|

Pivot Point (stock Market)

In financial markets, a pivot point is a price level that is used by traders as a possible indicator of market movement. A pivot point is calculated as an average of significant prices (high, low, close) from the performance of a market in the prior trading period. If the market in the following period trades above the pivot point it is usually evaluated as a bullish sentiment, whereas trading below the pivot point is seen as bearish. It is customary to calculate additional levels of support and resistance, below and above the pivot point, respectively, by subtracting or adding price differentials calculated from previous trading ranges of the market. A pivot point and the associated support and resistance levels are often turning points for the direction of price movement in a market. In an up-trending market, the pivot point and the resistance levels may represent a ceiling level in price above which the uptrend is no longer sustainable and a reversal may occur. In a declining ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Pivot Point DJI2009 8M1d

Pivot may refer to: *Pivot, the point of rotation in a lever system *More generally, the center point of any rotational system *Pivot joint, a kind of joint between bones in the body *Pivot turn, a dance move Companies *Incitec Pivot, an Australian chemicals and explosives manufacturer *Pivot Legal Society, a legal advocacy organization based in Vancouver, British Columbia *Pivot Wireless, a cell phone service, created by a joint venture between Sprint and multiple cable companies Computing *Apache Pivot, an open-source platform for building applications in Java *Microsoft Live Labs Pivot, a data search application *Morrow Pivot and Morrow Pivot II, early laptop computers *Pivot, an element of the quicksort algorithm *Pivot, now PivotX, a content management system designed for bloggers *Pivot display, a display which can change orientation *Pivot Stickfigure Animator, stick-figure animation software *Pivot table, a data summarization tool in spreadsheets *Pivotal Games, a former ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

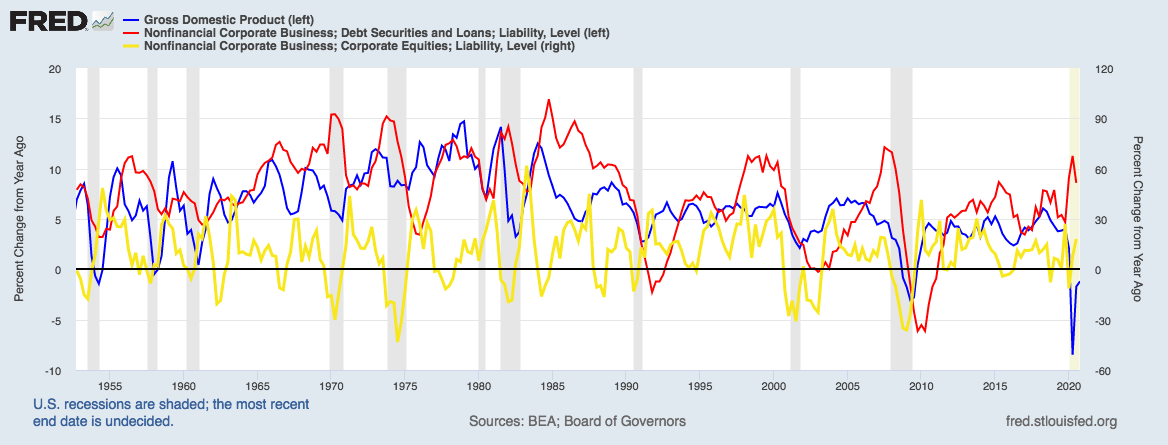

Leading Indicator

An economic indicator is a statistic about an economic activity. Economic indicators allow analysis of economic performance and predictions of future performance. One application of economic indicators is the study of business cycles. Economic indicators include various indices, earnings reports, and economic summaries: for example, the unemployment rate, quits rate (quit rate in American English), housing starts, consumer price index (a measure for inflation), Inverted yield curve, consumer leverage ratio, industrial production, bankruptcies, gross domestic product, broadband internet penetration, retail sales, price index, and money supply changes. The leading business cycle dating committee in the United States of America is the private National Bureau of Economic Research. The Bureau of Labor Statistics is the principal fact-finding agency for the U.S. government in the field of labor economics and statistics. Other producers of economic indicators includes the United State ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Sentiment

Market sentiment, also known as investor attention, is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events. If investors expect upward price movement in the stock market, the sentiment is said to be ''bullish''. On the contrary, if the market sentiment is ''bearish'', most investors expect downward price movement. Market participants who maintain a static sentiment, regardless of market conditions, are described as ''permabulls'' and ''permabears'' respectively. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis Software

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa durin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Indicator

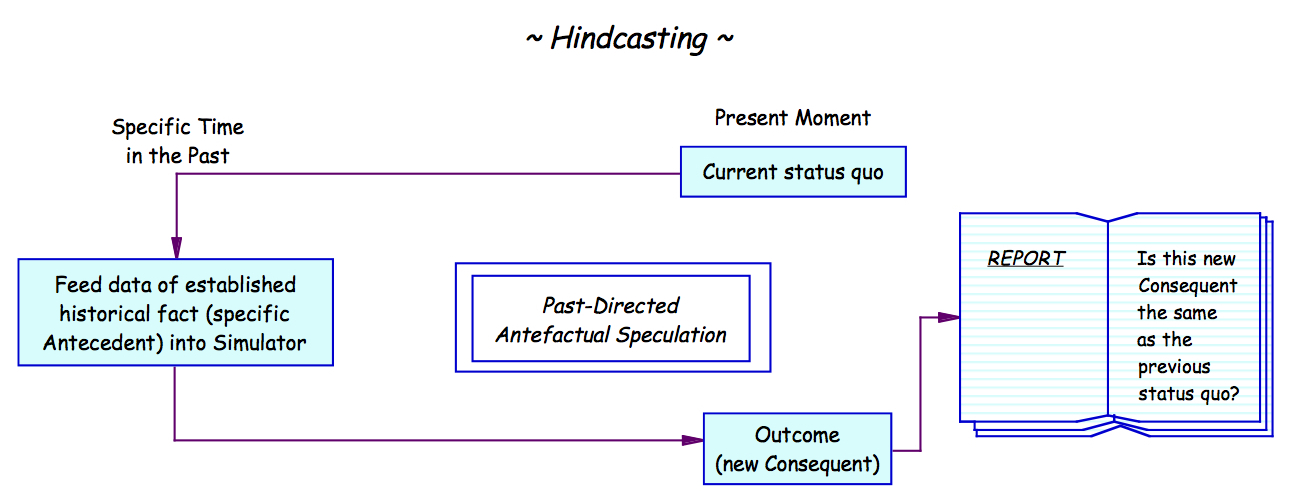

In technical analysis in finance, a technical indicator is a mathematical calculation based on historic price, volume, or (in the case of futures contracts) open interest information that aims to forecast financial market direction. Technical indicators are a fundamental part of technical analysis and are typically plotted as a chart pattern to try to predict the market trend A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-fram .... Indicators generally overlay on price chart data to indicate where the price is going, or whether the price is in an "overbought" condition or an "oversold" condition. Many technical indicators have been developed and new variants continue to be developed by traders with the aim of getting better results. New Indicators are often backtested on historic pric ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Timing

Market timing is the strategy of making buying or selling decisions of financial assets (often stocks) by attempting to predict future market price movements. The prediction may be based on an outlook of market or economic conditions resulting from technical or fundamental analysis. This is an investment strategy based on the outlook for an aggregate market rather than for a particular financial asset. The efficient-market hypothesis is an assumption that asset prices reflect all available information, meaning that it is theoretically impossible to systematically "beat the market." Approaches Market timing can cause poor performance. After fees, the average "trend follower" does not show skills or abilities compared to benchmarks. "Trend Tracker" reported returns are distorted by survivor bias, selection bias, and fill bias. At the Federal Reserve Bank of St. Louis, YiLi Chien, Senior Economist wrote about return-chasing behavior. The average equity mutual fund investor tends to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Analysis

A market analysis studies the attractiveness and the dynamics of a special market within a special industry. It is part of the industry analysis and thus in turn of the global environmental analysis. Through all of these analyses the strengths, weaknesses, opportunities and threats (SWOT) of a company can be identified. Finally, with the help of a SWOT analysis, adequate business strategies of a company will be defined. The market analysis is also known as a documented investigation of a market that is used to inform a firm's planning activities, particularly around decisions of inventory, purchase, work force expansion/contraction, facility expansion, purchases of capital equipment, promotional activities, and many other aspects of a company. Market segmentation Market segmentation is the basis for a differentiated market analysis. Differentiation is important. One main reason is the saturation of consumption, which exists due to the increasing competition in offered products. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fundamental Analysis

Fundamental analysis, in accounting and finance, is the analysis of a business's financial statements (usually to analyze the business's assets, liabilities, and earnings); health; and competitors and markets. It also considers the overall state of the economy and factors including interest rates, production, earnings, employment, GDP, housing, manufacturing and management. There are two basic approaches that can be used: bottom up analysis and top down analysis. These terms are used to distinguish such analysis from other types of investment analysis, such as quantitative and technical. Fundamental analysis is performed on historical and present data, but with the goal of making financial forecasts. There are several possible objectives: * to conduct a company stock valuation and predict its probable price evolution; * to make a projection on its business performance; * to evaluate its management and make internal business decisions and/or to calculate its credit risk; * to fin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Sentiment

Market sentiment, also known as investor attention, is the general prevailing attitude of investors as to anticipated price development in a market. This attitude is the accumulation of a variety of fundamental and technical factors, including price history, economic reports, seasonal factors, and national and world events. If investors expect upward price movement in the stock market, the sentiment is said to be ''bullish''. On the contrary, if the market sentiment is ''bearish'', most investors expect downward price movement. Market participants who maintain a static sentiment, regardless of market conditions, are described as ''permabulls'' and ''permabears'' respectively. Market sentiment is usually considered as a contrarian indicator: what most people expect is a good thing to bet against. Market sentiment is used because it is believed to be a good predictor of market moves, especially when it is more extreme. Very bearish sentiment is usually followed by the market going u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Midpoint Pivots

In geometry, the midpoint is the middle point of a line segment. It is equidistant from both endpoints, and it is the centroid both of the segment and of the endpoints. It bisects the segment. Formula The midpoint of a segment in ''n''-dimensional space whose endpoints are A = (a_1, a_2, \dots , a_n) and B = (b_1, b_2, \dots , b_n) is given by :\frac. That is, the ''i''th coordinate of the midpoint (''i'' = 1, 2, ..., ''n'') is :\frac 2. Construction Given two points of interest, finding the midpoint of the line segment they determine can be accomplished by a compass and straightedge construction. The midpoint of a line segment, embedded in a plane, can be located by first constructing a lens using circular arcs of equal (and large enough) radii centered at the two endpoints, then connecting the cusps of the lens (the two points where the arcs intersect). The point where the line connecting the cusps intersects the segment is then the midpoint of the segment. It is more ch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market (economics)

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in exchange. While parties may exchange goods and services by barter, most markets rely on sellers offering their goods or services (including labour power) to buyers in exchange for money. It can be said that a market is the process by which the prices of goods and services are established. Markets facilitate trade and enable the distribution and allocation of resources in a society. Markets allow any tradeable item to be evaluated and priced. A market emerges more or less spontaneously or may be constructed deliberately by human interaction in order to enable the exchange of rights (cf. ownership) of services and goods. Markets generally supplant gift economies and are often held in place through rules and customs, such as a booth fee, competitive pricing, and source of goods for sale (local produce or stock registration). Markets can dif ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |