Confederate Tax-in-kind on:

[Wikipedia]

[Google]

[Amazon]

Confederate war finance involved the various means, fiscal and monetary, through which the

The financing of war expenditures by the means of currency issues (printing money) was by far the major avenue resorted to by the Confederate government. Between 1862 and 1865, more than 60% of total revenue was created in this way. While the North doubled its

The financing of war expenditures by the means of currency issues (printing money) was by far the major avenue resorted to by the Confederate government. Between 1862 and 1865, more than 60% of total revenue was created in this way. While the North doubled its  Lerner used the

Lerner used the  On April 1, 1864, the Currency Reform Act of 1864 went into effect. This decreased the Southern money supply by one-third. However, because of Union control of the

On April 1, 1864, the Currency Reform Act of 1864 went into effect. This decreased the Southern money supply by one-third. However, because of Union control of the

Issued loans accounted for roughly 21% of the finance of Confederate war expenditure. Initially the South was more successful in selling debt than the North, partially because

Issued loans accounted for roughly 21% of the finance of Confederate war expenditure. Initially the South was more successful in selling debt than the North, partially because

In the beginning of the war, the majority of finance for the Southern government came via duties on international trade. The import tariff, enacted in May 1861, was set at 12.5% and it roughly matched in coverage the previously existing Federal tariff, the

In the beginning of the war, the majority of finance for the Southern government came via duties on international trade. The import tariff, enacted in May 1861, was set at 12.5% and it roughly matched in coverage the previously existing Federal tariff, the

The Confederate government also tried to raise revenue through unorthodox means. In the first half of 1861, when the support for secession and the military effort was running strong, the donation of coins and gold to the government accounted for about 35% of all sources of government funds. This source, however, dried up over time as individuals and institutions in the South both ran down their personal holdings of

The Confederate government also tried to raise revenue through unorthodox means. In the first half of 1861, when the support for secession and the military effort was running strong, the donation of coins and gold to the government accounted for about 35% of all sources of government funds. This source, however, dried up over time as individuals and institutions in the South both ran down their personal holdings of

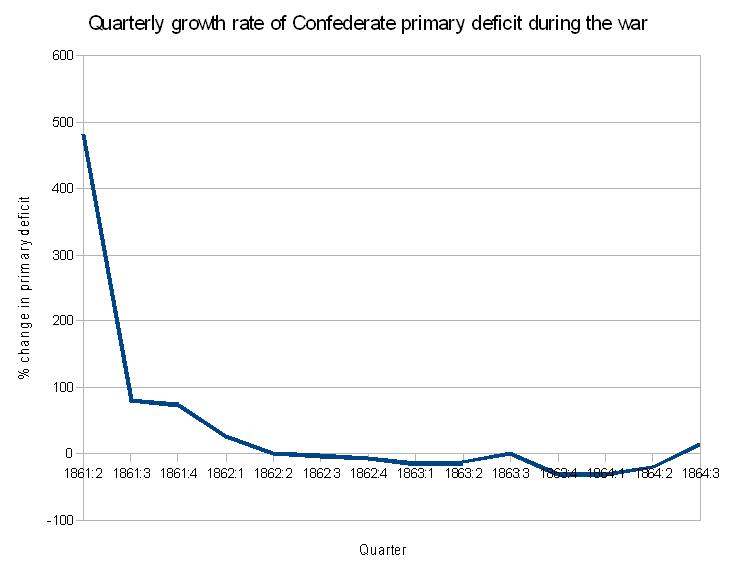

While, unsurprisingly, military spending constituted the largest part of the national government's budget over the course of the war, over time the payment of interest and principal on acquired debt grew as a share of the Confederate government's expenditure. While initially, in early 1861, war expenditure was 95% of the budget, by October 1864 that share fell to 40%, with the majority of the rest (56% overall) being accounted for by debt service. Civilian expenditures and spending on the Navy (recorded separately from general war expenditures in Confederate records) never exceeded 10% of the budget.

While, unsurprisingly, military spending constituted the largest part of the national government's budget over the course of the war, over time the payment of interest and principal on acquired debt grew as a share of the Confederate government's expenditure. While initially, in early 1861, war expenditure was 95% of the budget, by October 1864 that share fell to 40%, with the majority of the rest (56% overall) being accounted for by debt service. Civilian expenditures and spending on the Navy (recorded separately from general war expenditures in Confederate records) never exceeded 10% of the budget.

Dissertations in American economic history

', Ayer Publishing, 1978. *

The Ascent of Money: A Financial History of the World

', Penguin Group, 2008. * Judith Fenner Gentry, “A Confederate Success in Europe: The Erlanger Loan.” ''Journal of Southern History'' 36#2 (1970), pp. 157–88

online

*Eli Ginzberg, "The economics of British neutrality during the American Civil War." ''Agricultural History'' 10.4 (1936): 147-156. *Eugene Lerner, "Money, Prices and Wages in the Confederacy, 1861-1865", ''

Volume 12 of The International Library of Macroeconomic and Financial History

', Edward Elgar Publishing, 1994. *Richard Cecil Todd,

Confederate Finance

, University of Georgia Press, 2009. *Timothy D. Tregarthen, Libby Rittenberg,

Macroeconomics

', Macmillan, 1999, p. 240. *Marc Weidenmier,

Money and Finance in the Confederate States of America

, EH.Net Encyclopedia. *Marc Weidenmier,

Bogus Money Matters: Sam Upham and His Confederate Counterfeiting Business

''Business and Economic History'' 28 no. 2 (1999b): 313-324. *Russell Frank Weigley,

A Great Civil War: A Military and Political History, 1861-1865

', Indiana University Press, 2000. {{good article Economic history of the American Civil War Economic history of the Confederate States of America

Confederate States of America

The Confederate States of America (CSA), commonly referred to as the Confederate States or the Confederacy was an unrecognized breakaway republic in the Southern United States that existed from February 8, 1861, to May 9, 1865. The Confeder ...

financed its war effort during the American Civil War

The American Civil War (April 12, 1861 – May 26, 1865; also known by other names) was a civil war in the United States. It was fought between the Union ("the North") and the Confederacy ("the South"), the latter formed by states th ...

of 1861-1865. As the war lasted for nearly the entire existence of the Confederacy, military considerations dominated national finance.

Early in the war the Confederacy relied mostly on tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and poli ...

s on import

An import is the receiving country in an export from the sending country. Importation and exportation are the defining financial transactions of international trade.

In international trade, the importation and exportation of goods are limited ...

s and on tax

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or n ...

es on export

An export in international trade is a good produced in one country that is sold into another country or a service provided in one country for a national or resident of another country. The seller of such goods or the service provider is an ...

s to raise revenues. However, with the imposition of a voluntary self-embargo

Economic sanctions are commercial and financial penalties applied by one or more countries against a targeted self-governing state, group, or individual. Economic sanctions are not necessarily imposed because of economic circumstances—they m ...

in 1861 (intended to "starve" Europe of cotton

Cotton is a soft, fluffy staple fiber that grows in a boll, or protective case, around the seeds of the cotton plants of the genus ''Gossypium'' in the mallow family Malvaceae. The fiber is almost pure cellulose, and can contain minor perce ...

and force diplomatic recognition of the Confederacy), as well as the blockade of Southern ports, declared in April 1861 and enforced by the Union Navy

), (official)

, colors = Blue and gold

, colors_label = Colors

, march =

, mascot =

, equipment =

, equipment_label ...

, the revenue from taxes on international trade

International trade is the exchange of capital, goods, and services across international borders or territories because there is a need or want of goods or services. (see: World economy)

In most countries, such trade represents a significant ...

declined. Likewise, the financing obtained through early voluntary donations of coins and bullion

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes from t ...

from private individuals in support of the Confederate cause, which early on proved quite substantial, dried up by the end of 1861. As a result, the Confederate government had to resort to other means of financing its military operations. A "war-tax" was enacted but proved difficult to collect. Likewise, the appropriation of Union property in the South and the forced repudiation of debts owned by Southerners to Northerners failed to raise substantial revenue. The subsequent issuance of government debt

A country's gross government debt (also called public debt, or sovereign debt) is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit oc ...

and substantial printing of the Confederate dollars contributed to high inflation

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reductio ...

, which plagued the Confederacy until the end of the war. Military setbacks in the field also played a role by causing loss of confidence and by fueling inflationary expectations.Burdekin and Langdana, pp. 352–362

At the beginning of the war, the Confederate dollar cost 90¢ worth of gold (Union) dollars. By the war's end, its price had dropped to .017¢.Neal, p. xxiii Overall, prices in the South increased by more than 9000% during the war, averaging about 26% a month.Weidenmier The Secretary of the Treasury of the Confederate States, Christopher Memminger (in office 1861-1864), was keenly aware of the economic problems posed by inflation and loss of confidence. However, political considerations limited internal taxation ability, and as long as the voluntary embargo and the Union blockade remained in place, it was impossible to find adequate alternative sources of finance.

Tax finance

The South financed a much lower proportion of its expenditures throughdirect tax

Although the actual definitions vary between jurisdictions, in general, a direct tax or income tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. There is a dis ...

es than the North. The share of direct taxes in total revenue for the North was about 20%, while for the South the same share was only about 8%. Much of the reason that tax revenue did not play as large a role for the Confederacy was the individual states' opposition to a strong central government and the belief in states' rights

In American political discourse, states' rights are political powers held for the state governments rather than the federal government according to the United States Constitution, reflecting especially the enumerated powers of Congress and the ...

, which precluded giving too much taxing power to the government in Richmond

Richmond most often refers to:

* Richmond, Virginia, the capital of Virginia, United States

* Richmond, London, a part of London

* Richmond, North Yorkshire, a town in England

* Richmond, British Columbia, a city in Canada

* Richmond, California, ...

. Historically the states had invested little money in infrastructure or public goods. Another factor for not extending the tax system more broadly was the belief, which was present in both the North and the South, that the war would be of limited duration and so there was no compelling reason to increase the tax burden

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The t ...

.Godfrey, p. 14

However, the realities of the prolonged war, the necessity of paying interest on existing debt, and the drop in revenues from other sources, forced both the central Confederate government and the individual states to agree by the middle of 1861 to an imposition of a "War Tax." Passed on August 15, 1861, the law covered property of more than $500 (Confederate) in value and several luxury items. The tax was also levied on ownership of slaves

Slavery and enslavement are both the state and the condition of being a slave—someone forbidden to quit one's service for an enslaver, and who is treated by the enslaver as property. Slavery typically involves slaves being made to perf ...

. However, the tax proved very difficult to collect. In 1862, only 5% of total revenue came from direct taxes, and it was not until 1864 that the amount reached the still-low level of 10%.

Taking account of difficulty of collection, the Confederate Congress passed a tax in kind Tax in kind or tax-in-kind usually refers to any taxation that is paid in kind, that is with goods or services rather than money, including:

* ''fisc

Under the Merovingians and Carolingians, the fisc (from Latin ''fiscus,'' whence we derive " ...

in April 1863, which was set at one tenth of all agricultural product by state. The tax was directly tied to the provisioning of the Confederate Army

The Confederate States Army, also called the Confederate Army or the Southern Army, was the military land force of the Confederate States of America (commonly referred to as the Confederacy) during the American Civil War (1861–1865), fighting ...

, and although it also ran into some collection problems, it was mostly successful. After its implementation, it accounted for about half of total revenue if it was converted into currency equivalent.

Monetary finance and inflation

money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

during the war, the money supply in the South increased twenty times over.

The extensive reliance on the money-printing press to finance the war contributed significantly to the high inflation the South experienced over the course of the war, although fiscal matters and negative war news also played a role. Estimates of the extent of inflation vary by source, method used, estimation technique, and definition of the aggregate price level. According to a classic study by Eugene Lerner in 1956, a standard price index of commodities rose from 100 at the beginning of the war to more than 9200 by the war's ''de facto'' end in April 1865.Tregarthen, Rittenberg, p. 240 By October 1864, the price index was at 2800, which implies that a very large portion of the rise in prices occurred in the last six months of the war. This drop in the demand for money, the corresponding increase in "velocity of money" (see next paragraph) and the resulting rapid increase in the price level has been attributed to the loss of confidence in Southern military victory or the success of the South's bid for independence.

quantity theory of money

In monetary economics, the quantity theory of money (often abbreviated QTM) is one of the directions of Western economic thought that emerged in the 16th-17th centuries. The QTM states that the general price level of goods and services is directly ...

to decompose the inflation in the Confederacy during the war into that resulting from increases in money supply, changes in the velocity of money

image:M3 Velocity in the US.png, 300px, Similar chart showing the logged velocity (green) of a broader measure of money M3 that covers M2 plus large institutional deposits. The US no longer publishes official M3 measures, so the chart only runs thr ...

, and the change in real output of the Southern economy. According to the equation of exchange In monetary economics, the equation of exchange is the relation:

:M\cdot V = P\cdot Q

where, for a given period,

:M\, is the total money supply in circulation on average in an economy.

:V\, is the velocity of money, that is the average frequency w ...

:

where M is the money supply, V is the velocity of money (related to people's demand for money

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1 (directly spendable ...

), P is the price level and Y is real output. If it is assumed that real incomes remained constant in the South during the war (Lerner actually concluded that they fell by about 40%) then the equation implies that for the price level to increase 92 times in the presence of a 20 times increase in money supply, the velocity of money must have increased 4.6 times over (92/20=4.6), reflecting a very significant drop in the demand for money.Lerner, ''Journal of Political Economy''

The problems of money-caused inflation were exacerbated by the influx of counterfeit bills from the North. These were plentiful because Southern "Greybacks" were fairly crude and easy to copy, as the Confederacy lacked modern printing equipment. One of the most prolific and most famous of the Northern counterfeiters was Samuel C. Upham

Samuel Curtis Upham (February 2, 1819 – June 29, 1885) was an American journalist, lyricist, merchant, bookkeeper, clerk, navy officer, prospector, and counterfeiter, during the later part of the 19th century, sometimes, known as "Honest S ...

from Philadelphia

Philadelphia, often called Philly, is the largest city in the Commonwealth of Pennsylvania, the sixth-largest city in the U.S., the second-largest city in both the Northeast megalopolis and Mid-Atlantic regions after New York City. Sinc ...

. By one calculation Upham's notes made up between 1 and 2.5 percent of all of the Confederate money supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (curren ...

between June 1862 and August 1863. Jefferson Davis

Jefferson F. Davis (June 3, 1808December 6, 1889) was an American politician who served as the president of the Confederate States from 1861 to 1865. He represented Mississippi in the United States Senate and the House of Representatives as a ...

placed a $10,000 bounty on Upham, though the "Yankee Scoundrel", as he was known in the South, evaded capture by Southern agents. Counterfeiting was a problem for the North as well, and the United States Secret Service

The United States Secret Service (USSS or Secret Service) is a federal law enforcement agency under the Department of Homeland Security charged with conducting criminal investigations and protecting U.S. political leaders, their families, and ...

was formed to deal with this problem.

On April 1, 1864, the Currency Reform Act of 1864 went into effect. This decreased the Southern money supply by one-third. However, because of Union control of the

On April 1, 1864, the Currency Reform Act of 1864 went into effect. This decreased the Southern money supply by one-third. However, because of Union control of the Mississippi River

The Mississippi River is the second-longest river and chief river of the second-largest drainage system in North America, second only to the Hudson Bay drainage system. From its traditional source of Lake Itasca in northern Minnesota, it f ...

, until January 1865 the law was effective only east of the Mississippi.

A fairly peculiar economic phenomenon occurred during the war in that the Confederate government issued both regular money notes and interest-bearing money. The United States also issued Interest Bearing Notes during the war that were legal tender for most financial transactions. The circulation of the interest-bearing money and the convertibility of one kind of money into the other was enforced by fiat

Fiat Automobiles S.p.A. (, , ; originally FIAT, it, Fabbrica Italiana Automobili di Torino, lit=Italian Automobiles Factory of Turin) is an Italian automobile manufacturer, formerly part of Fiat Chrysler Automobiles, and since 2021 a subsidiary ...

and Southern banks were threatened with a return to the gold standard if they did not cooperate. Because of the amount of Southern debt held by foreigners, to ease currency convertibility, in 1863 the Confederate Congress

The Confederate States Congress was both the Provisional government, provisional and permanent Legislature, legislative assembly of the Confederate States of America that existed from 1861 to 1865. Its actions were for the most part concerned w ...

decided to adopt the gold standard

A gold standard is a monetary system in which the standard economic unit of account is based on a fixed quantity of gold. The gold standard was the basis for the international monetary system from the 1870s to the early 1920s, and from the la ...

. But convertibility was not implemented until 1879 (the 1863 law was never implemented, as it was superseded by the Coinage Act of 1873

The Coinage Act of 1873 or Mint Act of 1873, was a general revision of laws relating to the Mint of the United States. By ending the right of holders of silver bullion to have it coined into standard silver dollars, while allowing holders of go ...

and the end of the Confederacy).

Debt finance

New Orleans

New Orleans ( , ,New Orleans

Merriam-Webster. ; french: La Nouvelle-Orléans , es, Nuev ...

was a major financial center. Its financiers bought up two-fifths of a 15 million dollar loan in early 1861.Weigley, p. 69

The two main types of loans issued by the South during the war were "Cotton Bonds", denominated in pounds sterling and sold in Merriam-Webster. ; french: La Nouvelle-Orléans , es, Nuev ...

London

London is the capital and largest city of England and the United Kingdom, with a population of just under 9 million. It stands on the River Thames in south-east England at the head of a estuary down to the North Sea, and has been a majo ...

, and high risk unbacked loans sold in the Netherlands

)

, anthem = ( en, "William of Nassau")

, image_map =

, map_caption =

, subdivision_type = Sovereign state

, subdivision_name = Kingdom of the Netherlands

, established_title = Before independence

, established_date = Spanish Netherl ...

. The Cotton Bonds were convertible directly into bales of cotton, with a caveat, included as a means of political pressure on European countries to recognize the Confederacy, that any such shipments needed to be picked up by the bondholder in one of the blockaded Southern ports (mostly New Orleans).

Cotton Bonds initially were very popular and in high demand among the British; William Ewart Gladstone

William Ewart Gladstone ( ; 29 December 1809 – 19 May 1898) was a British statesman and Liberal politician. In a career lasting over 60 years, he served for 12 years as Prime Minister of the United Kingdom, spread over four non-conse ...

, who at the time was the Chancellor of the Exchequer

The chancellor of the Exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and head of His Majesty's Treasury. As one of the four Great Offices of State, the Chancellor is ...

, was supposedly one of the buyers--his family fortune came from slavery in the West Indies. The Confederate government managed to honor the Cotton Bonds throughout the war, and in fact their price rose steeply until the fall of Atlanta to Sherman

Sherman most commonly refers to:

*Sherman (name), a surname and given name (and list of persons with the name)

** William Tecumseh Sherman (1820–1891), American Civil War General

*M4 Sherman, a tank

Sherman may also refer to:

Places United St ...

. This rise reflected both the increase in the underlying cotton prices and perhaps the possibility that George B. McClellan

George Brinton McClellan (December 3, 1826 – October 29, 1885) was an American soldier, Civil War Union general, civil engineer, railroad executive, and politician who served as the 24th governor of New Jersey. A graduate of West Point, McCl ...

might get elected as US President

The president of the United States (POTUS) is the head of state and head of government of the United States of America. The president directs the executive branch of the federal government and is the commander-in-chief of the United Stat ...

on a peace platform. In contrast, the price of the Dutch-issued high risk loans fell throughout the war, and the South selectively defaulted on servicing these obligations.

In France vigorous fund raising yielded £3 million (about $14.5 in US dollars) from the 1862 bond sale to the Erlanger bank in Paris. It was not repeated.

The main Confederacy failure was its banking on European financial support and military intervention but it proved a fallacy that " Cotton is King". Britain needed Northern grain more urgently than Southern cotton, for it had large stocks of cotton when the war began.Eli Ginzberg, "The economics of British neutrality during the American Civil War." ''Agricultural History'' 10.4 (1936): 147-156.

Revenue from international trade

In the beginning of the war, the majority of finance for the Southern government came via duties on international trade. The import tariff, enacted in May 1861, was set at 12.5% and it roughly matched in coverage the previously existing Federal tariff, the

In the beginning of the war, the majority of finance for the Southern government came via duties on international trade. The import tariff, enacted in May 1861, was set at 12.5% and it roughly matched in coverage the previously existing Federal tariff, the Tariff of 1857

The Tariff of 1857 was a major tax reduction in the United States that amended the Walker Tariff of 1846 by lowering rates to between 15% and 24%.

The Tariff of 1857 was developed in response to a federal budget surplus in the mid-1850s. The firs ...

.Todd, p. 123 Between February 17 and May 1 of 1861, 65% of all government revenue was raised from the import tariff. However, revenue from the tariffs all but disappeared after the Union imposed its blockade of Southern coasts. By November 1861 the proportion of government revenue coming from custom duties had dropped to one-half of one percent. Secretary of Treasure Memminger had expected that the tariff would bring in about 25 million dollars in revenue in the first year alone. But the total revenue raised in this way during the entire war was only about $3.4 million.

A similar source of funds was to be the tax on exports of cotton. However, in addition to the difficulties associated with the blockade, the self-imposed embargo on cotton meant that for all practical purposes the tax was completely ineffective as a fund raiser. Initial optimistic estimates of revenue to be collected through this tax ran as high as 20 million dollars, but in the end only $30,000 was collected.

Other sources of revenue

The Confederate government also tried to raise revenue through unorthodox means. In the first half of 1861, when the support for secession and the military effort was running strong, the donation of coins and gold to the government accounted for about 35% of all sources of government funds. This source, however, dried up over time as individuals and institutions in the South both ran down their personal holdings of

The Confederate government also tried to raise revenue through unorthodox means. In the first half of 1861, when the support for secession and the military effort was running strong, the donation of coins and gold to the government accounted for about 35% of all sources of government funds. This source, however, dried up over time as individuals and institutions in the South both ran down their personal holdings of bullion

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes from t ...

and became less willing to make donations as war-weariness

War-weariness is the public or political disapproval for the continuation of a prolonged conflict or war. The causes normally involve the intensity of casualties—financial, civilian, and military. It also occurs when a belligerent has the abil ...

set in. As a consequence, by the summer of 1862, the share of government revenue coming from these donations fell to less than 1%. Over the course of the entire war, this source of revenue contributed only 0.2% of total wartime expenditure.

Another potential source of finance could be found in the property and physical capital

Physical capital represents in economics one of the three primary factors of production. Physical capital is the apparatus used to produce a good and services. Physical capital represents the tangible man-made goods that help and support the produc ...

owned by Northerners in the South, and the debts owed by individuals in a parallel manner. The Sequestration Act of 1861 provided for confiscation of all Union "lands, tenements, goods and chattels, right and credits" and the transfer of debt obligation on the part of Confederate citizens from Northern creditors directly to the Confederate government. However, many Southerners proved unwilling to transfer their debt obligations. Furthermore, what exactly constituted "Northern property" proved hard to define in practice. As a result, the share of this source of revenue in government funding never exceeded 0.34% and ultimately contributed only 0.25% to the overall financial war effort.

Expenditures

See also

*Economic history of the United States Civil War The economic history of the American Civil War concerns the financing of the Union (American Civil War), Union and Confederate States of America, Confederate war efforts from 1861 to 1865, and the economic impact of the war.

The Union economy grew ...

*Economy of the Confederate States of America

The Confederate States of America (1861–1865) started with an agrarian-based economy that relied heavily on slave-worked plantations for the production of cotton for export to Europe and to the northern US. If classed as an independent countr ...

Notes

References

*Richard Burdekin and Farrokh Langdana, "War Finance in the Southern Confederacy, 1861-1865", ''Explorations in Economic History'', Vol 30, No 3, July 1993. *John Munro Godfrey, "Monetary expansion in the Confederacy",Dissertations in American economic history

', Ayer Publishing, 1978. *

Niall Ferguson

Niall Campbell Ferguson FRSE (; born 18 April 1964)Biography

Niall Ferguson

, Niall Ferguson

The Ascent of Money: A Financial History of the World

', Penguin Group, 2008. * Judith Fenner Gentry, “A Confederate Success in Europe: The Erlanger Loan.” ''Journal of Southern History'' 36#2 (1970), pp. 157–88

online

*Eli Ginzberg, "The economics of British neutrality during the American Civil War." ''Agricultural History'' 10.4 (1936): 147-156. *Eugene Lerner, "Money, Prices and Wages in the Confederacy, 1861-1865", ''

Journal of Political Economy

The ''Journal of Political Economy'' is a monthly peer-reviewed academic journal published by the University of Chicago Press. Established by James Laurence Laughlin in 1892, it covers both theoretical and empirical economics. In the past, the ...

'', 63, 1955.

* Larry Neal, ''War Finance, Volume 1'', Volume 12 of The International Library of Macroeconomic and Financial History

', Edward Elgar Publishing, 1994. *Richard Cecil Todd,

Confederate Finance

, University of Georgia Press, 2009. *Timothy D. Tregarthen, Libby Rittenberg,

Macroeconomics

', Macmillan, 1999, p. 240. *Marc Weidenmier,

Money and Finance in the Confederate States of America

, EH.Net Encyclopedia. *Marc Weidenmier,

Bogus Money Matters: Sam Upham and His Confederate Counterfeiting Business

''Business and Economic History'' 28 no. 2 (1999b): 313-324. *Russell Frank Weigley,

A Great Civil War: A Military and Political History, 1861-1865

', Indiana University Press, 2000. {{good article Economic history of the American Civil War Economic history of the Confederate States of America