Buffett Indicator on:

[Wikipedia]

[Google]

[Amazon]

The Buffett indicator (or the Buffett metric, or the Market capitalization-to-GDP ratio) is a valuation multiple used to assess how expensive or cheap the aggregate stock market is at a given point in time. It was proposed as a metric by investor

The Buffett indicator (or the Buffett metric, or the Market capitalization-to-GDP ratio) is a valuation multiple used to assess how expensive or cheap the aggregate stock market is at a given point in time. It was proposed as a metric by investor

Market Cap to GDP: An Updated Look at the Buffett Valuation Indicator

(''AdvisorPerspectives'', February 2021)

The Buffett Indicator

(''CurrentMarketValuation'', February 2021)

Stock Market Capitalization-to-GDP Ratio

(Investopedia, January 2021)

Market Cap to GDP Ratio (the Buffett Indicator)

(

Buffett Indicator: Where Are We with Market Valuations?

(''GuruFocus'', 2021)

Market Cap to GDP: The Buffett Indicator

(''LongTermTrends'', 2021) {{Financial ratios Financial ratios Valuation (finance) 2000 neologisms 2000s economic history Economic indicators

The Buffett indicator (or the Buffett metric, or the Market capitalization-to-GDP ratio) is a valuation multiple used to assess how expensive or cheap the aggregate stock market is at a given point in time. It was proposed as a metric by investor

The Buffett indicator (or the Buffett metric, or the Market capitalization-to-GDP ratio) is a valuation multiple used to assess how expensive or cheap the aggregate stock market is at a given point in time. It was proposed as a metric by investor Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the most successful investors in the world and has a net ...

in 2001, who called it "probably the best single measure of where valuations stand at any given moment", and its modern form compares the capitalization

Capitalization (American English) or capitalisation (British English) is writing a word with its first letter as a capital letter (uppercase letter) and the remaining letters in lower case, in writing systems with a case distinction. The term ...

of the US Wilshire 5000

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all American-stocks actively traded in the United States. As of March 31, 2022, the index contained 3,660 c ...

index to US GDP

Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is ofte ...

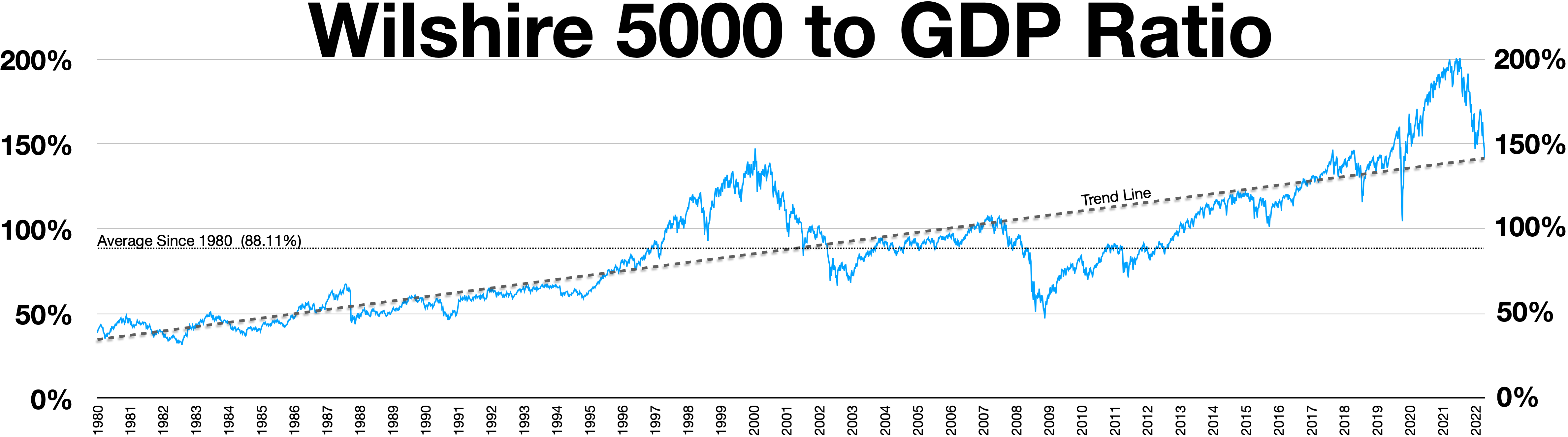

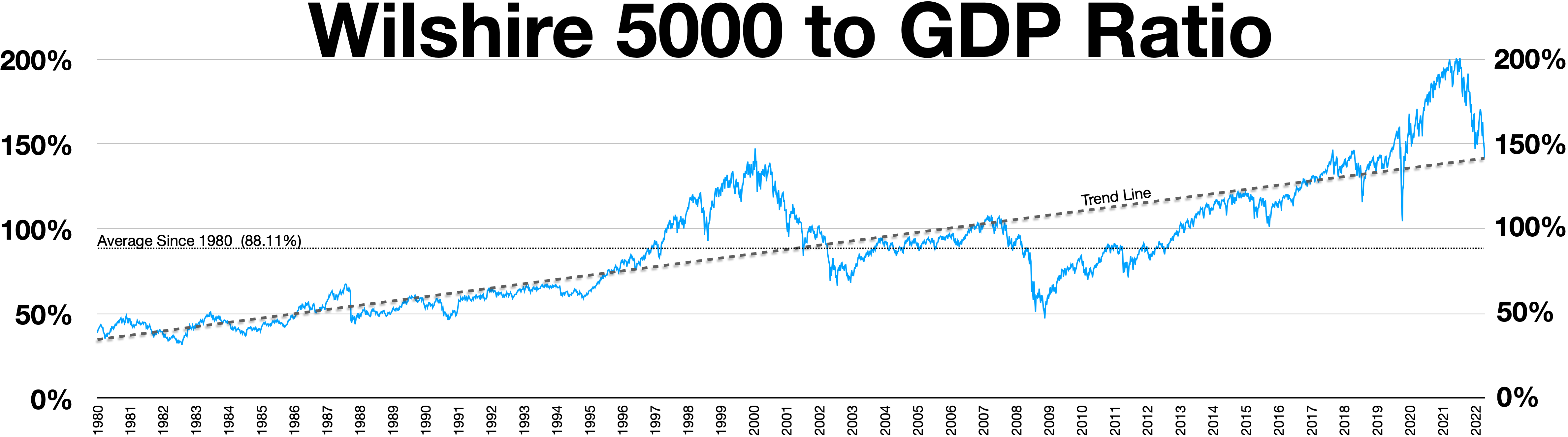

. It is widely followed by the financial media as a valuation measure for the US market in both its absolute, and de-trended forms.

The indicator set an all-time high during the so-called "everything bubble

The expression "everything bubble" refers to the correlated impact of monetary easing by the Federal Reserve (and followed by the European Central Bank and the Bank of Japan) on asset prices in most asset classes, namely equities, housing, bon ...

", crossing the 200% level in February 2021; a level that Buffett warned if crossed, was "playing with fire".

History

On 10 December 2001, Buffett proposed the metric in a ''Fortune

Fortune may refer to:

General

* Fortuna or Fortune, the Roman goddess of luck

* Luck

* Wealth

* Fortune, a prediction made in fortune-telling

* Fortune, in a fortune cookie

Arts and entertainment Film and television

* ''The Fortune'' (1931 film) ...

'' essay co-authored with journalist Carol Loomis. In the essay, Buffett presented a chart going back 80 years that showed the value of all "publicly traded securities" in the US as a percentage of "US GNP". Buffett said of the metric: "Still, it is probably the best single measure of where valuations stand at any given moment. And as you can see, nearly two years ago the ratio rose to an unprecedented level. That should have been a very strong warning signal".

Buffett explained that for the annual return of US securities to materially exceed the annual growth of US GNP for a protracted period of time: "you need to have the line go straight off the top of the chart. That won't happen". Buffett finished the essay by outlining the levels he believed the metric showed favorable or poor times to invest: "For me, the message of that chart is this: If the percentage relationship falls to the 70% or 80% area, buying stocks is likely to work very well for you. If the ratio approaches 200%–as it did in 1999 and a part of 2000–you are playing with fire".

Buffett's metric became known as the "Buffett Indicator", and has continued to receive widespread attention in the financial media, and in modern finance textbooks.

In 2018, finance author Mark Hulbert writing in the ''Wall Street Journal

''The Wall Street Journal'' is an American business-focused, international daily newspaper based in New York City, with international editions also available in Chinese and Japanese. The ''Journal'', along with its Asian editions, is published ...

'', listed the Buffett indicator as one of his "Eight Best Predictors of the Long-Term Market".

A study by two European academics published in May, 2022 found the Buffett Indicator "explains a large fraction of ten-year return variation for the majority of countries outside the United States". The study examined 10-year periods in fourteen developed markets, in most cases with data starting in 1973. The Buffett Indicator forecasted an average of 83% of returns across all nations and periods, though the predictive value ranged from a low of 42% to as high as 93% depending on the specific nation. Accuracy was lower in nations with smaller stock markets.

Theory

Buffett acknowledged that his metric was a simple one and thus had "limitations", however the underlying theoretical basis for the indicator, particularly in the US, is considered reasonable. For example, studies have shown a consistent and strong annual correlation between US GDP growth, and US corporate profit growth, and which has increased materially post theGreat Recession

The Great Recession was a period of marked general decline, i.e. a recession, observed in national economies globally that occurred from late 2007 into 2009. The scale and timing of the recession varied from country to country (see map). At ...

of 2007–2009. GDP captures effects where a given industry's margins increase materially for a period, but the effect of reduced wages and costs, dampening margins in other industries.

The same studies show a poor annual correlation between US GDP growth and US equity returns, underlining Buffett's belief that when equity prices get ahead of corporate profits (via the GNP/GDP proxy), poor returns will follow. The indicator has also been advocated for its ability to reduce the effects of "aggressive accounting" or "adjusted profits", that distort the value of corporate profits in the price-earnings ratio or EV/EBITDA ratio metrics; and that it is not affected by share buybacks (which don't affect aggregate corporate profits).

The Buffett indicator has been calculated for most international stock markets, however, caveats apply as other markets can have less stable compositions of listed corporations (e.g. the Saudi Arabia metric was materially impacted by the 2018 listing of Aramco

Saudi Aramco ( ar, أرامكو السعودية '), officially the Saudi Arabian Oil Company (formerly Arabian-American Oil Company) or simply Aramco, is a Saudi Arabian public petroleum and natural gas company based in Dhahran. , it is one of ...

), or a significantly higher/lower composition of private vs public firms (e.g. Germany vs. Switzerland), and therefore comparisons ''across'' international markets using the indicator as a ''comparative'' measure of valuation are not appropriate.

The Buffett indicator has also been calculated for industries (but also noting that it is not relevant for ''cross industry'' valuation comparison).

Trending

There is evidence that the Buffett indicator has trended upwards over time, particularly post 1995, and the lows registered in 2009 would have registered as average readings from the 1950–1995 era. Reasons proposed include that GDP might not capture all the overseas profits of US multinationals (e.g. use oftax havens

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, o ...

or tax structures by large US technology and life sciences multinationals), or that the profitability of US companies has structurally increased (e.g. due to increased concentration of technology companies), thus justifying a higher ratio; although that may also revert over time. Other commentators have highlighted that the omission by metric of corporate debt, could also be having an effect.

Formula

Buffett's original chart used US GNP as the divisor, which captures the domestic and international activity of all US resident entities even if based abroad, however, many modern Buffett metrics use US GDP as the metric. US GDP has historically been within 1 percent of US GNP, and is more readily available (other international markets have greater variation between GNP and GDP). Buffett's original chart used theFederal Reserve Economic Data

Federal Reserve Economic Data (FRED) is a database maintained by the Research division of the Federal Reserve Bank of St. Louis that has more than 816,000 economic time series from various sources. They cover banking, business/fiscal, consumer pri ...

(FRED) database from the Federal Reserve Bank of St. Louis

The Federal Reserve Bank of St. Louis is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the United States' central bank. Missouri is the only state to have two main Federal Reserve Banks (Ka ...

for "corporate equities", as it went back for over 80 years; however, many modern Buffett metrics simply use the main S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of ...

index, or the broader Wilshire 5000

The Wilshire 5000 Total Market Index, or more simply the Wilshire 5000, is a market-capitalization-weighted index of the market value of all American-stocks actively traded in the United States. As of March 31, 2022, the index contained 3,660 c ...

index instead.

A common modern formula for the US market, which is expressed as a percentage, is:

:

(E.g. if US GDP is USD 20 trillion and the market capitalization of the Wilshire 5000 is USD 40 trillion, then the Buffett indicator for the US is 200%; i.e. the US stock market is twice as big as the US economy)

The choice of how GDP is calculated (e.g. deflator), can materially affect the ''absolute value'' of the ratio; for example, the Buffett indicator calculated by the Federal Reserve Bank of St. Louis

The Federal Reserve Bank of St. Louis is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the United States' central bank. Missouri is the only state to have two main Federal Reserve Banks (Ka ...

peaks at 118% in Q1 2000, while the version calculated by Wilshire Associates

Wilshire Associates, Inc. is an American independent investment management firm that offers consulting services and analytical products and manages fund of funds investment vehicles for a global client base. Wilshire manages capital for more tha ...

peaks at 137% in Q1 2000, while the versions following Buffett's original technique, peak at very close to 160% in Q1 2000.

Records

Using Buffett's original calculation basis in his 2001 article, but with GDP, the metric has had the following lows and highs from 1950 to February 2021: * A low of 33.0% in 1953, a low of 32.2% in 1982, and a low of c. 79% in 2002, and a low of 66.7% in 2009 * A high of 87.1% in 1968, a high of 159.2% in 2000, a high of c. 118% in 2007, and a high of 189.6% in (Feb) 2021. Using the more common modern Buffett indicator with the Wilshire 5000 and US GDP, the metric has had the following lows and highs from 1970 to February 2021: * A low of 34.6% in 1982, a low of 72.9% in 2002, and a low of 56.8% in 2009 * A high of 81.1% in 1972, a high of 136.9% in 2000, a high of 105.2% in 2007, and a high of 172.1% in (Feb) 2021. De-trended data of Buffett's original calculation basis (see above) has had the following lows and highs from 1950 to February 2021 (expressed a % deviation from mean): * A low of -28% in 1953, a low of -51% in 1982, and a low of -5% in 2002, and a low of -27% in 2009 * A high of +58% in 1968, a high of +96% in 2000, a high of c. +30% in 2007, and a high of +80% in (Feb) 2021.See also

*Economy monetization

The Economy monetization is a metric of the national economy, reflecting its saturation with liquid assets. The level of monetization is determined both by the development of the national financial system and by the whole economy. The monetizati ...

* EV/EBITDA

* Everything bubble

The expression "everything bubble" refers to the correlated impact of monetary easing by the Federal Reserve (and followed by the European Central Bank and the Bank of Japan) on asset prices in most asset classes, namely equities, housing, bon ...

Notes

References

Further reading

Market Cap to GDP: An Updated Look at the Buffett Valuation Indicator

(''AdvisorPerspectives'', February 2021)

The Buffett Indicator

(''CurrentMarketValuation'', February 2021)

External links

Stock Market Capitalization-to-GDP Ratio

(Investopedia, January 2021)

Market Cap to GDP Ratio (the Buffett Indicator)

(

Corporate Finance Institute

Corporate Finance Institute (CFI) is an online training and education platform for finance and investment professionals, providing courses and certifications in financial modeling, valuation, and other corporate finance topics. These are the s ...

, 2021)Buffett Indicator: Where Are We with Market Valuations?

(''GuruFocus'', 2021)

Market Cap to GDP: The Buffett Indicator

(''LongTermTrends'', 2021) {{Financial ratios Financial ratios Valuation (finance) 2000 neologisms 2000s economic history Economic indicators