|

Treasurer

A treasurer is the person responsible for running the treasury of an organization. The significant core functions of a corporate treasurer include cash and liquidity management, risk management, and corporate finance. Government The treasury of a country is the department responsible for the country's economy, finance and revenue. The treasurer is generally the head of the treasury, although, in some countries (such as the United Kingdom or the United States) the treasury reports to a Secretary of the Treasury or Chancellor of the Exchequer. In Australia, the Treasurer is a senior minister and usually the second or third most important member of the government after the Prime Minister and Deputy Prime Minister. Each Australian state and self-governing territory also has its own treasurer. From 1867 to 1993, Ontario's Minister of Finance was called the Treasurer of Ontario. Originally the word referred to the person in charge of the treasure of a noble; however, it ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasurer Of Australia

The Treasurer of Australia (or Federal Treasurer) is a high ranking official and senior minister of the Crown in the Government of Australia who is the head of the Ministry of the Treasury which is responsible for government expenditure and for collecting revenue. The Treasurer plays a key role in the economic policy of the government. The current Australian Treasurer is Jim Chalmers whose term began on 23 May 2022. The Treasurer implements ministerial powers through the Department of the Treasury and a range of other government agencies. According to constitutional convention, the Treasurer is always a member of the Parliament of Australia with a seat in the House of Representatives. The office is generally seen as equivalent to the Chancellor of the Exchequer in the United Kingdom or the Secretary of the Treasury in the United States or, in some other countries, the finance minister. It is one of only four ministerial positions (along with Prime Minister, Minister fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lord High Treasurer

The post of Lord High Treasurer or Lord Treasurer was an English government position and has been a British government position since the Acts of Union of 1707. A holder of the post would be the third-highest-ranked Great Officer of State in England, below the Lord High Steward and the Lord High Chancellor of Great Britain. The Lord High Treasurer functions as the head of His Majesty's Treasury. The office has, since the resignation of Charles Talbot, 1st Duke of Shrewsbury in 1714, been vacant. Although the United Kingdom of Great Britain and Ireland was created in 1801, it was not until the Consolidated Fund Act 1816 that the separate offices of Lord High Treasurer of Great Britain and Lord High Treasurer of Ireland were united into one office as the 'Lord High Treasurer of the United Kingdom of Great Britain and Ireland' on 5 January 1817. Section 2 of the Consolidated Fund Act 1816 also provides that "whenever there shall not be Lord High Treasurer of the United K ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deputy Prime Minister Of Australia

The deputy prime minister of Australia is the deputy chief executive and the second highest ranking officer of the Australian Government. The office of deputy prime minister was officially created as a ministerial portfolio in 1968, although the title had been used informally for many years previously. The deputy prime minister is appointed by the governor-general on the advice of the prime minister. When Australia has a Labor government, the deputy leader of the parliamentary party holds the position of deputy prime minister. When Australia has a Coalition government, the Coalition Agreement mandates that all Coalition members support the leader of the Liberal Party becoming prime minister and mandates that the leader of the National Party be selected as deputy prime minister. The 2017–18 Australian parliamentary eligibility crisis resulted in the position being made vacant for the first time since its official creation. Barnaby Joyce, the then-incumbent, was ruled ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ministry Of Finance (Ontario)

The Ministry of Finance is a portfolio in the Executive Council of Ontario, commonly known as the cabinet. The Minister of Finance is responsible for managing the fiscal, financial and related regulatory affairs of the Canadian province of Ontario. The cabinet post used to be called the Treasurer of Ontario and was changed to be in line with similar posts in other Canadian provinces and in the federal government. History For most of the period from 1867 until 1993, the minister was called the treasurer or provincial treasurer. https://tvo.org/blog/current-affairs/here-comes-the-budget The ministry were renamed the Ministry of Economics in 1956 and the minister became known as Minister in charge of Economics instead of treasurer. From January to December 1961, the ministry became the Ministry of Economics and Federal and Provincial Relations. The title of treasurer was revived in December 1961 with the minister also often holding the secondary title of minister of economics or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Lord Of The Treasury

The first lord of the Treasury is the head of the Lords Commissioners of the Treasury exercising the ancient office of Lord High Treasurer in the United Kingdom, and is by convention also the prime minister. This office is not equivalent to the usual position of the " treasurer" in other governments; the closer equivalent of a treasurer in the United Kingdom is Chancellor of the Exchequer, who is the second lord of the Treasury. Lords of the Treasury As of the beginning of the 17th century, the running of the Treasury was frequently entrusted to a commission, rather than to a single individual. Since 1714, it has permanently been in commission. The commissioners have always since that date been referred to as Lords Commissioners of the Treasury, and adopted ordinal numbers to describe their seniority. Eventually in the middle of the same century, the first lord of the Treasury came to be seen as the natural head of the overall ministry running the country, and, as of the ti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chancellor Of The Exchequer

The chancellor of the Exchequer, often abbreviated to chancellor, is a senior minister of the Crown within the Government of the United Kingdom, and head of His Majesty's Treasury. As one of the four Great Offices of State, the Chancellor is a high-ranking member of the British Cabinet. Responsible for all economic and financial matters, the role is equivalent to that of a finance minister in other countries. The chancellor is now always Second Lord of the Treasury as one of at least six lords commissioners of the Treasury, responsible for executing the office of the Treasurer of the Exchequer the others are the prime minister and Commons government whips. In the 18th and early 19th centuries, it was common for the prime minister also to serve as Chancellor of the Exchequer if he sat in the Commons; the last Chancellor who was simultaneously prime minister and Chancellor of the Exchequer was Stanley Baldwin in 1923. Formerly, in cases when the chancellorship was vacant, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Treasury

A treasury is either *A government department related to finance and taxation, a finance ministry. *A place or location where treasure, such as currency or precious items are kept. These can be state or royal property, church treasure or in private ownership. The head of a treasury is typically known as a treasurer. This position may not necessarily have the final control over the actions of the treasury, particularly if they are not an elected representative. The adjective for a treasury is normally treasurial. The adjective "tresorial" can also be used, but this normally means pertaining to a ''treasurer''. History The earliest found artefacts made of silver and gold are from Lake Varna in Bulgaria dated 4250–4000 BC, the earliest of copper are dated 9000–7000 BC. The term ''treasury'' was first used in Classical times to describe the votive buildings erected to house gifts to the gods, such as the Siphnian Treasury in Delphi or many similar buildings er ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

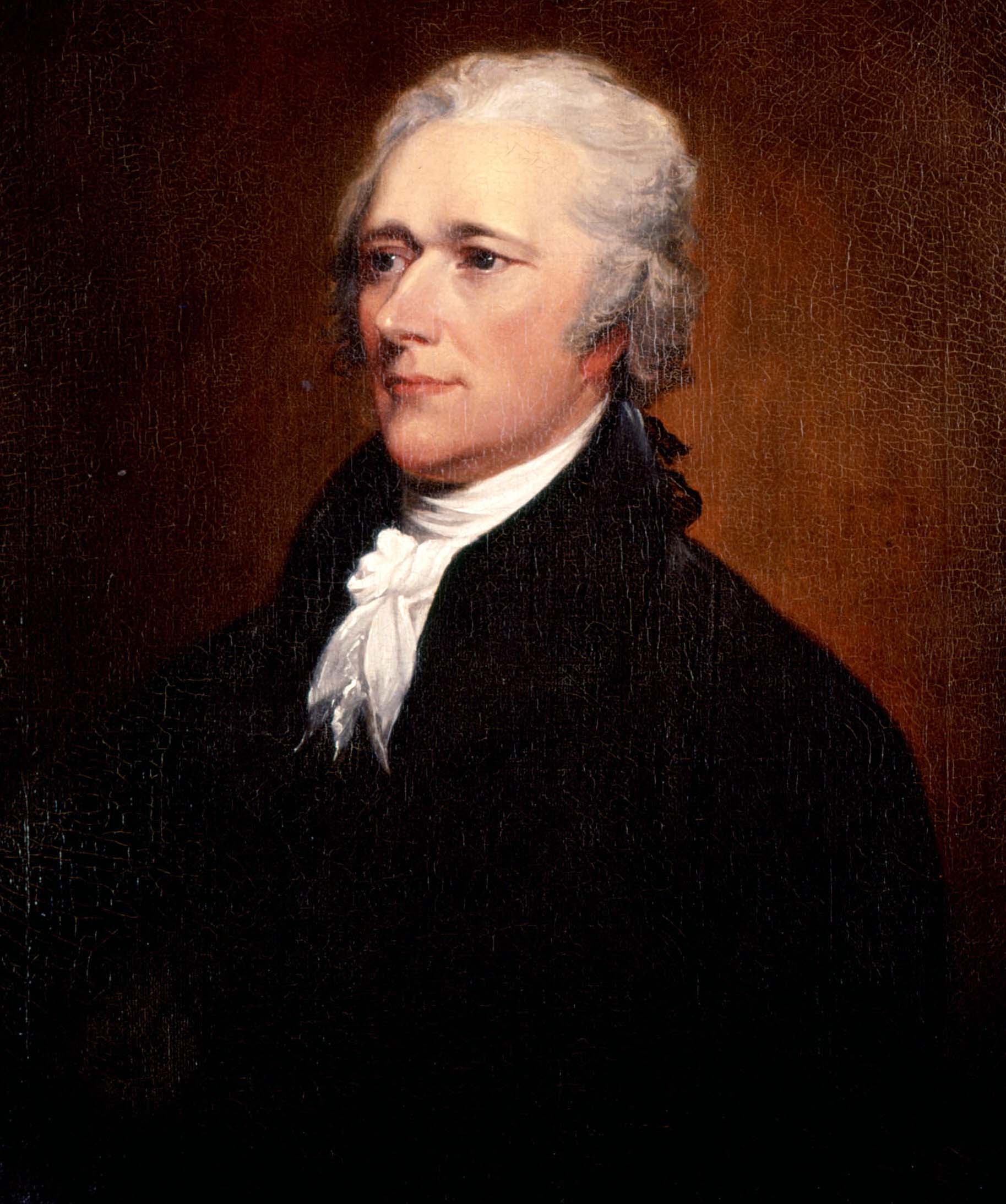

United States Secretary Of The Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the Senate Committee on Finance, is confirmed by the United States Senate. The secretary of state, the secretary of the treasury, the secretary of defense, and the attorney general are generally regarded as the four most important Cabinet officials, due to the size and importance of their respective departments. The current secre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

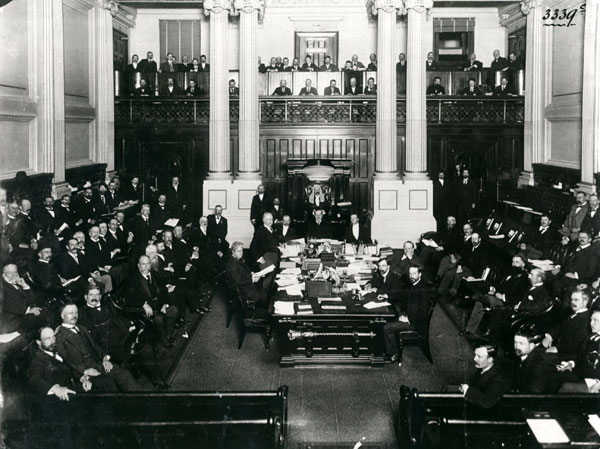

Prime Minister Of Australia

The prime minister of Australia is the head of government of the Commonwealth of Australia. The prime minister heads the executive branch of the Australian Government, federal government of Australia and is also accountable to Parliament of Australia, federal parliament under the principles of responsible government. The current prime minister is Anthony Albanese of the Australian Labor Party, who became prime minister on 23 May 2022. Formally appointed by the Governor-General of Australia, governor-general, the role and duties of the prime minister are not described by the Constitution of Australia, Australian constitution but rather defined by Constitutional convention (political custom), constitutional convention deriving from the Westminster system. To become prime minister, a politician should be able to Confidence and supply, command the confidence of the House of Representatives (Australia), House of Representatives. As such, the prime minister is typically the leader o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money or other agreed-upon value to another party, the creditor. Debt is a deferred payment, or series of payments, which differentiates it from an immediate purchase. The debt may be owed by sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of principal and interest. Loans, bonds, notes, and mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity. The term can also be used metaphorically to cover moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century. The term "debt" com ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Market

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)