|

Sugary Beverage Tax

A sugary drink tax, soda tax, or sweetened beverage tax (SBT) is a tax or surcharge (food-related fiscal policy) designed to reduce consumption of sweetened beverages. Drinks covered under a soda tax often include carbonated soft drinks, sports drinks and energy drinks. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight, however the medical evidence supporting the benefits of a sugar tax on health is of very low certainty. The tax is a matter of public debate in many countries and beverage producers like Coca-Cola often oppose it. Advocates such as national medical associations and the World Health Organization promote the tax as an example of Pigovian taxation, aimed to discourage unhealthy diets and offset the growing economic costs of obesity. Design Tax design approaches include direct taxes on the product and indirect taxes. Indirect taxes include import/export taxes on sugar or other ingredients before it has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

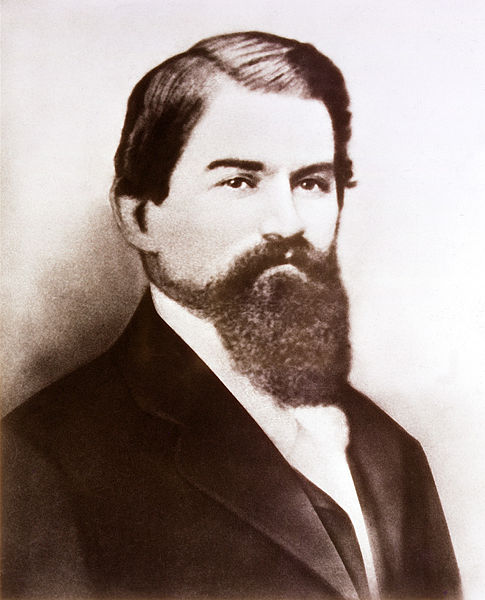

Coca-Cola In Israel

Coca-Cola, or Coke, is a carbonated soft drink manufactured by the Coca-Cola Company. Originally marketed as a temperance drink and intended as a patent medicine, it was invented in the late 19th century by John Stith Pemberton in Atlanta, Georgia. In 1888, Pemberton sold Coca-Cola's ownership rights to Asa Griggs Candler, a businessman, whose marketing tactics led Coca-Cola to its dominance of the global soft-drink market throughout the 20th and 21st century. The drink's name refers to two of its original ingredients: coca leaves and kola nuts (a source of caffeine). The current formula of Coca-Cola remains a closely guarded trade secret; however, a variety of reported recipes and experimental recreations have been published. The secrecy around the formula has been used by Coca-Cola in its marketing as only a handful of anonymous employees know the formula. The drink has inspired imitators and created a whole classification of soft drink: colas. The Coca-Cola Company pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

France

France (), officially the French Republic ( ), is a country primarily located in Western Europe. It also comprises of Overseas France, overseas regions and territories in the Americas and the Atlantic Ocean, Atlantic, Pacific Ocean, Pacific and Indian Oceans. Its Metropolitan France, metropolitan area extends from the Rhine to the Atlantic Ocean and from the Mediterranean Sea to the English Channel and the North Sea; overseas territories include French Guiana in South America, Saint Pierre and Miquelon in the North Atlantic, the French West Indies, and many islands in Oceania and the Indian Ocean. Due to its several coastal territories, France has the largest exclusive economic zone in the world. France borders Belgium, Luxembourg, Germany, Switzerland, Monaco, Italy, Andorra, and Spain in continental Europe, as well as the Kingdom of the Netherlands, Netherlands, Suriname, and Brazil in the Americas via its overseas territories in French Guiana and Saint Martin (island), ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Australian Beverages Council

The Australian Beverages Council, previously known as the Australian Soft Drinks Association (ASDA) is an industry group that represents the interests of Australian manufacturers, importers and distributors of non-alcoholic beverages. Their headquarters is in Waterloo, New South Wales, Australia Australia, officially the Commonwealth of Australia, is a Sovereign state, sovereign country comprising the mainland of the Australia (continent), Australian continent, the island of Tasmania, and numerous List of islands of Australia, sma .... References External linksThe Australian Beverages Council Official Website Business organisations based in Australia Food and drink in Australia {{business-org-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sugary Drink Taxes

A sugary drink tax, soda tax, or sweetened beverage tax (SBT) is a tax or surcharge (food-related fiscal policy) designed to reduce consumption of sweetened beverages. Drinks covered under a soda tax often include carbonated soft drinks, sports drinks and energy drinks. This policy intervention is an effort to decrease obesity and the health impacts related to being overweight, however the medical evidence supporting the benefits of a sugar tax on health is of very low certainty. The tax is a matter of public debate in many countries and beverage producers like Coca-Cola often oppose it. Advocates such as national medical associations and the World Health Organization promote the tax as an example of Pigovian taxation, aimed to discourage unhealthy diets and offset the growing economic costs of obesity. Design Tax design approaches include direct taxes on the product and indirect taxes. Indirect taxes include import/export taxes on sugar or other ingredients before it has ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Externalities

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's (or parties') activity. Externalities can be considered as unpriced goods involved in either consumer or producer market transactions. Air pollution from motor vehicles is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport to the rest of society. Water pollution from mills and factories is another example. All consumers are all made worse off by pollution but are not compensated by the market for this damage. A positive externality is when an individual's consumption in a market increases the well-being of others, but the individual does not charge the third party for the benefit. The third party is essentially getting a free product. An example of this might be the apartment above a bakery receiving the benefit of enjoyment from smelling fresh pastries every mornin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Berkeley, California

Berkeley ( ) is a city on the eastern shore of San Francisco Bay in northern Alameda County, California, United States. It is named after the 18th-century Irish bishop and philosopher George Berkeley. It borders the cities of Oakland and Emeryville to the south and the city of Albany and the unincorporated community of Kensington to the north. Its eastern border with Contra Costa County generally follows the ridge of the Berkeley Hills. The 2020 census recorded a population of 124,321. Berkeley is home to the oldest campus in the University of California System, the University of California, Berkeley, and the Lawrence Berkeley National Laboratory, which is managed and operated by the university. It also has the Graduate Theological Union, one of the largest religious studies institutions in the world. Berkeley is considered one of the most socially progressive cities in the United States. History Indigenous history The site of today's City of Berkeley was the territo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Effect Of Taxes And Subsidies On Price

Taxes and subsidies change the price of goods and, as a result, the quantity consumed. There is a difference between an Ad valorem tax and a specific tax or subsidy in the way it is applied to the price of the good. In the end levying a tax moves the market to a new equilibrium where the price of a good paid by buyers increases and the proportion of the price received by sellers decreases. The incidence of a tax does not depend on whether the buyers or sellers are taxed since taxes levied on sellers are likely to be met by raising the price charged to buyers. Most of the burden of a tax falls on the less elastic side of the market because of a lower ability to respond to the tax by changing the quantity sold or bought. Introduction of a subsidy, on the other hand, may either lowers the price of production which encourages firms to produce more, or lowers the price paid by buyers, encouraging higher sales volume. Such a policy is beneficial both to sellers and buyers. Specific tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Supply And Demand

In microeconomics, supply and demand is an economic model of price determination in a Market (economics), market. It postulates that, Ceteris paribus, holding all else equal, in a perfect competition, competitive market, the unit price for a particular Good (economics), good, or other traded item such as Labour supply, labor or Market liquidity, liquid financial assets, will vary until it settles at a point where the quantity demanded (at the current price) will equal the quantity supplied (at the current price), resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics. In macroeconomics, as well, the AD–AS model, aggregate demand-aggregate supply model has been used to depict how the quantity of real GDP, total output and the aggregate price level may be determined in equilibrium. Graphical representations Supply schedule A supply schedule, depicted graphically as a supply cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Lancet

''The Lancet'' is a weekly peer-reviewed general medical journal and one of the oldest of its kind. It is also the world's highest-impact academic journal. It was founded in England in 1823. The journal publishes original research articles, review articles ("seminars" and "reviews"), editorials, book reviews, correspondence, as well as news features and case reports. ''The Lancet'' has been owned by Elsevier since 1991, and its editor-in-chief since 1995 has been Richard Horton. The journal has editorial offices in London, New York City, and Beijing. History ''The Lancet'' was founded in 1823 by Thomas Wakley, an English surgeon who named it after the surgical instrument called a lancet (scalpel). Members of the Wakley family retained editorship of the journal until 1908. In 1921, ''The Lancet'' was acquired by Hodder & Stoughton. Elsevier acquired ''The Lancet'' from Hodder & Stoughton in 1991. Impact According to the ''Journal Citation Reports'', the journal has a 202 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Congressional Budget Office

The Congressional Budget Office (CBO) is a federal agency within the legislative branch of the United States government that provides budget and economic information to Congress. Inspired by California's Legislative Analyst's Office that manages the state budget in a strictly nonpartisan fashion, the CBO was created as a nonpartisan agency by the Congressional Budget and Impoundment Control Act of 1974. Whereas politicians on both sides of the aisle have criticized the CBO when its estimates have been politically inconvenient, economists and other academics overwhelmingly reject that the CBO is partisan or that it fails to produce credible forecasts. There is a consensus among economists that "adjusting for legal restrictions on what the CBO can assume about future legislation and events, the CBO has historically issued credible forecasts of the effects of both Democratic and Republican legislative proposals." History The Congressional Budget Office was created by Title II of th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Department Of Health And Human Services

The United States Department of Health and Human Services (HHS) is a cabinet-level executive branch department of the U.S. federal government created to protect the health of all Americans and providing essential human services. Its motto is "Improving the health, safety, and well-being of America". Before the separate federal Department of Education was created in 1979, it was called the Department of Health, Education, and Welfare (HEW). HHS is administered by the Secretary of Health and Human Services, who is appointed by the president with the advice and consent of the United States Senate. The position is currently held by Xavier Becerra. The United States Public Health Service Commissioned Corps, the uniformed service of the PHS, is led by the Surgeon General who is responsible for addressing matters concerning public health as authorized by the secretary or by the assistant secretary for Health in addition to his or her primary mission of administering the Commission ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tobacco Taxes

Tobacco smoking is the practice of burning tobacco and ingesting the resulting smoke. The smoke may be inhaled, as is done with cigarettes, or simply released from the mouth, as is generally done with pipes and cigars. The practice is believed to have begun as early as 5000–3000 BC in Mesoamerica and South America. Tobacco was introduced to Eurasia in the late 17th century by European colonists, where it followed common trade routes. The practice encountered criticism from its first import into the Western world onwards but embedded itself in certain strata of a number of societies before becoming widespread upon the introduction of automated cigarette-rolling apparatus. Smoking is the most common method of consuming tobacco, and tobacco is the most common substance smoked. The agricultural product is often mixed with additives and then combusted. The resulting smoke is then inhaled and the active substances absorbed through the alveoli in the lungs or the oral mucosa. Many ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)