|

Project Finance

Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation. They are most commonly non-recourse loans, which are secured by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a decision in part supported by financial modeling; see Project finance model. The financing is typically secured by all of the project assets, including the revenue-producing contracts. Project lenders are given a lien on all of these assets and are able to assume control of a project if the project company has difficulties complying with the loan terms. Generally, a special purpose entity is created for ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Developing Countries

A developing country is a sovereign state with a less-developed Secondary sector of the economy, industrial base and a lower Human Development Index (HDI) relative to developed countries. However, this definition is not universally agreed upon. There is also no clear agreement on which countries fit this category. The terms low-and middle-income country (LMIC) and newly emerging economy (NEE) are often used interchangeably but they refer only to the economy of the countries. The World Bank classifies the world's economies into four groups, based on gross national income per capita: high-, upper-middle-, lower-middle-, and low-income countries. Least developed countries, landlocked developing countries, and Small Island Developing States, small island developing states are all sub-groupings of developing countries. Countries on the other end of the spectrum are usually referred to as World Bank high-income economy, high-income countries or Developed country, developed countries. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

North Sea

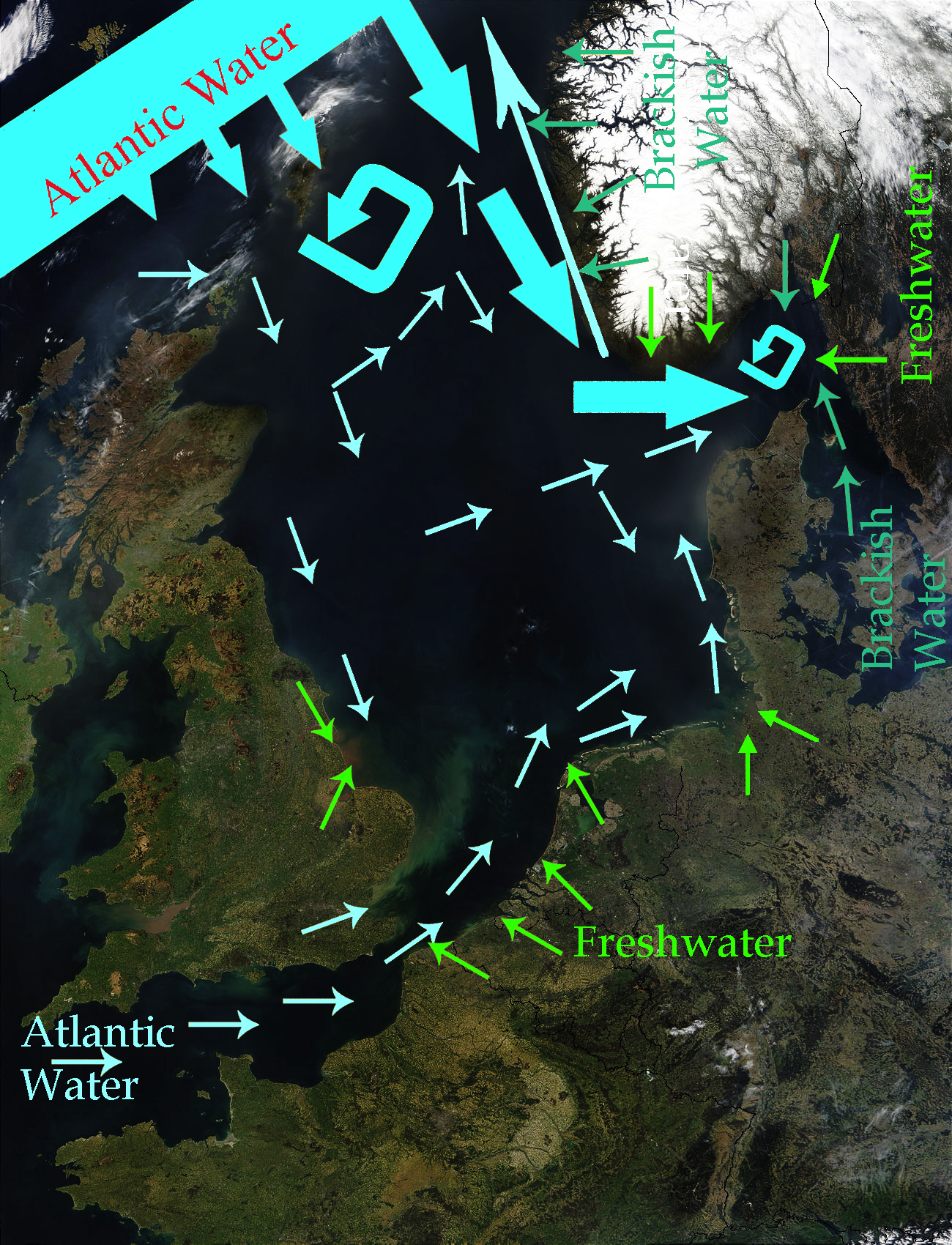

The North Sea lies between Great Britain, Denmark, Norway, Germany, the Netherlands, Belgium, and France. A sea on the European continental shelf, it connects to the Atlantic Ocean through the English Channel in the south and the Norwegian Sea in the north. It is more than long and wide, covering . It hosts key north European shipping lanes and is a major fishery. The coast is a popular destination for recreation and tourism in bordering countries, and a rich source of energy resources, including wind energy, wind and wave power. The North Sea has featured prominently in geopolitical and military affairs, particularly in Northern Europe, from the Middle Ages to the modern era. It was also important globally through the power northern Europeans projected worldwide during much of the Middle Ages and into the modern era. The North Sea was the centre of the Viking Age, Vikings' rise. The Hanseatic League, the Dutch Golden Age, Dutch Republic, and Kingdom of Great Britain, Brita ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Panama Canal

The Panama Canal () is an artificial waterway in Panama that connects the Caribbean Sea with the Pacific Ocean. It cuts across the narrowest point of the Isthmus of Panama, and is a Channel (geography), conduit for maritime trade between the Atlantic and Pacific Oceans. Lock (water navigation), Locks at each end lift ships up to Gatun Lake, an artificial fresh water lake Above mean sea level, above sea level, created by damming the Chagres River and Lake Alajuela to reduce the amount of excavation work required for the canal. Locks then lower the ships at the other end. An average of of fresh water is used in a single passing of a ship. The canal is threatened by low water levels during droughts. The Panama Canal shortcut greatly reduces the time for ships to travel between the Atlantic and Pacific oceans, enabling them to avoid the lengthy, hazardous route around the southernmost tip of South America via the Drake Passage, the Strait of Magellan or the Beagle Channel. Its ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ancient Rome

In modern historiography, ancient Rome is the Roman people, Roman civilisation from the founding of Rome, founding of the Italian city of Rome in the 8th century BC to the Fall of the Western Roman Empire, collapse of the Western Roman Empire in the 5th century AD. It encompasses the Roman Kingdom (753–509 BC), the Roman Republic (50927 BC), and the Roman Empire (27 BC476 AD) until the fall of the western empire. Ancient Rome began as an Italic peoples, Italic settlement, traditionally dated to 753 BC, beside the River Tiber in the Italian peninsula. The settlement grew into the city and polity of Rome, and came to control its neighbours through a combination of treaties and military strength. It eventually controlled the Italian Peninsula, assimilating the Greece, Greek culture of southern Italy (Magna Graecia) and the Etruscans, Etruscan culture, and then became the dominant power in the Mediterranean region and parts of Europe. At its hei ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ancient Greece

Ancient Greece () was a northeastern Mediterranean civilization, existing from the Greek Dark Ages of the 12th–9th centuries BC to the end of classical antiquity (), that comprised a loose collection of culturally and linguistically related city-states and communities. Prior to the Roman period, most of these regions were officially unified only once under the Kingdom of Macedon from 338 to 323 BC. In Western history, the era of classical antiquity was immediately followed by the Early Middle Ages and the Byzantine period. Three centuries after the decline of Mycenaean Greece during the Bronze Age collapse, Greek urban poleis began to form in the 8th century BC, ushering in the Archaic period and the colonization of the Mediterranean Basin. This was followed by the age of Classical Greece, from the Greco-Persian Wars to the death of Alexander the Great in 323 BC, and which included the Golden Age of Athens and the Peloponnesian War. The u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to protect against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Options Valuation

Real options valuation, also often termed real options analysis,Adam Borison (Stanford University)''Real Options Analysis: Where are the Emperor's Clothes?'' (ROV or ROA) applies option (finance), option Valuation of options, valuation techniques to capital budgeting decisions.Campbell, R. Harvey''Identifying real options'' Duke University, 2002. A real option itself, is the right—but not the obligation—to undertake certain business initiatives, such as deferring, abandoning, expanding, staging, or contracting a Project#Corporate_finance, capital investment project. For example, real options valuation could examine the opportunity to invest in the expansion of a firm's factory and the alternative option to sell the factory.Nijssen, E. (2014)''Entrepreneurial Marketing; an effectual approach. Chapter 2'' Routelegde, 2014. Real options are most valuable when uncertainty is high; management has significant flexibility to change the course of the project in a favorable direction a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Securitization

Securitization is the financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans, or credit card debt obligations (or other non-debt assets which generate receivables) and selling their related cash flows to third party investors as securities, which may be described as bonds, pass-through securities, or collateralized debt obligations (CDOs). Investors are repaid from the principal and interest cash flows collected from the underlying debt and redistributed through the capital structure of the new financing. Securities backed by mortgage receivables are called mortgage-backed securities (MBS), while those backed by other types of receivables are asset-backed securities (ABS). The granularity of pools of securitized assets can mitigate the credit risk of individual borrowers. Unlike general corporate debt, the credit quality of securitized debt is non- stationary due to changes in volatility that are time ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is an area of finance that deals with the sources of funding, and the capital structure of businesses, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value.SeCorporate Finance: First Principles Aswath Damodaran, New York University's Stern School of Business Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding Project#Corporate finance, projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term operating balance of current assets and Current liability, cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Surety

In finance, a surety , surety bond, or guaranty involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Usually, a surety bond or surety is a promise by a person or company (a ''surety'' or ''guarantor'') to pay one party (the ''obligee'') a certain amount if a second party (the ''principal'') fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal's failure to meet the obligation. Overview A surety bond is defined as a contract among at least three parties: * the ''obligee'': the party who is the recipient of an obligation * the ''principal'': the primary party who will perform the contractual obligation * the ''surety'': who assures the obligee that the principal can perform the task European surety bonds can be issued by banks and surety companies. If issued by banks they are called "Bank Guaranties" in English a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Profit (economics)

In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. It is equal to total revenue minus total cost, including both Explicit cost, explicit and implicit cost, implicit costs. It is different from accounting profit, which only relates to the explicit costs that appear on a firm's financial statements. An accountant measures the firm's accounting profit as the firm's total revenue minus only the firm's explicit costs. An Economists, economist includes all costs, both explicit and implicit costs, when analyzing a firm. Therefore, economic profit is smaller than accounting profit. ''Normal profit'' is often viewed in conjunction with economic profit. Normal profits in business refer to a situation where a company generates revenue that is equal to the total costs incurred in its operation, thus allowing it to remain operational in a competitive industry. It is the mi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |