|

Unicorn (finance)

In business, a unicorn is a privately held startup company valued at over US$1 billion. The term was first published in 2013, coined by venture capitalist Aileen Lee, choosing the mythical animal to represent the statistical rarity of such successful ventures. CB Insights identified 1,170 unicorns worldwide . Unicorns with over $10 billion in valuation have been designated as "decacorn" companies. For private companies valued over $100 billion, the terms "centicorn", "hectocorn", and "super-unicorn" have been used. The term "kilocorn" has been used for companies valued at $1 trillion, of which Apple was the first. History Aileen Lee originated the term "unicorn" in a 2013 ''TechCrunch'' article, "Welcome To The Unicorn Club: Learning from Billion-Dollar Startups". At the time, 39 companies were identified as unicorns. In a different study done by ''Harvard Business Review'', it was determined that startups founded between 2012 and 2015 were growing in valuation twice as f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Startup Company

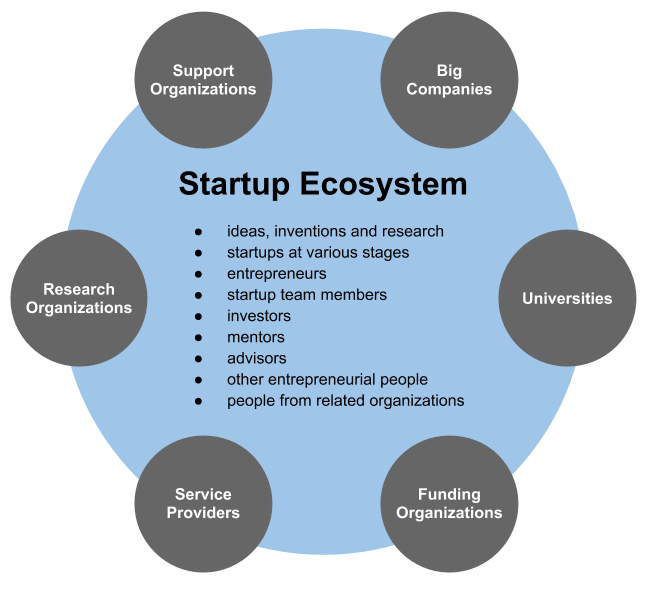

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Klarna

Klarna Bank AB, commonly referred to as Klarna, is a Swedish fintech company that provides online financial services such as payments for online storefronts and direct payments along with post-purchase payments. The company has more than 4,000 employees, most of them working at the headquarters in Stockholm and Berlin. In 2021, the company handled about US$80 billion in online sales. As of 2011, about 40% of all e-commerce sales in Sweden went through Klarna. In 2021, the company was Europe's most valuable private tech company, at a $45.6 billion valuation, however this crashed to $6.7 billion in 2022. Klarna's core service is to provide payment processing services for the e-commerce industry, managing store claims and customer payments. It has become known as a "Buy now, pay later" (BNPL) service provider, offering customers credit on their purchases as part of the checkout process. History The three founders Sebastian Siemiatkowski, Niklas Adalberth and Victor Jacobsson pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peer-to-peer

Peer-to-peer (P2P) computing or networking is a distributed application architecture that partitions tasks or workloads between peers. Peers are equally privileged, equipotent participants in the network. They are said to form a peer-to-peer network of nodes. Peers make a portion of their resources, such as processing power, disk storage or network bandwidth, directly available to other network participants, without the need for central coordination by servers or stable hosts. Peers are both suppliers and consumers of resources, in contrast to the traditional client–server model in which the consumption and supply of resources are divided. While P2P systems had previously been used in many application domains, the architecture was popularized by the file sharing system Napster, originally released in 1999. The concept has inspired new structures and philosophies in many areas of human interaction. In such social contexts, peer-to-peer as a meme refers to the egalitarian so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Smartphone

A smartphone is a portable computer device that combines mobile telephone and computing functions into one unit. They are distinguished from feature phones by their stronger hardware capabilities and extensive mobile operating systems, which facilitate wider software, internet (including web browsing over mobile broadband), and multimedia functionality (including music, video, cameras, and gaming), alongside core phone functions such as voice calls and text messaging. Smartphones typically contain a number of metal–oxide–semiconductor (MOS) integrated circuit (IC) chips, include various sensors that can be leveraged by pre-included and third-party software (such as a magnetometer, proximity sensors, barometer, gyroscope, accelerometer and more), and support wireless communications protocols (such as Bluetooth, Wi-Fi, or satellite navigation). Early smartphones were marketed primarily towards the enterprise market, attempting to bridge the functionality of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economies Of Scale

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control. This is just a partial description of the concept. Economies of scale apply to a variety of the organizational and business situations and at various levels, such as a production, plant or an entire enterprise. When average costs start falling as output increases, then economies of scale occur. Some economies of scale, such as capital cost of manufacturing facilities and friction loss of transportation and industrial equipment, have a physical or engineering basis. The economic concept dates back to Adam Smith and the idea of obtaining larger production returns through the use ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sarbanes–Oxley Act

The Sarbanes–Oxley Act of 2002 is a United States federal law that mandates certain practices in financial record keeping and reporting for corporations. The act, (), also known as the "Public Company Accounting Reform and Investor Protection Act" (in the Senate) and "Corporate and Auditing Accountability, Responsibility, and Transparency Act" (in the House) and more commonly called Sarbanes–Oxley, SOX or Sarbox, contains eleven sections that place requirements on all U.S. public company boards of directors and management and public accounting firms. A number of provisions of the Act also apply to privately held companies, such as the willful destruction of evidence to impede a federal investigation. The law was enacted as a reaction to a number of major corporate and accounting scandals, including Enron and WorldCom. The sections of the bill cover responsibilities of a public corporation's board of directors, add criminal penalties for certain misconduct, and require t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trivago

Trivago N.V., marketed with lowercase styling as trivago, is a German technology company specializing in internet-related services and products in the hotel, lodging and metasearch fields. The company is headquartered in Düsseldorf. The American online travel company Expedia Group owns a majority of the company's stock. History The company was founded in Düsseldorf, Germany, in January 2005. Seeing an opportunity in the hotel search space, the founding team developed Germany's first hotel search engine. Shortly after launch, Stephan Stubner resigned as Managing Director, but the three other founders (Rolf Schrömgens, Peter Vinnemeier and Malte Siewert) remained. Initially, Trivago received €1 million from investors, including the Samwer brothers, Florian Heinemann, and Christian Vollmann. In 2007, Trivago received US$1.14 million in Series B funding from the British company HOWZAT media LLP. In December 2010, Trivago sold a quarter of the company for US$52.86 million to a US i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Initial Public Offering

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as ''floating'', or ''going public'', a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded. After the IPO, shares are traded freely in the open market at what is known as the free float. Stock exchanges stipulate a minimum free float both in absolute terms (the total value as determined by the share price multiplied by the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jumpstart Our Business Startups Act

The Jumpstart Our Business Startups Act, or JOBS Act, is a law intended to encourage funding of small businesses in the United States by easing many of the country's securities regulations. It passed with bipartisan support, and was signed into law by President Barack Obama on April 5, 2012. Title III, also known as the CROWDFUND Act, has drawn the most public attention because it creates a way for companies to use crowdfunding to issue securities, something that was not previously permitted. Title II went into effect on September 23, 2013. On October 30, 2015, the SEC adopted final rules allowing Title III equity crowdfunding. These rules went into effect on May 16, 2016; this section of the law is known as Regulation CF. Other titles of the Act had previously become effective in the years since the Act's passage. Legislative history Following a decrease in small business activity in the wake of the 2008 financial crisis, Congress considered a number of solutions to help spur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Internet Age

The Internet Age refers to the time period since the Internet became widely available to the public for general use, and the resulting impacts on and fundamental changes in the nature of global communication and access to information. The beginning of the modern notion of and current form of the Internet is considered by some to have occurred in late 1990 (though the internet was officially created a few years prior) when Tim Berners-Lee created what is now referred to as HTML code, and created what is generally considered to be the first genuine web page, which marks the origin of the World Wide Web. History Origins The origins of the Internet date back to the development of packet switching and research commissioned by the United States Department of Defense in the 1960s to enable time-sharing of computers. The primary precursor network, the ARPANET, initially served as a backbone for interconnection of regional academic and military networks in the 1970s. The funding of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dot-com Bubble

The dot-com bubble (dot-com boom, tech bubble, or the Internet bubble) was a stock market bubble in the late 1990s, a period of massive growth in the use and adoption of the Internet. Between 1995 and its peak in March 2000, the Nasdaq Composite stock market index rose 400%, only to fall 78% from its peak by October 2002, giving up all its gains during the bubble. During the dot-com crash, many online shopping companies, such as Pets.com, Webvan, and Boo.com, as well as several communication companies, such as Worldcom, NorthPoint Communications, and Global Crossing, failed and shut down. Some companies that survived, such as Amazon, lost large portions of their market capitalization, with Cisco Systems alone losing 80% of its stock value. Background Historically, the dot-com boom can be seen as similar to a number of other technology-inspired booms of the past including railroads in the 1840s, automobiles in the early 20th century, radio in the 1920s, television in the 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |