|

Solvency Cone

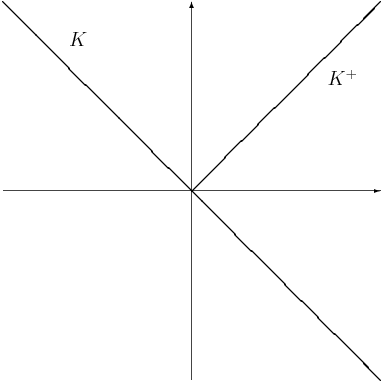

The solvency cone is a concept used in financial mathematics which models the possible trades in the Market (economics), financial market. This is of particular interest to markets with transaction costs. Specifically, it is the convex cone of portfolios that can be exchanged to portfolios of non-negative components (including paying of any transaction costs). Mathematical basis If given a bid-ask matrix \Pi for d assets such that \Pi = \left(\pi^\right)_ and m \leq d is the number of assets which with any non-negative quantity of them can be "discarded" (traditionally m = d), then the solvency cone K(\Pi) \subset \mathbb^d is the convex cone spanned by the unit vectors e^i, 1 \leq i \leq m and the vectors \pi^e^i-e^j, 1 \leq i,j \leq d. Definition A solvency cone K is any closed convex cone such that K \subseteq \mathbb^d and K \supseteq \mathbb^d_+. Uses A process of (random) solvency cones \left\_^T is a model of a financial market. This is sometimes called a market process. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Mathematics

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical finan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market (economics)

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services (including labour power) to buyers in exchange for money. It can be said that a market is the process by which the prices of goods and services are established. Markets facilitate trade and enable the distribution and allocation of resources in a society. Markets allow any tradeable item to be evaluated and priced. A market emerges more or less spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights (cf. ownership) of services and goods. Markets generally supplant gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for sale (local produce or stock registration). Markets can dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transaction Costs

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike production costs, decision-makers determine strategies of companies by measuring transaction costs and production costs. Transaction costs are the total costs of making a transaction, including the cost of planning, deciding, changing plans, resolving disputes, and after-sales. Therefore, the transaction cost is one of the most significant factors in business operation and management. Oliver E. Williamson's ''Transaction Cost Economics'' popularized the concept of transaction costs. Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs. In this sense, institutions that facilitate low transaction costs, boost economic growth.North, Douglass C. 1992. “Transac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convex Cone

In linear algebra, a ''cone''—sometimes called a linear cone for distinguishing it from other sorts of cones—is a subset of a vector space that is closed under scalar multiplication; that is, is a cone if x\in C implies sx\in C for every . When the scalars are real numbers, or belong to an ordered field, one generally calls a cone a subset of a vector space that is closed under multiplication by a ''positive scalar''. In this context, a convex cone is a cone that is closed under addition, or, equivalently, a subset of a vector space that is closed under linear combinations with positive coefficients. It follows that convex cones are convex sets. In this article, only the case of scalars in an ordered field is considered. Definition A subset ''C'' of a vector space ''V'' over an ordered field ''F'' is a cone (or sometimes called a linear cone) if for each ''x'' in ''C'' and positive scalar ''α'' in ''F'', the product ''αx'' is in ''C''. Note that some authors define co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-financing Portfolio

In financial mathematics, a self-financing portfolio is a portfolio having the feature that, if there is no exogenous infusion or withdrawal of money, the purchase of a new asset must be financed by the sale of an old one. Mathematical definition Let h_i(t) denote the number of shares of stock number 'i' in the portfolio at time t , and S_i(t) the price of stock number 'i' in a frictionless market with trading in continuous time. Let : V(t) = \sum_^ h_i(t) S_i(t). Then the portfolio (h_1(t), \dots, h_n(t)) is self-financing if : dV(t) = \sum_^ h_i(t) dS_(t). Discrete time Assume we are given a discrete filtered probability space (\Omega,\mathcal,\_^T,P), and let K_t be the solvency cone (with or without transaction costs) at time ''t'' for the market. Denote by L_d^p(K_t) = \. Then a portfolio (H_t)_^T (in physical units, i.e. the number of each stock) is self-financing (with trading on a finite set of times only) if : for all t \in \ we have that H_t - H_ \in -K ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dual Cone

Dual or Duals may refer to: Paired/two things * Dual (mathematics), a notion of paired concepts that mirror one another ** Dual (category theory), a formalization of mathematical duality *** see more cases in :Duality theories * Dual (grammatical number), a grammatical category used in some languages * Dual county, a Gaelic games county which in both Gaelic football and hurling * Dual diagnosis, a psychiatric diagnosis of co-occurrence of substance abuse and a mental problem * Dual fertilization, simultaneous application of a P-type and N-type fertilizer * Dual impedance, electrical circuits that are the dual of each other * Dual SIM cellphone supporting use of two SIMs * Aerochute International Dual a two-seat Australian powered parachute design Acronyms and other uses * Dual (brand), a manufacturer of Hifi equipment * DUAL (cognitive architecture), an artificial intelligence design model * DUAL algorithm, or diffusing update algorithm, used to update Internet protocol routing ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consistent Pricing System

A consistent pricing process (CPP) is any representation of ( frictionless) "prices" of assets in a market. It is a stochastic process in a filtered probability space (\Omega,\mathcal,\_^T,P) such that at time t the i^ component can be thought of as a price for the i^ asset. Mathematically, a CPP Z = (Z_t)_^T in a market with d-assets is an adapted process in \mathbb^d if ''Z'' is a martingale with respect to the physical probability measure P, and if Z_t \in K_t^+ \backslash \ at all times t such that K_t is the solvency cone for the market at time t. The CPP plays the role of an equivalent martingale measure in markets with transaction costs In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike pro .... In particular, there exists a 1-to-1 correspondence between the CPP Z and the EMM ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Frictionless Market

Frictionless can refer to: * Frictionless market * Frictionless continuant * Frictionless sharing * Frictionless plane The frictionless plane is a concept from the writings of Galileo Galilei. In his 1638 '' The Two New Sciences'', Galileo presented a formula that predicted the motion of an object moving down an inclined plane. His formula was based upon his past e ... * Frictionless flow {{disambiguation ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Illiquid

In business, economics or investment, market liquidity is a market's feature whereby an individual or firm can quickly purchase or sell an asset without causing a drastic change in the asset's price. Liquidity involves the trade-off between the price at which an asset can be sold, and how quickly it can be sold. In a liquid market, the trade-off is mild: one can sell quickly without having to accept a significantly lower price. In a relatively illiquid market, an asset must be discounted in order to sell quickly. Money, or cash, is the most liquid asset because it can be exchanged for goods and services instantly at face value. Overview A liquid asset has some or all of the following features: It can be sold rapidly, with minimal loss of value, anytime within market hours. The essential characteristic of a liquid market is that there are always ready and willing buyers and sellers. It is similar to, but distinct from, market depth, which relates to the trade-off between quantit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |