|

Risk Aversion (psychology)

Risk aversion is a preference for a sure outcome over a gamble with higher or equal expected value. Conversely, the rejection of a sure thing in favor of a gamble of lower or equal expected value is known as risk-seeking behavior. The psychophysics of chance induce overweighting of sure things and of improbable events, relative to events of moderate probability. Underweighting of moderate and high probabilities relative to sure things contributes to risk aversion in the realm of gains by reducing the attractiveness of positive gambles. The same effect also contributes to risk seeking in losses by attenuating the aversiveness of negative gambles. Low probabilities, however, are overweighted, which reverses the pattern described above: low probabilities enhance the value of long-shots and amplify aversion to a small chance of a severe loss. Consequently, people are often risk seeking in dealing with improbable gains and risk averse in dealing with unlikely losses. Related theories ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-seeking

In accounting, finance, and economics, a risk-seeker or risk-lover is a person who has a preference ''for'' risk. While most investors are considered risk ''averse'', one could view casino-goers as risk-seeking. A common example to explain risk-seeking behaviour is; If offered two choices; either $50 as a sure thing, or a 50% chance each of either $100 or nothing, a risk-seeking person would prefer the gamble. Even though the gamble and the "sure thing" have the same expected value, the preference for risk makes the gamble's expected utility for the individual much higher. The Utility Function and Risk-Seekers Choice under uncertainty is when a person facing a choice is not certain of the possible outcomes or their probability of occurring. The standard way to model how people choose under uncertain condition, is by using expected utility. In order to calculate expected utility, a utility function 'u' is developed in order to translate money into Utility. Therefore, if a person ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Affect Heuristic

The affect heuristic is a heuristic, a mental shortcut that allows people to make decisions and solve problems quickly and efficiently, in which current emotion—fear, pleasure, surprise, etc.—influences decisions. In other words, it is a type of heuristic in which emotional response, or " affect" in psychological terms, plays a lead role. It is a subconscious process that shortens the decision-making process and allows people to function without having to complete an extensive search for information. It is shorter in duration than a mood, occurring rapidly and involuntarily in response to a stimulus. Reading the words "lung cancer" usually generates an affect of dread, while reading the words "mother's love" usually generates a feeling of affection and comfort. The affect heuristic is typically used while judging the risks and benefits of something, depending on the positive or negative feelings that people associate with a stimulus. It is the equivalent of "going with your ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Motivational Theories

Motivation is the reason for which humans and other animals initiate, continue, or terminate a behavior at a given time. Motivational states are commonly understood as forces acting within the agent that create a disposition to engage in goal-directed behavior. It is often held that different mental states compete with each other and that only the strongest state determines behavior. This means that we can be motivated to do something without actually doing it. The paradigmatic mental state providing motivation is desire. But various other states, such as beliefs about what one ought to do or intentions, may also provide motivation. Motivation is derived from the word 'motive', which denotes a person's needs, desires, wants, or urges. It is the process of motivating individuals to take action in order to achieve a goal. The psychological elements fueling people's behavior in the context of job goals might include a desire for money. Various competing theories have been proposed con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Game Theory

Game theory is the study of mathematical models of strategic interactions among rational agents. Myerson, Roger B. (1991). ''Game Theory: Analysis of Conflict,'' Harvard University Press, p.&nbs1 Chapter-preview links, ppvii–xi It has applications in all fields of social science, as well as in logic, systems science and computer science. Originally, it addressed two-person zero-sum games, in which each participant's gains or losses are exactly balanced by those of other participants. In the 21st century, game theory applies to a wide range of behavioral relations; it is now an umbrella term for the science of logical decision making in humans, animals, as well as computers. Modern game theory began with the idea of mixed-strategy equilibria in two-person zero-sum game and its proof by John von Neumann. Von Neumann's original proof used the Brouwer fixed-point theorem on continuous mappings into compact convex sets, which became a standard method in game theory and mathema ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. The international standard definition of risk for common understanding in different applications is “effect of uncertainty on objectives”. The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, environment, finance, information technology, health, insurance, safety, security etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and generic guidelines on managing risks faced by organizations. Definitions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Modern Portfolio Theory

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. It uses the variance of asset prices as a proxy for risk. Economist Harry Markowitz introduced MPT in a 1952 essay, for which he was later awarded a Nobel Memorial Prize in Economic Sciences; see Markowitz model. Mathematical model Risk and expected return MPT assumes that investors are risk averse, meaning that given two portfolios that offer the same expected return, investors will prefer the less risky one. Thus, an investor will take on increased risk only if compensat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Expected Value

In probability theory, the expected value (also called expectation, expectancy, mathematical expectation, mean, average, or first moment) is a generalization of the weighted average. Informally, the expected value is the arithmetic mean of a large number of independently selected outcomes of a random variable. The expected value of a random variable with a finite number of outcomes is a weighted average of all possible outcomes. In the case of a continuum of possible outcomes, the expectation is defined by integration. In the axiomatic foundation for probability provided by measure theory, the expectation is given by Lebesgue integration. The expected value of a random variable is often denoted by , , or , with also often stylized as or \mathbb. History The idea of the expected value originated in the middle of the 17th century from the study of the so-called problem of points, which seeks to divide the stakes ''in a fair way'' between two players, who have to end th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neuroeconomics

Neuroeconomics is an interdisciplinary field that seeks to explain human decision-making, the ability to process multiple alternatives and to follow through on a plan of action. It studies how economic behavior can shape our understanding of the brain, and how neuroscientific discoveries can guide models of economics.Center for Neuroeconomics Study at Duke University http://dibs.duke.edu/research/d-cides/research/neuroeconomics It combines research from neuroscience, experimental An experiment is a procedure carried out to support or refute a hypothesis, or determine the efficacy or likelihood of something previously untried. Experiments provide insight into cause-and-effect by demonstrating what outcome occurs when ... and behavioral economics, and Cognitive psychology, cognitive and Social psychology, social psychology. As research into decision-making behavior becomes increasingly computational, it has also incorporated new approaches from theoretical biology, comput ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fear Conditioning

Pavlovian fear conditioning is a behavioral paradigm in which organisms learn to predict aversive events. It is a form of learning in which an aversive stimulus (e.g. an electrical shock) is associated with a particular neutral context (e.g., a room) or neutral stimulus (e.g., a tone), resulting in the expression of fear responses to the originally neutral stimulus or context. This can be done by pairing the neutral stimulus with an aversive stimulus (e.g., an electric shock, loud noise, or unpleasant odor). Eventually, the neutral stimulus alone can elicit the state of fear. In the vocabulary of classical conditioning, the neutral stimulus or context is the "conditional stimulus" (CS), the aversive stimulus is the "unconditional stimulus" (US), and the fear is the "conditional response" (CR). Fear conditioning has been studied in numerous species, from snails to humans. In humans, conditioned fear is often measured with verbal report and galvanic skin response. In other animals ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Decision-making

In psychology, decision-making (also spelled decision making and decisionmaking) is regarded as the Cognition, cognitive process resulting in the selection of a belief or a course of action among several possible alternative options. It could be either Rationality, rational or irrational. The decision-making process is a reasoning process based on assumptions of value (ethics and social sciences), values, preferences and beliefs of the decision-maker. Every decision-making process produces a final choice, which may or may not prompt action. Research about decision-making is also published under the label problem solving, particularly in European psychological research. Overview Decision-making can be regarded as a Problem solving, problem-solving activity yielding a solution deemed to be optimal, or at least satisfactory. It is therefore a process which can be more or less Rationality, rational or Irrationality, irrational and can be based on explicit knowledge, explicit or tacit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Negativity Bias

The negativity bias,Kanouse, D. E., & Hanson, L. (1972). Negativity in evaluations. In E. E. Jones, D. E. Kanouse, S. Valins, H. H. Kelley, R. E. Nisbett, & B. Weiner (Eds.), ''Attribution: Perceiving the causes of behavior.'' Morristown, NJ: General Learning Press. also known as the negativity effect, is the notion that, even when of equal intensity, things of a more negative nature (e.g. unpleasant thoughts, emotions, or social interactions; harmful/traumatic events) have a greater effect on one's psychological state and processes than neutral or positive things. In other words, something very positive will generally have less of an impact on a person's behavior and cognition than something equally emotional but negative. The negativity bias has been investigated within many different domains, including the formation of impressions and general evaluations; attention, learning, and memory; and decision-making and risk considerations. Explanations Paul Rozin and Edward Royzman p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loss Aversion

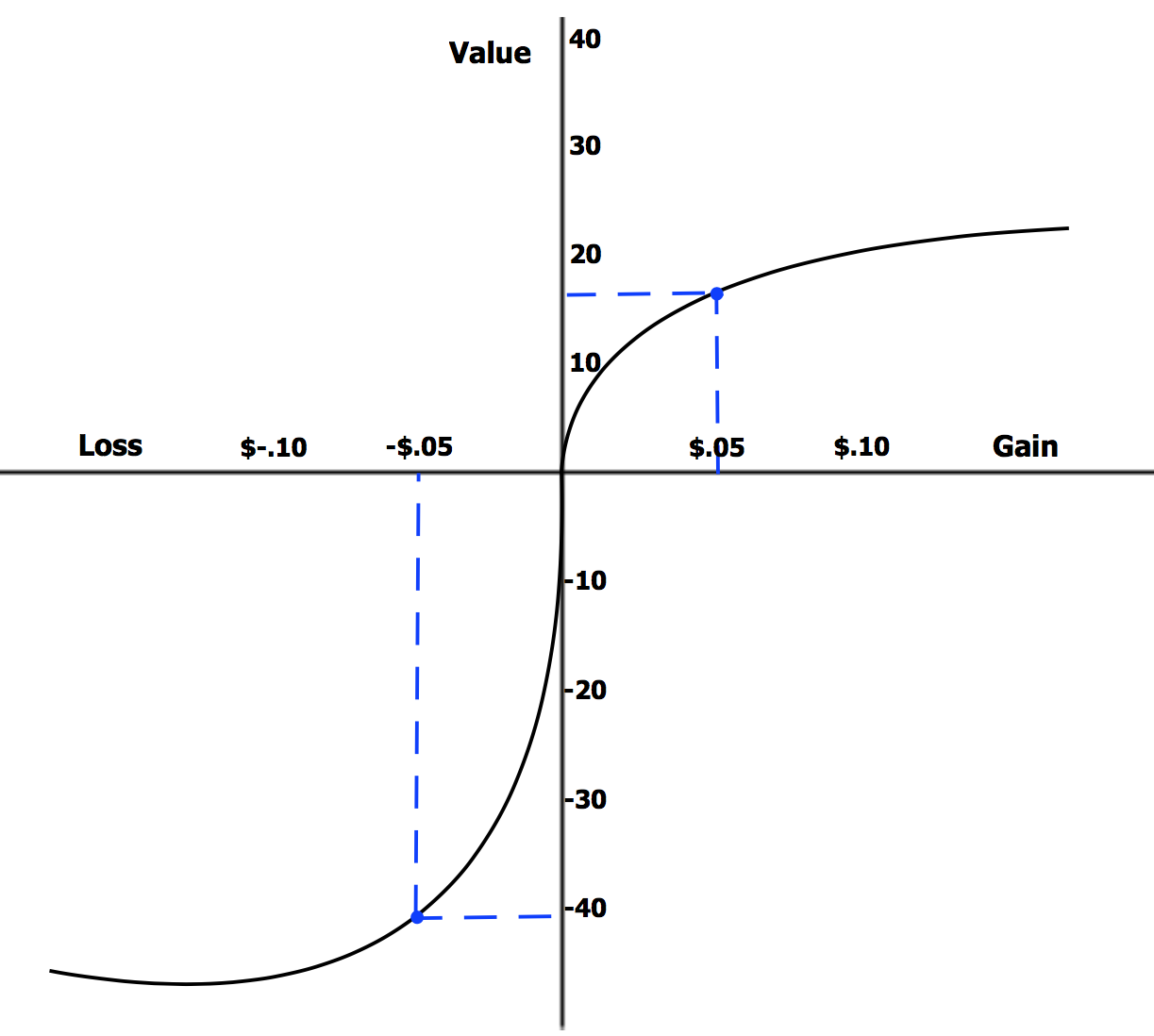

Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. The principle is prominent in the domain of economics. What distinguishes loss aversion from risk aversion is that the utility of a monetary payoff depends on what was previously experienced or was expected to happen. Some studies have suggested that losses are twice as powerful, psychologically, as gains. Loss aversion was first identified by Amos Tversky and Daniel Kahneman. Loss aversion implies that one who loses $100 will lose more satisfaction than the same person will gain satisfaction from a $100 windfall. In marketing, the use of trial periods and rebates tries to take advantage of the buyer's tendency to value the good more after the buyer incorporates it in the status quo. In past behavioral economics studies, users participate up until the threat of loss equals any incurred gains. Recent methods established by Botond Kőszegi and Matthew Rabin in experimental economics illustrat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |