|

Ulcer Index

The ulcer index is a stock market risk measure or technical analysis indicator devised by Peter Martin in 1987, and published by him and Byron McCann in their 1989 book ''The Investors Guide to Fidelity Funds''. It is a measure of downwards volatility, the amount of drawdown or retracement over a period. Other volatility measures like standard deviation treat up and down movement equally, but most market traders are long and so welcome upward movement in prices, it is the downside that causes stress and the stomach ulcers that the index's name suggests. (The name pre-dates the discovery that most gastric ulcers are caused by a bacterium rather than stress.) The term ''ulcer index'' has also been used (later) by Steve Shellans, editor and publisher of MoniResearch Newsletter for a different calculation, also based on the ulcer-causing potential of drawdowns. Shellans' index is not described in this article. Calculation The index is based on a given past period of N days. Wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of squ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deviation

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean (also called the expected value) of the set, while a high standard deviation indicates that the values are spread out over a wider range. Standard deviation may be abbreviated SD, and is most commonly represented in mathematical texts and equations by the lower case Greek letter σ (sigma), for the population standard deviation, or the Latin letter '' s'', for the sample standard deviation. The standard deviation of a random variable, sample, statistical population, data set, or probability distribution is the square root of its variance. It is algebraically simpler, though in practice less robust, than the average absolute deviation. A useful property of the standard deviation is that, unlike the variance, it is expressed in the same unit as the data. The standard deviation of a popu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long (finance)

In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. The holder of the position has the expectation that the financial instrument will increase in value. This is known as a bullish position. Security In terms of a security, such as a stock or a bond, or equivalently ''to be long'' in a security, means the holder of the position owns the security, on the expectation that the security will increase in value, and will profit if the price of the security goes up. ''Going long'' a security is the more conventional practice of investing. Future Going long in a future means the holder of the position is obliged to buy the underlying instrument at the contract price at expiry. The holder of the position will profit if the price of the underlying instrument goes up, as the price he will pay will be less than the market price. Option An options investor goes long in an underlying investment (in technical j ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stress (medicine)

Stress, either physiological, biological or psychological, is an organism's response to a stressor such as an environmental condition. Stress is the body's method of reacting to a condition such as a threat, challenge or physical and psychological barrier. There are two hormones that an individual produces during a stressful situation, these are well known as adrenaline and cortisol. There are two kinds of stress hormone levels. Resting (basal) cortisol levels are normal everyday quantities that are essential for standard functioning. Reactive cortisol levels are increases in cortisol in response to stressors. Stimuli that alter an organism's environment are responded to by multiple systems in the body. In humans and most mammals, the autonomic nervous system and hypothalamic-pituitary-adrenal (HPA) axis are the two major systems that respond to stress. The sympathoadrenal medullary (SAM) axis may activate the fight-or-flight response through the sympathetic nervous system, w ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

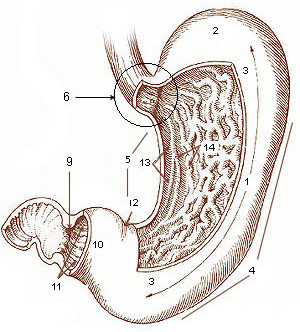

Stomach Ulcer

The stomach is a muscular, hollow organ in the gastrointestinal tract of humans and many other animals, including several invertebrates. The stomach has a dilated structure and functions as a vital organ in the digestive system. The stomach is involved in the gastric phase of digestion, following chewing. It performs a chemical breakdown by means of enzymes and hydrochloric acid. In humans and many other animals, the stomach is located between the oesophagus and the small intestine. The stomach secretes digestive enzymes and gastric acid to aid in food digestion. The pyloric sphincter controls the passage of partially digested food (chyme) from the stomach into the duodenum, where peristalsis takes over to move this through the rest of intestines. Structure In the human digestive system, the stomach lies between the oesophagus and the duodenum (the first part of the small intestine). It is in the left upper quadrant of the abdominal cavity. The top of the stomach lies against ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

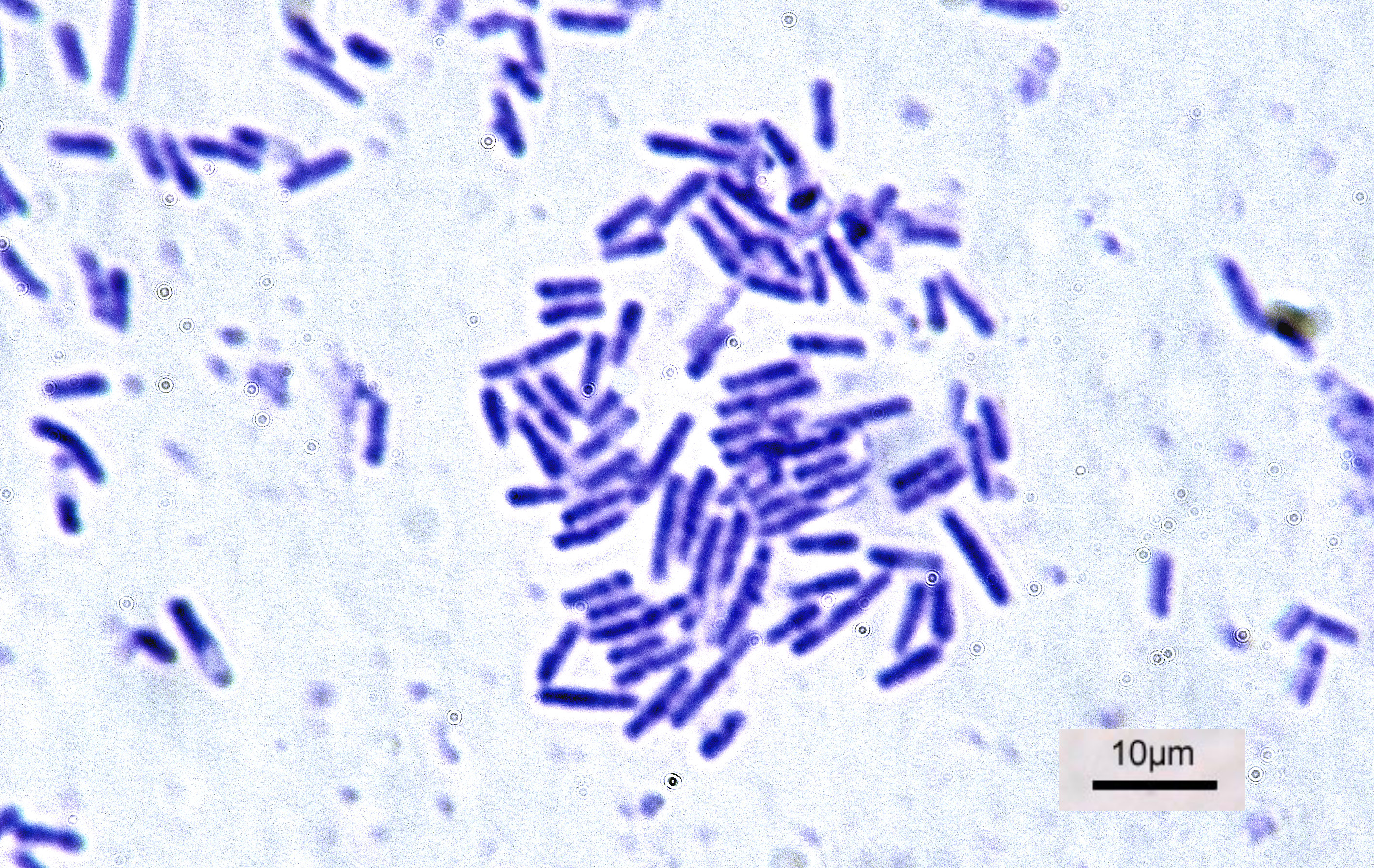

Bacterium

Bacteria (; singular: bacterium) are ubiquitous, mostly free-living organisms often consisting of one biological cell. They constitute a large domain of prokaryotic microorganisms. Typically a few micrometres in length, bacteria were among the first life forms to appear on Earth, and are present in most of its habitats. Bacteria inhabit soil, water, acidic hot springs, radioactive waste, and the deep biosphere of Earth's crust. Bacteria are vital in many stages of the nutrient cycle by recycling nutrients such as the fixation of nitrogen from the atmosphere. The nutrient cycle includes the decomposition of dead bodies; bacteria are responsible for the putrefaction stage in this process. In the biological communities surrounding hydrothermal vents and cold seeps, extremophile bacteria provide the nutrients needed to sustain life by converting dissolved compounds, such as hydrogen sulphide and methane, to energy. Bacteria also live in symbiotic and parasitic relationshi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quadratic Mean

In mathematics and its applications, the root mean square of a set of numbers x_i (abbreviated as RMS, or rms and denoted in formulas as either x_\mathrm or \mathrm_x) is defined as the square root of the mean square (the arithmetic mean of the squares) of the set. The RMS is also known as the quadratic mean (denoted M_2) and is a particular case of the generalized mean. The RMS of a continuously varying function (denoted f_\mathrm) can be defined in terms of an integral of the squares of the instantaneous values during a cycle. For alternating electric current, RMS is equal to the value of the constant direct current that would produce the same power dissipation in a resistive load. In estimation theory, the root-mean-square deviation of an estimator is a measure of the imperfection of the fit of the estimator to the data. Definition The RMS value of a set of values (or a continuous-time waveform) is the square root of the arithmetic mean of the squares of the values, or t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Root Mean Square

In mathematics and its applications, the root mean square of a set of numbers x_i (abbreviated as RMS, or rms and denoted in formulas as either x_\mathrm or \mathrm_x) is defined as the square root of the mean square (the arithmetic mean of the squares) of the set. The RMS is also known as the quadratic mean (denoted M_2) and is a particular case of the generalized mean. The RMS of a continuously varying function (denoted f_\mathrm) can be defined in terms of an integral of the squares of the instantaneous values during a cycle. For alternating electric current, RMS is equal to the value of the constant direct current that would produce the same power dissipation in a resistive load. In estimation theory, the root-mean-square deviation of an estimator is a measure of the imperfection of the fit of the estimator to the data. Definition The RMS value of a set of values (or a continuous-time waveform) is the square root of the arithmetic mean of the squares of the values, or th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sharpe Ratio

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk. It is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment returns. It represents the additional amount of return that an investor receives per unit of increase in risk. It was named after William F. Sharpe, who developed it in 1966. Definition Since its revision by the original author, William Sharpe, in 1994, the '' ex-ante'' Sharpe ratio is defined as: : S_a = \frac = \frac, where R_a is the asset return, R_b is the risk-free return (such as a U.S. Treasury security). E_a-R_b/math> is the expected value of the excess of the asset return over the benchmark return, and is the standard deviation of the asset excess return. The ''ex-post' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hindenburg Omen

The Hindenburg Omen was a proposed technical analysis pattern, named after the Hindenburg disaster of May 6, 1937. It was created bJim Miekka who believed that it predicted stock market crashes. History The theory is largely based on Norman G. Fosback's High Low Logic Index (HLLI). The value of the HLLI is the lesser of the NYSE new highs or new lows divided by the number of NYSE issues traded, smoothed by an appropriate exponential moving average. The theory itself was promoted by Jim Miekka,.Morris, Gregory (2005). ''The Complete Guide to Market Breadth Indicators: How to Analyze and Evaluate Market Direction and Strength'', p. 219. McGraw-Hill. . Mechanics The pattern functions on a combination of technical factors that attempt to measure the health of the NYSE, and by extension, the stock market as a whole. The goal of the indicator is to signal increased probability of a stock market crash. The rationale is that under "normal conditions" a substantial number of stocks may ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Wiley & Sons

John Wiley & Sons, Inc., commonly known as Wiley (), is an American multinational publishing company founded in 1807 that focuses on academic publishing and instructional materials. The company produces books, journals, and encyclopedias, in print and electronically, as well as online products and services, training materials, and educational materials for undergraduate, graduate, and continuing education students. History The company was established in 1807 when Charles Wiley opened a print shop in Manhattan. The company was the publisher of 19th century American literary figures like James Fenimore Cooper, Washington Irving, Herman Melville, and Edgar Allan Poe, as well as of legal, religious, and other non-fiction titles. The firm took its current name in 1865. Wiley later shifted its focus to scientific, technical, and engineering subject areas, abandoning its literary interests. Wiley's son John (born in Flatbush, New York, October 4, 1808; died in East Orange, New Je ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |