|

Risk Management Tools

Risk management tools allow the uncertainty to be addressed by identifying and generating metrics, parameterizing, prioritizing, and developing responses, and tracking risk. These activities may be difficult to track without tools and techniques, documentation and information systems. There are two distinct types of risk tools identified by their approach: market-level tools using the capital asset pricing model (CAP-M) and component-level tools with probabilistic risk assessment (PRA). Market-level tools use market forces to make risk decisions between securities. Component-level tools use the functions of probability and impact of individual risks to make decisions between resource allocations. ISO/IEC 31010 (Risk assessment techniques) has a detailed but non-exhaustive list of tools and techniques available for assessing risk. Market-level (CAP-M) CAP-M uses market or economic statistics and assumptions to determine the appropriate required rate of return of an asset, given ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Asset Pricing Model

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio. The model takes into account the asset's sensitivity to non-diversifiable risk (also known as systematic risk or market risk), often represented by the quantity beta (β) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. CAPM assumes a particular form of utility functions (in which only first and second moments matter, that is risk is measured by variance, for example a quadratic utility) or alternatively asset returns whose probability distributions are completely described by the first two moments (for example, the normal distribution) and zero transaction costs (necessary for diversification to get rid of all idiosyncratic risk). Under these conditions, CAPM shows that the cost of eq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Project Risk Management

Within project management, risk management refers to activities for minimizing project risks, and thereby ensuring that a project is completed within time and budget, as well as fulfilling its goals. Definition of risk and risk management Risk management activities are applied to project management. Project risk is defined by the Project Management Institute (PMI) as, "an uncertain event or condition that, if it occurs, has a positive or negative effect on a project’s objectives." Within disciplines such as operational risk, financial risk and underwriting risk management, the concepts of risk, risk management and individual risks are nearly interchangeable; being either personnel or monetary impacts respectively. However, impacts in ''project'' risk management are more diverse, overlapping monetary, schedule, capability, quality and engineering disciplines. For this reason it is necessary in project risk management to specify the differences (paraphrased from the U.S. "Departm ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Problematic Integration Theory

Problematic Integration Theory is a theory of communication that addresses the processes and dynamics of how people receive, evaluate, and respond to information and experiences. The premises of PI are based on the view that message processing, specifically the development of probabilistic and evaluative orientations (our perceptions of something's likelihood of occurring and its value, respectively), is a social and cultural construction. In situations where there is agreement between probabilistic orientation (a person's constructed belief about an object's likelihood, i.e., how likely something is to occur) and evaluative orientation (a person's constructed belief about an object's value), integration is in harmony, i.e., not problematic. However, when there is disagreement between these orientations about an object (i.e., an event, thing, person, idea, outcome, etc.), then integration becomes problematic. This disharmony leads to conflict and discomfort, which can manifest itself ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Peren–Clement Index

The Peren–Clement index is a method of country-specific risk analysis for businesses engaged in international trade and direct investment. This instrument provides a guideline when deciding which foreign markets offer the possibility of additional business engagement and investment and the extent of an existing engagement or investment can be increased or should be reduced. The Peren-Clement index can be used as an early detection system, which evaluates probabilities and risks of an investment in a certain foreign market, which are determined by the political situation, its social, economical and judicial environment as well as its predictable or anticipated future developments of that country. Users These kind of analyses are conducted amongst other things by international rating agencies, export credit insurances and international organisations. In many cases the analysed countries are brought into a country rating. Methods The aim is the classification of countries in an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ISO 31000

ISO 31000 is a family of standards relating to risk management codified by the International Organization for Standardization. ISO 31000:2018 provides principles and generic guidelines on managing risks that could be negative faced by organizations as these could have consequence in terms of economic performance and professional reputation. ISO 31000 seeks to provide a universally recognized paradigm for practitioners and companies employing risk management processes to replace the myriad of existing standards, methodologies and paradigms that differed between industries, subject matters and regions. For this purpose, the recommendations provided in ISO 31000 can be customized to any organization and its contex As of 2020, ISO/TC 262, the committee responsible for this family of standards, has published five standards, while four additional standards are in the proposal/development stages.Published standards * ISO 31000:2018 - Risk management - Guidelines * ISO/TR 31004:2013 - Ri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

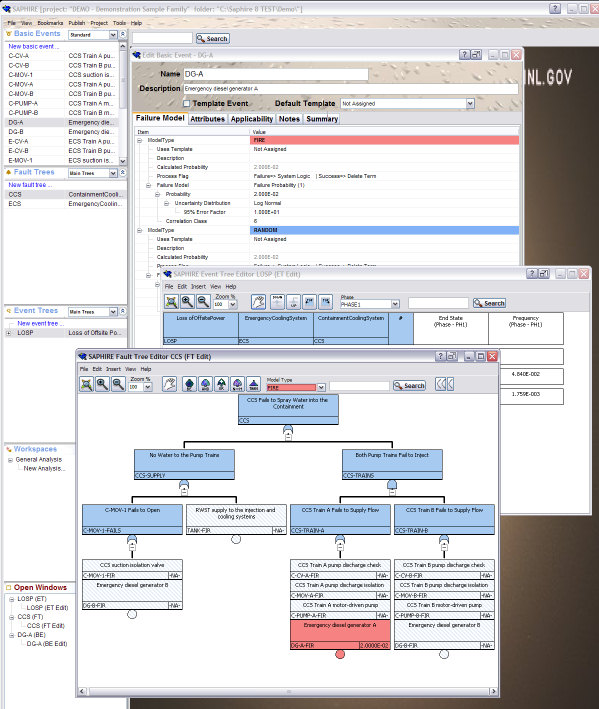

SAPHIRE

{{primary sources, date=March 2015 SAPHIRE is a probabilistic risk and reliability assessment software tool. SAPHIRE stands for ''Systems Analysis Programs for Hands-on Integrated Reliability Evaluations''. The system was developed for the U.S. Nuclear Regulatory Commission (NRC) by the Idaho National Laboratory. Development began in the mid-1980s when the NRC began exploring two notions: 1) that Probabilistic Risk Assessment (PRA) information could be displayed and manipulated using the emerging microcomputer technology of the day and 2) the rapid advancement of PRA technology required a relatively inexpensive and readily available platform for teaching PRA concepts to students. The history of SAPHIRE 1987 Version 1 of the code called IRRAS (now known as SAPHIRE) introduced an innovative way to draw, edit, and analyze graphical fault trees. 1989 Version 2 is released incorporating the ability to draw, edit, and analyze graphical event trees. 1990 Analysis improvements to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Register

A risk register (PRINCE2) is a document used as a risk management tool and to fulfill regulatory compliance acting as a repository for all risks identified and includes additional information about each risk, e.g., nature of the risk, reference and owner, mitigation measures. It can be displayed as a scatterplot or as a table. ISO 73:2009 Risk management—Vocabulary defines a risk register to be a "record of information about identified risks". Example Risk register of the project "barbecue party" with somebody inexperienced handling the grill, both in table format (below) and as plot (right). Terminology A Risk Register can contain many different items. There are recommendations for Risk Register content made by the Project Management Institute Body of Knowledge (PMBOK) and PRINCE2. ISO 31000:2009 does not use the term risk register, however it does state that risks need to be documented. There are many different tools that can act as risk registers from comprehensive s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Event Chain Methodology

Event chain methodology is a network analysis technique that is focused on identifying and managing events and relationship between them (event chains) that affect project schedules. It is an uncertainty modeling schedule technique. Event chain methodology is an extension of quantitative project risk analysis with Monte Carlo simulations. It is the next advance beyond critical path method and critical chain project management. Event chain methodology tries to mitigate the effect of motivational and cognitive biases in estimating and scheduling. It improves accuracy of risk assessment and helps to generate more realistic risk adjusted project schedules. History Event chain methodology is an extension of traditional Monte Carlo simulation of project schedules where uncertainties in task duration and costs are defined by statistical distribution. For example, task duration can be defined by three point estimates: low, base, and high. The results of analysis is a risk adjusted proje ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probabilistic Risk Assessment

Probabilistic risk assessment (PRA) is a systematic and comprehensive methodology to evaluate risks associated with a complex engineered technological entity (such as an airliner or a nuclear power plant) or the effects of stressors on the environment (probabilistic environmental risk assessment, or PERA). Risk in a PRA is defined as a feasible detrimental outcome of an activity or action. In a PRA, risk is characterized by two quantities: #the magnitude (severity) of the possible adverse consequence(s), and #the likelihood (probability) of occurrence of each consequence. Consequences are expressed numerically (e.g., the number of people potentially hurt or killed) and their likelihoods of occurrence are expressed as probabilities or frequencies (i.e., the number of occurrences or the probability of occurrence per unit time). The total risk is the expected loss: the sum of the products of the consequences multiplied by their probabilities. The spectrum of risks across classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probabilistic Risk Assessment

Probabilistic risk assessment (PRA) is a systematic and comprehensive methodology to evaluate risks associated with a complex engineered technological entity (such as an airliner or a nuclear power plant) or the effects of stressors on the environment (probabilistic environmental risk assessment, or PERA). Risk in a PRA is defined as a feasible detrimental outcome of an activity or action. In a PRA, risk is characterized by two quantities: #the magnitude (severity) of the possible adverse consequence(s), and #the likelihood (probability) of occurrence of each consequence. Consequences are expressed numerically (e.g., the number of people potentially hurt or killed) and their likelihoods of occurrence are expressed as probabilities or frequencies (i.e., the number of occurrences or the probability of occurrence per unit time). The total risk is the expected loss: the sum of the products of the consequences multiplied by their probabilities. The spectrum of risks across classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diversification (finance)

In finance, diversification is the process of allocating capital in a way that reduces the exposure to any one particular asset or risk. A common path towards diversification is to reduce risk or volatility by investing in a variety of assets. If asset prices do not change in perfect synchrony, a diversified portfolio will have less variance than the weighted average variance of its constituent assets, and often less volatility than the least volatile of its constituents. Diversification is one of two general techniques for reducing investment risk. The other is hedging. Examples The simplest example of diversification is provided by the proverb "Don't put all your eggs in one basket". Dropping the basket will break all the eggs. Placing each egg in a different basket is more diversified. There is more risk of losing one egg, but less risk of losing all of them. On the other hand, having a lot of baskets may increase costs. In finance, an example of an undiversified portfoli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asset

In financial accountancy, financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. Assets can be grouped into two major classes: Tangible property, tangible assets and intangible assets. Tangible ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |