Budapest Stock Exchange on:

[Wikipedia]

[Google]

[Amazon]

Budapest Stock Exchange (BSE) ( hu, Budapesti Értéktőzsde (BÉT)) is the 2nd largest stock exchange in

List of Exchange Members

'

The Hungarian Stock Exchange, the ancestor of today's Budapest Stock Exchange (BSE) started its operation on 18 January 1864 in Pest on the banks of the

The Hungarian Stock Exchange, the ancestor of today's Budapest Stock Exchange (BSE) started its operation on 18 January 1864 in Pest on the banks of the

Central and Eastern Europe

Central and Eastern Europe is a term encompassing the countries in the Baltics, Central Europe, Eastern Europe and Southeast Europe (mostly the Balkans), usually meaning former communist states from the Eastern Bloc and Warsaw Pact in Europ ...

by market capitalization

Market capitalization, sometimes referred to as market cap, is the total value of a publicly traded company's outstanding common shares owned by stockholders.

Market capitalization is equal to the market price per common share multiplied by ...

and liquidity

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include:

* Market liquidity, the ease with which an asset can be sold

* Accounting liquidity, the ability to meet cash obligations when due

* Liq ...

. It is located at 55 Krisztina Boulevard, Budapest

Budapest (, ; ) is the capital and most populous city of Hungary. It is the ninth-largest city in the European Union by population within city limits and the second-largest city on the Danube river; the city has an estimated population o ...

, Hungary

Hungary ( hu, Magyarország ) is a landlocked country in Central Europe. Spanning of the Carpathian Basin, it is bordered by Slovakia to the north, Ukraine to the northeast, Romania to the east and southeast, Serbia to the south, Cr ...

, in the Buda Centre of the Hungarian National Bank

The Hungarian National Bank ( hu, Magyar Nemzeti Bank (MNB)) is the central bank of Hungary and as such part of the European System of Central Banks (ESCB). The Hungarian National Bank was established in 1924 and succeeded the Royal Hungarian St ...

Previously, from 1864, during the Austro-Hungarian Empire

Austria-Hungary, often referred to as the Austro-Hungarian Empire,, the Dual Monarchy, or Austria, was a constitutional monarchy and great power in Central Europe between 1867 and 1918. It was formed with the Austro-Hungarian Compromise of ...

it was located in the Budapest Stock Exchange Palace building, until a large trading floor was necessary. The exchange is controlled by listed issuers, by Hungarian private investors and by the central bank

A central bank, reserve bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union,

and oversees their commercial banking system. In contrast to a commercial bank, a centra ...

. The BSE is member of the World Federation of Exchanges

The World Federation of Exchanges (WFE), formerly the ''Federation Internationale des Bourses de Valeurs'' (FIBV), or International Federation of Stock Exchanges, is the trade association of publicly regulated stock, futures, and options exchang ...

and the Federation of European Securities Exchanges.

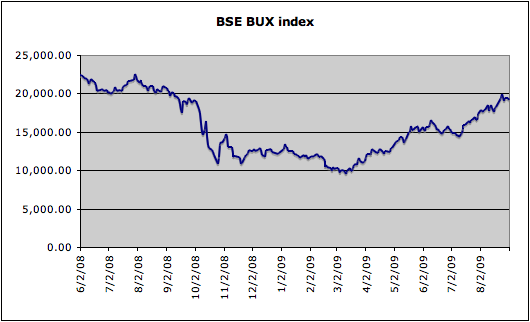

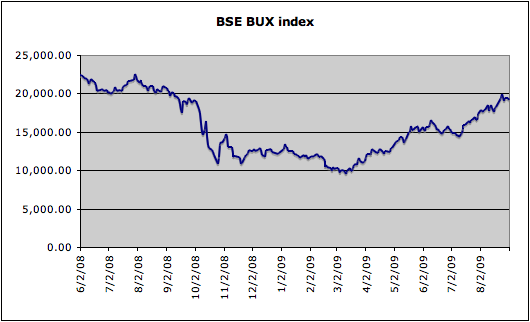

Since its reinstatement in 1990, the Budapest Stock Exchange accounts for all the turnover in the Hungarian market and a large share of the Central and Eastern European market. In 2007, BSE agreed to move to abolish floor trading, the trading today takes place via the Xetra system, with redundant floor brokers taking on the role of market-makers. Xetra is the reference market for all exchange trading in Hungarian equities and exchange traded funds. The prices on Xetra serve as the basis for calculating the BUX, the best-known Hungarian share index

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance.

Two of the pri ...

. Xetra has 60 per cent market share throughout Europe

Europe is a large peninsula conventionally considered a continent in its own right because of its great physical size and the weight of its history and traditions. Europe is also considered a Continent#Subcontinents, subcontinent of Eurasia ...

with over 230 trading participants from 18 European countries, plus Hong Kong

Hong Kong ( (US) or (UK); , ), officially the Hong Kong Special Administrative Region of the People's Republic of China (abbr. Hong Kong SAR or HKSAR), is a List of cities in China, city and Special administrative regions of China, special ...

and the United Arab Emirates

The United Arab Emirates (UAE; ar, اَلْإِمَارَات الْعَرَبِيَة الْمُتَحِدَة ), or simply the Emirates ( ar, الِْإمَارَات ), is a country in Western Asia (Middle East, The Middle East). It is ...

are connected via Xetra. Xetra trading at Budapest runs from 09:00 to 17:00 with closing auction from 17:00-17:05, and post-trading trading times until 17:20. BSE was introduced a pre market trading from 08:15 to 08:30 and an opening auction call from 08:30 to 09:00.

Organisation

The Exchange's organisation, internal trading supervision, implementation of the Board's decisions, publication of information on the exchange and the Exchange's overall business administration are duties of thechief executive officer

A chief executive officer (CEO), also known as a central executive officer (CEO), chief administrator officer (CAO) or just chief executive (CE), is one of a number of corporate executives charged with the management of an organization especiall ...

. The Exchange shall comply with the principles established by the Capital Market Act and shall ensure that investment service providers trading on the Exchange, issuers and investors should have the power to issue their opinion while equally participating in the decision-making process affecting the Exchange. In order to ensure this, the Exchange operates committees for the representation of interests. Committee members are elected by traders and issuers, and their mandates expire at the same time as the mandates of the Board of the Exchange.

The ''Trading Committee'' formulates the professional view of the vendors, represents vendors’ interests in professional issues and ensures the institutional possibility of professional control of decisions. The ''Committee of Issuers'' formulates the professional view of the issuers, represents issuers’ interests in professional issues and ensures the institutional possibility of professional control of decisions. The ''representative promoting investors’ interests'' is authorized to issue an opinion on all proposals concerning the interests of investors. The representative is elected by the organisations and associations representing investors’ interests. The ''Settlement Committee'' participates in the preparation of decisions regarding the Exchange's settlement system and ensures effective professional oversight. Its members and Chairman are elected by the BSE Board based on vendor recommendations. The ''Index Committee'' was set up to oversee the expansion and ongoing maintenance of the BSE's main indexes. In addition, it is charged with developing and publishing the Exchange's other indicators. The members of the Committee are independent market experts appointed by the Board of Directors.

Listing

Listing of equity series takes place on Prime or Standard Markets. In September 2017, BSE also launched a market tailored to medium-sized companies calledXtend

Xtend is a general-purpose high-level programming language for the Java Virtual Machine. Syntactically and semantically Xtend has its roots in the Java programming language but focuses on a more concise syntax and some additional functionalit ...

. On the Standard Market, in addition to the basic requirements of the law, BSE prescribes a public transaction to be carried out, with regard to the equity series to be listed. In case admission is sought to the Prime Market, the company and the series of securities to be listed shall comply with certain further requirements (size of the series, free float, completed business years, etc.). A public transaction, involving the securities series to be listed is mandatory on the Prime Market as well, however, in this category, issuers may request a one-year postponement to fulfill this obligation.

In July 2019 the Budapest Stock Exchange launched BÉT Xbond, which is closely related to the Bond Funding for Growth Scheme (BGS) of the Hungarian National Bank and offers an alternative trading venue for companies planning to issue bonds.

Trading

On the Exchange, the right to trade is ensured exclusively for persons to whom the Exchange has given the respective licence, the so-called trading licence. Investors can realize their deals on the exchange through these exchange-trading companies. Exchange trading takes place in sections, at present there are four such sections: equities section, debt securities section, derivatives section, commodity section. Current exchange trading members are provided here:List of Exchange Members

'

Market surveillance and protective mechanisms

Trading at the Budapest Stock Exchange is governed by clear rules, which apply equally for all trading participants. Independentmarket surveillance

Market surveillance for products ensures that products on the market conform to applicable laws and regulations. This helps to foster trust among consumers buying products or financial services and protects consumers and professionals from harm f ...

is made by Hungarian National Bank

The Hungarian National Bank ( hu, Magyar Nemzeti Bank (MNB)) is the central bank of Hungary and as such part of the European System of Central Banks (ESCB). The Hungarian National Bank was established in 1924 and succeeded the Royal Hungarian St ...

’s Market Supervision Board. It holds primary responsibility for enforcing the securities

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any for ...

laws, proposing securities rules, and regulating the securities industry, the country's stock and options exchanges, and other activities and organizations, including the electronic securities markets in Hungary.

With a view to improving the continuity of prices and to avoid mistrades, several protective mechanisms are in place for the trading venues Xetra and Budapest Stock Exchange. These include volatility interruption, market order interruption, and liquidity interruption measures.

History

The Hungarian Stock Exchange, the ancestor of today's Budapest Stock Exchange (BSE) started its operation on 18 January 1864 in Pest on the banks of the

The Hungarian Stock Exchange, the ancestor of today's Budapest Stock Exchange (BSE) started its operation on 18 January 1864 in Pest on the banks of the Danube

The Danube ( ; ) is a river that was once a long-standing frontier of the Roman Empire and today connects 10 European countries, running through their territories or being a border. Originating in Germany, the Danube flows southeast for , pa ...

, in a building of the Lloyd Insurance Company. The committee in charge of setting up the exchange was led by Frigyes Kochmeister, who was also elected as the first chairman of the exchange (1864–1900). When the exchange was launched in 1864, there were 17 equities, one debenture, 11 foreign currencies and 9 bills of exchange listed. After a few years of slow growth, 1872 saw the first significant market boom, when the Minister of Trade approved the articles of incorporation of 15 industrial and 550 financial companies whose shares were then listed on the exchange. The BSCE moved into a new building in 1873 and until 1905 continued its operations in a building on the corner of Wurm Street (now Szende Pál Street). In 1905 it relocated to the Exchange Palace on Liberty Square.

The first real market crash of the exchange occurred in May 1873. The early 1890s marked another period of spectacular market boom in the exchange's history, partially fuelled by a general investment optimism that was characteristic of the Millennium years, and by recent trends in the international stock markets. Following 1889 the stock prices of companies listed on the Budapest Stock Exchange were also published in Vienna, Frankfurt, London and Paris. From the 1890s Hungarian government bonds were regularly traded on the stock exchanges of London, Paris, Amsterdam and Berlin.

By the turn of the century, there were already 310 securities traded on the exchange; by the beginning of World War I, this increased to almost 500. The annual turnover in 1913 reached one million shares and the turnover of the Budapest Giro and Mutual Society amounted to 2.7 billion Crowns (the ancestor of the Forint). At the same time there was also a dynamic expansion in grain trading with almost 400,000 tons in 1875, growing to one million tons by the turn of the century and close to one and a half million tons by WWI. As a result of this expansion the BSCE was propelled to become the leading grain exchange in Europe.

As in most European countries, the outbreak of World War I

World War I (28 July 1914 11 November 1918), often abbreviated as WWI, was List of wars and anthropogenic disasters by death toll, one of the deadliest global conflicts in history. Belligerents included much of Europe, the Russian Empire, ...

brought about the exchange's closure on 27 July 1914, although trading did not cease. Brokers continued trading during the war and equity prices showed a massive increase starting in 1914. By 1918 over 7.2 million securities had been traded in a year. The exchange reopened after the war were, the post-war inflationary environment pushed exchange turnover to exceptional highs, tempered only by the introduction in 1925 of the country's new currency, the pengő. The following four years leading to the market crash of the New York Stock Exchange in October 1929 saw the downturn of the BSCE. On 14 July 1931, the BSCE was closed down again as a result of a German banking moratorium and a series of financial collapses of the continent's major banks. Bond trading officially resumed only in 1932, followed by trading in the 18 most traded equities. Following a short period of recovery, the market entered an expansionary phase in 1934, reaching its peak in 1936. Gustav Szabo became the youngest person ever to have a seat on Budapest Stock exchange at 18 years old when his father died in 1939.

When Hungary entered World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the World War II by country, vast majority of the world's countries—including all of the great power ...

, the exchange saw a period of unprecedented boom, and equity prices in the heavy and military industries increased manifold. In 1942 the government applied stricter measures for the BSCE articles of incorporation and set maximum values on daily price changes. Despite these restrictions the exchange was able to continue its operations until the start of the city's siege in mid-December 1944. World War II was followed by a period of hyperinflation, characterized by a lively private stock and real exchange trading in currencies and precious metals, conducted partially in the damaged building of the exchange. The exchange officially re-opened in August 1946, following the launch of the forint on August 1. As companies defaulted on their payments of bonds issued previously in the crown and pengő currencies, and since limited companies failed to pay dividends on their stocks due to the war damages they suffered, prices kept falling. Two months after the 1948 nationalisation of the majority of private Hungarian firms, the government officially dissolved the Budapest Stock and Commodity Exchange, and the exchange's assets became state property.

The first milestone in the re-open of Budapest Stock Exchange was the Government of Hungary

The Government of Hungary ( hu, Magyarország Kormánya) exercises executive (government), executive power in Hungary. It is led by the Prime Minister of Hungary, Prime Minister, and is composed of various ministers. It is the principal organ of p ...

’s decision to give green light for the preparation of the Securities Act of 1989. The draft bill was submitted to Parliament

In modern politics, and history, a parliament is a legislative body of government. Generally, a modern parliament has three functions: representing the electorate, making laws, and overseeing the government via hearings and inquiries. Th ...

in January 1990 and came into force on 1 March. At the same time that the bill came into force on 21 June 1990, the BSE held its statutory general meeting and the Exchange re-opened its doors. With 41 founding members and one single equity, IBUSZ, the Budapest Stock Exchange was set up as a sui generis organisation, an independent legal entity. The re-establishment of the market economy

A market economy is an economic system in which the decisions regarding investment, production and distribution to the consumers are guided by the price signals created by the forces of supply and demand, where all suppliers and consumers ...

during the same time and the privatisation

Privatization (also privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a synonym for deregulation when ...

of businesses played a decisive role in the exchange’s operations. Even though the sale of the larger state-owned businesses often involved the assistance of strategic investors, the BSE played a significant role in the privatisation

Privatization (also privatisation in British English) can mean several different things, most commonly referring to moving something from the public sector into the private sector. It is also sometimes used as a synonym for deregulation when ...

of many leading Hungarian companies including Rába

The Rába (german: Raab; hu, Rába; sl, Raba ) is a river in southeastern Austria and western Hungary and a right tributary of the Danube.

Geography

Its source is in Austria, some kilometres east of Bruck an der Mur below Heubodenhöhe Hill. ...

, MOL Group

MOL Plc. ( hu, Magyar OLaj- és Gázipari Részvénytársaság, lit=Hungarian Oil and Gas Public Limited Company), also commonly known as MOL Group, is a Hungarian multinational oil and gas company headquartered in Budapest, Hungary. Members of ...

, OTP Bank, Magyar Telekom, Danubius Hotels Group, Richter Gedeon Co., IBUSZ, Skála-Coop, Globus and more.

The first trading floor was in the Trade Center on Váci Street, followed by its move in 1992 to the atmospheric old building at Deák Ferenc Street in Belváros-Lipótváros

District V is the heart of Budapest and the political, financial, commercial and touristic center of Hungary. The name of the district is Belváros-Lipótváros (English: Inner City – Leopold Town), which refers to the two historical neighbourh ...

, where it continued its operations for 15 years. In March, 2007 the BSE moved to the former Herczog Palace at 93 Andrássy Avenue

The House of Andrássy is the name of a Hungarian noble family of very ancient lineage that was prominent in Hungarian history. The full family name is ''Andrássy de Csíkszentkirály et Krasznahorka''. ''Csíkszentkirály'' is a town in modern ...

. The Open outcry

Open outcry is a method of communication between professionals on a stock exchange or futures exchange, typically on a trading floor. It involves shouting and the use of hand signals to transfer information primarily about buy and sell orde ...

system of the physical trading floor that characterized the spot market functioned with partial electronic support until 1995. From 1995 until November, 1998 securities trading took place concurrently on the trading floor and in a remote trading system, when the new MultiMarket Trading System (MMTS), based entirely on remote trading was launched. The traditional “battlefield rumble” of the physical trading floor ceased within a year by September 1999, at which time physical trading was entirely replaced by the electronic remote trading platform of the derivatives market. Derivatives market

The derivatives market is the financial market for derivatives, financial instruments like futures contracts or options, which are derived from other forms of assets.

The market can be divided into two, that for exchange-traded derivatives a ...

of the BSE in futures and options contracts has been available to investors since 1995. BUX contracts have been available for trading since the start of the futures market on 31 March 1995. In July, 1998 the BSE was among the first exchanges in the world to introduce contracts based on individual equities. Another series of standardised derivatives in the options market appeared in February, 2000 and on 6 September 2004 trading commenced in the exchange's second index, the BUMIX. In January, 2010, BSE became a member of the CEE Stock Exchange Group.

On 6 December 2013, on the occasion of the exchange's new trading platform launch the stock exchange trading was ceremonially opened by Mihály Varga, Minister of National Economy. That day the new Xetra trading system replaced the system that has been in use for 15 years. In February 2015 the BSE moved to new premises in Liberty Square. On 20 November 2015 the Hungarian National Bank

The Hungarian National Bank ( hu, Magyar Nemzeti Bank (MNB)) is the central bank of Hungary and as such part of the European System of Central Banks (ESCB). The Hungarian National Bank was established in 1924 and succeeded the Royal Hungarian St ...

concluded a sales contract with the Austrian CEESEG AG and Österreichische Kontrollbank AG, the entities that to date held a 68.8 per cent ownership in BSE. The BSE currently operates in the Buda Centre of the Hungarian National Bank on Krisztina Boulevard.

In its strategy for the period 2021-2025, the Budapest Stock Exchange outlined its earlier efforts to develop the domestic capital markets. According to this, the BSE's goal remains to increase the role of capital markets in Hungary and to support the growth and competitiveness of companies, taking into account sustainability aspects, thus ensuring the prosperity of Hungarian households.

Chairmen

Board of Directors

Stock Exchange Advisory Body

The Stock Exchange Advisory Board was founded in 2016. With 12 members, the body is responsible for preparing, establishing and commenting on BSE's strategic and business decisions.See also

* BUX * Economy of Hungary * Economy of Budapest *List of companies of Hungary

Hungary is a unitary parliamentary republic in Central Europe. It covers an area of , situated in the Carpathian Basin and bordered by Slovakia to the north, Romania to the east, Serbia to the south, Croatia to the southwest, Slovenia to the we ...

* List of European stock exchanges

*List of stock exchange opening times

This is a list of major stock exchanges. Those futures exchanges that also offer trading in securities besides trading in futures contracts are listed both here and in the list of futures exchanges.

There are sixteen stock exchanges in the wor ...

*Hungarian National Bank

The Hungarian National Bank ( hu, Magyar Nemzeti Bank (MNB)) is the central bank of Hungary and as such part of the European System of Central Banks (ESCB). The Hungarian National Bank was established in 1924 and succeeded the Royal Hungarian St ...

(Securities and exchange surveillance)

*New York Stock Exchange

The New York Stock Exchange (NYSE, nicknamed "The Big Board") is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is by far the world's largest stock exchange by market capitalization of its liste ...

References

External links

* {{Coord, 47, 30, 10, N, 19, 03, 07, E, region:HU_type:landmark_source:kolossus-ruwiki, display=title 1864 establishments in Hungary Belváros-LipótvárosStock Exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for t ...

Financial markets

Stock exchanges in Europe

Financial services companies established in 1864

1864 establishments in Europe

Commodity exchanges

Securities clearing and depository institutions

Finance in Hungary