|

Repos

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price. The repo market is an important source of funds for large financial institutions in the non-depository banking sector, which has grown to rival the traditional depository banking sector in size. Large institutional investors such as money market mutual funds lend money to financial institutions such as investment banks, either in exchange for (or secured by) collateral, such as Treasury bonds and mortgage-backed securities held by the borrower financial institutions. An estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets. In 2007–2008, a run on the repo market, in which funding for investment banks was e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reverse Repo

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price. The repo market is an important source of funds for large financial institutions in the non-depository banking sector, which has grown to rival the traditional depository banking sector in size. Large institutional investors such as money market mutual funds lend money to financial institutions such as investment banks, either in exchange for (or secured by) collateral, such as Treasury bonds and mortgage-backed securities held by the borrower financial institutions. An estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets. In 2007–2008, a run on the repo market, in which funding for investment banks was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Repo Transaction Components

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price. The repo market is an important source of funds for large financial institutions in the non-depository banking sector, which has grown to rival the traditional depository banking sector in size. Large institutional investors such as money market mutual funds lend money to financial institutions such as investment banks, either in exchange for (or secured by) collateral, such as Treasury bonds and mortgage-backed securities held by the borrower financial institutions. An estimated $1 trillion per day in collateral value is transacted in the U.S. repo markets. In 2007–2008, a run on the repo market, in which funding for investment banks was e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and regulating banks, maintaining the stabili ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The New York Times

''The New York Times'' (''the Times'', ''NYT'', or the Gray Lady) is a daily newspaper based in New York City with a worldwide readership reported in 2020 to comprise a declining 840,000 paid print subscribers, and a growing 6 million paid digital subscribers. It also is a producer of popular podcasts such as '' The Daily''. Founded in 1851 by Henry Jarvis Raymond and George Jones, it was initially published by Raymond, Jones & Company. The ''Times'' has won 132 Pulitzer Prizes, the most of any newspaper, and has long been regarded as a national " newspaper of record". For print it is ranked 18th in the world by circulation and 3rd in the U.S. The paper is owned by the New York Times Company, which is publicly traded. It has been governed by the Sulzberger family since 1896, through a dual-class share structure after its shares became publicly traded. A. G. Sulzberger, the paper's publisher and the company's chairman, is the fifth generation of the family to head the pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Secured Loan

A secured loan is a loan in which the borrower pledges some asset (e.g. a car or property) as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan. The debt is thus secured against the collateral, and if the borrower defaults, the creditor takes possession of the asset used as collateral and may sell it to regain some or all of the amount originally loaned to the borrower. An example is the foreclosure of a home. From the creditor's perspective, that is a category of debt in which a lender has been granted a portion of the bundle of rights to specified property. If the sale of the collateral does not raise enough money to pay off the debt, the creditor can often obtain a deficiency judgment against the borrower for the remaining amount. The opposite of secured debt/loan is unsecured debt, which is not connected to any specific piece of property. Instead, the creditor may satisfy the debt only against the borrower, rather than the bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ESM Government Securities

ESM Government Securities, Inc. was a Fort Lauderdale, Florida-based government securities dealer, specializing in repurchase agreements and reverse repurchase agreements. The failure of the company in March 1985 precipitated the collapse of Home State Savings Bank, deposit runs on dozens of other banks in Ohio, and the downfall of the private Ohio Deposit Guarantee Fund. History ESM was started in 1975 by Ronnie Ewton, Robert Seneca and George Mead, taking the name of the company from the first letter of their last names. (Seneca resigned from the company in 1978.) Alan Novick joined soon afterwards and would later become president (but died in November 1984 of a heart attack). Stephen Arky, an attorney, met Ronnie Ewton in his National Guard unit, and introduced him to his father-in-law Marvin Warner, the owner of Home State Savings Bank in Cincinnati, Ohio. Fraud shutdown ESM was shut down on March 4, 1985, by the Securities and Exchange Commission and placed into receivers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chase Bank

JPMorgan Chase Bank, N.A., doing business as Chase Bank or often as Chase, is an American national bank headquartered in New York City, that constitutes the consumer and commercial banking subsidiary of the U.S. multinational banking and financial services holding company, JPMorgan Chase. The bank was known as Chase Manhattan Bank until it merged with J.P. Morgan & Co. in 2000. Chase Manhattan Bank was formed by the merger of the Chase National Bank and the Manhattan Company in 1955. The bank merged with Bank One Corporation in 2004 and in 2008 acquired the deposits and most assets of Washington Mutual. Chase offers more than 5,100 branches and 17,000 ATMs nationwide. JPMorgan Chase & Co. has 250,355 employees (as of 2016) and operates in more than 100 countries. JPMorgan Chase & Co. had assets of $3.31 trillion in 2022, which makes it the largest bank in the United States as well as the bank with the most branches in the United States and the only bank with a presence in a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2011 U

Eleven or 11 may refer to: *11 (number), the natural number following 10 and preceding 12 * one of the years 11 BC, AD 11, 1911, 2011, or any year ending in 11 Literature * ''Eleven'' (novel), a 2006 novel by British author David Llewellyn *''Eleven'', a 1970 collection of short stories by Patricia Highsmith *''Eleven'', a 2004 children's novel in The Winnie Years by Lauren Myracle *''Eleven'', a 2008 children's novel by Patricia Reilly Giff *''Eleven'', a short story by Sandra Cisneros Music *Eleven (band), an American rock band * Eleven: A Music Company, an Australian record label * Up to eleven, an idiom from popular culture, coined in the movie ''This Is Spinal Tap'' Albums * ''11'' (The Smithereens album), 1989 * ''11'' (Ua album), 1996 * ''11'' (Bryan Adams album), 2008 * ''11'' (Sault album), 2022 * ''Eleven'' (Harry Connick, Jr. album), 1992 * ''Eleven'' (22-Pistepirkko album), 1998 * ''Eleven'' (Sugarcult album), 1999 * ''Eleven'' (B'z album), 2000 * ''Eleven'' (Reamon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Home State Savings Bank

Home State Savings Bank was a Cincinnati, Ohio based savings and loan. Its failure in March 1985 led to a bank holiday for 70 other savings institutions that were insured by the Ohio Deposit Guarantee Fund, a private organization. Background Home State Savings Bank was the largest savings institution in Ohio, with $1.4 billion in assets. It was owned by Marvin L. Warner, a local real estate developer and investor. He bought the bank in 1958. Warner had been a part owner of the New York Yankees and the Tampa Bay Buccaneers in the 1970s, and was the original owner of the United States Football League Birmingham Stallions. Warner was also a substantial political donor, and had been appointed as the United States ambassador to Switzerland in 1977 by President Jimmy Carter. Downfall ESM Government Securities, Inc. of Fort Lauderdale, Florida, was a securities brokerage firm specializing in term repurchase agreements and reverse repurchase agreements. The company was shut down by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

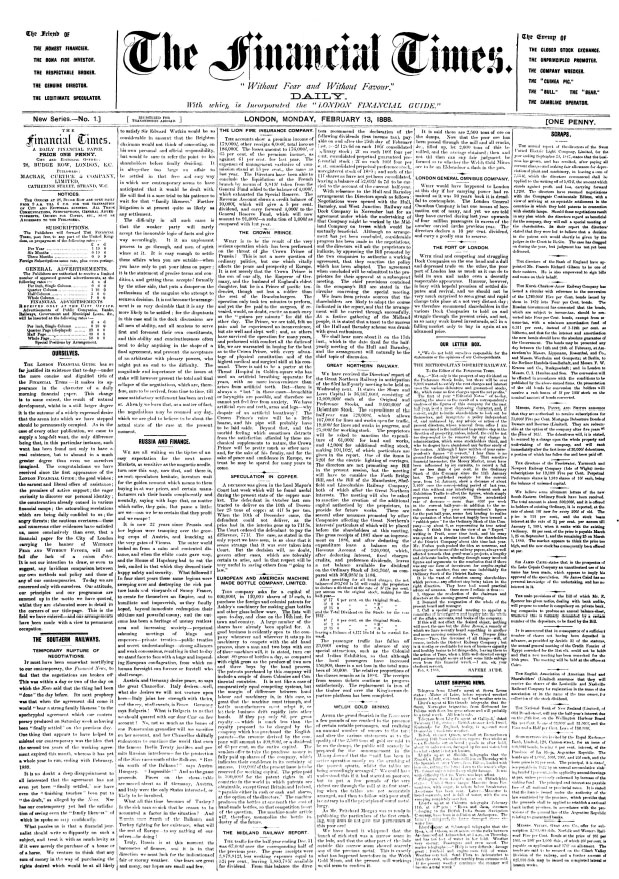

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million (US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.png)