Crisis Of 1857 on:

[Wikipedia]

[Google]

[Amazon]

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by

online edition

* Rezneck, Samuel. ''Business Depressions and Financial Panics'' (Greenwood 1968). * Ross, Michael A. ''Justice of Shattered Dreams: Samuel Freeman Miller and the Supreme Court During the Civil War Era'' . Baton Rouge: Louisiana State University Press, 2003. * * * * * Van Vleck, George W. ''The Panic of 1857, an Analytical Study'' (New York: Columbia University Press, 1943)

"A New Tariff"

''New York Daily Times,'' February 4, 1857

"House Divided."

Accessed October 30, 2010

Visit to Dred Scott

1857, Library of Congress {{DEFAULTSORT:Panic Of 1857 Banking in the United States Economic crises in the United States Financial crises 19th-century economic history Presidency of James Buchanan 1857 in the United States 1857 in economics

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by

The Panic of 1857 was a financial panic in the United States caused by the declining international economy and over-expansion of the domestic economy. Because of the invention of the telegraph by Samuel F. Morse

Samuel Finley Breese Morse (April 27, 1791 – April 2, 1872) was an American inventor and painter. After having established his reputation as a portrait painter, in his middle age Morse contributed to the invention of a single-wire telegraph ...

in 1844, the Panic of 1857 was the first financial crisis to spread rapidly throughout the United States. The world economy was also more interconnected

Georg Wilhelm Friedrich Hegel (; ; 27 August 1770 – 14 November 1831) was a German philosopher. He is one of the most important figures in German idealism and one of the founding figures of modern Western philosophy. His influence extends ...

by the 1850s, which also made the Panic of 1857 the first worldwide economic crisis. In Britain, the Palmerston government circumvented the requirements of the Bank Charter Act 1844

The Bank Charter Act 1844 (7 & 8 Vict. c. 32), sometimes referred to as the Peel Banking Act of 1844, was an Act of Parliament, Act of the Parliament of the United Kingdom, passed under the government of Robert Peel, which restricted the powers ...

, which required gold and silver reserves to back up the amount of money in circulation. Surfacing news of this circumvention set off the Panic in Britain.

Beginning in September 1857, the financial downturn did not last long, but a proper recovery was not seen until the onset of the American Civil War in 1861. The sinking of contributed to the panic of 1857, as New York banks were awaiting a much-needed shipment of gold. American banks did not recover until after the Civil War. After the failure of Ohio Life Insurance and Trust Company, the financial panic quickly spread as businesses began to fail, the railroad industry experienced financial declines, and hundreds of workers were laid off.

Because the years immediately preceding the Panic of 1857 were prosperous, many banks, merchants, and farmers had seized the opportunity to take risks with their investments, and, as soon as market prices began to fall, they quickly began to experience the effects of financial panic.

Background

The early 1850s saw great economic prosperity in the United States, stimulated by the large amount of gold mined in theCalifornia Gold Rush

The California Gold Rush (1848–1855) was a gold rush that began on January 24, 1848, when gold was found by James W. Marshall at Sutter's Mill in Coloma, California. The news of gold brought approximately 300,000 people to California fro ...

that greatly expanded the money supply. By the mid-1850s, the amount of gold mined began to decline, causing western bankers and investors to become wary. Eastern banks became cautious with their loans in the eastern US, and some even refused to accept paper currencies issued by western banks.

The US Supreme Court decided '' Dred Scott v. Sandford'' in March 1857. After the slave Dred Scott sued for his freedom, Chief Justice Roger Taney ruled that Scott was not a citizen because he was Black, and so did not have the right to sue in court. Taney also called the Missouri Compromise unconstitutional and said that the federal government could not prohibit slavery in US territories. The decision would clearly have a significant impact on the development of the western territories. Soon after the decision, "the political struggle between ' free soil' and slavery in the territories" began. The western territories north of the Missouri Compromise line were now opened to the expansion of slavery, which would obviously have drastic financial and political effects: "Kansas land warrants and western railroad securities' prices declined slightly just after the Dred Scott decision in early March." This fluctuation in railroad securities proved "that political news about future territories called the tune in the land and railroad securities markets".

Before 1857, the railroad industry had been booming due to large migrations of people to the west, especially to Kansas. The large influx of people made the railroads a profitable industry, and the banks began to provide railroad companies with large loans. Many of the companies never made it past the stage of a paper railroad

In the United States, a paper railroad is a company in the railroad business that exists "on paper only": as a legal entity which does not own any track, locomotives, or rolling stock.

In the early days of railroad construction, paper railroads h ...

and never owned the physical assets necessary to run a real one. Prices of railroad stocks as a whole began to experience a stock bubble, and railroad stocks saw increasingly-speculative entries into the fray, worsening the bubble. In the meantime, the Dred Scott decision lent uncertainty to railroads in general.

Stock market decline

In July 1857, railroad stock values peaked. On August 11, 1857,N. H. Wolfe and Company

N is the fourteenth letter of the Latin alphabet.

N or n may also refer to:

Mathematics

* \mathbb, the set of natural numbers

* N, the field norm

* N for ''nullae'', a rare Roman numeral for zero

* n, the size of a statistical sample

Sci ...

, the oldest flour and grain company in New York City, failed, shaking investor confidence and beginning a slow selling-off in the market that continued into late August.

Failure of Ohio Life Insurance and Trust Company

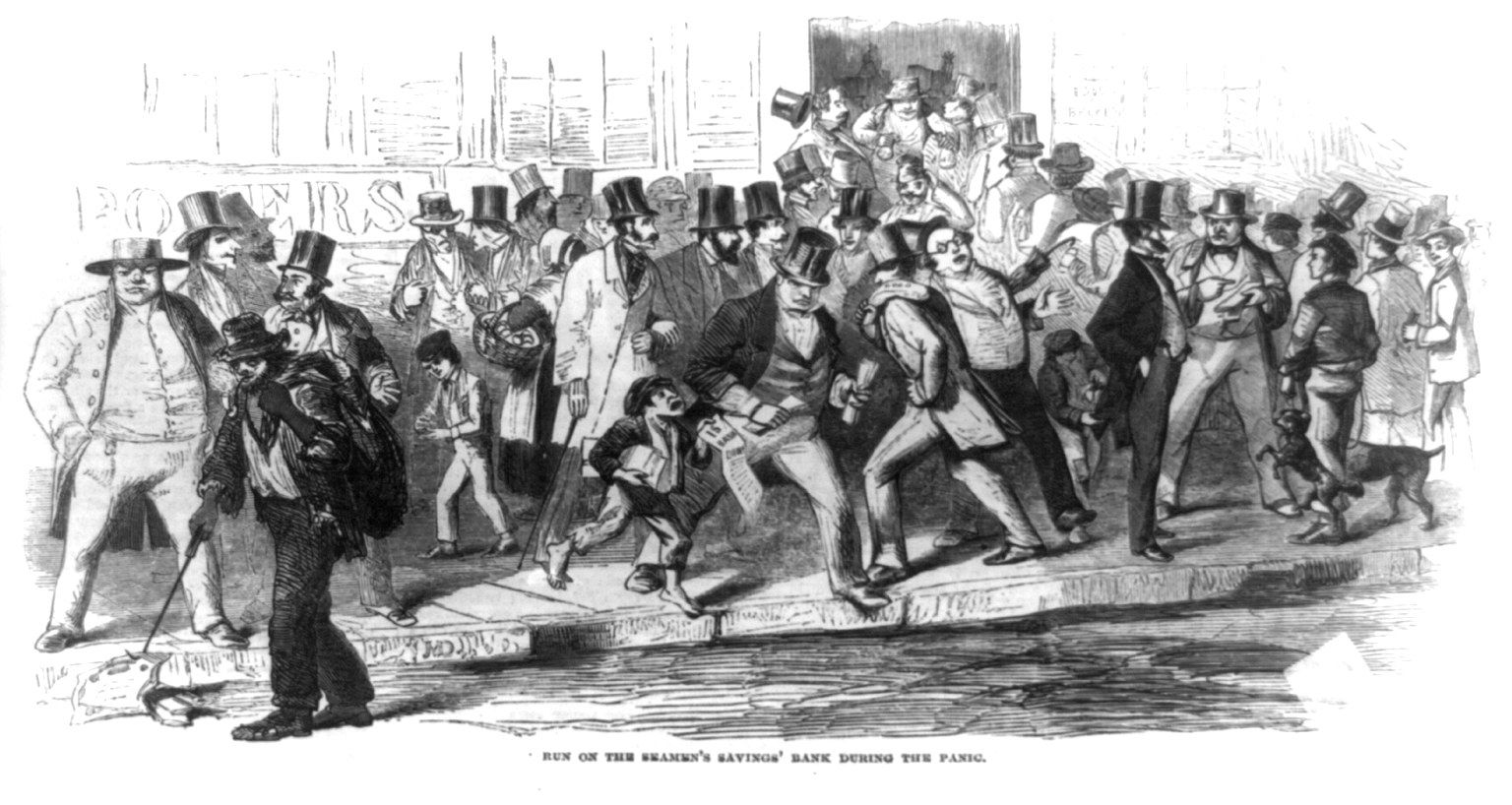

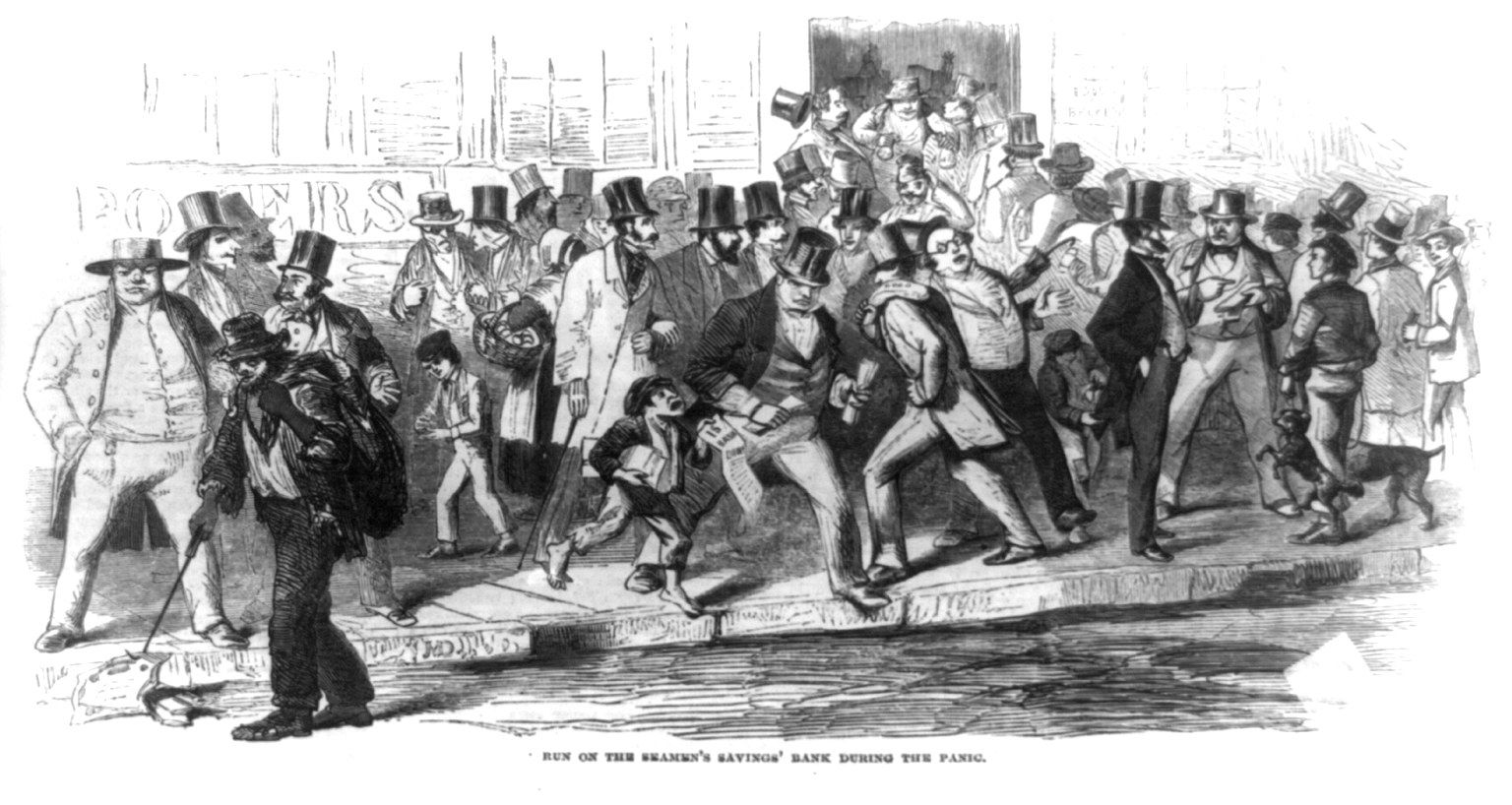

On the morning of August 24, 1857, the president of Ohio Life Insurance and Trust Company announced that its New York branch had suspended payments. The company, an Ohio-based bank with a second main office in New York City, had large mortgage holdings and was the liaison to other Ohio investment banks. Ohio Life went bankrupt because of fraudulent activities by the company's management, which threatened to precipitate the failure of other Ohio banks or, even worse, to create arun on the banks

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe Bank failure, the bank may cease to function in the near future. In other words, it is when, in a fractional-reserve banking system (w ...

. According to an article printed in the ''New York Daily Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid ...

'', Ohio Life's "New York City and Cincinnati ranches were

A ranch (from es, rancho/Mexican Spanish) is an area of land, including various structures, given primarily to ranching, the practice of raising grazing livestock such as cattle and sheep. It is a subtype of a farm. These terms are most often ...

suspended; with liabilities, it is said, of $7,000,000". Fortunately, the banks connected to Ohio Life were reimbursed and "avoided suspending convertibility by credibly coinsuring one another against runs." The failure of Ohio Life brought attention to the financial state of the railroad industry and land markets and caused the financial panic to become more public.

Lasting effects

By the spring of 1858, "commercial credit had dried up, forcing already debt-ridden merchants of the West to curtail new purchases of inventory". The limited purchasing in the West led to merchants around the country seeing decreases in sales and profits. The railroads "had created an interdependent national economy, and now an economic downturn in the West threatened.... neconomic crisis. Since many banks had financed railroads and land purchases, they began to feel the pressures of the falling value of railroad securities. TheIllinois Central

The Illinois Central Railroad , sometimes called the Main Line of Mid-America, was a railroad in the Central United States, with its primary routes connecting Chicago, Illinois, with New Orleans, Louisiana, and Mobile, Alabama. A line also co ...

; Erie; Pittsburgh, Fort Wayne and Chicago; and Reading Railroad lines were all forced to shut down by the financial downturn. The Delaware, Lackawanna and Western Railroad

The Delaware, Lackawanna and Western Railroad (also known as the DL&W or Lackawanna Railroad) was a U.S. Class 1 railroad that connected Buffalo, New York, and Hoboken, New Jersey (and by ferry with New York City), a distance of . Incorporated in ...

and the Fond du Lac Railroad were forced to declare bankruptcy. The Boston and Worcester Railroad Company also experienced heavy financial difficulties. The employees were informed in a memo written in late October 1857 that "the receipts from Passengers and Freight have fallen off during helast month (as compared with the corresponding month of last year), over twenty thousand dollars, with very little prospect of any improvement during the coming winter." The company also announced that their workers would receive a "reduction in pay of ten percent". In addition to the decreasing value of railroad securities, farmers began to default on payments on their mortgaged lands in the West, which put even more financial pressure on banks.

The prices of grain also decreased significantly, and farmers experienced a loss in revenue, causing banks to foreclose on recently-purchased lands. Grain prices in 1855 had skyrocketed to $2.19 a bushel, and farmers began to purchase land to increase their crop supply, which, in turn, would increase their profits. However, by 1858, grain prices dropped severely to $0.80 a bushel. Many Midwestern towns felt the pressures of the Panic. For example, the town of Keokuk, Iowa

Keokuk is a city in and a county seat of Lee County, Iowa, United States, along with Fort Madison. It is Iowa's southernmost city. The population was 9,900 at the time of the 2020 census. The city is named after the Sauk chief Keokuk, who is ...

, experienced financial strife from the economic downturns of the Panic:

A huge municipal debt magnified Keokuk's problems. By 1858 the town owed $900,000, mostly on railroad bonds, while the value of its taxable property dropped by $5.5 million. Lots that brought $1,000 before the crash now could not be sold for $10. Hard-hit property owners were unable to pay their taxes, and thousands of properties slipped into tax delinquency.As a result of such a decrease of prices, land sales declined dramatically and westward expansion essentially halted until the Panic ended. Both merchants and farmers began to suffer for the investment risks that they had taken when the prices were high.

Remedies

By 1859, the Panic began to level off, and the economy had begun to stabilize. PresidentJames Buchanan

James Buchanan Jr. ( ; April 23, 1791June 1, 1868) was an American lawyer, diplomat and politician who served as the 15th president of the United States from 1857 to 1861. He previously served as secretary of state from 1845 to 1849 and repr ...

announced that the paper-money system seemed to be the root cause of the Panic and then decided to withdraw the usage of all bank notes under twenty dollars. He also "advised the State banks to break away from the banks nd urgedthem to follow the example of the Federal Government

A federation (also known as a federal state) is a political entity characterized by a union of partially self-governing provinces, states, or other regions under a central federal government (federalism). In a federation, the self-governin ...

." He felt that would decrease the paper money supply to allow the specie supply time to increase and to reduce inflation rates. Buchanan wanted the state banks to follow the federal government, specifically the Independent Treasury system, which allowed the federal government to keep up with specie payments. That helped to alleviate some of the financial stress that had been brought on by the bank suspensions.

In his State of the Union

The State of the Union Address (sometimes abbreviated to SOTU) is an annual message delivered by the president of the United States to a joint session of the United States Congress near the beginning of each calendar year on the current conditio ...

message December 7, 1857, Buchanan said:

He also revealed the new strategy of "reform not relief" and expressed his feeling that "the government sympathized but could do nothing to alleviate the suffering individuals." To avoid further financial panics, Buchanan encouraged the US Congress to pass a law to provide the immediate forfeiture of a bank's charter if a bank suspended specie payments. Additionally, he asked state banks to keep one dollar in specie for every three issued as paper, and he discouraged the use of federal or state bonds as security on bank notes to avoid future inflation.

Results

The result of the Panic of 1857 was that the largely-agrarian southern economy, which had few railroads, suffered little, but the northern economy took a significant hit and made a slow recovery. The area affected the most by the Panic was the Great Lakes region, and the troubles of that region were "quickly passed to those enterprises in the East that depended upon western sales". After approximately a year, much of the economy in the North and the entire South had recovered from the Panic. By the end of the Panic, in 1859, tensions between the North and South regarding the issue of slavery in the United States were increasing. The Panic of 1857 encouraged those in the South who believed the North needed the South to keep a stabilized economy, and southern threats of secession were temporarily quelled. Southerners believed that the Panic of 1857 made the North "more amenable to southern demands" and would help to keep slavery alive in the United States. According to Kathryn Teresa Long, the religious revival of 1857–1858 led byJeremiah Lanphier

Jeremiah Calvin Lanphier (September 3, 1809 – December 26, 1898) was an American lay missionary in New York City, popularly regarded as having been instrumental in instigating the American religious revival of 1857–58.

Early life and conversio ...

began among New York City businessmen in the early months of the Panic.

See also

* Black Friday (1869)—Also referred to as the ''Gold Panic of 1869'' * Panic of 1873 *Panic of 1893

The Panic of 1893 was an economic depression in the United States that began in 1893 and ended in 1897. It deeply affected every sector of the economy, and produced political upheaval that led to the political realignment of 1896 and the pres ...

* New England Shoemakers Strike of 1860 The New England Shoemakers Strike of 1860 began on February 22, 1860 with 3,000 shoemakers walking off their jobs in Lynn, Massachusetts. It ended in April with modest gains for shoemakers, including pay increases and owner recognition of some labor ...

Notes

Bibliography

* * Glasner, David, ed. ''Business Cycles and Depressions: An Encyclopedia'' 1997. * * * *Klein, Philip Shriver. ''President James Buchanan'' (Pennsylvania State University Press, 1962). * * * Long, Kathryn Teresa. ''The Revival of 1857–58: Interpreting an American Religious Awakening'' Oxford University Press, 199online edition

* Rezneck, Samuel. ''Business Depressions and Financial Panics'' (Greenwood 1968). * Ross, Michael A. ''Justice of Shattered Dreams: Samuel Freeman Miller and the Supreme Court During the Civil War Era'' . Baton Rouge: Louisiana State University Press, 2003. * * * * * Van Vleck, George W. ''The Panic of 1857, an Analytical Study'' (New York: Columbia University Press, 1943)

Contemporary newspaper

* "Commercial Affairs" ''New York Daily Times,'' August 28, 1857"A New Tariff"

''New York Daily Times,'' February 4, 1857

External links

* * * Dickinson College"House Divided."

Accessed October 30, 2010

Visit to Dred Scott

1857, Library of Congress {{DEFAULTSORT:Panic Of 1857 Banking in the United States Economic crises in the United States Financial crises 19th-century economic history Presidency of James Buchanan 1857 in the United States 1857 in economics