|

Policyholder

Insurance is a means of protection from financial loss in which, in exchange for a fee, a party agrees to compensate another party in the event of a certain loss, damage, or injury. It is a form of risk management, primarily used to hedge against the risk of a contingent or uncertain loss. An entity which provides insurance is known as an insurer, insurance company, insurance carrier, or underwriter. A person or entity who buys insurance is known as a policyholder, while a person or entity covered under the policy is called an insured. The insurance transaction involves the policyholder assuming a guaranteed, known, and relatively small loss in the form of a payment to the insurer (a premium) in exchange for the insurer's promise to compensate the insured in the event of a covered loss. The loss may or may not be financial, but it must be reducible to financial terms. Furthermore, it usually involves something in which the insured has an insurable interest established by ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Claims Adjuster

A claims adjuster, desk adjuster, field adjuster, or general adjuster (claim adjuster, claims handler, claim handler or loss adjuster in the United Kingdom, Ireland, Australia, South Africa, the Caribbean and New Zealand) investigates insurance claims by interviewing the claimant and witnesses, consulting police and hospital records, and inspecting property damage to determine the extent of the insurance company's liability. Other claims adjusters who represent policyholders may aid in the preparation of an insurance claim. Duties In the United States, claims adjusters typically: * Verify an insurance policy exists for the insured person and/or property. In general, these are written by the policy-holding insurance company. * Review the insurance policy to determine if coverage exists for the loss(es). * Assess risk(s) of loss(es), or damages to property, culminating in the loss of property and or bodily injury. * After completing the above investigations, evaluate the covered i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deductible

In an insurance policy, the deductible (in British English, the excess) is the amount paid out of pocket by the policy holder before an insurance provider will pay any expenses. In general usage, the term ''deductible'' may be used to describe one of several types of clauses that are used by insurance companies as a threshold for policy payments. Deductibles are typically used to deter the large number of claims that a consumer can be reasonably expected to bear the cost of. By restricting its coverage to events that are significant enough to incur large costs, the insurance firm expects to pay out slightly smaller amounts much less frequently, incurring much higher savings. As a result, insurance premiums are typically cheaper when they involve higher deductibles. For example, health insurance companies offer plans with high premiums and low deductibles, or plans with low premiums and high deductibles. One plan may have a premium of $1,087 a month with a $6,000 deductible, while ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract

A contract is a legally enforceable agreement between two or more parties that creates, defines, and governs mutual rights and obligations between them. A contract typically involves the transfer of goods, services, money, or a promise to transfer any of those at a future date. In the event of a breach of contract, the injured party may seek judicial remedies such as damages or rescission. Contract law, the field of the law of obligations concerned with contracts, is based on the principle that agreements must be honoured. Contract law, like other areas of private law, varies between jurisdictions. The various systems of contract law can broadly be split between common law jurisdictions, civil law jurisdictions, and mixed law jurisdictions which combine elements of both common and civil law. Common law jurisdictions typically require contracts to include consideration in order to be valid, whereas civil and most mixed law jurisdictions solely require a meeting of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurance Policy

In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language. Insurance contracts are designed to meet specific needs and thus have many features not found in many other types of contracts. Since insurance policies are standard forms, they feature boilerplate language which is similar across a wide variety of different types of insurance policies. Available through HeinOnline. The insurance policy is generally an integrated contract, meaning that it includes all forms associated with the agreement between the insured and insurer.Wollner KS. (1999). How to Draft and Interpret Insurance Policies. Casualty Risk Publishing LLC. In some cases, however, supplementary writings such as letters sent after ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Insurable Interest

Insurable interest exists when an insured person derives a financial or other kind of benefit from the continuous existence, without repairment or damage, of the insured object (or in the case of a person, their continued survival). A person has an insurable interest in something when loss of or damage to that thing would cause the person to suffer a financial or other kind of loss. Normally, insurable interest is established by ownership, possession, or direct relationship. For example, people have insurable interests in their own homes and vehicles, but not in their neighbors' homes and vehicles, and almost certainly not those of strangers. The "factual expectancy test" and "legal interest test" are the two major concepts of insurable interest. Historical background The concept of insurable interest as a prerequisite for the purchase of insurance distanced the insurance business from gambling, thereby enhancing the industry's reputation and leading to greater acceptance of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Reinsurance

Reinsurance is insurance that an insurance company purchases from another insurance company to insulate itself (at least in part) from the risk of a major claims event. With reinsurance, the company passes on ("cedes") some part of its own insurance liabilities to the other insurance company. The company that purchases the reinsurance policy is called a "ceding company" or "cedent" or "cedant" under most arrangements. The company issuing the reinsurance policy is referred to as the "reinsurer". In the classic case, reinsurance allows insurance companies to remain solvent after major claims events, such as major disasters like hurricanes and wildfires. In addition to its basic role in risk management, reinsurance is sometimes used to reduce the ceding company's capital requirements, or for tax mitigation or other purposes. The reinsurer may be either a specialist reinsurance company, which only undertakes reinsurance business, or another insurance company. Insurance companies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shipwreck

A shipwreck is the wreckage of a ship that is located either beached on land or sunken to the bottom of a body of water. Shipwrecking may be intentional or unintentional. Angela Croome reported in January 1999 that there were approximately three million shipwrecks worldwide (an estimate rapidly endorsed by UNESCO and other organizations). When a ship's crew has died or abandoned the ship, and the ship has remained adrift but unsunk, they are instead referred to as ghost ships. Types Historic wrecks are attractive to maritime archaeologists because they preserve historical information: for example, studying the wreck of revealed information about seafaring, warfare, and life in the 16th century. Military wrecks, caused by a skirmish at sea, are studied to find details about the historic event; they reveal much about the battle that occurred. Discoveries of treasure ships, often from the period of European colonisation, which sank in remote locations leaving few livi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

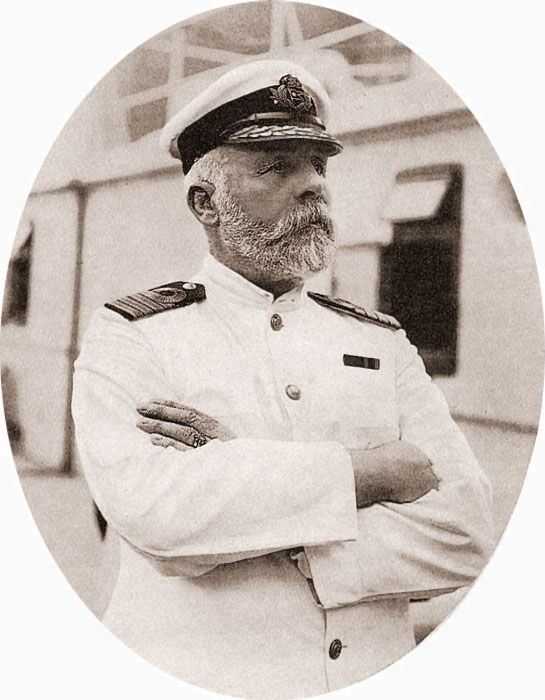

Sea Captain

A sea captain, ship's captain, captain, master, or shipmaster, is a high-grade licensed mariner who holds ultimate command and responsibility of a merchant vessel.Aragon and Messner, 2001, p.3. The captain is responsible for the safe and efficient operation of the ship, including its seaworthiness, safety and security, cargo operations, navigation, crew management, and legal compliance, and for the persons and cargo on board. Duties and functions The captain ensures that the ship complies with local and international laws and complies also with company and flag state policies. The captain is ultimately responsible, under the law, for aspects of operation such as the safe navigation of the ship,Aragon and Messner, 2001, p.4. its cleanliness and seaworthiness,Aragon and Messner, 2001, p.5. safe handling of all cargo,Aragon and Messner, 2001, p.7. management of all personnel,Aragon and Messner, 2001, p.7-11. inventory of ship's cash and stores,Aragon and Messner, 2001, p.11-12. an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Management

In general, technical management is the systematic efforts used in the deployment of a system or process and in balancing its cost, effectiveness and supportability during its life cycle. Technical managers can be found at the interface of application and technique; they act between the user and the technical means. Examples of technical management are: ICT management, real estate management, financial management, quality management. Often the managed field is a resource of the organisation. Technical managers combine technical and management knowledge for the benefit of the user. In logistics, technical management involves the duties a shipping company must perform for the technical operation of a vessel. This involves management related to crew management with related tasks, logistics related to operations as well as operations, service and maintenance. Often technical management is performed by the ship owning company, but not always. Technical management is sometimes perfor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chartering (shipping)

Chartering is an activity within the shipping industry whereby a shipowner hires out the use of their vessel to a charterer. The contract between the parties is called a charterparty (from the French ''"charte partie"'', or "parted document"). The three main types of charter are: demise charter, voyage charter, and time charter. The charterer In some cases a charterer may own cargo and employ a shipbroker to find a ship to deliver the cargo for a certain price, called freight rate. Freight rates may be on a per-ton basis over a certain route (e.g. for iron ore between Brazil and China), in Worldscale points (in case of oil tankers) or alternatively may be expressed in terms of a total sum - normally in U.S. dollars - per day for the agreed duration of the charter. A charterer may also be a party without a cargo who takes a vessel on charter for a specified period from the owner and then trades the ship to carry cargoes at a profit above the hire rate, or even makes a prof ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pro Rata

''Pro rata'' is an adverb or adjective meaning in equal portions or in proportion. The term is used in many legal and economic contexts. The hyphenated spelling ''pro-rata'' for the adjective form is common, as recommended for adjectives by some English-language style guides. In American English this term has been vernacularized to ''prorated'' or ''pro-rated''. Meanings More specifically, ''pro rata'' means: * In proportionality to some factor that can be exactly calculated * To count based on an amount of time that has passed out of the total time * Proportional ratioInvestigator web site Accessed May 29, 2008. Pro rata has a |