|

Statistical Discrimination (economics)

Statistical discrimination is a theorized behavior in which racial or gender inequality results when economic agents (consumers, workers, employers, etc.) have imperfect information about individuals they interact with. According to this theory, inequality may exist and persist between demographic groups even when economic agents are rational and non-prejudiced. It stands in contrast with taste-based discrimination which uses racism, sexism and the likes to explain different labour market outcomes of groups. The theory of statistical discrimination was pioneered by Kenneth Arrow (1973) and Edmund Phelps (1972). The name "statistical discrimination" relates to the way in which employers make employment decisions. Since their information on the applicants' productivity is imperfect, they use statistical information on the group they belong to in order to infer productivity. If the minority group is less productive initially (due to historic discrimination or having navigated a bad e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Theory

Economics () is the social science that studies the production, distribution, and consumption of goods and services. Economics focuses on the behaviour and interactions of economic agents and how economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on these elements. Other broad distinctions within economics include those between positive economics, describing "what is", and normative economics, advocating "what ought to be"; between economic theory and applied economics; between rational an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Inequality

There are wide varieties of economic inequality, most notably income inequality measured using the distribution of income (the amount of money people are paid) and wealth inequality measured using the distribution of wealth (the amount of wealth people own). Besides economic inequality between countries or states, there are important types of economic inequality between different groups of people. Important types of economic measurements focus on wealth, income, and consumption. There are many methods for measuring economic inequality, the Gini coefficient being a widely used one. Another type of measure is the Inequality-adjusted Human Development Index, which is a statistic composite index that takes inequality into account. Important concepts of equality include equity, equality of outcome, and equality of opportunity. Whereas globalization has reduced global inequality (between nations), it has increased inequality within nations. Income inequality between nations peak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taste-based Discrimination

Taste-based discrimination is an economic model of labor market discrimination which argues that employers' prejudice or dislikes in an organisational culture rooted in prohibited grounds can have negative results in hiring minority workers, meaning that they can be said to have a taste for discrimination. The model further posits that employers discriminate against minority applicants to avoid interacting with them, regardless of the applicant's productivity, and that employers are willing to pay a financial penalty to do so. It is one of the two leading theoretical explanations for labor market discrimination, the other being statistical discrimination. The taste-based model further supposes that employers' preference for employees of certain groups is unrelated to their preference for more productive employees. According to this model, employees that are members of a group that is discriminated against may have to work harder for the same wage or accept a lower wage for the sam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kenneth Arrow

Kenneth Joseph Arrow (23 August 1921 – 21 February 2017) was an American economist, mathematician, writer, and political theorist. He was the joint winner of the Nobel Memorial Prize in Economic Sciences with John Hicks in 1972. In economics, he was a major figure in post-World War II neo-classical economic theory. Many of his former graduate students have gone on to win the Nobel Memorial Prize themselves. His most significant works are his contributions to social choice theory, notably "Arrow's impossibility theorem", and his work on general equilibrium analysis. He has also provided foundational work in many other areas of economics, including endogenous growth theory and the economics of information. Education and early career Arrow was born on 23 August 1921, in New York City. Arrow's mother, Lilian (Greenberg), was from Iași, Romania, and his father, Harry Arrow, was from nearby Podu Iloaiei. The Arrow family were Romanian Jews. His family was very supportive of his ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Edmund Phelps

Edmund Strother Phelps (born July 26, 1933) is an American economist and the recipient of the 2006 Nobel Memorial Prize in Economic Sciences. Early in his career, he became known for his research at Yale's Cowles Foundation in the first half of the 1960s on the sources of economic growth. His demonstration of the golden rule savings rate, a concept related to work by John von Neumann, started a wave of research on how much a nation should spend on present consumption rather than save and invest for future generations. Phelps was at the University of Pennsylvania from 1966 to 1971 and moved to Columbia University in 1971. His most seminal work inserted a microfoundation, one featuring imperfect information, incomplete knowledge and expectations about wages and prices, to support a macroeconomic theory of employment determination and price-wage dynamics. That led to his development of the natural rate of unemployment: its existence and the mechanism governing its size. In the ear ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

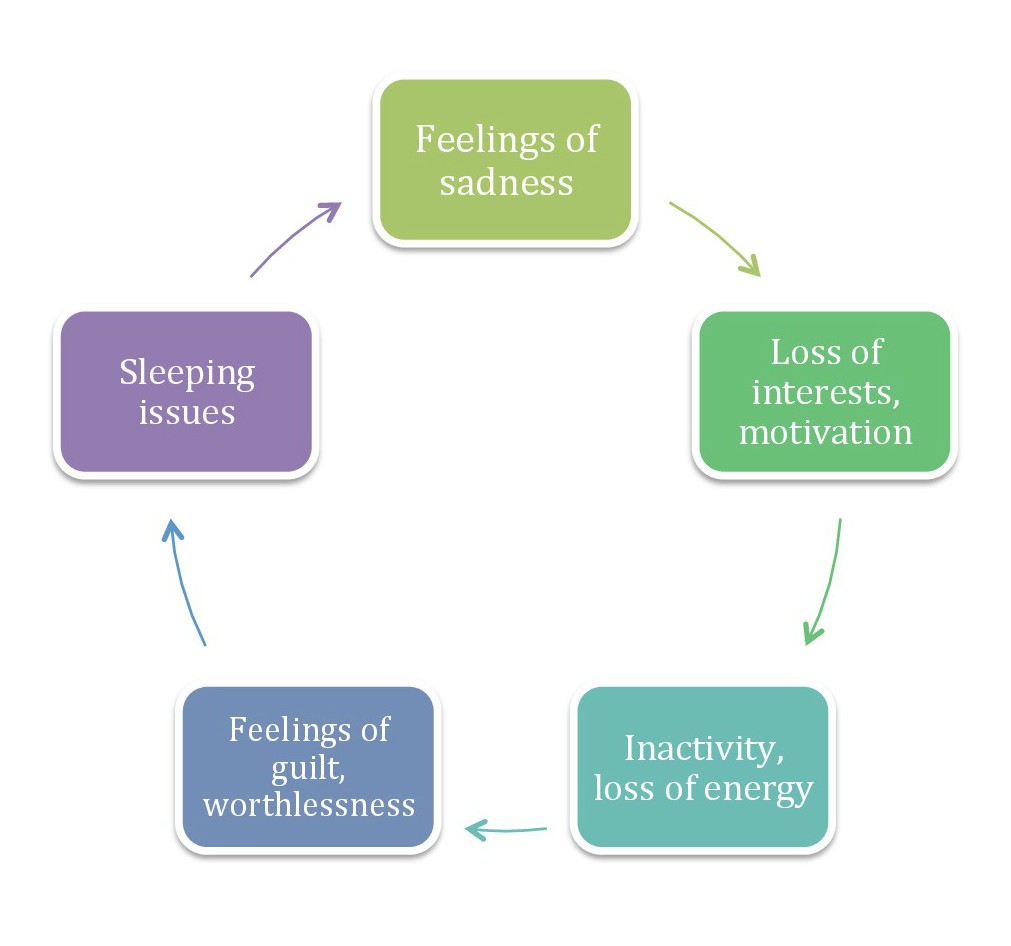

Vicious Circle

A vicious circle (or cycle) is a complex chain of events that reinforces itself through a feedback loop, with detrimental results. It is a system with no tendency toward equilibrium (social, economic, ecological, etc.), at least in the short run. Each iteration of the cycle reinforces the previous one, in an example of positive feedback. A vicious circle will continue in the direction of its momentum until an external factor intervenes to break the cycle. A well-known example of a vicious circle in economics is hyperinflation. A virtuous circle is an equivalent system with a favorable outcome. Examples Vicious circles in the subprime mortgage crisis The contemporary subprime mortgage crisis is a complex group of vicious circles, both in its genesis and in its manifold outcomes, most notably the late 2000s recession. A specific example is the circle related to housing. As housing prices decline, more homeowners go " underwater", when the market value of a home drops below ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regression To The Mean

In statistics, regression toward the mean (also called reversion to the mean, and reversion to mediocrity) is the fact that if one sample of a random variable is extreme, the next sampling of the same random variable is likely to be closer to its mean. Furthermore, when many random variables are sampled and the most extreme results are intentionally picked out, it refers to the fact that (in many cases) a second sampling of these picked-out variables will result in "less extreme" results, closer to the initial mean of all of the variables. Mathematically, the strength of this "regression" effect is dependent on whether or not all of the random variables are drawn from the same distribution, or if there are genuine differences in the underlying distributions for each random variable. In the first case, the "regression" effect is statistically likely to occur, but in the second case, it may occur less strongly or not at all. Regression toward the mean is thus a useful concept to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variance

In probability theory and statistics, variance is the expectation of the squared deviation of a random variable from its population mean or sample mean. Variance is a measure of dispersion, meaning it is a measure of how far a set of numbers is spread out from their average value. Variance has a central role in statistics, where some ideas that use it include descriptive statistics, statistical inference, hypothesis testing, goodness of fit, and Monte Carlo sampling. Variance is an important tool in the sciences, where statistical analysis of data is common. The variance is the square of the standard deviation, the second central moment of a distribution, and the covariance of the random variable with itself, and it is often represented by \sigma^2, s^2, \operatorname(X), V(X), or \mathbb(X). An advantage of variance as a measure of dispersion is that it is more amenable to algebraic manipulation than other measures of dispersion such as the expected absolute deviation; for e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Averse

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. Th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Error Term

In mathematics and statistics, an error term is an additive type of error. Common examples include: * errors and residuals in statistics, e.g. in linear regression * the error term in numerical integration In analysis, numerical integration comprises a broad family of algorithms for calculating the numerical value of a definite integral, and by extension, the term is also sometimes used to describe the numerical solution of differential equations ... {{sia, mathematics Error measures ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

African Americans

African Americans (also referred to as Black Americans and Afro-Americans) are an ethnic group consisting of Americans with partial or total ancestry from sub-Saharan Africa. The term "African American" generally denotes descendants of enslaved Africans who are from the United States. While some Black immigrants or their children may also come to identify as African-American, the majority of first generation immigrants do not, preferring to identify with their nation of origin. African Americans constitute the second largest racial group in the U.S. after White Americans, as well as the third largest ethnic group after Hispanic and Latino Americans. Most African Americans are descendants of enslaved people within the boundaries of the present United States. On average, African Americans are of West/ Central African with some European descent; some also have Native American and other ancestry. According to U.S. Census Bureau data, African immigrants generally do not se ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_-_Galton_1889_diagram.png)