|

Quantal Response Equilibrium

Quantal response equilibrium (QRE) is a solution concept in game theory. First introduced by Richard McKelvey and Thomas Palfrey, it provides an equilibrium notion with bounded rationality. QRE is not an equilibrium refinement, and it can give significantly different results from Nash equilibrium. QRE is only defined for games with discrete strategies, although there are continuous-strategy analogues. In a quantal response equilibrium, players are assumed to make errors in choosing which pure strategy to play. The probability of any particular strategy being chosen is positively related to the payoff from that strategy. In other words, very costly errors are unlikely. The equilibrium arises from the realization of beliefs. A player's payoffs are computed based on beliefs about other players' probability distribution over strategies. In equilibrium, a player's beliefs are correct. Application to data When analyzing data from the play of actual games, particularly from labor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Nash Equilibrium

In game theory, the Nash equilibrium is the most commonly used solution concept for non-cooperative games. A Nash equilibrium is a situation where no player could gain by changing their own strategy (holding all other players' strategies fixed). The idea of Nash equilibrium dates back to the time of Cournot, who in 1838 applied it to his model of competition in an oligopoly. If each player has chosen a strategy an action plan based on what has happened so far in the game and no one can increase one's own expected payoff by changing one's strategy while the other players keep theirs unchanged, then the current set of strategy choices constitutes a Nash equilibrium. If two players Alice and Bob choose strategies A and B, (A, B) is a Nash equilibrium if Alice has no other strategy available that does better than A at maximizing her payoff in response to Bob choosing B, and Bob has no other strategy available that does better than B at maximizing his payoff in response to Alice c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Mean Field Theory

In physics and probability theory, Mean-field theory (MFT) or Self-consistent field theory studies the behavior of high-dimensional random (stochastic) models by studying a simpler model that approximates the original by averaging over degrees of freedom (the number of values in the final calculation of a statistic that are free to vary). Such models consider many individual components that interact with each other. The main idea of MFT is to replace all interactions to any one body with an average or effective interaction, sometimes called a ''molecular field''. This reduces any many-body problem into an effective one-body problem. The ease of solving MFT problems means that some insight into the behavior of the system can be obtained at a lower computational cost. MFT has since been applied to a wide range of fields outside of physics, including statistical inference, graphical models, neuroscience, artificial intelligence, epidemic models, queueing theory, computer-network ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Behavioral Game Theory

Behavioral game theory seeks to examine how people's strategic decision-making behavior is shaped by social preferences, social utility and other psychological factors. Behavioral game theory analyzes interactive strategic decisions and behavior using the methods of game theory, experimental economics, and experimental psychology. Experiments include testing deviations from typical simplifications of economic theory such as the independence axiom and neglect of altruism, fairness, and framing effects. As a research program, the subject is a development of the last three decades. Traditional game theory is a critical principle of economic theory, and assumes that people's strategic decisions are shaped by rationality, selfishness and utility maximisation. It focuses on the mathematical structure of equilibria, and tends to use basic rational choice theory and utility maximization as the primary principles within economic models. At the same time rational choice theory is an ideal ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Bounded Rationality

Bounded rationality is the idea that rationality is limited when individuals decision-making, make decisions, and under these limitations, rational individuals will select a decision that is satisficing, satisfactory rather than optimal. Limitations include the difficulty of the problem requiring a decision, the cognitive capability of the mind, and the time available to make the decision. Decision-makers, in this view, act as satisficers, seeking a satisfactory solution, with everything that they have at the moment rather than an optimal solution. Therefore, humans do not undertake a full Cost–benefit analysis, cost-benefit analysis to determine the optimal decision, but rather, choose an option that fulfills their adequacy criteria. Some models of human behavior in the social sciences assume that humans can be reasonably approximated or described as rationality, rational entities, as in rational choice theory or An Economic Theory of Democracy, Downs' political agency model.M ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Perfect Information

Perfect information is a concept in game theory and economics that describes a situation where all players in a game or all participants in a market have knowledge of all relevant information in the system. This is different than complete information, which implies Common knowledge (logic), common knowledge of each agent's utility functions, payoffs, strategies and "types". A system with perfect information may or may not have complete information. In economics this is sometimes described as "no hidden information" and is a feature of perfect competition. In a market with perfect information all consumers and producers would have complete and instantaneous knowledge of all market prices, their own utility and cost functions. In game theory, a sequential game has perfect information if each player, when making any decision, is perfectly informed of all the events that have previously occurred, including the "initialization event" of the game (e.g. the starting hands of each player ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Sequential Game

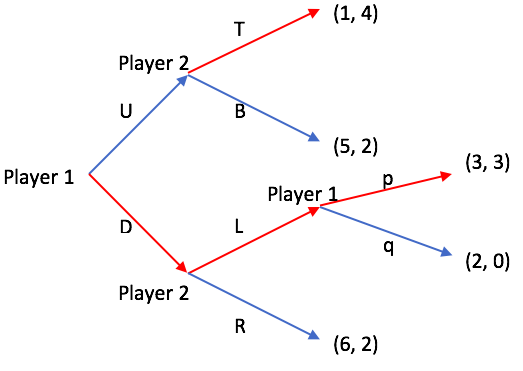

In game theory, a sequential game is defined as a game where one player selects their action before others, and subsequent players are informed of that choice before making their own decisions. This turn-based structure, governed by a time axis, distinguishes sequential games from Simultaneous game, simultaneous games, where players act without knowledge of others’ choices and outcomes are depicted in Payoff Matrix, payoff matrices (e.g., Rock paper scissors, rock-paper-scissors). Sequential games are a type of dynamic game, a broader category where decisions occur over time (e.g., Differential game, differential games), but they specifically emphasize a clear order of moves with known prior actions. Because later players know what earlier players did, the order of moves shapes strategy through information rather than timing alone. Sequential games are typically represented using Decision tree, decision trees, which map out all possible sequences of play, unlike the static matr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

The Price Is Right (American Game Show)

''The Price Is Right'' is an American television game show where contestants compete by guessing the prices of merchandise to win cash and prizes. A 1972 revival by Mark Goodson and Bill Todman of their 1956–1965 show of the same name, the new version added many distinctive gameplay elements. Contestants are selected from the studio audience. When the announcer calls their name, they use the show's famous catchphrase, "Come on down!" The program premiered September 4, 1972, on CBS. Bob Barker was the series's longest-running host from its debut until his retirement in June 2007, when Drew Carey took over. Barker was accompanied by a series of announcers, beginning with Johnny Olson, followed by Rod Roddy and Rich Fields. In December 2010, George Gray became the announcer. The show has used several models, most notably Anitra Ford, Janice Pennington, Dian Parkinson, Holly Hallstrom, Kathleen Bradley, and Rachel Reynolds. ''The Price Is Right'' has aired over 10,000 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Subgame Perfection

In game theory, a subgame perfect equilibrium (SPE), or subgame perfect Nash equilibrium (SPNE), is a refinement of the Nash equilibrium concept, specifically designed for dynamic games where players make sequential decisions. A strategy profile is an SPE if it represents a Nash equilibrium in every possible subgame of the original game. Informally, this means that at any point in the game, the players' behavior from that point onward should represent a Nash equilibrium of the continuation game (i.e. of the subgame), no matter what happened before. This ensures that strategies are credible and rational throughout the entire game, eliminating non-credible threats. Every finite extensive game with complete information (all players know the complete state of the game) and perfect recall (each player remembers all their previous actions and knowledge throughout the game) has a subgame perfect equilibrium. A common method for finding SPE in finite games is backward induction, wher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Extensive Form Game

In game theory, an extensive-form game is a specification of a game allowing for the explicit representation of a number of key aspects, like the sequencing of players' possible moves, their choices at every decision point, the (possibly imperfect) information each player has about the other player's moves when they make a decision, and their payoffs for all possible game outcomes. Extensive-form games also allow for the representation of incomplete information in the form of chance events modeled as " moves by nature". Extensive-form representations differ from normal-form in that they provide a more complete description of the game in question, whereas normal-form simply boils down the game into a payoff matrix. Finite extensive-form games Some authors, particularly in introductory textbooks, initially define the extensive-form game as being just a game tree with payoffs (no imperfect or incomplete information), and add the other elements in subsequent chapters as refinements ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Matching Pennies

Matching pennies is a non-cooperative game studied in game theory. It is played between two players, Even and Odd. Each player has a penny and must secretly turn the penny to heads or tails. The players then reveal their choices simultaneously. If the pennies match (both heads or both tails), then Even wins and keeps both pennies. If the pennies do not match (one heads and one tails), then Odd wins and keeps both pennies. Theory Matching Pennies is a zero-sum game because each participant's gain or loss of utility is exactly balanced by the losses or gains of the utility of the other participants. If the participants' total gains are added up and their total losses subtracted, the sum will be zero. The game can be written in a payoff matrix (pictured right - from Even's point of view). Each cell of the matrix shows the two players' payoffs, with Even's payoffs listed first. Matching pennies is used primarily to illustrate the concept of mixed strategies and a mixed str ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Logit Equilibrium

In statistics, the logit ( ) function is the quantile function associated with the standard logistic distribution. It has many uses in data analysis and machine learning, especially in data transformations. Mathematically, the logit is the inverse of the standard logistic function \sigma(x) = 1/(1+e^), so the logit is defined as : \operatorname p = \sigma^(p) = \ln \frac \quad \text \quad p \in (0,1). Because of this, the logit is also called the log-odds since it is equal to the logarithm of the odds \frac where is a probability. Thus, the logit is a type of function that maps probability values from (0, 1) to real numbers in (-\infty, +\infty), akin to the probit function. Definition If is a probability, then is the corresponding odds; the of the probability is the logarithm of the odds, i.e.: : \operatorname(p)=\ln\left( \frac \right) =\ln(p)-\ln(1-p)=-\ln\left( \frac-1\right)=2\operatorname(2p-1). The base of the logarithm function used is of little importance in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |

Experimental Economics

Experimental economics is the application of experimental methods to study economic questions. Data collected in experiments are used to estimate effect size, test the validity of economic theories, and illuminate market mechanisms. Economic experiments usually use cash to motivate subjects, in order to mimic real-world incentives. Experiments are used to help understand how and why markets and other exchange systems function as they do. Experimental economics have also expanded to understand institutions and the law (experimental law and economics). A fundamental aspect of the subject is design of experiments. Experiments may be conducted in the field or in laboratory settings, whether of individual or group behavior. Variants of the subject outside such formal confines include natural and quasi-natural experiments. Experimental topics One can loosely classify economic experiments using the following topics: * Markets * Games * Evolutionary game theory * Decision making * Bar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] [Amazon] |