|

Underbanked

The underbanked is a characteristic describing people or organizations who do not (or volunteer to not) have sufficient access to mainstream financial services and products typically offered by retail banks and thus often deprived of banking services such as credit cards or loans. The underbanked can be characterized by a strong reliance on non-traditional forms of finance and micro-finance often associated with disadvantaged and the poor, such as cheque cashers, loan sharks and pawnbrokers. Many people who are classified as underbanked may also have a language barrier, such as migrant workers, be unable to access banking facilities due to distance, such as the elderly, or simply feel uncomfortable using automated teller machines. The underbanked are a distinct group from the '' unbanked'', who are characterized by having no banking facilities at all. Distribution Small countries have fewer banking provisions than large countries, even allowing for the smaller size of their eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unbanked

The unbanked are adults who do not have their own bank accounts. Along with the underbanked, they may rely on alternative financial services for their financial needs, where these are available. Causes Some reasons a person might not have a bank account include: * Lack of access via a nearby bank branch or mobile phone * Minimum balance fees * Distrust of the banking system, typically due to lack of transparency regarding fees and deposit timingThe Unbanking Of America - ''Think'' interview with economist Lisa Servon * No access to government-issued ID, which is required to open a bank account The unbanked in the United States The ''unbanked'' are described by the[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Payday Lending

A payday loan (also called a payday advance, salary loan, payroll loan, small dollar loan, short term, or cash advance loan) is a short-term unsecured loan, often characterized by high interest rates. The term "payday" in payday loan refers to when a borrower writes a postdated check to the lender for the payday salary, but receives part of that payday sum in immediate cash from the lender. However, in common parlance, the concept also applies regardless of whether repayment of loans is linked to a borrower's payday. The loans are also sometimes referred to as "cash advances", though that term can also refer to cash provided against a prearranged line of credit such as a credit card. Legislation regarding payday loans varies widely between different countries, and in federal systems, between different states or provinces. To prevent usury (unreasonable and excessive rates of interest), some jurisdictions limit the annual percentage rate (APR) that any lender, including payday ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services

Financial services are the economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer-finance companies, stock brokerages, investment funds, individual asset managers, and some government-sponsored enterprises. History The term "financial services" became more prevalent in the United States partly as a result of the GrammLeachBliley Act of the late 1990s, which enabled different types of companies operating in the U.S. financial services industry at that time to merge. Companies usually have two distinct approaches to this new type of business. One approach would be a bank that simply buys an insurance company or an investment bank, keeps the original brands of the acquired firm, and adds the acquisition to its holding company simply to diversify its earnings. Outside the U.S. (e.g. Japan), non-financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automated Teller Machine

An automated teller machine (ATM) or cash machine (in British English) is an electronic telecommunications device that enables customers of financial institutions to perform financial transactions, such as cash withdrawals, deposits, funds transfers, balance inquiries or account information inquiries, at any time and without the need for direct interaction with bank staff. ATMs are known by a variety of names, including automatic teller machine (ATM) in the United States (sometimes redundantly as "ATM machine"). In Canada, the term ''automated banking machine'' (ABM) is also used, although ATM is also very commonly used in Canada, with many Canadian organizations using ATM over ABM. In British English, the terms ''cashpoint'', ''cash machine'' and ''hole in the wall'' are most widely used. Other terms include ''any time money'', ''cashline'', ''tyme machine'', ''cash dispenser'', ''cash corner'', ''bankomat'', or ''bancomat''. ATMs that are not operated by a financial i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Remittance

A remittance is a non-commercial transfer of money by a foreign worker, a member of a diaspora community, or a citizen with familial ties abroad, for household income in their home country or homeland. Money sent home by migrants competes with international aid as one of the largest financial inflows to developing countries. Workers' remittances are a significant part of international capital flows, especially with regard to labor-exporting countries. According to the World Bank, in 2018 overall global remittance grew 10% to US$689 billion, including US$528 billion to developing countries. Overall global remittance is expected to grow 3.7% to US$715 billion in 2019, including US$549 billion to developing nations. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Prepaid Debit Card

A debit card, also known as a check card or bank card is a payment card that can be used in place of cash to make purchases. The term '' plastic card'' includes the above and as an identity document. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of a purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase. Some debit cards carry a stored value with which a payment is made (prepaid card), but most relay a message to the cardholder's bank to withdraw funds from the cardholder's designated bank account. In some cases, the payment card number is assigned exclusively for use on the Internet and there is no physical card. This is referred to as a virtual card. In many countries, the use of debit cards has become so widespread they have overtaken checks in volume, or have entirely replaced them; in some instances, debit card ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banking Agent

A banking agent is a retail or postal outlet contracted by a financial institution or a mobile network operator to process clients’ transactions. Rather than a branch teller, it is the owner or an employee of the retail outlet who conducts the transaction and lets clients deposit, withdraw, transfer funds, pay their bills, inquire about an account balance, or receive government benefits or a direct deposit from their employer. Banking agents can be pharmacies, supermarkets, convenience stores, lottery outlets, post offices, and more. Globally, these retailers and post offices are increasingly utilized as important distribution channels for financial institutions. The points of service range from post offices in the Outback of Australia where clients from all banks can conduct their transactions, to rural France where the bank Crédit Agricole uses corner stores to provide financial services, to small lottery outlets in Brazil at which clients can receive their social payments a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Grameen Bank

Grameen Bank ( bn, গ্রামীণ ব্যাংক) is a microfinance organisation and community development bank founded in Bangladesh. It makes small loans (known as microcredit or "grameencredit") to the impoverished without requiring collateral. Grameen Bank originated in 1976, in the work of Professor Muhammad Yunus at University of Chittagong, who launched a research project to study how to design a credit delivery system to provide banking services to the rural poor. In October 1983 the Grameen Bank was authorised by national legislation to operate as an independent bank. The bank grew significantly between 2003 and 2007. As of January 2011, the total borrowers of the bank number 8.4 million, and 97% of those are women. In 1998 the Bank's "Low-cost Housing Program" won a World Habitat Award. In 2006, the bank and its founder, Muhammad Yunus, were jointly awarded the Nobel Peace Prize. History Muhammad Yunus was inspired during the Bangladesh fami ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Microfinance

Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services. Microfinance includes microcredit, the provision of small loans to poor clients; savings account, savings and checking accounts; microinsurance; and payment systems, among other services. Microfinance services are designed to reach excluded customers, usually poorer population segments, possibly socially marginalized, or geographically more isolated, and to help them become self-sufficient.Christen, Robert Peck Christen; Rosenberg, Richard; Jayadeva, Veena. ''Financial institutions with a double-bottom line: Implications for the future of microfinance''. CGAP, Occasional Papers series, July 2004, pp. 2–3. ID Ghana is an example of a microfinance institution. Microfinance initially had a limited definition: the provision of microloans to poor entrepreneurs and small businesses lacking access to credit. The two main mechanism ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

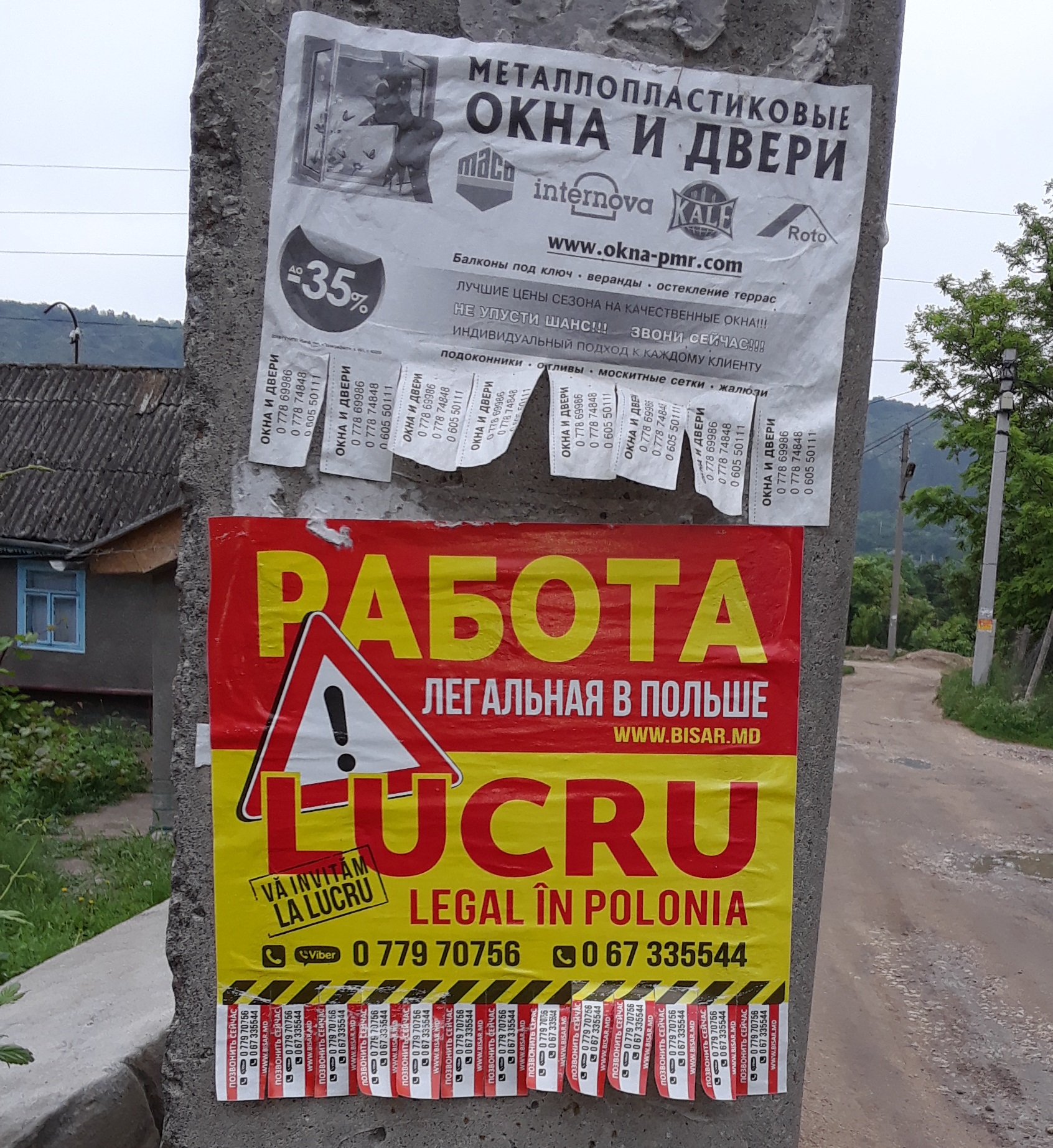

Migrant Worker

A migrant worker is a person who migrates within a home country or outside it to pursue work. Migrant workers usually do not have the intention to stay permanently in the country or region in which they work. Migrant workers who work outside their home country are also called foreign workers. They may also be called expatriates or guest workers, especially when they have been sent for or invited to work in the host country before leaving the home country. The International Labour Organization estimated in 2019 that there were 169 million international migrants worldwide. Some countries have millions of migrant workers. Some migrant workers are undocumented immigrants or slaves. Worldwide An estimated 14 million foreign workers live in the United States, which draws most of its immigrants from Mexico, including 4 or 5 million undocumented workers. It is estimated that around 5 million foreign workers live in Northwestern Europe, half-a-million in Japan, and 5 million in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Retail Banking

Retail banking, also known as consumer banking or personal banking, is the provision of services by a bank to the general public, rather than to companies, corporations or other banks, which are often described as wholesale banking. Banking services which are regarded as retail include provision of savings and transactional accounts, mortgages, personal loans, debit cards, and credit cards. Retail banking is also distinguished from investment banking or commercial banking. It may also refer to a division or department of a bank which deals with individual customers. In the U.S., the term commercial bank is used for a ''normal'' bank to distinguish it from an investment bank. After the Great Depression, the Glass–Steagall Act restricted normal banks to banking activities, and investment banks to capital market activities. That distinction was repealed in the 1990s. Commercial bank can also refer to a bank or a division of a bank that deals mostly with deposits and loans fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Language Barrier

A language barrier is a figurative phrase used primarily to refer to linguistic barriers to communication, i.e. the difficulties in communication experienced by people or groups originally speaking different languages, or even dialects in some cases. Language barrier impedes the formation of interpersonal relationships and can cause misunderstandings that lead to conflict, frustration, offense, violence, hurt feelings, and wasting time, effort, money, and human life. Communication Typically, little communication between speakers of different languages occurs unless one or both parties learn a new language, which requires an investment of much time and effort. People travelling abroad often encounter a language barrier. The people who come to a new country at an adult age, when language learning is a cumbersome process, can have particular difficulty "overcoming the language barrier". Similar difficulties occur at multinational meetings, where interpreting services can be co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)

.jpg)