|

Trend Following

Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue. There are a number of different techniques, calculations and time-frames that may be used to determine the general direction of the market to generate a trade signal, including the current market price calculation, moving averages and channel breakouts. Traders who employ this strategy do not aim to forecast or predict specific price levels; they simply jump on the trend and ride it. Due to the different techniques and time frames employed by trend followers to identify trends, trend followers as a group are not always strongly correlated to one another. Trend following is used by commodity trading advisors (CTAs) as the predominant strategy of technical traders. Research done by Galen Burghardt has shown that between 2000-2009 there was a very high correlation (.97) between tre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Trading Strategy

In finance, a trading strategy is a fixed plan that is designed to achieve a profitable return by going long or short in markets. The main reasons that a properly researched trading strategy helps are its verifiability, quantifiability, consistency, and objectivity. For every trading strategy one needs to define assets to trade, entry/exit points and money management rules. Bad money management can make a potentially profitable strategy unprofitable.Nekrasov, V. Knowledge rather than Hope: A Book for Retail Investors and Mathematical Finance Students''. 2014pages 24-26 Trading strategies are based on fundamental or technical analysis, or both. They are usually verified by backtesting, where the process should follow the scientific method, and by forward testing (a.k.a. 'paper trading') where they are tested in a simulated trading environment. Types of trading strategies The term trading strategy can in brief be used by any fixed plan of trading a financial instrument, but the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Swing Trading

Swing trading is a speculative trading strategy in financial markets where a tradable asset is held for one or more days in an effort to profit from price changes or 'swings'. A swing trading position is typically held longer than a day trading position, but shorter than buy and hold investment strategies that can be held for months or years. Profits can be sought by either buying an asset or short selling. Momentum signals (e.g., 52-week high/low) have been shown to be used by financial analysts in their buy and sell recommendations that can be applied in swing trading. Swing trading methods Using a set of mathematically-based objective rules for buying and selling is a common method for swing traders to eliminate the subjectivity, emotional aspects, and labor-intensive analysis of swing trading. The trading rules can be used to create a trading algorithm or "trading system" using technical analysis or fundamental analysis to give buy-and-sell signals. Simpler rule-based tradi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Drawdown (economics)

The drawdown is the measure of the decline from a historical peak in some variable (typically the cumulative profit or total open equity of a financial trading strategy). Somewhat more formally, if X(t), \; t \ge 0 is a stochastic process with X(0) = 0, the drawdown at time T, denoted D(T), is defined as: D(T) = \max\left max_X(t)-X(T),0 \right \equiv \left \max_X(t)-X(T) \right The average drawdown (AvDD) up to time T is the time average of drawdowns that have occurred up to time T:\operatorname(T) = \int_0^T D(t) \, dtThe maximum drawdown (MDD) up to time T is the maximum of the drawdown over the history of the variable. More formally, the MDD is defined as: \operatorname(T)=\max_D(\tau)=\max_\left max_ X(t)- X(\tau) \right/math> Pseudocode The following pseudocode computes the Drawdown ("DD") and Max Drawdown ("MDD") of the variable "NAV", the Net Asset Value of an investment. Drawdown and Max Drawdown are calculated as percentages: MDD = 0 peak = -99999 for i = 1 to N step ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Backtest

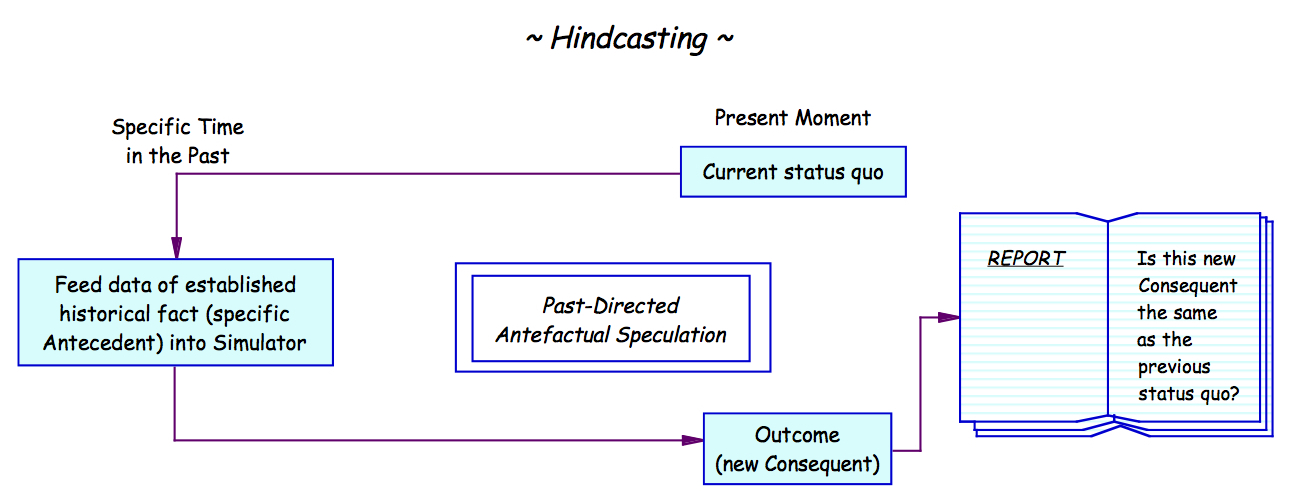

Backtesting is a term used in modeling to refer to testing a predictive model on historical data. Backtesting is a type of retrodiction, and a special type of cross-validation applied to previous time period(s). Financial analysis In a trading strategy, investment strategy, or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future. Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data. Backtesting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Conventional Wisdom

The conventional wisdom or received opinion is the body of ideas or explanations generally accepted by the public and/or by experts in a field. In religion, this is known as orthodoxy. Etymology The term is often credited to the economist John Kenneth Galbraith, who used it in his 1958 book ''The Affluent Society'':''E.g.,'Mark Leibovich, "A Scorecard on Conventional Wisdom", ''N.Y. Times'' (March 9, 2008) However, the term dates back to at least 1838. ''Conventional wisdom'' was used in a number of other works before Galbraith, occasionally in a benign''E.g.,'1 Nahum Capen, ''The History of Democracy'' (1874), page 477("millions of all classes alike are equally interested and protected by the practical judgment and conventional wisdom of ages"). or neutral''E.g.,'"Shallow Theorists", ''American Educational Monthly'' 383 (Oct. 1866)("What is the result? Just what conventional wisdom assumes it would be."). sense, but more often pejoratively.''E.g.,'Joseph Warren Beach, ''The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Order (exchange)

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders. Market order A market order is a buy or sell order to be executed immediately at the ''current'' ''market'' prices. As long as there are willing sellers and buyers, market orders are filled. Market orders are used when certainty of execution is a priority over the price of execution. A market order is the simplest of the order types. This order type does not allow any control over the price received. The order is filled at the best price available at the relevant time. In fast-moving markets, the price paid or received may be quite different from the last price quoted before the order was entered. A market order may b ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Simple Moving Average

In statistics, a moving average (rolling average or running average) is a calculation to analyze data points by creating a series of averages of different subsets of the full data set. It is also called a moving mean (MM) or rolling mean and is a type of finite impulse response filter. Variations include: simple, cumulative, or weighted forms (described below). Given a series of numbers and a fixed subset size, the first element of the moving average is obtained by taking the average of the initial fixed subset of the number series. Then the subset is modified by "shifting forward"; that is, excluding the first number of the series and including the next value in the subset. A moving average is commonly used with time series data to smooth out short-term fluctuations and highlight longer-term trends or cycles. The threshold between short-term and long-term depends on the application, and the parameters of the moving average will be set accordingly. It is also used in economi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Short (finance)

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional " long" position, where the investor will profit if the value of the asset rises. There are a number of ways of achieving a short position. The most fundamental method is "physical" selling short or short-selling, which involves borrowing assets (often securities such as shares or bonds) and selling them. The investor will later purchase the same number of the same type of securities in order to return them to the lender. If the price has fallen in the meantime, the investor will have made a profit equal to the difference. Conversely, if the price has risen then the investor will bear a loss. The short seller must usually pay a fee to borrow the securities (charged at a particular rate over time, similar to an interest payment), and reimburse the lender for any cash returns such as dividends that were ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Long (finance)

In finance, a long position in a financial instrument means the holder of the position owns a positive amount of the instrument. The holder of the position has the expectation that the financial instrument will increase in value. This is known as a bullish position. Security In terms of a security, such as a stock or a bond, or equivalently ''to be long'' in a security, means the holder of the position owns the security, on the expectation that the security will increase in value, and will profit if the price of the security goes up. ''Going long'' a security is the more conventional practice of investing. Future Going long in a future means the holder of the position is obliged to buy the underlying instrument at the contract price at expiry. The holder of the position will profit if the price of the underlying instrument goes up, as the price he will pay will be less than the market price. Option An options Option or Options may refer to: Computing *Option key, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Andreas Clenow

Andreas ( el, Ἀνδρέας) is a name usually given to males in Austria, Greece, Cyprus, Denmark, Armenia, Estonia, Ethiopia, Eritrea, Finland, Flanders, Germany, Norway, Sweden, Switzerland, Romania, the Netherlands, and Indonesia. The name derives from the Greek noun ἀνήρ ''anēr'', with genitive ἀνδρός ''andros'', which means "man". See the article on ''Andrew'' for more information. The Scandinavian name is earliest attested as antreos in a runestone from the 12th century. The name Andrea may be used as a feminine form, but is instead the main masculine form in Italy and the canton of Ticino in Switzerland. Given name Andreas is a common name, and this is not a comprehensive list of articles on people named Andreas. See instead . Surname * Alfred T. Andreas, American publisher and historian * Casper Andreas (born 1972), American actor and film director * Dwayne Andreas, a businessman * Harry Andreas * Lisa Andreas Places *Andreas, Isle of Man, a village a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)