|

Physics Of Financial Markets

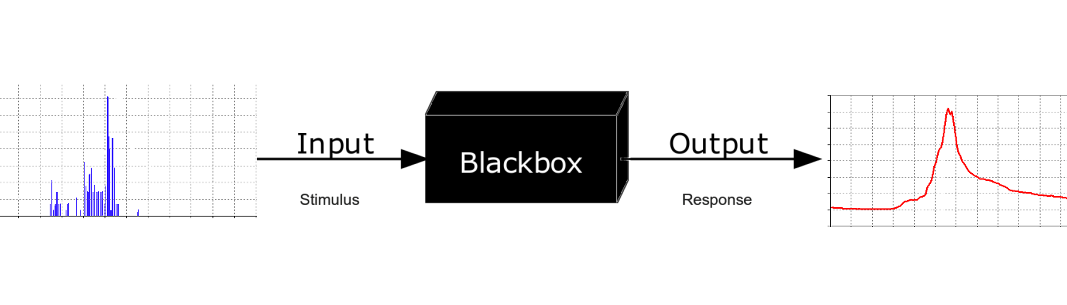

Physics of financial markets is a discipline that studies financial markets as physical systems. It seeks to understand the nature of financial processes and phenomena by employing the scientific method and avoiding beliefs, unverifiable assumptions and immeasurable notions, not uncommon to economic disciplines. Physics of financial markets addresses issues such as theory of price formation, price dynamics, market ergodicity, collective phenomena, market self-action, and market instabilities. Physics of financial markets should not be confused with mathematical finance, which are only concerned with descriptive mathematical modeling of financial instruments without seeking to understand nature of underlying processes. See also *Econophysics *Social physics *Quantum economics *Thermoeconomics *Quantum finance *Kinetic exchange models of markets *Brownian model of financial markets **Ergodicity economics Ergodicity economics is an approach to economic theory which emphasizes the e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Physics

Physics is the natural science that studies matter, its fundamental constituents, its motion and behavior through space and time, and the related entities of energy and force. "Physical science is that department of knowledge which relates to the order of nature, or, in other words, to the regular succession of events." Physics is one of the most fundamental scientific disciplines, with its main goal being to understand how the universe behaves. "Physics is one of the most fundamental of the sciences. Scientists of all disciplines use the ideas of physics, including chemists who study the structure of molecules, paleontologists who try to reconstruct how dinosaurs walked, and climatologists who study how human activities affect the atmosphere and oceans. Physics is also the foundation of all engineering and technology. No engineer could design a flat-screen TV, an interplanetary spacecraft, or even a better mousetrap without first understanding the basic laws of physic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Scientific Method

The scientific method is an empirical method for acquiring knowledge that has characterized the development of science since at least the 17th century (with notable practitioners in previous centuries; see the article history of scientific method for additional detail.) It involves careful observation, applying rigorous skepticism about what is observed, given that cognitive assumptions can distort how one interprets the observation. It involves formulating hypotheses, via induction, based on such observations; the testability of hypotheses, experimental and the measurement-based statistical testing of deductions drawn from the hypotheses; and refinement (or elimination) of the hypotheses based on the experimental findings. These are ''principles'' of the scientific method, as distinguished from a definitive series of steps applicable to all scientific enterprises. Although procedures vary from one field of inquiry to another, the underlying process is frequently the sa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ergodicity Economics

Ergodicity economics is an approach to economic theory which emphasizes the ergodicity question, namely whether expectation values of stochastic processes are equal to their time averages. This yields alternative solutions to classic problems in economics. In decision theory, problems traditionally addressed using expected-utility theory have alternative solutions within ergodicity economics. Ergodicity economics also provides insights into the dynamics of economic inequality and suggests a possible solution for the equity premium puzzle. Background Relation to ergodic theory Ergodic theory is a branch of mathematics which investigates the relationship between time averages and expected values (or, equivalently, ensemble averages) in dynamical systems. Ergodicity economics inherits from this branch the probing of this relationship in the context of stochastic processes used as economic models. Early economic theory was developed at a time when the expected value had been ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Modeling

A mathematical model is a description of a system using mathematical concepts and language. The process of developing a mathematical model is termed mathematical modeling. Mathematical models are used in the natural sciences (such as physics, biology, earth science, chemistry) and engineering disciplines (such as computer science, electrical engineering), as well as in non-physical systems such as the social sciences (such as economics, psychology, sociology, political science). The use of mathematical models to solve problems in business or military operations is a large part of the field of operations research. Mathematical models are also used in music, linguistics, and philosophy (for example, intensively in analytic philosophy). A model may help to explain a system and to study the effects of different components, and to make predictions about behavior. Elements of a mathematical model Mathematical models can take many forms, including dynamical systems, statistical m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Instrument

Financial instruments are monetary contracts between parties. They can be created, traded, modified and settled. They can be cash (currency), evidence of an ownership interest in an entity or a contractual right to receive or deliver in the form of currency (forex); debt ( bonds, loans); equity ( shares); or derivatives ( options, futures, forwards). International Accounting Standards IAS 32 and 39 define a financial instrument as "any contract that gives rise to a financial asset of one entity and a financial liability or equity instrument of another entity". Financial instruments may be categorized by "asset class" depending on whether they are equity-based (reflecting ownership of the issuing entity) or debt-based (reflecting a loan the investor has made to the issuing entity). If the instrument is debt it can be further categorized into short-term (less than one year) or long-term. Foreign exchange instruments and transactions are neither debt- nor equity-based and bel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Econophysics

Econophysics is a Heterodox economics, heterodox interdisciplinary research field, applying theories and methods originally developed by physicists in order to solve problems in economics, usually those including uncertainty or stochastic processes and Chaos theory, nonlinear dynamics. Some of its application to the study of financial markets has also been termed statistical finance referring to its roots in statistical physics. Econophysics is closely related to social physics. History Physicists' interest in the social sciences is not new (see e.g.,); Daniel Bernoulli, as an example, was the originator of utility-based preferences. One of the founders of neoclassical economic theory, former Yale University Professor of Economics Irving Fisher, was originally trained under the renowned Yale physicist, Josiah Willard Gibbs. Likewise, Jan Tinbergen, who won the first Nobel Memorial Prize in Economic Sciences in 1969 for having developed and applied dynamic models for the analysis of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Physics

Social physics or sociophysics is a field of science which uses mathematical tools inspired by physics to understand the behavior of human crowds. In a modern commercial use, it can also refer to the analysis of social phenomena with big data. Social physics is closely related to econophysics which uses physics methods to describe economics. History The earliest mentions of a concept of social physics began with the English philosopher Thomas Hobbes. In 1636 he traveled to Florence, Italy, and met physicist-astronomer Galileo Galilei, known for his contributions to the study of motion. It was here that Hobbes began to outline the idea of representing the "physical phenomena" of society in terms of the laws of motion. In his treatise ''De Corpore'', Hobbes sought to relate the movement of "material bodies" to the mathematical terms of motion outlined by Galileo and similar scientists of the time period. Although there was no explicit mention of "social physics", the sentiment of exam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantum Economics

Quantum economics is an emerging research field which applies mathematical methods and ideas from quantum physics to the field of economics. It is motivated by the belief that economic processes such as financial transactions have much in common with quantum processes, and can be appropriately modeled using the quantum formalism. It draws on techniques from the related areas of quantum finance and quantum cognition, and is a sub-field of quantum social science. History A number of economists including Paul Samuelson and Bernard Schmitt (whose "quantum macroeconomics" treated production as an instantaneous emission) have found inspiration in quantum theory. Perhaps the first to directly exploit quantum techniques in economic analysis, however, was the Pakistani mathematician Asghar Qadir. In his 1978 paper ''Quantum Economics'', he argued that the formalism of quantum mechanics is the best mathematical framework for modeling situations where "consumer behavior depends on infini ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thermoeconomics

Thermoeconomics, also referred to as biophysical economics, is a school of heterodox economics that applies the laws of statistical mechanics to economic theory. Thermoeconomics can be thought of as the statistical physics of economic value and is a subfield of econophysics. It is the study of the ways and means by which human societies procure and use energy and other biological and physical resources to produce, distribute, consume and exchange goods and services, while generating various types of waste and environmental impacts. Biophysical economics builds on both social sciences and natural sciences to overcome some of the most fundamental limitations and blind spots of conventional economics. It makes it possible to understand some key requirements and framework conditions for economic growth, as well as related constraints and boundaries. Thermodynamics ''"Rien ne se perd, rien ne se crée, tout se transforme"'' ''"Nothing is lost, nothing is created, everything is tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Quantum Finance

Quantum finance is an interdisciplinary research field, applying theories and methods developed by quantum physicists and economists in order to solve problems in finance. It is a branch of econophysics. Background on instrument pricing Finance theory is heavily based on financial instrument pricing such as stock option pricing. Many of the problems facing the finance community have no known analytical solution. As a result, numerical methods and computer simulations for solving these problems have proliferated. This research area is known as computational finance. Many computational finance problems have a high degree of computational complexity and are slow to converge to a solution on classical computers. In particular, when it comes to option pricing, there is additional complexity resulting from the need to respond to quickly changing markets. For example, in order to take advantage of inaccurately priced stock options, the computation must complete before the next chan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |