Bank Of Upper Canada (8061879779) on:

[Wikipedia]

[Google]

[Amazon]

The Bank of Upper Canada was established in 1821 under a charter granted by the legislature of

The first Bank of Upper Canada was located on the south-east corner of King and Frederick streets in

The first Bank of Upper Canada was located on the south-east corner of King and Frederick streets in

A history of banking in Canada

'. Рипол Классик; 1909. . p. 21, 35. The government refused to accept its notes given its American ties, and it went bankrupt in 1822. After its failure, the Bank of Upper Canada used all of its influence to prevent any other bank from being chartered in the province. The monopoly was crucial to keeping its notes in circulation and boosting its profits. It succeeded only until 1832, when the Commercial Bank of the Midland District was chartered finally giving Kingston the bank it desired.

On 10 July 1832, President Andrew Jackson vetoed the bill for the rechartering of the Second Bank of the United States, arguing that it was utilized by a "moneyed aristocracy" to oppress the common man. The same complaint was lodged by the Reformers against the Bank of Upper Canada, which served a similar role. The dismantling of the bank plunged the Anglo-American world into an enormous depression (1836-8) that was worsened by bad wheat harvests in Upper Canada in 1836. Farmers were unable to pay their debts. Most banks, including the Bank of Upper Canada,- suspended payments (i.e. declared bankruptcy) by July 1837 and requested government support. While the banks received government support, ordinary farmers and the poor did not.

On 10 July 1832, President Andrew Jackson vetoed the bill for the rechartering of the Second Bank of the United States, arguing that it was utilized by a "moneyed aristocracy" to oppress the common man. The same complaint was lodged by the Reformers against the Bank of Upper Canada, which served a similar role. The dismantling of the bank plunged the Anglo-American world into an enormous depression (1836-8) that was worsened by bad wheat harvests in Upper Canada in 1836. Farmers were unable to pay their debts. Most banks, including the Bank of Upper Canada,- suspended payments (i.e. declared bankruptcy) by July 1837 and requested government support. While the banks received government support, ordinary farmers and the poor did not.

Evolving Financial Markets and International Capital Flows: Britain, the Americas, and Australia, 1865–1914

'. Cambridge University Press; 7 May 2001. . p. 409–.

Inside the Museums: Toronto's Heritage Sites and their Most Prized Objects

'. Dundurn; 7 June 2014. . p. 101–. Designed by architect William Warren Baldwin, 1825–27, the bank resembled a London townhouse with a Doric portico. The Toronto building is on the Registry of Historical Places of Canada, along with two branches. The 86 John Street branch in Port Hope, Ontario, built in 1857 and the 46 West Street branch in

File:Bank of Upper Canada.JPG, Bank of Upper Canada

File:260 Adelaide Street East, at George Street, in 1977.jpg, Bank of Upper Canada 1977 condition

File:One Penny Token, 1854 - Bank of Upper Canada.jpg, 1 penny

Upper Canada

The Province of Upper Canada (french: link=no, province du Haut-Canada) was a part of British Canada established in 1791 by the Kingdom of Great Britain, to govern the central third of the lands in British North America, formerly part of the ...

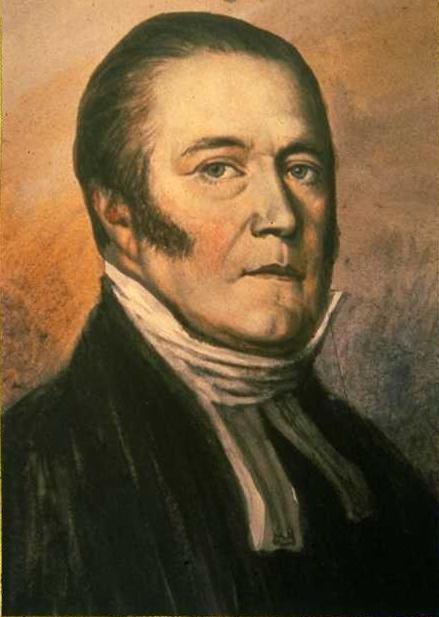

in 1819 to a group of Kingston merchants. The charter was appropriated by the more influential Executive Councillors to the Lt. Governor, the Rev. John Strachan

John Strachan (; 12 April 1778 – 1 November 1867) was a notable figure in Upper Canada and the first Anglican Bishop of Toronto. He is best known as a political bishop who held many government positions and promoted education from common sch ...

and William Allan, and moved to Toronto. The bank was closely associated with the group that came to be known as the Family Compact, and it formed a large part of their wealth. The association with the Family Compact and its underhanded practices made Reformers, including Mackenzie, regard the Bank of Upper Canada as a prop of the government. Complaints about the bank were a staple of Reform agitation in the 1830s because of its monopoly and aggressive legal actions against debtors.

History

Bank of the Family Compact

York

York is a cathedral city with Roman origins, sited at the confluence of the rivers Ouse and Foss in North Yorkshire, England. It is the historic county town of Yorkshire. The city has many historic buildings and other structures, such as a ...

, Upper Canada

The Province of Upper Canada (french: link=no, province du Haut-Canada) was a part of British Canada established in 1791 by the Kingdom of Great Britain, to govern the central third of the lands in British North America, formerly part of the ...

(later Toronto

Toronto ( ; or ) is the capital city of the Canadian province of Ontario. With a recorded population of 2,794,356 in 2021, it is the most populous city in Canada and the fourth most populous city in North America. The city is the ancho ...

, Canada West). York was then too small for a bank, and its promoters were unable to raise even the minimal 10% of the £200,000 authorized capital required for start-up. The bank succeeded only because its promoters had the political influence to have that minimum reduced by half, and the provincial government subscribed for 2000 of its 8000 shares. The lieutenant-governor appointed four of the bank's fifteen directors, making for a tight bond between the nominally private company and the state. Despite the tight bonds, the Receiver General

A receiver general (or receiver-general) is an officer responsible for accepting payments on behalf of a government, and for making payments to a government on behalf of other parties.

See also

* Treasurer

* Receiver General for Canada

* Recei ...

, the reform-leaning John Henry Dunn

John Henry Dunn (1792 – April 21, 1854) was a public official and businessman in Upper Canada, who later entered politics in the Province of Canada. Born on Saint Helena of English parents, he came to Upper Canada as a young man to take u ...

, refused to use the bank for government business.

The bank's principal promoters were the Rev. John Strachan

John Strachan (; 12 April 1778 – 1 November 1867) was a notable figure in Upper Canada and the first Anglican Bishop of Toronto. He is best known as a political bishop who held many government positions and promoted education from common sch ...

and William Allan. William Allan, who became president, was also an Executive and Legislative Councillor. He, like Strachan, played a key role in solidifying the Family Compact and ensuring its influence within the colonial state. Forty-four men served as bank directors during the 1830s; eleven of them were executive councillors, fifteen of them were legislative councillors, and thirteen were magistrates in Toronto. More importantly, all 11 men who had ever sat on the Executive Council also sat on the board of the bank at one time or another. Ten of the men also sat on the Legislative Council. The overlapping membership on the boards of the Bank of Upper Canada and on the Executive and Legislative Councils served to integrate the economic and political activities of the church, state, and the "financial sector." The overlapping memberships reinforced the oligarchic nature of power in the colony and allowed the administration to operate without any effective elective check. Henry John Boulton

Henry John Boulton, (1790 – June 18, 1870) was a lawyer and political figure in Upper Canada and the Province of Canada, as well as Chief Justice of Newfoundland.

Boulton began his legal career under the tutelage of John Beverly Robin ...

, the solicitor general, author of the bank incorporation bill and the bank's lawyer, admitted the bank was a "terrible engine in the hands of the provincial administration."

William Lyon Mackenzie, the Reform politician and newspaper publisher, was the first to demonstrate the nature of that oligarchic power by showing that the government, its officers, and legislative councillors owned 5,381 of its 8,000 shares. Once elected to the House of Assembly, he criticized the Bank's lack of transparency and accountability to the legislature.

Bank officers of the Family Compact

* William Allan (1822–1835) * William Proudfoot (1835–1861) * Thomas Gibbs Ridout, cashier (general manager) (1822–1861) *Henry John Boulton

Henry John Boulton, (1790 – June 18, 1870) was a lawyer and political figure in Upper Canada and the Province of Canada, as well as Chief Justice of Newfoundland.

Boulton began his legal career under the tutelage of John Beverly Robin ...

, lawyer (1825-1833)

The directorate of the bank was dominated by government officers. Forty-four men served as bank directors during the 1830s, eleven of them being executive councillors, fifteen of them were legislative councillors, and thirteen were magistrates in Toronto.

The "Pretended Bank" (at Kingston) and the Commercial Bank of the Midland District

The Bank of Upper Canada at York (Toronto) had obtained its charter at the expense of the larger, more economically developed town of Kingston. Deprived of their charter, they established an unchartered bank in 1818 supported with American capital.B.E. Walker.A history of banking in Canada

'. Рипол Классик; 1909. . p. 21, 35. The government refused to accept its notes given its American ties, and it went bankrupt in 1822. After its failure, the Bank of Upper Canada used all of its influence to prevent any other bank from being chartered in the province. The monopoly was crucial to keeping its notes in circulation and boosting its profits. It succeeded only until 1832, when the Commercial Bank of the Midland District was chartered finally giving Kingston the bank it desired.

Banknotes

Paper currency was a banking innovation in the era. It had been experimented with to fund the American Revolutionary War but had devalued badly, leading to general distrust of banknotes. Banknotes then were not legal tender, issued by a state bank. They were, rather, similar to cheques written by the bank promising to pay the bearer with "real" (usually metallic) money, or specie, if they returned the cheque to the bank. Any bank that could not redeem its banknotes with specie was forced to close for good. The Bank of Upper Canada was able to lend out many more banknotes than it had the cash to redeem because Upper Canada was a specie-poor province, and the notes would pass from hand to hand to enable trade without ever being returned to the bank. On average, the bank lent out more than three times more banknotes than it could redeem; it made 6% interest on each note that it loaned out. The bank's manager, Thomas Ridout, estimated that in the first three years of its operation, the bank's notes comprised between 74 and 77% of the province's money supply. Between 1823 and 1837, its profit on paid in capital ranged between 3.6% (1823) and 16.5% (1832) at a time when the maximum legal interest rate was 6%. The Bank of Upper Canada suspended payments from March 5, 1838 to November 1, 1839 during the financial panic of that year. It was bankrupt, but a special act of legislature allowed it to continue operating without having to repay its loans with specie. The bank was a small operation, which, like many other early Canadian banks, collapsed in 1866.The financial panic of 1836-8

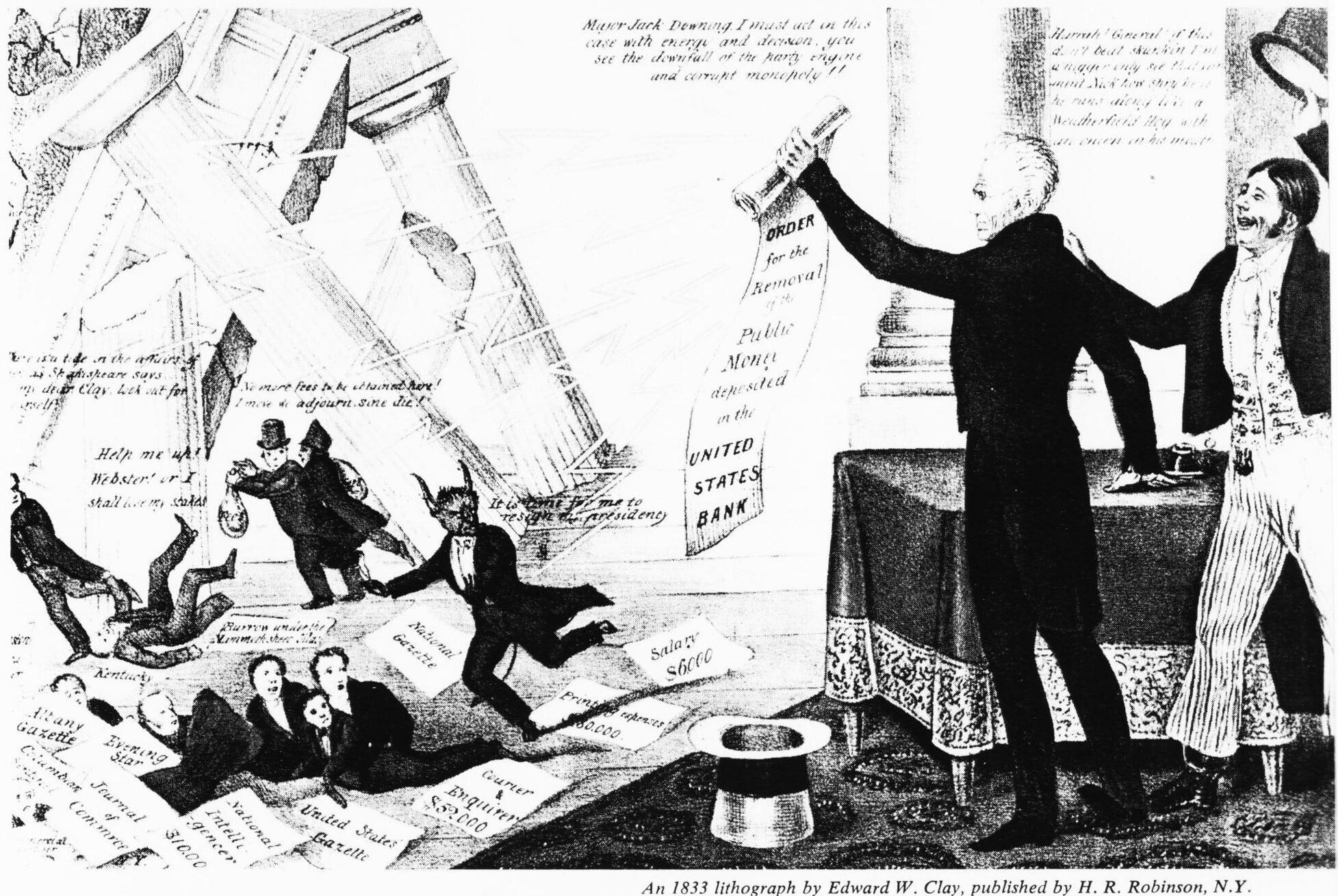

On 10 July 1832, President Andrew Jackson vetoed the bill for the rechartering of the Second Bank of the United States, arguing that it was utilized by a "moneyed aristocracy" to oppress the common man. The same complaint was lodged by the Reformers against the Bank of Upper Canada, which served a similar role. The dismantling of the bank plunged the Anglo-American world into an enormous depression (1836-8) that was worsened by bad wheat harvests in Upper Canada in 1836. Farmers were unable to pay their debts. Most banks, including the Bank of Upper Canada,- suspended payments (i.e. declared bankruptcy) by July 1837 and requested government support. While the banks received government support, ordinary farmers and the poor did not.

On 10 July 1832, President Andrew Jackson vetoed the bill for the rechartering of the Second Bank of the United States, arguing that it was utilized by a "moneyed aristocracy" to oppress the common man. The same complaint was lodged by the Reformers against the Bank of Upper Canada, which served a similar role. The dismantling of the bank plunged the Anglo-American world into an enormous depression (1836-8) that was worsened by bad wheat harvests in Upper Canada in 1836. Farmers were unable to pay their debts. Most banks, including the Bank of Upper Canada,- suspended payments (i.e. declared bankruptcy) by July 1837 and requested government support. While the banks received government support, ordinary farmers and the poor did not.

Bank Wars (1835-1838)

The Bank of Upper Canada was the subject of almost continuous political attack. Shortly after its founding, Reform critic William Lyon Mackenzie published a series of articles on how speculative the Bank's loan practices were, and how close to bankruptcy it was. That resulted in an event, now known as theTypes Riot

The Types Riot was the destruction of William Lyon Mackenzie's printing press and movable type by members of the Family Compact on June 8, 1826, in York, Upper Canada (now known as Toronto). The Family Compact was the ruling elite of Upper ...

, in 1826 in which the clique of Bank officers dubbed the Family Compact destroyed Mackenzie's printing press. Mackenzie, a bank critic, pushed for a non-speculative " hard money" policy where the bank loaned out only money that it actually had.

Until 1835, all banks in Upper Canada required a legislative charter. Reformers tried several legislative strategies to get their own bank, including attempts to incorporate credit unions such as the Farmers' Storehouse company

The Farmers’ Storehouse was Canada's first farmers' cooperative, founded in Toronto and the Home District in 1824. It stood at the centre of a broad economic and political reform movement that, in its essentials, was not greatly different from ...

. That came to an end in 1835 when Charles Duncombe produced a "Report on Currency" for the Legislative Assembly, which demonstrated the legality of the Scottish joint-stock bank system in Upper Canada.

The difference between the English chartered banks and the Scottish joint stock banks is that the Scottish banks were considered partnerships and hence didn't need a legislated Act in order to operate. The joint stock banks thus lacked limited liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to it ...

, and every partner in the bank was responsible for the bank's debts to the full extent of their personal property. The chartered banks, in contrast, protected their shareholders with limited liability

Limited liability is a legal status in which a person's financial liability is limited to a fixed sum, most commonly the value of a person's investment in a corporation, company or partnership. If a company that provides limited liability to it ...

and hence from major loss; they thus encouraged speculation. The Scottish joint-stock banks followed a "hard money policy

Hard money policies support a specie standard, usually gold or silver, typically implemented with representative money.

In 1836, when President Andrew Jackson's veto of the recharter of the Second Bank of the United States took effect, he issued ...

." They avoided speculative risk because if they failed, their shareholders were responsible for the full loss. Since the banks did not require a legislated charter, many more banks could be founded, and they were more competitive and freer from political influence and corruption.

Duncombe's report opened the gate for many new competitive banks to enter the market - just as the entire Anglo-American financial system was coming apart at the seams in a financial panic lasting until after the Rebellions of 1837. The Bank of Upper Canada survived only because of its influence on government.

The joint-stock banks

Following Duncombe's report, the Farmers' Bank and theBank of the People

The Bank of the People was created by radical Reform politicians James Lesslie, James Hervey Price, and Dr John Rolph in Toronto in 1835. It was founded after they failed to establish a "Provincial Loan Office" in which farmers could borrow s ...

were founded on a joint stock basis, until the Family Compact conspired to make new ones illegal in 1838.

The end of monopoly

The monopoly of the Bank of Upper Canada had been slowly eroding with the chartering of the Commercial Bank, and then the joint-stock banks. The Act to outlaw further joint-stock banks in 1838 again tilted towards monopoly. However, in 1841 theBank of Montreal

The Bank of Montreal (BMO; french: Banque de Montréal, link=no) is a Canadian multinational investment bank and financial services company.

The bank was founded in Montreal, Quebec, in 1817 as Montreal Bank; while its head office remains in ...

, long seeking an entry into Upper Canada, purchased the Bank of the People and quickly began to expand its branch network. The Bank of British North America

The Bank of British North America was founded by Royal Charter issued in 1836 in London, England with offices in Toronto, Montreal, Quebec City, Saint John, New Brunswick, Halifax and St. John's, Newfoundland. It was the first bank operating in B ...

also entered the provincial market around that time.

As a result, the Bank changed its strategy and in 1850 it became the official bank of the Province of Canada, collecting all government revenue and issuing all government cheques.

By 1863, the bank was struggling; in 1866 the Bank of Upper Canada closed its doors; the stockholders lost all of their investment of more than $3 million, and over $1 million dollars in taxpayers money was also lost.Evolving Financial Markets and International Capital Flows: Britain, the Americas, and Australia, 1865–1914

'. Cambridge University Press; 7 May 2001. . p. 409–.

Remaining buildings

The 1827Bank of Upper Canada Building

The Bank of Upper Canada Building is a former bank building in Toronto, Ontario, Canada, and one of the few remaining buildings in Toronto that predate the 1834 incorporation of the city. It is located at 252 Adelaide Street East (originally 28 Du ...

, its second headquarters, still exists, located on Toronto

Toronto ( ; or ) is the capital city of the Canadian province of Ontario. With a recorded population of 2,794,356 in 2021, it is the most populous city in Canada and the fourth most populous city in North America. The city is the ancho ...

's Adelaide St East. It has been designated a National Historic Site of Canada

National Historic Sites of Canada (french: Lieux historiques nationaux du Canada) are places that have been designated by the federal Minister of the Environment

An environment minister (sometimes minister of the environment or secretary of t ...

.John Goddard. Inside the Museums: Toronto's Heritage Sites and their Most Prized Objects

'. Dundurn; 7 June 2014. . p. 101–. Designed by architect William Warren Baldwin, 1825–27, the bank resembled a London townhouse with a Doric portico. The Toronto building is on the Registry of Historical Places of Canada, along with two branches. The 86 John Street branch in Port Hope, Ontario, built in 1857 and the 46 West Street branch in

Goderich, Ontario

Goderich ( or ) is a town in the Canadian province of Ontario and is the county seat of Huron County, Ontario, Huron County. The town was founded by John Galt (novelist), John Galt and William "Tiger" Dunlop of the Canada Company in 1827. First ...

, built in 1863.

Further reading

Gallery

Token

Token may refer to:

Arts, entertainment, and media

* Token, a game piece or counter, used in some games

* The Tokens, a vocal music group

* Tolkien Black, a recurring character on the animated television series ''South Park,'' formerly known as ...

of the Bank of Upper Canada, 1854.

References

{{DEFAULTSORT:Bank Of Upper Canada Defunct banks of Canada Economic history of Ontario Banks established in 1821 1866 disestablishments in Canada 1821 establishments in Upper Canada Banks disestablished in 1866 Canadian companies established in 1821