|

Tariffication

Tariffication is an effort to convert all existing agricultural non-tariff barriers to trade (NTBs) into bound tariffs and to reduce these tariffs over time. A ''bound tariff'' is one which has a "ceiling" beyond which it cannot be increased. Economic issues The main economic issues that arise with tariffication stem from the nonequivalence of tariffs in NTBs in a number of scenarios. The issue analyzes nonequivalence arising from the existence of imperfect competition in importing countries, price instability in importing and exporting countries, and inefficient allocation of quantitative restrictions. It is shown that in all these cases the definition of an appropriate "equivalent tariff" to be used in tariffication is not straightforward, and that in general this equivalent tariff cannot be computed on the basis of only observed price differences between countries. Tariff-rate quotas, which are meant to be the main tool in implement tariffication according to the existing prop ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Customs Duties

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tariff

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. Besides being a source of revenue for the government, import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. ''Protective tariffs'' are among the most widely used instruments of protectionism, along with import quotas and export quotas and other non-tariff barriers to trade. Tariffs can be fixed (a constant sum per unit of imported goods or a percentage of the price) or variable (the amount varies according to the price). Taxing imports means people are less likely to buy them as they become more expensive. The intention is that they buy local products instead, boosting their country's economy. Tariffs therefore provide an incentive to develop production and replace imports with domestic products. Tariffs are meant to reduce pressure from foreign competition and reduce th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-tariff Barriers To Trade

Non-tariff barriers to trade (NTBs; also called non-tariff measures, NTMs) are trade barriers that restrict imports or exports of goods or services through mechanisms other than the simple imposition of tariffs. The Southern African Development Community (SADC) defines a non-tariff barrier as "''any obstacle to international trade that is not an import or export duty. They may take the form of import quotas, subsidies, customs delays, technical barriers, or other systems preventing or impeding trade''". According to the World Trade Organization, non-tariff barriers to trade include import licensing, rules for valuation of goods at customs, pre-shipment inspections, rules of origin ('made in'), and trade prepared investment measures. A 2019 UNCTAD report concluded that trade costs associated with non-tariff measures were more than double those of traditional tariffs. History The transition from tariffs to non-tariff barriers One of the reasons why industrialized countries have m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Department Of Agriculture (Philippines)

The Department of Agriculture (abbreviated as DA; fil, Kagawaran ng Agrikultura) is the executive department of the Philippine government responsible for the promotion of agricultural and fisheries development and growth. It has its headquarters at Elliptical Road corner Visayas Avenue, Diliman, Quezon City. The department is currently led by the secretary of agriculture, nominated by the president of the Philippines and confirmed by the Commission on Appointments. The secretary is a member of the Cabinet. The current secretary is Bongbong Marcos, who assumed office on June 30, 2022 in concurrent capacity as President. History The Department of Agriculture had its spiritual beginnings when President Emilio Aguinaldo of the Revolutionary Government of the Philippines established the Department of Agriculture and Manufacturing on June 23, 1898. Jose Alejandrino was appointed the first secretary. American colonial government In 1901, under the American colonial government, prior ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Food Authority (Philippines)

The Philippines' National Food Authority ( fil, Pambansang Pangasiwaan ng Pagkain, abbreviated as NFA), is an agency of the Philippine government under the Department of Agriculture responsible for ensuring the food security of the Philippines and the stability of supply and price of rice, the Philippines' staple grain. History The National Food Authority was created through Presidential Decree No. 4 dated September 26, 1972, under the name National Grains Authority (NGA) with the mission of promoting the integrated growth and development of the grains industry covering rice, corn, feed grains and other grains like sorghum, mung beans, and peanuts. This decree abolished two agencies, namely, the Rice and Corn Board (RICOB) and the Rice and Corn Administration (RCA) and absorbed their respective functions into the NFA. The former was then regulating the rice and corn retail trade and was tasked to nationalize it within a target date. The latter was marketed and distributed gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IBON Foundation

The IBON Foundation is a non-profit research, education and information-development institution with programs in research, education and advocacy based in the Philippines. It provides socioeconomic research and analysis on people's issues to various sectors (primarily grassroots organizations). It aims to contribute to people's empowerment through education and advocacy support. The foundation is also engaged in international solidarity work. History 1970s The early 1970s were characterized by information control and civil-rights violations after the Marcos dictatorship declared martial law in the Philippines. Resistance to state attacks on people's rights intensified, and there was a need for information on socioeconomic issues. The IBON Foundation was founded in 1978 by Sister Mary Soledad Perpiñan (editor and chief coordinator), Sally Bulatao (chief researcher and finance officer) and Antonio Tujan (former political detainee, graphic artist and circulation manager), six years ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Infant Industry Argument

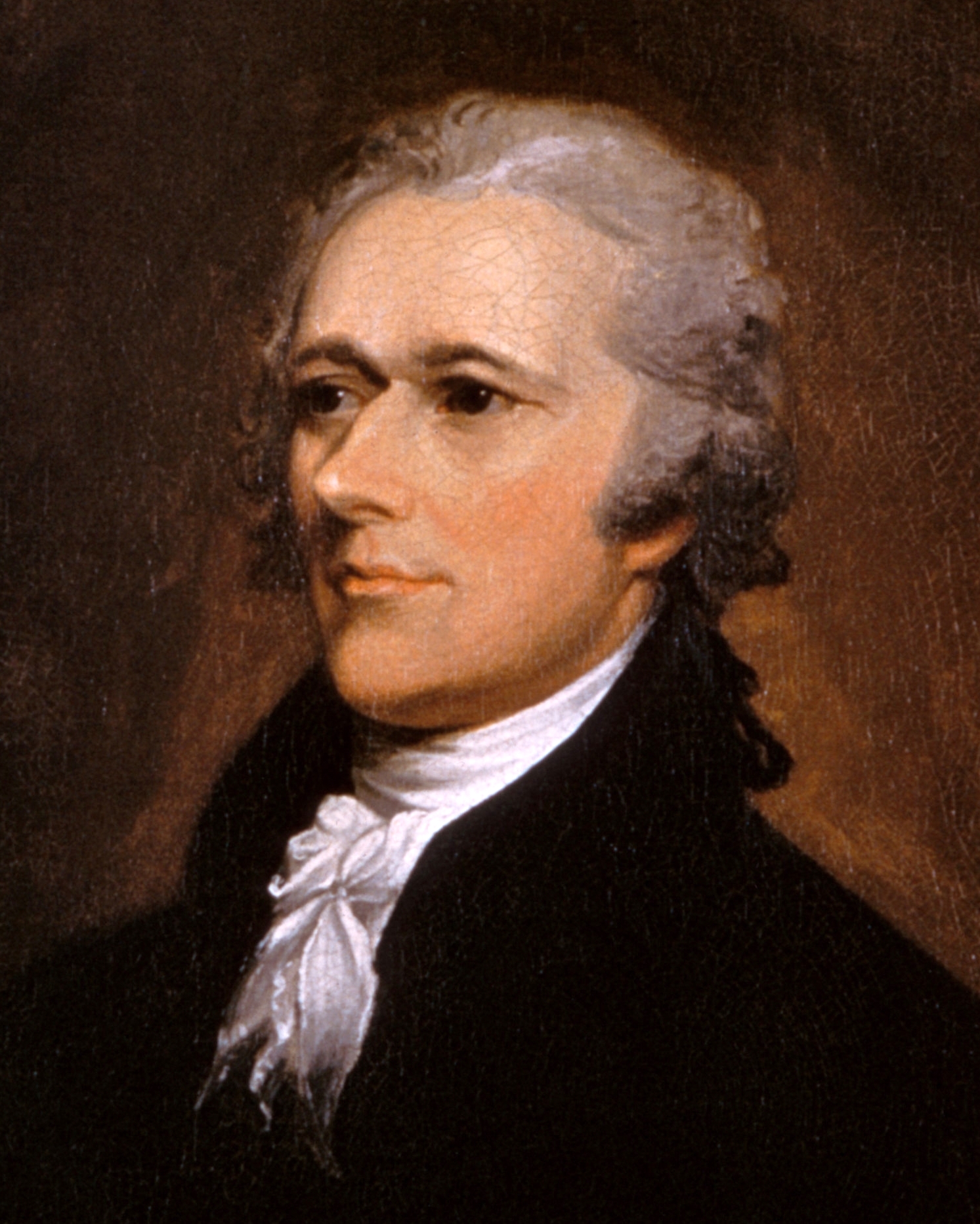

The infant industry argument is an economic rationale for trade protectionism. The core of the argument is that nascent industries often do not have the economies of scale that their older competitors from other countries may have, and thus need to be protected until they can attain similar economies of scale. The logic underpinning the argument is that trade protectionism is costly in the short run but leads to long-term benefits. Early articulations The argument was first fully articulated by the first United States Secretary of the Treasury Alexander Hamilton in his 1790 Report on Manufactures. Hamilton professed that developing an industrial base in a country was impossible without protectionism because import duties are necessary to shelter domestic "infant industries" until they could achieve economies of scale. The argument was systematically developed by American political economist Daniel Raymond, and was later picked up by economist Friedrich List in his 1841 work ''T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)