|

Trusts

A trust is a legal relationship in which the owner of property, or any transferable right, gives it to another to manage and use solely for the benefit of a designated person. In the English common law, the party who entrusts the property is known as the " settlor", the party to whom it is entrusted is known as the "trustee", the party for whose benefit the property is entrusted is known as the "beneficiary", and the entrusted property is known as the "corpus" or "trust property". A '' testamentary trust'' is an irrevocable trust established and funded pursuant to the terms of a deceased person's will. An inter vivos trust is a trust created during the settlor's life. The trustee is the legal owner of the assets held in trust on behalf of the trust and its beneficiaries. The beneficiaries are equitable owners of the trust property. Trustees have a fiduciary duty to manage the trust for the benefit of the equitable owners. Trustees must provide regular accountings of trust inc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Testamentary Trust

A testamentary trust (sometimes referred to as a will trust or trust under will) is a trust which arises upon the death of the testator, and which is specified in their will. A will may contain more than one testamentary trust, and may address all or any portion of the estate. A testamentary trust is an irrevocable trust established and funded pursuant to the terms of a deceased person's will. Testamentary trusts are distinguished from ''inter vivos'' trusts, which are created during the settlor's lifetime. There are four parties involved in a testamentary trust: *The person who specifies that the trust be created, usually as a part of their will, but it may be set up in abeyance during the person's lifetime. This person may be called the ''grantor'' or ''trustor'', but is usually referred to as the ''settlor''. *The ''trustee'', whose duty is to carry out the terms of the will. They may be named in the will, or may be appointed by the probate court that handles the will. *Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Settlor

In trust law, a settlor is a person who settles (i.e. gives into trust) their property for the benefit of the beneficiary. In some legal systems, a settlor is also referred to as a trustor, or occasionally, a grantor or donor. Where the trust is a testamentary trust, the settlor is usually referred to as the ''testator''. The settlor may also be the trustee of the trust (where he declares that he holds his own property on trusts) or a third party may be the trustee (where he transfers the property to the trustee on trusts). In the common law of England and Wales, it has been held, controversially, that where a trustee declares an intention to transfer trust property to a trust of which he is one of several trustees, that is a valid settlement notwithstanding the property is not vested in the other trustees. Capacity to be a trustee is generally co-extensive with the ability to hold and dispose of a legal or beneficial interest in property. In practice, special considerations aris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uniform Trust Code

The Uniform Trust Code is a model law in the United States created by the Uniform Law Commission, which, although not binding, is influential in the states and used by many as a model law. As of October 2022, 36 states and jurisdictions have enacted a version of the Uniform Trust Code (Alabama, Arizona, Arkansas, Colorado, Connecticut, District of Columbia, Florida, Hawaii, Illinois, Kansas, Kentucky, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, South Carolina, Tennessee, Utah, Vermont, Virginia, West Virginia, Wisconsin, and Wyoming). As of October 2022, legislation has been proposed in New York to adopt the UTC. Background The increased use of trusts in estate planning during the latter half of the 20th century highlighted inconsistencies in how trust law was governed across the United States. In 1993, recognizing the need for a more ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trustee

Trustee (or the holding of a trusteeship) is a legal term which, in its broadest sense, refers to anyone in a position of trust and so can refer to any individual who holds property, authority, or a position of trust or responsibility for the benefit of another. A trustee can also be a person who is allowed to do certain tasks but not able to gain income.''Black's Law Dictionary, Fifth Edition'' (1979), p. 1357, . Although in the strictest sense of the term a trustee is the holder of property on behalf of a beneficiary, the more expansive sense encompasses persons who serve, for example, on the board of trustees of an institution that operates for a charity, for the benefit of the general public, or a person in the local government. A trust can be set up either to benefit particular persons or for any charitable purposes (but not generally for non-charitable purposes): typical examples are a will trust for the testator's children and family, a pension trust (to confer bene ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fiduciary Duties

A fiduciary is a person who holds a legal or ethical relationship of trust with one or more other parties (legal person or group of persons). Typically, a fiduciary prudently takes care of money or other assets for another person. One party, for example, a corporate trust company or the trust department of a bank, acts in a fiduciary capacity to another party, who, for example, has entrusted funds to the fiduciary for safekeeping or investment. Likewise, financial advisers, financial planners, and asset managers, including managers of pension plans, endowments, and other tax-exempt assets, are considered fiduciaries under applicable statutes and laws. In a fiduciary relationship, one person, in a position of vulnerability, justifiably vests confidence, good faith, reliance, and trust in another whose aid, advice, or protection is sought in some matter... In such a relation, good conscience requires the fiduciary to act at all times for the sole benefit and interest of the one who ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conflict Of Interest

A conflict of interest (COI) is a situation in which a person or organization is involved in multiple wikt:interest#Noun, interests, financial or otherwise, and serving one interest could involve working against another. Typically, this relates to situations in which the personal interest of an individual or organization might adversely affect a duty owed to decision-making, make decisions for the benefit of a third party. An "interest" is a commitment, obligation, duty or goal associated with a specific social role or practice. By definition, a "conflict of interest" occurs if, within a particular decision-making context, an individual is subject to two coexisting interests that are in direct conflict with each other ("competing interests"). This is important because under these circumstances, the decision-making process can be disrupted or compromised, affecting the integrity or reliability of the outcomes. Typically, a conflict of interest arises when an individual occupies tw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

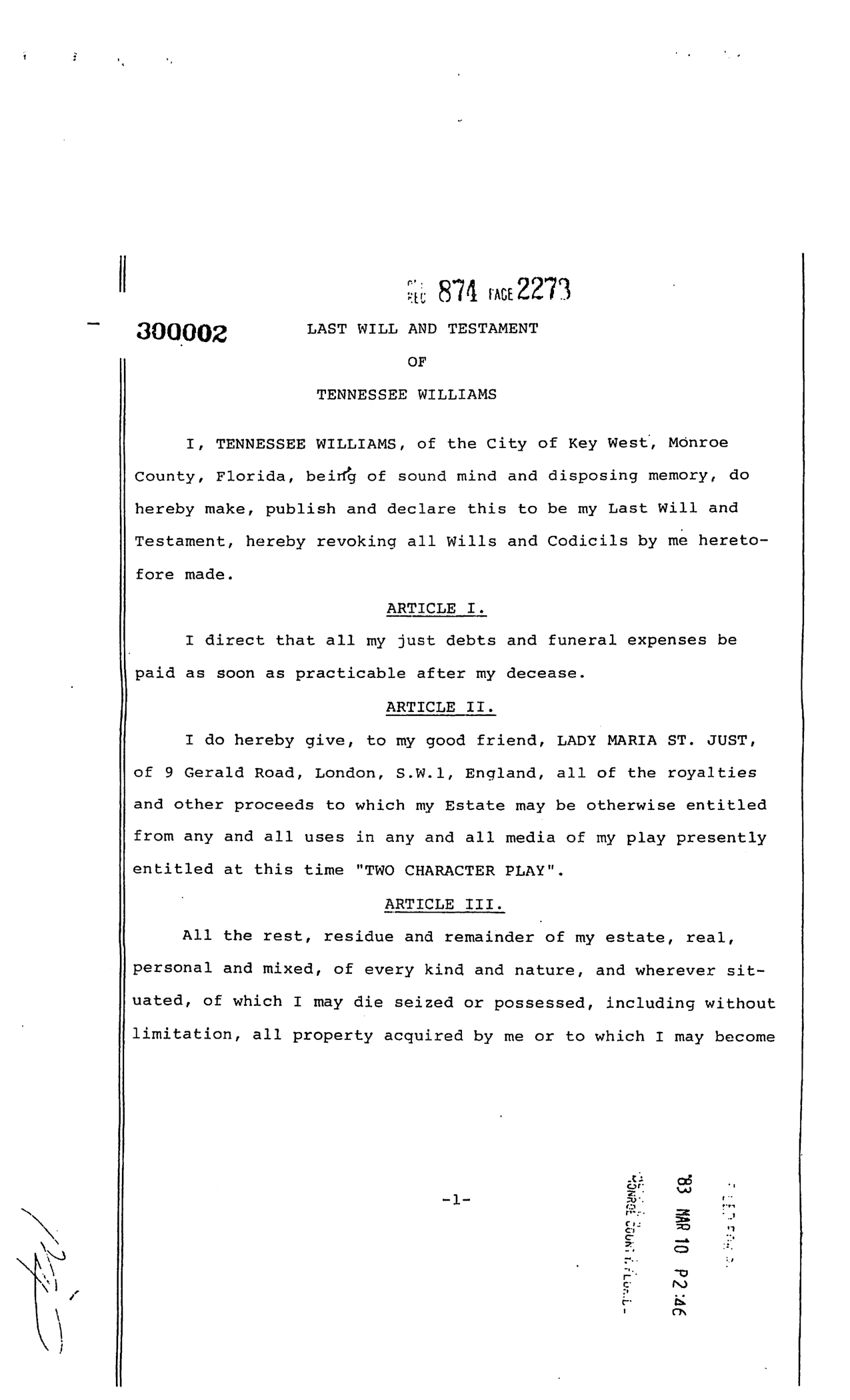

Will And Testament

A will and testament is a legal document that expresses a person's (testator) wishes as to how their property (estate (law), estate) is to be distributed after their death and as to which person (executor) is to manage the property until its final distribution. For the distribution (devolution) of property not determined by a will, see inheritance and intestacy. Though it has been thought a "will" historically applied only to real property, while "testament" applied only to personal property (thus giving rise to the popular title of the document as "last will and testament"), records show the terms have been used interchangeably. Thus, the word "will" validly applies to both personal and real property. A will may also create a testamentary Trust (property), trust that is effective only after the death of the testator. History Throughout most of the world, the disposition of a dead person's estate has been a matter of social custom. According to Plutarch, the written will was i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many businesses pay little or no tax, and some experience a backlash (sociology), backlash when their tax avoidance becomes known to the public. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection. "T ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Will (law)

A will and testament is a legal document that expresses a person's (testator) wishes as to how their property ( estate) is to be distributed after their death and as to which person ( executor) is to manage the property until its final distribution. For the distribution (devolution) of property not determined by a will, see inheritance and intestacy. Though it has been thought a "will" historically applied only to real property, while "testament" applied only to personal property (thus giving rise to the popular title of the document as "last will and testament"), records show the terms have been used interchangeably. Thus, the word "will" validly applies to both personal and real property. A will may also create a testamentary trust that is effective only after the death of the testator. History Throughout most of the world, the disposition of a dead person's estate has been a matter of social custom. According to Plutarch, the written will was invented by Solon. Originally ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fideicommissum

A is a type of bequest in which the beneficiary is encumbered to convey parts of the decedent's estate to someone else. For example, if a father leaves the family house to his firstborn, on condition that they will bequeath it to their first child. It was one of the most popular legal institutions in ancient Roman law for several centuries. The word is a conjunction of the Latin words ("to/for trust"), dative singular of '' fides'' ("trust") and ("left"), nominative neuter singular perfect past participle of ''committo'' ("to leave, bequeath, commit"), it thus denotes that something is committed to one's trust. Text and translation Exegesis This fragment dates to the reign of Caesar Augustus, who first decreed certain requirements for the institution of the . The institution itself was first mentioned in 200 BC by Terence in '' Andria'', 290–98: "". It functioned thus: the testator nominated an heir to act as , entrusted with devising the inheritance to a beneficiary ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Beneficiary

A beneficiary in the broadest sense is a natural person or other legal entity who receives money or other benefits from a benefactor. For example, the beneficiary of a life insurance policy is the person who receives the payment of the amount of insurance after the death of the insured. In trust law, beneficiaries are also known as '' cestui que use''. Most beneficiaries may be designed to designate where the assets will go when the owner(s) dies. However, if the primary beneficiary or beneficiaries are not alive or do not qualify under the restrictions, the assets will probably pass to the ''contingent beneficiaries''. Other restrictions such as being married or more creative ones can be used by a benefactor to attempt to control the behavior of the beneficiaries. Some situations such as retirement accounts do not allow any restrictions beyond the death of the primary beneficiaries, but trusts allow any restrictions that are not illegal or for an illegal purpose. The concept o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |