|

Wash Trade

A wash trade is a form of market manipulation in which an investor simultaneously sells and buys the same financial instruments to create misleading, artificial activity in the marketplace. First, an investor will place a sell order, then place a buy order to buy from themselves, or vice versa. This may be done for a number of reasons: * To artificially increase trading volume, giving the impression that the instrument is more in-demand than it actually is. * To generate commission fees to brokers in order to compensate them for something that cannot be openly paid for. This was done by some of the participants in the Libor scandal. Some exchanges now have protections built in, sometimes mandatory for participants, such as STPF (Self-Trade Prevention Functionality) on the Intercontinental Exchange (ICE). Wash trading has been illegal in the United States since the passage of the Commodity Exchange Act (CEA), of 1936. The practice is common in non-fungible token markets which ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Manipulation

In economics and finance, market manipulation is a type of market abuse where there is a deliberate attempt to interfere with the free and fair operation of the market; the most blatant of cases involve creating false or misleading appearances with respect to the price of, or market for, a product, security or commodity. Market manipulation is prohibited in most countries, in particular, it is prohibited in the United States under Section 9(a)(2) of the Securities Exchange Act of 1934, in the European Union under Article 12 of the ''Market Abuse Regulation'', in Australia under Section 1041A of the Corporations Act 2001, and in Israel under Section 54(a) of the securities act of 1968. In the US, market manipulation is also prohibited for wholesale electricity markets under Section 222 of the Federal Power Act and wholesale natural gas markets under Section 4A of the Natural Gas Act. The US Securities Exchange Act defines market manipulation as "transactions which create an a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investor

An investor is a person who allocates financial capital with the expectation of a future Return on capital, return (profit) or to gain an advantage (interest). Through this allocated capital most of the time the investor purchases some species of property. Types of investments include Stock, equity, Bond (finance), debt, Security (finance), securities, real estate, infrastructure, currency, commodity, Exonumia, token, derivatives such as put and call Option (finance), options, Futures contract, futures, Forward contract, forwards, etc. This definition makes no distinction between the investors in the primary and secondary markets. That is, someone who provides a business with capital and someone who buys a stock are both investors. An investor who owns stock is a shareholder. Types of investors There are two types of investors: retail investors and institutional investors. Retail investor * Individual investors (including Trust law, trusts on behalf of individuals, and umbr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form of currency (forex); debt ( bonds, loans); equity ( shares); or derivatives ( options, futures, forwards). International Accounting Standards IAS 32 and 39 define a financial instrument as "any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity". Financial instruments may be categorized by "asset class" depending on whether they are equity-based (reflecting ownership of the issuing entity) or debt-based (reflecting a loan the investor has made to the issuing entity). If the instrument is debt it can be further categorized into short-term (less than one year) or long-term. Foreign exchange instruments and transactions are neither debt- nor equity-based and bel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Demand

In economics, demand is the quantity of a good that consumers are willing and able to purchase at various prices during a given time. The relationship between price and quantity demand is also called the demand curve. Demand for a specific item is a function of an item's perceived necessity, price, perceived quality, convenience, available alternatives, purchasers' disposable income and tastes, and many other options. Factors influencing demand Innumerable factors and circumstances affect a consumer's willingness or to buy a good. Some of the common factors are: The price of the commodity: The basic demand relationship is between potential prices of a good and the quantities that would be purchased at those prices. Generally, the relationship is negative, meaning that an increase in price will induce a decrease in the quantity demanded. This negative relationship is embodied in the downward slope of the consumer demand curve. The assumption of a negative relationship is reaso ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Broker

A broker is a person or firm who arranges transactions between a buyer and a seller for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be confused with that of an agent—one who acts on behalf of a principal party in a deal. Definition A broker is an independent party whose services are used extensively in some industries. A broker's prime responsibility is to bring sellers and buyers together and thus a broker is the third-person facilitator between a buyer and a seller. An example would be a real estate or stock broker who facilitates the sale of a property. Brokers can furnish market research and market data. Brokers may represent either the seller or the buyer but generally not both at the same time. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. They then screen these potential buyers or sellers for the perfe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intercontinental Exchange

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets. ICE also owns and operates six central clearing houses: ICE Clear U.S., ICE Clear Europe, ICE Clear Singapore, ICE Clear Credit, ICE Clear Netherlands and ICE NGX. ICE has offices in Atlanta, New York, London, Chicago, Bedford, Houston, Winnipeg, Amsterdam, Calgary, Washington, D.C., San Francisco, Tel Aviv, Rome, Hyderabad, Singapore and Melbourne. History Jeffrey Sprecher was a power plant developer ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Exchange Act

Commodity Exchange Act (ch. 545, , enacted June 15, 1936) is a federal act enacted in 1936 by the U.S. Government, with some of its provisions amending the Grain Futures Act of 1922. The Act provides federal regulation of all commodities and futures trading activities and requires all futures and commodity options to be traded on organized exchanges. In 1974, the Commodity Futures Trading Commission (CFTC) was created as a result of the Commodity Exchange Act, and in 1982 the National Futures Association (NFA) was created by CFTC. See also *Grain Futures Act *National Futures Association *Commodity Futures Trading Commission *Futures exchange *Futures contract *Commodity Futures Modernization Act of 2000 The Commodity Futures Modernization Act of 2000 (CFMA) is United States federal legislation that ensured financial products known as over-the-counter (OTC) derivatives remained unregulated. It was signed into law on December 21, 2000 by President ... External links 7 U.S. Code ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

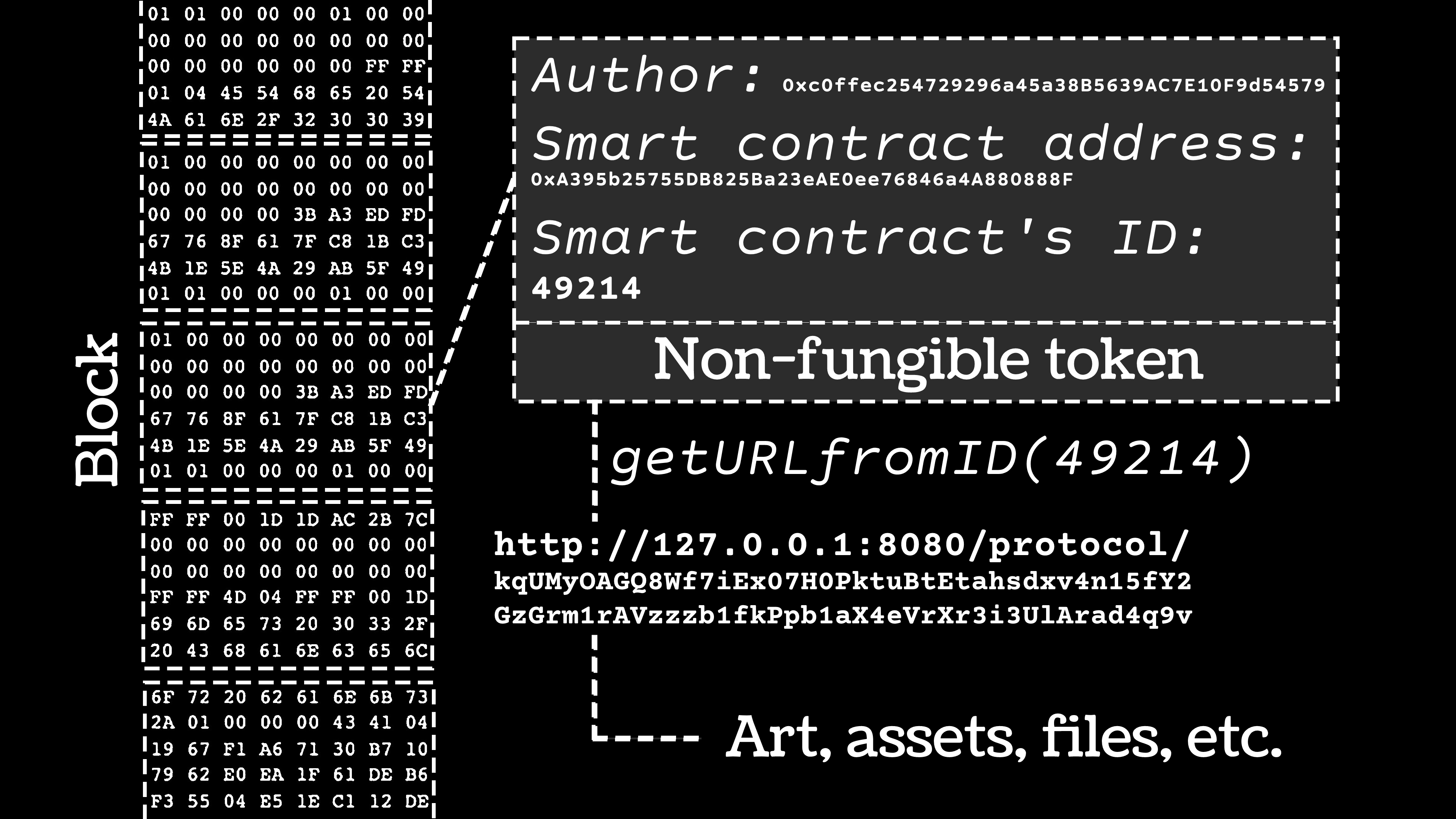

Non-fungible Token

A non-fungible token (NFT) is a unique digital identifier that cannot be copied, substituted, or subdivided, that is recorded in a blockchain, and that is used to certify authenticity and ownership. The ownership of an NFT is recorded in the blockchain and can be transferred by the owner, allowing NFTs to be sold and traded. NFTs can be created by anybody, and require few or no coding skills to create. NFTs typically contain references to digital files such as photos, videos, and audio. Because NFTs are uniquely identifiable assets, they differ from cryptocurrencies, which are Fungibility, fungible. Proponents of NFTs claim that NFTs provide a public certificate of authenticity or Title (property), proof of ownership, but the legal rights conveyed by an NFT can be uncertain. The ownership of an NFT as defined by the blockchain has no inherent legal meaning and does not necessarily grant copyright, intellectual property rights, or other legal rights over its associated digital ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bucket Shop (stock Market)

A bucket shop is a business that allows gambling based on the prices of stocks or commodities. A 1906 U.S. Supreme Court ruling defined a ''bucket shop'' as "an establishment, nominally for the transaction of a stock exchange business, or business of similar character, but really for the registration of bets, or wagers, usually for small amounts, on the rise or fall of the prices of stocks, grain, oil, etc., there being no transfer or delivery of the stock or commodities nominally dealt in". A person who engages in the practice is referred to as a bucketeer and the practice is sometimes referred to as bucketeering. Bucket shops were found in many large American cities from the mid-1800s but the practice was eventually ruled illegal and largely disappeared by the 1920s. Overview Definition and term origin According to ''The New York Times'' in 1958, a bucket shop is "an office with facilities for making bets in the form of orders or options based on current exchange prices of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Round-tripping (finance)

Round-tripping, also known as round-trip transactions or "Lazy Susans", is defined by ''The Wall Street Journal'' as a form of barter that involves a company selling "an unused asset to another company, while at the same time agreeing to buy back the same or similar assets at about the same price." Swapping assets on a round-trip produces no net economic substance, but may be fraudulently reported as a series of productive sales and beneficial purchases on the books of the companies involved, violating the substance over form accounting principle. The companies appear to be growing and very ''busy'', but the round-tripping ''business'' does not generate profits. Growth is an attractive factor to speculative investors, even if profits are lacking; such investment benefits companies and motivates them to undertake the illusory growth of round-tripping. They played a crucial part in temporarily inflating the market capitalization of energy traders such as Enron, CMS Energy, Reliant ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Substance Over Form

Substance over form is an accounting principle used "to ensure that financial statements give a complete, relevant, and accurate picture of transactions and events". If an entity practices the 'substance over form' concept, then the financial statements will convey the overall financial reality of the entity (economic substance), rather than simply reporting the legal record of transactions (form). In accounting for business transactions and other events, the measurement and reporting is for the economic impact of an event, instead of its legal form. Substance over form is critical for reliable financial reporting. It is particularly relevant in cases of revenue recognition, sale and purchase agreements, etc. The key point of the concept is that a transaction should not be recorded in such a manner as to hide the true intent of the transaction, which would mislead the readers of a company's financial statements. Examples There is widespread use of substance over form concept in a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |