|

Tax Uncertainty

Tax uncertainty is the term for the economic risk that results when future taxes and tax rates are undetermined. Similar to policy uncertainty, tax uncertainty can impact both individuals and businesses and has been shown in some studies to slow rates of economic growth. In the United States Temporary tax measures adopted in the 2000s, commonly referred to as Bush tax cuts, though extended in 2011, were scheduled to expire at the end of 2012. The uncertainty surrounding changes to tax rates, as well as the availability of certain tax deductions and credits, led to many businesses holding off on hiring and reducing spending. Honeywell CEO David Cote cited tax uncertainty as the reason why Honeywell has replaced only one quarter of departing employees in 2012 saying, "The last thing you want is to hire a lot of people and then have to lay them off." According to a report published by the Stanford Institute for Economic Policy Research financial and tax uncertainty played a signific ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. The international standard definition of risk for common understanding in different applications is “effect of uncertainty on objectives”. The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, environment, finance, information technology, health, insurance, safety, security etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and generic guidelines on managing risks faced by organizations. Definitions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Rate

In a tax system, the tax rate is the ratio (usually expressed as a percentage) at which a business or person is taxed. There are several methods used to present a tax rate: statutory, average, marginal, and effective. These rates can also be presented using different definitions applied to a tax base: inclusive and exclusive. Statutory A statutory tax rate is the legally imposed rate. An income tax could have multiple statutory rates for different income levels, where a sales tax may have a flat statutory rate. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate. Average An average tax rate is the ratio of the total amount of taxes paid to the total tax base (taxable income or spending), expressed as a percentage. * Let t be the total tax liability. * Let i be the total tax base. ::= \frac. In a proportional tax, the tax rate is fixed and the average tax rate equals this tax rate. In case of tax brackets, commonly used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Policy Uncertainty

Policy uncertainty (also called regime uncertainty) is a class of economic risk where the future path of government policy is uncertain, raising risk premia and leading businesses and individuals to delay spending and investment until this uncertainty has been resolved. Policy uncertainty may refer to uncertainty about monetary or fiscal policy, the tax or regulatory regime, or uncertainty over electoral outcomes that will influence political leadership. The Great Recession During the Great Recession of the late 2000s and the years following it, many academics, policymakers, and business leaders have asserted that levels of policy uncertainty had risen dramatically and had contributed to the depth of the recession and the weakness of the following recovery. United States Much of the policy uncertainty in the United States has revolved around fiscal policy as well as uncertainty over the tax code. This is best exemplified by partisan fights in the United States Congress over the Fi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uncertainty

Uncertainty refers to epistemic situations involving imperfect or unknown information. It applies to predictions of future events, to physical measurements that are already made, or to the unknown. Uncertainty arises in partially observable or stochastic environments, as well as due to ignorance, indolence, or both. It arises in any number of fields, including insurance, philosophy, physics, statistics, economics, finance, medicine, psychology, sociology, engineering, metrology, meteorology, ecology and information science. Concepts Although the terms are used in various ways among the general public, many specialists in decision theory, statistics and other quantitative fields have defined uncertainty, risk, and their measurement as: Uncertainty The lack of certainty, a state of limited knowledge where it is impossible to exactly describe the existing state, a future outcome, or more than one possible outcome. ;Measurement of uncertainty: A set of possible states or outc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bush Tax Cuts

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through: * Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) * Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) * Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 * American Taxpayer Relief Act of 2012 (partial extension) While each act has its own legislative history and effect on the tax code, the JGTRRA amplified and accelerated aspects of the EGTRRA. Since 2003, the two acts have often been spoken of together, especially in terms of analyzing their effect on the U.S. economy and population and in discussing their political ramifications. Both laws were passed using controversial Congressional reconciliation (United States Congress), reconciliation procedures. The Bush tax cuts had sunset provisions that made them expire at the end o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Deduction

Tax deduction is a reduction of income that is able to be taxed and is commonly a result of expenses, particularly those incurred to produce additional income. Tax deductions are a form of tax incentives, along with exemptions and tax credits. The difference between deductions, exemptions, and credits is that deductions and exemptions both reduce taxable income, while credits reduce tax. Above and below the line Above and below the line refers to items above or below adjusted gross income, which is item 37 on the tax year 2017 1040 tax form. Tax deductions above the line lessen adjusted gross income, while deductions below the line can only lessen taxable income if the aggregate of those deductions exceeds the standard deduction, which in tax year 2018 in the U.S., for example, was $12,000 for a single taxpayer and $24,000 for married couple. Limitations Often, deductions are subject to conditions, such as being allowed only for expenses incurred that produce current benefits. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credits

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Honeywell

Honeywell International Inc. is an American publicly traded, multinational conglomerate corporation headquartered in Charlotte, North Carolina. It primarily operates in four areas of business: aerospace, building technologies, performance materials and technologies (PMT), and safety and productivity solutions (SPS). Honeywell is a Fortune 100 company, ranked 94th in 2021. In 2021 the corporation had a global workforce of approximately 99,000 employees, down from 113,000 in 2019. The current chairman and chief executive officer (CEO) is Darius Adamczyk. The corporation's current name, Honeywell International Inc., is a product of the merger of Honeywell Inc. and AlliedSignal in 1999. The corporation headquarters were consolidated with AlliedSignal's headquarters in Morristown, New Jersey; however, the combined company chose the name "Honeywell" because of the considerable brand recognition. Honeywell was a component of the Dow Jones Industrial Average index from 1999 to 200 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

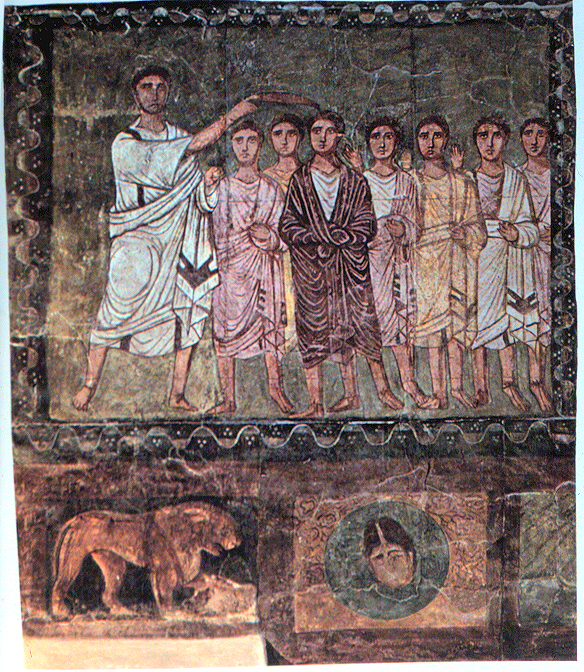

David M

David (; , "beloved one") (traditional spelling), , ''Dāwūd''; grc-koi, Δαυΐδ, Dauíd; la, Davidus, David; gez , ዳዊት, ''Dawit''; xcl, Դաւիթ, ''Dawitʿ''; cu, Давíдъ, ''Davidŭ''; possibly meaning "beloved one". was, according to the Hebrew Bible, the third king of the United Kingdom of Israel. In the Books of Samuel, he is described as a young shepherd and harpist who gains fame by slaying Goliath, a champion of the Philistines, in southern Canaan. David becomes a favourite of Saul, the first king of Israel; he also forges a notably close friendship with Jonathan, a son of Saul. However, under the paranoia that David is seeking to usurp the throne, Saul attempts to kill David, forcing the latter to go into hiding and effectively operate as a fugitive for several years. After Saul and Jonathan are both killed in battle against the Philistines, a 30-year-old David is anointed king over all of Israel and Judah. Following his rise to power, David ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stanford Institute For Economic Policy Research

The Stanford Institute for Economic Policy Research (SIEPR) is a nonpartisan economic research institution housed at Stanford University. It was founded in 1982 as a way to bring together economic scholars from different parts of the University. SIEPR's mission is to support research that informs economic policymaking while engaging future leaders and scholars. The institute shares knowledge and builds relationships among academics, government officials, the business community and the public. History George Shultz was a key player in its inception. The current director of the institute is Mark Duggan; past directors include John Shoven, Michael Boskin Michael Jay Boskin (born September 23, 1945) is the T. M. Friedman Professor of Economics and senior Fellow at Stanford University's Hoover Institution. He also is chief executive officer and president of Boskin & Co., an economic consulting com ..., Lawrence J. Lau, and James Sweeney. References External links * Stanfo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economy Of The United States

The United States is a highly developed mixed-market economy and has the world's largest nominal GDP and net wealth. It has the second-largest by purchasing power parity (PPP) behind China. It has the world's seventh-highest per capita GDP (nominal) and the eighth-highest per capita GDP (PPP) as of 2022. US share of Global economy is 15.78% in PPP terms in 2022. The United States has the most technologically powerful and innovative economy in the world. Its firms are at or near the forefront in technological advances, especially in artificial intelligence, computers, pharmaceuticals, and medical, aerospace, and military equipment. The U.S. dollar is the currency of record most used in international transactions and is the world's foremost reserve currency, backed by the nation’s massive economy, stable government, extensive natural resources, highly advanced military, its role as the reference standard for the petrodollar system, and its linked eurodollar and la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for Work (human activity), work during the reference period. Unemployment is measured by the unemployment rate, which is the number of people who are unemployed as a percentage of the labour force (the total number of people employed added to those unemployed). Unemployment can have many sources, such as the following: * new technology, technologies and inventions * the status of the economy, which can be influenced by a recession * competition caused by globalization and international trade * Policy, policies of the government * regulation and market (economics), market Unemployment and the status of the economy can be influenced by a country through, for example, fiscal policy. Furthermore, the monetary authority of a country, such as the central bank, can influ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |