|

Permanent Income Hypothesis

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his ''A Theory of Consumption Function'', published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income (human capital, property, assets), rather than changes in temporary income (unexpected income), are what drive changes in consumption. The formation of consumption patterns opposite to predictions was an outstanding problem faced by the Keynesian orthodoxy. Friedman's predictions of consumption smoothing, where people spread out transitory changes in income over time, departe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Clip Image00247

Clip or CLIP may refer to: Fasteners * Hair clip, a device used to hold hair together or attaching materials such as caps to the hair * Binder clip, a device used for holding thicker materials (such as large volumes of paper) together ** Bulldog clip, a common binder clip * Paper clip, a device for holding several sheets of paper together * Crocodile clip, or "alligator clip", a temporary electrical connector * Circlip, a semi-flexible metal ring fastener used to hold a pin in place * Roach clip, a holder used for smoking a cannabis cigarette * Bread clip, a device for closing bags * Rail clip, a rail fastener * Money clip, a device for storing cash and credit cards in a very compact fashion Arts and entertainment * Clip art, pre-made images used in graphic arts * Media clip, a short segment of electronic media, either an audio clip or a video clip ** Video clip * ''Clip'' (film), a 2012 film * ''Clips'' (game show), a game show that aired on YTV from 1993 to 1996 Science and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Absolute Income Hypothesis

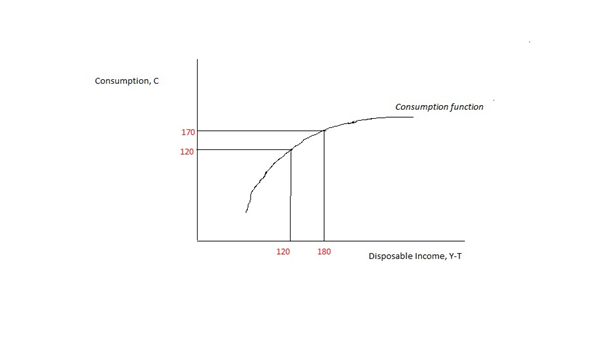

In economics, the absolute income hypothesis concerns how a consumer divides their disposable income between consumption and saving. It is part of the theory of consumption proposed by economist John Maynard Keynes. The hypothesis was subject to further research in the 1960s and 70s, most notably by American economist James Tobin (1918–2002).absolute income hypothesis ", wisdomsupreme.com. Retrieved 2019-03-01 Background Keynes' ''General Theory'' in 1936 identified the relationship between and[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Save

The marginal propensity to save (MPS) is the fraction of an increase in income that is not spent and instead used for saving. It is the slope of the line plotting saving against income. For example, if a household earns one extra dollar, and the marginal propensity to save is 0.35, then of that dollar, the household will spend 65 cents and save 35 cents. Likewise, it is the fractional decrease in saving that results from a decrease in income. The MPS plays a central role in Keynesian economics as it quantifies the saving-income relation, which is the flip side of the consumption-income relation, and according to Keynes it reflects the fundamental psychological law. The marginal propensity to save is also a key variable in determining the value of the multiplier. Calculation MPS can be calculated as the change in savings divided by the change in income. :MPS=\frac Or mathematically, the marginal propensity to save (MPS) function is expressed as the derivative of the savings ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Consume

In economics, the marginal propensity to consume (MPC) is a metric that quantifies induced consumption, the concept that the increase in personal consumer spending (consumption) occurs with an increase in disposable income (income after taxes and transfers). The proportion of disposable income which individuals spend on consumption is known as propensity to consume. MPC is the proportion of additional income that an individual consumes. For example, if a household earns one extra dollar of disposable income, and the marginal propensity to consume is 0.65, then of that dollar, the household will spend 65 cents and save 35 cents. Obviously, the household cannot spend ''more'' than the extra dollar (without borrowing or using savings). If the extra money accessed by the individual gives more economic confidence, then the MPC of the individual may well exceed 1, as they may borrow or utilise savings. The MPC is higher in the case of poorer people than in rich. According to John Mayna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neoclassical Economics

Neoclassical economics is an approach to economics in which the production, consumption and valuation (pricing) of goods and services are observed as driven by the supply and demand model. According to this line of thought, the value of a good or service is determined through a hypothetical maximization of utility by income-constrained individuals and of profits by firms facing production costs and employing available information and factors of production. This approach has often been justified by appealing to rational choice theory, a theory that has come under considerable question in recent years. Neoclassical economics historically dominated macroeconomics and, together with Keynesian economics, formed the neoclassical synthesis which dominated mainstream economics as "neo-Keynesian economics" from the 1950s to the 1970s.Clark, B. (1998). ''Principles of political economy: A comparative approach''. Westport, Connecticut: Praeger. Nadeau, R. L. (2003). ''The Wealth of Na ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neoclassical Synthesis

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book ''The General Theory of Employment, Interest and Money'' (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s, 60s, and 70s. A series of developments occurred that shook the neoclassical synthesis in the 1970s as the advent of stagflation and the work of monetarists like Milton Friedman cast doubt on neo-Keynesian conceptions of monetary theory. The conditions of the period proved the impossibility of maintaining sustainable growth and low level of inflation via the measures suggested by the school. The result would be a series of new ideas to bring tool ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Unemployment

Unemployment, according to the OECD (Organisation for Economic Co-operation and Development), is people above a specified age (usually 15) not being in paid employment or self-employment but currently available for Work (human activity), work during the reference period. Unemployment is measured by the unemployment rate, which is the number of people who are unemployed as a percentage of the labour force (the total number of people employed added to those unemployed). Unemployment can have many sources, such as the following: * new technology, technologies and inventions * the status of the economy, which can be influenced by a recession * competition caused by globalization and international trade * Policy, policies of the government * regulation and market (economics), market Unemployment and the status of the economy can be influenced by a country through, for example, fiscal policy. Furthermore, the monetary authority of a country, such as the central bank, can influ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wealth Effect

The wealth effect is the change in spending that accompanies a change in perceived wealth. Usually the wealth effect is positive: spending changes in the same direction as perceived wealth. Effect on individuals Changes in a consumer's wealth cause changes in the amounts and distribution of his or her consumption. People typically spend more overall when one of two things is true: when people ''actually are'' richer, objectively, or when people ''perceive themselves'' to be richer—for example, the assessed value of their home increases, or a stock they own goes up in price. Demand for some goods (called inferior goods) decreases with increasing wealth. For example, consider consumption of cheap fast food versus steak. As someone becomes wealthier, their demand for cheap fast food is likely to decrease, and their demand for more expensive steak may increase. Consumption may be tied to relative wealth. Particularly when supply is highly inelastic, or when the seller is a monopo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Average Propensity To Save

In Keynesian economics, the average propensity to save (APS), also known as the savings ratio, is the proportion of income which is saved, usually expressed for household savings as a fraction of total household disposable income (taxed income). APS=\frac The ratio differs considerably over time and between countries. The savings ratio for an entire economy can be affected by (for example) the proportion of older people (as they have less motivation and capability to save), and the rate of inflation (as expectations of rising prices can encourage people to spend now rather than later) or current interest rates. APS can express the social preference for investing in the future over consuming in the present. The complement (1 minus the APS) is the average propensity to consume (APC). Low average propensity to save might be the indicator of a large percentage of old people or high percentage of irresponsible young people in the population. With income level changes, APS becomes an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economist

An economist is a professional and practitioner in the social sciences, social science discipline of economics. The individual may also study, develop, and apply theories and concepts from economics and write about economic policy. Within this field there are many sub-fields, ranging from the broad philosophy, philosophical theory, theories to the focused study of minutiae within specific Market (economics), markets, macroeconomics, macroeconomic analysis, microeconomics, microeconomic analysis or financial statement analysis, involving analytical methods and tools such as econometrics, statistics, Computational economics, economics computational models, financial economics, mathematical finance and mathematical economics. Professions Economists work in many fields including academia, government and in the private sector, where they may also "study data and statistics in order to spot trends in economic activity, economic confidence levels, and consumer attitudes. They assess ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. Keynes's intellect was evident early in life; in 1902, he gained admittance to the competitive mathematics program at King's College at the University of Cambridge. During the Great Depression of the 1930s, Keynes spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |