|

Third Market

In finance, third market is the trading of exchange-listed securities in the over-the-counter (OTC) market. These trades allow institutional investors to trade blocks of securities directly, rather than through an exchange, providing liquidity and anonymity to buyers. Third market trading was pioneered in the 1960s by firms such as Jefferies & Company although today there are a number of brokerage firms focused on third market trading, and more recently dark pools. New York Times, August 25, 2001 See also * * |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Exchange

A stock exchange, securities exchange, or bourse is an exchange where stockbrokers and traders can buy and sell securities, such as shares of stock, bonds and other financial instruments. Stock exchanges may also provide facilities for the issue and redemption of such securities and instruments and capital events including the payment of income and dividends. Securities traded on a stock exchange include stock issued by listed companies, unit trusts, derivatives, pooled investment products and bonds. Stock exchanges often function as "continuous auction" markets with buyers and sellers consummating transactions via open outcry at a central location such as the floor of the exchange or by using an electronic trading platform. To be able to trade a security on a certain stock exchange, the security must be listed there. Usually, there is a central location for record keeping, but trade is increasingly less linked to a physical place as modern markets use electronic communic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securities

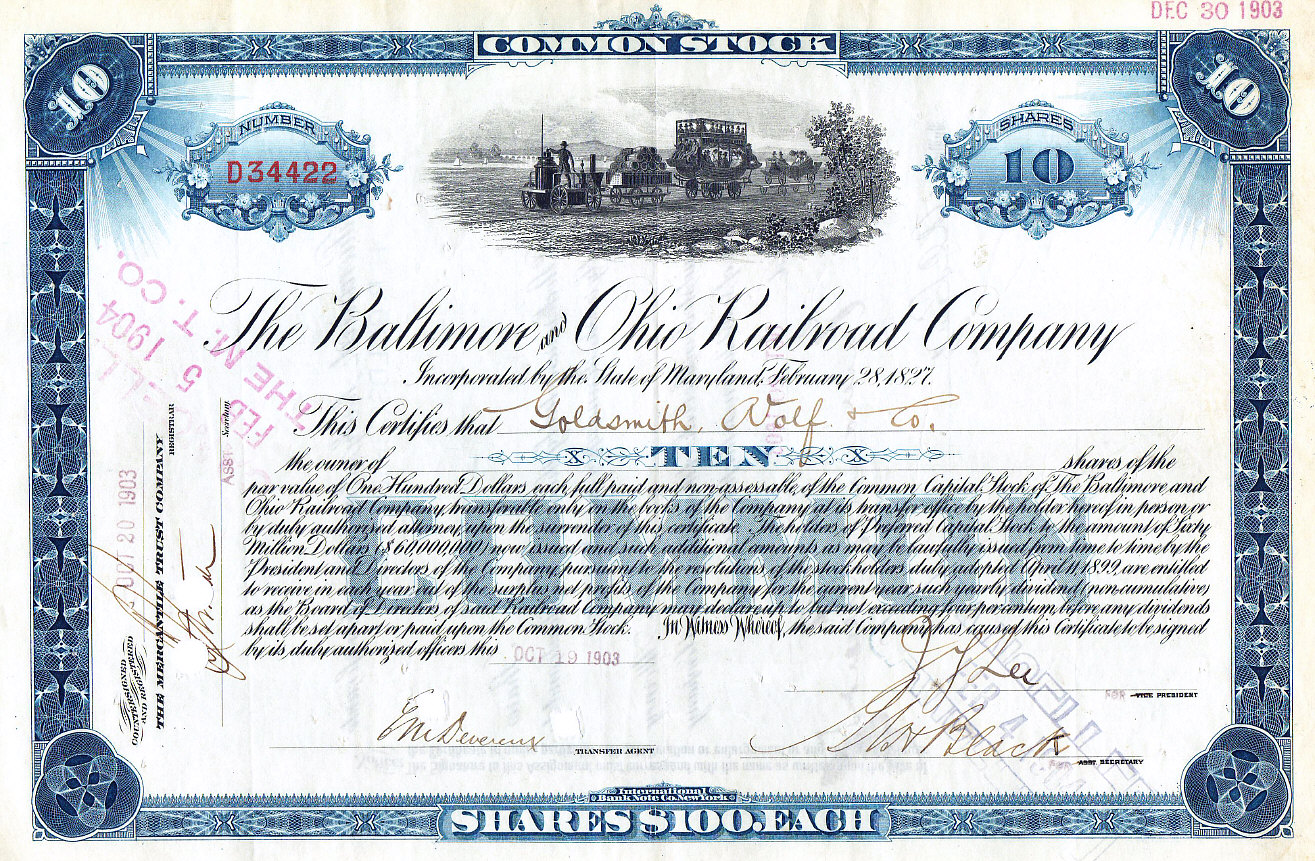

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Over-the-counter (finance)

Over-the-counter (OTC) or off-exchange trading or pink sheet trading is done directly between two parties, without the supervision of an exchange (organized market), exchange. It is contrasted with exchange trading, which occurs via exchanges. A stock exchange has the benefit of facilitating liquidity, providing transparency, and maintaining the current market price. In an OTC trade, the price is not necessarily publicly disclosed. OTC trading, as well as exchange trading, occurs with commodities, financial instruments (including stocks), and derivative (finance), derivatives of such products. Products traded traditional stock exchanges, and other regulated bourse platforms, must be well standardized. This means that exchanged deliverables match a narrow range of quantity, quality, and identity which is defined by the exchange and identical to all transactions of that product. This is necessary for there to be transparency in stock exchange-based equities trading. The OTC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Institutional Investors

An institutional investor is an entity which pools money to purchase securities, real property, and other investment assets or originate loans. Institutional investors include commercial banks, central banks, credit unions, government-linked companies, insurers, pension funds, sovereign wealth funds, charities, hedge funds, REITs, investment advisors, endowments, and mutual funds. Operating companies which invest excess capital in these types of assets may also be included in the term. Activist institutional investors may also influence corporate governance by exercising voting rights in their investments. In 2019, the world's top 500 asset managers collectively managed $104.4 trillion in Assets under Management (AuM). Although institutional investors appear to be more sophisticated than retail investors, it remains unclear if professional active investment managers can reliably enhance risk-adjusted returns by an amount that exceeds fees and expenses of investment management, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jefferies & Company

Jefferies Group LLC is an American multinational independent investment bank and financial services company that is headquartered in New York City. The firm provides clients with capital markets and financial advisory services, institutional brokerage, securities research, and asset management. This includes mergers and acquisitions, restructuring, and other financial advisory services. The Capital Markets segment also includes its securities trading (including the results of its indirectly partially owned subsidiary, Jefferies High Yield Trading, LLC) and investment banking activities. On November 12, 2012, Jefferies announced its merger with Leucadia National Corporation, its largest shareholder. At that time, Leucadia common shares were trading at $21.14 per share. As of December 31, 2015, Leucadia shares were trading at $17.39 per share. Jefferies remains independent and is the largest operating company within the Jefferies Financial Group, as Leucadia was renamed in May 2018 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dark Pool

In finance, a dark pool (also black pool) is a private forum (alternative trading system or ATS) for trading securities, derivatives, and other financial instruments."The New Financial Industry" (March 30, 2014). 65 ''Alabama Law Review'' 567 (2014); Temple University Legal Studies Research Paper No. 2014-11; via SSRN. Liquidity on these markets is called dark pool liquidity. The bulk of dark pool trades represent large trades by s that are offered away from public ex ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Primary Market

:''"Primary market" may also refer to a market in art valuation.'' The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proceeds. A primary market means the market for new issues of securities, as distinguished from the secondary market, where previously issued securities are bought and sold. "A market is primary if the proceeds of sales go to the issuer of the securities sold." Buyers buy securities that were not previously traded. Concept In a primary market, companies, governments, or public sector institutions can raise funds through bond issues, and corporations can raise capital through the sale of new stock through an initial public offering (IPO). This is often done through an investment bank or underwriter or finance syndicate of securities dealers. The process of selling new shares to buyers is called underwriting. Dealers earn a commission that i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Secondary Market

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the security by the issuer to a purchaser, who pays proceeds to the issuer, is the primary market. All sales after the initial sale of the security are sales in the secondary market. Whereas the term primary market refers to the market for new issues of securities, and " market is primary if the proceeds of sales go to the issuer of the securities sold," the secondary market in contrast is the market created by the later trading of such securities. With primary issuances of securities or financial instruments (the primary market), often an underwriter purchases these securities directly from issuers, such as corporations issuing shares in an IPO or private placement. Then the underwriter re-sells the securities to other buyers, in what is r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fourth Market

Fourth market trading is direct institution-to-institution trading without using the service of broker-dealers, thus avoiding both commissions, and the bid–ask spread. Trades are usually done in block trade, blocks. It is impossible to estimate the volume of fourth market activity because trades are not subject to reporting requirements. Studies have suggested that several million shares are traded per day. See also * Primary market * Secondary market * Third market * Dark pool References Financial markets {{Econ-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity Secondary Market

In finance, the private-equity secondary market (also often called private-equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private-equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private-equity funds as well as hedge funds can be more complex and labor-intensive. Sellers of private-equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private-equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including "pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets". For the vast majority of private-equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OTC Markets Group

OTC Markets Group (previously known as Pink Sheets) is an American financial market providing price and liquidity information for almost 10,000 over-the-counter (OTC) securities. The group has its headquarters in New York City. OTC-traded securities are organized into three markets to inform investors of opportunities and risks: OTCQX, OTCQB and Pink. History The company was first established in 1913 as the National Quotation Bureau (NQB). For decades, the NQB reported quotations for both stocks and bonds, publishing the quotations in the paper-based Pink Sheets and Yellow Sheets respectively. The publications were named for the color of paper on which they were printed. NQB was owned by CCH from 1963 to 1993. In September 1999, the NQB introduced the real-time Electronic Quotation Service. The National Quotation Bureau changed its name to Pink Sheets LLC in 2000 and subsequently to Pink OTC Markets in 2008. The company eventually changed to its current name, OTC Markets G ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)