt ( ar, مصر , ), officially the Arab Republic of Egypt, is a transcontinental country spanning the northeast corner of Africa and southwest corner of Asia via a land bridge formed by the Sinai Peninsula. It is bordered by the Mediter ...

and Syria

Syria ( ar, سُورِيَا or سُورِيَة, translit=Sūriyā), officially the Syrian Arab Republic ( ar, الجمهورية العربية السورية, al-Jumhūrīyah al-ʻArabīyah as-Sūrīyah), is a Western Asian country loc ...

attacked Israel

Israel (; he, יִשְׂרָאֵל, ; ar, إِسْرَائِيل, ), officially the State of Israel ( he, מְדִינַת יִשְׂרָאֵל, label=none, translit=Medīnat Yīsrāʾēl; ), is a country in Western Asia. It is situated ...

. During the ensuing 1973 oil crisis

The 1973 oil crisis or first oil crisis began in October 1973 when the members of the Organization of Arab Petroleum Exporting Countries (OAPEC), led by Saudi Arabia, proclaimed an oil embargo. The embargo was targeted at nations that had supp ...

, the Arab oil-producing states began to embargo oil shipments to Western Europe and the United States in retaliation for supporting Israel. Countries, including the United States, Germany, Japan, and Canada began to establish their own national energy programs that were focused on security of supply of oil, as the newly formed Organization of Petroleum Exporting Countries (OPEC) doubled the price of oil.

During the 1979 oil crisis, the global oil supply was "constrained" because of the 1979 Iranian Revolution

The Iranian Revolution ( fa, انقلاب ایران, Enqelâb-e Irân, ), also known as the Islamic Revolution ( fa, انقلاب اسلامی, Enqelâb-e Eslâmī), was a series of events that culminated in the overthrow of the Pahlavi dynas ...

—the price of oil "more than doubled", then began to decline in "real terms from 1980 onwards, eroding OPEC's power over the global economy," according to ''The Economist''.

The 1970s oil crisis gave rise to speculative trading and the WTI crude oil futures markets.

In the early 1980s, concurrent with the OPEC embargo, oil prices experienced a "rapid decline." In early 2007, the price of oil was US$50. In 1980, globally averaged prices "spiked" to US$107.27, and reached its all-time peak of US$147 in July 2008.

The 1980s oil glut

The 1980s oil glut was a serious surplus of crude oil caused by falling demand following the 1970s energy crisis. The world price of oil had peaked in 1980 at over US$35 per barrel (equivalent to $ per barrel in dollars, when adjusted for inf ...

was caused by non-OPEC countries—such as the United States and Britain—increasing their oil production, which resulted in a decrease in the price of oil in the early 1980s, according to ''The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Econo ...

''. When OPEC changed their policy to increase oil supplies in 1985, "oil prices collapsed and remained low for almost two decades", according to a 2015 World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Interna ...

report.

In 1983, the New York Mercantile Exchange (NYMEX) launched crude oil futures contracts, and the London-based International Petroleum Exchange

International is an adjective (also used as a noun) meaning "between nations".

International may also refer to:

Music Albums

* ''International'' (Kevin Michael album), 2011

* ''International'' (New Order album), 2002

* ''International'' (The T ...

(IPE)—acquired by Intercontinental Exchange

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell ...

(ICE) in 2005— launched theirs in June 1988.

The price of oil reached a peak of c. US$65 during the 1990 Persian Gulf crisis and war. The 1990 oil price shock occurred in response to the Iraqi invasion of Kuwait

The Iraqi invasion of Kuwait was an operation conducted by Iraq on 2 August 1990, whereby it invaded the neighboring State of Kuwait, consequently resulting in a seven-month-long Iraqi military occupation of the country. The invasion and Ira ...

, according to the Brookings Institution.

There was a period of global recessions and the price of oil hit a low of before it peaked at a high of $45 on 11 September 2001, the day of the September 11 attacks

The September 11 attacks, commonly known as 9/11, were four coordinated suicide terrorist attacks carried out by al-Qaeda against the United States on Tuesday, September 11, 2001. That morning, nineteen terrorists hijacked four commercia ...

, only to drop again to a low of $26 on 8 May 2003.

The price rose to $80 with the U.S.-led invasion of Iraq.

There were major energy crises in the 2000s including the 2010s oil glut

The 2010s oil glut is a significant surplus of crude oil that started in 2014–2015 and accelerated in 2016, with multiple causes. They include general oversupply as unconventional US and Canadian tight oil (shale oil) production reached crit ...

with changes in the world oil market.

Starting in 1999, the price of oil rose significantly. It was explained by the rising oil demand in countries like China and India. A dramatic increase from US$50 in early 2007, to a peak of US$147 in July 2008, was followed by a decline to US$34 in December 2008, as the

Starting in 1999, the price of oil rose significantly. It was explained by the rising oil demand in countries like China and India. A dramatic increase from US$50 in early 2007, to a peak of US$147 in July 2008, was followed by a decline to US$34 in December 2008, as the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

took hold.

By May 2008, The United States was consuming approximately 21 million bpd and importing about 14 million bpd—60% with OPEC supply 16% and Venezuela 10%. In the middle of the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

, the price of oil underwent a significant decrease after the record peak of US$147.27 it reached on 11 July 2008. On 23 December 2008, WTI crude oil spot price fell to US$30.28 a barrel, the lowest since the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

began. The price sharply rebounded after the crisis and rose to US$82 a barrel in 2009.

On 31 January 2011, the Brent price hit $100 a barrel briefly for the first time since October 2008, on concerns that the 2011 Egyptian protests

The 2011 Egyptian revolution, also known as the 25 January revolution ( ar, ثورة ٢٥ يناير; ), began on 25 January 2011 and spread across Egypt. The date was set by various youth groups to coincide with the annual Egyptian "Police ho ...

would "lead to the closure of the Suez Canal

The Suez Canal ( arz, قَنَاةُ ٱلسُّوَيْسِ, ') is an artificial sea-level waterway in Egypt, connecting the Mediterranean Sea to the Red Sea through the Isthmus of Suez and dividing Africa and Asia. The long canal is a popular ...

and disrupt oil supplies". For about three and half years the price largely remained in the $90–$120 range.

From 2004 to 2014, OPEC was setting the global price of oil. OPEC started setting a target price range of $100–110/bbl before the 2008 financial crisis —by July 2008 the price of oil had reached its all-time peak of US$147 before it plunged to US$34 in December 2008, during the financial crisis of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of fi ...

. Some commentators including ''Business Week

''Bloomberg Businessweek'', previously known as ''BusinessWeek'', is an American weekly business magazine published fifty times a year. Since 2009, the magazine is owned by New York City-based Bloomberg L.P. The magazine debuted in New York City ...

,'' the ''Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nik ...

'' and the ''Washington Post

''The Washington Post'' (also known as the ''Post'' and, informally, ''WaPo'') is an American daily newspaper published in Washington, D.C. It is the most widely circulated newspaper within the Washington metropolitan area and has a large nati ...

'', argued that the rise in oil prices prior to the financial crisis of 2007–2008 was due to speculation

In finance, speculation is the purchase of an asset (a commodity, good (economics), goods, or real estate) with the hope that it will become more valuable shortly. (It can also refer to short sales in which the speculator hopes for a decline i ...

in futures market

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or fi ...

s.

Up until 2014, the dominant factor on the price of oil was from the demand side—from "China and other emerging economies".

By 2014, production from unconventional reservoirs through hydraulic fracturing in the United States

Fracking in the United States began in 1949. According to the Department of Energy (DOE), by 2013 at least two million oil and gas wells in the US had been hydraulically fractured, and that of new wells being drilled, up to 95% are hydraulic ...

and oil production in Canada, caused oil production to surge globally "on a scale that most oil exporters had not anticipated" resulting in "turmoil in prices." The United States oil production was greater than that of Russia and Saudi Arabia, and according to some, broke OPEC's control of the price of oil. In the middle of 2014, price started declining due to a significant increase in oil production in USA, and declining demand in the emerging countries. According to Ambrose Evans-Pritchard

Ambrose Evans-Pritchard (born 7 December 1957) is the international business editor of the '' Daily Telegraph''.

Early life

Evans-Pritchard was born in Oxford. He was educated at Malvern College and Trinity College, Cambridge, where he read ...

, in 2014–2015, Saudi Arabia flooded the market with inexpensive crude oil in a failed attempted to slow down US shale oil production, and caused a "positive supply shock" which saved consumers about US$2 trillion and "benefited the world economy".

During 2014–2015, OPEC members consistently exceeded their production ceiling, and China experienced a marked slowdown in economic growth. At the same time, U.S. oil production nearly doubled from 2008 levels, due to substantial improvements in shale

Shale is a fine-grained, clastic sedimentary rock formed from mud that is a mix of flakes of clay minerals (hydrous aluminium phyllosilicates, e.g. kaolin, Al2 Si2 O5( OH)4) and tiny fragments (silt-sized particles) of other minerals, especial ...

"fracking

Fracking (also known as hydraulic fracturing, hydrofracturing, or hydrofracking) is a well stimulation technique involving the fracturing of bedrock formations by a pressurized liquid. The process involves the high-pressure injection of "frack ...

" technology in response to record oil prices. A combination of factors led a plunge in U.S. oil import requirements and a record high volume of worldwide oil inventories

Inventory (American English) or stock (British English) refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilisation.

Inventory management is a discipline primarily about specifying the shap ...

in storage, and a collapse in oil prices that continues into 2016. Between June 2014 and January 2015, according to the World Bank

The World Bank is an international financial institution that provides loans and grants to the governments of low- and middle-income countries for the purpose of pursuing capital projects. The World Bank is the collective name for the Interna ...

, the collapse in the price of oil was the third largest since 1986.

In early 2015, the US oil price fell below $50 per barrel dragging Brent oil to just below $50 as well.

The 2010s oil glut

The 2010s oil glut is a significant surplus of crude oil that started in 2014–2015 and accelerated in 2016, with multiple causes. They include general oversupply as unconventional US and Canadian tight oil (shale oil) production reached crit ...

—caused by multiple factors—spurred a sharp downward spiral in the price of oil that continued through February 2016. By 3 February 2016 oil was below $30— a drop of "almost 75% since mid-2014 as competing producers pumped 1–2 million barrels of crude daily exceeding demand, just as China's economy hit lowest growth in a generation." The North Sea oil and gas industry was financially stressed by the reduced oil prices, and called for government support in May 2016. According to a report released on 15 February 2016 by Deloitte

Deloitte Touche Tohmatsu Limited (), commonly referred to as Deloitte, is an international professional services network headquartered in London, England. Deloitte is the largest professional services network by revenue and number of profession ...

LLP—the audit and consulting firm—with global crude oil at near ten-year low prices, 35% of listed E&P oil and gas companies are at a high risk of bankruptcy worldwide. Indeed, bankruptcies "in the oil and gas industry could surpass levels seen in the Great Recession."

The global average price of oil dropped to US$43.73 per barrel in 2016.

By December 2018, OPEC members controlled approximately 72% of total world proved oil reserves, and produced about 41% of the total global crude oil supply. In June 2018, OPEC reduced production. In late September and early October 2018, the price of oil rose to a four-year high of over $80 for the benchmark Brent crude in response to concerns about constraints on global supply. The production capacity in Venezuela had decreased. United States sanctions against Iran

The United States has since 1979 applied various economic, trade, scientific and military sanctions against Iran. United States economic sanctions are administered by the Office of Foreign Assets Control (OFAC), an agency of the United States De ...

, OPEC's third-biggest oil producer, were set to be restored and tightened in November.

The price of oil dropped in November 2018 because of a number of factors, including "rising petro-nations’ oil production, the U.S. shale oil boom, and swelling North American oil inventories," according to ''Market Watch''.

shale oil

Shale oil is an unconventional oil produced from oil shale rock fragments by pyrolysis, hydrogenation, or thermal dissolution. These processes convert the organic matter within the rock (kerogen) into synthetic oil and gas. The resulting oil ca ...

production. US exports of petroleum—crude oil and products—exceeded imports in September and October 2019, "for the first time on record, based on monthly values since 1973."

When the price of Brent oil dropped rapidly in November 2018 to $58.71, more than 30% from its peak,—the biggest 30-day drop since 2008—factors included increased oil production in Russia, some OPEC countries and the United States, which deepened global over supply.

In 2019 the average price of Brent crude oil in 2019 was $64, WTI crude oil was $57, the OPEC Reference Basket

The OPEC Reference Basket (ORB), also referred to as the OPEC Basket, is a weighted average of prices for petroleum blends produced by OPEC members. It is used as an important benchmark for crude oil prices. OPEC has often attempted to keep the p ...

(ORB) of 14 crudes was $59.48 a barrel.

In 2020, the economic turmoil caused by the

In 2020, the economic turmoil caused by the COVID-19 recession

The COVID-19 recession, also referred to as the Great Lockdown, is a global recession, global economic recession caused by the COVID-19 pandemic. The recession began in most countries in February 2020.

After a year of global economic slowdown ...

, included severe impacts on crude oil markets, which caused a large stock market fall. The substantial decrease in the price of oil was caused by two main factors: the 2020 Russia–Saudi Arabia oil price war

On 8 March 2020, Saudi Arabia initiated a price war on oil with Russia, facilitating a 65% quarterly fall in the price of oil. In the first few weeks of March, US oil prices fell by 34%, crude oil fell by 26%, and Brent oil fell by 24%. The pr ...

and the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identif ...

, which lowered demand for oil because of lockdowns around the world.

The IHS Market reported that the "COVID-19 demand shock" represented a bigger contraction than that experienced during the Great Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

during the late 2000s and early 2010s. As demand for oil dropped to 4.5m million bpd below forecasts, tensions rose between OPEC members. At a 6 March OPEC meeting in Vienna, major oil producers were unable to agree on reducing oil production in response to the global COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identif ...

. The spot price of WTI benchmark crude oil on the NYM on 6 March 2020 dropped to US$42.10 per barrel. On 8 March, the 2020 Russia–Saudi Arabia oil price war

On 8 March 2020, Saudi Arabia initiated a price war on oil with Russia, facilitating a 65% quarterly fall in the price of oil. In the first few weeks of March, US oil prices fell by 34%, crude oil fell by 26%, and Brent oil fell by 24%. The pr ...

was launched, in which Saudi Arabia and Russia briefly flooded the market, also contributed to the decline in global oil prices. Later on the same day, oil prices had decreased by 30%, representing the largest one-time drop since the 1991 Gulf War

The Gulf War was a 1990–1991 armed campaign waged by a 35-country military coalition in response to the Iraqi invasion of Kuwait. Spearheaded by the United States, the coalition's efforts against Iraq were carried out in two key phases: ...

. Oil traded at about $30 a barrel. Very few energy companies can produce oil when the price of oil is this low. Saudi Arabia, Iran, and Iraq had the lowest production costs in 2016, while the United Kingdom, Brazil, Nigeria, Venezuela, and Canada had the highest. On 9 April, Saudi Arabia and Russia agreed to oil production cuts.

By April 2020 the price of WTI dropped by 80%, down to a low of about $5. As the demand for fuel decreased globally with pandemic-related lockdowns preventing travel, and due to excessive demand for storage of the large surplus in production, the price for future delivery of US crude in May became negative on 20 April 2020, the first time to happen since the New York Mercantile Exchange

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

...

began trading in 1983.In April, as the demand decreased, concerns about inadequate storage capacity resulted in oil firms "renting tankers to store the surplus supply". An October ''Bloomberg'' report on slumping oil prices—citing the EIA among others—said that, with the increasing number of virus cases, the demand for gasoline—particularly in the United States—was "particularly worrisome", while global inventories remained "quite high".

With the price of WTI at a record low, and 2019 Chinese 5% import tariff on U.S. oil lifted by China in May 2020, China began to import large quantities of US crude oil, reaching a record high of 867,000 bpd in July.

According to a January 2020 EIA report, the average price of Brent crude oil in 2019 was $64 per barrel compared to $71 per barrel in 2018. The average price of WTI crude oil was $57 per barrel in 2019 compared to $64 in 2018. On 20 April 2020, WTI Crude futures contracts

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset ...

dropped below $0 for the first time in history, and the following day Brent Crude fell below $20 per barrel. The substantial decrease in the price of oil was caused by two main factors: the 2020 Russia–Saudi Arabia oil price war

On 8 March 2020, Saudi Arabia initiated a price war on oil with Russia, facilitating a 65% quarterly fall in the price of oil. In the first few weeks of March, US oil prices fell by 34%, crude oil fell by 26%, and Brent oil fell by 24%. The pr ...

and the COVID-19 pandemic

The COVID-19 pandemic, also known as the coronavirus pandemic, is an ongoing global pandemic of coronavirus disease 2019 (COVID-19) caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The novel virus was first identif ...

, which lowered demand for oil because of lockdowns around the world. In the fall of 2020, against the backdrop of the resurgent pandemic, the U.S. Energy Information Administration (EIA) reported that global oil inventories remained "quite high" while demand for gasoline—particularly in the United States—was "particularly worrisome." The price of oil was about US$40 by mid-October. In 2021, the record-high energy prices were driven by a global surge in demand as the world quit the economic recession caused by COVID-19, particularly due to strong energy demand in Asia.

The ongoing 2019–2021 Persian Gulf crisis, which includes the use of drones to attack Saudi Arabia's oil infrastructure, has made the Gulf states aware of their vulnerability. Former US President "Donald Trump's 'maximum pressure' campaign led Iran to sabotage oil tankers in the Persian Gulf and supply drones and missiles for a surprise strike on Saudi oil facilities in 2019." In January 2022, Yemen's Houthi rebels drone attacks destroyed oil tankers in Abu Dhabi prompting concerns about further increases in the price of oil.

The oil prices were seen rising to hit $71.38 per barrel in March 2021, marking the highest since the beginning of the pandemic in January 2020. The oil price rise followed a missile drone attack on Saudi Arabia

Saudi Arabia, officially the Kingdom of Saudi Arabia (KSA), is a country in Western Asia. It covers the bulk of the Arabian Peninsula, and has a land area of about , making it the fifth-largest country in Asia, the second-largest in the A ...

's Aramco

Saudi Aramco ( ar, أرامكو السعودية '), officially the Saudi Arabian Oil Company (formerly Arabian-American Oil Company) or simply Aramco, is a Saudi Arabian public petroleum and natural gas company based in Dhahran. , it is one of ...

oil facility by Yemen

Yemen (; ar, ٱلْيَمَن, al-Yaman), officially the Republic of Yemen,, ) is a country in Western Asia. It is situated on the southern end of the Arabian Peninsula, and borders Saudi Arabia to the Saudi Arabia–Yemen border, north and ...

’s Houthi rebels. The United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territorie ...

said it was committed to defending Saudi Arabia.

On 5 October 2021, crude oil prices reached a multiyear high but retreated by 2% the following day. The price of crude was on the rise since June 2021, after a statement by a top US diplomat that even with a nuclear deal with Iran, hundreds of economic sanctions would remain in place. Since September 2021, Europe's energy crisis has been worsening, driven by high crude prices and a scarcity of Russian gas on the continent.

The high price of oil in late 2021, which resulted in US gasoline pump prices that rose by over $1 a gallon—a seven-year high—added pressure to the United States, which has extensive reserves of oil and has been one of the world's largest producers of oil since at least 2018. One of the major factors in the US refraining from increased oil production is related to "investor demands for higher financial returns". Another factor as described by Forbes, is 'backwardation'—when oil futures markets see the current price of $85+ as higher than what they can anticipate in the months and years in the future. If investors perceive lower future prices, they will not invest in "new drilling and fracking."

By mid-January 2022, ''Reuters'' raised concerns that an increase in the price of oil to $100—which seemed to be imminent—would worsen the inflationary environment that was already breaking 30-year-old records. Central banks were concerned that higher energy prices would contribute to a "wage-price spiral." The European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been des ...

(EU) embargo of Russian seaborne oil, in response to the Russian invasion of Ukraine

On 24 February 2022, in a major escalation of the Russo-Ukrainian War, which began in 2014. The invasion has resulted in tens of thousands of deaths on both sides. It has caused Europe's largest refugee crisis since World War II. An ...

in February, 2022, was one—but not the only—factor in the increase in the global price of oil, according to ''The Economist''. Updated 13 June 2022 When the EU added new restrictions to Russia's oil on May 30, there was a dramatic increase in the price of Brent crude to over $120 a barrel. Other factors affecting the surge in the price of oil included the tight oil market combined with a "robust demand" for energy as travel increased following the easing of coronavirus restrictions. At the same time, the United States was experiencing decreased refinery capacity which led to higher prices for petrol and diesel. In a effort to lower energy prices and to curb inflation, President Biden announced on March 31, 2022, that he would be releasing a million bbl/d from the Strategic Petroleum Reserve (SPR). Bloomberg described how the price of oil, gas and other commodities had risen driven by a global "resurgence in demand" as COVID-19 restrictions were eased, combined with supply chains problems, and "geopolitical tensions".

Oil-storage trade (contango)

The oil-storage trade, also referred to as contango, a market strategy in which large, often vertically integrated oil companies purchase oil for immediate delivery and storage—when the price of oil is low— and hold it in storage until the price of oil increases. Investors bet on the future of oil prices through a

The oil-storage trade, also referred to as contango, a market strategy in which large, often vertically integrated oil companies purchase oil for immediate delivery and storage—when the price of oil is low— and hold it in storage until the price of oil increases. Investors bet on the future of oil prices through a financial instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form ...

, oil futures in which they agree on a contract basis, to buy or sell oil at a set date in the future. Crude oil is stored in salt mines, tanks and oil tankers.

Investors can choose to take profits or losses prior to the oil-delivery date arrives. Or they can leave the contract in place and physical oil is "delivered on the set date" to an "officially designated delivery point", in the United States, that is usually Cushing, Oklahoma. When delivery dates approach, they close out existing contracts and sell new ones for future delivery of the same oil. The oil never moves out of storage. If the forward market is in "contango

Contango is a situation where the futures price (or forward price) of a commodity is higher than the ''expected'' spot price of the contract at maturity. In a contango situation, arbitrageurs or speculators are "willing to pay more owfor a comm ...

"—the forward price The forward price (or sometimes forward rate) is the agreed upon price of an asset in a forward contract. Using the rational pricing assumption, for a forward contract on an underlying asset that is tradeable, the forward price can be expressed in t ...

is higher than the current spot price

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement (payment and delivery) on the spot date, which is normally two business days after the ...

—the strategy is very successful.

Scandinavian Tank Storage AB and its founder Lars Jacobsson introduced the concept on the market in early 1990. But it was in 2007 through 2009 the oil storage trade expanded, with many participants—including Wall Street

Wall Street is an eight-block-long street in the Financial District of Lower Manhattan in New York City. It runs between Broadway in the west to South Street and the East River in the east. The term "Wall Street" has become a metonym for t ...

giants, such as Morgan Stanley

Morgan Stanley is an American multinational investment management and financial services company headquartered at 1585 Broadway in Midtown Manhattan, New York City. With offices in more than 41 countries and more than 75,000 employees, the fir ...

, Goldman Sachs

Goldman Sachs () is an American multinational investment bank and financial services company. Founded in 1869, Goldman Sachs is headquartered at 200 West Street in Lower Manhattan, with regional headquarters in London, Warsaw, Bangalore, H ...

, and Citicorp

Citigroup Inc. or Citi (Style (visual arts), stylized as citi) is an American multinational investment banking, investment bank and financial services corporation headquartered in New York City. The company was formed by the merger of banking ...

—turning sizeable profits simply by sitting on tanks of oil. By May 2007 Cushing's inventory fell by nearly 35% as the oil-storage trade heated up.

By the end of October 2009 one in twelve of the largest oil tankers was being used more for temporary storage of oil, rather than transportation.

From June 2014 to January 2015, as the price of oil dropped 60% and the supply of oil remained high, the world's largest traders in crude oil purchased at least 25 million barrels to store in supertankers to make a profit in the future when prices rise. Trafigura

Trafigura Group Pte. Ltd. is a Singaporean-based Swiss multinational commodity trading company founded in 1993 that trades in base metals and energy. It is the world's largest private metals trader and second-largest oil trader having built or p ...

, Vitol

Vitol is a Swiss-based multinational energy and commodity trading company that was founded in Rotterdam in 1966 by Henk Viëtor and Jacques Detiger. Though trading, logistics and distribution are at the core of its business, these are complemente ...

, Gunvor

Gunvor Group Ltd is a Cypriot-domiciled multinational commodity trading company registered in Cyprus, with its main trading office in Geneva, Switzerland. Gunvor also has trading offices in Singapore, the Bahamas, and Dubai, with a network of re ...

, Koch, Shell

Shell may refer to:

Architecture and design

* Shell (structure), a thin structure

** Concrete shell, a thin shell of concrete, usually with no interior columns or exterior buttresses

** Thin-shell structure

Science Biology

* Seashell, a hard o ...

and other major energy companies began to book oil storage supertankers for up to 12 months. By 13 January 2015 At least 11 Very Large Crude Carriers (VLCC) and Ultra Large Crude Carriers (ULCC)" have been reported as booked with storage options, rising from around five vessels at the end of last week. Each VLCC can hold 2 million barrels."

In 2015 as global capacity for oil storage was out-paced by global oil production, and an oil glut occurred. Crude oil storage space became a tradable commodity

Tradability is the property of a good or service that can be sold in another location distant from where it was produced. A good that is not tradable is called non-tradable. Different goods have differing levels of tradability: the higher the co ...

with CME Group

CME Group Inc. (Chicago Mercantile Exchange, Chicago Board of Trade, New York Mercantile Exchange, The Commodity Exchange) is an American global markets company. It is the world's largest financial derivatives exchange, and trades in asset class ...

— which owns NYMEX

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City.

...

— offering oil-storage futures contracts in March 2015. Traders and producers can buy and sell the right to store certain types of oil.

By 5 March 2015, as oil production outpaces oil demand by 1.5 million bpd, storage capacity globally is dwindling. In the United States alone, according to data from the Energy Information Administration

The U.S. Energy Information Administration (EIA) is a principal agency of the U.S. Federal Statistical System responsible for collecting, analyzing, and disseminating energy information to promote sound policymaking, efficient markets, and publ ...

, U.S. crude-oil supplies are at almost 70% of the U. S. storage capacity, the highest to capacity ratio since 1935.

In 2020, rail and road tankers and decommissioned oil pipe lines are also being used to store crude oil for contango trade. For the WTI crude to be delivered in May 2020, the price had fallen to -$40 per bbl (i.e. buyers would be paid by the sellers for taking delivery of crude oil) due to lack of storage/expensive storage. LNG carrier

An LNG carrier is a tank ship designed for transporting liquefied natural gas (LNG).

History

The first LNG carrier ''Methane Pioneer'' () carrying , classed by Bureau Veritas, left the Calcasieu River on the Louisiana Gulf coast on 25 January ...