|

Stealth Startup

A stealth startup is a type of startup company that operates in stealth and silence to outsiders, avoiding public attention. This may be done to hide information from competitors (which may include non-disclosure agreements), or as part of a marketing strategy to manage public image and generate expectations and interest from potential clients. A Stealth Startup normally only operates in stealth mode for its first few years. The phenomenon is well known in the venture capital Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to start-up company, startups, early-stage, and emerging companies that have been deemed to have high growth poten ... (VC) community. Since investors may have to disclose funding a stealth startup, their names are made public, but often only a general summary description is known about the company. Advantages * Protect ideas and intellectual property: If a startup is working ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Startup Company

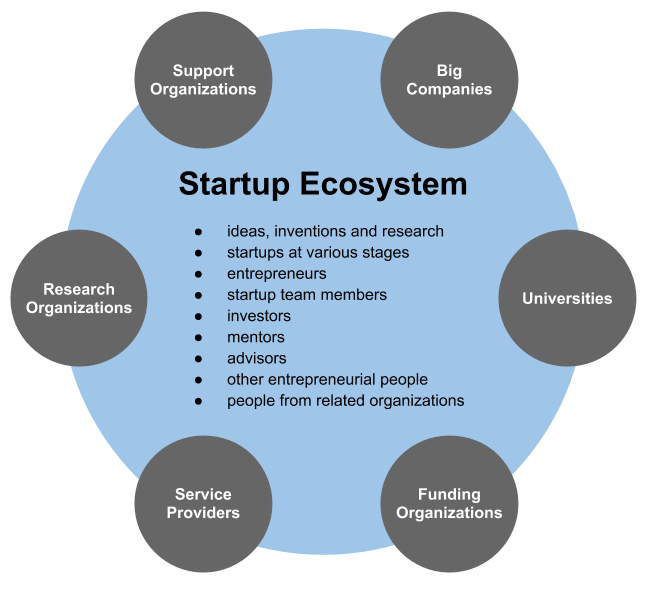

A startup or start-up is a company or project undertaken by an entrepreneur to seek, develop, and validate a scalable business model. While entrepreneurship refers to all new businesses, including self-employment and businesses that never intend to become registered, startups refer to new businesses that intend to grow large beyond the solo founder. At the beginning, startups face high uncertainty and have high rates of failure, but a minority of them do go on to be successful and influential.Erin Griffith (2014)Why startups fail, according to their founders Fortune.com, 25 September 2014; accessed 27 October 2017 Actions Startups typically begin by a founder (solo-founder) or co-founders who have a way to solve a problem. The founder of a startup will begin market validation by problem interview, solution interview, and building a minimum viable product (MVP), i.e. a prototype, to develop and validate their business models. The startup process can take a long period of time (by so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-disclosure Agreements

A non-disclosure agreement (NDA) is a legal contract or part of a contract between at least two parties that outlines confidential material, knowledge, or information that the parties wish to share with one another for certain purposes, but wish to restrict access to. Doctor–patient confidentiality (physician–patient privilege), attorney–client privilege, priest–penitent privilege and bank–client confidentiality agreements are examples of NDAs, which are often not enshrined in a written contract between the parties. It is a contract through which the parties agree not to disclose any information covered by the agreement. An NDA creates a confidential relationship between the parties, typically to protect any type of confidential and proprietary information or trade secrets. As such, an NDA protects non-public business information. Like all contracts, they cannot be enforced if the contracted activities are illegal. NDAs are commonly signed when two companies, individu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marketing Strategy

Marketing strategy allows organizations to focus limited resources on best opportunities to increase sales and achieve a competitive advantage in the market. Strategic marketing emerged in the 1970s/80s as a distinct field of study, further building on strategic management. Marketing strategy highlights the role of marketing as a link between the organization and its customers, leveraging the combination of resources and capabilities within an organization to achieve a competitive advantage (Cacciolatti & Lee, 2016). Marketing management versus marketing strategy The distinction between "strategic" and "managerial" marketing is used to distinguish "two phases having different goals and based on different conceptual tools. Strategic marketing concerns the choice of policies aiming at improving the competitive position of the firm, taking account of challenges and opportunities proposed by the competitive environment. On the other hand, managerial marketing is focused on the implem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stealth Mode

In business, stealth mode is a company's temporary state of secretiveness, usually undertaken to avoid alerting competitors to a pending product launch or another business initiative. When an entire company is in stealth mode it may attempt to mislead the public about its true company goals. For example, it may give code names to its pending products. It may operate a corporate website that does not disclose its personnel or location. New companies may operate under a temporary "stealth name" that does not disclose its field of business. To enforce stealthy behavior, companies often require employees to sign non-disclosure agreements, and strictly control who may speak with the media. At the in-company level, a stealth mode can also refer to a new project or idea that is kept secret, not just from external parties, but also from internal stakeholders in order to avoid a (premature) dismissal of the idea. Key behaviors can include soliciting informal project sponsors, engaging in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Venture Capital

Venture capital (often abbreviated as VC) is a form of private equity financing that is provided by venture capital firms or funds to startups, early-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth (in terms of number of employees, annual revenue, scale of operations, etc). Venture capital firms or funds invest in these early-stage companies in exchange for equity, or an ownership stake. Venture capitalists take on the risk of financing risky start-ups in the hopes that some of the firms they support will become successful. Because startups face high uncertainty, VC investments have high rates of failure. The start-ups are usually based on an innovative technology or business model and they are usually from high technology industries, such as information technology (IT), clean technology or biotechnology. The typical venture capital investment occurs after an initial "seed funding" round. The first ro ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Non-disclosure Agreement

A non-disclosure agreement (NDA) is a legal contract or part of a contract between at least two parties that outlines confidential material, knowledge, or information that the parties wish to share with one another for certain purposes, but wish to restrict access to. Doctor–patient confidentiality (physician–patient privilege), attorney–client privilege, priest–penitent privilege and bank–client confidentiality agreements are examples of NDAs, which are often not enshrined in a written contract between the parties. It is a contract through which the parties agree not to disclose any information covered by the agreement. An NDA creates a confidential relationship between the parties, typically to protect any type of confidential and proprietary information or trade secrets. As such, an NDA protects non-public business information. Like all contracts, they cannot be enforced if the contracted activities are illegal. NDAs are commonly signed when two companies, individu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |