|

Real Bills Doctrine

The real bills doctrine says that as long as bankers lend to businessmen only against the security (collateral) of short-term 30-, 60-, or 90-day commercial paper representing claims to real goods in the process of production, the loans will be just sufficient to finance the production of goods. The doctrine seeks to have real output determine its own means of purchase without affecting prices. Under the real bills doctrine, there is only one policy role for the central bank: lending commercial banks the necessary reserves against real customer bills, which the banks offer as collateral. The term "real bills doctrine" was coined by Lloyd Mints in his 1945 book, ''A History of Banking Theory''. The doctrine was previously known as "the commercial loan theory of banking". Moreover, as bank loans are granted to businessmen in the form either of new bank notes or of additions to their checking deposits, which deposits constitute the main component of the money stock, the doctrine assur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Paper

Commercial paper, in the global financial market, is an unsecured promissory note with a fixed maturity of rarely more than 270 days. In layperson terms, it is like an " IOU" but can be bought and sold because its buyers and sellers have some degree of confidence that it can be successfully redeemed later for cash, based on their assessment of the creditworthiness of the issuing company. Commercial paper is a money-market security issued by large corporations to obtain funds to meet short-term debt obligations (for example, payroll) and is backed only by an issuing bank or company promise to pay the face amount on the maturity date specified on the note. Since it is not backed by collateral, only firms with excellent credit ratings from a recognized credit rating agency will be able to sell their commercial paper at a reasonable price. Commercial paper is usually sold at a discount from face value and generally carries lower interest repayment rates than bonds due to the sh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Anna Schwartz

Anna Jacobson Schwartz (pronounced ; November 11, 1915 – June 21, 2012) was an American economist who worked at the National Bureau of Economic Research in New York City and a writer for ''The New York Times''. Paul Krugman has said that Schwartz is "one of the world's greatest monetary scholars." .html" ;"title="/sup>">/sup> Schwartz collaborated with Nobel laureate Milton Friedman on ''A Monetary History of the United States, 1867–1960'', which was published in 1963. .html" ;"title="/sup>">/sup> This book placed the blame for the Great Depression at the door of the Federal Reserve System. Robert J. Shiller describes the book as the "most influential account" of the Great Depression. She was also president of the Western Economic Association International in 1988. .html" ;"title="/sup>">/sup> Schwartz was inducted into the National Women's Hall of Fame in 2013. Early life and education Schwartz was born Anna Jacobson on November 11, 1915, in New York City to Pauline ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FDIC

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of the g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Monetarist

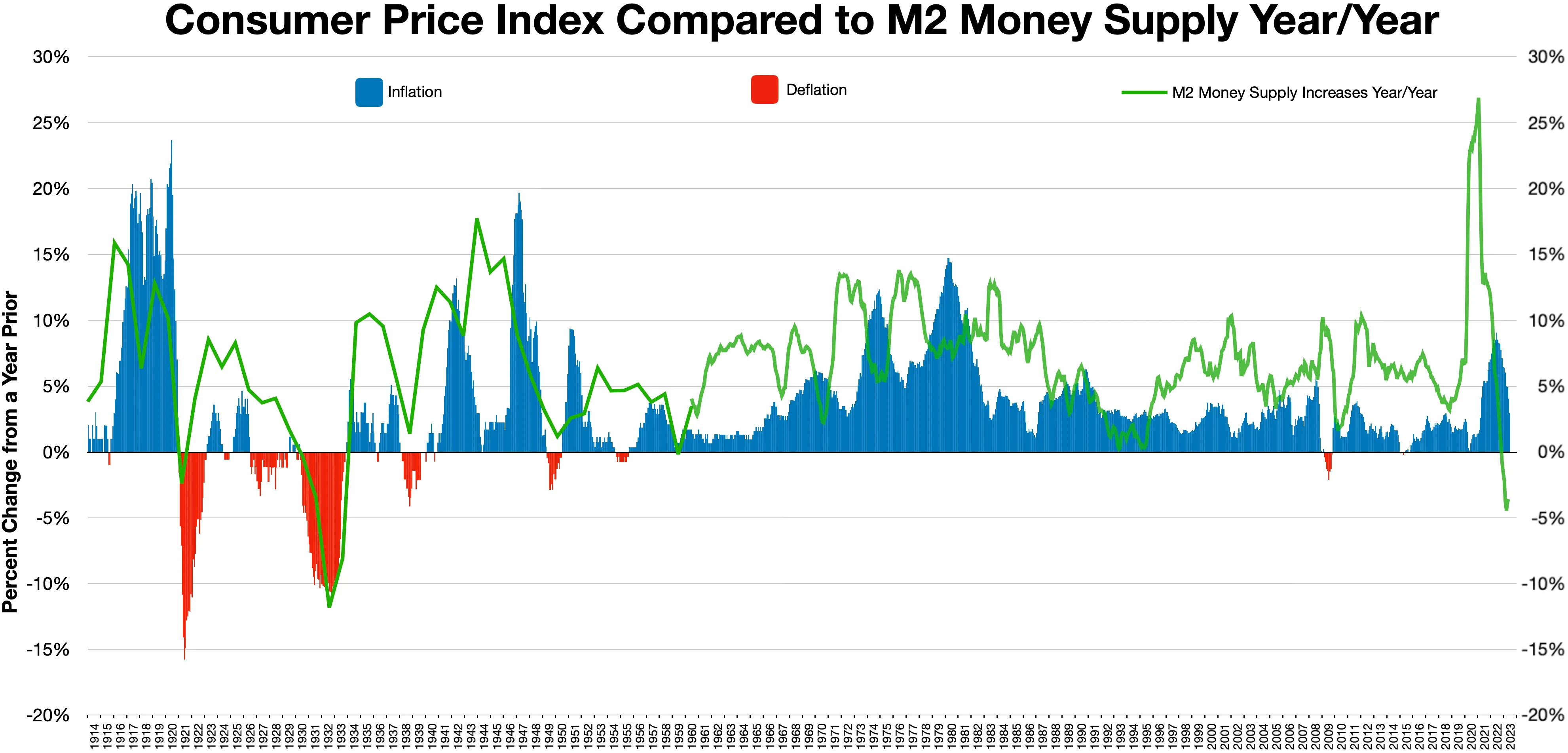

Monetarism is a school of thought in monetary economics that emphasizes the role of governments in controlling the amount of money in circulation. Monetarist theory asserts that variations in the money supply have major influences on national output in the short run and on price levels over longer periods. Monetarists assert that the objectives of monetary policy are best met by targeting the growth rate of the money supply rather than by engaging in discretionary monetary policy.Phillip Cagan, 1987. "Monetarism", '' The New Palgrave: A Dictionary of Economics'', v. 3, Reprinted in John Eatwell et al. (1989), ''Money: The New Palgrave'', pp. 195–205, 492–97. Monetarism is commonly associated with neoliberalism. Monetarism today is mainly associated with the work of Milton Friedman, who was among the generation of economists to reject Keynesian economics and criticise Keynes's theory of fighting economic downturns using fiscal policy ( government spending). Friedman and An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clark Warburton

Clark Warburton (27 January 1896, near Buffalo, New York – 18 September 1979, Fairfax, Virginia) was an American economist. He was described as the "first monetarist of the post-World War II period," the most uncompromising upholder of a strictly monetary theory of business fluctuations, and reviver of classic monetary-disequilibrium theory and the quantity theory of money. Life and works Warburton received bachelor's and master's degrees from Cornell University after military service overseas during World War I. From the 1920s to the early 1930s, he held teaching positions in India and the United States. He received a Ph.D. degree at Columbia University in 1932. There his interest had shifted from history to economics while attending lectures of Wesley C. Mitchell. His dissertation was published as ''The Economic Results of Prohibition.'' From 1932 to 1934, he worked at the Brookings Institution. In 1934 he joined the newly formed Federal Deposit Insurance Corporation. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1929 Crash

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed. It was the most devastating stock market crash in the history of the United States, when taking into consideration the full extent and duration of its aftereffects. The Great Crash is mostly associated with October 24, 1929, called ''Black Thursday'', the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called ''Black Tuesday'', when investors traded some 16 million shares on the New York Stock Exchange in a single day. The crash, which followed the London Stock Exchange's crash of September, signaled the beginning of the Great Depression. Background The "Roaring Twenties", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve Board Of Governors

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms.See Statutory description By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country". As stipulated in the Banking Act of 1935, the Chair and Vice Chair of the Board are two of seven members of the Board of Governors who are appointed by the President from among the sitting governors of the Federal Reserve Banks. The terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the preside ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Winfield W

Winfield may refer to: Places Canada * Winfield, Alberta * Winfield, British Columbia United States * Winfield, Alabama * Winfield, Arkansas * Winfield, Georgia * Winfield, Illinois * Winfield, Indiana * Winfield, Iowa * Winfield, Kansas * Winfield, Maryland ( southern Carroll County) * Winfield, Missouri * Winfield (town), New York * Winfield, Pennsylvania * Winfield, Tennessee * Winfield, Texas * Winfield, West Virginia * Winfield, Wisconsin * Winfield Township, Michigan * Winfield Township, Renville County, Minnesota * Winfield Township, New Jersey * Winfield Township, Butler County, Pennsylvania * West Winfield, New York People Given name Military * Winfield Scott Edgerly (1846–1927), United States Army General * Winfield Scott Hancock (1824–1886), United States Army General * Winfield Scott Schley (1839-1911), United States Navy Admiral * Winfield Scott (1786–1866), United States Army general * Winfield Scott (chaplain) (1837–1910), United States Army chaplain * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mississippi Bubble

The Mississippi Company (french: Compagnie du Mississippi; founded 1684, named the Company of the West from 1717, and the Company of the Indies from 1719) was a corporation holding a business monopoly in French colonies in North America and the West Indies. In 1717, the Mississippi Company received a royal grant with exclusive trading rights for 25 years. The rise and fall of the company is connected with the activities of the Scottish financier and economist John Law who was then the Controller General of Finances of France. When the speculation in French financial circles, and the land development in the region became frenzied and detached from economic reality, the Mississippi bubble became one of the earliest examples of an economic bubble. History The ''Compagnie du Mississippi'' was originally chartered in 1684 by the request of Renee-Robert Cavelier (La Salle) who sailed in that year from France with a large expedition with the intention of founding a colony at the m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

German Hyperinflation

German(s) may refer to: * Germany (of or related to) ** Germania (historical use) * Germans, citizens of Germany, people of German ancestry, or native speakers of the German language ** For citizens of Germany, see also German nationality law **Germanic peoples (Roman times) * German language **any of the Germanic languages * German cuisine, traditional foods of Germany People * German (given name) * German (surname) * Germán, a Spanish name Places * German (parish), Isle of Man * German, Albania, or Gërmej * German, Bulgaria * German, Iran * German, North Macedonia * German, New York, U.S. * Agios Germanos, Greece Other uses * German (mythology), a South Slavic mythological being * Germans (band), a Canadian rock band * "German" (song), a 2019 song by No Money Enterprise * ''The German'', a 2008 short film * "The Germans", an episode of ''Fawlty Towers'' * ''The German'', a nickname for Congolese rebel André Kisase Ngandu See also * Germanic (other) * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1929 Stock Market Crash

The Wall Street Crash of 1929, also known as the Great Crash, was a major American stock market crash that occurred in the autumn of 1929. It started in September and ended late in October, when share prices on the New York Stock Exchange collapsed. It was the most devastating stock market crash in the history of the United States, when taking into consideration the full extent and duration of its aftereffects. The Great Crash is mostly associated with October 24, 1929, called ''Black Thursday'', the day of the largest sell-off of shares in U.S. history, and October 29, 1929, called ''Black Tuesday'', when investors traded some 16 million shares on the New York Stock Exchange in a single day. The crash, which followed the London Stock Exchange's crash of September, signaled the beginning of the Great Depression. Background The "Roaring Twenties", the decade following World War I that led to the crash, was a time of wealth and excess. Building on post-war optimism, rural Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)